Horizontal integration refers to the process of increasing market shares or expanding by integrating at the same level of the supply chain, and within the same industry. Perhaps, a manufacturer who buys or merges with another manufacturer, in the same industry, is an example of horizontal integration.

| Aspect | Explanation |

|---|---|

| Concept | Horizontal Integration is a strategic business expansion approach where a company acquires or merges with other businesses operating at the same level of the supply chain or within the same industry. The goal is to strengthen market position, increase market share, reduce competition, and realize synergies by combining similar operations. It contrasts with vertical integration, which involves acquiring businesses at different supply chain stages. |

| Key Characteristics | Horizontal Integration is characterized by the following elements: – Same Industry: It involves acquiring or merging with companies that produce similar products or offer comparable services. – Market Expansion: The aim is often to reach a larger customer base and achieve economies of scale. – Competition Reduction: It can lead to reduced competition within the industry as fewer independent players remain. – Synergies: By combining operations, companies may realize cost savings, enhanced capabilities, and increased market power. |

| Motivations | Companies engage in Horizontal Integration for various reasons: – Market Dominance: To become a dominant player in a particular industry or market segment. – Economies of Scale: To achieve cost efficiencies by consolidating production and distribution processes. – Diversification: To diversify product or service offerings within the same industry. – Competitive Advantage: To gain a competitive edge by eliminating rivals or reducing price competition. |

| Benefits | Horizontal Integration offers several advantages: – Increased Market Share: It allows a company to capture a larger portion of the market. – Cost Reduction: By streamlining operations, businesses can achieve cost savings. – Enhanced Market Power: The consolidated entity may have more influence over pricing and industry dynamics. – Diversification: It can reduce risk by offering a wider range of products or services. |

| Challenges | There are challenges associated with Horizontal Integration: – Regulatory Hurdles: Antitrust regulations may prevent large-scale mergers that could stifle competition. – Integration Complexity: Merging operations and cultures can be challenging and may lead to disruptions. – Overpaying: Overestimating the value of the acquired company can result in financial strain. – Cultural Differences: Merging companies may have different organizational cultures that need to be harmonized. |

| Strategies | Companies employ different strategies for Horizontal Integration: – Friendly Mergers: Voluntary agreements where both parties agree to combine their operations. – Hostile Takeovers: Acquiring a company against its will through a majority shareholder vote or other means. – Strategic Alliances: Collaborative agreements where companies work together in specific areas without full mergers. |

| Real-World Application | Horizontal Integration is common in sectors like technology, healthcare, media, and consumer goods. For example, in the tech industry, companies often acquire competitors or complementary businesses to expand their product portfolios and customer base. |

Horizontal integration, just like vertical integration can happen in several ways. Companies willing to expand will do that by either using their internal resources to take more space within the same part of the supply chain and within the same industry (internal expansion).

Or they might merge, by forming a single entity. Or through acquisition.

When and why horizontal expansion makes sense?

Horizontal expansion can happen for several reasons:

Limiting competition

In some cases, companies look to dominate specific segments of a market, to retain a competitive advantage, for longer.

Growth and expansion

Horizontal integration can shortcut the growth and expansion within the same industry.

Economies of scale

In theory, horizontal integration might help the merged companies to benefit from economies of scale.

Survival

In other cases, horizontal acquisition also helps in surviving a market getting increasingly competitive.

What are the potential drawbacks of horizontal integration?

Market monopolies

Horizontal integrations can limit competition, at the point of creating monopolies, which overall might reduce the options for consumers.

On the other hand, they also raise regulatory concerns.

Diseconomies of scale

While in theory horizontal integration can create economies of scale, in practice, from integrating two different groups in he same industry can also lead to the opposite, effect, diseconomies of scale.

Cultural clashes

The hardest part of integrating or merging companies, might be about really making it work from a cultural standpoint.

And as horizontal integration usually works by creating a new, larger group.

This renewed scale might cause cultural clashes, which are hard to overcome.

Horizontal integration case studies

Let’s see a set of horizontal integrations happened in the digital era, which might help us understand how the process has been used by current market players to expand, defend or redefine their business models.

Uber Eats’ acquisition of Postmates to stay competitive in the meal delivery industry

Uber Eats is among the largest players in the meal delivery industry. Launched by Uber, it gained traction quickly, and it became among the largest players in the US.

In July 2020, Uber announced a multi-billion dollar deal, which would enable it to be among the largest players as a result of the consolidation happening in the meal delivery industry, which leads us to the next example.

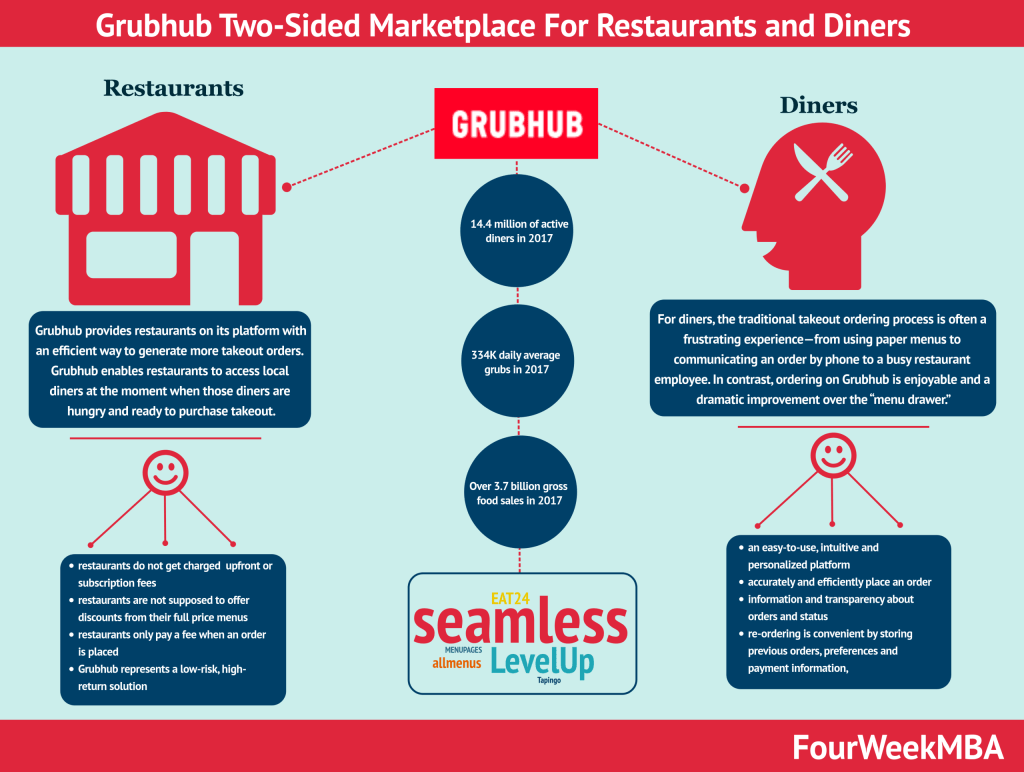

The merger between GrubHub and JustEat to create one of the largest meal delivery players on earth

In June 2020, GrubHub and JustEat merged in a deal worth over seven billion dollars to create one of the largest meal delivery players in the world.

The deal happened after Uber had been looking into the possibility of acquiring GrubHub.

That raised concerns as it would have created a monopoly in the US. At the same time, GrubHub and Uber might have not found a deal given their cultural differences.

As the deal slipped, the merger between GrubHub and JustEat got finalized.

TikTok’s acquisition of Musical.ly and its rebranding

In 2017, TikTok acquired Music.ly, and by 2018, it rebranded it within its own app to create a single platform, which scaled exceptionally quickly.

TikTok, therefore, used the acquisition of Music.ly to expand quickly.

Facebook acquired Instagram and kept it as the independent product (for a few years)

Back in 2012, Facebook acquired Instagram for a billion dollars.

What seemed expensive at the time for a mobile app that wasn’t profitable, became among the most valuable products for the Facebook portfolio.

At the time, Facebook opted for a multi-product strategy (for the first time), where Instagram was left as an independent product of the Facebook family, free to develop on its own and by slowly integrating it into the Facebook ecosystem.

Yet, over the years, Facebook tightened its clasp over Instagram, and it became part of its advertising platform. Today Instagram is the product that makes most of the revenues for Facebook, as it successfully converted to mobile.

In addition, thanks to Instagram, Facebook also managed to thrive in the coming wave of social media apps. Where Facebook had to convert its website to mobile, and it took a few years. Instagram was native to that!

Google’s acquisition of YouTube

When back in 2006, Google acquired YouTube for $1.65 billion, which seemed a disproportionate amount for a company that was so young and which burned cash at high speed.

However, since YouTube’s growth had been skyrocketing, Google tried to launch its own video division, called Google Video, yet it didn’t work.

The Google acquisition of YouTube is a great example of horizontal integration, where the company acquired a valuable asset to expand its presence in an existing market.

When the web finally moved from text to videos, Google found itself extremely well-positioned to take advantage of that!

Today, YouTube is an incredible advertising machine, which generated almost $30 billion in 2021, thus probably giving it a valuation of anywhere between $300-500 billion!

The Walt Disney Company and Pixar Animation Studios

The Walt Disney Company acquired Pixar Animation Studios in 2006 in an all-stock deal worth $7.4 billion.

The deal was part of a broader move by Disney to acquire brand-name properties and reinvigorate the company’s lackluster animation capabilities, which became less competitive as the industry went more digital.

Pixar had neither Disney’s legacy nor its brand value. But what it did possess was the technology and expertise to produce modern animation films.

The merger proved to be one of the most successful examples of horizontal integration.

Disney increased its market share and profit by combining its strong storytelling heritage with Pixar’s innovations.

United Airlines and Continental Airlines

United Airlines (then UAL Corporation) merged with Continental Airlines in an all-stock deal valued at $8.5 billion in 2010.

The merger of two of the world’s premier airlines enabled the new company to be more competitive in a dynamic and crowded aviation industry.

The resultant airline, known as United Airlines, offered services to four continents from ten hubs across the United States.

The merger also allowed United Airlines to offer enhanced services to business customers in small and medium-sized communities.

Arcelor and Mittal

Indian company Mittal Steel merged with Arcelor of Luxembourg in 2006 in a deal worth €26.9 billion.

As part of the merger, the new company would incorporate Mittal’s steel plants across four different continents and several low-cost facilities in Mexico, Kazakhstan, and the Czech Republic.

These facilities would be combined with Arcelor’s predominantly western European mills that specialized in high-grade steel production for the automotive industry

Then chairman of Arcelor Mittal Joseph Kinsch noted that the deal would create “global leadership in steel” in terms of value and tonnage.

Indeed, the new company would become a behemoth with three times the capacity of second-placed rival Nippon Steel and a 10% global market share.

Exxon and Mobil

The $75.3 billion merger of Exxon and Mobil in 1998 was, at the time, the largest merger in corporate history.

The heavily scrutinized deal gave Exxon access to Mobile’s gas stations and oil reserves, but it was also driven by a need to cut costs since an excess of crude oil had forced prices to rock-bottom levels.

Nevertheless, the merger reunited two of the most significant parts of John D. Rockefeller’s Standard Oil monopoly that was broken up by regulators in 1911.

With $203 billion in revenue, ExxonMobil became the largest corporation in the world and surpassed Shell as the largest privately-owned oil and gas company.

Smaller gasoline operators objected to the proposed merger, particularly in states such as Connecticut where Exxon and Mobile owned around 40% of all service stations.

Environmentalists were also concerned that the new company would intensify its exploration activities and exacerbate global warming.

Case Studies from the Tech Industry

- Facebook, Inc.:

- Description: Facebook has pursued horizontal integration by acquiring and integrating various social media platforms and digital services into its ecosystem.

- Method: Facebook’s acquisitions include Instagram, WhatsApp, and Oculus VR, among others. By integrating these platforms into its core offerings, Facebook expands its user base, enhances engagement, and diversifies its revenue streams. For example, Instagram’s photo-sharing platform complements Facebook’s social networking service, while WhatsApp provides messaging and communication tools.

- Implication: Facebook’s horizontal integration strategy allows it to consolidate its position as a dominant player in the social media and digital communication market. By acquiring complementary services and integrating them into its ecosystem, Facebook strengthens its competitive advantage and maintains relevance in an evolving digital landscape.

- Alphabet Inc. (Google):

- Description: Alphabet, Google’s parent company, has pursued horizontal integration by expanding its portfolio of products and services across various industries.

- Method: Google’s acquisitions include companies like YouTube (video-sharing platform), Waze (navigation app), and Nest Labs (smart home devices). By integrating these services into its ecosystem, Google enhances its offerings and captures new market opportunities. For example, YouTube complements Google’s search and advertising business, while Waze provides real-time navigation and traffic information.

- Implication: Alphabet’s horizontal integration strategy allows it to diversify its revenue streams and extend its reach into adjacent markets. By acquiring companies with complementary products and services, Alphabet strengthens its position as a leading provider of digital services and maintains innovation across multiple industries.

- Microsoft Corporation:

- Description: Microsoft has pursued horizontal integration by expanding its portfolio of software products, cloud services, and digital platforms.

- Method: Microsoft’s acquisitions include LinkedIn (professional networking), GitHub (software development platform), and Minecraft (gaming). By integrating these services into its ecosystem, Microsoft enhances its productivity tools, developer resources, and gaming experiences. For example, LinkedIn complements Microsoft’s enterprise offerings, while GitHub provides tools for software developers.

- Implication: Microsoft’s horizontal integration strategy allows it to broaden its product portfolio and address diverse customer needs. By acquiring companies with complementary expertise and technologies, Microsoft strengthens its position in key markets and drives innovation across its ecosystem.

- Amazon.com, Inc.:

- Description: Amazon has pursued horizontal integration by expanding its e-commerce platform to include a wide range of products and services, as well as diversifying into various industries.

- Method: Amazon’s acquisitions include companies like Whole Foods Market (grocery retail), Ring (home security), and Twitch (live streaming). By integrating these services into its ecosystem, Amazon enhances its offerings and captures new market segments. For example, Whole Foods Market complements Amazon’s online retail business, while Twitch provides a platform for gamers and content creators.

- Implication: Amazon’s horizontal integration strategy allows it to diversify its revenue streams and enter new industries. By acquiring companies with complementary capabilities and customer bases, Amazon strengthens its position as a leading provider of e-commerce, cloud computing, and digital services.

- Apple Inc.:

- Description: Apple has pursued horizontal integration by expanding its ecosystem of products and services to include devices, software, digital content, and services.

- Method: Apple’s acquisitions include companies like Beats Electronics (audio products), Shazam (music identification), and Texture (digital magazine subscription service). By integrating these services into its ecosystem, Apple enhances the user experience and expands its offerings. For example, Beats Electronics complements Apple’s hardware lineup with premium audio products, while Shazam enhances the music discovery experience for users.

- Implication: Apple’s horizontal integration strategy allows it to strengthen its ecosystem of products and services and enhance customer loyalty. By acquiring companies with unique capabilities and content, Apple enriches its offerings and reinforces its position as a leader in consumer electronics and digital services.

- Salesforce.com, Inc.:

- Description: Salesforce has pursued horizontal integration by expanding its cloud-based CRM platform to include a wide range of business applications and services.

- Method: Salesforce’s acquisitions include companies like Tableau Software (data visualization), Slack Technologies (collaboration software), and MuleSoft (integration platform). By integrating these services into its platform, Salesforce enhances its capabilities and provides comprehensive solutions for businesses. For example, Tableau Software complements Salesforce’s analytics offerings, while Slack Technologies enhances communication and collaboration for teams.

- Implication: Salesforce’s horizontal integration strategy allows it to expand its portfolio of products and services and address diverse customer needs. By acquiring companies with complementary expertise and technologies, Salesforce strengthens its position as a leading provider of cloud-based business solutions.

Key Highlights:

- Definition and Examples: Horizontal integration involves merging or acquiring companies operating at the same level of the supply chain and within the same industry. Examples include manufacturers merging with other manufacturers in the same industry.

- Methods: Horizontal integration can occur through internal expansion (using internal resources to grow) or external expansion through mergers and acquisitions.

- Reasons for Horizontal Expansion:

- Limiting Competition: Dominating specific market segments to maintain a competitive advantage.

- Growth and Expansion: Faster growth within the same industry by joining forces.

- Economies of Scale: Gaining cost advantages through increased production efficiency.

- Survival: Staying competitive in a challenging market environment.

- Drawbacks:

- Market Monopolies: Reducing competition and potentially creating monopolies, limiting consumer choices.

- Diseconomies of Scale: Becoming too large, leading to inefficiencies and increased costs per unit.

- Cultural Clashes: Challenges in integrating and aligning the cultures of merged companies.

- Case Studies:

- Uber Eats and Postmates: Uber Eats acquired Postmates to consolidate its position in the meal delivery industry.

- GrubHub and JustEat: Merger created a major player in the meal delivery sector.

- TikTok and Musical.ly: TikTok’s acquisition of Musical.ly facilitated rapid expansion.

- Facebook and Instagram: Facebook’s acquisition of Instagram led to strategic integration and revenue growth.

- Google and YouTube: Google’s acquisition of YouTube capitalized on the rise of video content.

- Disney and Pixar: The merger combined storytelling with technology to revitalize animation.

- United Airlines and Continental Airlines: Merging enhanced competitiveness and service offerings.

- Arcelor and Mittal: Combined companies’ strengths for global leadership in steel production.

- Exxon and Mobil: Largest merger at the time, driven by cost-cutting and market dominance.

- Outcomes:

- Horizontal integration can lead to increased market share, cost efficiencies, and enhanced competitiveness.

- Successful integration requires addressing challenges like cultural differences and regulatory concerns.

- Companies that effectively integrate horizontally can gain access to new markets, technology, and customer bases.

Case Studies

| Context | Description | Implications | Examples |

|---|---|---|---|

| Media and Entertainment | Media conglomerates often engage in horizontal integration by acquiring other media companies, such as film studios, television networks, and publishing houses. This allows them to control content creation, distribution, and broadcasting. | – Expands content portfolio and audience reach. – Increases bargaining power with advertisers and distributors. – Enhances cross-promotion and synergy among media properties. | The Walt Disney Company’s acquisition of 21st Century Fox was a major horizontal integration move, consolidating film, television, and content production under one umbrella. |

| Retail | Retail chains may pursue horizontal integration by acquiring or merging with competitors in the same retail sector. This strategy can lead to increased market share, cost savings, and a broader customer base. | – Gains access to a larger customer base and geographic markets. – Achieves economies of scale in purchasing and supply chain management. – May lead to store closures or rebranding efforts. | Walmart’s acquisition of various retail chains, including Asda in the UK and Jet.com in the U.S., demonstrates horizontal integration in the retail industry. |

| Technology and Software | Technology companies may engage in horizontal integration to expand their product offerings and gain access to new technologies. Acquiring companies with complementary products or services can enhance their competitive position. | – Diversifies product portfolio and revenue streams. – Increases customer value through integrated solutions. – Can lead to challenges in integrating different technology platforms. | Microsoft’s acquisition of LinkedIn is an example of horizontal integration, combining Microsoft’s software products with LinkedIn’s professional networking platform. |

| Pharmaceutical and Healthcare | Pharmaceutical companies often pursue horizontal integration by acquiring other pharmaceutical firms or biotechnology companies. This allows them to expand their drug portfolio, access new markets, and accelerate research and development. | – Enhances drug pipeline and research capabilities. – Expands market presence and global reach. – May result in regulatory hurdles and integration challenges. | Pfizer’s acquisition of Wyeth is an example of horizontal integration in the pharmaceutical industry, combining their drug portfolios and research capabilities. |

| Fast Food | Fast-food chains may engage in horizontal integration by acquiring or merging with other fast-food brands. This can lead to a larger market share, greater operational efficiencies, and access to new customer segments. | – Increases brand presence and customer loyalty. – Streamlines supply chain and operations management. – May involve rebranding or co-branding efforts. | Yum! Brands, the parent company of KFC, Taco Bell, and Pizza Hut, demonstrates horizontal integration in the fast-food industry by owning multiple popular fast-food chains. |

| Automotive | Automotive manufacturers may pursue horizontal integration by acquiring or partnering with other automotive companies. This strategy can expand their product range, improve economies of scale, and share research and development costs. | – Offers a broader range of vehicles and technologies to customers. – Enhances operational efficiency and cost savings. – Can lead to brand consolidation or platform sharing. | Fiat Chrysler Automobiles (FCA) merged with Peugeot S.A. (Groupe PSA) to form Stellantis, a major automotive company, demonstrating horizontal integration in the industry. |

| Financial Services | Financial institutions sometimes engage in horizontal integration by acquiring other banks or financial firms. This can lead to a larger customer base, a broader range of financial products, and increased market presence. | – Expands product offerings and geographic reach. – Increases customer loyalty and cross-selling opportunities. – Requires regulatory compliance and integration of diverse financial systems. | JPMorgan Chase’s acquisition of Bear Stearns and Washington Mutual during the financial crisis exemplifies horizontal integration in the financial services sector. |

| Airlines and Aviation | Airlines may pursue horizontal integration by merging with or acquiring other airlines. This can lead to route network expansion, cost savings through fleet consolidation, and increased bargaining power with suppliers. | – Enhances route network and connectivity options. – Achieves cost savings through fleet consolidation and synergies. – May involve rebranding and integration of airline operations. | Delta Air Lines’ acquisition of Northwest Airlines is an example of horizontal integration in the airline industry, resulting in an expanded route network and improved operational efficiency. |

| Energy and Utilities | Energy companies often engage in horizontal integration by acquiring or merging with other energy firms. This can lead to increased energy production, distribution capabilities, and market share in the energy sector. | – Enhances energy production and distribution capacity. – Improves resilience and competitiveness in the energy market. – Requires regulatory approvals and management of diverse energy assets. | ExxonMobil’s acquisition of XTO Energy demonstrates horizontal integration in the energy industry, combining ExxonMobil’s resources with XTO’s expertise in unconventional natural gas production. |

| Food and Beverage | Food and beverage companies may pursue horizontal integration by acquiring or merging with other companies in the same industry. This strategy can lead to a more extensive product portfolio, improved distribution networks, and cost efficiencies. | – Diversifies product range and distribution channels. – Achieves economies of scale in production and marketing. – May involve brand consolidation or co-branding efforts. | The Coca-Cola Company’s acquisition of Costa Coffee is an example of horizontal integration in the food and beverage industry, expanding Coca-Cola’s product offerings in the coffee segment. |

What is horizontal integration with example?

Horizontal integration is the process of expanding the presence of company within a market by integrating at the same level of a supply chain. Take the example of Google taking over YouTube, thus expanding its market shares in the video segment. Or Facebook acquiring Instagram to horizontally cover more in the same space.

What are vertical and horizontal integrations?

Whereas in horizontal integration a company expands by acquiring other companies that move in the same space of the supply chain. In vertical integration the company moves either upstream or downstream to cover more parts of that supply chain. Take the case of Google, which in 2017, acquired a chunk of HTC’s smartphone division so it would get into the manufacturing of hardware to serve its market.

Connected Economic Concepts

Positive and Normative Economics

Main Free Guides: