Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry.

Some use cases comprise:

- Digital banking

- Alternative credit scoring

- Unbundling

- Demographic-focused products

- Different fee structures

- Insurtech

| Aspect | Explanation |

|---|---|

| Definition | The Fintech (Financial Technology) Business Model refers to a category of innovative companies that leverage technology to provide financial services and solutions. Fintech companies use software, applications, and digital platforms to disrupt and enhance traditional financial services, including banking, lending, payments, insurance, investing, and more. They often focus on improving user experiences, increasing accessibility, and offering cost-effective financial solutions. The Fintech sector has witnessed rapid growth and transformation, challenging traditional financial institutions and reshaping the way individuals and businesses manage their finances. |

| Key Concepts | – Technology Integration: Fintech companies integrate advanced technologies, such as AI, blockchain, and data analytics, into financial services. – User-Centric Design: Emphasis on user-friendly interfaces and experiences to simplify financial transactions. – Disruption: Fintech disrupts traditional financial services by offering alternative, often more efficient, solutions. – Financial Inclusion: Expanding access to financial services for underserved populations globally. – Partnerships: Collaboration with traditional financial institutions or other fintech companies to extend service offerings. |

| Characteristics | – Digital Platforms: Fintech services are primarily delivered through digital platforms, including mobile apps and websites. – Automation: Automation and AI algorithms are used for tasks like risk assessment, underwriting, and customer support. – Real-Time Transactions: Many fintech solutions enable real-time transactions and data access. – Cost Efficiency: Fintech companies often provide cost-effective solutions compared to traditional financial institutions. – Agility: Rapid development and adaptation to changing market conditions and customer needs. |

| Implications | – Regulatory Challenges: Fintech companies must navigate complex and evolving regulatory environments in various regions. – Cybersecurity: Strong security measures are crucial to protect sensitive financial data. – Customer Trust: Building and maintaining customer trust in digital financial services is essential. – Market Competition: The fintech sector is highly competitive, with many startups vying for market share. – Financial Inclusion: Fintech has the potential to address financial inclusion challenges but may also leave certain populations behind due to digital barriers. |

| Advantages | – Enhanced Convenience: Fintech offers convenient, on-demand access to financial services 24/7. – Cost Savings: Often provides lower fees and reduced transaction costs compared to traditional banks. – Accessibility: Increases access to financial services, particularly in underserved regions. – Innovation: Drives innovation in the financial industry, leading to new products and services. – Efficiency: Streamlines processes, reducing paperwork and time-consuming tasks. |

| Drawbacks | – Regulatory Compliance: Navigating complex and evolving regulations can be challenging. – Security Risks: Cybersecurity threats and data breaches pose risks to both companies and customers. – Lack of Human Interaction: Some customers may miss the personal touch of traditional banking. – Market Competition: Intense competition may lead to market saturation and consolidation. – Digital Divide: Not all individuals have access to the necessary technology and internet connectivity for fintech services. |

| Applications | Fintech solutions span various sectors, including but not limited to: – Payments: Mobile payment apps, digital wallets, and peer-to-peer transfers. – Lending: Online lending platforms, peer-to-peer lending, and microloans. – Insurance: Insurtech companies offering digital insurance solutions. – Investing: Robo-advisors, online stock trading, and crowdfunding platforms. – Blockchain and Cryptocurrency: Cryptocurrency exchanges, blockchain-based applications, and digital assets. |

| Use Cases | – Mobile Banking: Fintech startups offer mobile banking services with no physical branches. – Peer-to-Peer Lending: Platforms connect borrowers with individual lenders, bypassing traditional banks. – Digital Wallets: Mobile apps facilitate cashless transactions and store payment information. – Robo-Advisors: Automated investment platforms provide portfolio management and financial advice. – Cryptocurrency Exchanges: Digital platforms for buying, selling, and trading cryptocurrencies. |

Background

Fintech companies incorporate technology into financial services and in so doing, have changed the way financial assets are managed, created, and exchanged.

Compared to traditional financial organizations, fintech operations are more streamlined and manage risk in a different yet more efficient way.

Many fintech organizations also adopt a more inclusive approach to personal finance, giving a broad swathe of consumers access to financial products and services. Furthermore, these products and services are typically available on mobile devices and do not have convoluted sign-up processes.

So how is the fintech approach different, exactly? This article will briefly explore some common fintech business models.

- How Does Venmo Make Money?

- How Does Discord Make Money?

- How Does Zelle Make Money?

- How Does Affirm Make Money?

Digital banking

Fintech organizations offer individual and business bank accounts based on a complete digital infrastructure.

While this model is more or less the same as a traditional banking institution, fintech companies save money on having to maintain physical branches. A portion of this saving is passed to the customer.

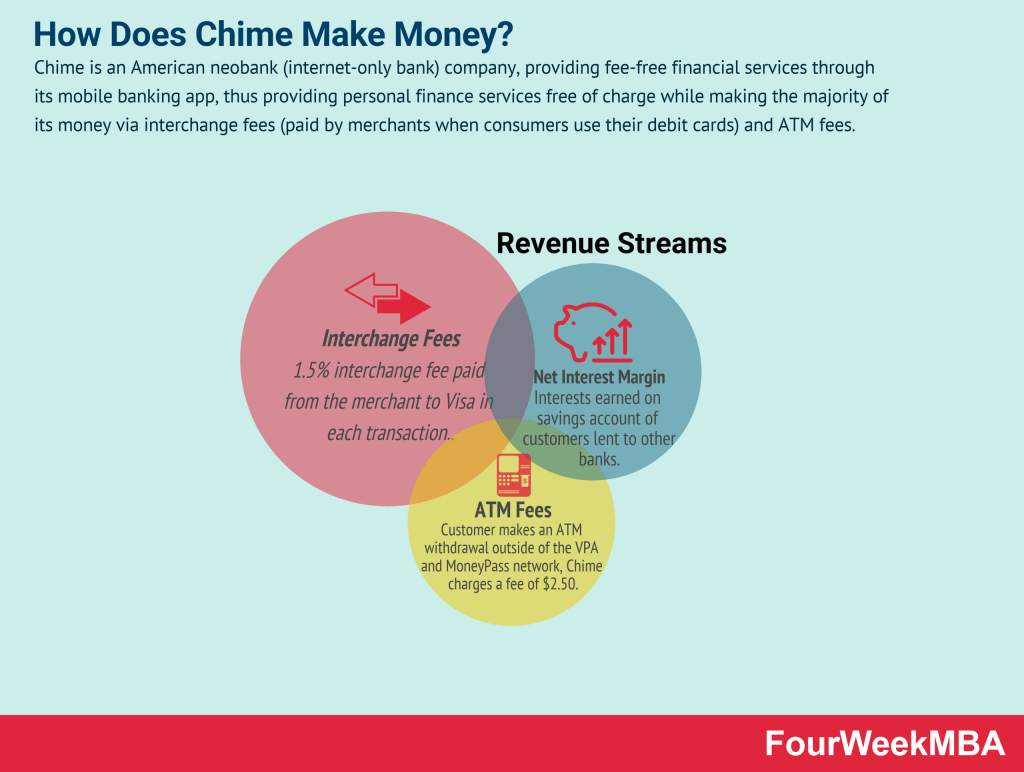

Importantly, companies like Aspiration, Chime, and Varo are bringing simple digital banking to the North American market with elegant design and better customer experiences.

Alternative credit scoring

Self-employed individuals typically have difficulties securing finance from a traditional lender. To some extent, this trend has been exacerbated by the gig economy and the rising popularity of entrepreneurship.

Instead of assessing strict credit scores, fintech companies are using social signal data in conjunction with AI algorithms to assess the creditworthiness of an applicant more accurately.

Unbundling

Most traditional financial organizations offer a suite of bundled products and services including investment banking, insurance, car loans, home loans, and credit cards.

Fintech companies are challenging the status quo by becoming specialists in just a few select services. This is particularly true of start-up fintechs who, because of their limited product offering, can focus value delivery more effectively.

Demographic-focused products

Some fintech companies are creating products based on the specific demographic of their target audience.

For example, True Link Financial offers fraud protection for elderly customers. Camino Financial offers lending designed for Latino-owned small and medium-sized businesses. Brex is a service designed for start-ups, eCommerce companies, and other smaller business segments.

Different fee structures

Robinhood is an investment application offering free stock trading. Instead, the company makes money selling retail order flow.

Wise (formerly TransferWise) offers consumers who want to send money abroad the mid-market exchange rate. Using economies of scale, its fee structure is based on transparent transaction charges.

Built on low-cost digital infrastructure, many neobanks have been able to turn a profit on debit exchanges and deposit brokering. These are options that would not be cost-effective for a traditional banking institution.

Insurtech

Many insurance companies are changing to the “insurtech” fintech business model – a portmanteau of insurance and technology.

This model utilizes AI, data analytics, and blockchain to help companies sell insurance using virtual branches and process claims more efficiently. It also has important applications in sales, distribution, underwriting, and lead management.

Key takeaways:

- Using technology, fintech company business models are changing the way consumers access financial products and services. Consumers can now create accounts on handheld devices regardless of their physical location.

- Specialized fintech companies that offer just a few select services are an example of unbundling. Specialization together with more elegant user interfaces increases customer value.

- Fintech companies are also targeting a broader swathe of user demographics. Some companies offer fraud protection to elderly customers while others offer loans to Latino small and medium-sized business owners.

Key highlights of fintech business models and use cases:

Digital Banking:

- Fintech companies offer complete digital infrastructure for individual and business bank accounts.

- Savings from not maintaining physical branches are passed on to customers.

- Examples include Aspiration, Chime, and Varo, offering simple digital banking with better customer experiences.

Alternative Credit Scoring:

- Fintech companies use social signal data and AI algorithms to assess creditworthiness more accurately.

- Helps self-employed individuals and others with non-traditional credit profiles secure finance.

- Provides more inclusive access to financial services.

Unbundling:

- Fintech companies focus on specialized services instead of offering a suite of bundled products like traditional financial institutions.

- Start-up fintechs can deliver value more effectively by concentrating on a few select services.

Demographic-Focused Products:

- Fintech companies create products tailored to specific target audiences.

- Examples include True Link Financial’s fraud protection for elderly customers, Camino Financial’s lending for Latino-owned businesses, and Brex’s service for startups and eCommerce companies.

Different Fee Structures:

- Robinhood offers free stock trading and makes money through selling retail order flow.

- Wise (formerly TransferWise) provides mid-market exchange rates and uses transparent transaction charges for sending money abroad.

- Neobanks turn a profit on debit exchanges and deposit brokering, which may not be cost-effective for traditional banks.

Insurtech:

- Insurtech combines insurance and technology, using AI, data analytics, and blockchain to sell insurance and process claims more efficiently.

- Enables virtual branches and improves sales, distribution, underwriting, and lead management in the insurance industry.

Connected Business Models

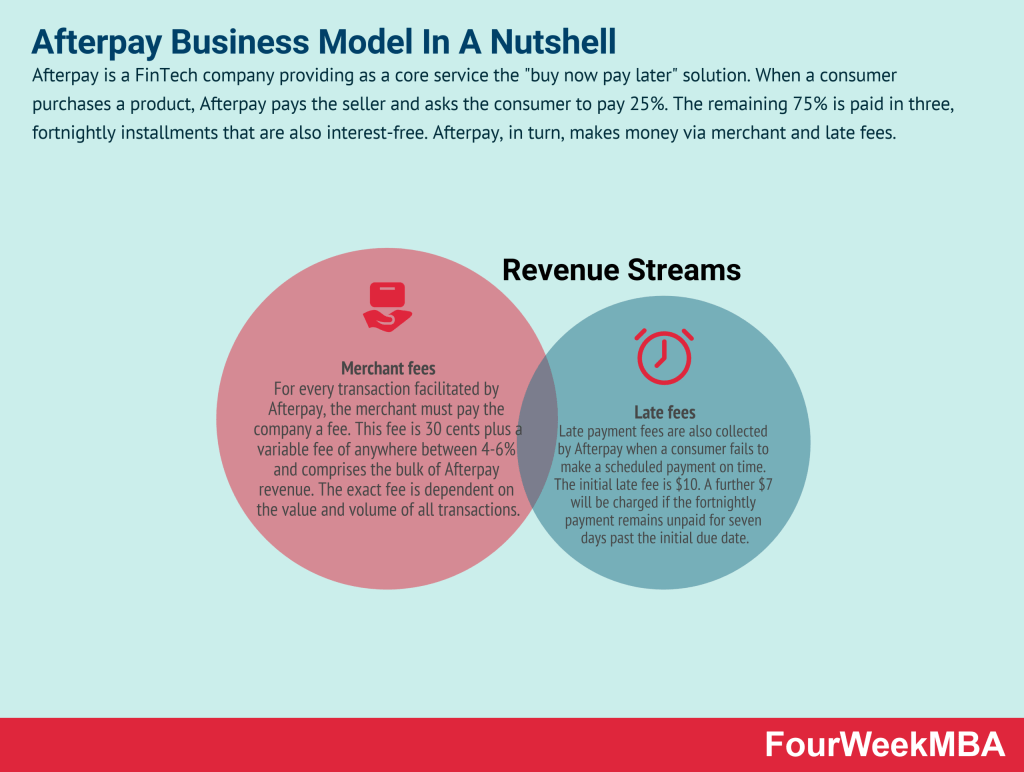

Afterpay Business Model

Quadpay Business Model

Klarna Business Model

SoFi Business Model

Chime Business Model

How Does Venmo Make Money

FinTech Business Models

List of FinTech Business Models

Braintree

Read Next: Fintech Business Models, IaaS, PaaS, SaaS, Enterprise AI Business Model, Cloud Business Models.

Read Next: Affirm Business Model, Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Main Free Guides: