PayPal makes money primarily by processing customer transactions on the Payments Platform and other value-added services. Thus, the revenue streams are divided into transaction revenues based on the volume of activity or total payments volume—and value-added services, such as interest and fees earned on loans and interest receivable. In 2023, PayPal generated nearly $30 billion in revenues and $4.24 billion in net profits.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | PayPal’s value proposition is built on: – Online Payments: Offers a secure and convenient way to make online payments. – Money Transfer: Facilitates cross-border money transfers. – Buyer and Seller Protection: Provides protection against fraud and disputes. – One-Touch Checkout: Allows for quick and hassle-free online shopping. – Integration with E-commerce: Offers payment solutions for businesses. PayPal empowers users with a trusted and versatile platform for managing digital transactions. | Ensures secure and convenient online payments for users. Facilitates cross-border transactions, reducing the barriers of international payments. Builds trust through buyer and seller protection mechanisms. Simplifies online shopping with one-touch checkout. Attracts businesses with payment integration options. Appeals to a wide range of users and businesses seeking digital payment solutions. | – Secure and convenient online payments. – Cross-border money transfer capabilities. – Fraud and dispute protection. – One-touch checkout for seamless shopping. – E-commerce payment solutions for businesses. – Attracting users and businesses in need of digital payment services. |

| Customer Segments | PayPal serves various customer segments, including: 1. Online Shoppers: Individuals who use PayPal for online purchases. 2. Freelancers and Small Businesses: Users looking for payment solutions for services and products. 3. E-commerce Merchants: Businesses seeking to accept online payments. 4. International Users: Individuals and businesses requiring cross-border transactions. PayPal caters to a broad audience with diverse transaction needs. | Addresses the needs of online shoppers for secure online payments. Provides payment solutions for freelancers and small businesses. Offers e-commerce payment services for online merchants. Serves international users requiring cross-border transactions. Customizes offerings to cater to diverse customer segments. | – Meeting the needs of online shoppers. – Providing payment solutions for freelancers and businesses. – Offering e-commerce payment services. – Serving international users with cross-border transactions. – Customizing offerings for diverse customer preferences. |

| Distribution Strategy | PayPal’s distribution strategy includes several key elements: – Website and Mobile App: Offers online and mobile platforms for users to create accounts, manage funds, and make payments. – Partnerships: Collaborates with e-commerce platforms, banks, and financial institutions to expand its reach. – Payment Buttons and APIs: Provides tools for businesses to integrate PayPal into their websites and apps. – Mobile Wallets: Offers digital wallets like PayPal One Touch and Venmo for convenient mobile payments. PayPal ensures accessibility and convenience through multiple distribution channels. | Provides online and mobile platforms for user accessibility. Collaborates with partners to expand its reach and user base. Enables businesses to integrate PayPal using payment buttons and APIs. Enhances mobile payments through digital wallets. Prioritizes accessibility and convenience in its distribution strategy. | – Offering online and mobile platforms for user access. – Collaborating with partners to expand reach. – Enabling businesses to integrate PayPal through APIs. – Enhancing mobile payments with digital wallets. – Prioritizing accessibility and convenience. |

| Revenue Streams | PayPal generates revenue through the following sources: 1. Transaction Fees: Charges fees for processing payments and money transfers. 2. Currency Conversion Fees: Earns revenue from currency exchange services. 3. Merchant Services: Collects fees from businesses using PayPal’s payment solutions. 4. Interest Income: Gains interest from user funds held in PayPal accounts. 5. Credit and Financing Services: Generates revenue from interest on consumer and business loans. Diversifies income sources across transaction-based fees, currency services, merchant services, and financial products. | Relies on transaction fees, currency conversion fees, and merchant service fees. Earns interest income from user funds and generates revenue through credit and financing services. Diversifies income streams for financial stability. Offers financial products and services to complement its core payments business. | – Earnings from transaction fees and currency conversion. – Revenue from merchant services and partnerships. – Interest income from user funds. – Revenue from credit and financing services. – Diversifying income sources for financial stability. |

| Marketing Strategy | PayPal’s marketing strategy focuses on the following elements: – Brand Recognition: Emphasizes PayPal as a trusted and widely accepted payment platform. – User Convenience: Highlights the ease of use and convenience of PayPal for online payments. – Partnerships: Collaborates with e-commerce platforms and banks for mutual benefits. – Promotions and Discounts: Offers incentives like cashback and discounts to attract users. – Security and Trust: Assures users of the security measures in place to protect their financial transactions. PayPal prioritizes brand recognition, user convenience, partnerships, incentives, and security in its marketing efforts. | Emphasizes its brand as a trusted and widely accepted payment platform. Highlights user convenience and the ease of online payments. Collaborates with partners to expand its user base. Offers promotions and incentives to attract and retain users. Builds trust through security measures and user protection. Prioritizes user acquisition and retention in its marketing strategy. | – Emphasizing brand recognition as a trusted platform. – Highlighting user convenience for online payments. – Collaborating with partners for mutual benefits. – Offering promotions and incentives to attract users. – Assuring users of security measures for trust building. – Prioritizing user acquisition and retention. |

| Organization Structure | PayPal operates with a functional organizational structure: – Leadership Team: Led by the CEO and top executives responsible for strategic direction. – Technology and Product Development: Focuses on platform development and feature enhancements. – Sales and Marketing: Drives user acquisition, partnerships, and marketing efforts. – Risk and Compliance: Manages regulatory compliance and fraud prevention. – Customer Support: Ensures customer satisfaction and support. PayPal’s structure emphasizes functional specialization and user-centric services. | Employs a functional structure with clear divisions for efficient operations. Prioritizes platform development, user acquisition, and risk management. Collaborates with partners for mutual benefits. Ensures regulatory compliance and fraud prevention. Supports strategic direction and decision-making from top executives. Maintains a focus on functional specialization and user-centric services. | – Functional structure with clear divisions. – Prioritizing platform development and user acquisition. – Collaborating with partners for mutual benefits. – Ensuring regulatory compliance and fraud prevention. – Supporting strategic direction from top executives. – Focusing on functional specialization and user-centric services. |

| Competitive Advantage | PayPal’s competitive advantage is derived from: – Trusted Brand: Enjoys widespread trust and recognition as a secure payment platform. – Network Effect: Grows stronger as more users and businesses join the platform. – Global Reach: Offers cross-border payment solutions and currency services. – Diverse Product Portfolio: Provides various financial products, including credit and financing services. – Security Measures: Implements robust security measures to protect user transactions. PayPal stands out as a trusted, widely accepted, and comprehensive financial platform. | Derives a competitive advantage from a trusted brand and widespread recognition. Benefits from the network effect, growing stronger with each user and business. Offers global solutions for cross-border transactions and currency exchange. Diversifies its offerings with financial products and ensures secure transactions. Stands out as a trusted and comprehensive financial platform. | – Trusted brand and recognition as a secure platform. – Network effect strengthening with more users and businesses. – Global solutions for cross-border transactions. – Diversified financial product portfolio. – Robust security measures for user protection. – Standing out as a trusted and comprehensive financial platform. |

Who owns PayPal?

Before we dive into the PayPal business models, it is important to notice that as of the time of this writing, PayPal is a sub-organization of eBay, purchased for $1.5 billion in 2002.

That was the deal that made rich people like Peter Thiel, Elon Musk, and Reid Hoffman, which respectively founded companies like Founders Fund, Tesla, and LinkedIn.

The deal was sealed just a few months after PayPal went public. In fact, at the time, eBay customers made up the bulk of PayPal’s users.

As reported on cnet.com “63 percent of dollar volume for transactions in the first nine months of 2001 came from settling auction purchases, particularly on eBay.“

It is interesting to dive a bit into PayPal origin story, as it uncovers some critical strategic insights on its early growth and user acquisition until its deal with eBay.

PayPal origin story

You can listen to the whole History of PayPal based on our episode of the Digital Business Models Podcast, with an incredible interview with Jimmy Soni, author of the book: The Founders. This is an incredible research and account of PayPal in its early years and how it built a business playbook as an early Internet startup.

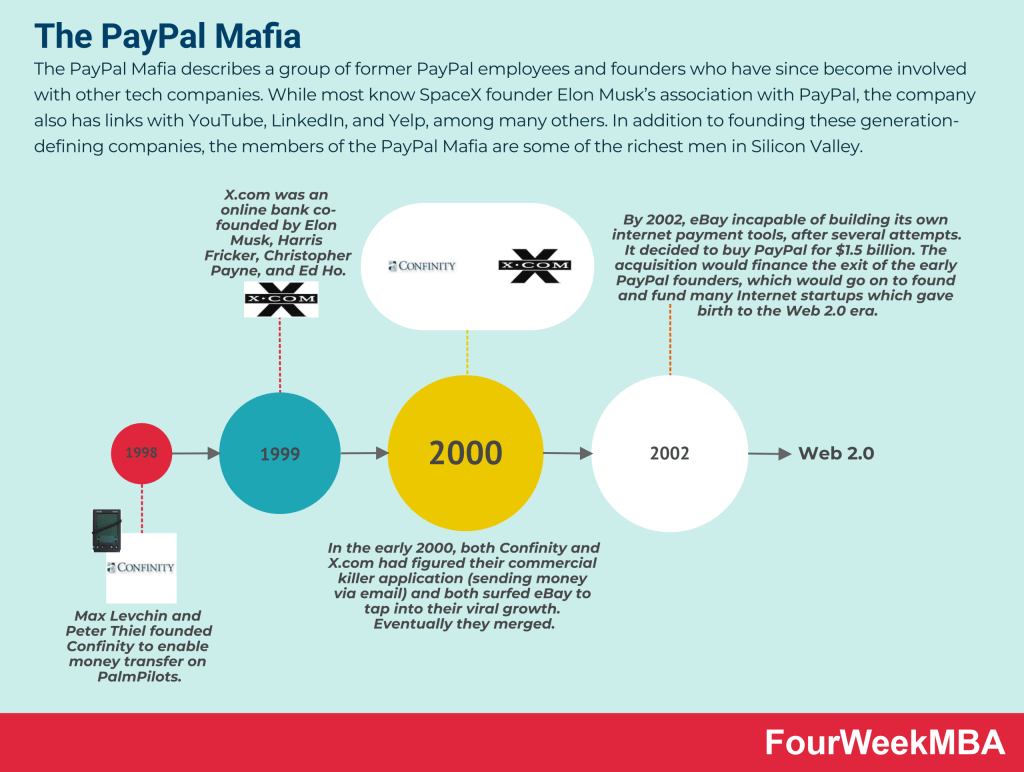

PayPal was founded in 1998 by a company called Confinity. In fact, just in 1999, PayPal was launched as a money transfer system.

At the time, Confinity had a fierce competitor called X.com. This was a company founded by Elon Musk (yes, that Musk!). The companies, rather than competing with each other, just merged to take over the payment industry.

Once the company merged, it could finally focus on the commercial strategy. Rather than boiling the ocean, PayPal started with a small niche at the time until they monopolized it and grew further.

Little business strategy note: If you’re familiar with Peter Thiel’s book Zero to One, he explains how the business world is about monopolies rather than competition. In fact, if you attended even for a day business school, you might have learned about the myth of market competition and how this is what makes capitalism work. In reality, how Peter Thiel pointed out capitalism is way more about monopolizing a market to grab most of its profits. In fact, in a situation of perfect competition, margins are so thin that companies can go easily go bankrupt. The real market dominator is the one that takes it all. Thus, the reason why many are not aware of this can be attributed to the fact that monopolies reframe their market position to hide the fact that they control a particular market. They do it because this is the secret that makes them successful. The moment when regulators and market players will find out about a monopoly they’ll try to bring it down.

PayPal’s first growth hack: The bot that gave the company a bit of traction

A little caveat: the story of this paragraph was inspired from the book “The PayPal Wars” a self-published book, based on account of a marketing employee at PayPal. Take this story as a reference, not as history as the account of the author might bias it.

The merger that brought together PayPal and X.com

As reported by Julie Anderson on Quora:

After the merger everyone tried to play nicely together at first, but – as has been widely chronicled from various perspectives – it took just a few months before the differences in opinion turned ugly. Elon took a vacation that year and I’ve always hated that I didn’t realize they were going to oust him as CEO in time; he called that day from somewhere in Africa and asked “How bad is it?” and I said “Not that bad. I think it’s going to be okay.” Middle of the night I sat straight up in bed and headed back to the office; the lights were blazing and everyone was there. It was done by morning, the company became known as PayPal, and that was that.

Whether or not the merger was painful and whether or not it created conflicts it also brought together a group of very smart people, the so-called PayPal Mafia.

The rise of the PayPal Mafia

You might not see PayPal’s business model as the most interesting one. Yet, the story of PayPal is compelling as this is the place where the so-called PayPal mafia was born.

This group of talented individuals would create among the most valued companies in the Silicon Valley. Let’s start with the deal that made this possible.

The PayPal Mafia phenomenon

Source: telegraph.co.uk

A group of people that were called PayPal Mafia after the eBay deal went on to create many prominent start-ups that would contribute in the later years to the Silicon Valley scene:

Jawed Karim (Youniversity Ventures)

AtPayPal, Jawed Karim was in charge for the company’s real-time anti-fraud system.Once he left PayPal, by 2008, he founded Youniversity Ventures with early PayPal investors Kevin Hartz and Keith Rabols. A company targeting students and graduates to implement viablebusiness ideas.

Jeremy Stoppelman (founded Yelp with Russel Simmons)

Jeremy Stoppelman was one of the early executives at PayPal, first, as an engineer (when PayPal still didn’t change its name from X.com). He eventually became Vice President of Engineering.After leaing PayPal he founded Yelp, together with Russel Simmons.

Andrew McCormack (partner at venture capital firm Valar Ventures)

Andrew McCormack was Peter Thiel’s assistant, as Peter Thiel became CEO of the company, succeeding Elon Musk. As he left PayPal he assisted Pether Thiel in funding various venture capital funds afterward. Until co-founded Valar Ventures, in 2010. A private equity firm backed by Peter Thiel “focused on startups outside of Silicon Valley.”

Premal Shah (non-profit organization Kiva)

Premal Shah was among the initial executive team and he was principal product manager at PayPal. He then founded Kiva, a non-profit organization “on a mission to expand financial access to help underserved communities thrive.”

Luke Nosek (Founders Firm)

Among the PayPal’s co-founder, Luke Nosek was in charge of VP, business development, marketing and strategy at PayPal. After leaving the company he co-founded The Founders Fund, Pether Thiel’s venture capital fund, which invested in many startups turned multi-billion dollars companies.

Some of the companies in which The Founders’ Fund has invested in, through the years.

Some of the companies in which The Founders’ Fund has invested in, through the years.

Ken Howery (VP at Clarium Capital)

Ken Howery, after being co-founder and CFO of PayPal, joined eBay as Director of Corporate Development. Later on, he co-founded The Founders Fund together with Peter Thiel, until 2019, when by September 2019, he joined the U.S. Department of State, as U.S. Ambassador to the Kingdom of Sweden.

David Sacks (produced “Thank You for Smoking”)

David Sacks joined PayPal in 1999 from McKinsey & Company.He would become a successful angel investor in technology companies involved in the industry for two decades with investments suchAirbnb,Eventbrite,Opendoor,Postmates, Scribd,Slack, andUber.

Peter Thiel (created hedge fund Clarium Capital and The Founders Firm)

Referred as the “Don” of thePayPalMafia, he co-foundedPayPal, and led it to the merge with Elon Musk’s company X.comBeyond Clarium Capital, he also co-founded The Founders Fund and Palantir, an enterprise software company working with the United States Government, military, intelligence, and police.

Keith Rabois (held senior positions at LinkedIn, Slide)

After being Executive Vice President at PayPal, he held several positions, from Vice President, Business & Corporate Development at LinkedIn, to Until joining Founders Fund as General Partner in 2019.

Reid Hoffman (LinkedIn)

Reid Hoffman also played a key role within PayPal, later on co-founding LinkedIn, which sold to Microsoft. He is the author of Blitzscaling. After being Executive Vice-PresidentHe also served as board member in many startups, and sat as borad member in Microsoft since 2017, as the company acquired LinkedIn.

Max Levchin (Slide. Google bought it for $182 million in 2010)

After PayPal, Max Levchin worked on many interesting business projects (among which he was VP of Engineering at Google between 2010-11). Until he founded Affirm, back in 2012, a major fintech company.

Roelof Botha (Sequoia Capital)

He was PayPal CFO between 2000-2003, then he joined various startups as board members, as a Sequoia Capital Partner since 2003.

Russel Simmons (Yelp)

He was reimagining the experience of learning. Breaking from traditional models of education, we buildstreamlinedproducts for students toexplorethe subjects of theircuriosity.”

Elon Musk (Tesla, SpaceX)

Elon Musk is among the most emblematic from the PayPal Mafia. His entrepreneurial story after PayPal, saw the investments in Tesla, the creation of SpaceX, and later on Neuralink and The Boring Company.

Read Also: PayPal Mafia

The PayPal acquisition by eBay

Finally in 2001, after a few months from PayPal IPO, eBay decided to buy the payment company. We don’t know the “real reasons” for eBay to acquire PayPal.It seems though that at the time most PayPal users were coming from eBay. As reported by a release on July 2002:

The agreement also should benefit eBay shareholders. The combination of the two networks should expand both platforms while minimizing shared operational costs. Strengthening the marketplace and realizing the efficiencies made possible by the acquisition will increase the value of both businesses.

In other words, on the one hand, eBay users were already accustomed to PayPal. On the other hand, PayPal could allow eBay to tap into a new audience as reported in the same press release:

PayPal, which will continue to operate as an independent brand, is a leading online payments solution. Approximately 60% of PayPal’s business takes place on eBay, making it the most preferred electronic payment method among eBay users. The remaining 40% occurs primarily among small merchants who constitute a potential new audience for eBay. Likewise, eBay’s community of 46 million users worldwide represents a growth opportunity for PayPal. eBay’s current payment service, eBay Payments by Billpoint, will be phased out after the close of the transaction.

It is important to notice here that the acquisition of Billpoint that was to meant to allow eBay to have its own transactions system to speed up payments and enable fraud prevention was not successful.As it failed, this might also have been a critical reason for eBay to purchase PayPal at that price.

PayPal business model dissected

We’re going to see the ecosystem the company was able to build throughout the years via acquisitions and international expansion. We’ll also look at the overall business model.

PayPal Network Effects Explained

- Two-sided network—PayPal offers an end-to-end product experiences while gaining valuable insights into customer behavior.

- Scale, the company has been growing organically for years. As of 2020, it had 377 million active accounts, of which 348 million consumer active accounts and 29 million merchant active accounts.

- Brands—PayPal comprises a galaxy of fintech brands spanning from PayPal as core product, Braintree, Venmo, Xoom, Hyperwallet, iZettle, and Honey.

- Risk and Compliance Management—the core platform uses built-in tokenization to keep customer information secure, and to help ensure we process legitimate transactions around the world, while identifying and minimizing illegal, high-risk, or fraudulent transactions.

- Regulatory—over the years the company has been building a portfolio of regulatory licenses, which enable it to operate in markets around the world. This is a key competitive moat for companies operating in the financial field, as without licenses it’s not possible to operate in may juristiciton. And it does play as a disincentive for new players, as it might take massive investments in time and financial resources to gain these licenses.

PayPal Customer Segments, Key Partners and Value Propositions

PayPal serves two main segments/key partners:

- Merchants.

- And Consumers.

Merchant Value Proposition

As PayPal highlights in its financials, the key elements that make up its offering for merchants is to help:

Grow and expand their businesses by providing global reach and powering all aspects of digital checkout. We offer alternative payment methods, including access to credit solutions, provide fraud prevention and risk management solutions, reduce losses through proprietary protection programs, and offer tools and insights for leveraging data analytics to attract new customers and improve sales conversion

Cuustomer Value Proposition

For customers, some of the key values offered comprise:

Providing affordable consumer products intended to democratize the management and movement of money. We provide consumers with a digital wallet that enables them to send payments to merchants more safely using a variety of funding sources, which may include a bank account, a PayPal Cash or Cash Plus account balance, a Venmo account balance, our consumer credit products, a credit card, debit card, or other stored value products such as coupons, gift cards, and eligible credit card rewards.

The PayPal family: the galaxy of payment systems and apps around PayPal

PayPal, as part of eBay over the years, has created an ecosystem of payments that comprise platforms and mobile gateways that allow it to penetrate several markets. Around PayPal there are other four primary brands:

What is Braintree?

Source: crunchbase.com

In 2013 Braintree, a company that allows acceptance and processing of payments got acquired by PayPal in 2013. This was an all-cash deal of $800 million, and as reported by Tech Crunch after the acquisition, eBay Inc. President and CEO John Donahoe said: “Bill Ready [CEO of Braintree] and his team add complementary talent and technology that we believe will help accelerate PayPal’s global leadership in mobile payments.“

What is Venmo?

Venmo has become so prominent among millennials that it has become a verb (“venmo me money”):

Source: crunchbase.com

Thus, before Braintree would become part of PayPal, it acquired Venmo, an app that allows users to share and make payments with friends for a variety of services. The social aspect of this app is critical, and it is also what makes Venmo so successful among millennials.

What is Paydiant?

The Paydiant Platform is a white label mobile wallet solution. Thus, it provides solutions for merchants and banks, as well as for resellers and distributors, and point-of-sale and ATM providers. In short, they can deploy branded mobile wallet apps that work at the point of purchase at retail, restaurant, fuel site, cash access atm, and other in-person locations.

What is Xoom?

Xoom is a PayPal service that provides worldwide money transfers. It allows consumers to send money, pay bills and reload mobile phones from the United States to 52 countries. As pointed out by PCmag “Xoom lets you send money to recipients in 66 different countries, as well as top up cell plans and pay utilities abroad. It’s a convenient and well-designed service, though its rates are less favorable than some of the competition.“

PayPal Growth Strategy Explained

As PayPal highlights, the growth strategy moves along four main areas:

- Growing the core business: by expanding global capabilities, customer base and scale, increasing customers’ use of products and services by better addressing everyday needs related to accessing, managing, and moving money, and expanding the adoption of solutions by merchants and consumers;

- Expanding the value proposition for merchants and consumers: by being technology and platform agnostic, partnering with merchants to grow and expand their business online and in-store, and providing consumers with simple, secure, and flexible ways to manage and move money across different markets, merchants, and platforms;

- Forming strategic partnerships: by building new strategic partnerships to provide better experiences for customers, offering greater choice and flexibility, acquiring new customers, and reinforcing role in the payments ecosystem;

- Seeking new areas of growth: organically and through acquisitions and strategic investments in existing and new international markets around the world and focusing on innovation both in the digital and physical world.

Revenue streams

- Transaction revenues: Net transaction fees charged to consumers and merchants primarily based on the volume of activity, or Total Payments Volume

- Other value-added services:Net revenues derived principally from interest and fees earned on loans and interest receivable

If you don’t measure it, you can’t improve it: PayPal key metrics to measure its business success

As Peter Drucker would put it, “if you can’t measure it, you can’t improve it.”This principle applies to any business model. In a way, the metrics a business picks up to measure its success as a business are also indicative of its culture and values that it tries to create. Of course, financial metrics have to be easy to measure.Which in some ways allow them to be very actionable. On the other hand, a business model will have several kinds of metrics that might in part be disjoined from the bottom line. In PayPal’s cases we have a few KPIs (key performance metrics):

- Active customers accounts

- Payment transactions

- Total payment volume

Source: PayPal Financials

What are active customer accounts?

An active customer account is a registered account that successfully sent or received at least one payment or payment reversal through our Payments Platform, excluding transactions processed through our gateway and Paydiant products, in the past 12 months.

This is the definition of active customer account given by PayPal. As of 2021 PayPal added 48.9 million new accounts.

What is the number of payment transactions?

Number of payment transactions is defined as the total number of payments, net of payment reversals, successfully completed through our Payments Platform, excluding transactions processed through our gateway and Paydiant products.

What is TPV?

TPV is the value of payments, net of payment reversals, successfully completed through our Payments Platform, excluding transactions processed through our gateway and Paydiant products

The total payment volume passed a trillion-dollar in 2021, reaching $1.25 trillion in the same year!

Strategic partnerships

For PayPal success it is crucial the company keeps building new strategic partnerships to provide better experiences to customers, offering greater choice and flexibility. In short, the value of PayPal is given by the strength of the ecosystem it creates.

Example of the DoorDash PayPal integration, as a key partnership in 2021.

Seeking new areas of growth

PayPal growth is also part of the long-term plan. The growth can be driven by international markets expansion and innovation in the digital technology landscape.

What is the PayPal value proposition?

As highlighted in the annual report PayPal focuses on trust and simplicity, providing risk management and insights from our two-sided Payments Platform and being technology and platform agnostic.

Two-sided Platform

PayPal is a classic example of a two-sided platform. The platform connects merchants and consumers. Thus, it gains valuable insights into customer behavior through data. The aim is to keep the platform both brand and technology agnostic. This aspect is critical as it leverages on trust.

Branding

Branding is a critical building block of PayPal overall strategy. In fact, over the years the company has been able to build a trusted brand. There’s no transaction without trust and PayPal is at this stage a globally recognized brand.

Competition

The competitive landscape shows several challenges:

- retain and engage both merchants and consumers part of the two-sided platform;

- show merchants incremental sales via end-to-end services;

- safety and security of transactions

- the simplicity of fee structure;

- ability to develop products and services across multiple commerce channels

- trust in dispute resolution and buyer and seller protection programs;

- customer service;

- brand recognition and preference;

- the website, mobile platform and application onboarding, ease-of-use, speed, availability, and dependability;

- the technology and payment agnostic nature of Payments Platform;

- system reliability and data security;

- ease and quality of integration into third-party mobile applications and operating systems;

- quality of developer tools

- other vital challenges are related to the regulatory landscape:

PayPal in numbers

PayPal ESG Strategy

PayPal business model explained in an infographic

Key takeaways

- PayPal started out as a service launched by Confinity, and it eventually became a service offered by the merger between Confinity and X.com.

- The team behind the initial traction phase and before PayPal arrived at the deal with eBay comprised brilliant people, the so-called PayPal Mafia.

- Many former PayPal employees would participate in developing a new startup that became critical in the Silicon Valley landscape.

- After the deal with eBay, PayPal became a giant comprising other companies like Braintree and Venmo.

- Today PayPal is a two-sided platform whose success depends on its ability to cope with the competitive and regulatory landscape.

How does PayPal make its profits?

PayPal makes money primarily by processing customer transactions. Therefore most of its money comes from transactions revenues. As of 2020 PayPal generated over $21.5 billion in net revenues with a 25% operating margin.

How does PayPal make money if it's free?

PayPal is a free service, but it makes money via transaction revenues. Indeed, as the company offers an end-to-end transaction platform when transactions go through the company collects a fee on top of each transaction.

What is PayPal's biggest competitor?

PayPal competitors are those offering end-to-end payment services for either consumers or merchants. Among these competitors, we have Google with Google Pay, Square with Cash App, and Apple with Apple Pay.

Read More: How Does TD Ameritrade Make Money, How Does Dave Make Money, How Does Webull Make Money, How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

Related to PayPal

PayPal Transactions Per Active Users

Read More: How Does TD Ameritrade Make Money, How Does Dave Make Money, How Does Webull Make Money, How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

List of FinTech Business Models

Braintree

Read Next: Fintech Business Models, IaaS, PaaS, SaaS, Enterprise AI Business Model, Cloud Business Models.

Read Next: Affirm Business Model, Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Main Free Guides:

Great information. Thanks

Thank you Devin!