Costco is a large American multinational corporation with a focus on low-cost, membership-only retail warehouse clubs. Costco is the 4th largest retail operator in the world, operating 785 warehouses in 10 different countries. Indeed, it has enjoyed rapid success growing from zero to $3 billion in sales within six years.

To determine the secrets of Costco’s success and how the company might look moving forward, here is a SWOT analysis.

Strengths

- Low prices – Costco’s low price strategy is its major strength. But it differs from low-cost competitors like Walmart in that it sells bulk items at low profit margins in warehouse-style stores. In fact, the average mark-up of Costco products is less than half of the Walmart average and a third of that seen at Home Depot stores.

- Membership model – Costco utilizes a subscription business model. In other words, customers who want to shop at the store must buy a membership to do so. What consumers are actually paying for is access to Costco’s ability to use economies of scale to sell goods at low prices. If nothing else, this gives Costco a competitive advantage and a point of difference over other retailers.

- No advertising spend – Costco has no budget for advertising, but not because they cannot afford to do so. Former CEO Jim Sinegal noted that he believed advertising was evil and costed huge sums of money that would have to be passed on to consumers. With fewer overheads, this allows Costco to maintain their low-cost business model.

Weaknesses

- Limited product selection – although you can buy your breakfast cereal and a television at the same time, most Costco stores only carry about 3700 different products. This makes them much less diverse than Walmart (150,000 products) and Target (80,000 products).

- Dependence on North America – sales in the US and Canada account for over 80% of Costco’s revenue. It is especially reliant on the single state of California, accounting for 32% of sales. Any number of problems in that state could seriously impact on Costco’s bottom line.

- Membership model – one of Costco’s greatest strengths may also be a weakness. The membership model will be too high a barrier for many consumers who are unsure of the benefits or simply cannot be bothered filling out a membership form to buy groceries.

Opportunities

- Attracting younger consumers – Costco currently has a customer base skewed toward older baby boomer consumers. Unfortunately, older consumers tend to spend less as they age. To make up for this shortfall in revenue, Costco needs to do more to attract a younger demographic with more purchasing power. The company hopes to do this by offering higher-quality apparel and increasing its organic food selection to cater to health-conscious younger generations.

- Expansion – international markets have the potential to increase company revenue, particularly those that offer a higher profit margin than can be found in the United States. China is also a significant growth market, with Costco’s first store in Shanghai having to shut early on opening day because of overcrowding.

Threats

- eCommerce – because of Costco’s business model of low-cost goods bought in bulk, it is difficult to see how they could become competitive in the eCommerce sector. Even if Costco executives decide to change their model, Amazon offers similarly low prices and has a better range of products with long-established supply chain networks.

- Labour and transport costs – with increasing costs in the United States, Costco’s low-cost model is vulnerable, and any product price increases could alienate loyal customers.

- Economic slowdown – during periods of economic uncertainty that result in a recession, consumers may be less likely to buy goods in bulk or indeed pay for the privilege of doing so.

Related Visual Stories

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

Other case studies:

- Amazon SWOT Analysis Example

- Apple SWOT Analysis Example

- Facebook SWOT Analysis Example

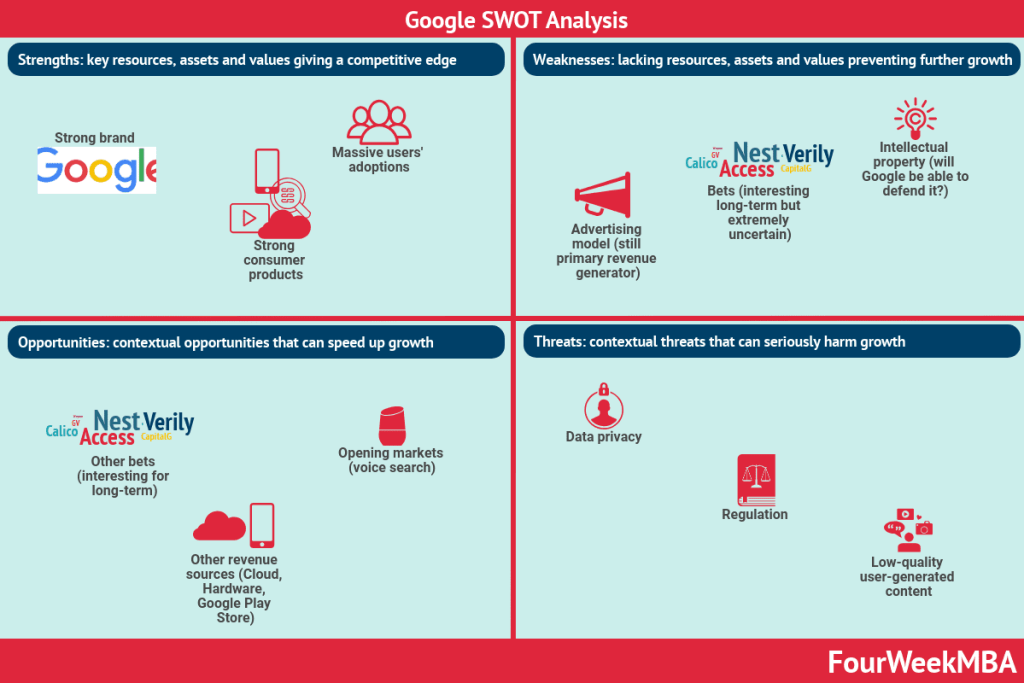

- Google SWOT Analysis Example

- Netflix SWOT Analysis Example

- Starbucks SWOT Analysis Example

- Tesla SWOT Analysis Example

Other resources: