ARPU, or average revenue per user, is a crucial metric for attention merchants like Facebook. It assesses the ability of the platform to monetize its users. For instance, by the end of 2023, Meta’s ARPU worldwide was $13.12. In the US & Canada, it was $68.44; in Europe, it was $23.14; in Asia-Pacific, $5.52; and in the rest of the world, it was $4.50.

Understanding Facebook’s ARPU and why it’s so important to its business model

ARPU, or average revenue per user, is a critical measure to assess Facebook’s ability to monetize its users. ARPU is given by total revenue in given geography during a given quarter, divided by the average of the number of monthly active users in the geography at the beginning and end of the quarter.

As specified on Facebook financials: “this is calculated by computing revenue by user geography based on our estimate of the geography in which ad impressions are delivered.“

Important Note: It is important to notice that, as reported on Facebook financials, “ARPU includes all sources of revenue; the number of MAUs used in this calculation only includes users of Facebook and Messenger as described in the definition of MAU above.” That means the metric might be biased in favor of Facebook, as it comprises all the sources of revenues (comprising Instagram and WhatsApp). This implies that in part the monetization ability of Facebook might also be due to the increase in revenues from other platforms such as WhatsApp and Instagram. We can’t know for sure as this is not broken down in Facebook financials.

Why ARPU is a critical metric for Facebook’s financial success

The critical business metrics Facebook tracks comprise:

- Daily active users (DAUs): daily active users are defined by Facebook “as a registered Facebook user who logged in and visited Facebook through the website or a mobile device, or used the Messenger application (and is also a registered Facebook user), on a given day.“

- Monthly active users (MAUs): monthly active users are defined by Facebook “as a registered Facebook user who logged in and visited Facebook through the website or a mobile device, or used the Messenger application (and is also a registered Facebook user), in the last 30 days as of the date of measurement.“

- And average revenue per user (ARPU).

As an attention merchant, Facebook has to make sure to have its users to go back to the platform.

Indeed, attention harvesting and the ability to sell it back to advertisers and marketers is Facebook’s primary business model.

That is also why it is critical to monitor the ARPU to understand how its business model is evolving.

In 2023, Facebook’s ARPU was primarily driven in the US and Canada.

This means that Facebook primarily needs to monetize its users in the US and Canada.

How? In several ways. For instance, an increase in ad spending, a larger market base, and better engagement rates of users all affect the ARPU.

Warning: ARPU is not how much your data is worth

It is critical to remark that what Facebook can make of users in terms of monetization doesn’t represent the real value.

In other words, the value of users’ data might be way higher than what Facebook can generate via advertising.

Therefore, it is important not to confuse average revenue per user with the real value of the data behind users, which is another story!

In fact, in recent years, privacy concerns have led to a complete rehaul of user experience across various platforms.

This, in turn, affects the overall Facebook business model.

To understand how effective is the Facebook advertising machine compared to other digital advertising players.

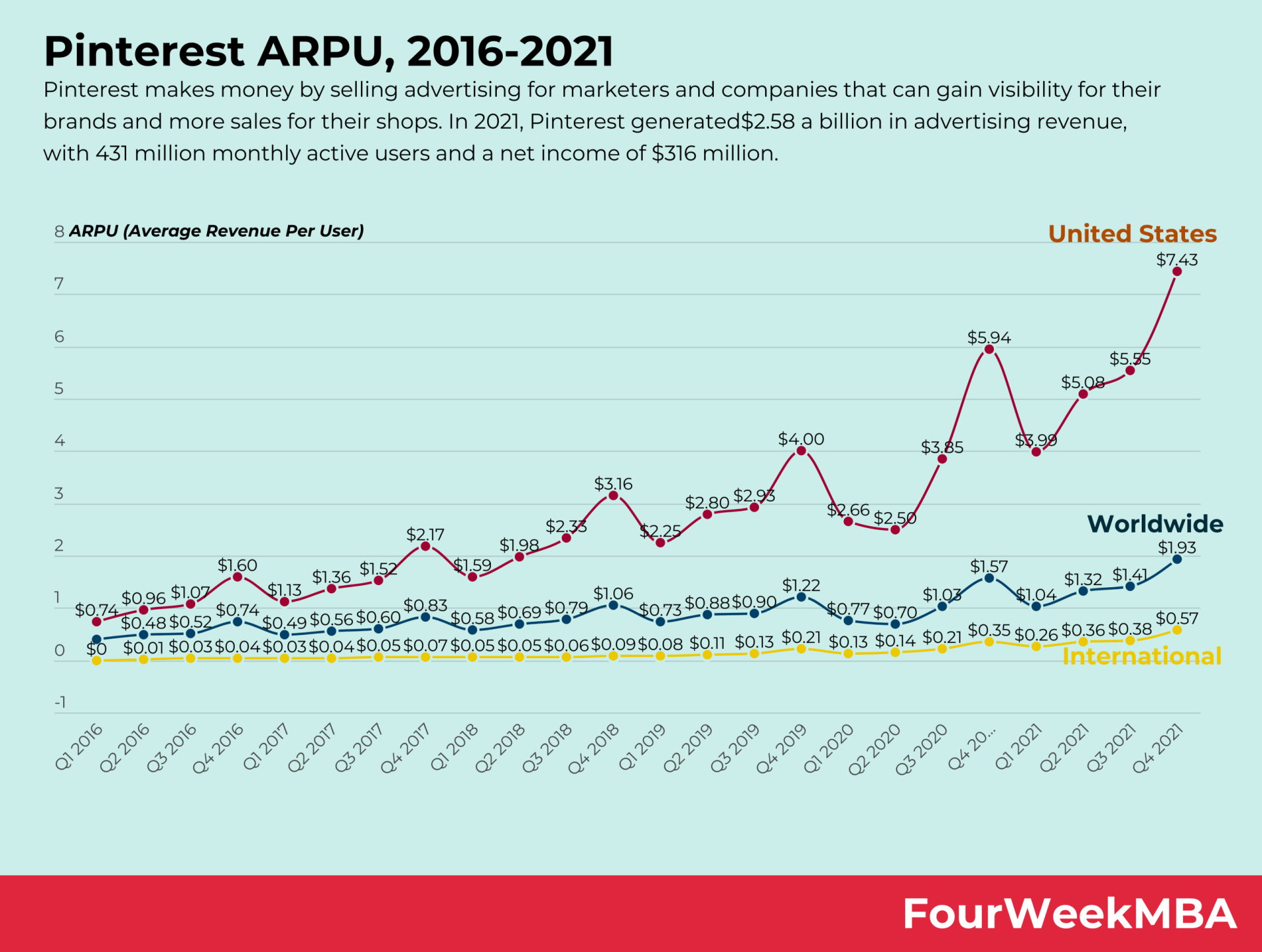

See the Pinterest’s ARPU:

Comparing it to Facebook ARPU, you get a full picture:

In North America and worldwide, Facebook ARPU is almost 10x compared to Pinterest.

Read Also: Facebook Business Model

Related Visual Stories

Facebook Organizational Structure