One of the key elements of platform business models is their ability to create strong network effects.

One major issue when kicking off a platform from scratch is to create “liquidity.”

What is the business world is referred to as a “cold start problem.”

Indeed, network effects only become valuable after a certain threshold (which depends on the type of product and service offered).

Understanding network liquidity

As pointed out on Uber Financial Prospectus:

Our network becomes smarter with every trip. In over 700 cities around the world, our network powers movement at the touch of a button for millions, and we hope eventually billions, of people. We have massive network scale and liquidity, with 1.5 billion Trips and an average wait time of five minutes for a rider to be picked up by a Driver in the quarter ended December 31, 2018.

In order to trigger network effects, Uber needs to think in terms of nodes of a graph, rather than just customers. Indeed:

Every node we add to our network increases liquidity, and we intend to continue to add more Drivers, consumers, restaurants, shippers, carriers, and docklesse-bikesand e-scooters.

Looking at the future Uber will be widely investing in other areas as well:

We also hope to add autonomous vehicles, delivery drones, and vertical takeoff and landing vehicles to our network, along with other future innovations.

This means the ability to generate enough supply, which improves the service. Thus it generates even more demand.

Network effects marketing as a flywheel

This flywheel effect is the key to triggering the network effects needed to unlock growth.

As pointed out:

Our strategy is to create the largest network in each market so that we can have the greatest liquidity network effect, which we believe leads to a margin advantage.

Building a valuable network: beyond the cold start problem

Thus, Uber looks after a liquidity network, which allows it to create a competitive advantage, which over time becomes a margin advantage!

Source: Uber Financial Prospectus

Uber leverages liquidity network effects, which starts by creating driver’s supply, which determines lower wait times and fares for riders.

In turn, this attracts more riders.

Thus, with more riders per hour, there is a higher earning potential for drivers.

When this happens more drivers join the platform, thus making this network effect speed up.

That’s how Uber kicks off growth from its platform!

It’s important to notice, that initially, these network effects might take time to materialize.

Indeed, the hardest part, is the initial kick-off of network effects, valuable enough, to make a network liquid.

As explained in its financial prospectus:

Increasing scale, creating category leadership and a margin advantage.We can choose to use incentives, such as promotions for Drivers and consumers, to attract platform users on both sides of our network, which can result in a negative margin until we reach sufficient scale to reduce incentives.

Therefore, to focus on growth, Uber kicks off a market by eating up its margins, which become negative, until sufficient scale is reached.

At that stage, incentives are reduced.

Build-in subsidies to kick off local markets

The thing with Uber is that it’s not just a digital player.

It combines a digital platform and a strong physical presence, in a highly regulated industry.

Thus, when kicking off operations in other countries or regions, the company can still leverage its playbook and user base, but it still has to create liquidity for that local network, almost from scratch.

How does it do that?

Uber subsidizes a market when it first enters it.

That is also why and how Uber has been able to build up a global presence:

Source: Uber Financial Prospectus

In certain markets, other operators may use incentives to attempt to mitigate the advantages of our more liquid network, and we will generally choose to match these incentives, even if it results in a negative margin, to compete effectively and grow our business.

Uber here clarifies even further how Uber eats up its margins, by making and prioritizing Growth.

Prioritizing on growth over profitability

For its first 12 years of life, Uber has been aggressively prioritizing growth.

Caring little about profitability,

This aggressive growth strategy, it’s described by LinkedIn’s founder Reid Hoffman, as Blitzscaling:

Generally, for a given geographic market, we believe that the operator with the larger network will have a higher margin than the operator with the smaller network.

In short, Uber prioritizes making its network larger, so that over time it can gain higher margins on its operations.

To the extent that competing ridesharing category participants choose to shift their strategy towards shorter-term profitability by reducing their incentives or employing other means of increasing their take rate, we believe that we would not be required to invest as heavily in incentives given the impact of price and Driver earnings on consumer and Driver behavior, respectively.

Therefore, according to Uber, those players that prioritize “short-term profitability” make it easier for Uber to be competitive.

In addition to competing against ridesharing category participants, we also expect to continue to use Driver incentives and consumer discounts and promotions to grow our business relative to lower-priced alternatives, such as personal vehicle ownership, and to maintain balance between Driver supply and consumer demand.

Leverage network liquidity to scale in adjacent markets

The interesting part is that once a network becomes liquid, you can potentially build other networks on top of it.

An example is how Uber expanded its service, with Uber Eats, which now has grown as another company within Uber.

In short, Uber can borrow the liquidity of its core network, to kick off adjacent networks (in this case delivery services).

This is how the company can scale quickly.

Changing playbook: from growth at all costs, to profitability

As the market conditions, by the end of 2021, and the beginning of 2022, have tightened, also companies like Uber that have been prioritizing growth their all life, are now turning back to profitability.

As Uber’s CEO, Dara Khosrowshahi explained:

It’s clear that the market is experiencing a seismic shift and we need to react accordingly.

We have to make sure our unit economics work before we go big,

The least efficient marketing and incentive spend will be pulled back.

We will treat hiring as a privilege and be deliberate about when and where we add headcount,

We will be even more hardcore about costs across the board.”

For the first time, in its history, Uber changed its focus from growth to profitability.

Uber as Amazon’s cash machine?

This isn’t that far from Amazon’s cash machine strategy, where Amazon voluntarily reduced its margins to prioritize aggressive growth and acquisition of market shares.

It is important to remark that Amazon has been profitable for many of its years of operations.

This business strategy used by Uber is a clear example of how platform business models can gain long-term competitive advantage by tapping into larger and larger networks.

Key takeaways

Yet, in this specific case,

- Network effects take time before they become valuable, and actually making them valuable in the first place is one of the most difficult challenges for platform business models.

- Uber focused for most of its life on generating as much liquidity for its network. As the network works on a local basis, Uber has to leverage its existing playbook, but adapt it to the local market, to thrive

- Once the network is liquid Uber leveraged it to move to adjacent industries. Like Uber Eats, which has become a company within Uber.

- Uber has been prioritizing growth for most of its life. And from 2022 going forward is looking at profitability, first.

Key Highlights:

- Platform Business Models and Network Effects:

- Platform business models leverage network effects to create strong value for users. Network effects become valuable after reaching a certain threshold, which is crucial for platform success.

- Network effects refer to the phenomenon where the value of a product or service increases as more people use it.

- Creating Network Liquidity:

- One major challenge for platforms is creating “liquidity” or network activity. This is especially important at the initial stage to overcome the “cold start problem.”

- Liquidity is essential for triggering network effects and enhancing user experience.

- Flywheel Marketing and Network Effects:

- The concept of flywheel marketing, likened to a mechanical device, is essential for platforms to achieve network effects. Once momentum is built, the platform becomes self-sustaining.

- Network effects are key to triggering growth and gaining a competitive advantage.

- Uber’s Network Liquidity Strategy:

- Uber leverages liquidity to build a strong network of drivers and riders, improving service quality and attracting more users.

- Uber’s network effect creates a cycle of more riders leading to more drivers, accelerating growth.

- Initial Challenges and Subsidies:

- The initial challenge is to kick-start network effects valuable enough to create liquidity. To achieve this, Uber sometimes operates at negative margins until reaching sufficient scale.

- Uber often subsidizes new markets to build network liquidity and overcome challenges unique to each market.

- Growth vs. Profitability:

- Uber prioritized growth over profitability in its early years. It focused on building a large network for long-term advantage.

- As market conditions change, Uber has shifted its focus to profitability, similar to Amazon’s strategy.

- Expanding into Adjacent Markets:

- Once a network becomes liquid, platforms can leverage their existing network to enter adjacent markets. Uber’s success with Uber Eats is an example of this strategy.

- Changing Strategies:

- While growth was a priority for years, market shifts have prompted Uber to shift its focus to profitability. This change marks a significant shift in its strategy.

Visual Stories Related To Uber Business Model

In 2022, Uber mobility took 27% of each booking on the platform. At the same time, Uber Eats took 20% of each booking on the delivery platform. The take rate varies according to demand and supply but also market dynamics. In short, in periods of increased competition, the service might charge lower take rates to keep up with it. In 2022, Uber pushed on efficiency, thus raising its take rates, to move toward profitability.

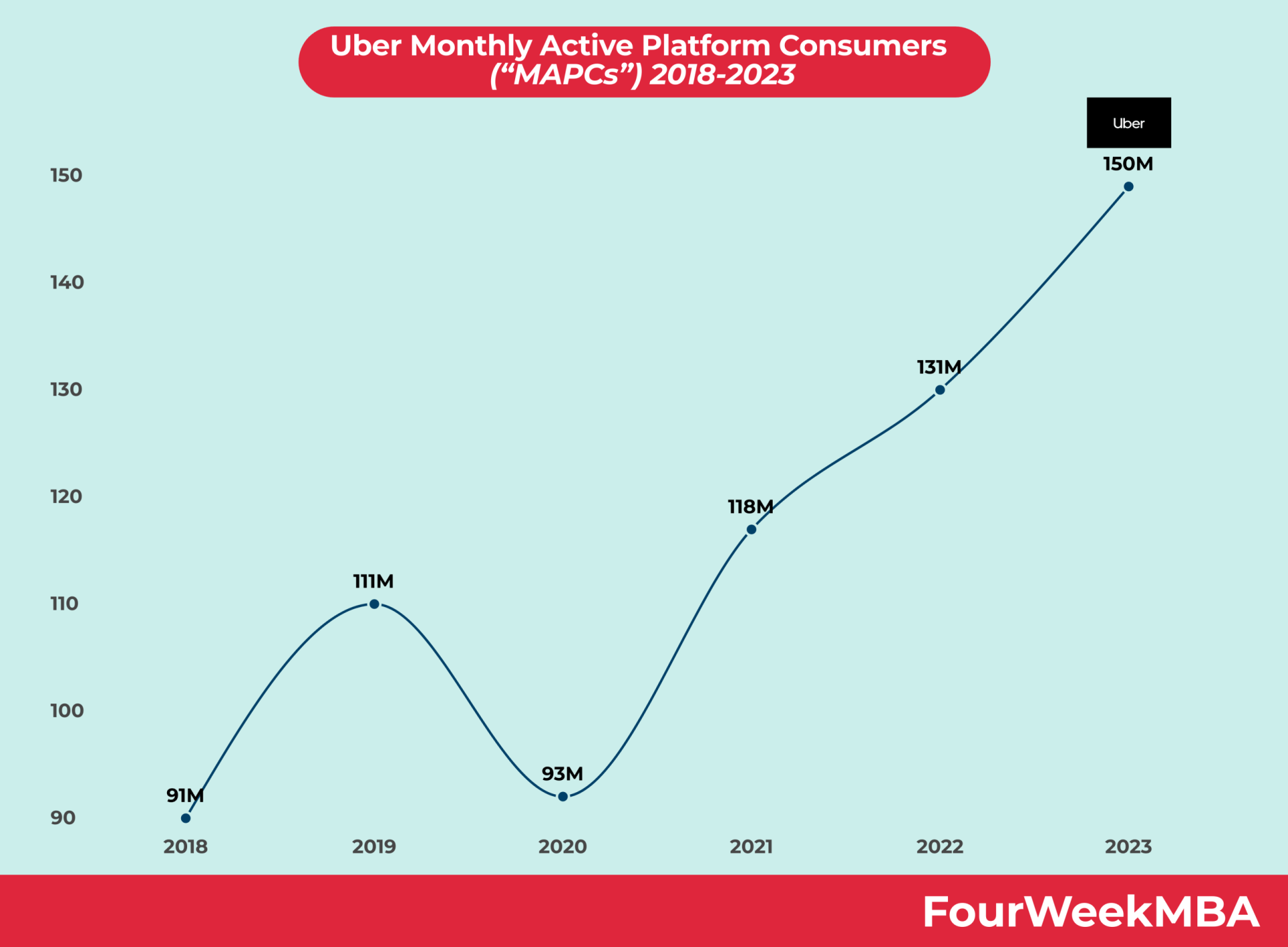

Uber Platform Users