| Company | Key Characteristics and Business Strategies | Core Value Proposition | Customer Segments | Distribution Channels |

|---|---|---|---|---|

| Square | 1. Mobile Payments: Square is known for its mobile payment solutions, including Square Reader for in-person transactions. 2. Small Business Focus: It targets small and local businesses. 3. Holistic Ecosystem: Square offers various business services beyond payments. | Providing simple, accessible, and integrated payment and business solutions for local and small businesses to thrive. | Small businesses, local retailers, service providers | Mobile devices, point-of-sale hardware, online platforms. |

| PayPal | 1. Global Reach: PayPal is widely accepted internationally, allowing users to make and receive payments across borders. 2. Ease of Use: It offers a user-friendly platform for online transactions. 3. Payment Security: PayPal prioritizes security and fraud prevention. | Enabling secure and convenient online payments for individuals and businesses, with a focus on international transactions. | Individuals, online shoppers, freelancers, businesses | Online platforms, websites, mobile apps. |

| Stripe | 1. Developer-Centric: Stripe provides tools and APIs for developers to build customized payment solutions. 2. Scalability: It caters to businesses of all sizes, from startups to enterprises. 3. Subscription Billing: Stripe offers subscription management tools. | Empowering businesses to accept and manage online payments with customizable solutions and support for scaling. | E-commerce websites, SaaS companies, startups, developers | Websites, mobile apps, customized integrations. |

| Robinhood | 1. Commission-Free Trading: Robinhood popularized commission-free stock trading. 2. User-Friendly App: The mobile app offers a user-friendly experience. 3. Fractional Shares: Allowing users to invest with small amounts of money. | Democratizing finance by making investing accessible to everyone with commission-free trading and a user-centric app experience. | Millennial investors, first-time investors | Mobile app, online platform. |

| Coinbase | 1. Cryptocurrency Exchange: Coinbase is a prominent cryptocurrency exchange platform. 2. Security Focus: Emphasizing security measures for crypto assets. 3. Educational Resources: Offering resources for crypto education. | Providing a secure and user-friendly platform for buying, selling, and managing cryptocurrencies while educating users about the crypto space. | Cryptocurrency enthusiasts, investors, traders | Online platform, mobile app. |

| Venmo | 1. Social Integration: Venmo incorporates social elements, allowing users to share payments and interact with friends. 2. P2P Payments: It specializes in peer-to-peer transactions. 3. Mobile App: Venmo is primarily accessed via mobile. | Facilitating social and personal payments among friends and acquaintances through an easy-to-use mobile app. | Young adults, social users, individuals | Mobile app, limited online platforms. |

| Adyen | 1. Global Payment Solutions: Adyen provides payment processing solutions for online and in-store transactions globally. 2. Unified Commerce: It offers a unified platform for online and offline payments. 3. Data-Driven Insights: Using data for optimization. | Enabling businesses to accept payments seamlessly across channels and geographies while leveraging data insights for optimization and growth. | Enterprises, e-commerce businesses, multinational retailers | Online and offline payment solutions, customized integrations. |

| Revolut | 1. Multi-Currency Accounts: Revolut allows users to hold and transact in multiple currencies with interbank exchange rates. 2. Crypto Support: It offers cryptocurrency trading and wallets. 3. Global Spending: Low-cost international spending. | Empowering users to manage their finances globally with multi-currency accounts, cryptocurrency access, and cost-effective international spending. | Travelers, international professionals, crypto enthusiasts | Mobile app, online platform. |

| TransferWise | 1. Transparent Fees: TransferWise provides transparent and low-cost international money transfers. 2. Borderless Accounts: Users can hold money in multiple currencies. 3. Business Solutions: TransferWise for Business caters to companies. | Offering affordable and transparent international money transfers, borderless accounts, and tailored business solutions for companies with international operations. | Individuals, expatriates, businesses | Online platform, mobile app. |

| SoFi | 1. Financial Services: SoFi offers a range of financial products, including loans, investments, and insurance. 2. Member Benefits: Membership includes career coaching and financial planning. 3. Robo-Advisory: Automated investment services. | Providing a holistic approach to financial wellness by offering loans, investments, career services, and personalized advice to members. | Millennials, young professionals, borrowers | Online platform, mobile app. |

| Plaid | 1. Financial Data Infrastructure: Plaid provides APIs that connect applications with users’ financial accounts. 2. Data Security: Focusing on secure and reliable data connectivity. 3. Developer Ecosystem: Supporting fintech innovation. | Enabling fintech apps to access and use financial data securely, fostering innovation and empowering developers to build financial services and applications. | Fintech companies, developers, financial institutions | APIs and integrations. |

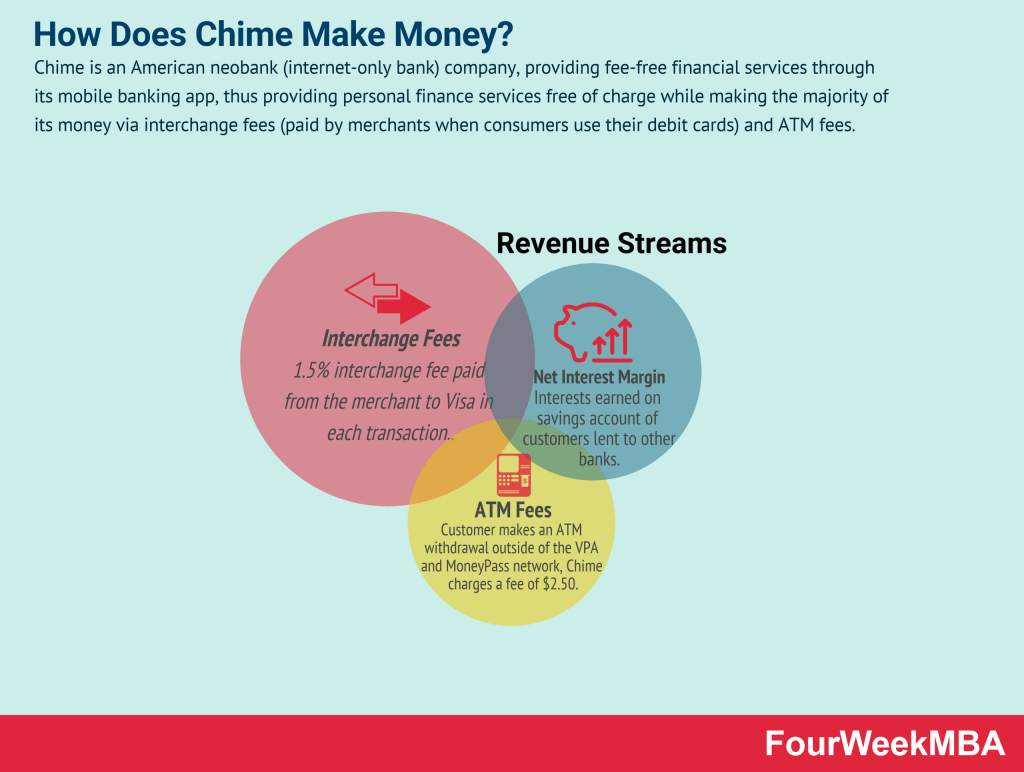

| Chime | 1. No-Fee Banking: Chime offers a no-fee checking and savings account with early direct deposit. 2. Mobile-First: Chime is primarily accessed via mobile. 3. Automatic Savings: Helping users save effortlessly. | Providing a fee-free mobile banking experience that focuses on convenience, early access to funds, and automatic savings features. | Millennials, budget-conscious individuals | Mobile app, online platform. |

| Affirm | 1. Buy Now, Pay Later: Affirm enables shoppers to make purchases with installment payments. 2. Transparent Financing: Clear terms and no hidden fees. 3. Merchant Partnerships: Affirm partners with online retailers. | Offering transparent and flexible financing options at the point of sale, allowing consumers to budget and pay for purchases over time without hidden costs. | Online shoppers, e-commerce retailers | Integration with online retailers, mobile app. |

| Alipay | 1. Digital Wallet: Alipay serves as a digital wallet for users in China. 2. Mobile Payments: Extensive use of mobile payments in China. 3. FinTech Services: Expanding into financial services, including wealth management. | Providing a comprehensive digital payment and financial ecosystem in China, facilitating mobile payments and access to a wide range of financial services. | Chinese consumers, tourists, merchants | Mobile app, online platform, merchant partnerships. |

| WeChat Pay | 1. Integration with WeChat: WeChat Pay is tightly integrated with the WeChat social platform in China. 2. Mobile Payments: Dominant in mobile payments within China. 3. QR Code Payments: QR codes for transactions. | Seamlessly integrating payment functionality into the WeChat app, offering convenient and widespread mobile payment solutions through QR codes and social connections. | Chinese consumers, businesses, tourists | WeChat app, online platform. |

| N26 | 1. Digital Banking: N26 offers mobile-based banking services with no hidden fees. 2. Global Banking: Available in multiple countries. 3. Savings and Investment Features: Offering various financial products. | Empowering users with a mobile-first, global banking experience that includes transparency, accessibility, and savings and investment opportunities. | Mobile-centric users, international travelers | Mobile app, online platform. |

| Wise (formerly TransferWise) | 1. Transparent Fees: Wise offers low-cost international money transfers with transparent exchange rates. 2. Multi-Currency Account: Users can hold money in various currencies. 3. Borderless Debit Card: Spending in multiple currencies. | Enabling individuals and businesses to send money internationally with transparency, low fees, and the convenience of multi-currency accounts and debit cards. | Expatriates, international businesses, travelers | Online platform, mobile app. |

| Greensill | 1. Supply Chain Finance: Greensill provides supply chain financing solutions for businesses. 2. Working Capital Optimization: Helping companies manage cash flow. 3. Technology-Driven: Utilizing technology for financial solutions. | Offering innovative supply chain finance solutions and working capital optimization tools, leveraging technology to improve cash flow for businesses globally. | Businesses, suppliers, manufacturers | Online platform, technology-driven solutions. |

| Affirm | 1. Buy Now, Pay Later: Affirm enables shoppers to make purchases with installment payments. 2. Transparent Financing: Clear terms and no hidden fees. 3. Merchant Partnerships: Affirm partners with online retailers. | Offering transparent and flexible financing options at the point of sale, allowing consumers to budget and pay for purchases over time without hidden costs. | Online shoppers, e-commerce retailers | Integration with online retailers, mobile app. |

Acorns

Affirm

Alipay

Betterment

Braintree

Chime

Binance

Coinbase

Compass

Dosh

E-Trade

Klarna

Lemonade

Monzo

NerdWallet

Quadpay

Revolut

Robinhood

SoFi

Squarespace

Stash

Venmo

Wealthfront

Zelle

Read Next: How Does Venmo Make Money

Main Free Guides: