Microsoft has a diversified business model, spanning from Office to gaming (with Xbox), LinkedIn, search (with Bing), and enterprise services (with GitHub). In 2023, Microsoft made almost $212 billion in revenues, of which almost $80 billion came from Server products and cloud services, and almost $49 billion came from Office products and cloud services. Windows generated $21.5 billion, Gaming generated over $15.4 billion, LinkedIn over $15 billion, and search advertising (through Bing) over $12 billion. Enterprise (GitHub) generated $7.7 billion, and devices (PC) generated $5.5 billion.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Microsoft’s value proposition is based on several key factors: – Productivity and Collaboration Tools: Offers a suite of software and cloud-based tools for productivity and collaboration, including Microsoft Office and Microsoft 365. – Cloud Services: Provides Azure cloud computing services for businesses and developers. – Gaming: Owns Xbox and offers gaming experiences and services. – Enterprise Solutions: Delivers enterprise software and services, including Windows and SharePoint. Microsoft empowers individuals and organizations to achieve more by providing essential software, cloud services, gaming experiences, and enterprise solutions. | Enhances productivity and collaboration through its software tools. Supports businesses and developers with Azure cloud services. Offers gaming enthusiasts an immersive Xbox experience. Provides essential enterprise solutions for organizations. Appeals to a wide range of individuals and industries with varied needs. | – Microsoft Office and Microsoft 365 for productivity. – Azure cloud computing services for businesses. – Xbox for gaming enthusiasts. – Windows and SharePoint for enterprise solutions. – Attracting a diverse range of customers with various needs. |

| Customer Segments | Microsoft serves diverse customer segments, including: 1. Individuals: Providing software like Windows and Office for personal use. 2. Businesses: Offering productivity tools, Azure cloud services, and enterprise solutions. 3. Developers: Supporting software development through Azure and Visual Studio. 4. Gamers: Offering Xbox consoles, games, and services. Microsoft caters to a wide range of customers in the consumer, business, developer, and gaming markets. | Addresses the needs of individuals, businesses, and developers with software and cloud services. Offers immersive gaming experiences for gamers. Provides customized solutions for various industry sectors. Diversifies offerings for a broad customer base. | – Meeting personal and professional software needs. – Supporting developers in software development. – Offering gaming experiences for enthusiasts. – Customizing solutions for diverse industries. – Diversifying offerings for a broad customer base. |

| Distribution Strategy | Microsoft’s distribution strategy includes several key components: – Licensing Agreements: Sells software licenses to individuals and organizations. – Online Stores: Offers software downloads and subscriptions through its online stores. – Channel Partners: Collaborates with resellers and partners to reach businesses. – Cloud Services: Distributes Azure cloud services through data centers worldwide. Microsoft ensures accessibility through various channels and partners with a global presence. | Sells software licenses through licensing agreements and online stores. Collaborates with resellers and partners to reach businesses effectively. Distributes cloud services through a global network of data centers. Ensures accessibility and global reach through diverse distribution channels. | – Selling software licenses through agreements. – Offering software downloads and subscriptions online. – Collaborating with partners to reach businesses. – Distributing cloud services through a global network of data centers. – Ensuring accessibility and global reach through diverse channels. |

| Revenue Streams | Microsoft generates revenue from various sources: 1. Software Licensing: Earns income from software licenses and subscriptions, including Office and Windows. 2. Cloud Services: Generates revenue through Azure cloud computing services. 3. Enterprise Solutions: Offers business solutions like SharePoint and Dynamics 365. 4. Hardware: Sells devices such as Surface laptops and Xbox consoles. 5. Gaming Services: Monetizes through Xbox Live and Game Pass subscriptions. Microsoft diversifies income through software, cloud services, enterprise solutions, hardware, and gaming. | Relies on revenue from software licensing as a primary income source. Earns significant income from Azure cloud computing services. Provides enterprise solutions for additional revenue streams. Sells hardware devices and monetizes gaming services. Diversifies income sources for financial stability. | – Earnings from software licenses and subscriptions. – Generating significant income from Azure cloud services. – Offering enterprise solutions for additional revenue. – Selling hardware devices and monetizing gaming services. – Diversifying income sources for financial stability. |

| Marketing Strategy | Microsoft’s marketing strategy focuses on the following elements: – Productivity and Innovation: Highlights productivity tools and innovation. – Customer Success Stories: Showcases case studies and customer success stories. – Cloud and AI: Emphasizes Azure cloud and artificial intelligence (AI) capabilities. – Community Engagement: Engages with developer communities and enthusiasts. Microsoft promotes its products, customer successes, cloud services, and fosters community engagement to build trust and brand loyalty. | Showcases productivity tools and innovation to attract users. Demonstrates real-world benefits through customer success stories. Highlights cloud and AI capabilities for businesses. Engages with developer communities and gaming enthusiasts. Prioritizes trust-building and community engagement in marketing efforts. | – Highlighting productivity and innovation in products. – Showcasing real-world customer successes. – Emphasizing cloud and AI capabilities for businesses. – Engaging with developer communities and gaming enthusiasts. – Prioritizing trust-building and community engagement in marketing. |

| Organization Structure | Microsoft’s organizational structure includes: – CEO and Leadership Team: Led by the CEO responsible for overall strategy. – Business Units: Divided into business units like Cloud, Productivity, and Gaming. – Research and Development: Focuses on innovation and technology development. – Sales and Marketing: Manages sales, marketing, and customer engagement. – Global Presence: Operates globally with offices, data centers, and partners worldwide. Microsoft’s structure emphasizes innovation, technology development, customer engagement, and global reach. | Led by a CEO responsible for overall strategy and direction. Divides operations into specialized business units. Prioritizes research and development for innovation. Manages sales, marketing, and customer engagement effectively. Operates globally with a strong presence worldwide. Supports Microsoft’s strategic growth and industry leadership. | – Led by a CEO for strategic direction. – Specialized business units for operational efficiency. – Prioritizing research and development for innovation. – Effective management of sales, marketing, and customer engagement. – Strong global presence supporting strategic growth. – Maintaining industry leadership in technology and software. |

| Competitive Advantage | Microsoft’s competitive advantage is derived from: – Diverse Product Portfolio: Offers a wide range of essential software and services. – Azure Cloud: Leads in cloud computing services with Azure. – Enterprise Solutions: Provides comprehensive enterprise solutions. – Gaming Ecosystem: Owns Xbox and a robust gaming ecosystem. – Research and Development: Invests in cutting-edge technology and innovation. Microsoft stands out with its diverse software portfolio, Azure cloud leadership, comprehensive enterprise solutions, gaming ecosystem, and commitment to research and development. | Derives a competitive advantage from offering diverse and essential software. Leads in cloud computing with Azure’s extensive capabilities. Offers comprehensive enterprise solutions for businesses. Owns a strong gaming ecosystem with Xbox. Invests in innovation and cutting-edge technology. Maintains a leading position in technology and software industries. | – Offering diverse and essential software products. – Leading in cloud computing with Azure. – Providing comprehensive enterprise solutions. – Owning a strong gaming ecosystem with Xbox. – Investing in innovation and cutting-edge technology. – Maintaining a leading position in technology and software industries. |

Understanding Microsoft’s business model today

Microsoft has a diversified business model spanning Office products, Windows, Gaming (Xbox), Search Advertising (Bing), Hardware, LinkedIn, Cloud, and more.

Microsoft is among the largest tech giants, which in 2021 made over $168 billion in revenues.

The most interesting part is that by 2019, servers and cloud services passed the Microsoft Office revenues, thus making them the main products for the company.

Also, the acquisition of LinkedIn has allowed Microsoft to enter the social media market.

As a dominant tech company, Microsoft tries to keep innovating and acquiring companies that allow it to enter new markets quickly.

The real turning point for Microsoft came when back in 2016; it became the go-to platform for developing machine learning models for an AI research lab called OpenAI!

Indeed, Microsoft worked as a partner for OpenAI to keep developing its large language models by offering the Azure infrastructure as a supercomputer for AI models.

This partnership would grow, turning into one of the most important deals of our times. In fact, by 2019, Microsoft had invested a billion dollars into the partnership with OpenAI, making the company the only commercial distributor of these AI products.

OpenAI, thanks to the support of Microsoft, built various versions of a large language model called GPT, thus eventually releasing a turning AI model called GPT-3 in 2020.

GPT-3 spurred a whole industry based on AI. Until the release of ChatGPT in 2022, which is completely reshaping the tech industry with a product, that can rival Google after over twenty years of market domination.

Today, OpenAI, turned from a research lab into a for-profit, capped organization is further strengthening the partnership with Microsoft.

By 2023, Microsoft got in talks to invest a further ten billion dollars into the partnership, which might make the company the most significant investor.

Microsoft is integrating all OpenAI products into Microsoft’s infrastructure!

By January 23rd, 2023, Microsoft officialized its muti-year, multi-billion partnership with OpenAI, clarifying that its strategy will be based on three pillars:

-

Supercomputing at scale – Microsoft will increase our investments in the development and deployment of specialized supercomputing systems to accelerate OpenAI’s groundbreaking independent AI research. We will also continue to build out Azure’s leading AI infrastructure to help customers build and deploy their AI applications on a global scale.

-

New AI-powered experiences – Microsoft will deploy OpenAI’s models across our consumer and enterprise products and introduce new categories of digital experiences built on OpenAI’s technology. This includes Microsoft’s Azure OpenAI Service, which empowers developers to build cutting-edge AI applications through direct access to OpenAI models backed by Azure’s trusted, enterprise-grade capabilities and AI-optimized infrastructure and tools.

-

Exclusive cloud provider – As OpenAI’s exclusive cloud provider, Azure will power all OpenAI workloads across research, products and API services.

Read: OpenAI, OpenAI Business Model, OpenAI-Microsoft Partnership.

Micro-soft, the name

When Bill Gates and Paul Allen needed to pick a name, Paul Allen reported in his memoir, “We considered Allen & Gates, but it sounded too much like a law firm. My next idea: Micro-Soft, for microprocessors and software. While the typography would be in flux over the next year or so (including a brief transition as Micro Soft), we both knew instantly that the name was right. Micro-Soft was simple and straightforward. It conveyed just what we were about.“

As Paul Allen explained in his memoir, the turning point for Microsoft came when a new chip was created by Intel.

It was November 1971; Gordon Moore, the co-founder of Intel, noted, “now we can make a single chip and sell it for several thousand different applications.”

In that same year, the chip 4004 was announced, which was the beginning of the CPU market, which would become a key industry for Intel in the coming decades.

In March 1972, the follow-up to the 4004 chip came out; it was the 8008. As the story goes, Allen went to Gates and proposed the idea of developing a sort of operating system for that chip.

Yet Bill Gates was quite a skeptic, as he feared that the chip was too slow to handle an operating system.

Thus, Paul Allen went back and waited for the real turning point, the launch of the Intel 8080 by Italian chip designer Federico Faggin!

That was the moment when Gates and Allen went to develop an operating system for the 8080, as the first minicomputers were built on top of that chip. From that moment, Microsoft was born.

How did Bill Gates end up with the majority of the company?

According to Paul Allen’s memoir, “From the inception of Microsoft, Bill insisted he got a 60-40, then 64-36 share of the money.”

While Paul Allen accepted – for some reason – the 60-40 deal so that more shares would go to Bill Gates – mainly on the basis that Bill Gates had contributed more to the code – Bill Gates tried again to get hold of more shares of Microsoft. That attempt, though, wasn’t successful.

In a few years, Microsoft will become the dominant tech company in the world.

It is important to remark this is the side of the story told by Paul Allen, seldom mentioned Microsoft co-founder. The accounts from Paul Allen reflect his perspectives on Microsoft in its first years.

Who owns Microsoft?

Currently, on the company’s financials, it’s possible to see the top individual beneficial owners or those with a stake in the company, which also sit on the board of directors.

Among the largest shareholders, who also sit on the board of directors, there is Satya Nadella, Bradford Smith, and Amy Hood.

What about Bill Gates?

In reality, since he left the board of directors back in 2020, he doesn’t have to report its ownership to Microsoft anymore.

Yet, by looking at Microsoft’s ownership structure, in 2019, the last available statement when Bill Gates (named William H. Gates III) was available, back then he owned 1.34% of Microsoft.

We might assume that this stake has remained unchanged, and if that is the case, it means Bill Gates’s stake is valued at billions.

The most prominent institutional investors are The Vanguard Group and Blackrock.

What is the Microsoft pay mix?

Microsoft has a pay based on three main aspects:

- base salary

- cash incentives

- and equity

To create proper compensation, Microsoft looks at a group of peers that comprise:

Peer group: • Alphabet • Amazon • Apple • Cisco Systems • Facebook • Hewlett-Packard • IBM • Intel • Oracle • Qualcomm • AT&T • Chevron • Coca-Cola • Comcast • ExxonMobil • General Electric • Johnson & Johnson • Merck • PepsiCo • Pfizer • Procter & Gamble • Verizon • Wal-Mart • Walt Disney

What are Microsoft Segments?

Microsoft segments can be broken down into four main types:

Productivity and business processes

The productivity and Business Processes segment consists of products and services in the portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. This segment primarily comprises:

- Office Commercial, including Office 365 subscriptions and Office licensed on-premises, comprising Office, Exchange, SharePoint, Skype for Business, and Microsoft Teams, and related Client Access Licenses (“CALs”).

- Office Consumer, including Office 365 subscriptions and Office licensed on-premises, and Office Consumer Services, including Skype, Outlook.com, and OneDrive.

- LinkedIn, including Talent Solutions, Marketing Solutions, and Premium Subscriptions.

- Dynamics business solutions, including Dynamics ERP on-premises, Dynamics CRM on-premises, and Dynamics 365, a set of cloud-based applications across ERP and CRM.

Intelligent cloud

Productivity and Business Processes segment consists of products and services in the portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. This segment primarily comprises:

- Server products and cloud services, including Microsoft SQL Server, Windows Server, Visual Studio, System Center, and related CALs, and Azure.

- Enterprise Services, including Premier Support Services and Microsoft Consulting Services.

More personal computing

More Personal Computing segment consists of products and services geared towards harmonizing the interests of end-users, developers, and IT professionals across all devices. This segment primarily comprises:

- Windows, including Windows OEM licensing (“Windows OEM”) and other non-volume licensing of the Windows operating system; Windows Commercial, comprising volume licensing of the Windows operating system, Windows cloud services, and other Windows commercial offerings; patent licensing; Windows IoT; and MSN display advertising.

- Devices, including Microsoft Surface, PC accessories, and other intelligent devices.

- Gaming, including Xbox hardware and Xbox software and services, comprising Xbox Live transactions, subscriptions, and advertising (“Xbox Live”), video games, and third-party video game royalties.

- Search advertising.

Corporate and other

Microsoft develops most of its products and services internally through the following engineering groups.

- Office Product Group focuses on Microsoft business across productivity, communications, education, and other information applications and services.

- Artificial Intelligence and Research, focuses on Microsoft AI development and other forward-looking research and development efforts spanning infrastructure, services, applications, and search.

- Cloud and Enterprise, focuses on Microsoft cloud infrastructure, server, database, CRM, ERP, management and development tools, and other business process applications and services for enterprises.

- Windows and Devices Group focuses on Microsoft Windows platform, applications, games, store, and devices that power the Windows ecosystem.

- LinkedIn, focuses on services that transform the way customers hire, market, sell, and learn.

Microsoft revenues breakdown for 2022

From its financial statements, you can see how Microsoft has netted over $198 billion in revenues in 2022, compared to over $168 billion in 2021.

Among the primary business operations lines, Intelligent Cloud netted over $75 billion in 2022, followed by Productivity and Business Processes, which netted over $63 billion in 2022, and personal computing, which netted over $59 billion.

How does Microsoft really make money?

Let’s look at the operating income and operating margin of each segment. It’s interesting to notice how the Intelligent Cloud business has very wide margins.

The company’s pretty diversified, and it also makes money in Gaming (with products like Xbox), search advertising (with Bing), Devices, and LinkedIn.

How Does LinkedIn make money?

LinkedIn generated over $13.8 billion in 2022 and 900 million members, spanning Talent Solutions, Marketing Solutions, and Premium Subscriptions.

What is Azure? How the Microsoft cloud service is growing at a fast speed

Server products and cloud services revenue rose to over $67 billion in 2022, driven by Azure revenue growth.

Thus, the increase in revenues for the intelligent cloud is primarily due to Azure’s growth.

Cloud is powering up the businesses of several tech giants, from Amazon AWS to Google Cloud; this business unit has become a critical component for those companies’ profitability.

Today Azure is also the enterprise infrastructure that powers up the Microsoft and OpenAI partnership.

OpenAI and Microsoft partnered up from a commercial standpoint in 2016, thanks to the Azure infrastructure.

The history of the partnership started in 2016 when OpenAI was looking for a partner to train its large language models at scale.

This required a huge amount of computing power, which could be provided only by a few players in the space.

Thus, since then, Microsoft’s Azure has become the go-to machine learning computing platform for developing OpenAI’s products.

The partnership consolidated in 2019, with Microsoft investing a billion dollars into the partnership.

And it has taken a leak forward, with a multi-year, multi-billion commercial partnership between Microsoft and OpenAI, which enables Microsoft to distribute OpenAI’s products into its Azure enterprise platform.

While also enabling Microsoft to integrate those same products into its existing consumer and business applications.

How much money does Bing make?

If we look at the advertising revenues generated by Microsoft – which can be primarily attributed to Bing – those amount to about $11.6 billion in 2022.

That makes Bing another important piece of the pie for Microsoft’s overall revenues.

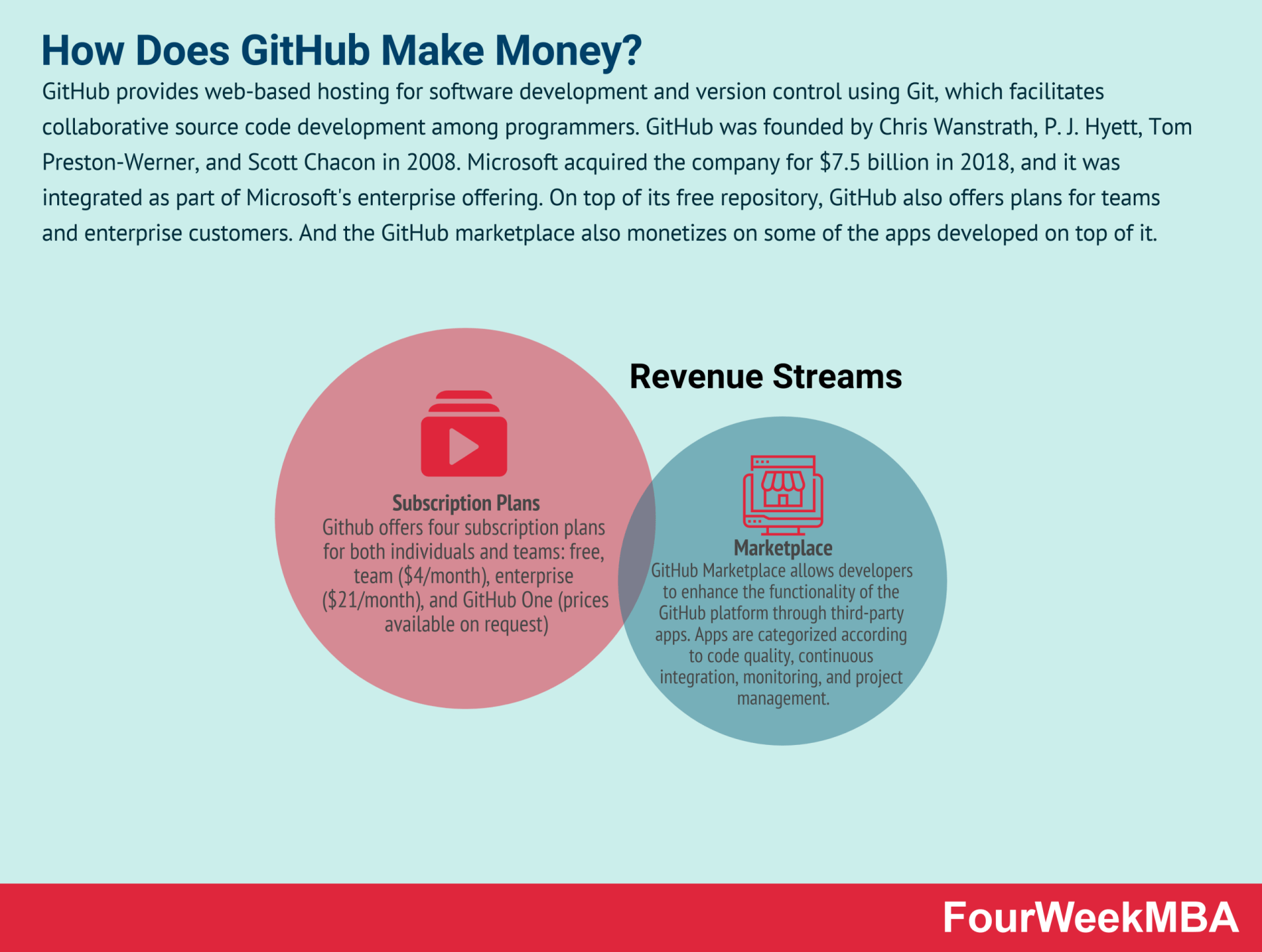

GitHub acquisition: how did Microsoft integrate GitHub into its business model?

GitHub today is a critical component of the Enterprise services that Microsoft offers.

In June 2018, Microsoft bought GitHub for $7.5 billion in an all-stock transaction.

GitHub is among the most known open-source libraries which enable companies of any size to store their codes.

While its free-to-use public open-source library is the most known, the company also offers enterprise solutions.

While presumably the company never managed to turn profits, it seems that Microsft’s high valuation on the company can be seen as a way to enhance Microsoft’s product line by enabling the existing Microsoft customer base to purchase GitHub plans.

Microsoft’s current salesforce and distribution successfully integrated GitHub’s offering within its sales portfolio, thus making GitHub profitable within Microsoft’s overall operations.

GitHub generated over $7 billion in revenues, in 2022. It will be interesting to look at the growth in revenues of GitHub, as it launched the GitHub Copilot, a coding assistant powered by OpenAI’s language model.

What are the Microsoft distribution channels?

Those can be broken down in:

- OEMs, OEMs that pre-install Microsoft software on new devices and servers they sell. The largest component of the OEM business is the Windows operating system pre-installed on devices.

- Direct. Microsoft offers direct sales programs targeted to reach small, medium, and corporate customers, in addition to those offered through the reseller channel. A large network of partner advisors supports many of these sales.

- Distributors and resellers, license Microsoft products and services indirectly, primarily through licensing solution partners (“LSP”), distributors, value-added resellers (“VAR”), OEMs, and retailers.

Key takeaways from the Microsoft business model

- The company has a pretty diversified business model. And when we talk about a company like Microsoft, it’s easy to fall into simplifications and give it a simple label. The company has many moving parts.

- While Office products and Windows remain the core products of the company. Microsoft business units span across productivity tools, cloud services (Azure), gaming (Xbox), search advertising (Bing), social media (LinkedIn), and devices (Microsoft phones and Surface).

- Microsoft also bought LinkedIn in 2016 for over $26 billion and GitHub in 2018 for an all-stock transaction of $7 Billion dollars.

- Microsoft has been pushing hard on the cloud, which is the fastest-growing business unit, with substantially high operating margins, given its scalability. Azure has contributed to a good chunk of this growth. Azure is today the most important piece of Microsoft, as it is also the AI supercomputer powering up OpenAI’s products!

- In search advertising, while Microsoft didn’t manage to create a second player in search (Google still controls most of the market shares) the company still generates over $11 billion in advertising.

- The company has integrated LinkedIn pretty well within the organization. Bought for over $26 billion in 2016, LinkedIn revenues jumped from over $2 billion in 2017 to over $13 billion in 2022.

- Microsoft also bought GitHub in 2018, with the bet that it could make it profitable within its business, as it could leverage the existing Microsoft customer base to sell enterprise GitHub solutions. Today GitHub is a thriving segment, and it launched GitHub Copilot.

- In short, Microsoft is a moving giant with its hands in many places, it still has a massive customer base to whom it’s trying to integrate more innovative tools and products, like LinkedIn and GitHub.

Read Next: Microsoft Business Model, Who Owns Microsoft?, Microsoft Organizational Structure, Microsoft SWOT Analysis, Microsoft Mission Statement, Microsoft Acquisitions, Microsoft Subsidiaries, Bill Gates Companies.

Related Visual Stories

Microsoft Revenue Per Employee

Microsoft Organizational Structure

OpenAI Organizational Structure

Stability AI Ecosystem