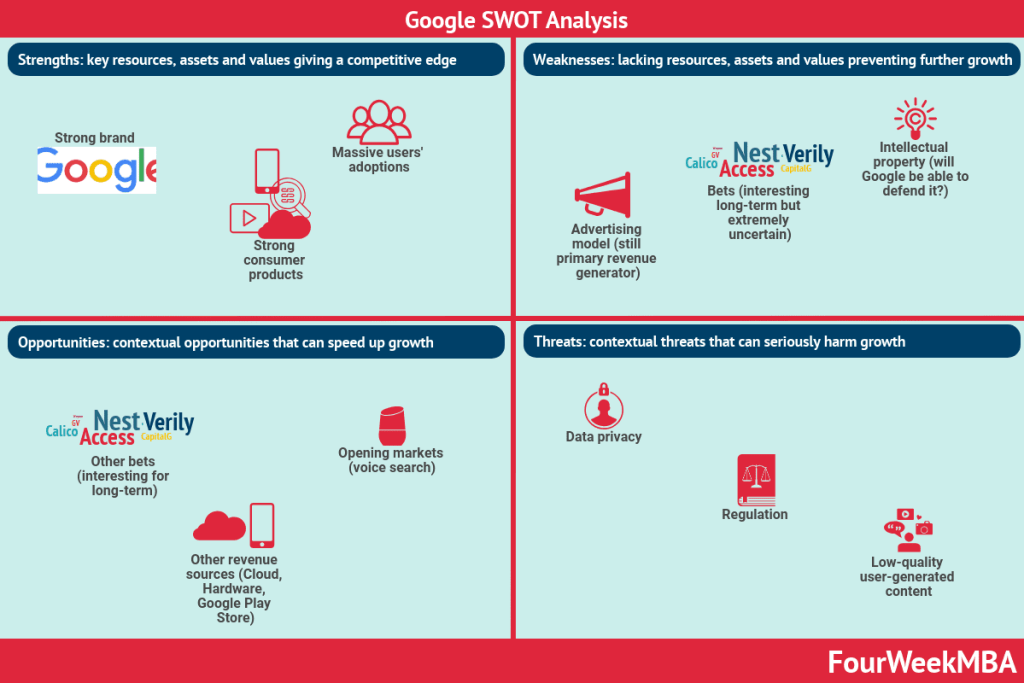

Google’s strength is its strong consumer brand. The company is grabbing new opportunities by opening up industries like voice search and consolidating in industries like the cloud. As a weakness, its revenues primarily come from advertising. A primary threat is the quick change of search and potential intervention by regulators.

Read: Business Strategy: Examples, And Case Studies, And Tools

Strengths

Brand

Google enjoys a brand that is extremely strong. The company’s products are used each day by billions of people across the world, with incredible engagements rate.

Strong consumer products

Google’s core product, its search engine I a goldmine of search intent data which makes it possible for Google to still have a long-term advantage against competitors in the space.

Massive users’ adoptions

The company’s products are incredibly sticky for users, which are the key stakeholders for Google’s continuous growth and development as an organization.

Opportunities

Google has substantial cash to invest back in R&D activities on its core products but also to invest to open up new market opportunities.

This makes Google a unique company.

While bets are companies that do not have a current impact on Google business (that is why we’ll see them also in the weakness section), other revenue sources, like cloud, and hardware are also a strong contributors to Google’s revenues.

Weaknesses

For a company like Google, sustained success means that the company will be able to keep its products sticky for billions of users across the globe.

That is why the core focus is on users’ adoption of continuous growth. Indeed, the more users join the platform the more that becomes interesting for advertisers who contributed to 83% of Google’s revenues in 2019.

So what are some of Google’s weaknesses?

- A significant portion of Google revenues are generated from advertising, therefore a reduced spending by advertisers, a loss of partners, or new and existing technologies blocking ads could seriously harm the business.

- While other bets are long-term strategic initiatives for Google, those bets are highly uncertain and the company will not be able to assess whether any of those will become successful, if not in hindsight.

- As Google has become a global player primarily based on the digital advertising industry, as the industry matures and consolidates this also might mean stagnating revenues for Google and a strong reduction of its margins.

- If the company fails to protect its intellectual property rights that might also result in a substantial risk for the business.

- Brands are among the most important assets for organizations, but they are also expensive to maintain, thus, Google’s strength as a mass appealing consumer brand can also turn in weakness as the company has to keep pouring billions back to the business to maintain its assets in the short term.

Threats

The current market propelled by technological companies has become highly fluid, as those companies all fight for the same pocket. This makes it harder to keep track of all the possible threats and which one might really harm the business. For the sake of this analysis some of the key threats for Google are:

- Intense competition: innovation isn’t easy, neither inexpensive. If Google doesn’t successfully manage to keep its innovation pace it might eventually lose its dominating position, thus jeopardize the business.

- As people access to the internet now happens through a variety of platforms, that increases substantially the pressure for companies like Google, which business model is based on the attention and interest of its users. That means the company has to be able to keep anticipating those trends.

- Data privacy, security concerns, and regulations become a serious threat to Google’s future success.

- Low-quality user-generated content, web spam, content farms, can seriously worsen the quality of the content provided on Google thus making suddenly less appealing to users.

Key takeaway

The SWOT analysis is an interesting exercise to get to know an organization more intimately. However, when it comes to the business landscape it’s extremely hard to predict where the next threat will come from, or whether the opportunity you’re pursuing will turn out to be successful. That is why it’s important to have a strong experimental framework.

Key Highlights from Google’s SWOT Analysis:

Strengths:

- Strong Brand: Google enjoys a powerful and globally recognized brand with high engagement rates among billions of users.

- Robust Consumer Products: Google’s core search engine provides valuable search intent data, giving the company a long-term advantage over competitors.

- Massive User Adoption: Google’s products are sticky and widely adopted by users, driving the company’s continuous growth.

Opportunities:

- Investment in Innovation: Google’s substantial revenue allows for investments in both core product research and new market opportunities.

- Startup Bets: Google’s bets on potential moonshot companies open doors to new industries, despite potential losses.

- Diverse Revenue Sources: Beyond search, Google benefits from revenues in areas like cloud services and hardware.

Weaknesses:

- Dependence on Advertising: Google’s significant revenue reliance on advertising makes it vulnerable to changes in ad spending, partner losses, or ad-blocking technologies.

- Uncertain Bets: While Google invests in innovative startups, the outcomes are uncertain, posing a risk to business impact.

- Competition and Stagnation: Intense competition and industry consolidation could challenge Google’s dominance and revenue growth potential.

Threats:

- Market Competition: The dynamic nature of the technology market, with companies like Facebook, Amazon, Apple, Netflix, and Google (FAANG) vying for attention, increases competition.

- Changing Internet Access: As internet access diversifies across platforms, Google needs to anticipate trends to maintain user engagement.

- Data Privacy and Regulations: Concerns over data privacy, security, and increasing regulations pose threats to Google’s operations.

- Content Quality Concerns: Low-quality user-generated content and content farms could diminish Google’s content quality and user appeal.

Other case studies:

- How Does Google Make Money?

- The Power of Google Business Model in a Nutshell

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

- Google Mission Statement

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- How Does Netflix Make Money? Netflix Business Model Explained

- How Does Spotify Make Money? Spotify Business Model In A Nutshell

- DuckDuckGo: The [Former] Solopreneur That Is Beating Google at Its Game

- How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

- Amazon SWOT Analysis

Related To Google

Google Traffic Acquisition Costs

Main Free Guides:

- Business Models

- Business Competition

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Organizational Structure

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

Read next:

- Google Business Model

- How Does Facebook Make Money?

- How Does DuckDuckGo Make Money?

- Amazon Business Model

- Netflix Business Model

- Spotify Business Model

Read Next: Organizational Structure, Google Business Model, Google Mission Statement, Google SWOT Analysis.

Other business resources:

- What Is a Business Model?

- What Is a Value Proposition?

- What Is a Lean Startup Canvas?

- What Is Business Model Innovation?

- What Is Business Analysis?

- Business Strategy

- Marketing Strategy

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.