Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Klarna’s value proposition includes: – “Pay Later” Options: Allowing consumers to shop online and pay for their purchases later, either within a specified period or through installment plans. – Smooth Checkout Experience: Offering a seamless and quick checkout process with no registration required. – Financing Solutions: Providing flexible financing options for consumers. – Merchant Services: Assisting merchants in increasing sales and conversion rates. Klarna appeals to consumers with convenient payment options and merchants with improved sales and customer satisfaction. | Attracts consumers seeking flexible and convenient payment options. Enhances the online shopping experience with a smooth checkout process. Empowers consumers with financing choices. Engages merchants with services that boost sales and customer satisfaction. Provides a comprehensive value proposition for the e-commerce ecosystem. | – “Pay later” options for consumers. – Seamless and quick checkout experience. – Financing choices for consumers. – Merchant services for increased sales. |

| Customer Segments | Klarna serves the following customer segments: 1. Consumers: Individuals who shop online and use Klarna’s payment solutions. 2. Merchants: Online businesses and e-commerce platforms that integrate Klarna’s services. Klarna connects consumers and merchants, creating a win-win scenario. | Attracts consumers seeking flexible payment options. Engages merchants looking to improve sales and customer satisfaction. Connects consumers and merchants within the e-commerce ecosystem. Focuses on two primary customer segments for maximum impact. | – Online shoppers using Klarna’s payment solutions. – Merchants integrating Klarna’s services. |

| Distribution Strategy | Klarna’s distribution strategy includes: – Integration with E-commerce Platforms: Partnering with online retailers and e-commerce platforms to offer Klarna’s payment solutions directly on their websites. – Mobile App: Providing a mobile app for consumers to shop and manage payments. – Online Presence: Maintaining a strong online presence through the official website and digital marketing efforts. Klarna ensures accessibility through partnerships, mobile access, and digital marketing. | Expands reach by partnering with online retailers and platforms. Offers mobile access for convenient shopping and payment management. Utilizes digital marketing to attract consumers and promote its services. Implements a multi-channel distribution strategy for accessibility. | – Integration with partner e-commerce platforms. – Mobile app for consumer convenience. – Strong online presence and digital marketing efforts. |

| Revenue Streams | Klarna generates revenue through the following streams: 1. Transaction Fees: Charging merchants a fee for each successful transaction made using Klarna’s payment solutions. 2. Interest and Financing Charges: Earning interest and fees from consumers who choose financing options. 3. Late Payment Fees: Collecting fees from consumers who miss payment deadlines. 4. Merchant Services: Offering premium services to merchants for a fee. Klarna’s primary revenue sources are transaction fees and interest/financing charges. | Earns income from transaction fees on successful payments. Generates revenue from interest and fees on consumer financing. Collects fees from consumers for late payments. Provides premium services to merchants for additional income. Diversifies revenue streams with a merchant-focused approach. Ensures financial sustainability through multiple income sources. | – Transaction fees from merchants. – Interest and fees from consumer financing. – Late payment fees from consumers. – Premium services offered to merchants. |

| Marketing Strategy | Klarna’s marketing strategy involves: – Digital Advertising: Running online advertising campaigns to promote its services to consumers and merchants. – Partnerships: Collaborating with e-commerce platforms, retailers, and influencers for mutual promotion. – Incentives: Offering special promotions and discounts to attract consumers. – Content Marketing: Providing valuable content related to online shopping and payment options. Klarna focuses on digital advertising, partnerships, incentives, and content marketing to attract and engage users. | Increases brand visibility through online advertising campaigns. Collaborates with e-commerce partners, retailers, and influencers for mutual promotion. Attracts consumers with special promotions and discounts. Provides valuable content to educate and engage users. Implements a comprehensive marketing strategy for user acquisition and engagement. | – Online advertising campaigns for brand visibility. – Collaborations with e-commerce partners, retailers, and influencers. – Special promotions and discounts to attract consumers. – Content marketing to educate and engage users. |

| Organization Structure | Klarna’s organizational structure includes: – Executive Leadership: Responsible for strategic direction and decision-making. – Technology and Development Teams: Overseeing software development, platform maintenance, and innovation. – Sales and Customer Support: Engaging with merchants and assisting with their payment needs. – Marketing and Partnerships: Promoting Klarna’s services and collaborating with partners. Klarna maintains a structured approach to efficiently deliver its services and support its user base. | Led by executive leadership for strategic direction and growth. Employs teams dedicated to software development and innovation. Focuses on sales and customer support for merchant engagement. Promotes services and collaborates with partners for brand visibility. Maintains an organized structure for efficient operation. | – Led by executive leadership for strategic direction and growth. – Teams responsible for software development and innovation. – Focus on sales and customer support for merchant engagement. – Marketing and partnerships for service promotion and engagement. – Organized structure for efficient operation and ecosystem growth. |

| Competitive Advantage | Klarna’s competitive advantage stems from: – “Pay Later” Options: Offering consumers the flexibility to shop and pay later, enhancing the shopping experience. – Merchant Services: Assisting merchants in improving sales and customer satisfaction. – User-Friendly Experience: Providing a smooth and convenient checkout process. – Comprehensive Marketing: Attracting consumers and merchants through online advertising and partnerships. – Diversified Revenue Streams: Ensuring financial stability through multiple income sources. Klarna’s strengths in payment flexibility, merchant services, user-friendliness, marketing, and diversified revenue streams make it a competitive player in the online payment solutions industry. | Distinguishes itself with flexible “Pay Later” options for consumers. Engages merchants with services that enhance sales and customer satisfaction. Provides a seamless and convenient checkout experience. Attracts users through comprehensive marketing efforts. Ensures financial stability with diversified income sources. Enjoys a competitive edge in the online payment solutions market. | – Flexible “Pay Later” options for consumers. – Merchant services enhancing sales and satisfaction. – User-friendly checkout experience. – Comprehensive marketing to attract users. – Diversified revenue streams for financial stability. – A competitive edge in the online payment solutions market. |

Origin story

Klarna is a Swedish financial technology company founded in Stockholm in 2005 by Sebastian Siemiatkowski, Victor Jacobsson, and Niklas Adalberth.

The trio started the company while Siemiatkowski was nearing the end of his master’s degree at the Stockholm School of Economics.

In a later interview with Forbes, Siemiatkowski noted that:

“We presented our idea at an innovators pitch, and they said, ‘Forget about it. It’s never going to work’. It didn’t feel great.”

Despite the lackluster feedback, however, another attendee encouraged the co-founders to pursue their idea because banks would never understand what they were trying to accomplish.

The first transaction facilitated by the Klarna platform occurred on April 10, 2005, at a Swedish bookstore known as Pocketklubben.

At the time, however, Klarna was not a fintech company as most understand the term.

Instead, the source of the company’s competitive advantage was an old business idea that had been repurposed for the eCommerce revolution by the Klarna’s non-technical founders.

The first Klarna website enabled consumers who ordered items online to be sent an invoice in the mail within 30 days.

This made eCommerce – still in its infancy in 2005 – more attractive to those who were weary of the concept and increased retail sales in the process.

According to eventual Klarna investor Niklas Zennström, consumers referred to this early version of Klarna “as the invoicing company.”

Turning into a fintech company

Klarna is most definitely a fintech company today, with a TechCrunch article noting that in late 2020, around 37% of its 3,500 staff were software engineers.

Operations are now entirely cloud-based with various automated processes handling everything from the shopping app to algorithms that assess credit worthiness.

The company is perhaps best known for its buy now, pay later (BNPL) service.

This enables consumers to purchase a product with no upfront cost.

Instead, the product is paid off over four interest-free installments over a predetermined period.

For larger purchases, Klarna users can finance their purchases over 3 years.

To onboard customers, Klarna allows consumers to shop with a temporary Visa card number known as a “ghost card”.

That is, the customer does not need to provide payment details to the merchant when making a purchase.

Klarna then performs a soft credit check on the card number ID and pays the merchant.

Lastly, the consumer receives the product and an invoice from Klarna with payment instructions.

ChatGPT integration

In March 2023, Klarna announced a partnership with OpenAI to add a streamlined, personalized, and unique shopping experience to the latter’s ChatGPT AI chatbot.

Klarna noted that it was one of the first brands to build an integrated plugin for ChatGPT, with users able to ask the chatbot for advice and inspiration.

In response, ChatGPT would serve links that point to where the products could be purchased in Klarna’s search and compare tool.

The tool, which perfectly complements the OpenAI collaboration, is currently used to compare prices across Klarna’s more than 500,000 retail partners.

As part of the announcement, Siemiatkowski said that ”I’m super excited about our plugin with ChatGPT because it passes my ‘north star’ criteria that I call my ‘mom test’, i.e. would my mom understand and benefit from this. And it does because it’s easy to use and genuinely solves a ton of problems – it drives tremendous value for everyone.”

How does Klarna’s ChatGPT plugin work?

To start, Klarna customers need to install the plugin from OpenAI’s dedicated plugin store. Next, it is a matter of asking ChatGPT for ideas to receive a selection of curated items. Note that the chatbot determines when to provide these recommendations based on the conversation.

For example, a Klarna who enters the prompt “My budget is $250. Which headphones can I afford?” will receive a list of headphones in their price range. The user can then ask follow-up questions or clarify details. In this example, they may ask ChatGPT to only list noise-canceling headphones or those from a certain manufacturer.

Clarity AI integration

Klarna also announced in March 2023 the launch of so-called “conscious badges” in collaboration with sustainability tech platform Clarity AI.

The feature allows customers to access metrics about an electronics brand’s GHG emissions and the amount of energy it derives from renewable sources, among other metrics.

The unbiased, AI-driven environmental assessment follows the launch of Klarna’s Conscious Collections in 2022 – an initiative that increases transparency around sustainable practices in the apparel and footwear industry.

Five different badges are available based on various criteria:

- Lower direct GHG emissions – for companies in the top 10% of Clarity AI-tested firms with the lowest direct and energy-related emissions.

- Lower indirect GHG emissions – for companies in the top 10% of those with the lowest indirect emissions.

- Committed to reducing GHG emissions – awarded to companies that have committed to reducing emissions to limit global warming to 1.5 degrees Celsius.

- Disclosing GHG emissions – awarded if the company discloses direct, indirect, and energy-related emissions, and

- Using renewable energy – for companies whose energy requirements come from at least 90% renewable sources.

Klarna mission and vision

Klarna’s mission is to “make paying as simple, safe, and smooth as possible.“

While Klarna’s vision is to “transfer the power from the large corporations to the consumer and empower consumers to make fast and informed decisions.”

Klarna revenue generation

To drive revenue, Klarna very much relies on charging the merchant as opposed to the consumer.

Let’s take a look at some of the primary revenue drivers of Klarna.

Payment fees

The majority of Klarna’s revenue is derived from a merchant transactions and variable percentage fees.

These fees fluctuate according to the payment method and country of origin of the customer.

In the United States, for example, merchants must pay Klarna a 30-cent transaction fee on top of a variable fee between 3.29-5.99%.

Payment fees are also generated when customers:

- Want to check out with a few clicks. Known as the Instant Shopping feature, Klarna charges merchants a $30 monthly product fee with a fixed $0.30 transaction fee. Merchants are also hit with a 3.29% fee for onsite transactions and a 3.79% fee for offsite transactions.

- Want to pay in four installments. In this case, Klarna charges the same $0.30 transaction fee combined with variable fees as high as 5.99%.

- Want to pay monthly. Here, Klarna takes a $0.30 fixed transaction fee and 3.29% in variable fees. Customers will also be charged interest throughout the loan, with annual percentage rates as high as 29.99%.

- Fail to pay by the specified date. The company charges a fee of up to $8 for late or missed payments that are not made within 10 days of the payment due date.

- Purchases below $25 in value do not incur a late fee, but to encourage prompt payment and healthy spending habits, Klarna structures its late fees in a tier-based system for purchases above $25. The maximum late fee for any order is $24.

Interchange fees

Klarna recently launched a bank account facility with the issuance of a free debit card to users in collaboration with Visa.

When a consumer makes an eligible purchase, an interchange fee (typically around 1%) is paid by the merchant to the card issuer.

Klarna then takes a portion of the interchange fee in exchange for promoting Visa as a service to its customer base.

Cash interest

With the aforementioned bank account facility, Klarna earns money on the cash in those accounts by lending it out to other institutions.

Klarna vs Affirm vs Afterpay

Klarna, Affirm, and Afterpay are all buy-now-pay-later (BNPL) providers that allow consumers to purchase goods and services and then pay them off with micro-installments over a set period.

While a new market entrant in this industry feels like a daily occurrence, Klarna, Affirm, and Afterpay represent some of the largest and most popular BNPL providers in 2022.

In this article, we’ll compare and contrast aspects of their respective businesses to enable consumers and merchants to choose the one that best suits their needs.

Credit approval

Little separates the three companies in terms of credit approvals, which many critics argue is a serious deficiency of the BNPL concept in any case.

Each app combines typical “soft” information such as salary and credit history with insights gleaned from machine learning and a user’s social media activity.

For consumers, this means there is little appreciable difference between providers in terms of whether their application is accepted or rejected.

Interest and late fees

Where there are differences, however, is in the way payments and fees are charged.

For customers of Klarna and Afterpay, the “loan” that allows them to purchase products without having the funds to do so comes with no interest fees.

Affirm will collect interest fees if the consumer chooses the monthly installment option instead of the typical fortnightly plan.

In terms of late fees, Affirm does not charge them while the fee is $7 for Klarna and $8 for Afterpay.

Instead of a monetary penalty, Affirm will block its customers from being able to make additional purchases.

Note that these are fees for North American customers and will vary by country.

Payment scheduling

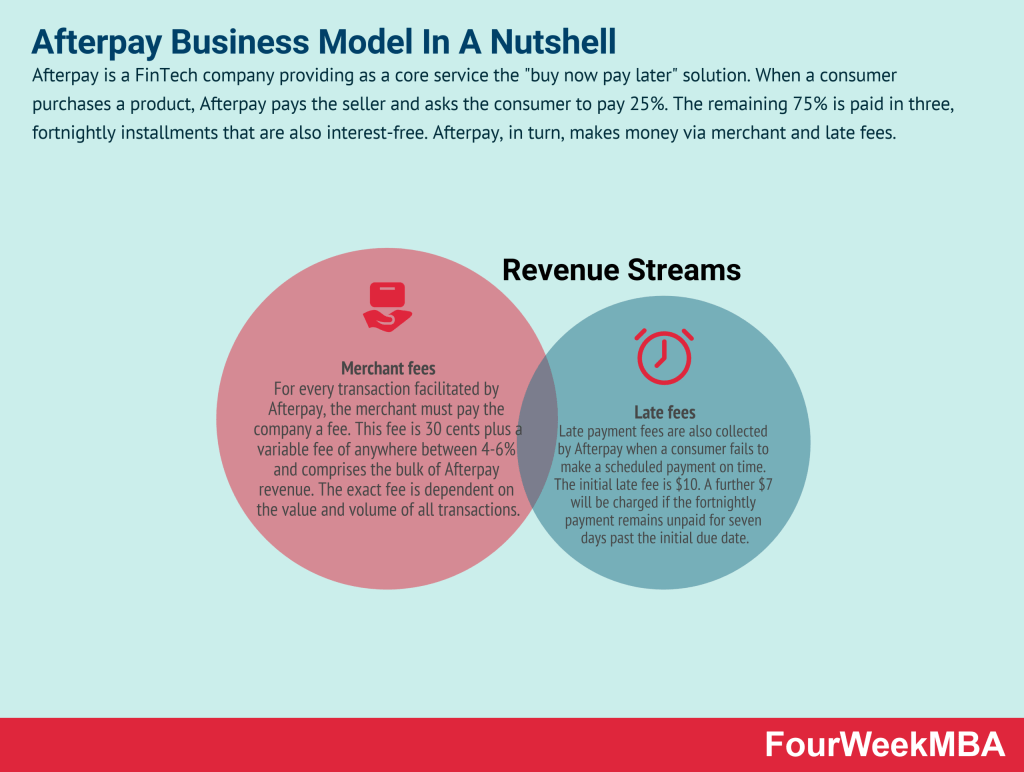

Afterpay users must pay 25% of the total purchase price upfront and split the remaining 75% with payments over the next three fortnights (six weeks).

Affirm is more lenient, allowing customers to spread their payments out over up to three years.

This makes it better suited to high-ticket items or for those who simply want a simple, long-term payment solution, not unlike a traditional loan.

Klarna, on the other hand, offers terms similar to those of Afterpay when it was first launched. That is, four payments split over two months or eight weeks.

Merchant fees and features

Merchants that want to include Afterpay as a payment option pay a commission rate of 4-6% of the transaction plus 30 cents.

The exact fee is based on a negotiated amount between the merchant and Afterpay.

Note also that merchants are not paid until the customer has received their items in the mail.

Affirm merchants are paid within 1-3 business days of the purchase and the company provides more flexibility with respect to the payment terms that are offered to consumers.

Affirm also charges a commission and while the exact rate is undisclosed, most estimates suggest it is around 3%.

Klarna’s merchant fee structure is comparable to those offered by Afterpay. There is a 30-cent transaction fee plus a variable fee of between 3.29% to 5.99%.

Klarna’s services offer a diverse range of payment methods to merchants from direct checkout options to loan financing. In return, the company pays the merchant upfront and assumes the customer’s credit risk.

Payment fees are also applicable for customers in the following scenarios:

- Checking out with just a few clicks, otherwise known as the Instant Shopping feature. In this case, Klarna charges merchants a $30 monthly product fee with a fixed $0.30 transaction fee. Merchants are also hit with a 3.29% fee for onsite transactions and a 3.79% fee for offsite transactions.

- Payment via four instalments. Here, Klarna charges the same $0.30 transaction fee combined with variable fees as high as 5.99%. The total order amount also needs to be more than $35 but less than $1000, with Klarna performing a soft credit check that does not impact the customer’s credit score.

- Longer term monthly payments, where Klarna takes a $0.30 fixed transaction fee and 3.29% variable fee. Customers will also be charged interest throughout the loan, with annual percentage rates as high as 29.99%. This option is for loans with larger principal amounts to be paid back in anywhere between 6 and 36 months. The service itself is handled by Klarna’s financial partner WebBank and a hard credit check is performed.

- Failure to pay by the specified date. Late fees are capped at $9 and can only be charged at the rate of 1 late fee per installment. Note that Klarna does not charge late fees on order amounts or balances under $50.

Unlike Afterpay, however, Klarna pays the merchant upfront and assumes the customer’s credit risk. It also offers merchants a diverse range of payment options, including direct checkout and even loan financing.

Summarizing the key differences between Klarna, Affirm and Afterpay

- Klarna, Affirm, and Afterpay represent some of the largest and most popular BNPL providers in 2022, but there are subtle differences in their business models.

- Klarna and Afterpay charge no interest fees provided the customer makes their payments on time, while Affirm will collect interest fees if a buyer chooses the monthly payment plan. Late fees are also charged by Klarna and Afterpay for missed payments. Affirm, on the other hand, simply chooses to ban customers from making additional purchases.

- In terms of payment scheduling, Afterpay asks for 25% of the total purchase price upfront with the remainder to be paid across three fortnights. Klarna has a similar schedule with payments spread out after eight weeks instead of six. Affirm allows consumers to spread their payments out over as many as three years. As a result, it tends to be more suitable for more significant purchases.

Key takeaways:

- Klarna is a Swedish financial technology company founded in 2005. The company is known for its innovative payment services, including BNPL functionality and other flexible arrangements.

- Klarna makes its money by charging the merchant and not the consumer. The company only makes money from the customer when they elect to spread out the cost of a purchase over multiple months.

- In addition to typical payment and transaction fees, Klarna also earns a percentage of interchange fees as a commission. They also derive income from the cash sitting in the accounts of their customers.

Business Model Explorers

List of FinTech Business Models

Braintree

Read Next: Fintech Business Models, IaaS, PaaS, SaaS, Enterprise AI Business Model, Cloud Business Models.

Read Next: Affirm Business Model, Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Main Free Guides: