A digital business model might be defined as a model that leverages digital technologies to improve several aspects of an organization. From how the company acquires customers, to what product/service it provides. A digital business model is such when digital technology helps enhance its value proposition.

A few myths about digital business models

We all like to think of digital business models as innovative for their own sake.

However, in many cases innovation happens by combining aspects of existing business models to create a unique formula.

Not a single formula, but rather a recipe with ingredients to be tested

Almost like taking the existing ingredients, and remixing them by using different quantities and cooking time, an “innovative” business model is often the result of those recombinations.

And it requires a lot of tweaking.

Digital is not just about the product/service

You create an ebook, sell it on the web and you call your business a digital business.

Sure, that is a digital product but the fact that your product is delivered digitally doesn’t make it a digital business.

There are a few other things to take into account.

Digital is not just about distribution

You build a website, call it a platform, and you have a digital business.

However, a website is just like a physical window shop, in order for you to create a sustainable flow of customers/partners/users you need to make it scalable.

That requires understanding what models fit best the potential customers/users identified.

Start simple, make it viable

If you look at a business model like Google, you think of it as a complex platform from the start.

However, it took years before Google would develop all the building blocks (former Google AdWords, and Adsense) to make it extremely scalable.

Initially, Google was just closing advertising deals on its search pages leveraging on salespeople, just like a traditional organization.

When Google finally built its two primary ad platforms (AdWords, now Google Ads and AdSense) its business growth picked up together with its traffic growth.

Before Netflix would become a viable streaming platform it took decades. And before that, it was primarily a DVD-rental company.

DVD-rental, in 2019, made up less than two percent of the overall Netflix revenues (interesting enough the company still reported over two million DVD members as of 2019).

Yet, when video streaming became technically viable, Netflix’s business model also evolved, thus making the company surf a different market (video streaming) rather than DVD rental.

A simple business model that delivers enough value to potential customers will get you through the first growth stages.

A model for each stage

Amazon wanted to develop a way for third-party sellers to build their e-commerce on top of Amazon’s infrastructure (at the time that was called Merchant.com) to push on its mission to provide a wide variety of products.

Yet Merchant.com was a “jumbled mess,” and the company over the years developed what would become Amazon AWS, now one of the most successful business units, within Amazon.

While Amazon AWS is now a company within a company.

That infrastructure helped Amazon build a more scalable business model and push to a different stage of growth, probably not possible without the contribution of AWS.

Yet, what would later become AWS only started to be developed in 2000 (Amazon started in 1994).

And only after a few stages of hypergrowth do the company goes through.

A new way of doing business

Therefore, building a digital business requires mastering new ways of looking at your business.

They primarily move around a key pillar (your customers/users or those for which your service/product provides a clear advantage) and a few elements:

Product/Service

Building a digital product/service requires a mindset that goes from something scarce to something potentially unlimited.

Digital products/services can also be quite expensive.

Think of how platforms like Google have to spend billions to keep operating their digital assets by also investing in massive physical infrastructures (data centers).

Yet those products often leverage network effects.

Distribution

Building a digital distribution means understanding the various channels existing on the web.

New channels come every few years.

But some of the channels you might want to take into account to enhance your digital business are:

- Email marketing (newsletter),

- Search engines (Google, YouTube, DuckDuckGo, Bing, Yahoo),

- Social media/discovery-driven platforms (Google Discover, Facebook, Instagram, YouTube),

- And creative media (TikTok) to mention a few.

Value proposition

A digital business model value proposition can often be delivered by providing the upside without the downside.

Think of how Google makes you search for anything without requiring you to bring an encyclopedia in your pocket.

Leveraging on consolidated models

As the story goes McDonald’s started to use a franchising model to grow its restaurant business, and it became over the 1960s a giant in the restaurant business (or real estate depending on the perspective).

McDonald’s leveraged the existing “Speedy Service System” developed by the McDonald’s brothers (what we would later call “fast food”) which was an incredible process development able to provide an improved product at a faster pace.

The speedy system itself represented the application of the manufacturing process to the restaurant business.

Later another important building block was added.

The franchising model really became widely applied during the 1920s and 1930s in the restaurant business.

As new physical communication networks (in the US the Interstate Highway System) enabled people to move long distances with their cars.

Later on, Ray Kroc would apply in its most aggressive form the franchising model (different formats already existed centuries before) to McDonald’s existing operation to create one of the most scalable restaurant businesses in the world.

But is franchising a business model, a revenue model, or a growth (expansion) strategy?

Well, franchising alone is just a distribution/growth/expansion strategy.

Yet, franchising combined with a product delivered differently (the “speedy system”) made up a whole new experience, that made it a new business model: the heavy franchised McDonald’s business model.

Amazon’s flywheel? Part product, part distribution

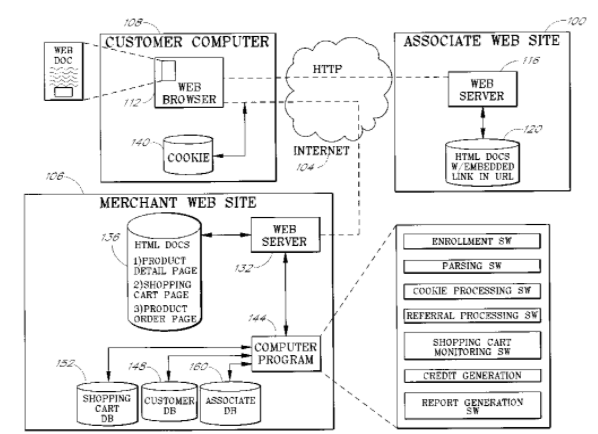

Amazon was among those players on the web who developed a successful affiliate program, which would work as an incredible growth strategy for the company.

In 1996, Amazon associates could place banner or text links that were directed to Amazon to get a commission on the sale.

Not so different from the franchising model in the physical world, the affiliate model would enable a digital property to leverage Amazon’s brand and sell its products and get a commission in exchange.

The affiliate model wasn’t new, as it was already launched starting in 1994, yet Amazon tweaked it and made it widely successful.

Not surprised, then, if you associate affiliate marketing with Amazon.

Affiliate marketing today sounds as old as the web (indeed it is), yet back in the late 1990s that was one of those innovations (which idea was old yet applied to the web) that helped build some of the tech giants we know today.

Yet affiliate marketing alone doesn’t make a business model.

It was the combination of affiliate marketing within Amazon’s flywheel and the shift toward becoming a platform that made the overall Amazon business model.

Are digital businesses fragile?

Many of the new digital business models try to apply old or new philosophies to the web.

For such reason, they might work in the short-medium term (5-10 years), but prove extremely fragile in the long run (20-50 years).

Thus, it’s important when building a digital business to know its advantages but also its drawbacks.

And a way to prevent a digital business from failing is to have a buffer (that is also why tech giants sit on large piles of cash as a buffer).

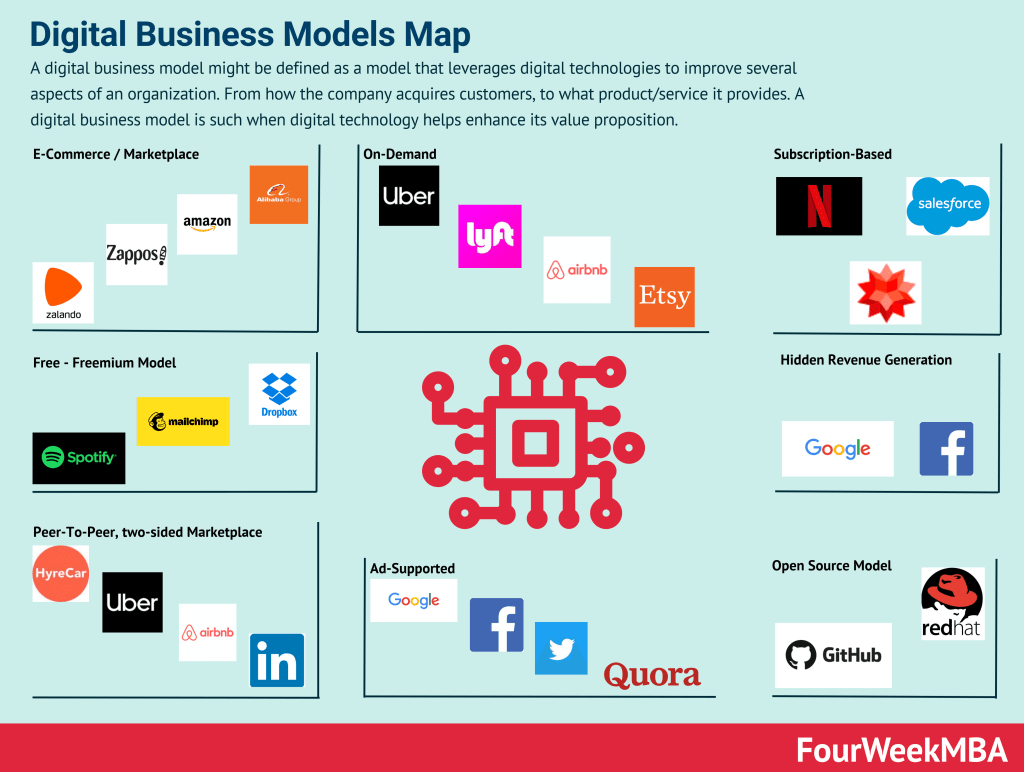

Digital business models types

Below are some of the digital business models types (remember those can be really called business models when mixed up with a product, distribution, and value proposition):

- Open-source (see GitHub, Wikipedia, and for a hybrid open-source, see Gitlab and WordPress).

- Free.

- Freemium, (see Dropbox, Slack, and for the enterprise version, sees Zoom).

- Subscription, (see Netflix).

- On-demand

- Peer-to-peer, (see LinkedIn, Etsy, Vinted).

- E-commerce, (see Amazon, Shopify).

- Ad-supported, (see Spotify)

- Hidden revenue, (see Google and Facebook).

Open-source model

An open-source model makes software free to access, and it generally gives a community of programmers the ability to contribute to it.

Those two ingredients are essential.

Free makes it spread very quickly. And the community side of it is what eventually determines its success.

An open source isn’t a model which companies can leverage to build a sustainable business model.

Companies like Red Hat, for instance, make money by charging premium subscriptions and for training and services associated with its open-source software.

Indeed, in 2018, Red Hat generated over $2.9 billion in revenues, of which, $2.57 was from subscriptions and $346 million from training and services.

Red Hat isn’t the only possible way to monetize open-source software.

For instance, we have already covered the Mozilla Business Model and how its for-profit side makes money through partnerships and distribution agreements with search engines.

Going back to the Red Hat case study by looking at its annual report Red Hat explains its business model as follows:

Development. We employ an open source development model. The open source development model allows us to use the collective input, resources and knowledge of a global community of contributors who can collaborate to develop, maintain and enhance software because the human-readable source code for that software is publicly available and licenses permit modification.

Licensing. We typically distribute our software offerings under open source licenses that permit access to the software’s human-readable source code.

Subscriptions. We provide our software offerings primarily under annual or multi-year subscriptions as well as ondemand through our certified cloud and service providers (“CCSPs”).

- Quick and effective development via a global community of qualified contributors who are not on the company’s balance sheet.

- Great distribution via free licensing of its software.

- Paid subscriptions for premium and enterprise customers.

Building up an open source-based business model isn’t simple and its success highly depends on the ability of the project to engage the community of developers and contributors in working on the source code to improve it and make it very valuable.

Also, such a model where a free service does allow strong marketing for the product.

But it doesn’t necessarily translate into revenues for the company.

For instance, Red Hut 2018 employed $1.2 billion in sales and marketing expenses to distribute its paying subscriptions.

That represented 41% of its total revenues which comprised “primarily of salaries and other related costs for sales and marketing personnel, sales commissions, travel, public relations and marketing materials and trade shows.“

Free model

The free model has become quite pervasive on the web.

Starting from Netscape going on, companies have built great products and released them for free with the hope that once enough people would get used to them, monetization would not be an issue.

While this model worked pretty well for products that scaled up quickly, amassed investments to sustain their infrastructure in the short term, and then found a monetization strategy.

Companies like Google and Facebook have started in this way.

They released a free service to a larger and larger user base.

Attracted the first angel investors, then venture capitalists they had to then quickly turn to the advertising model to monetize their users, to avoid being left without cash and investors.

Thus, while a free service allows to scale up at a marketing level, the company will still have to figure out how to monetize the service provided.

There are usually a few routes:

- A basic version of the product, and a more advanced paid version (freemium model).

- One side gets the service for free, and the other side finances it (asymmetric model).

- Training materials or info products adjacent to the core topic of the product (educational model).

- A free basic service, and a more advanced paid service (usage model).

- A job board that connects talented people with employees (job board model).

Those are just some examples of how an open-source model can be monetized.

Freemium model

The freemium model has gained popularity in the last decade. The reason is simple; this model allows a high virality growth.

Cases like Dropbox, MailChimp, Spotify, and many others have created viral growth thanks to these models.

At its core, a freemium model has a free version available to anyone, with no friction.

Prompts within those free services to switch to paid subscriptions to get more volume, no advertising, or more data.

For instance, Spotify offers a free limited service, advertising-supported.

But if users decide to get the premium service, they can listen to music without interruption from advertising and also download music to listen to offline.

Dropbox, instead, makes you use more space with a premium service.

And MailChimp gives you advanced features and the ability to handle more subscribers in your email list.

If you opt for this model, you need to make sure you have the following:

- A strong enterprise customer base.

- An optimized conversion funnel to switch free users to paid ones.

- A robust technological infrastructure that can handle a broad base of free users.

Subscription-based model

We’re living in a subscription economy.

The most entertaining and customer-centered services we know today, from Netflix to Spotify and Amazon Prime, follow a subscription model.

This model can be very powerful as it carries a few built-in advantages:

- A loyal user base.

- A continuous stream of predictable revenues.

- A more predictable sales pipeline.

In short, many companies are “subscribing” to this model as it allows them to build a sustainable revenue stream over time.

However, it is essential to remark that creating this kind of model isn’t a simple task.

Indeed, companies like Netflix and Spotify spend billions of dollars in producing original content that can make those subscribers want to renew their plans.

Usually, a model that relies on a subscription also requires essential investments in infrastructures, as what makes the services offered through this model is the ability of those platforms to know precisely what to watch or listen to next.

Also, you’ll need to build a process skewed toward a great customer experience to minimize churn rates and improve lifetime customer value.

When your CAC or customer acquisition cost is higher than the lifetime value of your customers, your business will soon be bankrupt.

On-demand model

The Web finally allowed people to consume content at their own pace and schedule.

What mass media, like TV and Radio, didn’t accomplish, the Web did.

An on-demand consumption allows people to have access to the content at different time intervals.

Also, it doesn’t make sense any longer to have a single product or service offering for anyone at scale.

Thanks to the on-demand model

This is true for content but also for any other kind of service. Netflix had popularized this model when it made it available at any time its shows through the platform.

Yet other services, like Uber, and Lyft also built their success by leveraging the on-demand model.

Technological platforms allow people to interact instantaneously, making those kinds of services possible.

The on-demand model can be monetized in several ways. From subscriptions to fees for each transaction on a platform.

The critical ingredient is to create a smooth user experience, in which you barely realize there is someone in the backend manufacturing that experience.

Peer-to-peer, two-sided marketplace

A peer-to-peer marketplace is a platform where usually two sides are participating in a transaction, which can be about products (Etsy) or services (Uber, Airbnb, LinkedIn).

A peer-to-peer, or two-sided marketplace often falls into the chicken or the egg dilemma, where the marketplace to work needs both sides to interact.

Yet the paradox is that to have demand on the platform you need a continuously generated supply.

At the same time to have the supply you need to create demand.

Imagine the Uber case; the platform works as soon as there are enough drivers on the road to offer an on-demand and convenient service when riders need it.

However, drivers want to drive at their convenience and when the fees are high enough to justify their effort.

Therefore, the peer-to-peer marketplace usually faces several challenges in making sure the supply side is served adequately to justify the demand.

Uber, Airbnb, and Etsy all face this issue. For instance, Uber uses several strategies to enhance the supply of drivers on its platform by using dynamic pricing strategies, like surge pricing.

You can appreciate the importance of drivers’ supply for Uber by the fact that companies like HyreCar have built their whole value proposition based on the supply scarcity on Uber.

E-commerce model

One of the first companies that proved the web wasn’t made just of connected computers but of people ready to purchase physical stuff on it was Amazon.

Started as a book store the company soon branched out to sell music and related products.

Until it became the everything store!

Today an e-commerce business model is taken for granted and is among the most used digital business models.

Ad-supported model

If Amazon had proved that the web could become an everything store, a company that changed the way media could be consumed was Google.

Rather than just having to type a website address in a browser, people could search for anything they wanted.

Google made all its services and apps completely free.

While on the other side, it monetized the data captured via its search engine pages with an advertising network called AdWords (now Google Ads).

When Google IPOed back in 2004, it showed the business world how powerful its digital advertising business was.

Indeed, in a matter of a few years, Google passed the billion dollars mark. In 2017 its advertising business passed the hundred and ten billion dollar mark!

To make sure, while a digital advertising business might be easy to set up, it’s not an easy one to run and make profitable.

Unless you’re Google or Facebook with their dominant advertising marketplaces, you won’t be probably able to make money via advertising alone unless you have a very large user base.

Hidden revenue generation model

Hidden revenue generation is about making money while the people that most use your service barely realize that.

A great example is Facebook (and Google).

If you ask an average Facebook or Google user, she won’t know how the company monetizes.

That’s because those companies have invested massive resources in creating this kind of experience.

It’s all about mixing things up to find your own recipe

Each model we saw above isn’t a complete business model that can be applied entirely to a company.

Often business models are the fruit of the combination of several parts. For instance, Airbnb and Uber are on-demand, peer-to-peer marketplaces.

Amazon is an e-commerce platform, which leveraged over the years on affiliates to spin its flywheel.

Many businesses we analyzed throughout the research use several models to build a successful business model.

For instance, Google leverages an open-source model for some of its products, while it monetizes its core product (the search engine) with a hidden revenue model and it also leverages on making its products free to large masses to gain traction quickly and make of its products a standard!

Thus, finding your digital business model will require time, customer feedback, vision, understanding of the existing market, and potentially opening new markets.

Level of digitalization of a business model

When looking at a digital business model, there might be several layers of digitalization of a company.

You start from a level where digital channels are primarily leveraged to amplify the reach of the product and service. Thus, there is no change in real terms of the product or service, but only in terms of perceived value.

A second step, if when the wall between product and marketing/distribution is wrecked off, there you start getting a digital business, in a sense, as finally, the digital part becomes a key component of the product’s value proposition.

And from there you can move to tech business models or platforms, where the technology becomes the key enhancer of the value proposition.

How do you analyze digital/tech business models?

You can leverage the VTDF framework:

Blockchain-based business models and the Web 3.0

As we move toward Web 3.0, it’s important to understand how Blockchain Business Models work, and below is a FourWeekMBA framework to analyze them:

The new era of AI Business Models

With the rise of a new AI paradigm, which relies on large language models, able to generalize across many tasks, the whole software industry is undergoing a massive change.

The wave of generative AI which was prompted by software (from narrow to general) and hardware paradigms (from CPU to GPU) is creating a whole new industry, which can enhance the software industry developed in the last twenty years by many times.

In this context, AI business models are becoming de facto the new digital business models. Where every company on earth will have a component of AI in it.

Just like today, we don’t talk anymore about “Internet business models” as any company is – in some way – an internet company (at least the majority of companies out there), in the future we won’t talk anymore about AI companies, as every company will leverage AI in one of more parts of their business model, to enhance the value proposition for their customers!

Key Highlights

-

Myths about Digital Business Models: The article addresses some misconceptions about digital business models. It highlights that innovation often results from combining existing business model elements in unique ways, and that it’s important to understand that digital doesn’t just pertain to the product or distribution.

-

Digital Business Models are More than Just Products and Distribution: The article emphasizes that having a digital product or distribution method isn’t enough to be considered a true digital business. It’s necessary to focus on various other aspects, including value proposition, customer relationships, and understanding the best models that fit the identified customer/user base.

-

Start Simple and Evolve: The article cites examples of well-known companies, such as Google and Netflix, that started with simpler business models before evolving into more complex and scalable ones. It stresses the importance of starting with a simple model that delivers value and then adapting it over time.

-

Different Stages of Business Models: The article discusses how successful companies often go through different stages of growth and business model evolution. It uses Amazon AWS as an example of how developing a new way for third-party sellers to build their e-commerce on top of Amazon’s infrastructure (Amazon AWS) contributed to the company’s growth.

-

Digital Business Requires New Perspectives: The article emphasizes that building a successful digital business requires a new way of looking at the business. It revolves around understanding key pillars (customers/users) and elements (product/service, distribution) that drive value.

-

Types of Digital Business Models: The article outlines various types of digital business models, including:

- Open-source Model: Making software freely accessible to a community of developers, often monetized through premium subscriptions and services.

- Free Model: Offering free services to a large user base and finding monetization strategies later.

- Freemium Model: Providing both free and paid versions of a product/service, where advanced features are available in the paid version.

- Subscription-based Model: Charging users on a recurring basis for access to services.

- On-demand Model: Allowing users to access content or services at their preferred time intervals.

- Peer-to-peer, Two-sided Marketplace: Connecting users to exchange products or services, relying on supply and demand dynamics.

- E-commerce Model: Selling physical products online.

- Ad-supported Model: Offering free services and monetizing through advertising.

- Hidden Revenue Generation Model: Monetizing services without users being fully aware, often through data utilization.

-

Mixing Business Models: The article highlights that successful digital business models are often a combination of different types and elements. It cites examples of companies like Google and Amazon that leverage multiple models to create a successful business strategy.

-

Analyzing Digital and Tech Business Models: The article introduces the VTDF framework (Value, Technological, Distribution, and Financial models) as a way to analyze digital business models. It underscores the importance of understanding each component and how they come together to form a solid tech business model.

-

Blockchain and Web 3.0 Business Models: The article briefly touches on the concept of Blockchain Business Models within the context of Web 3.0. It presents a framework for analyzing these models, including components related to value, blockchain protocol, distribution, and economic dynamics.

-

AI Business Models: The article briefly mentions the rise of AI-driven business models, highlighting that AI will likely become an integral part of most businesses in the future.

Read Next:

Handpicked popular case studies from the site:

- Google Business Model

- How Does Google Make Money?

- DuckDuckGo Business Model

- How Amazon Makes Money

- Netflix Business Model

- Spotify Business Model

- Apple Business Model

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: