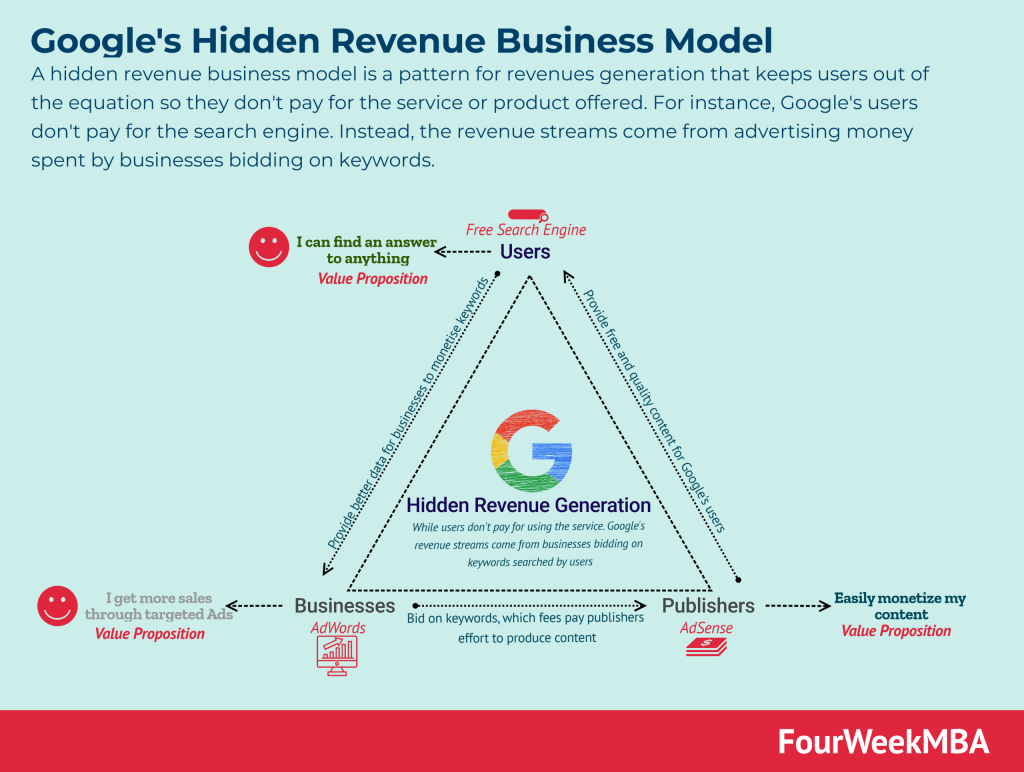

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.

Asymmetric business models explained

A couple of core examples of asymmetric business models that are easier to understand as are companies we all know are Google and Facebook.

Both are attention-based models, where users’ data get sold to advertisers. It’s important to highlight that it isn’t necessarily the data that is sold directly but rather how the data is refined by those companies’ search algorithms (for Google) and social graph algorithms (for Facebook), repackaged and sold to advertisers.

The key point is not about the advertising business model but rather how monetization happens. In an asymmetric model, users and customers are two different people.

The user is the most valuable stakeholder as it provides the data which gets used to refine the core asset of the company. Combined with technology, that is how the core asset is sold to a key customer.

To go back to Google’s example, users search through Google providing valuable search intent data but also behavioral data.

When this gets refined by Google’s algorithms, that is when the core asset becomes monetizable, as it gets sustained by the advertising revenues paid by customers paying for visibility on the platform.

Other asymmetric business models examples

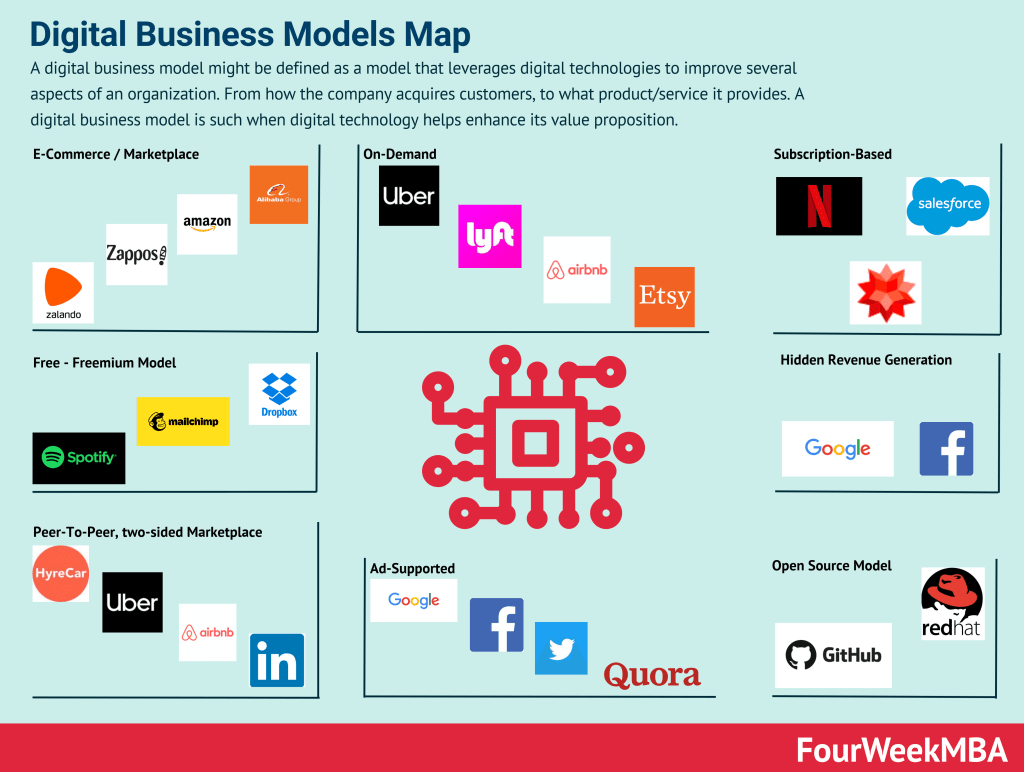

In general, business models where the user and customer are not the same people can be classified as asymmetric.

Therefore the attention generated by the free service or product gets monetized indirectly. Google and Facebook are classic examples. Other platforms like Netflix simply monetize their users’ data by providing them with a subscription service. Thus, this is an asymmetric model where user/customer matches.

Asymmetric business models if used properly can scale quickly. However, those are also usually built on large numbers.

Key Highlights

- Asymmetric Business Models: A pattern for revenue generation where users do not directly pay for the service or product offered. Instead, revenue streams come from other sources, such as advertising or data monetization.

- Google’s Advertising Model: Google’s main revenue comes from advertising, with users providing data used to refine the core asset (search engine) which is then monetized through paid advertising.

- Facebook’s Attention Merchant Model: Facebook generates revenue primarily through advertising, capitalizing on the attention of its vast user base by selling ad space to businesses.

- User vs. Customer Distinction: In asymmetric models, users and customers are different entities. Users provide valuable data, and the core asset is sold to customers (advertisers) who pay for visibility.

- Netflix’s Data-Driven Subscription Model: Netflix is an example of an asymmetric model where users pay for a subscription service, and their data is used to refine content offerings and improve user experience.

- Scaling and User Base: Asymmetric models can scale quickly, but their success often relies on having a large number of users or customers to generate significant revenue.

Business Model Explorers

Examples of asymmetric business models:

- How Does Google Make Money? It’s Not Just Advertising!

- How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

- The Google of China: Baidu Business Model In A Nutshell

- How Does Twitter Make Money? Twitter Business Model In A Nutshell

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

Resources:

- What Is Business Model Innovation And Why It Matters

- Successful Types of Business Models You Need to Know

- Business Strategy: Definition, Examples, And Case Studies

- Marketing Strategy: Definition, Types, And Examples

- Platform Business Models

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: