A real-time insurance business model enables Tesla to build its own insurance arm, by dynamically adjusting the premiums, based on real-time driving behavior. Reduced insurance premiums hooked with the leasing arm, enable Tesla to scale its demand side of the business.

| Aspect | Explanation |

|---|---|

| Definition | The Real-Time Insurance Business Model is a modern approach to insurance that leverages technology and data analytics to provide personalized insurance coverage and pricing in real-time. It uses data from various sources, including IoT devices, telematics, and customer behavior, to assess risk and adjust insurance rates and coverage instantaneously. This model offers policyholders flexibility, cost savings, and the ability to tailor their insurance to their specific needs and circumstances, fostering a more dynamic and customer-centric insurance industry. Real-time insurance is prevalent in auto, health, and property insurance, among other sectors. |

| Key Concepts | – Data Analytics: Utilizes data analytics and algorithms to assess risk and determine insurance rates. – IoT and Telematics: Collects data from Internet of Things (IoT) devices and telematics to monitor behavior and conditions in real-time. – Personalization: Offers highly personalized insurance coverage based on individual behavior and circumstances. – Dynamic Pricing: Adjusts insurance premiums in real-time based on current data and risk factors. – Customer-Centric: Focuses on meeting the unique needs and preferences of policyholders. |

| Characteristics | – Data Collection: Constantly collects and analyzes data from various sources, including IoT sensors, mobile apps, and telematics devices. – Real-Time Adjustments: Adjusts coverage and pricing in response to changing circumstances or behavior. – Mobile Apps: Often includes mobile apps that allow policyholders to monitor and manage their insurance. – Flexible Policies: Policies are highly customizable to meet individual needs. – Risk Mitigation: Encourages safer behavior and risk mitigation by providing immediate feedback and incentives. |

| Implications | – Privacy Concerns: Collecting extensive data raises privacy and security concerns that need to be addressed. – Regulatory Compliance: Adherence to data protection and insurance regulations is essential. – Data Accuracy: The accuracy and reliability of data sources are critical for risk assessment. – Customer Engagement: Effective engagement strategies are needed to encourage policyholders to embrace real-time insurance. – Pricing Dynamics: Pricing can fluctuate frequently, impacting policyholder expectations and budgeting. |

| Advantages | – Cost Savings: Policyholders may pay lower premiums by demonstrating safer behavior. – Personalization: Offers tailored coverage that better suits individual needs. – Improved Risk Assessment: Real-time data allows for more accurate risk assessment. – Incentives for Safe Behavior: Encourages safer driving, healthier lifestyles, and risk mitigation. – Competitive Advantage: Insurers adopting this model can gain a competitive edge in the market. |

| Drawbacks | – Privacy Concerns: Gathering extensive data can raise privacy and security concerns. – Data Reliability: The accuracy and reliability of data sources must be ensured. – Complex Pricing: Frequent pricing adjustments can be challenging for policyholders to understand. – Market Adoption: Widespread adoption of real-time insurance may take time. – Customer Education: Policyholders may need education on how the model works and its benefits. |

| Applications | Real-Time Insurance is applicable to various insurance types, including: – Auto Insurance: Monitoring driving behavior in real-time to adjust premiums. – Health Insurance: Tracking health metrics and encouraging healthy lifestyles. – Property Insurance: Adjusting coverage based on property conditions and risk factors. – Usage-Based Insurance: Insurance tailored to the frequency and manner of usage, such as pay-per-mile auto insurance. |

| Use Cases | – Usage-Based Auto Insurance: Insurance premiums adjust based on driving behavior, encouraging safe driving practices. – Health and Wellness Programs: Health insurers offer incentives for policyholders who meet health and fitness goals. – Property Monitoring: Property insurers use IoT devices to monitor the condition of insured properties and adjust coverage accordingly. – Telematics for Fleet Insurance: Fleet operators use telematics to optimize insurance costs by improving driver behavior and vehicle maintenance. – On-Demand Insurance: Policyholders can activate or deactivate coverage as needed, such as insuring a rental car for the duration of a trip. |

Understanding the Real-Time insurance business model

How Tesla adjusted the Insurance premiums based on real-time driving behavior. In short, through real-time driving behavior, drivers can improve their scores, thus making it possible to get insurance coverages at better premiums.

As Tesla highlighted:

Unlike any other telematics or usage-based insurance products, Tesla Insurance does not require an additional device to be in your vehicle. Tesla uses specific features within the vehicles to evaluate the premium for your vehicle.

In short, through real-time behavior, for each user, a safety score is built. This safety score determines also the insurance premium.

Understanding the Safety Score

The safety score is a key element of the overall real-time insurance business model, as based on it, insurance premiums will be adjusted.

It consists of five main factors

Based on those, Tesla computes what it calls the Predicted Collision Frequency formula, or:

Predicted Collision Frequency (PCF) formula below to predict how many collisions may occur per 1 million miles driven, based on your driving behaviors measured by your Tesla vehicle.

The PCF is then converted into a 0 to 100 Safety Score using the following formula:

| Safety Score = 115.382324 – 22.526504 | x | PCF |

Based on the above, drivers know they can practically improve their safety score by engaging in better driving behaviors like:

- Maintain a safe following distance.

- Engage the brake pedal early when slowing down.

- Engage in gradual turns, no sudden turns.

- Do not tailgate or drive close to the vehicle in front.

- Maintain hands on the steering wheel when the Autopilot is engaged.

Not a fixed score

The main innovation is in the fact that the driving score isn’t a fixed, often not personalized metric.

Indeed, driving scores from legacy companies are often assessed simply based on the context around them.

For instance, if you live in an area with a high number of incidents, with a certain whether, or depending on the cost of repair of the vehicle, your driving score might go up independently from your driving ability.

Other factors like age, location, marital status, and homeownership, all might play a role in making the insurance coverage premium higher.

And it doesn’t adjust easily.

Personalized, changing driving score

The way Tesla has designed it, the driving score is pretty much dynamic. As the company explains:

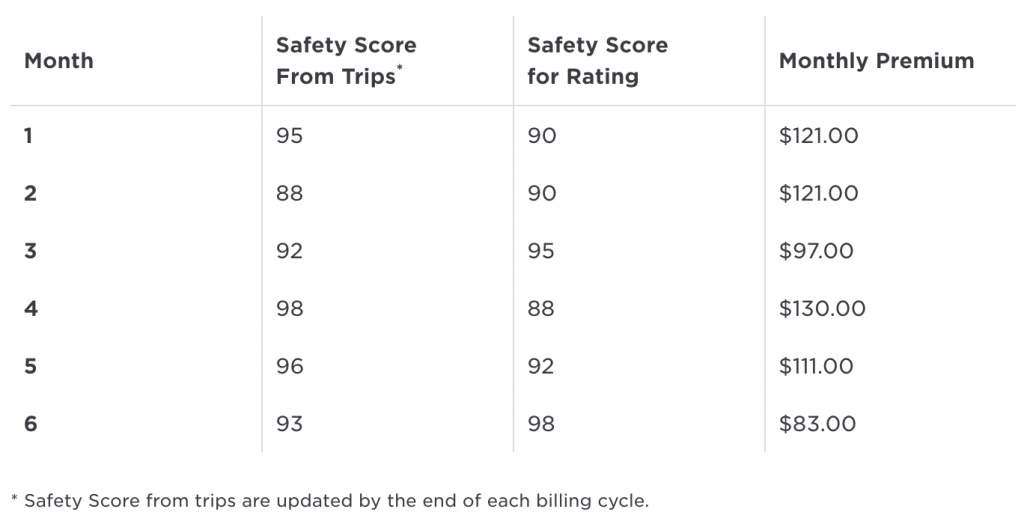

Your Safety Score for each vehicle gets updated at the end of each month based on your driving in the previous 30 days and it will impact your premium in the following month. Tesla will notify you in advance of your new monthly premium. Here is an illustration of how the Safety Score impacts the premium each month:

Cutting the middleman

By gathering its own data, Tesla is building its own dataset for drivers, thus turning into a real insurance company.

As Tesla highlighted in one of its latest financial releases:

Our insurance business continues to expand with recent launches in Colorado, Oregon, and Virginia. In these states, Tesla acts as the insurance carrier, which means that we are the underwriter and bear financial risk.

Tesla’s service business is growing on top of its insurance service, which for now, is in Beta mode, but it can become a massive business for its own sake.

When I think of the Tesla’s insurance service, based on real-time driving behavior, it comes to mind Amazon AWS, which was a side business Amazon built to enhance its infrastructure, and that it turned into a powerhouse.

So, also when it comes to the Tesla insurance business, the company can leverage the millions of vehicles the company will have on the road in the coming years, to build an incredible insurance platform.

And to be sure, the service business had turned already into a multi-billion dollar business for Tesla, in 2021. Indeed, it almost reached $4 billion, by 2021.

Understanding the dynamics between insurance and distribution

Why the insurance business matters so much for Tesla’s business model scale?

Simple, the insurance business coupled with the leasing arm will be a key distribution enhancer for Tesla.

Indeed, for years Tesla had production issues, primarily due, to what Musk has labeled as “production hell” or the ability of the company to provide millions of cars to potential customers.

However, Tesla has finally passed through this hurdle, with the opening up of the Gigafactory in Shangai and Berlin.

Thus, now, it’s very important to enable the demand to keep up with the supply of cars.

How? Through the leasing arm.

Just like the iPhone, one of the most expensive devices has been subsidized by mobile carriers, the third-party Apple’s arm has been critical for the overall success of its strategy in the last fifteen years:

Also, Tesla is finding its own distribution enhancer through the leasing arm.

By hoping the dynamic driving score, and insurance premiums for the leasing of vehicles, the cost of the car can be substantially decreased, at scale.

In fact, it might usually be more expensive (especially in the US) to ensure a car via leasing, as the company leasing the car will require certain insurance standards, and coverage, you might opt-out form if you were to buy it.

By hooking the Tesla’s insurance premiums to real-time driving behaviors, leasing the car gets way more affordable, thus enhancing the demand-side of Tesla’s distribution.

In short, where in the last decade Tesla had to solve for the supply-side at scale (by enabling mass-manufacturing through its Gigafacotries), this decade will be all about unlocking the demand-side, to make a Tesla (one of the most expensive cars) affordable at scale!

This will be a key for the overall Tesla business model scale!

Key takeaways

- Tesla is engineering a dynamic way to adjust insurance premiums based on real-time driving behaviors. Indeed, the legacy paradigm is to assign a driving score, often based on metrics that are not aligned with the actual driving ability of an individual.

- By gathering data continuously, through its vehicles, Tesla can monitor, track, and adjust accordingly, to the driving behavior of millions of drivers, thus building its own “insurance platform” able to offer more convenient insurance premiums.

- This model hooked with the Tesla leasing arm, makes it possible for the company to enhance its distribution at scale. Indeed, Tesla has been building its manufacturing at scale, in the last ten years. The coming decade is all about enabling the demand-side at scale. Just like the iPhone has found its subsidies through the mobile carrier industries, Tesla can find its subsidies in the leasing arm.

Key Insights

- Real-Time Driving Behavior: Tesla adjusts insurance premiums based on real-time driving behavior, enabling drivers to improve their safety scores and get better premiums.

- Safety Score: Tesla’s safety score consists of factors like forward collision warnings, hard braking, aggressive turning, unsafe following, and forced autopilot disengagement.

- Personalized, Changing Driving Score: Unlike legacy companies, Tesla’s driving score is dynamic and personalized, updated monthly based on the previous 30 days of driving data.

- Cutting the Middleman: By gathering its own data, Tesla becomes its own insurance company, acting as the underwriter and bearing financial risk.

- Distribution Enhancer: Tesla’s insurance business, coupled with the leasing arm, enhances distribution by making leasing more affordable through dynamic driving scores and insurance premiums.

- Scaling Demand-Side: Tesla’s focus on scaling demand-side complements its previous efforts in mass-manufacturing through Gigafactories.

- Similar to Apple’s Strategy: Tesla’s leasing arm and insurance model are similar to Apple’s approach, where indirect channels have been critical for sales amplification and scale.

Read Next: Tesla Business Model.

- Business Model Patterns

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Tech Business Model

- What Is Entrepreneurship

Related Business Model Types

Attention Merchant Business Model