Uber is a multi-sided marketplace, a platform business model that connects drivers and riders. It has an interface with gamification elements that make it easy for two sides to connect and transact. Uber has three main segments: mobility, freight (both are two-sided marketplaces), and delivery (a three-sided platform). Uber makes money by collecting fees from the platform’s gross bookings. In 2022, Uber generated over $31.87 billion in revenues, mostly from mobility, delivery (Uber Eats), and freight.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Uber’s value proposition is built on several key elements: – Ride-Hailing: Provides convenient, on-demand transportation services. – Uber Eats: Offers food delivery with a wide range of restaurant options. – Safety and Reliability: Ensures safety through driver background checks and tracking. – Cashless Payments: Enables cashless and secure transactions through the app. – Convenience: Allows users to book rides and order food with ease. Uber enhances mobility, convenience, and safety while offering multiple services through its platform. | Provides accessible and convenient transportation services. Offers a range of services to cater to diverse needs. Prioritizes safety and reliability through background checks and tracking. Simplifies payments with cashless options. Enhances user experience by offering convenience and accessibility. Attracts users seeking reliable transportation and food delivery. | – Accessible ride-hailing and food delivery services. – Ensuring safety through background checks and tracking. – Offering cashless payment options. – Prioritizing convenience and accessibility for users. – Attracting users looking for reliable transportation and food delivery. |

| Customer Segments | Uber serves diverse customer segments, including: 1. Riders: Individuals seeking convenient transportation. 2. Drivers: Individuals looking to earn income through driving. 3. Restaurants: Food establishments partnering with Uber Eats. 4. Businesses: Companies using Uber for Business for employee travel. 5. Delivery Partners: Individuals delivering food orders. Uber caters to various user types and industries, expanding its services. | Addresses the transportation needs of individuals and businesses. Provides income opportunities for drivers and delivery partners. Collaborates with restaurants to expand food delivery options. Offers corporate solutions for employee travel. Diversifies offerings to accommodate a broad range of users and industries. | – Meeting the transportation needs of individuals and businesses. – Providing income opportunities for drivers and delivery partners. – Collaborating with restaurants to expand food delivery. – Offering corporate solutions for employee travel. – Diversifying offerings for a broad range of users and industries. |

| Distribution Strategy | Uber’s distribution strategy includes several key elements: – Mobile App: Provides a user-friendly mobile app for booking rides and food delivery. – Partner Network: Collaborates with drivers, restaurants, and businesses. – Global Reach: Offers services in numerous countries and cities worldwide. – Marketing and Promotions: Utilizes targeted promotions and incentives. Uber ensures accessible booking through its app, collaborates with partners for service availability, operates globally, and attracts users with marketing efforts. | Provides accessible and user-friendly booking through the mobile app. Collaborates with a network of partners for service availability. Expands services worldwide, catering to diverse markets. Utilizes marketing and promotions to attract and retain users. Prioritizes accessibility, global reach, and user engagement through distribution channels. | – Offering a user-friendly mobile app for booking. – Collaborating with a network of partners. – Expanding services worldwide to diverse markets. – Utilizing marketing and promotions to attract users. – Prioritizing accessibility, global reach, and user engagement in distribution. |

| Revenue Streams | Uber generates revenue from various sources: 1. Ride-Hailing Fees: Charges riders for trips and takes a commission from drivers. 2. Uber Eats Fees: Takes a portion of the total food order value. 3. Uber for Business: Charges companies for employee travel solutions. 4. Advertising: Earns income through in-app advertising. 5. Subscription Services: Offers subscription plans for frequent users. Uber diversifies income through ride fees, food delivery fees, corporate solutions, advertising, and subscription services. | Relies on revenue from ride fees and food delivery fees as primary income sources. Expands income potential through corporate solutions and advertising. Offers subscription plans for user loyalty and recurring revenue. Diversifies income sources for financial stability. | – Earnings from ride fees and food delivery fees. – Generating income through corporate solutions and advertising. – Offering subscription plans for user loyalty and recurring revenue. – Diversifying income sources for financial stability. |

| Marketing Strategy | Uber’s marketing strategy focuses on the following elements: – User Promotions: Offers discounts and promotions to attract and retain users. – Referral Programs: Encourages users to refer others with incentives. – Local Marketing: Adapts marketing efforts to local markets and cultures. – Social Media: Utilizes social media for brand visibility and engagement. Uber promotes user incentives, referrals, local relevance, and social media engagement to attract and retain a broad user base. | Attracts users with discounts, promotions, and referral incentives. Adapts marketing strategies to local markets for relevance. Engages users through social media for brand visibility. Prioritizes elements that enhance user acquisition and retention. | – Offering discounts, promotions, and referral incentives. – Adapting marketing to local markets for relevance. – Utilizing social media for brand visibility and engagement. – Prioritizing elements that enhance user acquisition and retention. |

| Organization Structure | Uber’s organizational structure includes: – CEO and Leadership Team: Led by the CEO responsible for strategic direction. – Operations: Manages day-to-day operations and service delivery. – Technology: Focuses on app development and platform improvements. – Marketing and Growth: Drives user acquisition and engagement efforts. – Finance and Legal: Manages financial and legal matters. Uber’s structure emphasizes innovation, technology development, user growth, and operational efficiency. | Led by a CEO responsible for strategic direction and decision-making. Divides operations into specialized functions for efficiency. Prioritizes technology development and user acquisition for growth. Manages financial and legal aspects effectively. Supports Uber’s strategic goals and industry leadership. | – Led by a CEO for strategic direction and decision-making. – Dividing operations into specialized functions for efficiency. – Prioritizing technology development and user acquisition for growth. – Managing financial and legal aspects effectively. – Supporting strategic goals and industry leadership. |

| Competitive Advantage | Uber’s competitive advantage arises from: – Extensive Network: Operates in numerous countries and cities worldwide. – User Base: Attracts a large and diverse user base. – Service Variety: Offers both ride-hailing and food delivery services. – App Technology: Provides a user-friendly and reliable mobile app. – Brand Recognition: Enjoys high brand visibility globally. Uber stands out with its vast network, user base, service variety, app technology, and brand recognition. | Boasts an extensive global network for service availability. Attracts and retains a diverse user base with multiple services. Offers a user-friendly app for convenient booking. Enjoys high brand visibility and recognition. Maintains a strong competitive position in the ride-hailing and food delivery industries. | – Operating in numerous countries and cities worldwide. – Attracting a large and diverse user base. – Offering a variety of services. – Providing a user-friendly and reliable mobile app. – Enjoying high brand visibility and recognition globally. – Maintaining a strong competitive position in the industry. |

Uber Business Model Short Description

We describe the Uber business model via the VTDF framework developed by FourWeekMBA.

| Uber Business Model | Description |

| Value Model: Flexible Mobility. |

The company’s mission is “to ignite opportunity by setting the world in motion.” The ambition of Uber’s business strategy emphasized first creating a whole new mass market for mobility and, by doing so, becoming the primary middleman (a platform that connects the leading mobility players).

|

| Technological Model: Two-Sided/Three-Sided Network Effects. |

Uber’s leading platform enjoys two-sided network effects. More drivers joining the platform makes it (to a certain extent) more valuable for riders (as they can find more route options, more pricing options, and lower wait times). Uber Eats enjoys three-sided network effects, where the dynamics between restaurants, drivers, and eaters make the platform more valuable for each, as each additional user type joins the platform.

|

| Distribution Model: Branding/Growth Hacking, Deal Making, Lobbying. |

Uber’s distribution leverages a strong brand/infrastructure built over the years, thanks to a smooth app and a vast network of drivers worldwide. As the company operates in a highly regulated segment, it also had to learn the “lobbying playbook” to connect with local and national policymakers to stabilize the service worldwide.

|

| Financial Model: Platform’s Tax. |

Uber’s platform consists of three main parts: mobility, delivery, and freight. Each of these sub-platforms enables many billions of gross bookings. Each booking on the platform collects a small tax, which is used to maintain, grow, and market the platform to more users.

|

Uber Business Model in 2023

Uber’s business model has substantially changed over the pandemic.

Yet, as the pandemic slowed, Uber’s core business model kept shifting again toward mobility.

The delivery platform (Uber Eats) is an important part of the overall business model, comparable to the mobility platform.

And the interesting part is that Uber is now a three-headed company, comprising both ride-sharing and delivery and freight as two core segments.

As Uber went through some structural changes that are worth highlighting before breaking it down in its entirety:

- The Mobility platform is again the core of the business even though delivery has also become a key segment: if we look at the growth of the mobility platform vs. the delivery platform, we can see how in 2021, the delivery platform grew at a 114% rate, compared to just the 14.2% of the mobility platform. This has been the effect of the pandemic, which has quickly transformed the food delivery business model into one of the most exciting areas for the company. Yet, it’s important to highlight that the mobility (ride-sharing) platform is the underlying infrastructure that enabled Uber to build other business segments. And as the pandemic slowed down, the mobility platform grew again at a double-digit rate. In 2023, while the mobile platform is back on track to be the most important segment, Uber Eats has also become vital to the company’s business model.

- The mobility platform is the one that runs at positive margins and is much wider. If we look at the EBITDA for the company, in 2022, the mobility platform generated $1.59 billion vs. the losses of the other segments. It’s important to remark that the other segments are also relatively new investment areas for Uber. Therefore it might take some time for them to get consolidated into the overall business model.

- Uber Eats and investments in further expanding the delivery business: the delivery business has become the most interesting part for Uber. So much so that by 2022 the revenues from the delivery business represented about 44% of the company’s total revenues. In 2022, Uber kept consolidating its position in the delivery business. Uber first tried to buy DoorDash in 2020, but it failed. Uber Eats today is one of the most exciting segments for the company.

- Uber Freight has been the fastest-growing segment for the company in 2022, growing at a 2x rate! Also, here, Uber leverages the existing platform to connect carriers with shippers and gives carriers upfront, transparent pricing and the ability to book a shipment.

As of 2022, Uber is a much more complex and interesting platform than just a few years ago.

The history of Uber

As Dara Khosrowshahi, CEO of Uber pointed out in its financial prospectus.

Uber started at a specific moment in the business world.

The “rise of smartphones, the advent of app stores, and the desire for on-demand work supercharged Uber’s growth and created an entirely new standard of consumer convenience.”

Some context below:

Uber is the very definition of a disruptor. The company, which at one point was the most valuable private startup in the world, has revolutionized the way consumers hail a ride, order takeout from their favorite restaurant, and even earn a living.

With its various transportation and delivery services now available in more than 10,500 cities across 72 countries, it is sometimes easy to forget that Uber started as a humble startup selling limousine rides.

One simple idea

It is December 2008, and friends Travis Kalanick and Garrett Camp are attending the LeWeb technology conference in Paris.

Both men were entrepreneurs cashed up after recently selling their respective startups.

One night during the conference, the two could not find a cab in the middle of a snowstorm.

Kalanick credits Camp with the idea for Uber, which at that time consisted of a rideshare limousine service that could be requested from a smartphone app.

UberCab

Kalanick and Camp went their separate ways after the conference, but the latter remained interested in the idea and started work on a prototype with friends Conrad Whelan and Oscar Salazar while he was still CEO of StumbleUpon.

Camp purchased the domain name UberCab.com and convinced Kalanick to come on board as a chief incubator.

In early 2010, the app was tested in New York City with three vehicles, and an official launch was held in San Francisco a few months later.

The service, which was initially more expensive than a traditional taxi, was nevertheless popular in the city among tech employees.

UberCab then became known as Uber after the founders realized that it was not a cab company in the traditional sense.

Around this time, Uber hired its first employee Ryan Graves with a now-infamous tweet from Kalanick explaining that he was looking for a product manager.

Expansion and funding

In May 2011, Uber expanded into New York City and was met with resistance and criticism from the city’s established taxi industry.

Uber then became available in Paris in December as an almost ceremonious nod to the place where it had all started three years earlier.

In the same month, at the 2011 LeWeb technology conference, Kalanick announced a Series B funding round worth $37 million with Jeff Bezos and Goldman Sachs among the backers.

The company launched UberX in July 2012 to open up the platform to non-limousine vehicles such as the Cadillac Escalade and Toyota Prius Hybrid.

This would mark the first time the company would seek out drivers using their own vehicles as transportation.

Perhaps more significantly, UberX would eventually expand into other vehicle models and other forms of transportation, such as scooters and bikes.

In August 2013, Uber expanded into Africa and India with a Series C funding round worth $258 million.

The following year, the first Uber ride was hailed in China – which may prove to be Uber’s largest market in the future.

Recapping the Uber history

- Uber was, at one point, the most valuable startup in the world and has now revolutionized how consumers hail a ride, order takeout, and even earn a living.

- The idea for the company came after co-founders Garrett Camp, and Travis Kalanick struggled to hail a cab in a snowstorm during a tech conference in Paris. Camp and two friends developed a prototype app for a service that would be known as UberCab.

- Uber gained early traction with tech employees after officially launching in San Francisco in 2010. Uber became available in New York City and Paris in 2011 and then in other countries in 2012 and 2013. The launch of UberX signaled a turning point for Uber as it allowed drivers to use their non-luxury vehicles.

What’s so special about Uber?

Bill Gurley Bill Gurley, general partner at Benchmark and an early investor in Uber, pointed out what he thought was its best feature:

no driver-partner is ever told where or when to work

And he continued:

This is quite remarkable — an entire global network miraculously “level loads” on its own. Driver-partners unilaterally decide when they want to work and where they want to work. The flip side is also true — they have unlimited freedom to choose when they do NOT want to work. Despite the complete lack of a “driver-partner schedule” this system delivers pick-up times that are less than 5 minutes (in most US cities (with populations over 25K) and in 412 cities in 55 other countries.

In short, Uber has been able to build with an invisible hand a global network able to “manage” bottom-up and with no such thing as a “schedule”!

Uber vision

Becoming a top urban mobility platform is part of Uber’s ultimate vision as pointed out by Uber:

We see the Uber app as moving from just being about car sharing and car hailing to really helping the consumer get from A to B int he most affordable, most dependable, most convenient way,

When acquiring a bike-sharing company called Jum, Uber specified:

Our ultimate goal is one we share with cities around the world: making it easier to live without owning a personal car. Achieving that goal ultimately means improving urban life by reducing congestion, pollution and the need for parking spaces.

Its core principles are:

- Expanding access.

- Delivering reliability.

- Providing choice.

- Aligning needs.

- Being upfront.

These elements give us a first glance at Uber’s long-term direction.

Uber value proposition

Uber’s value proposition was born on the need to make up for the scarcity of cab drivers and the inefficiencies of urban mobility.

Therefore, Uber attracts two key players:

- Drivers.

- And riders.

Let’s start with Uber’s first side of the marketplace, its drivers.

In a series of posts from Uber’s blog entitled “Why I drive,” several drivers explain why they do it. For instance, Susan explains:

It’s fun. It’s flexible. And it’s profitable!

Kevin instead explains:

I enjoy the flexibility it offers to me the ability to work whenever and however often you want

Calvin explains:

I love the freedom I have to work when I can, and make as much or as little as I need. Meeting different people everyday makes this more enjoyable. It’s the best business opportunity I have ever had. Thank you, Uber!

Thus, even though several drivers find different reasons to drive with Uber, there is a common thread which is a part-time “job” that provides supplemental income and flexibility to work any time without a boss.

While this value proposition seems compelling, as pointed out by earnest.com, about 84% of Uber drivers make anywhere between $0-499 per month, while only 2% make anywhere between $1500-1999 per month.

The ability to generate enough revenues for drivers to get back is a crucial ingredient to Uber’s success.

This is also why Uber tries hard to get drivers constantly. This need for drivers also fueled other business models, like HyreCar.

Related: How Does HyreCar Make Money? HyreCar Business Model In A Nutshell

On the other hand, when it comes to riders, Uber offers a few key elements that make up a unique value proposition that apply to most of them.

First, as urban dwellers have kept growing, the cost of ownership of a car has become higher and too expensive to bear.

In this respect, giving up car ownership has become a no-brainer in urban areas. This makes ride-sharing convenient.

Second, Uber and other apps like Lyft make it extremely easy to go anywhere with the least friction, thanks to their gamified marketplaces.

Another critical element for riders is safety. For instance, Uber now performs background checks on its drivers that comprise “felonies, violent crimes, sexual offenses, and registered sex offender status, among other types of criminal records” which automatically disqualify drivers from the platform.

Uber’s liquidity network effects

A two-sided marketplace has to have built-in mechanisms that allow network effects to pick up. This means that for each additional driver or rider joining the platform, it becomes better and better for the others joining next.

In Uber’s case, more drivers and riders have meant better pickup times, lower prices, better reviews of drivers, and increased revenues for the marketplace.

Uber tapped into inefficiencies created by misallocating supply and demand within the taxicab industry.

The more efficiencies Uber gains, the more appealing it becomes and the more revenues it grows.

Thus, Uber leverages the Liquidity Network Effects that aim at growing and broadening the network so that the company can capture higher margins in the long run.

Uber expanded market opportunities

Another key element is market expansion. Any successful two-sided marketplace will be able, at a particular stage, to expand market opportunities.

For Uber, in particular, the company taps into a few specific needs:

- Taxi Industry inefficiencies where the supply of cubs is limited at all times.

- Urban population growth and the impossibility of cities to keep up with car spaces.

- A growing number of people are willing to rent on demand rather than own a car.

When those needs are combined with a technological marketplace, it also generates several markets that before didn’t exist.

For instance, since Uber’s inception, a new need for cars for rent to make additional income over the platform has sparked new businesses.

Uber revenue model and pricing models

Uber makes money via a service fee that drivers pay. This service fee varies from trip to trip, representing the difference between what riders pay and what drivers earn once removed tips, tolls, and fees.

Uber covers several segments by offering different vehicles, with services like:

- Uber Black.

- UberX.

- Uber Pool.

Uber is also betting on other segments, such as:

- Uber Eats.

- Autonomous driving.

- Electric scooters.

Uber fees (take rates) range from 20% to 25% of the total amount the riders charges.

However, when it comes to taking rates we should distinguish between mobility (ride-sharing) and delivery (Uber Eats).

When it comes to ride-sharing, thanks to Uber’s much stronger market position, which dominates it, its take rates are higher. Indeed, in Q3 2022, take rates for Uber ride-sharing were 27.9%.

Instead, in the delivery segment, where Uber Eats got to compete for market share consolidations, take rates are slightly lower.

In Q2 2022, the take rate for Uber Eats was 20.2%.

Over time, as Uber Eats consolidates market shares, we can expect these take rates between mobility and delivery to balance out.

And potentially, in case the delivery business becomes larger than the mobility business, we might see even larger take rates for the delivery business.

The fares are calculated based on a few elements:

- A base rate.

- Rates for estimated time and distance of the route.

- The current demand for rides in the area.

Among the pricing models used by Uber, there are:

- Surge pricing.

- Upfront pricing.

- Route-based pricing.

Those strategies have several aims. With surge pricing, for instance, Uber can calibrate the demand and offering of rides to allow riders to pay more if they don’t want to way for a driver.

And at the same time, drivers can earn more if willing to move to “hot areas” when there is a surge in pricing.

With upfront pricing instead, the company shows the cost of a ride in advance.

As pointed out by Uber, riders feel confident taking trips when they have the information to make better decisions and drivers get more opportunities to earn.

Roud-pricing allows price adjustments on a route designed to expand access by making trips more affordable.

Uber dynamic pricing and surge pricing

Uber has used a particular kind of dynamic pricing called surge pricing.

This strategy has allowed Uber to match the demand and supply of rides and steadily repopulate its driver population, which has high churn rates.

It also works as a stimulus for drivers willing to make more money to move in certain areas.

For instance, in a classic case of surge pricing, Uber signals to drivers what area is experiencing them. So that drivers can go to that area and earn more.

When prices are surging, you’ll see a multiplier to the standard rates on the map. For example, you might see surge at 1.8x or 2.5x. This is how much your base fare will be multiplied by, so a fare that is usually $10 would be $18 when it’s at 1.8x Surge. Uber’s fee percentage does not change during surge pricing.

At a visual level, users can recognize surge areas based on the map’s change of color in specific neighborhoods.

Where areas that will go from orange to dark red going from standard pricing to multipliers:

Source: uber.com

How does Uber make money? Breaking down Uber’s revenue modelThe key operational metrics that Uber tracks are:

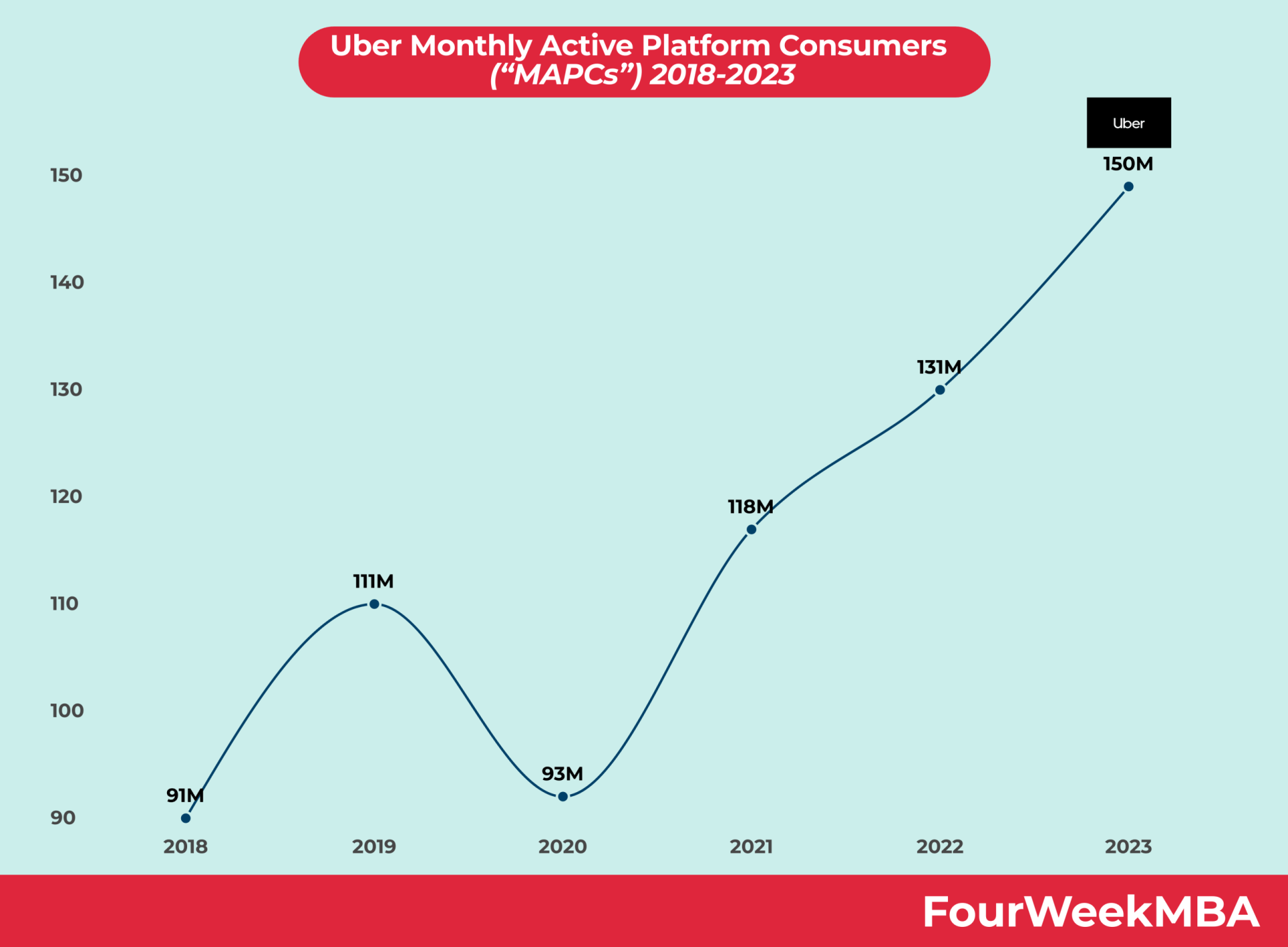

- MAPCs (Uber defines it as the number of unique consumers who completed a Rides or New Mobility ride or received an Eats meal on our platform at least once in a given month, averaged over each month in the quarter.).

- Trips (Uber defines it as the number of completed consumer Rides or New Mobility rides and Eats meal deliveries in a given period.).

- Gross Bookings (Uber defines it as the total dollar value, including any applicable taxes, tolls, and fees, of Rides and New Mobility rides, Eats meal deliveries, and amounts paid by Freight shippers, in each case without any adjustment for consumer discounts and refunds, Driver and Restaurant earnings, and Driver incentives.)

Uber’s agent revenue model

In generating revenues, Uber follows an agent model, where revenues come from fees paid by Drivers and Restaurants for the use of its platform.

The reason why Uber defines itself as an agent it’s because the platform does not provide the final service to customers, but “it arranges for other parties to provide the service to the end-user.”

As a classic platform business model, Uber connects consumers to drivers. And restaurants to consumers (Uber Eats).

In 2019, Uber made over $14 billion as an agent enabling rides and deliveries on its platform. And it lost over $8 billion from its operations.

The company acts as an agent in the transactions that happen through Uber.

Indeed, it connects the end-user with the proper ride-sharing or delivery service provision. As such, Uber makes money from three key areas:

- Core platform.

- Other bets.

The core platform revenues

- Ridesharing: Drivers’ revenues from service and booking fees for using the platform.

- Uber Eats revenues from service fees paid by restaurants and Drivers for its platform. The service fee is paid by both restaurants (a percentage of the meal price) and Drivers (the difference between the delivery fee amount paid by the consumer and the amount earned by the Driver).

- And others: revenues from the lease or rent of vehicles to third parties who could use these vehicles to provide Ridesharing or Uber Eats services through our platform. This revenue stream got mostly discontinued.

Other bets revenues

- Uber Freight: publicly launched in 2017, it generates revenue from its offerings from shippers that pay a pre-determined fee for each shipment to use Uber’s brokerage service.

- New Mobility: introduced in 2018. Revenue is generated through consumer fees for a ride on a dockless e-bike or e-scooter.

How will Uber make money in the future?

For the future, Uber is betting on a few potential revenue streams:

- Electric scooters.

- Bike-sharing.

- And autonomous vehicles.

In July 2018, Lime, a company whose mission is to “help people move around their cities affordably and conveniently while eliminating their carbon footprint,” announced a Series C financing round of $335 million led by Alphabet’s Google Ventures, which also involved Uber.

Interviewed on the deal Rachel Holt, Uber’s head of new modalities, specified, “Our investment and partnership in Lime is another step towards our vision of becoming a one-stop-shop for all your transportation needs.“

As part of a plan to cover all the possible transportation needs of people in the future, Uber acquired the dockless bike startup Jump in April 2018, which aligns with the vision of becoming the top urban mobility platform globally.

As specified on Uber’s blog:

we’re committed to bringing together multiple modes of transportation within the Uber app—so that you can choose the fastest or most affordable way to get where you’re going, whether that’s in an Uber, on a bike, on the subway, or more.

Among other visions, Uber also aims at “bringing safe, reliable self-driving transportation to everyone, everywhere.”

This is a bold claim, yet it would help Uber fix in one shot a critical element: automate rides and get rid of drivers.

Indeed, with its high-churn rate and difficulty in keeping up with supply and demand, self-driving might make the Uber business model way more sustainable.

Breaking down the Uber Eats business model

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner, and a customer with the Uber Eats platform at the center.

Uber Eats has become a key segment within Uber.

Indeed, Uber naturally positioned itself to solve the last-mile delivery problem and used its existing network and platform to launch Uber Eats, which gained traction quickly.

The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay small delivery charges and, at times, cancellation fees; Drivers earn through making reliable deliveries on time.

Uber Eats as a three-sided marketplace it connects three key players:

- Drivers.

- Restaurant owners.

- And customers.

With the Uber Eats platform at the center, the three-sided marketplace leverages the existing Uber platform to allow eaters to take advantage of the existing Uber infrastructure:

Source: Uber Engineering Blog

This model is very smart as it allowed Uber to enter another industry by leveraging its existing infrastructure, network effects, and community.

As noted in Uber Eats Business Model, the unit economics work in this way:

- Amount paid by YOU: $50 + $5 = $55

- The amount received by XYZ restaurant: $50 – (30% commission on order) = $35

- Delivery Charges: Pickup Fee + Delivery Fee + Per Mile Charges = $4 + $2 + ($2 x 3) = $12

- Net Revenue for Uber Eats = ($55 – $35) – $12 = $8

Last-mile problems and delivery wars

Uber Eats, thanks to the shared network effects of its mother company, Uber, managed to grow quickly in the US market, and according to some estimates it reached over 22% market shares of Meal Delivery by May 2020.

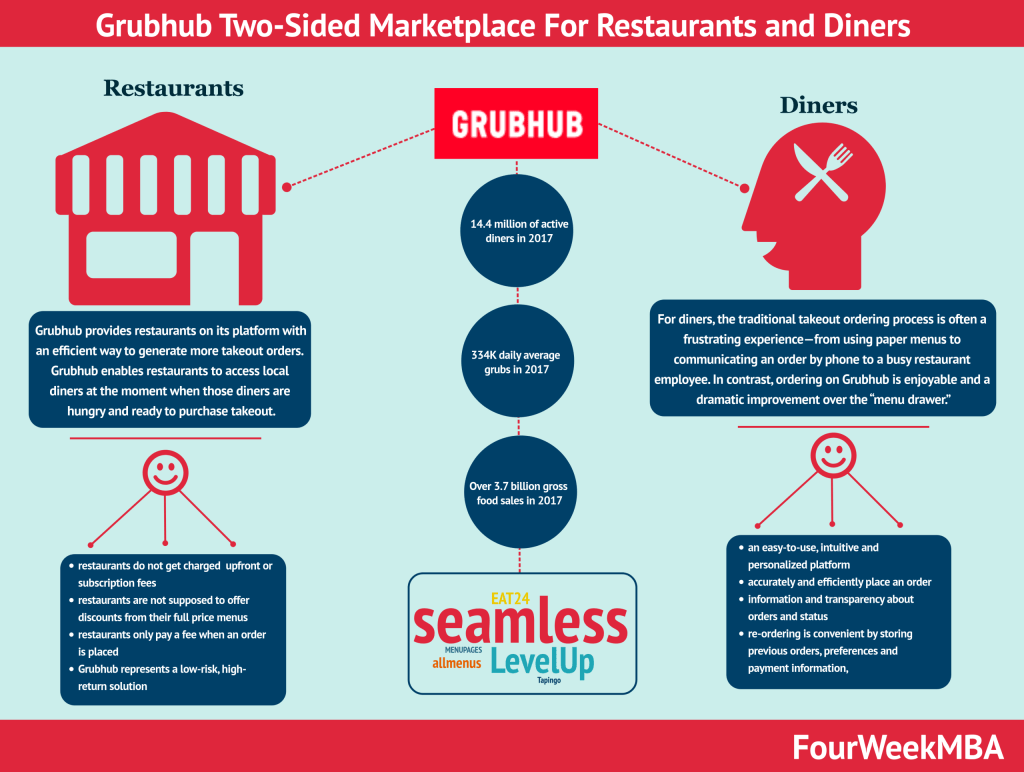

That brought Uber Eats head to head-with GrubHub. And in trajectory to reach the largest player, DoorDash. Thus, Uber attempted to overtake the US market by acquiring GrubHub.

Potentially the two players would have become the largest US player in the last-mile delivery food space (this raised some Antitrust concerns).

However, to Uber’s surprise, GrubHub closed a $7.3 billion-dollar deal with Just Eat to create the largest delivery firm outside China.

While this failed attempt might sound as a defeat, Uber Eats remain among the most interesting parts of the business, with an incredible growth potential.

And in July 2020, Uber agreed to buy Postmates (with an 8% market share in the US for meal delivery). With an all-stock transaction of $2.65 billion, Uber will further convert its business model to push toward consolidation in the meal delivery market.

Where Uber’s core business, in ride-sharing, has been suffering due to the pandemic. The same pandemic has created the perfect condition for the meal delivery service Uber Eats to thrive and grow.

Thus, now Uber is a three-headed company comprised of mobility, delivery, and freight!

What about Lyft?

While Lyft has been a strong competitor for Uber, over the years, the company has primarily stayed in the mobility space, where Uber has expanded to other areas.

From here, a massive divide between Uber and Lyft was created as an effect of the ability of Uber to expand its network effects beyond mobility.

Business Model Explorers

Visual Stories Related To the Uber Business Model

In 2022, Uber mobility took 27% of each booking on the platform. At the same time, Uber Eats took 20% of each booking on the delivery platform. The take rate varies according to demand and supply but also market dynamics. In short, in periods of increased competition, the service might charge lower take rates to keep up with it. In 2022, Uber pushed on efficiency, thus raising its take rates, to move toward profitability.

Uber Platform Users

![How Does Facebook [Meta] Make Money? Facebook Business Model Analysis 2024 facebook-business-model](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2024/02/facebook-business-model.png?resize=150%2C113&ssl=1)