Spotify is a two-sided marketplace, running a free ad-supported service and a paid membership. Founded in 2008 with the belief that music should be universally accessible, it generated €13.25 billion in 2023. Of these revenues, 87.3%, or €11.56 billion, came from premium memberships, while over 12.6%, or €1.68 billion, came from ad-supported members. By 2023, Spotify had over 600 million users, of which 236 million were premium members and 379 million weread-supported users.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Spotify’s value proposition is built on: – Extensive Music Library: Offers a vast catalog of songs and albums from various genres and languages. – Personalized Playlists: Curates playlists based on user preferences and listening history. – Podcasts and Exclusive Content: Provides a platform for podcasts and exclusive audio content. – Free and Premium Tiers: Offers both free, ad-supported and premium, ad-free subscription options. Spotify empowers users to discover, enjoy, and share music and audio content tailored to their tastes and preferences. | Provides access to a diverse music library catering to a wide range of musical tastes. Offers personalized playlists and recommendations for an enhanced listening experience. Includes podcasts and exclusive content, expanding content offerings. Provides flexibility with free and premium subscription options. Attracts users seeking a personalized and varied audio experience. | – Access to a vast music catalog from various genres. – Personalized playlists and music recommendations. – Podcasts and exclusive audio content. – Free, ad-supported and premium, ad-free subscription options. – Attracting users looking for a personalized and varied audio experience. |

| Customer Segments | Spotify serves various customer segments, including: 1. Music Enthusiasts: Individuals who enjoy listening to music regularly. 2. Podcast Listeners: Users interested in podcasts and exclusive audio content. 3. Advertisers: Businesses looking to reach a large and engaged audience through ads. 4. Artists and Creators: Musicians and content creators seeking to share their work. Spotify caters to a diverse user base and offers tools for content creators and advertisers. | Addresses the needs of music enthusiasts and podcast listeners. Attracts advertisers looking to promote products and services. Provides a platform for artists and creators to share their music and content. Customizes offerings for various user segments and industries. | – Meeting the entertainment needs of music enthusiasts. – Offering a platform for podcast listeners. – Attracting advertisers seeking a broad audience. – Providing tools for artists and content creators. – Customizing offerings for diverse user preferences. |

| Distribution Strategy | Spotify’s distribution strategy includes several key elements: – Mobile and Desktop Apps: Offers user-friendly apps for iOS, Android, and desktop platforms. – Web Player: Allows users to stream music directly from web browsers. – Smart Speakers: Integrates with various smart speaker devices for voice control. – Partnerships: Collaborates with device manufacturers and telecom companies for bundled subscriptions. Spotify ensures accessibility and convenience through multiple distribution channels. | Provides accessible and user-friendly apps for various platforms. Enables web-based streaming for desktop users. Integrates with smart speaker devices for voice-controlled listening. Collaborates with partners to expand its user base and reach. Prioritizes accessibility and convenience in distribution. | – Offering mobile and desktop apps for widespread access. – Providing web-based streaming for desktop users. – Integrating with smart speakers for voice control. – Collaborating with partners for bundled subscriptions. – Prioritizing accessibility and convenience through distribution channels. |

| Revenue Streams | Spotify generates revenue through the following sources: 1. Premium Subscriptions: Earns income from premium subscribers who pay for ad-free, offline listening. 2. Advertising: Generates ad revenue from free users who listen to ads. 3. Podcast Monetization: Offers advertising and subscription revenue-sharing for podcast creators. 4. Sponsored Content: Promotes sponsored playlists and content to users. Diversifies income sources across subscriptions, advertising, podcast monetization, and sponsored content. | Relies on premium subscriptions as a primary revenue source for ad-free listening. Generates ad revenue from free users through targeted advertising. Supports podcast monetization through ad sharing and subscription models. Collaborates with brands for sponsored playlists and content. Diversifies income streams for financial stability. | – Earnings from premium subscriptions for ad-free listening. – Revenue from advertising to free users. – Supporting podcast monetization through various models. – Promoting sponsored content to users. – Diversifying income sources for financial stability. |

| Marketing Strategy | Spotify’s marketing strategy focuses on the following elements: – Personalization: Emphasizes personalized playlists and music recommendations. – Content Discovery: Highlights the discovery of new music and podcasts. – Exclusive Content: Promotes exclusive podcasts and artist content. – User Engagement: Encourages users to create and share playlists and collaborate on content. – Partnerships: Collaborates with artists and influencers for promotional campaigns. Spotify prioritizes personalization, content discovery, exclusivity, user engagement, and partnerships in its marketing efforts. | Motivates users with personalized playlists and tailored music recommendations. Promotes content discovery to enhance the listening experience. Offers exclusive podcasts and artist content for user engagement. Encourages users to create, share playlists, and collaborate on content. Collaborates with artists and influencers to reach a wider audience. Prioritizes user engagement and content discovery in marketing. | – Motivating users with personalized playlists and recommendations. – Promoting content discovery for an enhanced experience. – Offering exclusive podcasts and artist content. – Encouraging user engagement and content creation. – Collaborating with artists and influencers for promotional campaigns. – Prioritizing user engagement and content discovery in marketing. |

| Organization Structure | Spotify operates with a functional organizational structure: – Leadership Team: Led by the CEO and top executives responsible for strategic direction. – Content Creation and Acquisition: Focuses on music and podcast content partnerships. – Technology and Product Development: Develops and maintains the platform and apps. – Sales and Partnerships: Drives advertiser relationships and artist collaborations. – User Support: Ensures user satisfaction and support. Spotify’s structure emphasizes functional specialization and user experience. | Employs a functional structure with clear divisions for efficient operations. Prioritizes content partnerships, technology development, sales, and support. Ensures user satisfaction and support. Supports strategic direction and decision-making from top executives. Maintains a focus on functional specialization and user experience. | – Functional structure with specialized divisions. – Prioritizing content partnerships, technology, and support. – Supporting strategic direction from top executives. – Focusing on user experience and satisfaction. – Ensuring efficient operations in each functional area. |

| Competitive Advantage | Spotify’s competitive advantage is derived from: – Extensive Music Library: Offers one of the largest music catalogs globally. – Personalization Algorithms: Utilizes advanced algorithms for music and playlist recommendations. – Exclusive Content: Secures exclusive podcast and artist partnerships. – User Base: Maintains a large and engaged user community. – Podcast Investment: Invests heavily in the podcasting industry. Spotify stands out as a leading music streaming platform with a vast library, personalized recommendations, exclusive content, a loyal user base, and a significant presence in the podcasting space. | Derives a competitive advantage from its extensive music library and personalized recommendations. Secures exclusive content and partnerships for differentiation. Benefits from a large and engaged user community. Invests in the growing podcasting industry for diversification. Stands out as a leading music streaming and podcasting platform. | – Offering one of the largest music catalogs globally. – Utilizing advanced algorithms for personalized recommendations. – Securing exclusive podcast and artist partnerships. – Maintaining a large and engaged user community. – Investing in the growing podcasting industry. – Standing out as a leading music streaming and podcasting platform. |

Understanding the logic of Spotify’s business model

In 2022, Spotify announced its financials and showed its key performance indicators.

It’s interesting to notice the two main components of Spotify’s business model. Indeed, in terms of revenues and users, the business model can be broken down into two parts, counting 489 million users in 2022:

- Ad-supported: Free users get the service for free. However, they are shown in advertising and have limited functionalities. By September 2022, Spotify had grown into a 295 million ad-supported user base.

- Premium: Premium users get all the content on the platform, unlimitedly, without ads, and with premium features (like skipping songs in an unlimited way). By September 2022, Spotify had grown into a 205 million premium subscriber base.

When it comes to cost structure, it’s worth noticing:

- The ad-supported business has a different cost structure than the premium business. In fact, in the ad-supported business, there is much more usage, as users can stream content for free. Thus, here, Spotify uses advertising to amortize the cost of the ad-supported side. However, the ad-supported side creates a funnel for premium users (most free users become premium subscribers over time).

- The premium business, with fewer subscribers, generates many times the revenues of the ad-supported users. For instance, in 2022, the premium users generated almost seven times more revenue than the free users. Nonetheless, premium members are less than free members.

In short, in terms of margins, the ad-supported business has tight margins, but it’s still critical to enhancing Spotify’s brand across the world and enabling a self-serving conversion funnel, which channels free users into premium members.

In short, chances are that if to become a premium member, you were a free member first.

Thus, it’s critical to frame the ad-supported business in light of the sales model, not revenues and margins.

To conclude, we should distinguish between the revenue and sales/growth models.

In fact, the ad-supported model’s aim is not just to generate revenues.

Instead, the primary goal of the ad-supported model is to enhance Spotify’s adoption and to create a self-serving funnel where free users can be triggered into a premium funnel.

Therefore, on the one hand, the ad-supported business is key to amplifying the company’s brand.

On the other hand, the ad-supported business is critical to funneling free users into premium members.

Spotify is a two-sided marketplace founded on the belief in universal music with streaming access

Spotify is where artists and people who want to listen to music can get together.

When Spotify launched its service back in 2008, the music industry wasn’t living a good moment.

That was also due to the growth in piracy and digital distribution, which were allowing people to listen to music while artists were losing control of monetizing their music.

As pointed out in its prospectus, Spotify “set out to reimagine the music industry and to provide a better way for both artists and consumers to benefit from the digital transformation of the music industry.“

In addition to that, Spotify was founded on the “belief that music is universal and that streaming is a more robust and seamless access model that benefits both artists and music fans.“

Spotify mission statement

Our mission is to unlock the potential of human creativity by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by these creators.

This mission is critical as it also drives the business model behind Spotify.

Indeed, as a two-sided marketplace, Spotify’s success depends on its ability to match the music offered by artists with its music fans’ preferences.

The more this match is successful, the more Spotify will be able to retain and grow its membership base, thus substantially increasing its revenues.

Spotify key partners and its challenge to gatekeepers

The principal partners of Spotify are:

- Employees.

- Users.

- The creative community.

- Brands.

- Investors.

Its primary challenge is to fight the old model where artists had to be signed to a label to access a recording studio, mainly when the radio was critical to achieving success.

Spotify’s mission is to allow artists to produce and release their own music.

Spotify monetization strategy: the ad-supported service as a funnel for

Spotify’s monetization strategy is based on two primary services:

- Premium memberships.

- And Ad-Supported Services.

The Premium and Ad-Supported Services work independently, yet they are critical to each other.

The ad-supported service is what allowed Spotify to scale, and it is also the crucial ingredient in the paid members’ acquisition of Spotify.

That’s because the ad-supported serves as a funnel, which drives more than 60% of Spotify’s total gross added Premium Subscribers.

At the same time, the ad-supported service is a viable stand-alone product.

Premium service monetization explained

Spotify service provides Premium Subscribers with unlimited online and offline high-quality streaming access to its catalog.

Premium Services include standard plans, Family Plans, and Student Plans.

The aim of each package is thought to appeal to Users with different lifestyles and across various demographics and age groups.

Also, in some markets where subscription services are not yet the norm, Spotify offers prepaid options.

Spotify counted over 205 million Premium Subscribers in 2022. Those members are activated via several marketing channels:

- By getting converted from the ad-supported services platform.

- By engaging ad-supported users by highlighting the critical features of paid plans.

- Via product links, campaigns targeting existing Users, and performance marketing across leading social media platforms.

Ad-supported services monetization explained

The ad-supported service has no subscription fees, but it offers limited on-demand online access to the Spotify catalog.

The ad-supported service is a critical ingredient to the Spotify funnel in terms of the acquisition of paid members.

At the same time, that represents a viable option for users that can’t afford the paid plan.

On the ad-supported service, Spotify monetizes from the sale of display, audio, and video advertising delivered through advertising impressions.

The revenues comprise primarily the number and hours of engagement of Spotify Ad-Supported Users and their ability to provide innovative advertising products.

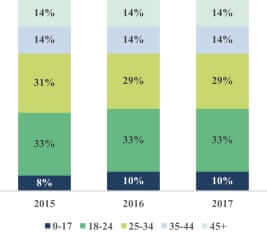

A key ingredient is Spotify’s demographic segment primarily made of users between 18 and 34 years old, which represents a massive opportunity for monetization via advertising:

Source: Spotify prospectus

In addition, thanks to the growing Spotify Audience Network, the company is strengthening its position in the audio-advertising industry.

This is key to understand, as over time, if the Spotify advertising network becomes scalable, advertising revenue can scale pretty quickly.

It’s, therefore, possible a scenario where ad-supported users become the key asset for the company.

In other words, the ad-supported base has been employed today as a strategy to grow the premium members’ base.

In the next decade, as Spotify’s advertising network strengthens, it might be possible to see the ad-supported business model take over or at least get much closer to the subscription-based business model.

Spotify evolving business model: membership or ad-supported?

The Spotify business model is still evolving.

Even though its revenues primarily come from paid members, the company might try to push more on its ad-supported services and enter more and more into the digital advertising space.

Therefore, a business model that is subscription-based might become advertising-based in the long run.

As of 2022, almost 87.4% or €10.2 billion came from premium memberships, while over 12.6% or €1.2 billion came from ad-supported members.

Spotify acquisition costs

Each company needs to tap into a distribution strategy that guarantees a stream of users to have a sustainable business model.

Much of Spotify’s costs are based on royalty and distribution costs related to content streaming.

Those are paid to specific music record labels, publishers, and other rights holders, for the right to stream music to Spotify Users.

Of course, the revenue generated on lower-priced plans (such as the Family and Student Plan) carries a lower cost compared to other plans.

The acquisition costs also depend on targets which can include measures such as:

- The number of Premium Subscribers.

- The ratio of Ad-Supported Users to Premium Subscribers.

- And/or the rates of Premium Subscriber churn.

Some of the licensing agreements that impact Spotify costs include Universal Music Group, Sony Music Entertainment, Warner Music Group, and Merlin.

Spotify key metrics

Understanding the metrics that an organization looks at to evaluate the growth of its platform.

In a way also highlights the vision that the company has about its users, its business model, and what it’s important for its financial success.

A set of metrics that Spotify looks at comprises:

- MAUs (monthly average users).

- Premium subscribers.

- Ad-supported MAUs.

- Premium ARPU (average revenues per user).

- Premium churn.

- Content hours.

MAUs

Spotify tracks MAUs as “an indicator of the size of the audience engaged with its Service.“

This is defined as the total count of Ad-Supported Users and Premium Subscribers that have consumed content for greater than zero milliseconds in the last thirty days from the period-end indicated.

In 2022, Spotify had 489 million monthly active users. Growth compared to 406 million monthly active users in 2021.

Premium Subscribers

Premium Subscribers are users that have completed registration with Spotify and have activated a payment method for Premium Service.

Premium Subscribers were 205 million in 2022, compared to 180 million premium subscribers in 2021.

The plan that most contributed to Spotify’s revenue growth was the Family Plan.

While the Spotify free service kept enabling the upgrade from free to paid, which also helped the company grow its revenues.

Ad-Supported MAUs

That is the total count of Ad-Supported monthly active users that have consumed content for greater than zero milliseconds in the last thirty days.

Ad-Supported MAUs were 295 million in 2022, compared to 236 million in 2021.

Premium ARPU

This monthly metric shows the revenue recognized in the quarter indicated divided by the average daily Premium Subscribers in that quarter, divided by three months.

As Spotify increased the growth of its revenues by enabling more people to join its Family Plan, the ARPU, or average revenue per user, declined in 2019.

Overall this had a positive effect on revenues, as Spotify tries to convert more free accounts to paid users, getting them into the basic plan and over time, making users switch to higher-paying plans.

Premium Churn

That represents the premium members’ cancellations in the quarter indicated divided by the average number of daily Premium Subscribers in that quarter, divided by three months.

We have old data about the churn, which in 2017 was 5.5%, compared to 6.6% in 2016. Churn is a critical metric in the subscription-based business model.

Indeed, when the churn rate is growing over time, this creates a sort of “leaky bucket syndrome” for the company, which doesn’t matter how much effort is placed to bring in new customers.

Those are burned over time as the churn rate speeds up.

What affects the churn rate?

Several factors can affect it. From products issue, like bad onboarding, unclear UX/UI, bad support, or low quality of the offered service.

It’s important to diagnose what’s causing a growing churn to prevent the subscription-based business from losing traction, slowing down, and potentially losing its core customer base.

Content Hours

That represents the aggregate number of hours. Users spent consuming audio and video content on Spotify.

We have interesting past data (Spotify isn’t sharing this anymore) that shows that users were spending an average of 40.3 hours per year on the platform, more than doubling, compared to 17.4 hours spent in 2015.

Spotify user-generated content

It’s easy to think of Spotify as a modern tech achievement made of automated algorithms able to find out any taste a music fan has.

Yet an exciting aspect of Spotify is its user-generated content, in which music listeners can easily and quickly curate and save their playlists to share with other Users.

As of 2017, Spotify had over 3.2 billion User-generated playlists, which generated over 500 million streams daily and accounted for approximately 36% of Spotify’s monthly Content Hours!

Source: Spotify financial prospectus

personalized playlists, automatically created by Spotify technology, accounted for approximately 17% of its monthly Content Hours.

Curated Playlists by Spotify editorial team which carefully curates that allow Users to listen to music in specific genres, account for approximately 15% of our monthly Content Hours.

Spotify marketing strategy

Spotify marketing is based on four main strategies:

- Brand marketing: made of online and offline brand marketing campaigns.

- Marketing for artists: Spotify’s artist marketing program uses billboards, other forms of traditional media, and digital outlets to highlight artists and their work.

- Premium Service discounts: Spotify offers bi-annual campaigns discounting its subscription offerings with a three-month subscription to the Premium Service. Those campaigns have proven very effective in driving the growth of paid memberships.

- Conversion Marketing: Ad-supported users get the highlight of key features that encourage conversion to its subscription offerings. These include product links, internal campaigns and user emails, and performance marketing across leading social media platforms. The Ad-Supported Service is the main funnel that drives more than 60% of Spotify added Premium Subscribers!

How licensing affects Spotify’s business model

The ad-supported business had a 10% gross margin in 2021, compared to 29% of the subscription-based business. That’s because the more the content gets streamed on the platform, the more that increases royalty costs for Spotify. That is also why the company invested in developing its content. Thus, in part transitioning from platform to brand.

From platform to brand

Source: open.spotify.com/

Started primarily as a platform the company has also in part transitioned into a production house.

This is part of the transition to becoming a strong consumer brand. But it has also to do with a business model evolution.

Where the licensing model makes Spotify’s future costs to monetize its users, too volatile.

The company has also been trying to develop content, which makes its costs more scalable as the platform keeps growing.

This is what I define as the transition from platform to brand.

Spotify during pandemic times (2020-2021)

During the pandemic, music and entertainment have become among the areas with the largest growth, where all else is falling.

Indeed, Spotify kept growing in the first quarter of 2020, adding six million premium subscribers and ten million ad-supported/free accounts for 286 million members.

Spotify during the economic slowdown (2022)

As the economic slowdown and potentially a recession hit the business world in 2022, Spotify is among the few tech companies that keep growing its topline revenues.

Driven by a strong premium members base and a fast-growing ad-supported base, Spotify kept growing fast.

Yet, the economic slowdown has influenced (in the short term) the company’s cost structure.

Spotify kept investing in growth initiatives through the slowdown, also finalizing a few more acquisitions, especially in the podcasting space.

In the short-term, these increased operational costs have reduced the company’s profitability and cash position.

Yet, long term, these growth initiatives might make Spotify’s business model even more solid.

In fact, premium members are still the core of Spotify’s business model.

And podcasting is driving even more adoption from the ad-supported user base.

A few key considerations here on how the Spotify’s business model is changing:

- Ad-supported users become premium members over time, thus, nurturing Spotify’s self-serving funnel.

- Once ad-supported users have been converted to premium members, Spotify can retain them for a long-time. In short, the company has a very low churn rate.

- By converting, Spotify is also strengthening its advertising network, thus making it possible for the ad-supported user base to generate much more revenues (at much lower costs) in the future. In short, the advertising side of the business has the ability to scale in the coming years.

Podcasting as a key driver for future growth

Another key driver for Spotify’s growth is podcasting, as the company keeps investing in this trajectory.

Indeed, 19% of the Total MAUs engage with podcast content, and as reported by Spotify, consumption grew at triple-digit rates year over year.

Spotify’s experimentation with monetizing the Metaverse

In May 2022, Spotify announced a partnership with Roblox, a virtual island on top of the platform, to enable artists to sponsor their content further.

As the company highlighted:

Today, we are introducing Spotify Island, a paradise of sound where fans and artists from all over the world can hang out and explore a wonderland of sounds, quests, and exclusive merch.

As Spotify further explained:

Spotify is the first music-streaming brand to have a presence on Roblox, a virtual universe where users can create and play games and share experiences with friends. Through this interactive world, we’re creating a place where fans can link up and create new sounds together, hang out in digital spaces, and gain access to exclusive virtual merch. Spotify Island is an audio oasis that has it all.

The Spotify Island on Roblox (Source: Spotify)

Each part of the creative journey within the Spotify Island leverages independent artists on the platform to create tracks, part of the adventures within Roblox:

Summary and conclusions

- Spotify started in 2008 as a freemium service aiming to create a two-sided platform connecting artists with music fans without having artists go through traditional distribution channels and gatekeepers.

- In 2021 Spotify made over €9.6 billion in revenues.

- Even though the company primarily makes money via its paid subscription members, it also has an ad-supported service.

- The ad-supported free service played a key role as an additional revenue stream in 2021, as it drove more than 12.5% of its sales and a critical sales funnel that drove 60% of added premium members in 2019.

- Even though Spotify made over nine billion euros in revenues, the company reported a net loss of €34 million in 2021. Spotify’s business model is still evolving, and it might well emphasize more and more on its ad-supported service to grow its revenues.

- An interesting aspect is that even though Spotify is driven by AI, one of the most popular features – that drives most of the content hours on the platform – is the user-generated playlists that represented about 36% of monthly content hours back in 2017! (When Spotify still reported these numbers).

Read: Who Owns Spotify, Spotify Competitors, How Does Spotify Pay Artists?

Handpicked related articles:

- How Does Netflix Make Money? Netflix Business Model Explained

- Successful Types of Business Models You Need to Know

- What Is a Business Model Canvas? Business Model Canvas Explained

- The Power of Google Business Model in a Nutshell

- How Does Google Make Money? It’s Not Just Advertising!

- Baidu Vs. Google: The Twins Of Search Compared

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

- The Google of China: Baidu Business Model In A Nutshell

- How Does PayPal Make Money? The PayPal Mafia Business Model Explained

- How Does WhatsApp Make Money? WhatsApp Business Model Explained

- How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

- How Does Twitter Make Money? Twitter Business Model In A Nutshell

- How Amazon Makes Money: Amazon Business Model in a Nutshell

Read Also: How Does Spotify Make Money, Spotify Model, Who Owns Spotify, How Does Twitch Make Money, How Does SoundCloud Make Money, Who is Daniel Ek?, Who Is Martin Lorentzon?

Read Also: How Does Spotify Make Money, Spotify Model, Who Owns Spotify, How Does Twitch Make Money, How Does SoundCloud Make Money, Who is Daniel Ek?, Who Is Martin Lorentzon?

Related Visual Stories

Spotify Advertising Business Model

Economics of the Spotify Business Model