Subscription-based business models are built on a recurring customer base, where customers rather than own, usually have access to the product or service. The customer can have the upside of the service, without owning the good underlying it, which is maintained by the company running the subscription-based business.

| Aspect | Explanation |

|---|---|

| Definition | The Subscription Business Model is a revenue model in which customers pay a recurring fee, typically on a monthly or annual basis, in exchange for continuous access to a product or service. It is characterized by an ongoing relationship between the provider and the subscriber, where customers enjoy continuous value and providers receive regular revenue. Subscriptions can cover a wide range of offerings, including digital content (e.g., streaming services), software (e.g., SaaS), physical products (e.g., subscription boxes), and more. This model has gained popularity due to its ability to generate stable, predictable revenue while fostering customer loyalty and long-term relationships. |

| Key Concepts | – Recurring Revenue: Subscribers pay a regular fee, ensuring a steady stream of income for the provider. – Customer Retention: Emphasis on keeping subscribers engaged and satisfied to minimize churn. – Scalability: The model can scale efficiently with the growth of the subscriber base. – Diverse Offerings: Subscription models are versatile and can apply to various industries and products. – Value Continuity: Subscribers expect continuous value delivery in exchange for their payments. |

| Characteristics | – Recurring Payments: Customers are billed on a regular basis (e.g., monthly, annually). – Customer Relationship: A strong customer-provider relationship is essential for ongoing success. – Access Over Ownership: Subscribers prioritize access to products or services over ownership. – Predictable Revenue: Subscription models offer predictable revenue streams. – Retention Focus: Providers aim to retain subscribers for as long as possible to maximize lifetime value. |

| Implications | – Steady Revenue: Subscriptions provide a consistent revenue stream, making financial planning more manageable. – Customer Loyalty: The model fosters customer loyalty as subscribers have a continuous relationship with the brand. – Value Delivery: Providers must consistently deliver value to justify ongoing payments. – Churn Management: Reducing subscriber churn is crucial to maintaining profitability. – Market Differentiation: Subscription offerings can differentiate a business in a competitive market. |

| Advantages | – Predictable Revenue: Subscriptions offer reliable, recurring income. – Customer Loyalty: The model fosters long-term customer relationships and loyalty. – Scalability: As the subscriber base grows, revenue scales efficiently. – Market Access: Subscriptions can provide access to a wider audience. – Diverse Monetization: Providers can offer tiered pricing and upsell opportunities. |

| Drawbacks | – Churn Rate: High churn rates can erode profitability. – Initial Acquisition Costs: Acquiring subscribers can be costly. – Content or Product Quality: Maintaining quality is essential to prevent churn. – Market Saturation: Saturated markets may face intense competition. – Customer Support: Ongoing customer support is crucial and can be resource-intensive. |

| Applications | – Streaming Services: Video and music streaming platforms like Netflix and Spotify. – Software as a Service (SaaS): Cloud-based software delivery, such as Microsoft 365. – Subscription Boxes: Curated product subscriptions like Birchbox. – Online Publications: Digital access to news and magazines, e.g., The New York Times. – E-commerce Subscriptions: Replenishment subscriptions for products like razors or pet food. |

| Use Cases | – Netflix: Provides a vast library of movies and TV shows through monthly subscriptions. – Amazon Prime: Offers a range of benefits, including streaming and free shipping, through an annual subscription. – Adobe Creative Cloud: Sells software subscriptions for tools like Photoshop and Illustrator. – Blue Apron: Delivers meal kits with ingredients and recipes on a weekly basis. – The Wall Street Journal: Provides digital access to news content via monthly subscriptions. |

Simplified anatomy of subscription-based business models

With the subscription-based business model, customers or members pay a set amount each week, month, or year, and in return, they get a product or service in exchange.

Today the subscription-based business model has become the standard for many tech companies.

From Netflix to Spotify and Amazon Prime, the subscription-based business model is appealing to companies because it allows them to build a more stable turnover.

Let’s take two scenarios. In the first, you launch a product that sells at $200 to 100 people. In the end, you have $20,000 at the bank.

Let’s take the case in which you sell a service for $100 to 100 people. In this case, you made $10,000.

Yet, in the coming month or year, you’ll not start from zero but you will have a predictable revenue (at least in theory, we’ll see why in practice that still isn’t the case).

That is why many businesses are adopting the subscription-based business model.

In other cases, like Amazone Prime, or Costco members those are not just additional revenue streams, but also programs that help those companies lock-in repeat customers.

Lastly, the subscription-based business model has also risen in the last decade as an alternative to the prevailing advertising-based business model (See Google and Facebook) dominating the web.

The subscription business model is as old as the newspaper

As reported via psprint.com:

At first, newspapers were only available to wealthy Americans, those who were literate and could afford to pay for subscriptions in advance. The subscriptions typically cost what a general laborer would make in an entire week of work, so most could not afford them.

That all changed in the 1830s, when advances in printing and papermaking made it possible to sell newspapers for one cent per copy.Increased literacy as well as technological advancementssuch as the telegraph – which made it possible to quickly share news over great distances – and the rotary press contributed to newspaper growth. The “Penny Press” made newspapers affordable to the entire public and spurred an explosion of newspaper publishing across the United States.

Thus the subscription business model isn’t new. However, what’s new about it is where it is getting applied.

For instance, since a few decades back it was hard to think of music as a service (see Spotify) or media that before was consumed at fixed time slots now it gets served at any time with streaming (see Netflix).

Is it the end of ownership?

As Tien Tzuo, chief executive officer and co-founder of Zuora pointed out:

The signs are everywhere — ownership is on the outs. From Spotify’s IPO to Amazon Prime hitting a hundred million memberships to Lyft’s new monthly pass, more and more people are opting for fluid services rather than static products. In fact, our physical world seems to be rapidly diminishing all around us. Companies aren’t buying buildings, they’re renting from WeWork or Servorp. Teenagers aren’t saving up to buy cheap cars, they’re catching rides with their phones. Even the malls are disappearing. The world is switching from capex to opex.

The reason for opting to usage rather than ownership can vary.

Some of the major drivers of change are related to the fact that as technology allows us to track and connect people it becomes also possible to transform traditional products in services.

Also, as on-demand services have become available, many people have become aware of the total cost of ownership, thus opting for access over ownership.

The total cost of ownership and why cars become expensive in the long-run

When you purchase a car, its initial cost is just one part of the expense. Real costs associated with the car will be the whole set of maintenance costs and operating costs to keep the car working.

As pointed out by consumerreports.org “many brands have low ownership costs during year three. Keep in mind that some—including BMW and Mini—have free maintenance for the first few years, making them relatively affordable out of the gate. But costs can skyrocket when the warranty and free maintenance periods are over.”

If you own a car, you know what we’re talking about. When you purchase a car you might have coverage for a few years, but the more the car gets older, the more expenses you’ll have. At the point in which maintenance expenses skyrocket.

The same issue applies to homeownership. If we take an estimate from caniretireyet.com you can see many of the hidden costs of homeownership:

In short, in the example above for a house valued at around $100k, we have several costs on a monthly basis which amount at $834.

Thus, if you could rent the same home for a lower price than renting might be an option.

One thing is important to point out. In many cases, ownership vs. renting is not about financial considerations alone. In many instances, emotional reasons apply.

At the same time companies like Airbnb are building their success more based on the home as a place to share and around experiences.

Online vs. physical? That might be the wrong dichotomy

As remarked on Zuora:

Retailers are mistakenly seeing the issue as e-commerce versus brick and mortar, but that’s not the problem,” says Tien Tzuo, chief executive of enterprise-software firm Zuora. “Online, in-store, it shouldn’t matter, it should all be blended: Consumers can shop wherever they want–it’s the retailers that build one-on-one relationship customers that will win.

Thus, it’s not about the channel it’s about the relationship. Tzuo remarked, “Amazon isn’t successful just because it’s an e-commerce site, but because it knows how to think like its customers.”

In other words, what makes Amazon’s strategy effective isn’t just the fact it has online stores.

The company uses data to make the user experience as personalized as possible. In short, when you go to an Amazon store, the way books are organized isn’t random.

Why subscription model might actually be easier for consumers

Source: neilpatel.com

What makes the subscription model so successful today isn’t only about ownership vs. usage.

That is also about how things get consumed. In an ownership model, the interaction between the provider and the consumer is entirely different compared to a model where the provider needs to establish a relationship with the “member.”

Where a provider that sells a product won’t need to know its customers.

The subscription business model to be successful requires an ongoing relationship with continuous feedback from members to the service provider.

This is also the reason why companies like Spotify and Netflix spend billions on producing TV Series and Music.

In short, to avoid the members to churn from their accounts any time soon they need to keep providing great experiences on a regular basis.

Also, as companies like Netflix gain a better and better understanding of their members (through the data fed to its algorithms), waiting for the next big hit coming from the Hollywood Studios might be too risky.

Instead, with all that data, Netflix can produce series that its members will find more compelling and stick to their premium plan longer.

That is also why as of the end of 2017, Netflix reported over $17 billion in streaming content obligations “primarily due to multi-year commitments associated with the continued expansion of our exclusive and original programming.“

Building and maintaining a relationship it’s quite expensive. Let’s dive a bit into the numbers of the subscription economy.

Software ate the world

Venture capitalist Marc Andreessen famously said, “Software is eating the world.” That was back in 2011, and that has become a reality. However, software companies have mostly found their realm in the subscription-based business model.

The so-called SaaS companies built software who continuously updates, and with that, a subscription economy worth billions. SaaS models though are all but easy to scale.

The SaaS industry has become competitive. Companies to differentiate had to add support teams on top of the software (what in SaaS lingo is called Customer Success) and professional services to help customize those otherwise commoditized services.

SaaS companies, as we’ll see, run against its greatest enemy: the churn rate (or what I like to call “the leaky bucket”).

Are we sure that the subscription economy is the answer?

Where the subscription economy has risen to become a multi-billion industry. And a great alternative to the otherwise dominating, advertising-driven business model.

It also has its drawbacks.

The real cost of not owning? Ask it when it all goes wrong!

One of the key advantages of only having access and usage is you don’t have to deal with the inconvenience coming with maintenance and ownership. However, if you don’t own it you don’t control it in full.

And when it all goes wrong, you would be better owning it. Thus, it’s great to have an access economy, where people can conveniently share things. However what happens when it all goes wrong?

Let’s take a simple example. Let’s say, you sold your car (who needs a car if we have Uber or car-sharing apps). Yet one day, you feel so bad you have to run to the hospital.

Right in that moment, there is no Uber available, no car shares, neither a cab that will take you there. You almost risk your life if you didn’t have your friend (owning a car) bringing you there.

True, you saved on the total cost of ownership for years, yet you risked your life once. Of course, this is an extreme example. But you get the point. Even if you only have access, are you sure you don’t need ownership if it all goes wrong?

The obsession to smooth things up

Running a business is a risky endeavor. Sales usually don’t follow a linear path. It is the dream of any manager to run a business with smooth revenues.

And a predictable revenue stream is as good as it gets. That makes subscription-based companies look for ways to lock-in customers. This can result in better service, in many cases.

However, in many others, it could also result in an attempt to create useless lock-in, which instead of creating a better customer experience, might actually worsen it.

In addition, where unit sales are less predictable, they also have a potentially unlimited upside. As Hollywood has known for years, a single blockbuster can make your bottom-line for years.

A subscription-based business instead, might try to bundle its blockbuster with the series of mediocre products it has to keep pushing its subscriptions up by creating a sort of lock-in effect.

Thus, building up a great subscription-based business model can be tricky.

Is it more expensive to run a subscription-based business model?

Netflix is dominating the subscription economy in the consumer segment. As it is among the most recognized brands in the world. While the company is extremely profitable, it also runs a negative cash flow business.

The company had over $5 billion in cash at the bank, however, most of that cash comes from financing activities.

There are several reasons for that, and of course, Netflix had to become a strong brand in a market dominated by established brands like Disney. Yet, the key point here is, running a successful subscription-based company is not simple.

Indeed, building a strong subscription-based business also means strengthening things like infrastructure, and support, that are very expensive parts of a business, to maintain.

Careful to the “Leaky Bucket” effect

Among the things that can affect a subscription business, that is what in the SaaS world is called churn (or the percentage rate at which customers cancel their subscriptions with respect to those who join).

Just like a bucket that fills but it has a hole that becomes larger and larger. Many companies fail to build a successful subscription-based business as the number of people joining cannot keep up with those who leave.

Finding a balance is tricky and not as simple as it might seem.

The Subscription Economy

Source: mckinsey.com

According to the McKinsey report, top five subscription business models include companies like Amazon Subscribe & Save, Dollar Shave Club, Ipsy, Blu Apron, and Birchbox:

Amazon Subscribe & Save

Dollar Shave Club

Ipsy

Blue Apron

Birchbox

As pointed out by McKinsey report:

Both men and women, buying for themselves or for others, use many of the leaders, but women are more likely to subscribe to beauty and apparel services, including Stitch Fix (apparel), AdoreMe (lingerie), and ShoeDazzle (shoes). Men, by contrast, are much more likely to gravitate to razors (Harry’s is the third-most-popular service for men but the seventh overall), video-gaming gear and collectibles (Loot Crate), and meal-kit or food-delivery services (Home Chef and Instacart’s subscription delivery option, in addition to Blue Apron and HelloFresh).

The interesting part of the Subscription Economy is that any kind of product can be transformed into an experience, thus a service that can become a subscription business model.

In fact, in some cases, the subscription business model depends upon creating a surprise box.

In other cases building up a subscription business model is really up to your creativity. Don’t believe me? See the next example.

Take a snack box mix it up and you get Gaze mini-snack subscription box

Graze is a mini-snack subscription box that sends a customized selection of treats weekly, bi-weekly, or monthly.

The process is simple:

- Create your account and tell them what you like

- Graze tailors your box and delivers it for free

- Once receive your snacks you can rate them so that Graze will learn your preferences

One thing you might notice. This isn’t a one-time relationship but a continuous process.

A feedback loop, between Graze and its members. After a few iterations Graze will know the tastes of the members so well that with no effort at all Graze will be able to deliver the best experience ever.

Three models of subscriptions

Although subscription business models can have unlimited applications. They can be categorized into three main groups.

Replenishment subscription

In the Replenishment subscription model, consumers get an automated purchase process of commodity items.

Think of razors or diapers that can be bought with one click.

You might think that the Amazon Dash Button is about making a transaction frictionless (in fact it is).

Yet this is only part of the story. Dash Buttons can be used by the “exclusive” Amazon Prime Members.

Thus, this is just one of the many strategies Amazon is employing to get more subscribers.

Also, all the data provided via those buttons will be a precious asset for Amazon in the long run!

You get toilet paper effortlessly. Yet Amazon receives valuable data about you, anywhere at any time.

Curation subscription

Just like we saw in the Graze business model above. That is based on “curation.”

Graze does a great job in personalizing the experience from time to time until it gets better over time:

For a curation subscription to be sustainable, it has to surprise and delight with highly personalized experiences.

Access subscription

The Amazon Dash Button above can also be included in the access subscription.

Here you pay a monthly fee to obtain lower prices or members-only perks.

Getting the dash button is itself a “perk” exclusively granted to Amazon Prime customers.

Another example might be Apple Music. Rather than buying a single song you can get a membership and listen to any:

Other subscription business model examples

Let’s see some other examples of subscription-based business models.

The NY Times successfully converted to a subscription-based model

The NY Times has been among the leading publishers in converting its business model to primarily driven by subscriptions.

How do you decide whether it makes sense to rise a paywall for your publishing business?

One way is to start from the decision tree above, where you can evaluate, if, and what kind of paywall might make more sense for your business.

Amazon Prime as a key for Amazon repeat customer

Those companies’ financial success depends upon their ability to keep their members churn.

Amazon Prime is an important component of the overall Amazon Business Model.

Costo members also matter to lock-in the repeat customer.

Source: medium.com/the-graph/subscription-economy

Netflix

The Netflix business model is a powerful example of a subscription-based model. Indeed, Netflix has used its monthly fee to boost its recurring revenues.

The subscription revenue model is also what allows Netflix to make substantial investments in content compared to traditional mass media, where each deal needs to be secured again:

Related: How Does Netflix Make Money? Netflix Business Model Explained

Spotify

Spotify is another powerful example of a subscription business model. The company has been able to create a massive base of users worldwide in a relatively short period. Spotify benefits from classic two-sided network effects.

When more users join the platform, the platform itself becomes more valuable for artists that decide to launch their music over the platform. And the more artists decide to feature their content exclusively on Spotify, the more the platform becomes valuable to more subscribers.

Related: How Does Spotify Make Money? Spotify Business Model In A Nutshell

Other enterprise subscription business models

Slack

Sumo Logic

Snowflake

Unity Software

Beware of members churn

Getting a fixed amount of money in the bank account each month is the dream of any company.

Yet, having members stick might be the hardest task. Why do members churn? Hubspot mentions five main reasons:

- Lack of (or Zero) Engagement

- Poor Product-Market Fit

- Product Bugginess

- Difficult User Experience

- Lack of Proactive Support

To make sure your subscription business model is sustainable in the long run you want to keep a careful eye on some key metrics.

The key metrics to measure whether your subscription business is successful over time

Running a successful subscription business model is about balancing things up.

Just like having your revenues cover your expenses, in a subscription business model your customer acquisition costs have to be lower compared to the lifetime value for your customers.

Thus, the following metrics are critical:

Subscriber acquisition cost

The subscriber acquisition cost comprises aggregate costs, such as marketing, sales commissions, installation for acquiring one subscriber.

Monthly recurring revenue (MRR)

This is the magic number many subscription-based startups need to look at to grow their business in the long run. This is the amount of fixed revenue retained every month.

This metric is pretty simple to compute: multiply net users per month by the subscription fee. A growing MRR is critical for the healthy growth of your subscription business model.

Churn rate

This is computed by multiplying net users left per month by the subscription fee. Keeping the churn rate in check is critical.

Monthly recurring costs (MRC)

The monthly recurring costs are the cost incurred to earn the recurring monthly revenue.

For instance, if you offer a software as a service, you will have server costs and support costs for those accounts.

They do bring you money each month, but also costs.

Lifetime value (LTV)

The Lifetime Value is the total revenue earned per subscriber.

Monthly active users (MAU)

Another key metric, especially used by tech companies in which survival depends upon the continuous interactions of its users with the platform is the monthly active users. Spotify is an example:

Does a freemium work with the subscription business model?

The freemium business model (or growth strategy depending on the perspective) has become omniscient in the tech startup world. Thus, many associate it with the subscription business model.

In reality, the freemium makes sense when the cost structure allows it.

What subscription models can you apply to your business?

According to The Automatic Customer, there are seven models you can apply to your business.

- Membership website model

- All-you-can-eat content model

- Private club model

- Front-of-the-line model

- Consumables model

- Surprise box model

- Simplifier model

- Network model

- Peace-of-mind model

Subscription Box Business Models Case Studies

Key takeaway

The subscription business model has become by itself an economy. In fact, if you look more carefully and dive deeper you’ll find examples of subscription business models anywhere.

The subscription business model is the financial dream for many companies because you can create a constant stream of revenues each month from your business.

However, maintaining that revenue stream is also quite costly. We saw how companies like Netflix and Spotify spend billions in content just to have their members stick.

A subscription business model requires community building, continuous engagement, and a feedback loop to keep personalizing the experience of the members.

What to read next?

- Business Model Innovation

- Business Models

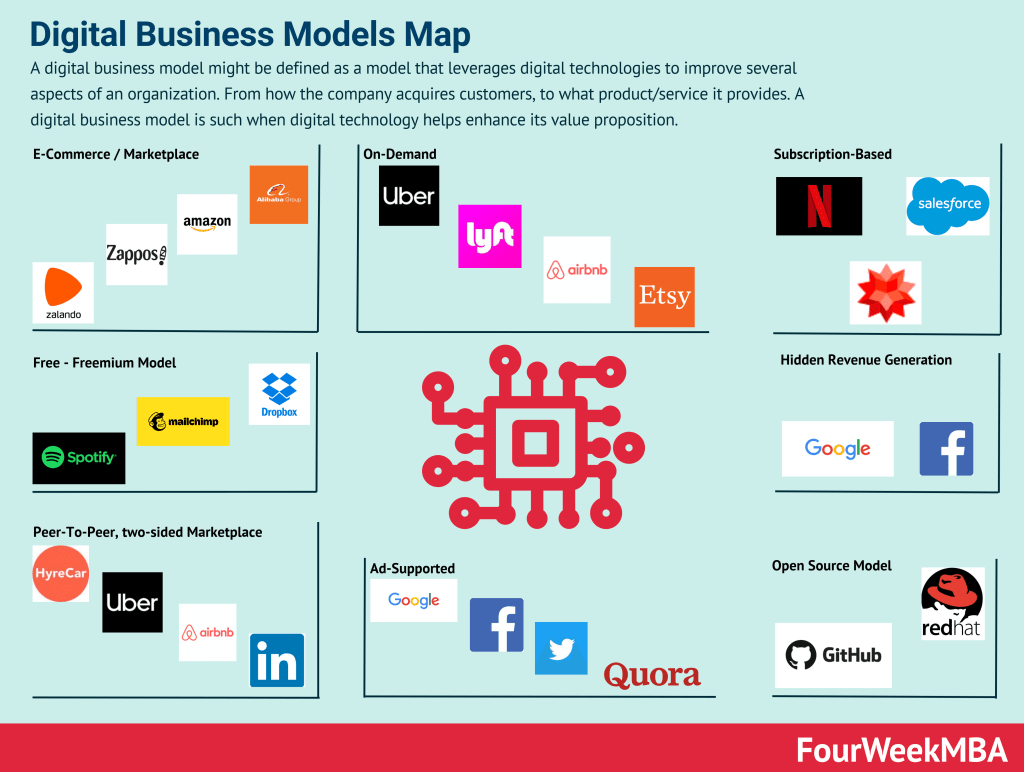

- Digital Business Models

- Business Strategy

- Value Proposition

- Marketing Strategy

Key Highlights

- Subscription Model Basics:

- Subscription models involve customers paying a regular fee to access a product or service.

- Examples include Netflix, Spotify, and Amazon Prime.

- Subscription models provide stability, predictable revenue, and customer retention.

- Benefits of Subscription Models:

- Predictable Revenue: Subscribers provide a consistent income stream.

- Customer Retention: Subscribers are more likely to stay loyal.

- Personalized Experiences: Companies need to engage and continuously improve to keep subscribers satisfied.

- Evolution of Subscription Models:

- Subscription models are not new and have historical roots in industries like newspapers.

- Technology and changing consumer preferences have expanded subscription models into various sectors.

- Shift from Ownership to Usage:

- The rise of on-demand services and the sharing economy has led to a preference for access over ownership.

- Total cost of ownership and changing consumer behavior are driving this shift.

- Challenges of Subscription Models:

- Maintaining Engagement: Ensuring subscribers remain engaged is crucial to prevent churn.

- Balancing Costs: Subscription companies must manage costs to ensure profitability.

- Loss of Control: Customers may expect access but not ownership, leading to potential issues.

- Key Metrics for Subscription Models:

- Subscriber Acquisition Cost: Costs to acquire new subscribers.

- Monthly Recurring Revenue (MRR): Predictable income from subscribers.

- Churn Rate: The rate at which subscribers cancel their subscriptions.

- Monthly Recurring Costs (MRC): Costs associated with maintaining the service.

- Lifetime Value (LTV): Total revenue earned per subscriber.

- Monthly Active Users (MAU): Number of users actively engaging with the service.

- Types of Subscription Models:

- Membership Website: Exclusive access to content or resources.

- All-You-Can-Eat Content: Unlimited access to a range of content.

- Private Club: Access to exclusive perks or experiences.

- Front-of-the-Line: Early access to products, services, or features.

- Consumables: Regular delivery of essential goods.

- Surprise Box: Curated surprise items delivered regularly.

- Simplifier: Streamlining or simplifying processes for subscribers.

- Network: Building a community or network around the service.

- Peace-of-Mind: Offering security or convenience to subscribers.

- Case Studies:

- Dollar Shave Club: Disrupted the razor industry with a subscription model.

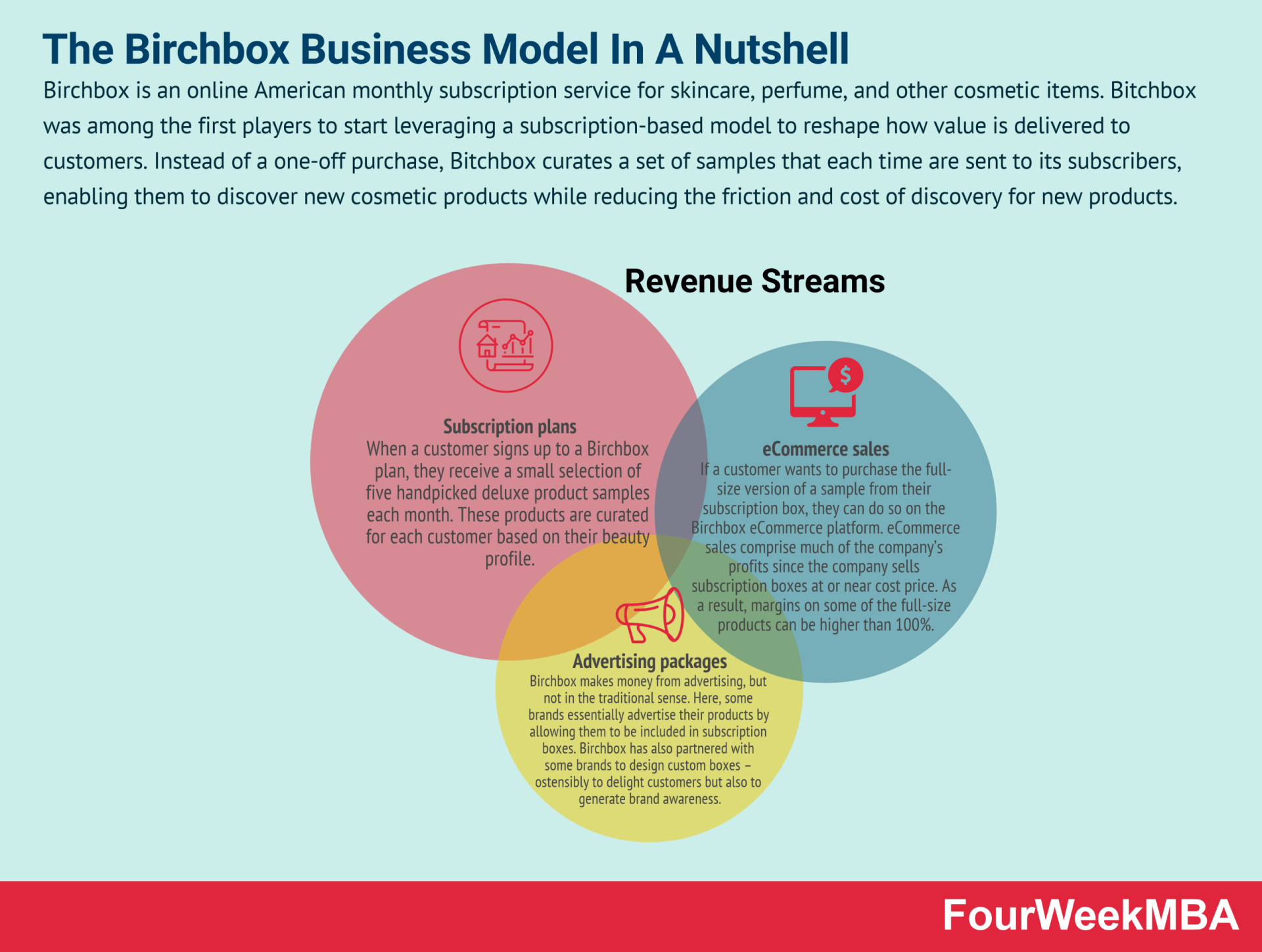

- Birchbox: Introduced beauty product discovery through subscription boxes.

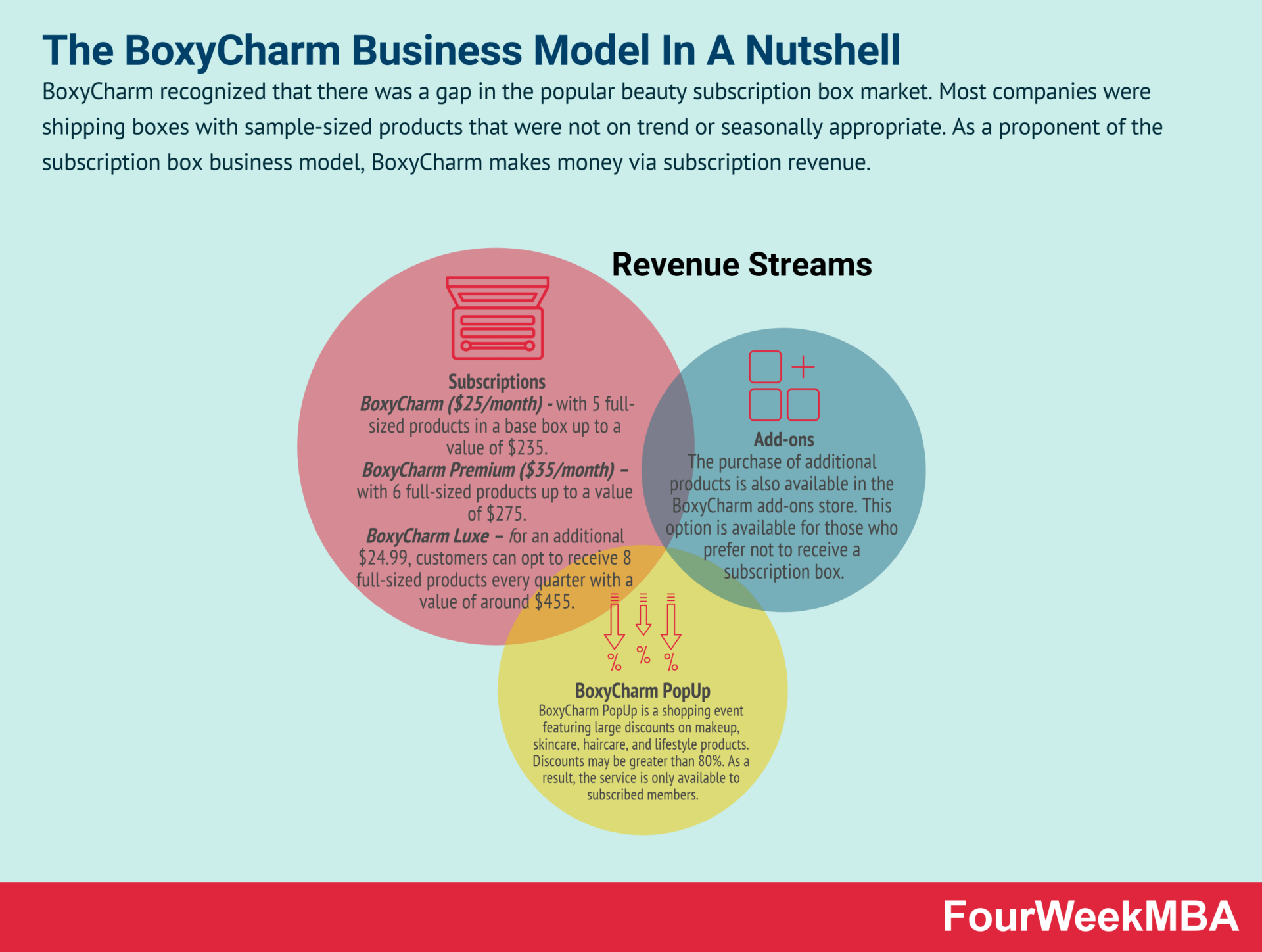

- BoxyCharm: Focused on delivering trendsetting beauty products to subscribers.

| Framework Name | Description | When to Apply |

|---|---|---|

| Churn Rate Analysis | – Measures the rate at which customers unsubscribe or cancel their subscriptions over a specific period, providing insights into customer retention and satisfaction levels. | – When assessing customer loyalty and the effectiveness of retention strategies, to identify areas for improvement and reduce churn. |

| Customer Lifetime Value (CLV) | – Predicts the total revenue a customer will generate over their entire relationship with a business, helping to prioritize customer acquisition and retention efforts. | – When evaluating the profitability of acquiring and retaining customers, to optimize marketing strategies and allocate resources effectively. |

| Freemium Model | – Offers a basic version of a product or service for free, with the option to upgrade to a premium version with additional features or functionality for a subscription fee. | – When introducing new products or services, to attract users with a free offering and convert them into paying subscribers through value-added features. |

| Tiered Pricing Structure | – Offers different subscription tiers with varying levels of features or benefits at different price points, catering to the diverse needs and budgets of customers. | – When pricing subscription plans or packages, to provide options that appeal to different customer segments and maximize revenue potential. |

| Usage-based Billing | – Charges customers based on their actual usage of a product or service, providing flexibility and aligning costs with value received, particularly relevant for software-as-a-service (SaaS) businesses. | – When pricing subscription plans or services, to offer transparent pricing and incentivize usage without overcharging or undercharging customers. |

| Retention Strategies | – Focuses on engaging and retaining customers over the long term, employing tactics such as personalized communication, loyalty programs, and continuous value delivery. | – When reducing churn and improving customer lifetime value, to foster loyalty and strengthen the relationship between the business and its subscribers. |

| Subscriber Acquisition Cost (SAC) | – Measures the cost of acquiring a new subscriber, including marketing expenses and sales commissions, relative to the revenue generated from that subscriber. | – When evaluating marketing campaigns and customer acquisition channels, to optimize spending and maximize the return on investment in subscriber acquisition. |

| Content Personalization | – Tailors content, recommendations, and experiences to individual subscriber preferences and behaviors, enhancing engagement and satisfaction with the subscription service. | – When delivering content or services to subscribers, to increase relevance and value perception, driving retention and reducing churn. |

| Automatic Renewal | – Enables subscriptions to renew automatically at the end of each billing period unless canceled by the subscriber, streamlining the renewal process and ensuring continuity of service. | – When managing subscription billing and renewal processes, to minimize subscriber effort and maintain a predictable revenue stream for the business. |

| Feedback Loop Management | – Establishes a systematic process for collecting, analyzing, and acting on customer feedback to continuously improve the subscription offering and address customer needs and concerns. | – When refining subscription services or introducing new features, to iterate based on customer insights and enhance the value proposition, driving satisfaction and retention. |

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: