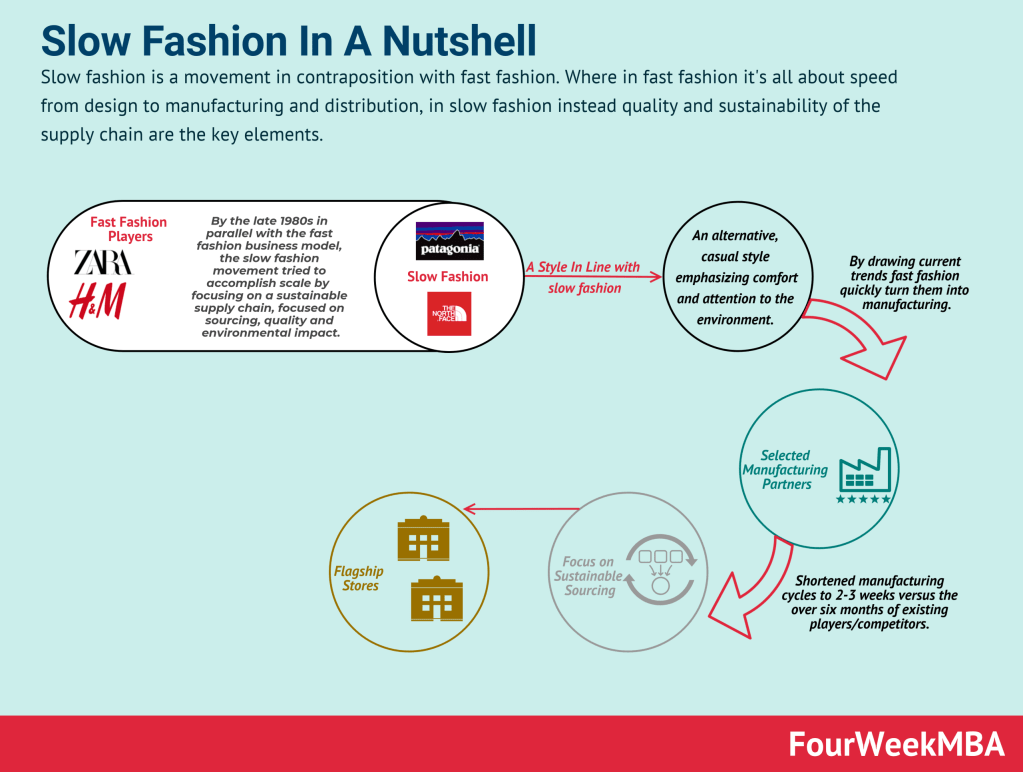

Slow fashion is a movement in contraposition with fast fashion. Where in fast fashion, it’s all about speed from design to manufacturing and distribution, in slow fashion instead, quality and sustainability of the supply chain are the key elements.

| Aspect | Explanation |

|---|---|

| Definition | Slow Fashion is an approach to fashion that emphasizes sustainability, ethical production, and long-lasting, quality garments. It stands in contrast to the fast fashion industry, which prioritizes rapid production and short-lived trends. Slow fashion promotes conscious consumer choices, fair labor practices, and environmental responsibility in clothing production. This movement aims to reduce the negative impacts of fashion on the planet and the people involved in the industry. |

| Key Concepts | – Sustainability: Slow fashion centers on sustainable practices that reduce the industry’s environmental footprint. – Ethical Production: It prioritizes fair wages, safe working conditions, and ethical treatment of workers. – Quality Over Quantity: Slow fashion encourages consumers to invest in high-quality, durable garments that last longer. – Minimalism: It promotes a minimalist approach to fashion, focusing on versatility and timeless designs over fleeting trends. |

| Characteristics | – Longevity: Slow fashion garments are designed to last, reducing the need for frequent replacements. – Transparent Supply Chain: Brands practicing slow fashion often have transparent supply chains, allowing consumers to trace the origins of their clothing. – Mindful Consumption: Slow fashion encourages consumers to be mindful and intentional in their clothing choices. – Local Production: Some slow fashion brands emphasize local production to support communities and reduce transportation-related emissions. |

| Principles | – Buy Less, Choose Well: Slow fashion encourages consumers to buy fewer items but to choose well by investing in quality pieces that align with their style and values. – Capsule Wardrobes: Many slow fashion advocates embrace the concept of a capsule wardrobe, consisting of versatile, essential items. – Repair and Upcycle: Instead of discarding damaged clothing, slow fashion promotes repairing and upcycling to extend a garment’s life. |

| Impact | – Reduced Environmental Impact: Slow fashion practices lead to reduced waste, lower carbon emissions, and less resource depletion. – Ethical Labor Practices: It supports fair wages and better working conditions for garment workers. – Consumer Empowerment: Slow fashion empowers consumers to make informed choices and question the status quo of fast fashion. |

| Challenges | – Higher Prices: Slow fashion items can be more expensive due to the use of sustainable materials and ethical labor practices. – Limited Accessibility: In some regions, access to slow fashion options may be limited compared to fast fashion. – Changing Mindsets: Shifting from fast fashion to slow fashion requires a shift in consumer mindset and shopping habits. |

| Examples | – Brands like Patagonia and Eileen Fisher are known for their commitment to slow fashion principles, including sustainability and ethical production. – Some consumers practice slow fashion by thrifting, swapping, or buying second-hand clothing to reduce their impact on the environment. |

| Future Trends | Slow fashion is expected to continue growing as consumer awareness of sustainability and ethical issues in the fashion industry increases. More mainstream brands may incorporate slow fashion principles into their practices. |

| Advocacy | Advocates for slow fashion often promote awareness through educational campaigns and sustainable fashion events. They encourage consumers to question the fashion industry’s status quo and seek alternatives that align with their values. |

A quick timeline of how Slow Fashion came to be

By the 2000s, a company building up its supply chain for decades had become the mammoth of fashion.

That company was Zara. Zara epitomized the fast fashion industry, as its business model sat on top of a few key principles (like the fast following, low price, and variety) and a core objective: speed.

By fast following fashion trends, shortening the manufacturing cycle, and setting up just-in-time logistics serving its flagship stores, Zara became a behemoth:

As the 2010s came, a new trend started to shape the fashion industry.

That was the social commerce trend. As in countries like the UK, the penetration of e-commerce was high; some UK players, like ASOS, led the way in this transformation, from fast fashion to ultra-fast fashion:

The ultra-fast fashion business model was epitomized by ASOS, among others, and it further prioritized the supply chain’s speed and efficiency with a strong online twist. In short, no more flagship stores to operate.

The money that other fast fashion players like Zara were spending to operate these stores were instead used by ultra-fast fashion players to run their online operations and further optimize manufacturing and logistics to serve a global audience:

From there, another, further evolution, this time headed by China, came with real-time retail, a further “improvement” from the ultra-fashion business model, where timing from idea/fashion meme to distribution got shortened further:

Among the players that most mastered this business model, SHEIN led the way:

In parallel, an opposite movement has been developed with the fast fashion business models from the 1990s to the 2020s.

A player that highly emphasized the slow fashion movement is Patagonia, which, as it highlighted in its Sustainable Apparel Coalition:

An apparel industry that produces no unnecessary environmental harm and has a positive impact on the people and communities associated with its activities.

The Slow Movement evolved in parallel with the fast fashion movement as an alternative business practice. Indeed, as explained on the Patagonia website:

Since 1985, Patagonia has pledged 1% of sales to the preservation and restoration of the natural environment. We’ve awarded over $140 million in cash and in-kind donations to domestic and international grassroots environmental groups making a difference in their local communities. In 2002, founder of Patagonia, Yvon Chouinard, and Craig Mathews, owner of Blue Ribbon Flies, created a non-profit corporation to encourage other businesses to do the same.

How does this translate into practice in terms of the supply chain? As Patagonia highlights:

The purpose of Patagonia’s Supply Chain Environmental Responsibility Program is to measure and reduce the environmental impacts of manufacturing Patagonia products and materials. We implement our program at supplier facilities all over the world and cover a broad range of impact areas, including environmental management systems, chemicals, water use, water emissions, energy use, greenhouse gases, other air emissions and waste.

The attempt to build a more sustainable supply chain moves along a few key areas, what Patagonia calls a “4-Fold Approach to Supply Chain Decisions,” which, as the company highlighted:

This process includes screening potential new suppliers for the ability to meet our (1) sourcing, (2) quality, (3) social and (4) environmental standards.

To execute this, Patagonia built a Social and Environmental Responsibility team (SER) to ensure these practices are implemented.

Key Highlights

- Contrast with Fast Fashion:

- Slow fashion is a counter-movement to fast fashion, focusing on ethical, sustainable, and environmentally responsible practices. It advocates for a departure from the rapid cycles of design, production, and distribution that characterize fast fashion.

- Fast Fashion Pioneers and Principles:

- Zara and H&M revolutionized the fashion industry in the late 1990s and early 2000s. Their core principles included speed, variety, and affordability.

- Fast fashion brands leveraged shortened design-to-market cycles, often measuring production in weeks rather than months. This allowed them to quickly respond to emerging trends and consumer demands.

- Ultra-Fast Fashion and Social Commerce:

- The 2010s brought the rise of social commerce, with ASOS being a prominent example. The shift to online operations enabled ultra-fast fashion.

- Ultra-fast fashion emphasized mobile e-commerce, short sales cycles, and rapid response to trends. Flagship physical stores became less relevant as online platforms took precedence.

- Real-Time Retail:

- China led the way in real-time retail, a progression beyond ultra-fast fashion. This approach further compressed the time between a trend’s emergence and its appearance in collections.

- SHEIN became a notable player in real-time retail, rapidly transforming fashion trends into clothing collections within days or a week.

- Slow Fashion Advocates and Sustainability:

- Patagonia emerged as a leader in advocating for slow fashion principles. The brand shifted the focus from speed and profit to environmental responsibility and community impact.

- Slow fashion promotes ethical practices, fair labor conditions, and reduced environmental harm in the production process.

- Sustainable Supply Chain and Patagonia’s Approach:

- Patagonia’s Supply Chain Environmental Responsibility Program aimed to mitigate the environmental impacts of manufacturing its products.

- The “4-Fold Approach” scrutinizes potential suppliers based on sourcing, quality, social responsibility, and environmental standards.

- Social Impact and Commitment:

- Patagonia’s commitment to sustainability extended to allocating a percentage of sales to environmental preservation and restoration. This approach encouraged other businesses to adopt similar practices.

Related Case Studies

- Fast Fashion

- Ultra Fast Fashion

- Real-Time Retail

- SHEIN Business Model

- Luxottica Vertically Integrated Business Model

- Nike Business Model

- Brunello Cucinelli

- LVMH Group Business Model

- How Does TOMS Shoes Make Money?

- Family-Owned Prada Business Model

- Tiffany Business Model

Read Next: SHEIN, ASOS, Zara, Slow Fashion, Fast Fashion, Ultra-Fast Fashion, Real-Time Retail.

Related Visual Resources

Patagonia Organizational Structure

Read Next: Zara Business Model, Inditex, Fast Fashion Business Model, Ultra Fast Fashion Business Model, SHEIN Business Model.

Fashion-Related Visual Stats

Read Next: Zara Business Model, Inditex, Fast Fashion Business Model, Ultra Fast Fashion Business Model, SHEIN Business Model.

Other business resources:

- What Is Business Model Innovation

- What Is a Business Model

- What Is A Heuristic

- What Is Bounded Rationality

- What Is Business Development

- What Is Business Strategy

- What is Blitzscaling

- What Is a Value Proposition

- What Is a Lean Startup Canvas

- What Is Market Segmentation

- What Is a Marketing Strategy

- What is Growth Hacking