Netflix is a subscription-based business model making money with three simple plans: basic, standard, and premium, giving access to stream series, movies, and shows. Leveraging on a streaming platform, Netflix generated over $33.7 billion in 2023, with an operating income of over $6.95 billion and a net income of over $5.4 billion. Starting in 2013, Netflix started to develop its content under the Netflix Originals brand, which today represents the most important strategic asset for the company that, in 2023, counted over 260 million paying members worldwide.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Netflix’s value proposition is centered on several key factors: – Extensive Content Library: Offers a vast collection of movies, TV shows, documentaries, and more. – Original Content: Produces exclusive original content, including series and films. – Ad-Free Experience: Provides an ad-free streaming environment. – Personalization: Uses algorithms to recommend content based on user preferences. – Accessibility: Allows users to watch content anytime, anywhere, on various devices. Netflix enhances entertainment by offering a wide range of content, personalized recommendations, and an ad-free viewing experience. | Provides a vast selection of entertainment options for subscribers. Offers exclusive original content not available elsewhere. Eliminates interruptions with an ad-free streaming experience. Enhances user satisfaction through personalized content recommendations. Ensures accessibility across multiple devices and locations. Attracts users seeking diverse, on-demand entertainment. | – A vast collection of movies, TV shows, and documentaries. – Exclusive original content like “Stranger Things” and “The Crown.” – Ad-free streaming experience without interruptions. – Personalized content recommendations based on user preferences. – Accessibility on various devices and locations. – Attracting users seeking diverse, on-demand entertainment. |

| Customer Segments | Netflix serves diverse customer segments, including: 1. Individuals: Subscribers seeking personal entertainment. 2. Families: Offers content suitable for all ages and family viewing. 3. Businesses: Provides business plans for corporate entertainment. 4. Content Creators: Collaborates with creators to produce original content. Netflix caters to a broad range of users and industries, expanding its content offerings and viewership. | Addresses the entertainment needs of individuals and families. Offers corporate solutions for employee entertainment. Collaborates with content creators to expand original content. Diversifies its content to accommodate various users and industries. | – Meeting personal and family entertainment needs. – Providing corporate solutions for employee entertainment. – Collaborating with content creators to expand original content. – Diversifying content for various users and industries. |

| Distribution Strategy | Netflix’s distribution strategy includes several key components: – Online Streaming: Delivers content via its online platform and app. – Global Reach: Offers services in over 190 countries worldwide. – Content Licensing: Acquires and licenses content from various studios. – Device Compatibility: Ensures accessibility on a wide range of devices. Netflix ensures convenient access to its content through online streaming, operates globally, acquires content from studios, and supports multiple devices for viewing. | Provides accessible streaming through its online platform and app. Expands services globally to reach diverse markets. Secures content through licensing agreements with studios. Ensures content accessibility on various devices. Prioritizes accessibility, global reach, and content availability through distribution channels. | – Offering accessible streaming through the online platform and app. – Expanding services to over 190 countries worldwide. – Securing content through licensing agreements with studios. – Ensuring content accessibility on various devices. – Prioritizing accessibility, global reach, and content availability in distribution. |

| Revenue Streams | Netflix generates revenue from various sources: 1. Subscription Fees: Charges subscribers on a monthly basis. 2. Original Content: Attracts and retains subscribers with exclusive content. 3. International Expansion: Increases revenue through global expansion. 4. Merchandise: Sells merchandise related to popular shows and series. Netflix relies primarily on subscription fees but also earns income from original content, international expansion, and merchandise sales. | Relies on subscription fees as the primary source of revenue. Attracts and retains subscribers with exclusive original content. Expands income potential through global expansion efforts. Monetizes popular shows and series through merchandise sales. Diversifies income sources for financial stability. | – Earnings from monthly subscription fees. – Generating income from exclusive original content. – Expanding revenue through global expansion efforts. – Monetizing popular shows and series through merchandise sales. – Diversifying income sources for financial stability. |

| Marketing Strategy | Netflix’s marketing strategy focuses on the following elements: – Personalized Recommendations: Utilizes algorithms to recommend content based on user preferences. – Original Content Promotion: Highlights exclusive shows and films. – User Engagement: Encourages user interaction through ratings and reviews. – Social Media: Utilizes social media platforms for brand engagement. Netflix promotes personalized content recommendations, exclusive content, user engagement, and social media interaction to attract and retain subscribers. | Attracts users with personalized content recommendations. Drives user interest with exclusive original content promotion. Encourages user interaction and feedback through ratings and reviews. Engages with users through social media for brand visibility. Prioritizes elements that enhance user acquisition and retention. | – Offering personalized content recommendations. – Highlighting exclusive original content. – Encouraging user interaction through ratings and reviews. – Utilizing social media for brand engagement. – Prioritizing elements that enhance user acquisition and retention. |

| Organization Structure | Netflix’s organizational structure includes: – CEO and Leadership Team: Led by the CEO responsible for strategic direction. – Content Acquisition: Focuses on acquiring and licensing content. – Original Content: Produces exclusive original shows and films. – Technology and Engineering: Manages platform development and innovation. – Marketing and Growth: Drives user acquisition and engagement efforts. Netflix’s structure emphasizes content acquisition, original content production, technology development, and user growth. | Led by a CEO responsible for strategic direction and decision-making. Divides operations into specialized functions for efficiency. Prioritizes content acquisition and original content production. Focuses on technology development for platform improvement. Drives user acquisition and engagement for growth. Supports Netflix’s strategic goals and industry leadership. | – Led by a CEO for strategic direction and decision-making. – Dividing operations into specialized functions for efficiency. – Prioritizing content acquisition and original content production. – Focusing on technology development for platform improvement. – Driving user acquisition and engagement for growth. – Supporting strategic goals and industry leadership. |

| Competitive Advantage | Netflix’s competitive advantage arises from: – Extensive Content Library: Offers a wide range of content across genres. – Original Content: Creates exclusive shows and films not available elsewhere. – Global Reach: Operates in over 190 countries, providing a vast audience. – User Data Insights: Utilizes data to personalize content recommendations. – Brand Recognition: Enjoys high brand visibility in the streaming industry. Netflix distinguishes itself with its vast content library, original content, global presence, data-driven recommendations, and strong brand recognition. | Offers a broad selection of content for diverse viewer preferences. Attracts and retains subscribers with exclusive original content. Reaches a global audience, expanding its user base. Enhances user satisfaction with personalized recommendations. Enjoys high brand visibility and recognition in the streaming industry. Maintains a strong competitive position in the streaming market. | – Providing a wide range of content across genres. – Creating exclusive original shows and films. – Operating in over 190 countries for a vast audience. – Personalizing content recommendations using data insights. – Enjoying high brand visibility and recognition in the industry. – Maintaining a strong competitive position in the streaming market. |

| Key Facts | |

| Founder |

Marc Randolph & Reed Hastings

|

| Year & Place Founded |

August 29, 1997, Scotts Valley, California

|

| Initial Business Model |

Sold DVD by mail, with subscription business model

|

| Year of IPO | 23 May 2002 |

| IPO Price | $15.00 |

| Total Revenues at IPO |

$75.9 million in 2001, before the IPO

|

| Business Model Change |

Started transition to streaming in 2007

|

| Total Revenues in 2023 | $33.72 billion |

| Netflix Employees |

As of December 2023, Netflix had 13,000 full-time employees located globally in 60 countries

|

| Revenues per Employee | $2.6 Million |

| Who owns Netflix? | Netflix’s largest individual shareholder is Reed Hastings, co-founder, and former CEO of the company, now Chairperson of Netflix, with a 1.76% stake, valued at over $4.5 billion as of January 2024. Other significant individual shareholders comprise Jay C. Hoag, the company’s directors since 1999, and Ted Sarandos, former chief content officer and now Chief Executive Officer of Netflix. Major institutional shareholders comprise The Vanguard Group (7.99% ownership), BlackRock (6.24% ownership), and FMR (5.35% ownership). |

Netflix Business Model Short Description

Netflix is a subscription-based business model making money with three simple plans: basic, standard, and premium, giving access to stream series, movies, and shows.

Leveraging on a streaming platform, Netflix generated over $31.6 billion in 2022.

Since 2013, Netflix has been transitioning from a platform (primarily providing licensed content) to a media powerhouse (mostly producing its own content). In 2021, Netflix spent over $4 billion on produced content.

We describe the Netflix business model via the VTDF framework developed by FourWeekMBA.

| Netflix Business Model | Description |

| Value Model: Media Company. |

Netflix’s core mission, strategy, and vision are that of “improving its members’ experience by expanding the streaming content with a focus on a programming mix of content that delights members and attracts new members.” Netflix does that via an on-demand streaming platform, on top of a subscription service, where members can find a large library of licensed content. And a larger and larger library of produced/original content, only available on Netflix.

|

| Technological Model: Content Platform. |

Netflix is a content platform business, leveraging the media consumption habits of its members to better produce new content, expand the content selection and improve the content recommendation within the existing library.

|

| Distribution Model: Deal Making, Branding, Vertical Integration of Content. |

Netflix over the years built its distribution thanks to deals that made the library available on various devices (think of the Netflix button you find on your smart TV controller), plus investment in marketing and branding, and increased investments in original content, which made the platform known to a larger audience.

|

| Financial Model: Content Arbitrage Multiple (Revenues/Content Investments). |

The company invests in both licensed and produced content. When the company is able to generate revenues many times over its content investments, this is what we call a “Content Arbitrage Multiple.” For instance, in 2021 Netflix Content Arbitrage Multiple was 2.4x, compared to the 2020 2.3x multiple.

|

Netflix’s business model today

Before we dive into the history and break down the Netflix business model.

Let’s look at some of the key highlights from the current landscape of 2022.

Let’s do that by looking at the graphic below:

2022 marked the year where The Walt Disney Company managed to build a streaming empire, which passed Netflix’s total subscription count.

Indeed, by November 2022, Disney’s streaming products had reached over 235 million subscribers, compared to the 230 million subscribers of Netflix.

It’s important to highlight and emphasize that Disney achieved that with a multi-product strategy, where with different streaming services (the primary ones are Disney+, ESPN+, and Hulu), it managed to grow big in a short time frame successfully.

Yet, it’s also true that Disney still has the option to bundle these streaming services up in a single offering. This indeed might be a possible move by Dinsey to expand its streaming empire further.

In fact, Netflix started as an aggregator, and by 2013, it had begun to invest more and more into original content. Going forward, Netflix’s main advantage will be built on original content.

2022 has been a difficult year for Netflix, and yet a year that is determining a business model transition that can help the company transition to a billion members/users worldwide.

To give you a little bit of context about what happened in 2022. By Q1 of 2022, for the first time in its history, Netflix subscribers had slowed down.

Yet by the end of 2022, Netflix was back on track, bringing its subscriber base to over 230 million subscribers.

This made the company rethink its all business model and evaluates, for the first time since its inception, an ad-supported Netflix.

Of course, the company might have been experimenting over the years with ads; we can’t know for sure.

Yet, the real move into the ad-supported business came this year.

Thus, let me take you through the journey to show you the various transitions, or if you wish, in startup lingo, the “pivots” Netflix has been going through for most of its history:

- Business model change number one: the initial idea of Netflix came when Randolph and Hastings carpooled for a few months, trying to figure out their next business venture. When Randolph pitched for the first time the idea of running a movie-by-mail business, Hastings wasn’t impressed. However, a couple of months after their discussion, a new technology (we were in the year 1997), the DVD, made the whole idea viable. As they started to roll this business model of DVD rentals by mail, orders began to pour in. However, it took a good year and a half for Netflix to transition and experiment with subscription services. Thus, eliminating the pain of having to pay for late fees (something Blockbuster was doing). As the co-founders explained over the years, rather than an aha moment, this was the result of a painful attempt to make Netflix survive.

- Business model change number two: As Netflix IPOed in 2002, Reed Hastings, who had succeeded Randolph as CEO of the company, already envisioned a future where Netflix had to make its content available on-demand. The Internet had exploded a few years earlier, and Netflix was already exploring ways to deliver content on demand. Yet, it would still take a few years for this model to become fully viable. In 2007, Netflix started to offer a streaming service. Eventually, the whole business model turned into that. An on-demand streaming service based on a subscription revenue model, where paying members could consume all the content they wanted at their own pace and without any additional fee.

- DVD rentals as a heritage of the old business model: when we look at today’s financials, it’s interesting to see how DVD rentals are a heritage of Netflix’s past business model. Indeed, in 2021 DVD revenues were about $182 million (a tiny number compared to the over $29 billion in revenues from streaming services). Yet it’s also interesting to notice how Netflix keeps generating revenues in that segment, also at a wide margin. This shows how the DVD subscription service was a great, viable idea. However, if Netflix had not changed its business model, its DVD market would have been way way smaller compared to the streaming services market.

- The pandemic effect is over: In 2021, the acquisition of new paid members slew down. From over 36 million new members in 2020 to over 18 million new members in 2021. The effect of the pandemic is over. Indeed, the fast growth of Netflix’s paying members was driven by the pandemic.

- Keep growing overall paying members’ base: Netflix still grew its overall paying members base, from over 189 million paying members in 2020 to over 210 million paying members in 2021. This is a good sign that the company, while maturing, can also pull some interesting growth numbers.

- Price spikes: since the overall paying members’ growth started to slow down, Netflix implemented various price spikes to its membership packages. This created a boost in revenues. While price spikes might be sustainable in the long term, it’s critical for Netflix to keep investing in great, original content only available on its platform. Because, over time, if Netflix were to lose traction in terms of the brand’s strength, additional price spikes might become way more burdening to users, which would cancel their subscriptions. For now, the basic packages are still convenient, thus, most paying members still stick with them.

- A media powerhouse: Netflix has been the first streaming media player to start massively investing in original content as its main asset. In fact, there is a key statistic to look at, which is licensed vs. paying content. Indeed, in 2019 the % spent on produced content was 21% vs. 79% on licensed content. This number changed by 2021 when the produced content grew to 34% of the total content spending. While licensed content in 2021 represented about 66% of the total content spending. This shows how Netflix is fully transitioning into a media company, where most of the content available on the platform might be produced content.

- Entering the ad business: since it inception, Netflix has worked with a simple subscription-based model. It’s incredible how the company managed to grow to over 220 million members worldwide, with a such simple revenue model. Yet, as of 2022, the company also realized that if it wanted to reach the next level of scale (a billion users?) in the next decade, it had to add an additional engine to its business model. Similar to Spotify’s business model, Netflix launched an ad-supported tier, in 2022. In my opinion, this is a way for Netflix to test, understand, and kick off a learning curve in the TV advertising business. If it will work out, we might see, over the years, Netflix offering a completely free ad-supported plan, as Spotify does. Why? Because, the ad-supported machine if scaled, can help Netflix reach a billion users worldwide, while it keeps growing its premium members base! Spotify has been the master of this model, and many companies like Netflix are trying to learn from it.

- Vertically integrating the content machine: the point above shows that Netflix is vertically integrating its business model, getting more and more into production, thus becoming a key player in the media industry. This approach is critical because the overall business model survival, in the long-term, depends on the ability of:

- Having content available on Netflix only. As we saw, this is critical to make its subscription sticky, for members, in the long term. Especially in light of the fact that paying members acquisition is slowing down. From that, it also depends on Netflix’s ability to keep increasing its prices, without triggering a leaky bucket.

- Having control over content gives control over the cost structure. The fact that Netflix will own the content makes it possible for the company (in the long term) to have control over its cost structure. Indeed, for now, when Netflix advances the money to acquire licensed content, this expense is amortized over the years, as members pay for their subscriptions. However, if the licensed content agreements expire, suddenly that content might not be available on the platform, making the subscription less interesting. In addition, relying too much on licensed content, also makes Netflix subject to competitors’ retaliation. In short, Netflix’s competitors might cut it out from licensing agreements, thus posing a threat to its business model.

- Having control over distribution: another key element of producing your own content, is the fact, that Netflix can freely distribute it across its global platform, without needing specific licensing agreements for each country. This is critical because it’s very hard to know at foresight, in which country, a TV series might be most successful. Indeed, over the years, Netflix has shown how series made in a country can become hits globally (see the “Casa de Papel” or “Money Heist” global success). The fact that Netflix does own the content makes it much easier to experiment, launch globally and benefit from that content.

- Also being able to license it to others, when it makes sense to amplify it. By owning its content, Netflix also has the option to license it to others, when it makes sense. This is critical to amplifying TV Series on other networks. Take the case of an old Netflix series, which had been already passed through the Netflix platform for years. As Netflix has already enjoyed the full distribution of this content on its platform, it can allow other networks to distribute it for a fee. Thus, creating an additional revenue stream, while amplifying its own content!

The Mediafication of Netflix Business Model

When many analysts look at Netflix, they consider it a tech company. Indeed, Netflix does have tech components that are an essential part of its business model.

And the company does work as a platform business model. However, Netflix identifies itself much more as a media company.

For instance, if you look at the underlying infrastructure for Netflix, this mostly relies on Amazon’s servers, as explained below:

Why didn’t Netflix build its own data centers? In reality, Netflix is focused on providing great content, and building its brand through that.

That is why, in these years, we’re assisting the “mediafication” of Netflix, and I won’t be surprised if in the coming years, at a certain point, produced content investments will pass the licensed content investments.

At that point, we can officially call Netflix a media company!

This index I like to call “Mediafication Index” and we can use it to track the full transitioning of Netflix from platform to media company.

Content Arbitrage Multiple

So how do we track the health and ability of Netflix to keep generating growing revenues compared to its content investments?

The answer is the Content Arbitrage Multiple. This metric, which we invented, is a ratio between the total revenues/content investments.

For instance, in 2021, the Content Arbitrage Multiple was 2.4x. Indeed, on the $29.7 billion of total revenues in 2021, Netflix had invested over $12.2 billion in content. This was a 5% growth compared to a Content Arbitrage Multiple of 2.3x in 2020.

Of course, there is a lagging issue here. For instance, when it comes to produced content, we’ll see the results of it in terms of revenues, profits and cash generated a few years in the future.

Indeed, with licensed content, this can be quickly made available on the platform and enhance its content selection.

When it comes to produced content, it might take 2-3 years from the first investment to see it going to fruition. Thus, it’s important to perform the same analysis on a 3-5 years basis at least.

Netflix origin story: the history of Netflix in a nutshell

As Marc Randolph, co-founder of Netflix, explained, the idea to start a company that would wreck down dominant players like Blockbuster wasn’t the result of a lightning moment, rather it happened after considering thousand of business ideas.

The initial launch of Netflix

For a bit of context, back in January of 1997, Randolph was working for a software company run by Reed Hastings. As the company got acquired, Randolph would be unemployed shortly after that. Both Randolph and Hastings were in the same situation, where the company who was acquiring them, was keeping them around for six months, as to enable a smooth transition after the acquisition.

Thus, in these six months, Randolph and Hastings started to brainstorm hundreds of business ideas. Indeed, Hastings and Randolph, which had the habit of carpooling, used that opportunity to brainstorm business ideas. As they drove each day to their office in the Santa Cruz Mountains, in Sunnyvale, the two men brainstormed hundreds of ideas, and for weeks they could not find a really good one to be the object of their next venture.

Among these ideas, Randolph pitched Hastings the idea of video rental by mail. Hastings was not impressed. Indeed, the business would not be viable considering that at the time video rentals came into big cassettes, which were heavy, expensive and fragile. Thus, not a feasible idea.

Yet, a couple of months after the idea came to Randolph, Hastings mentioned to him, how he had read about this new technology, called DVD. A thin and small flat rounded plastic object. This could easily fit into a small envelope.

They went right on to test the idea. Randolph placed a DVD into a pink gift envelope which he sent to Hastings’ home in Santa Cruz. The next day, Hastings received the DVD, intact, and handed it to Randolph. The CD inside was unbroken, and it had arrived in Hastings’ home in less than 24 hours for the price of a stamp!

That is how they realized their idea might work. And a few months later, Hastings wrote a check for 1.9 million dollars to Randolph to start the company.

After hiring a dozen people, and spending the next six months developing an e-commerce website, finally on April 14, 1998, Netflix was launched. As Randolph pointed out, at the time Netflix wasn’t trying to dominate the DVD market, to go against Blockbuster, or to look for a larger market, like streaming.

They were trying to survive. Indeed, for a year and a half, Netflix was struggling to find its business model, a business model that would make it viable and scalable.

Finding a viable business model for Netflix

Later on, the company would change leadership, with Hastings taking over as CEO (still to these days). Under Randolph, Netflix would go through a first transition phase becoming a subscription-based business model, with DVD rental. And it would later use the same model for streaming services.

Netflix started as a DVD-rental company. That was the most viable way to start a business that could compete with existing players like Blockbuster. Netflix could have tried to play it bigger.

Netflix had known for years that being a competitive player in the DVD-rental space, was “just the beginning of something else:”

In a Wired article, entitled “The Netflix Effect” from 2002, Reed Hastings, still current Netflix’s CEO, highlighted:

The dream 20 years from now, is to have a global entertainment distribution company that provides a unique channel for film producers and studios.

Converting the business model from DVD to streaming operations

Reed Hastings, after its initial investment, got more and more involved with the company until he took over as the new CEO. Already in the early 2000s, Netflix was looking into ways to transition from DVD, which had enabled the initial development of Netflix’s business model, to streaming.

For years, the Netflix executive team had been looking at how streaming was evolving. They thought by the early 2000s this might have been an option. Yet, they missed the shot for several years. Indeed, it would take longer for the streaming technology to become fully viable.

Yet when it did, it proved to be quite successful for Netflix’s business model. Indeed, Netflix started to offer streaming options by 2007. As the NYT announced at the time:

The impending death of the company, with its online system for renting DVDs delivered by mail, was predicted late in 2002, when Wal-Mart said it would enter the business; again last year, when Apple and Amazon announced movie-downloading services; and again last week, after the introduction of a series of products and services intended to bring Internet video to television sets.

The NYT highlighted, back in 2007, how Netflix’s death had been predicted several times (and indeed, the company did go through various near-death experiences in these years). Yet

Yet, as Hastings had highlighted “..DVD is not a hundred-year format, people wonder what will Netflix’s second act be.” Back then the NYT remarked:

Netflix is introducing a service to deliver movies and television shows directly to users’ PCs, not as downloads but as streaming video, which is not retained in computer memory. The service, which is free to Netflix subscribers, is meant to give the company a toehold in the embryonic world of Internet movie distribution.

As Netflix announced its streaming service, its shares dropped 6.3 percent and a JPMorgan Securities analyst downgraded the stock, citing increased competition.

Yet, by 2011, the streaming service execution had successfully been rolled out, with streaming subscribers passing the DVD subscribers. In 2011, in the US paid DVD subscribers were over 11 million, in the same period streaming subscribers had passed 20 million!

In 2009, Netflix’s revenues were over $1.6 billion. By 2011, the number passed the $3.2 billion mark!

Netflix had entered a new era, it had passed through the transitional business model of DVD subscription services, and tapped into a market expansion strategy, where the streaming segment became many times over the DVD segment.

In 2021, DVD subscriptions had become an obsolete business model, whereas the company generated over $29.5 billion from streaming subscription services!

However, to get there, Netflix had to go through another important transition in its business model. And move from being a platform/aggregator of content to becoming a media brand.

From platform to brand: Becoming the new Hollywood?

In a historic speech, in 2013, at the Edinburg International Film Festival, Kevin Spacey summarized well, the transition of Netflix, which created the company we know today:

Indeed, back in 2013, Netflix had started to implement a new strategy. The company no longer just aggregated content on top of its platform. It started to develop its own content, and it did that through a series called “House of Cards.”

Kevin Spacey’s speech captured the important transition that media companies had to go through if they wanted to survive the next wave of media, empowered by the Web. This speech is worth reading at it all because it opened up the way to the Netflix that we know today, and it created a new standard for media companies, where everyone followed the lead set by Netflix.

Like Kevin Spacey highlighted back in 2013:

House of Cards creatively actually follows the model more often employed here in Great Britain.The television industry here has never really embraced the pilot season looked to buy the networks in the United States as a worthwhile effort and now look of course we went out to all the major networks with House of Cards and every single one was interested in the idea but every single one wanted us to do a pilot first.

In short, Kevin Spacey highlighted how the “pilot content model” was broken. And how, thanks to the Internet, and new waves of content consumption, the habits of hundreds of millions of new consumers, had completely changed.

He further explained:

And look, it wasn’t out of arrogance that David Fincher and Beau Willimon (the producers of House of Cards) and I were not interested in having to audition the idea.

It was that we wanted to start to tell a story that would take a long time to tell. We were creating a sophisticated multi-layered story with complex characters who would reveal themselves over time and relationships that would need space to play out.

And the obligation of course of doing a pilot from the writing perspective is that you have to spend about 45 minutes establishing all the characters and create arbitrary cliffhangers and basically generally prove that what you’re setting out to do is network.

Netflix was the only network that said ‘we believe in you,’ we’ve run our data and it tells us that our audience would watch this series we don’t need you to do a pilot.

By comparison last year 113 pilots were made, 35 of those were chosen to go to air, 13 of those were renewed but most of those are gone now.

And this year 146 pilots were shot, 56 have gone to series but we don’t know the outcome of those yet, but the cost of these pilots was somewhere between 300 and 400 million dollars a year.

That makes our House of Cards deal for two seasons look really cost-effective.

In other words, Kevin Spacey explained how the new model, they envisioned, back then, was a model where it was way more about crafting a story, and the characters around the story. Thus, going way beyond the pilot.

This model not only focused more on building the story, and the characters, but it looked at creating such a hook for the people watching the series, that they wanted to watch it all at once.

Not only this model would be more convenient, eventually, as the cost of developing a few episodes would be much less expensive, in comparison, than that of developing a pilot. But, it would give it a different format. A format that would be more in line, with the way consumers approached it.

Indeed, Kevin Spacey explained:

Clearly the success of the Netflix model releasing the entire season of house of cards at once proved one thing: the audience wants the control they want the freedom!

If they want to binge as they’ve been doing on house of cards and lots of other shows then we should let them binge.

I mean I can’t tell you how many people have stopped me on the street and said thanks ‘you sucked three days out of my life.’

And through this new form of distribution we have demonstrated that we have learned the lesson that the music industry didn’t learn give people what they want when they want it in the form they want it in at a reasonable price and they’ll more likely pay for it rather than steal it.

Well, some will still steal it, but I think we can take a bite out of piracy so I predict that in the next decade or two any differentiation between these platforms will fall away.

This opened the way to binge-watching, a new, and powerful way, to distribute content. And Spacey also remarked:

Is 13 hours watched as one cinematic whole really any different than a film? do we define film as being something two hours or less? surely it goes deeper than that.

If you’re watching a film on your television is it no longer a film because you’re not watching it in the theater? if you watch TV show on your iPad is it no longer a TV show? The device and the length are irrelevant. The labels are useless except perhaps to agents and managers and lawyers who use these labels to conduct business deals.

But for kids growing up now there’s no difference watching avatar on an iPad or watching YouTube on a TV or watching Game of Thrones on their computer it’s all content it’s just story.

And the audience has spoken they want stories, they’re dying for them they’re rooting for us to give them the right thing and they will talk about it, binge on it carry it with them on the bus and to the hairdresser force it on their friends, tweet, blog, Facebook make fan pages silly gifs and God knows what else about it.

Engage with it with a passion and an intimacy that a blockbuster movie could only dream of.

And all we have to do is give it to them!

The prize fruit is right there shinier and juicier than it’s ever been before. So it’ll be all the more shame on each and every one of us if we don’t reach out and seize it.

And I want to leave you with the words of a man is as any to address the Nexus of Commerce and art Mr. Orson Welles who once said: “I hate television I hate it as much as peanuts.”

This was the start of Netflix’s transition from aggregator/platform to media powerhouse!

In 2013, Netflix became the first streaming platform to win a Primetime Emmy Award with House of Cards. By 2021, most awarded shows were coming from Netflix’s original production!

A glance at the Netflix business model

Starting in 2013, Netflix started to develop its own content under the Netflix Originals brand, which today represents the most important strategic asset for the company that in 2021 counted over 221 million paying members worldwide.

Netflix is changing the way we consume traditional media. From series like Stranger Things, Narcos, and Black Mirror, Netflix has been able to become a titan of the media industry, with more than a hundred and fifty thousand members across the globe.

With three simple subscription plans (basic, standard, and premium) from $9.99 to $19.99 (in the US), Netflix has been able to become a multi-billion dollar unicorn worth more than $150 billion in March 2022.

Netflix wasn’t an overnight success

Like any start-up, also Netflix has its founding myth. As the story goes Netflix founder and CEO Reed Hastings recounted how the idea behind Netflix came about:

The genesis of Netflix came in 1997 when I got this late fee, about $40, for Apollo 13. I remember the fee because I was embarrassed about it. That was back in the VHS days, and it got me thinking that there’s a big market out there.

So I started to investigate the idea of how to create a movie-rental business by mail. I didn’t know about DVDs, and then a friend of mine told me they were coming. I ran out to Tower Records in Santa Cruz, Calif., and mailed CDs to myself, just a disc in an envelope. It was a long 24 hours until the mail arrived back at my house, and I ripped them open and they were all in great shape. That was the big excitement point.

This was the year 1997, still a long way to go until Netflix reached its scale and international expansion worldwide, which can be dated in 2017.

Today Netflix is among the most successful brands in the world. And this happened not only because it managed to create one of the most successful streaming platforms of the Internet era. But also because Netflix has learned along the way when to transition its business model.

In fact, Netflix started with CD first, then it expanded its strategy by adopting streaming.

Also, it’s important to understand how Netflix changed the way we consume content (from movies to series) and also how it was the first platform player to transition from aggregator to media company.

Indeed, starting with House of Cards, in 2013, Netflix heavily invested in original programming, which today is the main growth driver and sticky engine for the company.

How does Netflix’s business model work? A simple subscription will do

As explained in the Netflix annual report:

Our business model is subscription based as opposed to a model generating revenues at a specific title level. Therefore, content assets, both licensed and produced, are reviewed in aggregate at the operating segment level when an event or change in circumstances indicates a change in the expected usefulness.

In short, Netflix sells three simple kinds of subscriptions:

With simple packaging and three subscriptions (basic, standard, and premium) you can get the streaming of all the available series, movies, and shows available on the Netflix library.

Currently, the subscription prices vary from a base plan of $9.99 to $19.99 (in the US).

Business segments

The business segments are the are of the business that has a different financial logic and thus require a separated strategy.

As of 2021 Netflix revenues were over $29 billion, with a staggering growth compared to just 2013, when the revenues passed $4 billion. And a continued growth after 2019. As the pandemic hit Netflix revenues kept growing. Yet Netflix also managed to consolidate the revenues generated during the pandemic (also thanks to increased service prices).

If we look at the global picture, you can see how Netflix has more than 221 million subscribers worldwide.

The company has three business segments:

- Domestic streaming: revenues from monthly membership fees for services consisting solely of streaming content to our members in the United States.

- International streaming: revenues from monthly membership fees for services consisting solely of streaming content to our members outside the United States.

- and Domestic DVD: revenues from monthly membership fees for services consisting solely of DVD-by-mail. This is a heritage of the old business model, which Netflix used to run before it became a streaming-first company.

Let’s dive a bit into the numbers of each of those segments to understand the financial logic behind those and also see what’s strategy of Netflix in the next future.

Netflix US streaming financials explained

From the numbers above you can see how the Netflix total number of members in the US grew from 67 million in 2019 to over 75 million in 2021.

As you can see from the financials above, Netflix has managed to both increase the number of paying members, and the rate each of those members pays. Indeed, the average monthly revenue per membership grew from $12.57 in 2019 to $14.56 in 2021.

This shows, that the platform, for now, is sticky enough for paying members to stay, even when there are price increases. Thus, the churn rate, which is a key metric for a subscription-based platform is stable enough to enable a consistent revenue growth for Netflix.

Of course, where the brand becomes less differentiated in the future, additional price increases might determine a sudden switch of users to other platforms, and therefore, an accelerating churn.

What about other geographical areas?

Netflix international streaming financials explained

The overall international segment has become larger than the US segment. This shows the ability of Netflix to successfully launch its content worldwide. This is, in fact, one of the most effective strategies that Netflix has been using in the last years.

Netflix invests in original content worldwide, making it accessible on its international platform, thus, enabling the content to become successful worldwide.

This has created international series, like La Casa de Papel (Spanish series, in the US, renamed as Money Heist), which not only were massive successes in the countries where they were launched, but they became incredible successes worldwide.

While changing the whole way people consume content across the world.

Netflix indeed mastered a new methodology for analyzing, developing, launching, and distributing content.

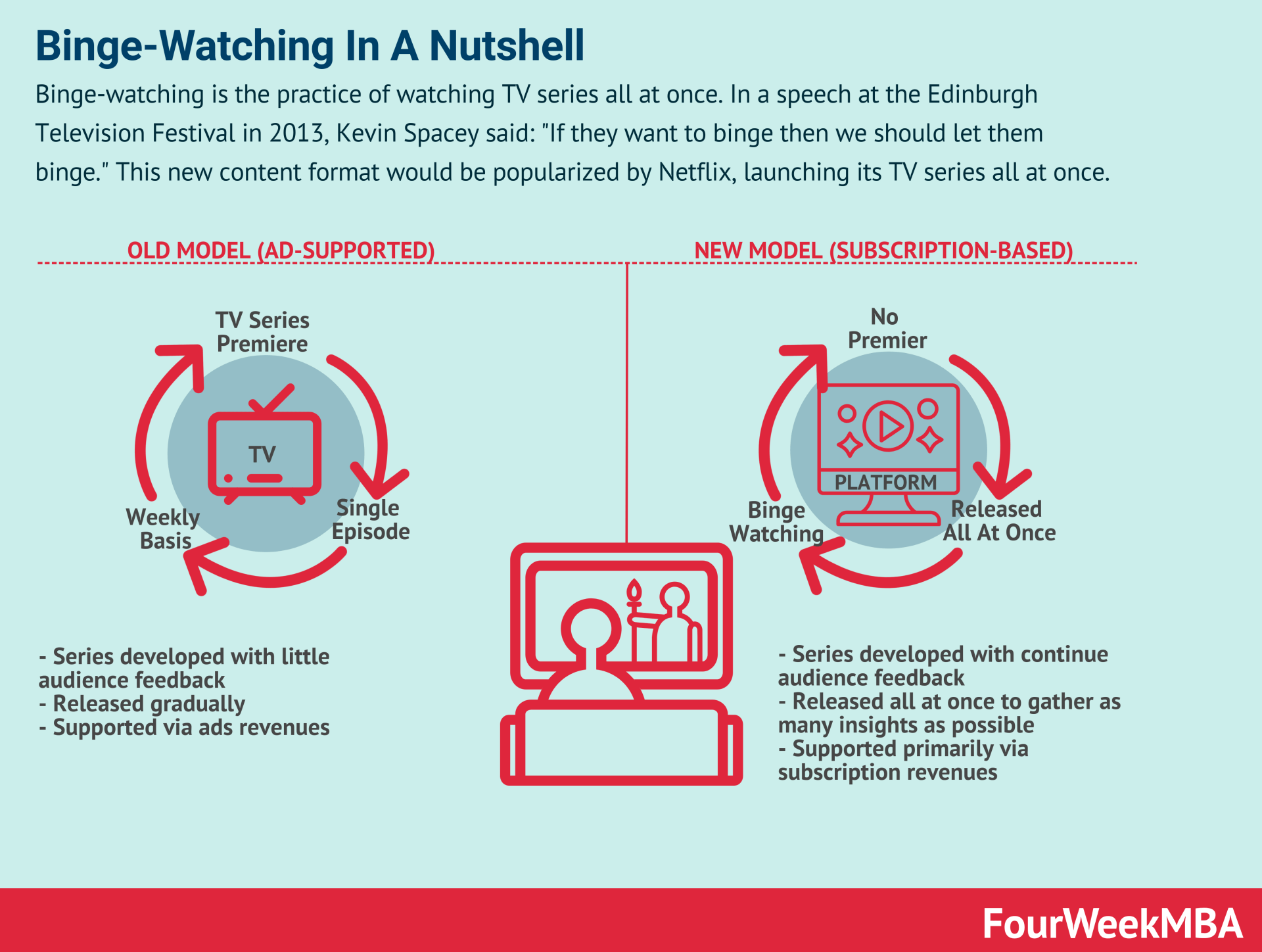

In a speech at the Edinburgh Television Festival in 2013, Kevin Spacey said: “If they want to binge then we should let them binge,” referring to the method of consumption that Netflix enabled for the members.

Where platforms and TV networks released series gradually, Netflix released entire seasons all at once, giving consumers the choice of how to consume content. This has created a habit of binge-watching, which also turned out to be one of Netflix’s sticky engines of growth.

Below I explain the difference between the old content model, and the new one, built by Netflix.

When looking at Netflix’s content model, it’s also important to frame it in the context of its overall financial model.

In fact, Netflix is a subscription-based platform, where members pay for content, which is made available through it. In short, Netflix advances the investments needed to develop, and license content. And those costs are amortized over time, as subscription revenue comes in.

It all started with that DVD pay per rental business model

Today we give for granted the on-demand business model of Netflix. Yet, back in the day, you could have movies “on-demand” only with the pay per rental business model. As technology has evolved, the on-demand model has been possible also for media companies.

Netflix has been able to transition its business model when streaming became viable as a technology at scale. Thus transitioning its business from a pay-per-rental or DVD subscription business to an on-demand streaming service.

Yet, it’s interesting to notice, as of 2021, how DVD revenues still show up, as a heritage of Netflix’s past business model. This is a historical relic of the evolution of Netflix’s business model and is very interesting to look at. Indeed, as of 2021, Netflix still had $182 million in DVD revenues.

Is Netflix profitable?

Netflix is a profitable company, which net profits were $5.1 billion in 2021. Growing from $2.7 billion in 2020.

The company runs a negative cash flow business model, where it anticipates the costs of content development and licensing through the platform.

Those costs get amortized over the years, as subscribers stick to the platform.

Netflix cash flow negative business and cost structure

Netflix Financial Statements 2021

As highlighted in its financials:

Net cash provided by operating activities decreased $2,034 million from the year ended December 31, 2020 to $393 million for the year ended December 31, 2021 primarily driven by an increase in investments in content that require more upfront cash payments, partially offset by a $4,702 million or 19% increase in revenues. The payments for content assets increased $4,933 million, from $12,537 million to $17,469 million, or 39%, as compared to the increase in the amortization of content assets of $1,423 million, from $10,807 million to $12,230 million, or 13%. The increase in payments for content assets was primarily driven by delays in productions resulting from the pandemic that impacted the prior year, which resulted in the timing of certain production payments being shifted into the current year. In addition, we had increased payments associated with higher operating expenses, primarily related to increased headcount to support our continued improvements in our streaming service and our international expansion

Therefore, the company has to invest substantial amounts of cash upfront to develop Netflix’s original content.

To understand why the Netflix business model also runs on negative cash flows, we need to dig into the Netflix cost structure:

We acquire, license and produce content, including original programing, in order to offer our members unlimited viewing of TV series and films. The content licenses are for a fixed fee and specific windows of availability. Payment terms for certain content licenses and the production of content require more upfront cash payments relative to the amortization expense. Payments for content, including additions to streaming assets and the changes in related liabilities, are classified within “Net cash used in operating activities” on the Consolidated Statements of Cash Flows.

What can we learn from Netflix’s business model?

For a company that started in 1997 as a website with 925 titles available for rent through a traditional pay-per-rental model; a company that in 2000 offered itself for acquisition to Blockbuster for $50 million and now it’s worth more than a hundred fifty billion dollars. What can we learn from it?

Business modeling isn’t about just how you monetize

There is a misconception in the business world, that a business model is seen as a monetization strategy. A business model also embraces a monetization strategy but is way more than that. It is how you monetize your business.

It is about how you make your product or service available to an audience.

It is about the value you create not only for your business but also for several stakeholders. In fact, as I see it, the more a business model creates values for several players, the more it will be able to create an ecosystem that will help the organization part of its scale.

In the end, the organization and the scale are just the result of that ecosystem. This also applies to Netflix. Looking at the financials is a good starting point. Yet Netflix isn’t only a subscription-based media provider. Netflix is also based on the concept of on-demand. It is a media production company.

It is a brand that in the mind of its subscribers can mean several things. In fact, among the over a hundred thousand subscribers some tribes get assembled around the Netflix series which has become the symbol of our generation.

We like to call things “innovative.” What’s new isn’t the business model but the application of it

The first critical aspect of business models is that we like so much the word “innovative” which we tend to call anything we see as such. In reality, in most cases, it is just about taking an old business model and applying it to a new industry.

Just like the wheel, invented in Mesopotamia over five thousand years ago, it took us way more than a thousand years to put it on the bottom of the luggage. In fact, the first wheeled luggage might date back to the 1970s.

In other words, in business just like in any different life domain, what’s hard isn’t the discovery of a new business model but the application of a business model that has always existed to new industries.

The subscription business model has been used by traditional newspapers, magazines, and academic journals for decades.

As technology evolves old business models become viable to new industries

One interesting aspect that you’ll notice if you go on the Netflix blog is that the most critical editorial piece is the Netflix ISP Speed Index, a monthly report that provides updates on which Internet Service Providers (ISPs) offer the best primetime Netflix streaming experience.

Companies like Netflix, or other tech giants like Google, Amazon, Facebook, and Microsoft’s successes are strictly tied to the technological advancements we’ve achieved as humanity. Imagine you had a poor internet connection.

Would you pay even a dollar for a Netflix subscription? Of course, you wouldn’t. Thus, as technology evolves, the business models of companies like Netflix depend on how fast technology has advanced. Had the internet not snowballed Netflix would still be a DVD rental company.

Why? The on-demand business model is possible thanks to the speed at which the internet infrastructure can travel today.

The power of the on-demand business model and the “Uberization” of the service economy

In the digital world, the on-demand economy is dominating the business arena. The “Uberization” of services means offering more options on how to consume something.

In the Netflix case, the subscriber is given more flexibility and optionality about what to watch. For years, TV has used us to rigid schedules. That worked in the years when large corporations with strict schedules were the norm.

Instead, with the rise of digital nomadism and the self-employed, freelancer our habits and the way we consume media has changed drastically. In this scenario, on-demand has become a dominant business model in the media industry.

Also in this case though what seems an innovative business model it’s not. In fact, once again what is innovative in its application. In fact, when Netflix back in 1997 started to rent DVDs from its website, it was already working on the premises of the on-demand business model.

However, as the web evolved and streaming became viable, they started to apply the on-demand model through their platform.

On-demand model plus the subscription business model

What makes a business model powerful is the mixture of several ingredients; in the Netflix case, the on-demand business model, with a simple subscription applied to the traditional media industry has made it incredibly effective.

The subscription business model can scale

Netflix proved that the subscription business model could scale. However, this doesn’t happen overnight. If we look at the international expansion of Netflix, we can see how it started to expand outside the US only in 2010.

Source: Annual report Netflix

And it was only in 2016 that it launched globally. This isn’t random. The subscription business model requires a lot of financial resources.

The subscription business model requires enormous investments

We acquire, license and produce content, including original programing, in order to offer our members unlimited viewing of TV shows and films.

This was specified in the Netflix Annual report for 2018. In fact, at this stage Netflix is as much a media production company as a service provider:

Netflix Financial Statements 2021

Content obligations represent one of the most important financial items of Netflix. In fact, based on the success of the content investments Netflix has made in the past years and will be making in the coming years, will determine the success of the overall business model.

No wonder, then, that content obligations also represent a risk factor for the company, which in its financial statements highlighted:

We have a substantial amount of indebtedness and other obligations, including streaming content obligations, which could adversely affect our financial position.

As of December 31, 2021, content obligations were comprised of $4.3 billion included in “Current content liabilities” and $3.1 billion of “Non-current content liabilities” on the Consolidated Balance Sheets and $15.8 billion of obligations that are not reflected on the Consolidated Balance Sheets as they did not then meet the criteria for recognition.

Content obligations include amounts related to the acquisition, licensing and production of content. An obligation for the production of content includes non-cancelable commitments under creative talent and employment agreements and other production related commitments. An obligation for the acquisition and licensing of content is incurred at the time we enter into an agreement to obtain future titles. Once a title becomes available, a content liability is recorded on the Consolidated Balance Sheets. Certain agreements include the obligation to license rights for unknown future titles, the ultimate quantity and/or fees for which are not yet determinable as of the reporting date. Traditional film output deals, or certain TV series license agreements where the number of seasons to be aired is unknown, are examples of these types of agreements. The contractual obligations table above does not include any estimated obligation for the unknown future titles, payment for which could range from less than one year to more than five years. However, these unknown obligations are expected to be significant and we believe could include approximately $1 billion to $4 billion over the next three years, with the payments for the vast majority of such amounts expected to occur after the next twelve months. The foregoing range is based on considerable management judgments and the actual amounts may differ. Once we know the title that we will receive and the license fees, we include the amount in the contractual obligations table above.

We all like the logic and the scalability of the subscription business model. You create a product or service have people enroll in it, and you make money each month, steadily. Yet this isn’t always the case. And also scaling a consumer subscription business model is not easy at all. And Netflix is among the few who have learned this playbook on the fly.

And yet, also a company like Netflix still runs substantial risks related to the investments made in content.

When you offer a subscription that will never come at a low price. Instead, you will need continuous support, development, new ideas, and ways to make sure your subscribers stick as long as possible.

In fact, only when you’re able to have a customer acquisition cost (CAC) that is way lower than your customer lifetime value (CLV) that is when your business gets viable.

However, this is easy said than done. In fact, a sales funnel of a subscription-based model is way longer than a company that sells a one-off product or service.

This is reflected in Netflix’s financial statement as in many other companies that operate with the logic of the subscription-based business model.

Netflix is a media company

Another line item that is interesting to look at to witness the transition of Netflix, from just a tech platform to a media company, is the proportion of investment into licensed vs. produced content.

Wherewith licensed content Netflix purchases the rights to distribute it across its platform. For produced content Netflix, de facto, invests in owning the content and distributing it according to its own rules.

Indeed, the licensing content presents its advantages. Some of them are:

- Netflix can expand its library, faster, making available titles that otherwise would cost too much to produce from scratch.

- Licensed content also is less expensive (at least in the short-term) compared to produced content.

- And it can help the company quickly change the kind of content it offers on the platform.

However, licensed content has its limitations:

- You don’t own it.

- Distribution rights change over time and can be subject to retaliation from competing platforms.

- Your service might be influenced by external factors you can’t control, like changing rights agreements, which can affect the whole business’s bottom line.

Indeed, the difference between licensed vs. produced content, for Netflix, doesn’t just mark the difference between tech and media companies. It also marks the difference between a company that distributes content and a company that is vertically integrated.

When Netflix invests in production, it has to learn a playbook of how to manufacture content from scratch, this gives the company the ability to create long-term competitive advantages, and really become a new Hollywood.

Therefore, while content production can be pretty expensive, and it needs to be amortized over time, making sure to have subscribers that are willing to pay more over time, and stick to the platform also presents important advantages:

- Control over distribution, as owned and produced content can be distributed at the company’s own wish, which gives it great flexibility to understand where it’s best suited, thus, creating more options to make it successful.

- Control over the long-term strategy of the company, as the owned content, won’t be subject to the volatility, intrinsic to licensed content.

- Differentiation, as the produced content, will represent the company’s ability to innovate and produce great series (think of the growing numbers of Netflix Originals becoming hits).

- Monetization, as while in the short-term content production is way more expensive, it’s also what keeps subscribers hooked to the platform over time (If I can find Netflix series everywhere else, why would I stick to the platform?).

- More distribution options, as the company can perhaps license its content to other platforms, thus creating more options over time.

Key takeaways

- Netflix has grown from a DVD rental site born in 1997 to an over a hundred fifty billion market cap company. Today Netflix has become a major player in the media industry, and it is investing billions of dollars in the production and development of TV Shows that have become a symbol for millions of people worldwide.

- At the same time, the international expansion is costing Netflix billion of dollars, and the subscription-based business model requires continuous investments to keep millions of people paying their monthly plans. As the SaaS industry has taken over the tech world, many give for granted that a subscription business model always makes sense.

- In reality, as we’ve seen in the Netflix case study, it took it thirteen years to start expanding outside the US. And only in 2016, after almost twenty years Netflix was able to reach Asia.

- Netflix runs a cash negative business model where it advances content development costs and amortizes them over time through paying subscriptions. Thus, it’s crucial that Netflix is able to make the platform sticky for subscribers.

- Netflix turned into a media company, as it started to invest more and more into content production, rather than content licensing.

- Netflix’s content model changed the industry, as it enabled members to have new options to consume content, it also generated whole new industries for series, based on binge-watching. What Netflix created in terms of a playbook for media platforms, in the course of the last decades has now become the standard playbook for anyone that wants to compete in the media industry!

Are we going toward an ad-supported Netflix?

For the first time, in 10 years, Netflix has lost subscribers.

As soon as Netflix announced its first-quarter results, on April 20th, 2022, the stock fell apart:

In a single session, the company lost 35%. And we’re not talking about a low-cap meme stock. That burned billions of dollars in a single stroke.

Not only this was unforeseen (clever investors like Bill Ackman had placed very large bets on Netflix) but it seems very hard to assess where the problem lies.

Indeed, it’s easy to point out all the issues Netflix has today.

But there is another fundamental problem: where’s the attention going?

Netflix explained how the COVID boost in revenues has ended, and numbers didn’t lie about that:

But what are the underlying problems Netflix has identified?

The executive team has identified a few core problems that caused this sudden loss in subscribers:

Uptake of connected TVs

As Netflix pointed out they do not control the hardware part, thus, the more streaming services are offered on smart TVs, and the more traditional TV services add their own on-demand services, the harder it gets for Netflix to keep the same level of attention.

In the past, I pointed out, how Netflix started to build its distribution on hardware, by placing its default button on the smart TV controller, before anyone else. Yet the remote controller is now, getting very busy!

100m additional households are watching but not paying for Netflix.

Over the years, Netflix has incentivized users to simply share their passwords. This is also what made Netflix cool in the first place.

Yet, when you reach saturation, you get, as a company, much less cool about users sharing their passwords.

Therefore, Netflix is working on new paid sharing features, where current members have the choice to pay for additional households, trying to monetize these users.

We can also foresee some crackdowns, where users will be prevented to access the platform if sharing the password on other devices (things might get ugly there!).

An ad-supported Netflix

In the last years, as we went through the pandemic, Netflix has been spiking up prices for its subscriptions, which worked pretty well in terms of revenue generation.

For one thing, it shows how much people love Netflix, as they kept the subscription, nonetheless these price spikes. Yet, this strategy doesn’t work well, especially when the macroeconomic scenario isn’t as good.

As Netflix CEO, Reed Hastings has highlighted, on arstechnica:

“Those who follow Netflix know I’ve been against the complexity of advertising and a big fan of the simplicity of subscription, but as much as I’m a fan of that, I’m a bigger fan of consumer choice, and allowing consumers who would like to have a lower price and are advertising-tolerant get what they want makes a lot of sense.”

And Hastings further highlighted, in relation to the ad-supported plan:

“I think it’s pretty clear that it’s working for Hulu. Disney’s doing it; HBO did it. I don’t think we have a lot of doubt that it works. You know that all those companies have figured it out. I’m sure we’ll just get in and figure it out as opposed to test it and maybe do it or not do it.”

How would this work?

Hastings explained: “it would be a plan layer like it is at Hulu so if you still want the ad-free option, you’ll be able to have that as a consumer. And if you’d rather pay a lower price and you’re ad-tolerant, we’re going to cater to you also.” While the ad-supported service is tempting, is also worth highlighting that it might run at very tight margins for the company if the underlying content is primarily licensed content (just like for Spotify, the more you stream licensed content, the more content royalties costs go up).

Instead, such a model might work, if Netflix were to do it to offer its own content, but with the caveat of pacing that out.

In short, when a new series comes out, instead of enabling ad-supported subscribers to binge-watch it, content would be paced out. And if they want to watch it all, at once, they would need to pay for a full subscription plan.

New streaming services have also been launched

Competition in the streaming market has gotten very rough, and more platforms compete for the same type of attention:

Based on that, Netflix will further ramp up the investments in content, to produce new hits and originals.

Macro factors

Including sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and some continued disruption from COVID are likely having an impact as well.

Here there is not much control if not keep focusing on re-growing the subscriber base.

What do I think should Netflix do instead?

First, we need to reassess competition, and where it’s coming from.

Is the competition really between TV and streaming only?

Attention is not an asset, easy to control.

And while Netflix is assessing its competition, linearly, in reality, the threat might be coming from unexpected places.

The main mistake I believe Netflix is doing is on assuming that the main competitors are TV and streaming services. There is more to it!

Beyond streaming, attention is a fluid asset

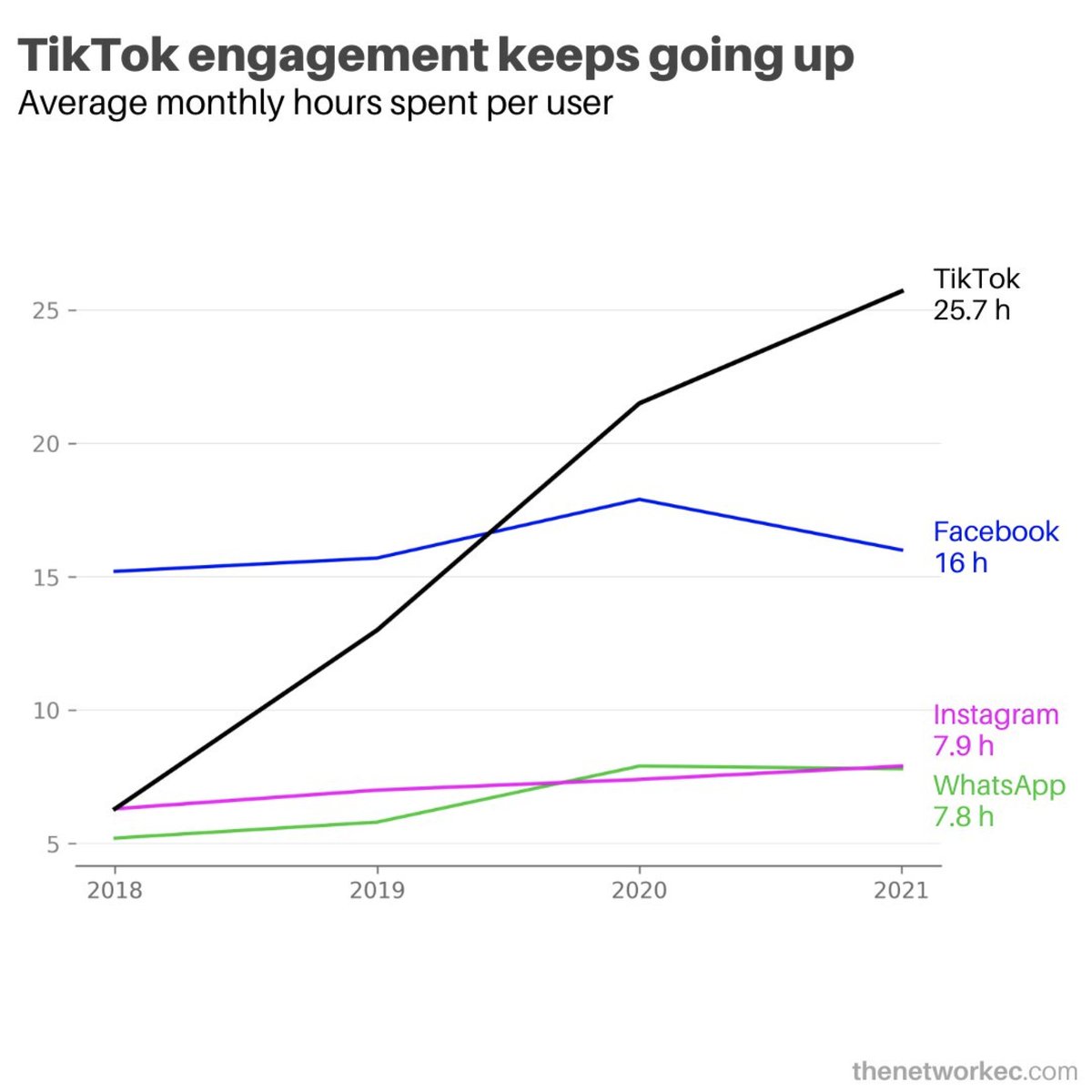

As Anand from CB Insights has highlighted “Maybe TikTok is what is killing Netflix?”

I think this is a great point to start with:

In fact, attention is a very fluid asset, which moves beyond traditional definition. And across platforms. In 2017, Netflix CEO, Reed Hastings highlighted:

“You get a show or a movie you’re really dying to watch, and you end up staying up late at night, so we actually compete with sleep, and we’re winning!”

Yet, today most of the attention is moving to other platforms. And the interesting part, is that, while platforms like TikTok offer natively short-form content. Many people end up spending hours on the platform.

So below are some of the things, I believe Netflix should do:

Vertical integration

Netflix managed to build an incredible brand over the years. It’s still an app, either on a Smart TV or on a mobile marketplace. The main company’s asset is its content. Not even the licensed content (that can be taken away from it, anytime), but its own content (the Netflix original series and movies). Thus, in order to build a long-term advantage, Netflix should also focus on bringing to market a successful device for consuming content.

As the story goes, back in 2007, Netflix was looking into building its own hardware. Indeed, its set-top box (it would enable to stream movies from the Netflix catalog) was ready for launch! Yet, at the very last minute, CEO, Reed Hastings canceled the project.

As reported by The Verge, Hastings’ fear was that “if the company released its own hardware, it would be seen as a competitor to the very companies with which it hoped to partner.”

Hastings has been quoted as saying: “I want to be able to call Steve Jobs and talk to him about putting Netflix on Apple TV, but if I’m making my own hardware, Steve’s not going to take my call.”

This shaped the company for years. Yet, what if Netflix got into the hardware game again? Instead of a Smart TV, Netflix could build a VR device to watch its series in high definition. Or perhaps a projector, smart theater device, to project Netflix anywhere in the house!

The company could sell it at cost while offering its subscription services within the device. In this way, if successful, over time, it can control the overall customer experience.

Reassess the content development strategy.

In the last years Netflix has produced great series, and important hits, yet, it shifted on quantity vs. quality. The content development efforts instead should be more skewed toward coming up with new content formats, innovating those formats, and raising the bar again (just like Netflix did in 2013 with House of Cards).

A hybrid between binge-watching and scheduled releases.

Binge-watching has been a disruptive content format, which has helped define Netlfix as a brand. Yet, one thing was to enable binge-watching, back in 2013, and toward the pandemic. Another is to ask, whether binge-watching is still a competitive format today.

In fact, binge-watching worked as an incredible flywheel in the early years. The rhythm it demands might not be sustainable over time, from a business standpoint.

While in the past, as a Netflix subscriber, once you had binge-watched your way through a series, you could still wait for the next series. Now, you have way more choices and options. And the need to jump on another series might drive you out of the platform.

Paradoxically then, in this scenario, it might make sense to start testing out some hybrid forms of content consumption. For instance, why not give the ability to binge-watch only for higher-tier plans? In short, binge-watching has been a defining feature of Netflix, in the early days. Might become a feature to discern between basic to more advanced plans.

Content formats that go beyond series

Netflix has been testing, for a few months, new short-form content formats, such as Kids Clips and Fast Laughs. Fast Laughs, in particular, is a TikTok-like platform where clips of popular shows on Netflix are hosted, and shown with a continuous scroll, and at full screen. In short, it tries to replicate TikTok’s successful formats.

Indeed, as Netflix highlighted: Fast Laughs offers a full-screen feed of funny clips from our big comedy catalog including films (Murder Mystery), series (Big Mouth), sitcoms (The Crew), and stand-up from comedians like Kevin Hart and Ali Wong.

Of course, this can be a powerful strategy to attract young users from platforms like TikTok, and Netflix has the data to understand what content on Netlfix makes sense to translate into short-form clips.

Yet to make those sorts of platforms successful, Netlfix should plug in user-generated content. In short, it should enable mechanisms on its platform that enable users to cut the clips they find most interesting and interact with the content.

This new, user-generated content, can become new formats, that can also serve as a way for the company to create new types of content, that are able to attract future generations.

More on Netflix Business Model

Netflix Yearly Average Revenue

Netflix Average Monthly Revenue Breakdown

Netflix Subscribers Per Region

Read Also: Netflix Business Model, Netflix Content Strategy, Netflix SWOT Analysis, Coopetition, Is Netflix Profitable.

![How Does Facebook [Meta] Make Money? Facebook Business Model Analysis 2024 facebook-business-model](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2024/02/facebook-business-model.png?resize=150%2C113&ssl=1)