Nestlé is a large multinational food and beverage manufacturer with more than 2000 brands spread across 197 countries. Some of Nestlé’s well-known brands include Nescafe, Kit-Kat, Purina, Aero, Butterfinger, Maggi, and Haagen-Dazs. Originally a producer of infant food in 1867, it is now considered to be the world’s largest food manufacturer.

Strengths

- Highly diversified – since Nestlé sells a vast range of products in most of the world’s countries, it does not rely on a select few markets.

- Well-established – Nestlé owns some of the food industry’s most recognized brands – some of which consumers have enjoyed for decades or across multiple generations. It also enjoys similarly well-established relationships with other brands such as Coca-Cola, Starbucks, Colgate, and Palmolive.

- Unrivaled research and development – Nestlé own a total of 21 research and development centers employing over 5000 personnel. This allows the company to introduce new, innovative products regularly and strengthen its competitive advantage.

- Valuable global brand – according to, Nestlé has a market capitalization of $304.1 billion, ranked 13 in the world. It also ranks inside the top 75 globally for sales and profit.

Weaknesses

- Controversy – Nestlé has attracted negative press over excessive water usage and forced child labor in developing nations. The company has also been implicated in selling noodles in India contaminated with lead.

- Product concentration – although relatively diversified, the company derives much of its revenue from a select few well-recognized brands. Nestlé’s grocery sales are also concentrated among western retail giants such as Walmart and Tesco. This leaves Nestlé vulnerable to changes in consumer behavior and competition from no-name supermarket brands.

- Misleading and contradictory advertising – Nestlé has been accused of consumer manipulation in a series of misleading advertisements. For example, the company was accused of using sucrose in infant milk formula in South Africa while promoting the same product in Hong Kong as being sucrose-free and great for infant health.

Opportunities

- Online retailing – the surge in popularity of eCommerce could open up a new market for Nestlé – particularly since the beginning of the coronavirus pandemic. This might allow the company to bypass traditional retailers and reach consumers directly.

- Emerging markets – second-world countries such as China and India with emerging middle-class populations represent a growth market for Nestlé consumer products.

- Emerging consumer trends – the shift toward longer workdays, single-person households and more women in the workplace increases demand for pre-packaged foods which are a mainstay of Nestlé’s product range.

Threats

- Water availability and misuse – Nestlé is highly dependent on water to maintain production, but water is a scarce commodity in some countries. They also derive large profits from selling bottled water that is sourced from increasingly depleted aquifers and underground storage.

- Competition – the food industry is one of the most saturated in the world. Some of Nestlé’s main competitors include Hershey, Mars, PepsiCo, and Unilever.

- Global challenges – Nestlé’s presence in nearly every country means the company is subject to a wide range of global challenges. For example, the rising prices of raw materials and fuel threaten to erode profits. In some third-world countries, Nestlé must also deal with political instability and supply chain issues.

Related Visual Stories

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

Other case studies:

- Amazon SWOT Analysis Example

- Apple SWOT Analysis Example

- Facebook SWOT Analysis Example

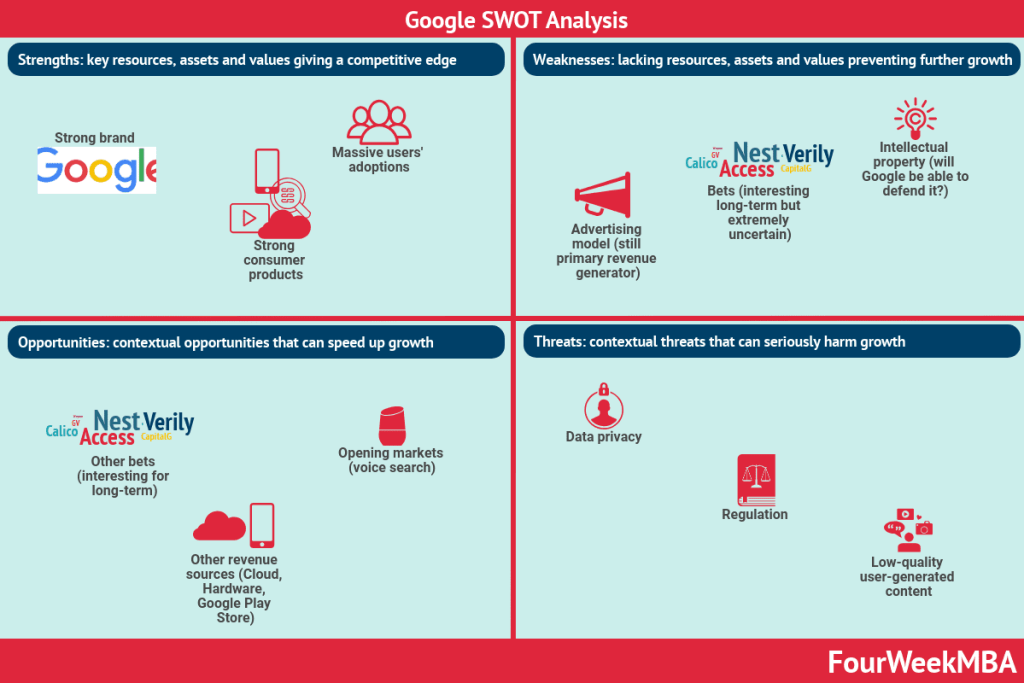

- Google SWOT Analysis Example

- Netflix SWOT Analysis Example

- Starbucks SWOT Analysis Example

- Tesla SWOT Analysis Example

Other resources: