Nike is an American multinational corporation founded by Bill Bowerman and Phil Knight in 1964.

The core focus of the company is supplying athletes with wearable products that increase sports performance.

This includes footwear, apparel, equipment, accessories, and other athletic wear. In recent times, the company has moved into athletic leisurewear.

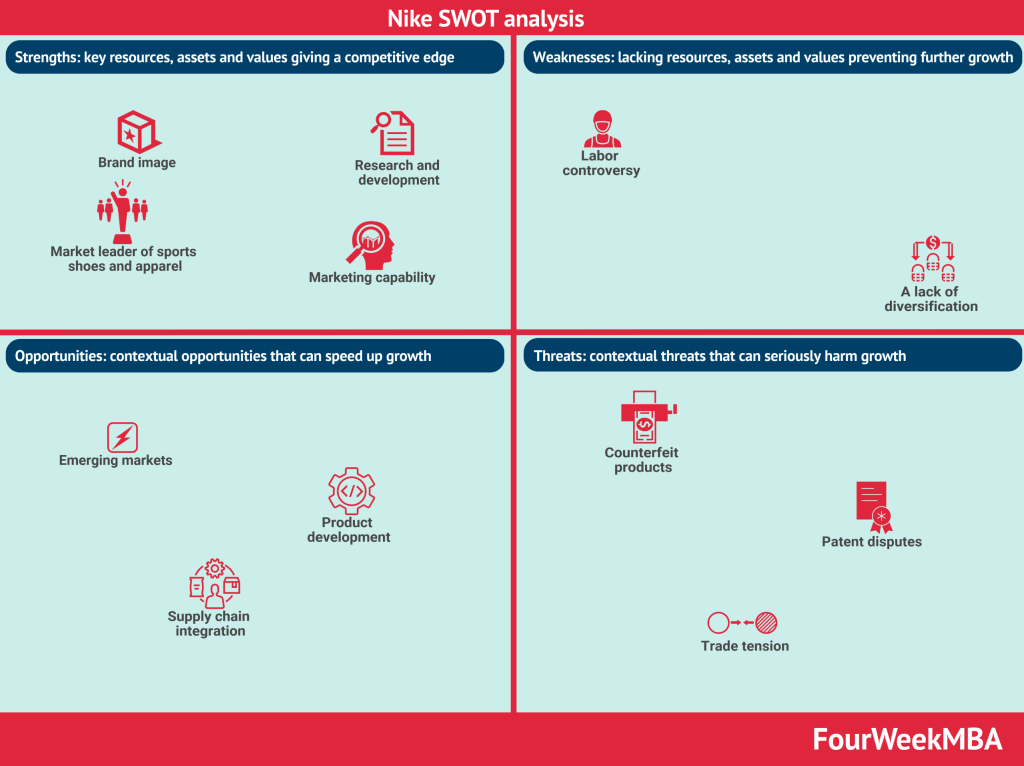

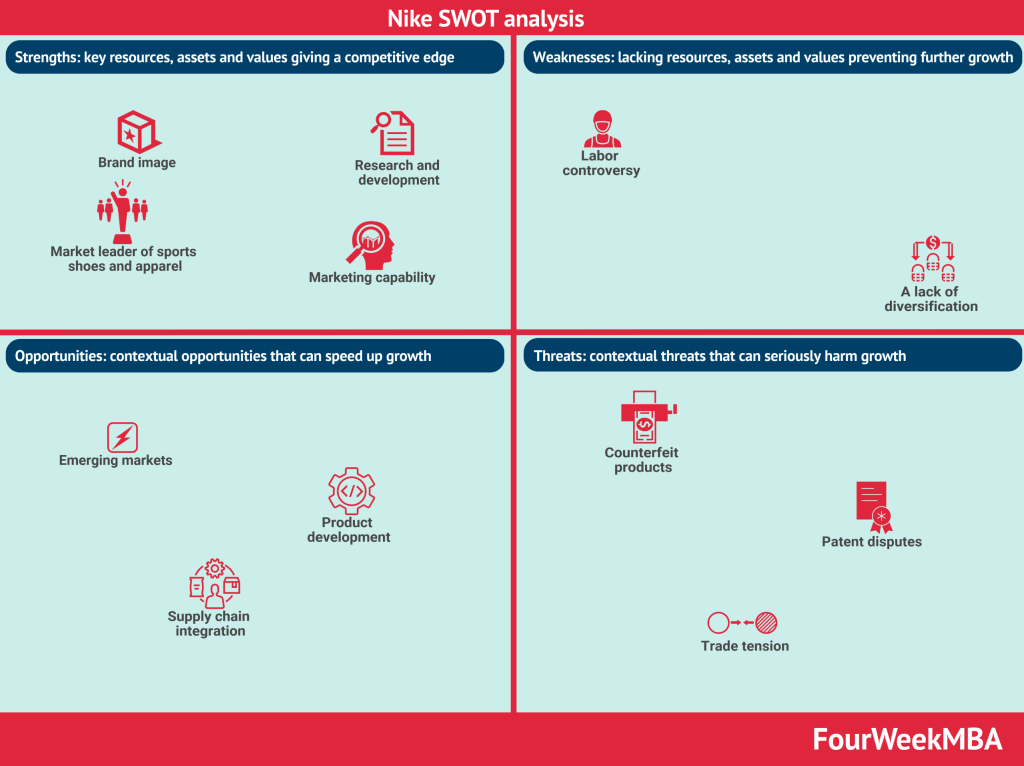

Strengths

Brand image

Nike is a brand that enjoys global recognition.

The famous Nike “swoosh” is instantly recognizable and the Nike brand alone was recently valued at approximately $30 billion.

Research and development

Allowing Nike to continually deliver innovative products and significantly lower manufacturing costs per unit.

Market leader in sport’s shoes and apparel

With a focus on quality, innovation, sustainability, and customer experience, Nike has maintained leader status in what is a very competitive market.

The company has secured 31% of the global athletic footwear market alone.

Marketing capability

In the past two years, Nike has spent a combined total of $7.2 billion on marketing.

The company is also skilled at delivering successful marketing campaigns on a range of platforms to increase market share.

Weaknesses

Labor controversy

Every Nike manufacturing facility is outside of the United States, with China, Vietnam, Thailand, and Indonesia accounting for all production.

The company has been criticized for poor working conditions with issues centered on forced labor, child labor, and low wages.

A lack of diversification

42% of revenue comes from the US market, arguably leaving Nike dependent on this major source of income.

Culture

Nike has had well-documented problems with organizational culture in the past.

The company has faced various legal challenges over employee discrimination, with one former employee claiming he was treated unfairly as a result of his Croatian heritage.

Nike was also taken to court over its toxic culture for women and violation of the Equal Pay Act.

Opportunities

Emerging markets

Nike has an opportunity to strengthen its global presence in emerging economies such as India, China, and Brazil.

Product development

Although the company prides itself on innovative athletic products, many consumers wear Nike products as a fashion statement.

This presents an opportunity for growth, provided that a broader focus does not dilute brand image.

Supply chain integration

To some extent, Nike relies on a host of independent manufacturers.

Acquiring these manufacturers could lead to process efficiencies, streamlined distribution, and economies of scale.

Threats

Counterfeit products

Given that Nike is such a globally dominant brand, imitation in the form of counterfeiting is a constant threat.

Low-quality counterfeit products have the potential to affect revenue generation and brand image.

Patent disputes

In such a competitive market, it is almost inevitable that there will be conflict over certain patented products.

One such example is the public battle between Nike and Adidas over patents concerning the design of a line of shoes.

Trade tension

Escalating tensions between the United States and China pose a serious threat to Nike.

The Chinese consumer market has shown renewed interest in Nike products and the company is also reliant on China for 36% of its manufacturing operations.

Related to Nike

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

- Amazon SWOT Analysis

- Apple SWOT Analysis

- Costco SWOT Analysis

- Coca-Cola SWOT Analysis

- Disney SWOT Analysis

- Ford SWOT Analysis

- Facebook SWOT Analysis

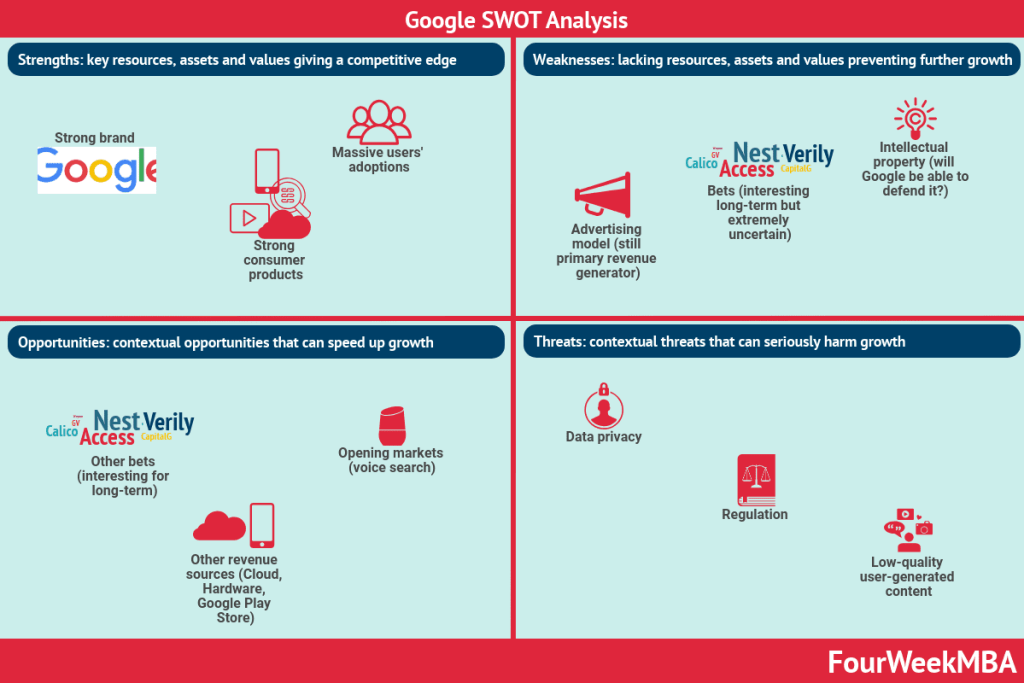

- Google SWOT Analysis

- Nestlé SWOT Analysis

- Netflix SWOT Analysis

- Microsoft SWOT Analysis

- SWOT Analysis Of Starbucks

- Tesla SWOT Analysis

- Uber SWOT Analysis

- Samsung SWOT Analysis

Main Free Guides: