In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.

Business Model Explorers

Understanding asymmetric business models

To me, the distinction between the attention merchants and the rest was clear, as I developed the idea of asymmetric business models. Let me further explain.

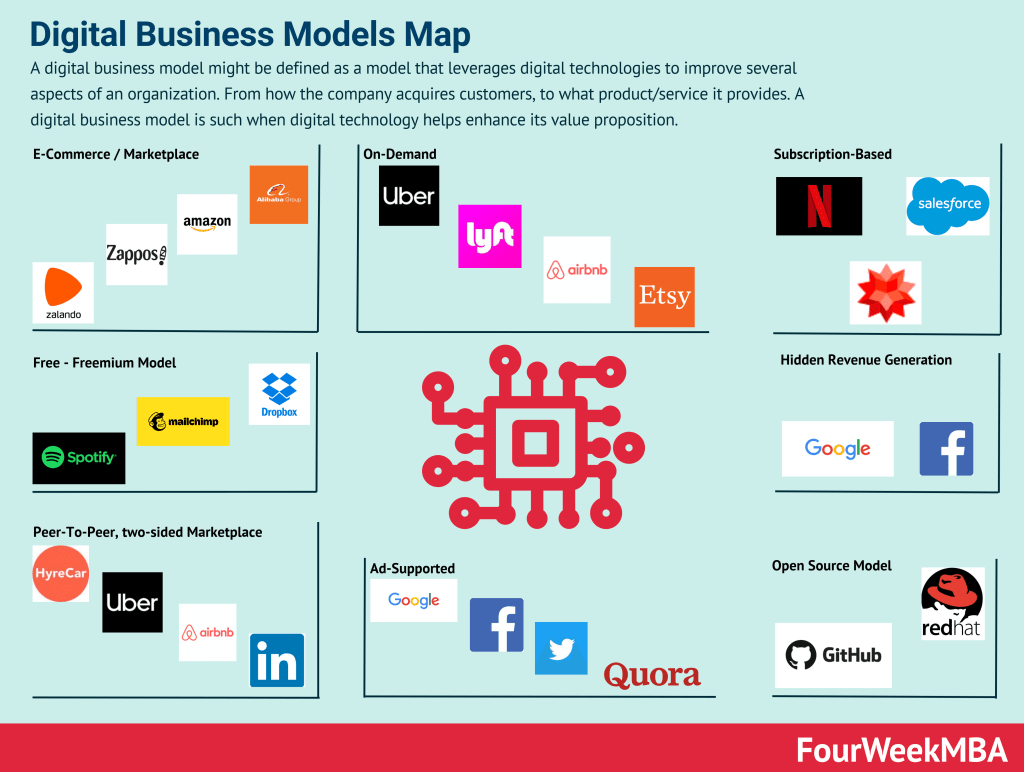

With the risk of sounding redundant, business models can be classified in many ways. For the sake of this piece, we’ll classify them according to the fact that companies break down the walls between product and distribution, to enhance the value proposition for potential customers/users.

When these conditions are met that is when we have a digital business model. And perhaps that is how we assist to the so hyped digital transformation. When you have not crossed that border where product and distribution have come together to enhance value proposition, thus enabling scalability, you’re still experimenting with digitalization.

Therefore a digital business model is such, when the digital part embraces product development and distribution, as a whole.

Thus, digital business models evolve into tech business models, where the technical component, the technology, becomes a key enhancer for the value proposition of the customer, thus making the company primarily a tech player.

And a further evolution from digital/tech business models to blockchain-based business models is also a further step we’re looking at in the coming decades. In the case of blockchain-based business models as we’ll see, they in part resemble open-source, but with built-in economic incentives to align developers, users, investors, and more. Understanding this transition is critical!

Let’s take a quick look at what asymmetry means, and let’s compare it with symmetric business models.

Asymmetric business models

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users‘ data, combined with the algorithms that repackage that data and sell it to advertisers for visibility.

Let me get back to further clarify what makes up an asymmetric business model:

- Asymmetry 1 or customer asymmetry – Key user ≠ Key Customer: The product is usually free and it’s not monetized directly (it’s not linear, like a freemium, where there is a free version and a paid, upgradable version). Instead, the core asset is supported by a key customer which is different from the key user (Google, Facebook, YouTube Free, Instagram, TikTok).

- Asymmetry 2 or monetization asymmetry – Non-Linear Monetization Pattern: The way the product is monetized is hidden from the average user’s eyes (in short, the average user doesn’t know and doesn’t care about how the free product is getting monetized as long as it works seamlessly). In fact, while the free users do represent the most important asset for the company (none would buy advertising from Google or Facebook if they hadn’t a large user base) they don’t pay directly through the product’s usage. They pay indirectly, as the data is repackaged, refined, rechanneled within an attention-based marketplace (as we’ll see below).

- Asymmetry 3 or Data/Information Asymmetry – Attention-based Marketplace supported by advertisers/marketers/businesses: The data provided by the users is repackaged in multiple ways, and usually resold on an attention-based marketplace. The attention-based marketplace is the monetization platform, which is highly scalable and built to draw in a large number of small to medium businesses, and also larger enterprise accounts (Google Ads, Facebook Ads).

Conversely, symmetric business models usually follow the opposite route:

- Key user = Key Customer: in this case the user is also the customer. It might be that the user can benefit from the free service, to a certain extent either through a free trial, or a free version of the product. But in general the user will be prompted to upgrade based on usage, premium features and more, or perhaps through an enterprise version of the same product (Netflix, Fastly, WordPress.com).

- Linear Monetization: connected on the previous point, monetization happens more linearly, as the same asset consumed by users is also the one they pay for. As an example, you get a free trial from Netflix, after the trial, you convert from user into paying customer, thus benefiting from the platform and by sustaining it as well.

- Pay-as-you-go/Upgrade/Subscription-based: usually these symmetric business models rely on usage-based models, or on premium-based models or yet on subscription-based models.

It’s important to note that when we look at very large organizations, they might be using both symmetric and asymmetric models. Perhaps, YouTube is both a free and asymmetric platform and a paid and symmetric one (with YouTube memberships). Amazon is both a symmetric platform, with Amazon prime, while at the same time selling the users’ attention on the platform via Amazon Advertising. However, each business model can be skewed toward one or the other.

For instance, Google and Facebook are skewed as asymmetric business models, whereas Netflix, WordPress, and Fastly are symmetric.

Key Highlights

- Overview: Asymmetric business models leverage user data and technology to sustain the core asset, while key customers pay for the value generated. This contrasts with symmetric models where users directly pay for the product or service.

- Customer Asymmetry: The key user is not the same as the key customer. The product is often free for users, and its core support comes from a different group, usually advertisers or marketers.

- Monetization Asymmetry: The monetization process is not apparent to the average user. The data provided by free users is repackaged, refined, and resold on an attention-based marketplace, which is the actual monetization platform.

- Data/Information Asymmetry: The data users provide is repurposed and sold on an attention-based marketplace, supporting advertisers, marketers, and businesses. This marketplace attracts a wide range of enterprises and accounts.

- Symmetric Business Models (Contrast):

- Key User = Key Customer: In symmetric models, the user is also the customer. Users may benefit from free services to a certain extent, and then are prompted to upgrade based on premium features or enterprise versions of the product.

- Linear Monetization: Monetization occurs directly in relation to the same asset consumed by users. For instance, users transition from a free trial to a paying customer for a platform.

- Pay-as-You-Go/Upgrade/Subscription-based: Symmetric models often use usage-based, premium-based, or subscription-based monetization approaches.

- Mixed Use Cases: Some large organizations use both symmetric and asymmetric models. For example, YouTube offers both free, asymmetric content and paid, symmetric memberships. Amazon operates as both a symmetric platform (Amazon Prime) and sells users’ attention through advertising.

- Business Model Examples:

- Asymmetric: Google and Facebook are skewed towards asymmetric models, leveraging user data and advertisers.

- Symmetric: Netflix, WordPress, and Fastly are skewed towards symmetric models, where users directly pay for products or services.

Examples of asymmetric business models:

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: