Disintermediation is the process in which intermediaries are removed from the supply chain, so that the middlemen who get cut out, make the market overall more accessible and transparent to the final customers. Therefore, in theory, the supply chain gets more efficient and, all in all can produce products that customers want.

| Company | Industry/Market Disintermediated | Disintermediation Method |

|---|---|---|

| Amazon | E-commerce | Removal of supply chain intermediaries and exploration of last-mile delivery. |

| Netflix | Entertainment | Direct production of original content and distribution. |

| Google & Facebook | Advertising | Data-driven digital advertising solutions, disrupting traditional ad agencies. |

| Apple | Mobile Carrier | Massive distribution via Apple stores and subsidization of iPhone. |

| Tesla | Automotive | Vertical integration and direct sales approach, bypassing traditional dealerships. |

| Uber | Taxi Services | Two-sided marketplace connecting riders and drivers directly via app. |

| Expedia | Travel | Direct booking of flights and accommodations, bypassing travel agencies. |

| Glossier | Beauty | Direct-to-consumer brand selling online and through owned retail stores. |

| Kickstarter | Funding | Crowdfunding platform, bypassing traditional sources of capital. |

| Airbnb | Lodging | Platform connecting hosts and travelers directly, disrupting hotels. |

| Wise (TransferWise) | Financial Services | Money transfer service with low fees and favorable exchange rates. |

| Etsy | Handmade Goods | Online marketplace connecting buyers and sellers directly. |

| Alibaba | E-commerce | B2B platform connecting manufacturers with global buyers directly. |

| Spotify | Music Streaming | On-demand music streaming, bypassing physical music sales. |

| Job Recruitment | Online professional network connecting job seekers with employers directly. | |

| Grubhub | Food Delivery | Online food ordering and delivery platform, bypassing traditional phone orders. |

| Zillow | Real Estate | Online real estate marketplace connecting buyers and sellers directly. |

| Shopify | E-commerce | E-commerce platform for businesses to sell products online directly. |

| Messaging | Instant messaging app enabling direct communication without SMS. | |

| Coinbase | Cryptocurrency | Cryptocurrency exchange allowing users to buy, sell, and trade digital assets. |

| Robinhood | Stock Trading | Commission-free stock trading app, bypassing traditional brokers. |

| Upwork | Freelance Services | Online platform connecting freelancers with clients directly. |

| Airbnb (continued) | Experiences & Activities | Platform for booking travel experiences directly with hosts. |

| DoorDash | Food Delivery | Food delivery app connecting restaurants with customers directly. |

| Google (continued) | Search Engine | Providing direct access to information online, bypassing libraries and encyclopedias. |

| Facebook (continued) | Social Networking | Direct communication and sharing of content among users, bypassing traditional media. |

| Airbnb (continued) | Event Spaces | Platform for booking event spaces directly with hosts. |

| Fiverr | Freelance Services | Online marketplace for freelance services, connecting freelancers and clients directly. |

| Peloton | Fitness | Direct-to-consumer fitness equipment and online classes, bypassing gyms. |

| Wayfair | Home Furnishings | Online home goods retailer connecting customers with furniture and decor directly. |

How the web disintermediated the old world

“Your margin is my opportunity,” this quote apparently attributed to Jeff Bezos, explains well the process of disintermediation that has been going on with the advent of the web.

One of the core premises of the web was the concept of decentralization and, as a result, intermediation.

Companies like Amazon, Google, Facebook, Netflix, Uber, Spotify, Shopify, and many other startups born in the web era, have all grown with the purpose of dismantling the old distribution pipelines, thus unlocking distribution.

Amazon has been disintermediating a whole supply chain for e-commerce, and now it’s looking into last-mile delivery to cut out from the supply chain of traditional large carriers (DHL, UPS, FedEx) to realize its dream of customer obsession.

Netflix has been, for over a decade, disintermediating the entertainment industry.

Google and Facebook unlocked branding and marketing at first.

In the previous era, if you wanted to get brand exposure, you had to go through a classical ad agency or a set of intermediaries that kept tight control over the industry and their marketing budgets.

As Google first Facebook later came up with a massive, mostly automated digital advertising machine, they first targeted a different segment of the ad industry (not that interesting to those who were used to the old way of advertising).

Indeed, Google itself proselytized a set of new marketers who learned to believe in the only god of performance-based marketing. No more branding or marketing is done without data, measuring, and clear ROI.

The engineering approach of Google first and Facebook later made the whole deal look promising to those companies (especially startups) who didn’t have the budgets to invest in TV advertising.

Those digital marketers started to look for what we might define as last-mile advertising, where it gets easy to track the click and therefore measure the impact of marketing.

With that simple yet powerful promise, Google and Facebook created a digital advertising industry that initially grabbed those who were all about performance and therefore didn’t need an ad agency.

And later on, digital advertising would transition and become much more complete. As those companies evolved, both brand and performance advertising on Google and Facebook were covered up, and this process of disintermediation brought the end of the traditional ad agency.

Yet, all in all, as those companies turned into tech giants, it started – I argue – a process of reintermediation. Before going there, let’s also look at the process of intermediation that happened after the consolidation of a new era, turning mature.

Disintermediation examples

Below we will list just a few of the many examples of how companies are removing intermediaries from a transaction.

Apple’s iPhone has been the product that has completely rehauled the mobile carrier industry by building a massive distribution via its stores and the subsidization of the iPhone from these mobile carriers.

Indeed, while today most of sales still come from the indirect channels, thanks to the incredible network of stores across the world, Apple has managed to build its own distribution pipeline.

This gives it much more leverage toward indirect distribution.

Eventually, also Tesla would follow this playbook.

Dell

No article on disintermediation would be complete without mentioning the American multinational electronics company Dell.

The company, which was founded in 1984, started as a direct seller with a mail-order system that eventually shifted online.

By 1997, Dell was direct selling around $4 million worth of computers each day.

While its competitors were selling pre-configured computers in retail stores, Dell used cost savings from cutting out the middleman to offer deeply discounted and highly customizable machines.

Tesla

Unlike other vehicle manufacturers that tend to sell via authorized dealers, Tesla employs a direct sales approach with a global network of company-owned showrooms in major cities.

The company claims disintermediation increases product development speed and creates a superior buying experience for the customer.

Interested customers can visit a showroom in person and chat with sales and service staff who are employed by Tesla and have no conflict of interest.

Alternatively, those wishing to purchase a Tesla vehicle can customize and order it online.

The company also handles its own servicing.

Many showrooms double as service centers, with these supplemented by a fleet of mobile technicians who can perform routine maintenance at a customer’s residence.

Tesla is also following the same playbook when it comes to offering insurance premiums through its real-time insurance.

Uber

The example of Uber disintermediation is perhaps the most controversial on this list.

The company was a major disrupter of the taxicab industry, enabling passengers to connect with drivers directly via an app.

While Uber has no doubt harmed the viability of taxis, it is nevertheless a representation of how removing the middleman can transform industries where regulation, lobbyists, and bureaucracy have created significant barriers to progress.

Expedia

One of the earlier examples of modern disintermediation comes from the travel site Expedia.

Once upon a time, consumers wishing to go on vacation would employ the services of a travel agent who would organize airline tickets, hotels, rental cars, and so forth.

Today, Expedia and many similar sites allow consumers to purchase airline tickets from the airline and accommodation from the hotel chain.

This has caused many travel agency businesses to shut down or move into related industries such as insurance.

Glossier

Glossier is a beauty brand that favors customer centricity over so-called “stale retail”.

Inspired by direct-to-consumer (D2C) brands such as Warby Parker and Dollar Shave Club, Glossier does not sell its products in traditional department stores like many of its competitors.

Instead, its skincare and makeup range is sold online and in a selection of retail stores across the United States which the company owns.

According to COO Henry Davis, Glossier is an innovative example of disintermediation because it controls the bottom section of its sales funnel and does not rely on third parties to make sales on its behalf.

The company is also looking at ways to disintermediate social media, noting that the brands of the future will need to take ownership of business-customer interactions away from companies such as YouTube and Instagram.

Kickstarter

Platforms like Kickstarter have democratized the process of acquiring capital to fund business ventures and other causes. Entrepreneurs and creators can now use Kickstarter’s platform to raise money directly from users and in the process, bypass banks, venture capitalists, and other more traditional investors.

The benefits of disintermediation in this context extend beyond easier access to capital. In a study from the University of British Columbia in 2016, researchers posited that the new form of early-stage financing improved the quality of entrepreneurial decisions because the individual received crucial early feedback on their idea.

Airbnb

One of the core principles of Airbnb’s business model is disintermediation. The company does not own accommodation itself and instead connects those who own property with those who are looking for somewhere to stay.

In providing a marketplace to connect supply with demand, Airbnb has reduced the need for various intermediaries that once dominated the hotel industry. These include hotel chains, travel agents, and booking sites.

The result is that Airbnb provides a more personalized and authentic accommodation experience for travelers. Many Airbnb stays are also in locations a hotel or travel agent could never facilitate, such as in a retired aircraft or secluded rainforest treehouse.

Etsy

Etsy is an online marketplace that connects buyers with various artists, craftspeople, designers, and entrepreneurs. In the past, many of these sellers would have been required to deal with merchant account providers to be able to accept online payments.

However, in Etsy’s marketplace, sellers instead use the company’s Etsy Payments service and avoid the hassle, cost, and complexity of dealing with merchant account providers themselves.

Sellers can also have their sales revenue deposited into an account in a currency of their choice and can also choose the payment schedule.

Wise

Wise is one of the numerous fintech companies to take advantage of the digital revolution, evolving customer expectations, proliferation of new channels, and ever-changing regulatory landscape of the finance industry.

The company’s global money transfer service enables individuals and businesses to send and receive money across borders with favorable exchange rates and low fees. In the process, TransferWise has obviated the need for banks and traditional services like Western Union.

Users can now move money to over 70 countries in a manner that is fast, affordable and does not include hidden fees or exchange rate markups.

Netflix

Netflix’s decision to disrupt the video rental industry with a new business model is also an example of disintermediation. Initially offering a postal DVD rental service, the company did not hit a home run on its first attempt.

Netflix’s ambitions to disrupt the industry for a second time were also initially halted by a lack of sufficient broadband speed in consumers’ homes.

Nevertheless, the company offered a point of difference to incumbent Blockbuster and its exorbitant fees, lackluster service, and lack of convenience.

Netflix ultimately pivoted toward producing content itself to not only remove DVD rental companies from the equation but also other intermediaries such as production companies and TV networks.

Reintermediation

As companies like Google and Facebook disintermediated the advertising industry. At the same time, the market has been adjusting to the new industry created by those players.

As marketing itself got redefined through the lenses of data and measurement, once ad agencies turned into digital marketing agencies.

Today the whole industry of consultancy companies born as a result of the SEO/SEM and SMO/SMM industries has seen the rise of digital agencies managing budgets for clients.

So, after all, after the first stage of actual disintermediation. The market adjusted, and the dream of disintermediation transformed into something else.

Another case of disintermediation

Another interesting case is how, thanks to the rise of Google, more and more vertical search engines started to spring up over the years.

Where Google could not offer a great search experience, users and qualified traffic would be sent there.

Whole new industries were born thanks to that. OTAs or online travel agencies were born, or at least further disintermediated travel agencies and locked-in demand in the travel sector, thanks to the massive amounts of traffic Google sent them:

Those digital players became the new intermediaries. They, together with Google, helped disintermediate an entire industry from fragmented players. Yet they became the primary intermediaries.

Disintermediating the disintermediators

Yet as Google turned in what we can call “the everything search engine” or the tool able to cover many verticals that before could not be covered.

Google started to roll out products like Google Travel (Trips), and Google Flights that have the potential to offer an end-to-end experience within its own platform, thus disintermediating the digital disintermediators.

Enter the gatekeeper’s hypothesis

Those once startups turned gatekeepers.

The old markets that crashed under the pressure of new industries also matured. That might have created a process of dominance, where winner-take-all effects took over.

And markets, once fragmented by many intermediaries, turned into new markets primarily dominated by a few central players, setting the rules of the game.

According to what I called the “Gatekeeping Hypothesis,” we sort of went back to an era of blocked distribution by a few key players, with some critical differences.

First, this time algorithms defined the rules to follow, even though at central levels, a few key people (usual engineers following the executives’ instructions made those rules in the first place).

Second, this era is primarily customer-centered.

Where in the past, it was all about keeping tight control on the supply chain and distribution so that, over time, consumers would get used to whatever got sold to them (standardized mass-marketing helped indeed).

To an era where those tech giants are stubborn and obsessed with customer experience.

When Google sets the rules for websites to follow, it does that by keeping as North Start, the user experience (of course defined a la Google), and those who do not conform to that are out from the walled garden.

Third, consolidation and asymmetry took over. Where many more intermediaries might have controlled fragmented industries. The new players learned that domination is what matters and they set for it.

In addition, most processes are now asymmetric.

When the user gives data to Facebook, the value it gets back is much lower compared to what Facebook can and will do with that data. Both in terms of usage and monetization.

In short, Facebook will be way better by getting the data of the user, as this will add up to its network effects. Compared to what the user gets back (some form of entertainment).

Therefore, winner-take-all effects created a few super-large players that became the main intermediaries.

Super platforms and super gatekeepers

Let’s add to that, those gatekeepers have been stretching their tentacles to cover more and more parts of the user experience, thus generating potential for the rise of super gatekeepers.

Blockchain and the renewed dream of decentralization at scale

There isn’t a single way for the web to evolve. And renewed dreams of scaled decentralization took place with the Blockchain and its potential commercial applications. Whether this will be a permanent effect, we can’t be sure.

However, for one thing, Blockchain might get us to the rise of a new form of organization, something that goes beyond the classic corporation and take the form of a super, decentralized company, made of many companies combined, and all joining a shared protocol.

Key takeaways

- Disintermediation is the process of cutting out intermediaries from the supply chain. The web has been a critical driver of this process, by disintermediating old industries to create whole new market opportunities for all.

- The wave of disintermediation is still going on (see Amazon last-mile). At the same time as those companies created new markets that are becoming more mature, a process of reintermediation (where new intermediaries are born as a result).

- As former startups, turned tech giants, those became gatekeepers and winner-take-all/intermediaries at large scale.

- The Blockchain brings back the dreams of disintermediation and decentralization at large scale. Whether this will happen, be permanent we don’t know yet, and can’t be sure either.

Key Highlights

- Definition of Disintermediation: Disintermediation is the process of removing intermediaries from the supply chain, making the market more accessible and transparent for end customers. It aims to increase efficiency and produce products customers want.

- Impact of the Web: The advent of the web brought about decentralization and disintermediation. Companies like Amazon, Google, Facebook, and others have disrupted traditional distribution pipelines to unlock new ways of reaching customers.

- Examples of Disintermediation:

- Amazon: Disintermediating the e-commerce supply chain and exploring last-mile delivery.

- Netflix: Disintermediating the entertainment industry by producing original content.

- Google and Facebook: Disintermediating the advertising industry by offering data-driven digital advertising solutions.

- Apple: Disintermediating the mobile carrier industry through its stores and subsidized iPhone sales.

- Tesla: Vertical integration and direct sales approach disintermediating traditional car dealerships.

- Uber: Two-sided marketplace disintermediating traditional taxi services.

- Expedia: Disintermediating traditional travel agencies by connecting travelers and service providers directly.

- Glossier: Direct-to-consumer brand disintermediating traditional retail channels.

- Kickstarter: Disintermediating traditional funding sources for entrepreneurial ventures.

- Airbnb: Platform disintermediating traditional hotels and lodging services.

- Wise: Fintech company disintermediating traditional banking and money transfer methods.

- Reintermediation: After the initial disintermediation phase, markets tend to adjust and new intermediaries may emerge. The rise of tech giants like Google and Facebook led to the emergence of digital marketing agencies and other new players within the digital ecosystem.

- Gatekeeper Hypothesis: As tech giants become dominant players in various industries, they act as gatekeepers that control access to customers. Algorithms define rules, and the market is more customer-centered, although consolidation and asymmetry are present.

- Super Platforms and Super Gatekeepers: Tech giants have expanded their influence across various parts of the user experience, leading to the potential rise of super gatekeepers.

- Blockchain and Decentralization: The emergence of blockchain technology rekindles the dream of large-scale decentralization and disintermediation. Blockchain’s potential commercial applications could reshape industries and organizational structures.

- Key Takeaways: Disintermediation continues to reshape industries, with the web and technology playing a pivotal role. New intermediaries may emerge after initial disintermediation, and blockchain technology introduces new possibilities for decentralization. The impact of super gatekeepers and the future of decentralization remain uncertain.

Other business phenomena of the Web 2.0 era

Let’s also look at a few other phenomena enabled by the web.

Business Platforms

In the digital era, business platforms have become the key foundation for massive entrepreneurial ecosystems to form, and, therefore the development of products used by a large consumer base.

The advent of business platforms has taught us that to scale up a product at a mass-consumption level; it’s not enough anymore to have the physical side (hardware).

Instead, the non-physical, comprising the software and all the other applications built on top of it, becomes critical.

In short, while hardware and software are critical to building a solid foundation, they are usually highly centralized.

Instead, there is another part where companies act more like governments, setting the policies and rules for the platform.

But then, the platform itself is left to develop.

The products made as a result of these platforms enhance the core products offered by the organization (your iPad would be worth much less without apps).

Customer-Centrism and Customer Obsession

In this era, customers got at the center of the business stage.

They became the focus for the development of products in the first place. Indeed, at an entrepreneurial level today, you first validate the market, understand if people want something, then go on and build it.

At the same time, as Amazon taught us, customer obsession also takes the form of random discovery, where the company is audacious enough to push products that customers don’t even know they want, yet, also win.

Decoupling

The decoupler learned how to look at the whole customer value chain, only to focus on one core aspect of it to enable a whole new experience, based on convenience, in terms of money, time and effort.

The new experience designed by the decoupler breaks apart the customer value chain, thus identifying and offering only the most valuable part.

Digital Platforms

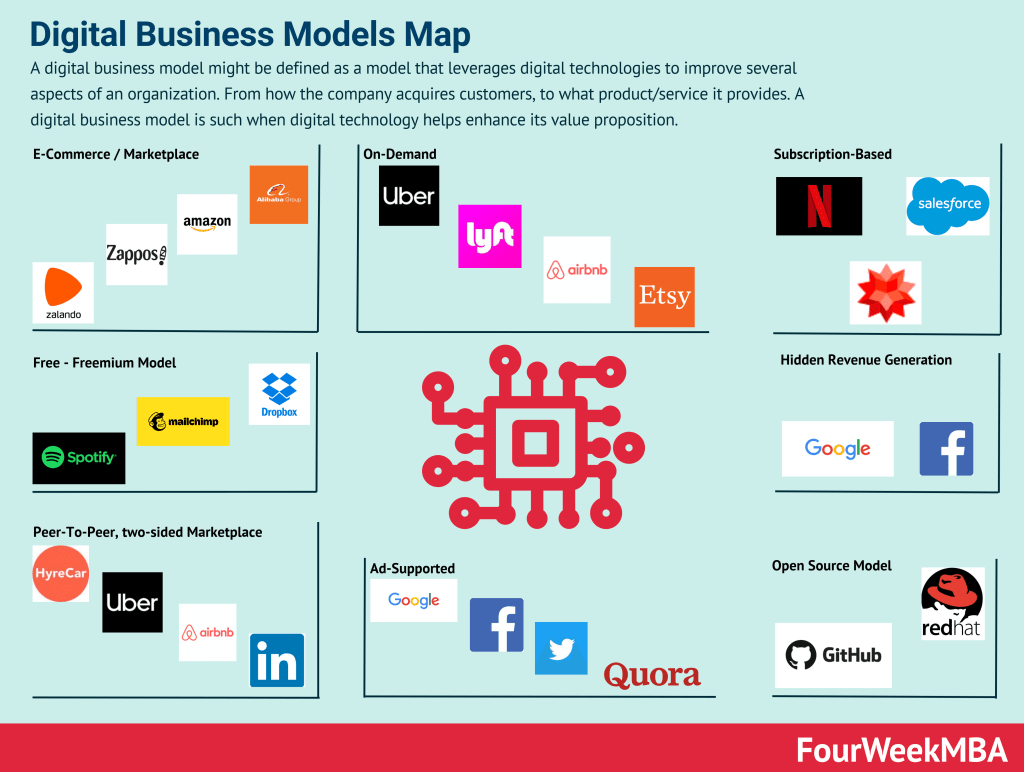

Digital platforms and digital business models, from e-commerce, to on-demand, subscription-based models, freemium, open source, and more, have all become natural players in the web era.

Flywheels

In this era, flywheels have become the key growth component of platform business models.

Network Effects

Network effects instead become critical to enable the platform to scale and, as it does, become more valuable. In short, where in the past we talked about economies of scale, in this era, we talked about network effects.

Negative Network Effects

Where platform business models enjoy network effects.

The opposite is true.

In the physical world, where this phenomenon is known more as diseconomies of scale.

In the digital business world, when the network becomes too busy (overcapacity), or it scales too much, negative network effects can pick up. Thus, redounding the value of the overall network.

Unbundling

Many of the companies that entered those new spaces, and dominated them, started out as an unbundler.

They took an existing “pre-packaged experience” from the previous era, and they only offered the most valuable part.

In short, they surfed the giants of the previous era.

And as they did, they gained massive growth.

As new companies come into the market and supplant incumbents with an unbundling process, they tend to consolidate their distribution, thus bundling things up to offer an end-to-end experience and gain as much control possible over the customer journey.

When this process is mature, other companies with a different mindset, willing to take the best of that experience and unbundle it, might gain traction at the expense of the incumbent.

Value Innovation

Innovators in the digital age have been able to innovate by breaking down the wall between cost and value.

This is at the core of the Blue Ocean Strategy.

On FourWeekMBA, I also advocate for a Blue Sea approach, where a minimum viable audience becomes the North Star to build a valuable small digital business.

Vertical Integration (in the bits world)

Over time, small players that have gained more and more market shares in their industry also expanded in adjacent markets.

Thus, controlling more parts of the journey for potential customers.

For instance, where Google has been able, for decades, to only find relevant information for users, it then sent them to whatever site was available on the web.

Google integrated more and more products into its search engine to enhance the user journey and create an end-to-end experience, and at the same time, by integrating its supply chain, to gain control over the whole process.

A phenomenon known for decades to the physical world has also become widely applied to the digital world.

Key Highlights

- Business Platforms:

- Business platforms are foundational for entrepreneurial ecosystems and the development of products used by a large consumer base.

- Hardware and software are central, while non-physical aspects such as software and applications on top become critical.

- Companies act as “governments” setting policies and rules, while the platform develops and enhances core products.

- Customer-Centrism and Customer Obsession:

- Customer obsession involves gathering valuable insights from customer feedback, intuition, and experimentation.

- Customers are at the center of product development, validating the market before building.

- Customer obsession includes audacious moves to push products customers don’t yet know they want.

- Decoupling:

- Decoupling is a wave of disruption where companies break the customer value chain to deliver part of the value without bearing the whole cost.

- Decouplers focus on core aspects of the value chain to create convenient experiences in terms of money, time, and effort.

- Digital Platforms:

- Digital business models leverage technology to enhance value propositions across various aspects of an organization.

- Different digital business models (e-commerce, subscription-based, freemium, etc.) have emerged in the web era.

- Flywheels:

- Flywheels are growth components in platform business models that leverage customer experience to drive traffic, enhance selections, and lower costs.

- Network Effects:

- Network effects occur as more users join a platform, improving the value for subsequent users.

- Network effects enable platforms to scale and become more valuable over time.

- Negative Network Effects:

- Negative network effects occur when the value of a platform decreases as the network grows or scales too much.

- Unbundling:

- Unbundling involves breaking down parts of a value chain to offer consumers the most valuable components.

- Successful companies often start as unbundlers, offering a specific core experience that resonates with customers.

- Value Innovation:

- Value innovation redefines market boundaries and creates new uncontested markets with enhanced value propositions and lower costs.

- Digital innovators break the cost-value trade-off, offering more value at lower costs.

- Vertical Integration (in the bits world):

- In the digital world, vertical integration occurs when a company controls access points to acquire data from consumers.

- Companies expand from their core offerings to adjacent markets, gaining control over the customer journey.

Hand-picked resources:

- Business Strategy Examples

- Types of Business Models You Need to Know

- Blitzscaling Business Model Innovation

- What Is a Value Proposition?

- What Is Business Model Innovation And Why It Matters

- Platform Business Models

- Network Effects In A Nutshell

- Digital Business Models

Connected Business Concepts And Frameworks

Horizontal vs. Vertical Integration

Read Also: Vertical Integration, Horizontal Integration, Supply Chain.

Read More:

Read next: