As of April 25th, 2022, Elon Musk tried to take over Twitter. Musk tried to purchase the company at $54.20 per share, or about $44 billion. The deal finally closed by October 27th, 2022, and Elon Musk became the largest shareholder. Twitter has been delisted and it’s now a private-owned company.

| Aspect | Description | Analysis | Examples |

|---|---|---|---|

| Products and Services | Twitter provides a social media platform that allows users to post short text-based messages known as “tweets.” Users can follow other accounts, engage with tweets through likes (formerly favorites) and retweets, send direct messages, and use hashtags to categorize and discover content. Twitter also offers advertising services for businesses to promote their products and services. | Twitter generates revenue through advertising, making it a key part of its business model. The platform’s simplicity, real-time nature, and ease of use make it popular among users and advertisers. Hashtags and trending topics enable content discovery and engagement. Twitter’s advertising tools help businesses reach their target audiences effectively. | Social media platform, tweets, following, likes, retweets, direct messages, hashtags, advertising services, revenue from advertising, user-friendly platform, content discovery, target audience reach. |

| Revenue Streams | Twitter primarily generates revenue through advertising, including promoted tweets, promoted trends, and promoted accounts. Advertisers pay Twitter to display their content to users based on targeting criteria such as demographics, interests, and keywords. Data licensing and other revenue sources, like data analysis services, contribute to Twitter’s income. | Advertising is the primary revenue source for Twitter, with promoted content being a significant contributor. Advertisers pay to promote tweets, trends, and accounts to reach their target audiences. Data licensing and other revenue streams diversify income sources. Twitter’s extensive user data is valuable for businesses and researchers. | Revenue from advertising, promoted tweets, promoted trends, promoted accounts, data licensing, data analysis services, diversified income sources, valuable user data. |

| Customer Segments | Twitter’s customer base includes individuals, businesses, public figures, celebrities, journalists, and organizations. Individual users use Twitter to connect with friends, share opinions, and discover content. Businesses and public figures utilize Twitter for brand promotion, customer engagement, and real-time communication. Journalists and media organizations rely on Twitter for news dissemination. | Twitter serves a broad customer base spanning individuals, businesses, celebrities, journalists, and organizations. It caters to diverse needs, from personal social networking to professional brand promotion and news dissemination. Twitter’s real-time nature makes it a valuable tool for staying updated on current events. | Individuals, businesses, public figures, celebrities, journalists, organizations, social networking, brand promotion, customer engagement, news dissemination, real-time updates. |

| Distribution Channels | Twitter’s primary distribution channel is its website and mobile app, where users can access and interact with the platform. The platform’s open API (Application Programming Interface) allows developers to create third-party applications and services that enhance the Twitter experience. Twitter also distributes content through its embedded tweets, which can appear on external websites and apps. | Twitter’s website and mobile app are the primary distribution channels, providing users with direct access to the platform. The open API fosters innovation by enabling developers to create complementary services. Embedded tweets extend Twitter’s reach beyond its platform, appearing on external websites and apps, amplifying content and engagement. | Website, mobile app, open API, third-party applications, embedded tweets, external distribution, content amplification, user engagement, innovation support. |

| Key Partnerships | Twitter collaborates with advertisers and businesses looking to promote their products and services. Media organizations and journalists form partnerships to disseminate news and engage with their audiences. Developers and third-party app creators use Twitter’s API to build tools and services. Twitter also partners with data licensees to monetize its user data. | Advertiser partnerships are crucial to Twitter’s revenue generation. Media organizations and journalists rely on Twitter for news distribution and engagement. Collaborations with developers and third-party app creators enhance the platform’s functionality. Data licensing partnerships leverage Twitter’s valuable user data for monetization. | Advertiser collaborations, media organization partnerships, journalist partnerships, developer collaborations, third-party app creator partnerships, data licensing partnerships, user data monetization. |

| Key Resources | Key resources for Twitter include its user base, the Twitter platform, the Twitter API, advertising technology and tools, user-generated content, data analytics capabilities, and brand recognition. The user base and user-generated content drive engagement and ad inventory. The Twitter API fosters third-party app development, while advertising technology supports revenue growth. | Twitter’s critical assets comprise its user base and user-generated content, which create engagement and ad opportunities. The Twitter API encourages innovation in app development. Advertising technology and tools drive revenue growth. Data analytics capabilities provide insights into user behavior. Strong brand recognition attracts users and advertisers. | User base, user-generated content, Twitter platform, Twitter API, advertising technology, ad inventory, user engagement, app development innovation, revenue growth, data analytics, brand recognition. |

| Cost Structure | Twitter incurs various costs, including expenses related to infrastructure maintenance, server hosting, user support, employee salaries and benefits, marketing and advertising campaigns, research and development, and acquisitions. Twitter also invests in data security and compliance measures. | Costs associated with Twitter’s operations encompass infrastructure maintenance, server hosting, user support, employee compensation, marketing and advertising campaign expenditures, research and development investments, acquisitions, and data security measures. The platform’s continuous development and data security are essential operational expenses. | Infrastructure maintenance costs, server hosting expenses, user support costs, employee compensation, marketing and advertising campaign costs, research and development investments, acquisition expenses, data security measures, operational expenses. |

| Competitive Advantage | Twitter’s competitive advantage lies in its real-time and open platform, enabling global conversations and quick information dissemination. The platform’s simplicity, character limit, and focus on trending topics create a unique user experience. Twitter’s brand recognition, widespread use by public figures and celebrities, and role in news distribution strengthen its position. | Twitter stands out with its real-time, open, and conversational platform that facilitates global engagement. Its simplicity and character limit foster concise communication. The focus on trending topics enhances content discoverability. Twitter’s brand recognition and prominent use by public figures and celebrities reinforce its role in news distribution and real-time updates. | Real-time and open platform, global conversations, information dissemination, simplicity, character limit, trending topics, content discoverability, brand recognition, public figure and celebrity usage, news distribution role, real-time updates. |

Origin story

Odeo was a directory and search destination website for podcast publishing and aggregation.

It was 2006, and the company felt the pressures of other giants at the time (Apple) competing for the same space.

Therefore, the founders of Odeo decided it was time to “reboot” the company to move in a new direction.

In 2000, inspired by early blogging pioneer LiveJournal, Jack Dorsey thought about a service in which posts appeared in real-time and “from the road.”

They broke the company into teams to brainstorm new ideas and determine what to do next.

In a brainstorming session, Jack Dorsey represented his idea to the other team members about “a service that uses SMS to tell small groups what you are doing.”

That idea made sense so much that by March 2006, a first test had started.

It was March 2006; Jack Dorsey was setting up the idea he had brainstormed, which would initially be called twttr.

As the story goes, Evan Williams, Jack Dorsey, and Biz Stone, who co-founded the company at the time, knew they “wanted to have this instant mobile, SMS, tech-space thing,” and Twitter (which referenced nature, as Twitter is the sound that birds make) was the perfect name they had in mind.

However, a bird enthusiast already had registered the name twitter.com. So they had to initially use twttr.com.

After six months after the project launch, they finally managed to get the domain twitter.com which would stick to these days.

The group could not easily explain the value of this new project to Odeo’s board, as the company was losing ground.

Thus, a new corporation was eventually set up to manage the twttr project.

As the project launched six months in, Jack Dorsey was one of the engineers working on what would be finally rebranded as Twitter.com.

The interesting part is that people could not still get the value of a platform that enabled those SMSs when they still paid for them.

In short, tweeting something at the time meant having the phone billed for messages that conveyed what one was doing.

For how entertaining it might be, it was not convenient.

To make things worse, there was no character limit. Thus, a long message would be split into multiple messages, increasing the phone bill.

So the team figured they needed to change the anatomy of the message. Indeed, to fit into what, at the time, was the character limit for a message (160), the Twitter.com team set the limit at 140 characters, so users had “room for the username and the colon in front of the message.”

From there, the official tweet was born (the character limit would be expanded only a decade later from 140 to 280).

Twitter’s team was the main advocate of the platform, and Jack Dorsey would show the power of the tweet as a way to express opinions about the world, is a powerful way:

By 2007 Twitter had gained traction, and Jack Dorsey would become the company’s CEO.

By December 2008, Twitter grew quickly, reaching 4.43 million unique visitors (a 752% growth over the previous year).

While Twitter was snowballing, its platform wasn’t stable, and Jack Dorsey wasn’t considered able to stay in the CEO’s position.

And by 2008, Dorsey had to leave the CEO position (kicked out from Twitter in 2009, Dorsey founded Square).

Nonetheless, Twitter kept growing in 2009. That was also the year when Facebook passed Myspace in traffic.

By 2009, Twitter’s popularity grew, so celebrities like Ashton Kutcher, Britney Spears, Ellen DeGeneres, Barack Obama, and Oprah Winfrey joined the platform.

By the end of 2010, the platform had more than 160 million users and started monetizing through ads.

This model would stick, even though Twitter would become profitable only by 2017-18.

In 2015 Jack Dorsey returned as Twitter’s CEO, splitting his time between Twitter and Square.

Elon musk is Twitter’s owner

After an epic battle that might stay forever in the business history books, Elon Musk entered Twitter’s HQ to make things even more interesting, saying, “let that sink in!”

In short, Musk confirmed himself as the meme king of the platform. While this might seem all a joke, it’s, in reality, the acquisition of one of the largest media platforms in the US.

As Musk took over, he had the main executive team resign immediately.

What’s going to happen next?

Twitter will be delisted (it won’t be a public company anymore) as Musk, and his new executive team will come in and try to restructure the company.

Thus, either opening up the change to list it again in the coming years or keep it as a private company, outside the influence of quarter-to-quarter financials.

How was Twitter ownership organized before Musk bought it?

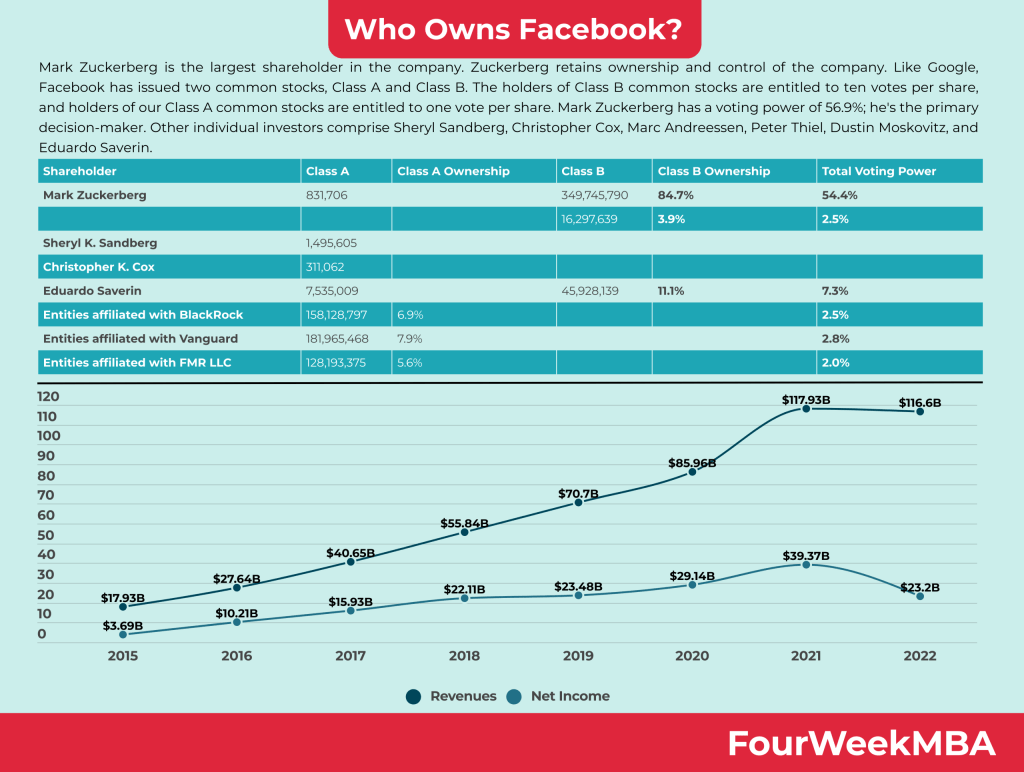

The largest individual shareholder is Elon Musk, followed by co-founder and former CEO Jack Dorsey. Other non-individual, institutional shareholders comprise The Vanguard Group (with 10.7%), BlackRock (with 6.8%), and Morgan Stanley (with 87%).

The timeline of Elon Musk’s acquisition of Twitter

In April 2022, Elon Musk tried to acquire Twitter in one of the most controversial deals in business history.

Let’s review the timeline.

Musk placed a bet to take over the whole company out of the blue. It was April 14th, 2022:

The public records show the whole conversation of the offer Musk made to take over Twitter.

Below is the main extract, of the conversation, between Musk and Twitter’s board.

As per SEC Filings, Musk had sent a message to Bret Taylor, Chairman of Twitter’s board:

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

Elon Musk

In a follow-up text, Musk highlighted:

As I indicated this weekend, I believe that the company should be private to go through the changes that need to be made.

After the past several days of thinking this over, I have decided I want to acquire the company and take it private.

I am going to send you an offer letter tonight, it will be public in the morning.

Are you available to chat?

Elon Musk

As a final message to Twitter’s board, Musk highlighted:

1. Best and final

a. I’m not playing the back-and-forth game.

b. I have moved straight to the end.

c. It’s a high price and your shareholders will love it.

d. If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder.

i. This is not a threat, it’s simply not a good investment without the changes that need to be made.

ii. And those changes won’t happen without taking the company private.

2. My advisors and my team are available after you get the letter to answer any questions

a. There will be more detail in our public filings. After you receive the letter and review the public filings, your team can call my family office with any questions.

Elon Musk

In short, Musk had offered to purchase Twitter for $54.20 per share, a 54% premium, before Musk had started to buy Twitter shares.

While the offer was good from a valuation standpoint, the board tried to fight it. Also influential business commentators were against it.

As Cramer highlighted:

This is one of those where they are literally not doing their job, there’s no fiduciary responsibility if they just say, ‘you know what, we take it, there are times when individual directors are opened up for a level of lack of fiduciary that I think crosses the line. This crosses the line.

Throughout the deal, none expected it to go through so quickly.

Indeed, given the controversy around Twitter, most business people thought this would have turned into a few months’ fight over Twitter’s ownership.

Yet, things tumbled very quickly. And by April 25th, 2022, the deal was officially announced!

As explained in the official press release:

Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing of the proposed transaction. The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter.

Bret Taylor, Twitter’s Independent Board Chair, highlighted:

The Twitter Board conducted a thoughtful and comprehensive process to assess Elon’s proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.

Parag Agrawal, Twitter’s CEO, highlighted on Twitter

Twitter has a purpose and relevance that impacts the entire world. Deeply proud of our teams and inspired by the work that has never been more important.

How did Elon Musk secure the funding to purchase the company?

He secured $25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21.0 billion equity commitment.

After one of our most epic business battles, the deal closed by October 26-27 as Musk entered Twitter’s HQ to meet the team.

Wanter Isaacson, working on a biography of Musk, thus following him as he talks to Twitter’s team for the first time, shows a group of people listening to Musk.

As Musk takes ownership of Twitter, he sends over a public letter to advertisers:

A Glance at Twitter Business Model

Read Also: Twitter Business Model, Digital Business Models, Platform Business Models, Attention-Based Business Models.

Related Tech Ownership Case Studies

Read More: