A platform business model generates value by enabling interactions between people, groups, and users by leveraging network effects. Platform business models usually comprise two sides: supply and demand. Kicking off the interactions between those two sides is one of the crucial elements for a platform business model success.

| Aspect | Explanation |

|---|---|

| Definition | A Platform Company is an organization that leverages digital technology and infrastructure to create and manage a platform ecosystem that connects various stakeholders, such as producers, consumers, and third-party developers. These platforms serve as a foundation for enabling interactions, transactions, and the exchange of goods, services, or information. Platform companies often facilitate and benefit from network effects, where the value of the platform increases as more participants join and engage with it. Examples of platform companies include Amazon, Uber, Airbnb, and Facebook. |

| Key Characteristics | – Ecosystem: Platform companies create an ecosystem where multiple stakeholders, including users, sellers, and developers, can interact and transact. – Network Effects: The value of the platform grows as more users and participants join, creating a positive feedback loop. – Digital Infrastructure: These companies heavily rely on digital technology, cloud computing, data analytics, and connectivity to operate and scale their platforms. – Scalability: Platform companies are designed to scale rapidly, accommodating millions or even billions of users and transactions. – Monetization Strategies: They employ various monetization models, including commission fees, subscription services, advertising, and data monetization. |

| Examples | – Amazon: Amazon operates a platform that connects buyers and sellers, enabling e-commerce transactions, third-party seller services, and Amazon Web Services (AWS) cloud computing. – Uber: Uber’s platform connects riders and drivers, facilitating on-demand transportation services in multiple countries. – Airbnb: Airbnb provides a platform for hosts to offer short-term lodging services to travelers. – Facebook: Facebook operates a social media platform connecting users, advertisers, and developers. |

| Impact | – Platform companies have disrupted traditional industries and business models, reshaping how products and services are delivered, consumed, and monetized. – They have the potential to reach a global audience and generate substantial revenue and market capitalization. – Platform ecosystems can foster innovation by allowing third-party developers to create new applications and services on the platform. – However, concerns related to data privacy, market dominance, and regulatory issues have arisen as platform companies have grown in influence. |

| Challenges | – Competition: Platform companies often face fierce competition from other platforms and traditional businesses. – Regulatory Scrutiny: They may encounter regulatory challenges related to antitrust, data privacy, and market dominance. – Security and Trust: Ensuring the security and trustworthiness of the platform is crucial to maintaining user confidence. – User Data: Managing and protecting user data is a significant responsibility and potential source of risk. |

From products to interactions

In a platform business model, an organization moves from offering a product to creating an ecosystem for those interactions to take place.

This shift is critical to understand how platforms work, as often those don’t require any capital or physical inventory.

The classic example is Airbnb having among the broadest variety of homes around the globe, yet owning none of them.

Often those interactions are on-demand; thus if I’m looking for a driver I might access my Uber or Lyft mobile app to find the driver that can give me a lift.

From connections to transactions

A platform also makes it easy for people to transact. For instance, if I get to Amazon, I will find a variety of products, anything from books to music, apparel, and more.

Amazon Flywheel or Virtuous Cycle enables third-party stores to feature their inventory within Amazon fulfillment centers that become part of programs like Amazon Prime, which makes them eligible for one-day delivery.

That makes it extremely easy to transact on those platforms, and the experience needs to be so smooth so that customers can have a great experience and sellers, which usually are small businesses, can benefit from Amazon‘s economies of scale.

From customers to network effects

Network effects are a crucial element of any platform business model. Indeed, platform business models are built on top of two kinds of network effects:

- Direct network effects: a classic example is a social media platform like Facebook, where for each additional user joining the platform it gets better for future users. Network effects can also be as powerful as they trigger social pressure. Imagine a group of friends all on Facebook, except one. The one person not on Facebook might feel marginalized, and the pressure to join the platform grows as more people within the social group join it.

- Indirect network effects: in a two-sided marketplace, when one side of the platform improves, the other side benefits from that. For instance, LinkedIn is a two-sided platform where the more experienced professionals join, the more the platform becomes valuable to the other side, the human resources professional or companies looking for qualified profiles.

A two-sided marketplace benefiting from network effects also need to leverage other key elements:

Negative network effects

When building up a platform business model, it’s important also to know its limitations as it scales in usage and size. Negative network effects can cause the platform to lose value quickly.

The chicken and egg strategy problem

Before the network’s effect kick in, it takes momentum which can be built “artificially” by bringing in the “chicken” that will allow the platform to take off.

In the Amazon Flywheel Model, before Amazon would become the tech giant we know today, it needed to broaden the variety of goods available in its store if it wanted to dominate the marketplace.

Rather than wait for Amazon to build up that variety, Amazon Virtuous Cycle made it possible for third-party sellers, which at the time were also Amazon competitors, to offer their products on the platform.

That solved the chicken and egg problem. As more sellers meant more variety, which was something customers valued a lot. That variety improved the customer experience which in turn made Amazon speed up its growth and take advantage of network effects!

Beyond technology and into business model innovation

One of the greatest misconceptions of platforms is that technology is all that matters for their success. However, a platform is, first of all, a business model, and as such to avoid failure, in the long run, one has to be able to build a distinctive business model that makes it hard to copy. Therefore, business model innovation is another key ingredient.

Related: What Is a Business Model? 30 Successful Types of Business Models You Need to Know

Platform business models types

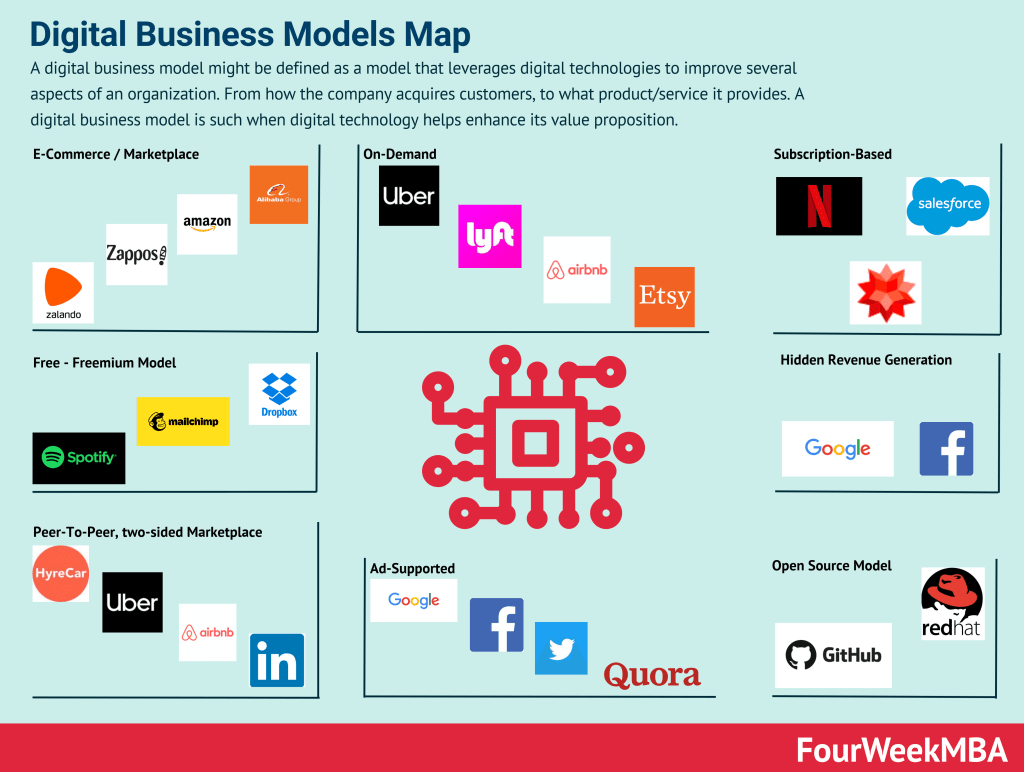

There isn’t a single way to classify platform business models. Those, indeed, can be classified in several ways. For instance, based on the kind of interactions that the platform creates, but also on the type of relationships those same platforms nurture, or with a functional approach.

Thus, if we use these three classification methodologies, we’ll come up with different platform business models.

For the sake of this analysis we’ll take into account the three approaches:

- Interactions approach.

- Relationship approach.

- Functional approach.

Platforms business models as interactions

Source: applicoinc.com

According to Applico platform business models can be divided into exchange platforms and maker platforms.

The primary difference is in the kind of interactions those platforms allow.

An exchange platform allows a one-to-one platform, where two sides interact as smoothly as possible.

Some examples are Airbnb, Amazon, and Dropbox. In this kind of interaction, the two parts are made to transact based on supply and demand.

A maker platform allows an interaction one-to-many. In short, a creator connects with her audience.

For instance, an app developer on the Apple Store can get many downloads, just like an author on Amazon Kindle can allow their community to purchase an info-product.

Platform business models as relationships

John Hagel, in The Power of Platforms – Deloitte University Press, 2015 divides the platform business models into four primary categories based on the kind of relationships they generate.

We move from a transactional platform where the parts are made to transact as smoothly as possible, to platforms that instead nurture mobilization:

- Aggregation platforms.

- Social platforms.

- Mobilization platforms.

- And learning platforms.

As pointed out in the paper “Aggregation platforms bring together a broad array of relevant resources and help users of the platform to connect with the most appropriate resources.” Instead, social platforms differ from aggregation platforms as they aim to “building and reinforcing long-term relationships across participants on the platform.“

Mobilization platforms take a step further, and they don’t just allow people to form relationships based on interests but to take actions together. And learning platforms that aim is to facilitate learning, but also insights exchange.

Platform business models as functional marketplaces

In The Rise of the Platform Enterprise Peter C. Evans and Annabelle Gawer platform business models are divided into:

- Transaction platforms: actings as an intermediary) facilitating exchange or transactions between different users, buyers, or suppliers.

- Innovation platforms: consisting of a technology, product, or service acting as a foundation for other firms to develop complementary technologies, products, or services (this is usually a loosely organized ecosystem).

- Integrated platforms: usually a technology, product, or service that works both as a transaction platform and an innovation platform.

- And investment platforms: consisting primarily of companies that have developed a platform portfolio strategy and act as a holding company, active platform investor, or both.

The course of platform business models

One of the most successful business models of this era has been the “platform business model” or a company that managed to nurture an ecosystem, and as such, it captured economic value in the form of transaction fees.

However, as these platforms have scaled, they became the major centralizers.

This became apparent as some of these same platforms’ changed policies had the ability to influence and negatively impact hundreds of small businesses across the world.

Thus, while the web digitized information thus creating “information superhighways” speeding up communication across the globe, and in the first wave, enabling anyone to become a medium.

It did almost nothing when it came to governance, money, and decentralization at scale.

Companies like Google did try in the early days different governance models, like perhaps holacracy – for at least the engineering team (where the power to make important decisions is decentralized and distributed).

Yet, over the years as the company grew it first organized in functional departments, then more hierarchical.

Some small departments (especially those involved in developing innovative products) might still be flatter, yet no denying how Google (and the rest of the tech giants) have turned into more centralized organizations.

For instance, if we look at companies like Google or Facebook, those created business ecosystems, but from a governance perspective, they are still companies owned by a few major shareholders.

Larry Page and Sergey Brin still owned more than 74% of the company’s stock, as of 2020, and they exercised a voting power of more than 50%.

This means that while those companies do have complex decisional organisms (boards, management) when it comes to the strategic decisions to potentially move a whole business ecosystem those are still in the hands of two people.

The same applies to all the other major tech giants, with no exceptions.

Therefore, while the web innovated at the information level (which we might argue is only the tip of the iceberg in terms of real potential impact) it leveraged the old way of doing business when it came to governance.

Once again, if you run a small or medium business, being in charge of it, and deciding its direction it’s legitimate and indeed it might not cause harm at a collective level. However, when a company turns into a platform and then a business ecosystem, the governance structure skewed in the hands of one or a few individuals doesn’t work anymore, as it becomes a “business tyranny.”

This is also where Blockchain Technologies and Protocols might help. As they propose a new form of governance based – as we’ll see – on decentralized autonomous organizations at scale.

This sort of governance might be extremely useful, especially when a whole business ecosystem needs to be governed.

Therefore, this new monster, which is the giant business-tech platform that becomes the sole decision-maker of where the whole ecosystem should go, might be the largest failure and most dangerous aspect for society overall.

It’s important to stress out that the Blockchain (intended as the set of protocols and applications that in the coming decades will form a “whole” just like the Web did) might become a new layer built on top of the Internet, which embraces everything from money to governance!

However, just like the web turned out to be eventually centralized by a few key players, the main risk for the Blockchain Ecosystem is to end up as a centralized entity.

That is why it’s critical to follow its evolution, as any technology at scale follows a sort of balance and push and pull from centralization and decentralization.

When I use the term “Blockchain” out of the context of a single protocol, I’m referring to the set of protocols and applications that will form the whole ecosystem and that will be an additional layer on top of the Web. This layer will bring three major forces centered around decentralization at scale to form decentralized autonomous organizations, and decentralized autonomous applications to disintermediate decision-making at scale. Those might embrace anything from information to payments and governance. Thus, its use case won’t just be potentially a few trillion-dollar, but in the order of magnitude of quadrillions.

Key Highlights

-

Platform Business Model Overview:

- A platform business model creates value by enabling interactions between users, leveraging network effects.

- Platform models consist of two sides: supply and demand, with interactions between them being crucial for success.

- Platforms shift from selling products to facilitating interactions and transactions.

-

Shift from Products to Interactions:

- Platforms create ecosystems for interactions, often without the need for physical inventory.

- Airbnb is a classic example, owning no homes but connecting hosts and guests.

- On-demand interactions, like ordering a ride from Uber or Lyft, exemplify the platform model.

-

From Connections to Transactions:

- Platforms simplify transactions; Amazon offers various products and services in one place.

- Amazon’s Flywheel model enables third-party sellers to offer products within Amazon’s ecosystem.

- Smooth transactions enhance user experience and benefit sellers through economies of scale.

-

Network Effects and Value:

- Network effects enhance the value of platforms as more users join.

- Direct network effects (e.g., social media) and indirect network effects (e.g., LinkedIn) play a role.

- Negative network effects can reduce platform value as it grows.

-

Chicken and Egg Strategy:

- Platforms often require a “chicken and egg” strategy to build momentum.

- Amazon solved this by bringing in third-party sellers to offer a variety of products.

-

Business Model Innovation:

- Technology is essential, but a successful platform relies on a distinctive business model.

- Business model innovation helps create a competitive advantage.

-

Platform Types:

- Platforms can be classified by interactions, relationships, and functionality.

- Exchange and maker platforms enable different types of interactions.

- Platforms can focus on aggregation, socializing, mobilization, or learning.

-

Evolving Challenges:

- As platforms grow, they centralize power and decision-making.

- Blockchain technology offers potential solutions for decentralized governance.

-

Platform Case Studies:

- Examples like Amazon, Airbnb, Apple, DoorDash, Etsy, Uber, Uber Eats, and LinkedIn highlight successful platform models.

| Aspect | Description | Advantages | Drawbacks | Examples |

|---|---|---|---|---|

| Two-Sided Platforms | Two-sided platforms facilitate interactions between two distinct user groups. They create value by connecting these groups and enabling transactions or interactions between them. For example, ride-sharing platforms connect drivers and passengers. | – Network effects: As more users join, the platform becomes more valuable for all participants. – Revenue potential from multiple user groups. – Scalability and potential for rapid growth. – Data-driven insights for optimizing user experience. | – Balancing supply and demand can be challenging. – Building trust and ensuring safety is crucial. – Competition with established players can be intense. – May require significant initial investment and marketing efforts. | Uber, Airbnb, eBay |

| One-Sided Platforms | One-sided platforms primarily serve a single user group, such as content creators or consumers. They offer products, services, or content to their user base, often generating revenue through subscriptions, advertising, or direct sales. | – Focused user experience tailored to a specific audience. – Direct revenue generation through sales, subscriptions, or advertising. – Opportunity for content monetization and partnerships. – Easier to manage without the complexities of multiple user groups. | – Limited network effects compared to two-sided platforms. – May require attracting a large user base to generate substantial revenue. – Dependence on specific revenue streams (e.g., advertising) can be risky. – Competition in niche markets can be intense. | Netflix, Spotify, YouTube |

| Marketplace Platforms | Marketplace platforms connect buyers and sellers, allowing transactions to take place on their platform. They provide tools and services for users to list, discover, and complete transactions for goods or services. | – Access to a wide range of products or services in one place. – Revenue potential through transaction fees or commissions. – Network effects: More buyers attract more sellers and vice versa. – Scalability with a growing user base. | – Managing quality, trust, and safety among users is crucial. – Balancing supply and demand can be challenging. – Competition with established marketplaces can be intense. – May face regulatory and legal challenges in some industries. | Amazon Marketplace, Etsy, Airbnb |

| Service Platforms | Service platforms connect service providers with customers seeking specific services. These platforms often facilitate bookings, payments, and reviews, enhancing trust between users. Examples include ride-hailing, food delivery, and home services. | – Convenience for users in finding and booking services. – Opportunity for providers to expand their client base. – Revenue generation through service fees or commissions. – User reviews and ratings contribute to trust and transparency. | – Ensuring the quality and reliability of service providers is crucial. – Competition among service providers can be intense. – Balancing supply and demand can be challenging. – May face regulatory and labor-related issues. | Uber, DoorDash, Thumbtack |

| Content Platforms | Content platforms offer a wide range of digital content, such as articles, videos, music, and more. They attract users with content, often providing free access with revenue generated through advertising, subscriptions, or content sales. | – Access to diverse content from various creators. – Revenue potential from advertising, subscriptions, or content sales. – Ability to engage users with personalized content recommendations. – Opportunity for user-generated content and community-building. | – Competition for user attention and advertising dollars is fierce. – Monetizing content can be challenging, especially for new platforms. – Balancing content quality and user-generated content can be difficult. – Dependence on creators and licensing agreements. | YouTube, Netflix, Spotify |

| Data Platforms | Data platforms collect, store, and provide access to data for various purposes, such as analytics, AI development, and research. They often offer data-as-a-service (DaaS) or data marketplace solutions, enabling data monetization. | – Valuable data resources for businesses and researchers. – Potential for recurring revenue through data access fees. – Facilitates data sharing and collaboration across organizations. – Supports data-driven decision-making and innovation. | – Data privacy and security concerns are paramount. – Building trust among data providers and users is essential. – Regulatory compliance and data governance can be complex. – Competition with established data providers and platforms. | Snowflake, DataRobot, AWS Data Exchange |

Platform business models case studies

Amazon Business Model

Airbnb Business Model

Apple Business Model

Doordash Business Model

Etsy Marketplace Business Model

Uber Two-Sided Business Model

Uber Eats Three-Sided Business Model

LinkedIn Multi-Sided Platform Business Model

Platform Business Models Types Case Studies

| Platform Business | Description | Examples | Revenue Models | Distribution Channels | Customer Segments |

|---|---|---|---|---|---|

| E-commerce Marketplace | Connects buyers and sellers, facilitating transactions. | Amazon, eBay, Alibaba | Transaction fees, subscriptions, advertising. | Online, Mobile Apps, Partnerships, Affiliates | Consumers, Sellers, Retailers |

| Ride-Sharing | Connects passengers with drivers for transportation services. | Uber, Lyft, Grab | Commission on rides, surge pricing, ads. | Mobile Apps, Website, Referral Programs | Passengers, Drivers |

| Social Media | Enables content sharing and community building. | Facebook, Instagram | Advertising, sponsored content, data analytics. | Mobile Apps, Website, API | Users, Advertisers, Businesses, Developers |

| Crowdfunding | Connects project creators with backers for fundraising. | Kickstarter, Indiegogo | Platform fees, tiered rewards, payment processing. | Website, Email Campaigns, Social Media | Creators, Backers |

| App Stores | Distributes and sells applications developed by developers. | Apple App Store, Google Play Store | Revenue share from app sales, in-app purchases. | Pre-installed on devices, Mobile Apps | Developers, Users |

| Online Advertising | Connects advertisers with publishers for ad placements. | Google AdWords, Facebook Ads | Pay-per-click, pay-per-impression, subscriptions. | Self-service platforms, Ad networks | Advertisers, Publishers, Agencies |

| Content Streaming | Offers a library of digital content (e.g., movies, music). | Netflix, Spotify, Disney+ | Subscription fees, ads, licensing content. | Mobile Apps, Smart TVs, Web | Subscribers, Content Producers, Advertisers |

| Freelance Marketplaces | Connects businesses with freelancers for project work. | Upwork, Fiverr, Freelancer | Service fees, subscription plans, featured listings. | Website, Email Marketing, SEO | Freelancers, Businesses, Entrepreneurs |

| Real Estate Booking | Facilitates booking and rental of accommodations. | Airbnb, Booking.com, Vrbo | Booking fees, host service fees, subscription plans. | Website, Mobile Apps, Partnerships | Travelers, Property Owners, Property Managers |

| Job Matching | Matches job seekers with job openings and employers. | LinkedIn, Indeed, Monster | Premium subscriptions, job listings, ads. | Website, Mobile Apps, Email Campaigns | Job Seekers, Employers, Recruiters |

| Payment Processing | Provides a platform for online and mobile payments. | PayPal, Stripe, Square | Transaction fees, currency conversion, subscriptions. | Website, APIs, Payment Gateways | Individuals, Businesses, E-commerce Platforms |

| Cloud Computing | Offers infrastructure, platforms, or software services. | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform | Subscription pricing, pay-as-you-go, data storage. | Online portals, Sales teams, Partnerships | Enterprises, Developers, IT Professionals |

| Food Delivery | Connects users with restaurants and delivery drivers for food orders. | Uber Eats, DoorDash, Grubhub | Commission on orders, delivery fees, ads. | Mobile Apps, Website, Partnerships | Consumers, Restaurants, Delivery Drivers |

What are examples of platform businesses?

Companies like Amazon, Uber, and Airbnb are all platform business models, meaning they primarily empower an ecosystem made by two or more parties that, by interacting and transacting, enable the platform to thrive and, as an effect of that thriving ecosystem, collect a tax (fee) on top of each transaction.

What are the benefits of a platform business model?

A platform business model is highly scalable as it enables it to be the foundation for a business ecosystem. For that reason, platform business models are extremely hard to build and maintain as they require the shift from developing products to developing and maintaining business ecosystems.

How does a platform business make money?

Platform business models mostly make money by charging a transaction fee, or a tax, on each transaction happening through the platform. In other words, as the platform enables a business ecosystem, as a side effect of enabling it, it’ll be able to collect a tax on each transaction. That tax, called the take rate, will vary depending on the industry and underlying business ecosystem.

What are the key aspects of a platform business?

Some of the critical elements of a platform business model are:

- Network effects.

- Viral loops.

- Incentives and disincentives.

- Business ecosystems.

In short, platforms grow due to network effects (as the platform has more members joining, it becomes more valuable for those joining afterward). And its foundation lies in the ability to enable a business ecosystem.

What is an advantage of a platform?

Platform business models are not easy to start or maintain. First, it’s hard to kick off network effects. Second, when they kick off, it’s not easy to maintain them unless they reach a critical mass. Yet, if you manage to do so, platforms are among the most scalable business models, as they grow as side-effects of a business ecosystem underlying them.

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: