Headquartered in San Francisco, California, Uber started as a peer-to-peer ridesharing platform. In more recent times, the company has moved into food delivery, rental cars, and bike-sharing. In one form or another, Uber now has a presence in over 900 cities worldwide.

Strengths

- Market position – Uber dominates the ride-sharing market because they invented it. They enjoy a 77% market share in the US, completing approximately 40 million trips per month. Lyft, who is Uber’s main competitor, has just 10% of the market.

- Convenience – a large part of Uber’s success has been due to its ability to make ride-sharing more convenient and cost-effective than hailing a taxi. A low-cost ride can be hailed with the simple push of a button in their app.

- Diversification – although quick to find success in ride-sharing, Uber has not wasted any time diversifying its services. Food delivery (Uber Eats), rental cars (Uber Rent), and bikes (Uber Bikes) are some examples. Uber has also managed to effectively bundle many of these services together, increasing market share, revenue, and profits.

- Technology – without a well-functioning app, Uber’s core business model would fail. Thus, the company boasts a strong technology department who work relentlessly to improve the Uber app experience for consumers.

Weaknesses

- Dependency on drivers – in the past few years, more than 100 Uber drivers have been accused of sexual harassment. A driver in India was also charged with rape in 2015 which led to the company being temporarily banned. To some extent, Uber is at the mercy of the unpredictable behavior of their drivers. But their reputation has been tarnished nonetheless and they have lost market share to competitors.

- Poor company culture – Uber’s culture of sexism and unethical practices have also damaged its brand, perhaps permanently in some cases. Then CEO and Uber co-founder Travis Kalanick had to resign because of public backlash to this culture, culminating in the #DeleteUber campaign where over 500,000 users deleted their accounts.

- Consistent losses – although revenue has increased, Uber has a history of reporting billion-dollar losses. Its aggressive strategy of providing bonuses to drivers and discounts to consumers to beat the competition is the reason for their lack of profitability thus far.

Opportunities

- Changes in consumer preferences – Uber is perfectly placed to take advantage of the fluid transportation market. For example, car ownership continues to decline in western society – particularly among millennials. Autonomous vehicle use is also gaining momentum and the aging US population also necessitates that more consumers will need ride services well into the future.

- Doubling down on core strategy – Uber has become popular because it offers shorter wait times than traditional taxis. By increasing driver recruitment, Uber could reduce wait times further and increase market share.

- Expansion – in developing countries where high-speed internet is becoming established, there is an opportunity for Uber to expand its services. Countries with emerging middle-class consumers such as China also represents a growth market.

Threats

- Changes in legislation – the introduction of Uber in a new city or country is often met with resistance, especially from the taxi industry. Changes in legislation have prohibited the company from operating in certain circumstances. For example, Uber was taken to court in Germany by Taxi Deutschland for violating competition rules and lacking the necessary licenses. Uber was consequently banned from operating in the country

- Dissatisfied drivers – in 2016, over 300,000 drivers initiated a class action against Uber for low wages, hurting its brand image and reducing its profitability by losing drivers to rival platforms. Uber is not immune from further actions in the future as it strives to undercut the taxi industry.

- Low profit margins – since Uber takes only 5 to 20% of each ride, its viability as a company will remain vulnerable until it can expand market share, reach, and revenue.

Visual Stories Related To Uber Business Model

In 2022, Uber mobility took 27% of each booking on the platform. At the same time, Uber Eats took 20% of each booking on the delivery platform. The take rate varies according to demand and supply but also market dynamics. In short, in periods of increased competition, the service might charge lower take rates to keep up with it. In 2022, Uber pushed on efficiency, thus raising its take rates, to move toward profitability.

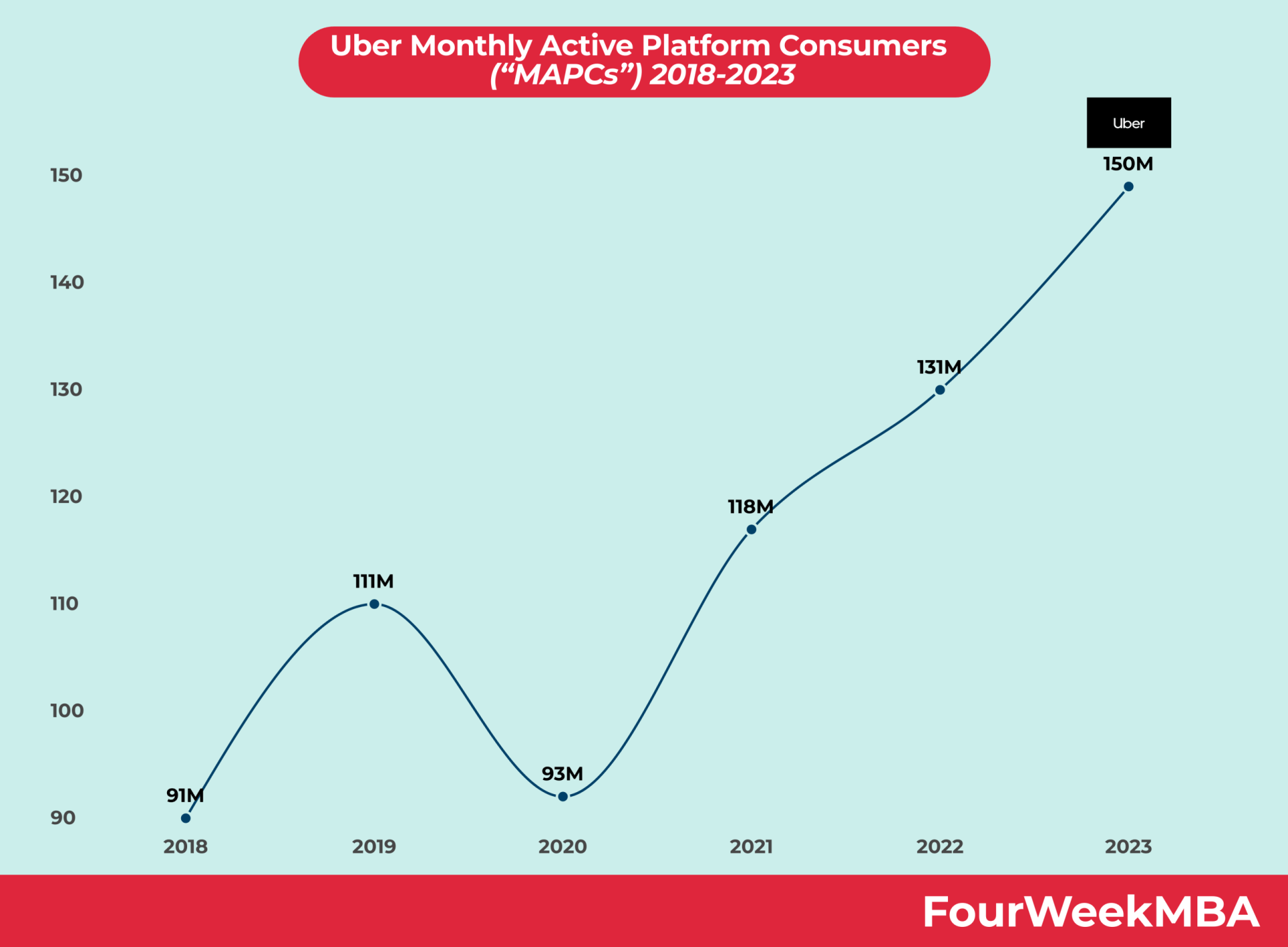

Uber Platform Users

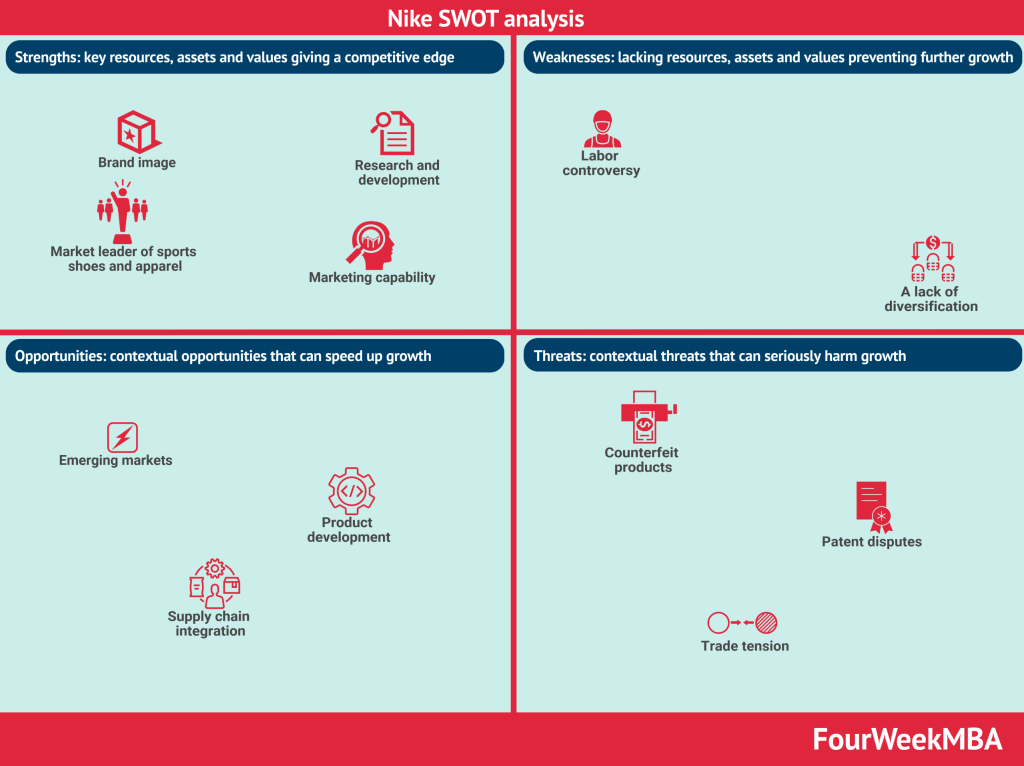

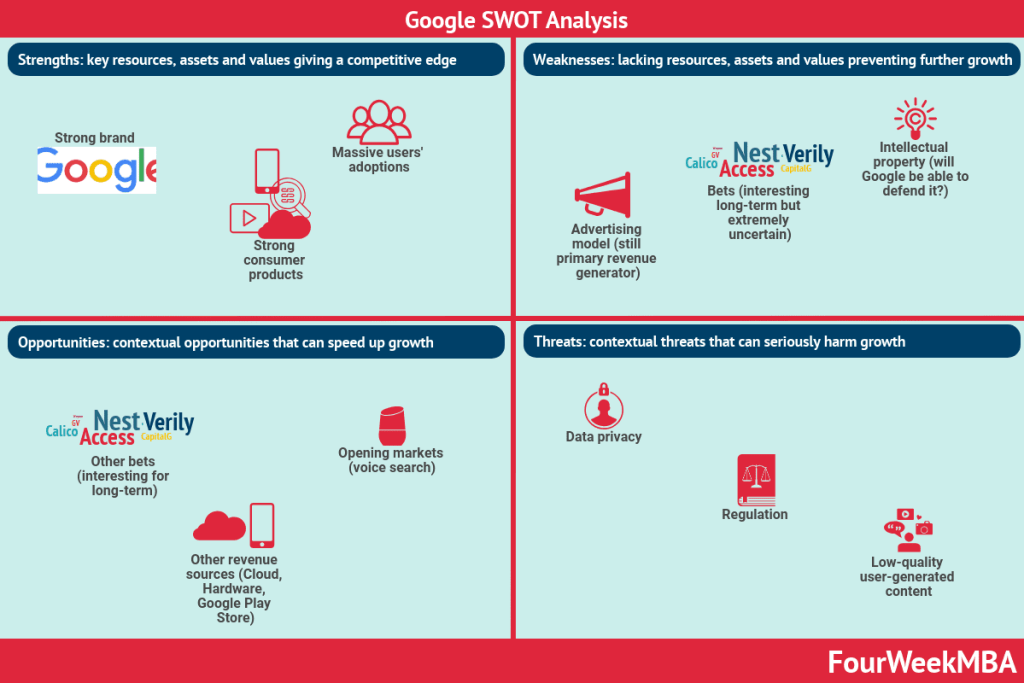

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

Other case studies:

- Amazon SWOT Analysis Example

- Apple SWOT Analysis Example

- Facebook SWOT Analysis Example

- Google SWOT Analysis Example

- Netflix SWOT Analysis Example

- Starbucks SWOT Analysis Example

- Tesla SWOT Analysis Example

Other resources: