Facebook is a cash machine worth billions that can generate revenues at higher margins than Google considering it has lower traffic acquisition costs. One of its secrets is its ability to attract billions of people each day and keep them hooked to its products (be it Facebook, Instagram, or WhatsApp).

Facebook advertising which comprised over ninety percent of revenues in 2023 consist primarily:

- Display Advertising: banner ads, interstitials, video ads, and rich media ads that aim to reach large numbers of consumers within a particular audience segment. Display advertising counts small brands and large brands, such as Walmart U.S. and Diageo.

- Performance-based Advertising. Performance-based advertising involves advertisers that seek specific user behaviors. Those can comprise:

- clicks on a search

- ad or a keyword-based content ad

- a response to an email campaign

- or an online purchase

The impressions economics: served vs. viewed impressions

In 2015 Facebook clarified:

Not all ad impressions are created equal. Increasingly, advertisers, publishers and advertising industry groups are adopting the position that it’s better to measure viewed impressions rather than served impressions.

If an ad is served, it means that a publisher has told its system to deliver an ad. As long as the system registers delivery of the ad, it’s counted as a success. What happens next is less certain. The ad could appear someplace where lots of people see it, like the top of a website homepage. Or it might be served without anyone ever seeing it. For instance, the ad could appear far down at the bottom of a web page (below the fold). Or a person could visit a site and then leave before the ad has fully rendered.

Viewed impressions add an extra layer of analytical rigor, as well as common sense. They more accurately define delivery and help ensure that people have seen the ads they’re supposed to see……We measure an ad impression the moment an ad enters the screen of a desktop browser or mobile app. If an ad doesn’t enter the screen, we don’t count it as an ad impression.

An impression is counted as the number of times an instance of an ad is on screen for the first time. (Example: If an ad is on screen and someone scrolls down, and then scrolls back up to the same ad, that counts as 1 impression. If an ad is on screen for someone 2 different times in a day, that counts as 2 impressions.) Since impressions are counted the same way for ads that contain either images or video, a video is not required to start playing for the impression to be counted. Though this method of counting video impressions differs from industry standards for video ads, it ensures consistency in reporting impressions when ad campaigns contain both videos and images.

A Facebook advertising system in a nutshell

When advertisers create an ad campaign with Facebook, they specify the types of users they would like to reach based on information that users chose to share about their age, location, gender, relationship status, educational history, workplace, and interests.

For example, a self-storage company ran a campaign to reach students on college campuses prior to summer break. Additionally, advertisers indicate the maximum price they are willing to pay for their ad and their maximum budget.

Advertisers choose to pay for their ads based on either cost per thousand impressions (CPM) on a fixed or bidded basis or cost per click (CPC) on a bidded basis. Our system also supports guaranteed delivery of a fixed number of ad impressions for a fixed price. Facebook’s ad serving technology dynamically determines the best available ad to show each user based on the combination of the user’s unique attributes and the real-time comparison of bids from eligible ads.

The Facebook cash cow is mobile advertising

Nonetheless, of all the buzz of 2017-18 around Facebook and the various data breaches from third parties, Facebook revenues grew primarily driven by mobile advertising, which in the first months of 2018 represented over 92% of its revenues.

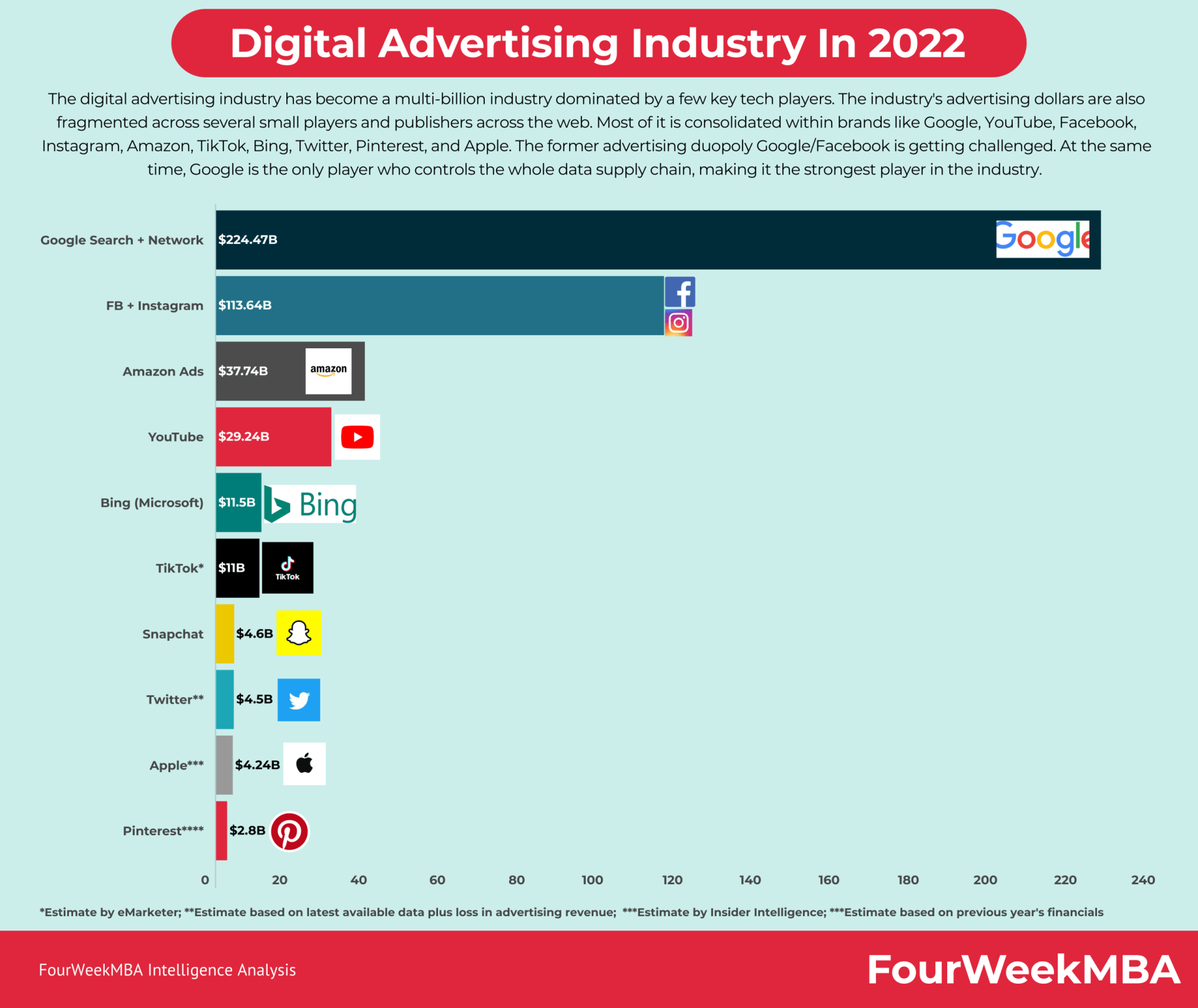

By 2022, the digital marketing industry started a process of reshaping which is leading to the wrecking of the Google/Facebook duopoly.

Marketers fooled by engineers: when the attention merchant decides the rules of the game

One interesting aspect of digital advertising is its ability to introduce complex algorithms and engineered systems to be able to track the marketing activity of any business. However, those digital businesses that took over the digital world, like Google and Facebook, still live the attention merchant paradox.

Where those platforms are the ones creating the rules of the game. They are also the ones that determine what metrics matter. When Facebook engineers sell marketers impressions and likes, all they are selling is a metric whose value is dubious.

Yet as that metric is tracked and packaged within a complex algorithm, it gives marketers and businesses, in general, the impression that it is all data-driven, and so it has a clear ROI. However, with a better look, you might realize that those engineers have become better than marketers at selling.

Thus, a paradox of this generation is that, finally, marketers got fooled by engineers!

Related Visual Stories

Facebook Organizational Structure