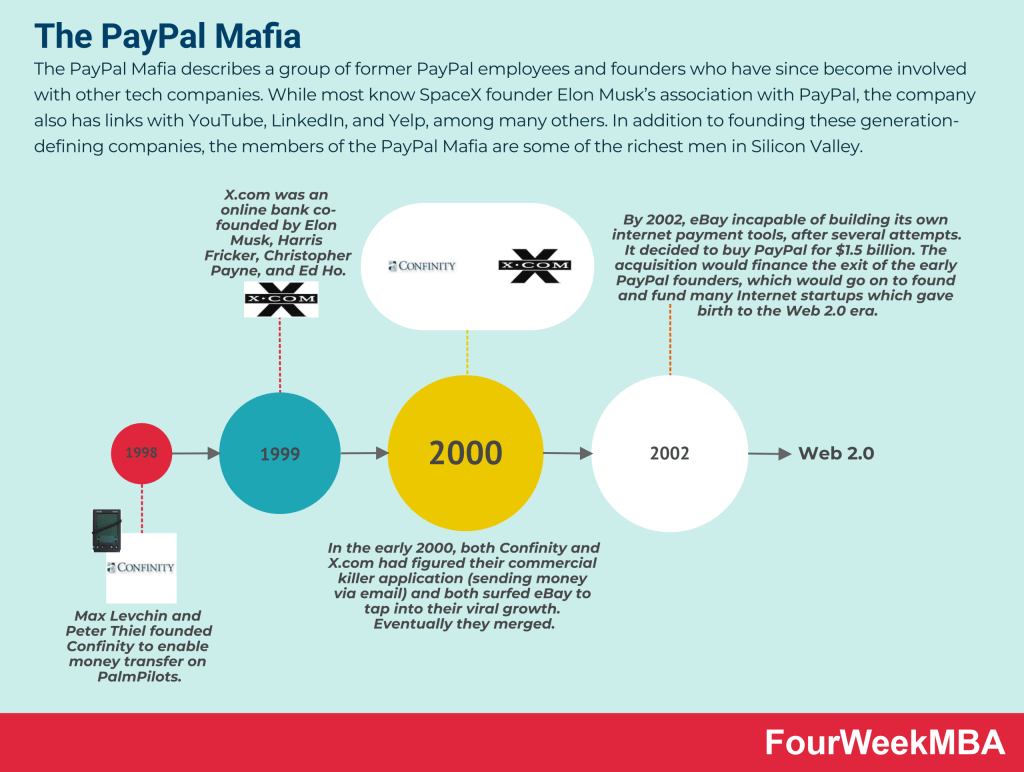

PayPal is an American multinational fintech company that offers a multitude of money transfer and associated services around the world. The company, which began life as Confinity in 1998, has enjoyed a first-mover advantage in the peer-to-peer payment industry for many years. Today, the company is consistently profitable and many assume that it will continue to grow and maintain market dominance as eCommerce and consumer finance evolves.

| Competitor | Description | Key Insights | Competitive Overlap | Differentiation |

|---|---|---|---|---|

| Stripe | A payment processing platform that provides tools for businesses to accept online payments, manage subscriptions, and handle various financial transactions. Stripe competes with PayPal in the online payment processing market. | Stripe offers payment processing solutions for online businesses, including support for credit card payments, subscription billing, and developer-friendly APIs. | Both offer online payment processing, but Stripe is known for its developer-friendly tools and customization options. | Stripe’s focus on developer-centric features and flexibility. |

| Square | A financial services and mobile payment company that offers a range of payment processing solutions, including point-of-sale (POS) systems and online payment tools. Square competes with PayPal in the payment processing and mobile payments market. | Square provides payment processing services for businesses, including online payment acceptance, POS systems, and invoicing tools. | Both offer payment processing solutions, but Square focuses on in-person payments with its POS hardware and mobile payment options. | Square’s emphasis on in-person payments and POS systems. |

| Amazon Pay | A payment processing service offered by Amazon, allowing customers to use their Amazon accounts to make online purchases on third-party websites. Amazon Pay competes with PayPal in the online payment and e-commerce market. | Amazon Pay enables online shoppers to use their Amazon credentials to complete transactions on partner websites, providing a streamlined checkout experience. | Both offer online payment solutions, but Amazon Pay leverages Amazon’s extensive user base and emphasizes a familiar checkout experience. | Amazon Pay’s integration with Amazon accounts and brand recognition. |

| Authorize.Net | A payment gateway and merchant services provider that facilitates online payments and secure transaction processing for businesses. Authorize.Net competes with PayPal in the online payment processing market. | Authorize.Net offers payment gateway services to enable online businesses to accept credit card payments, subscriptions, and e-checks securely. | Both provide online payment processing, but Authorize.Net specializes in payment gateway services and integrates with various merchant accounts. | Authorize.Net’s focus on payment gateways and merchant services. |

| Adyen | A global payment company that offers payment processing solutions, including online, in-app, and point-of-sale payments. Adyen competes with PayPal in the global online payment processing market. | Adyen provides payment processing services for online and in-store transactions, with a focus on global reach and unified commerce solutions. | Both offer online payment processing, but Adyen is known for its global payment capabilities and support for multiple payment methods. | Adyen’s global reach and unified commerce solutions. |

| Google Pay | A digital wallet platform developed by Google, enabling users to make payments and store payment methods for online and in-store transactions. Google Pay competes with PayPal in the digital wallet and online payment market. | Google Pay allows users to store payment methods, make online and in-store payments, and send money to contacts through the Google ecosystem. | Both offer digital wallet solutions, but Google Pay is integrated into Google’s ecosystem and offers a seamless mobile payment experience. | Google Pay’s integration with the Google ecosystem and mobile payment features. |

| Venmo | A mobile payment service owned by PayPal, primarily used for peer-to-peer (P2P) payments and splitting expenses among friends. Venmo competes with PayPal in the P2P payment and digital wallet market. | Venmo allows users to send and receive money from friends, make payments, and split bills, often used for social payments. | Both are owned by PayPal and offer digital wallet solutions, but Venmo is popular for its social payment features and P2P focus. | Venmo’s social payment functionality and popularity among younger users. |

| Apple Pay | A mobile payment and digital wallet service developed by Apple, allowing users to make secure payments using their Apple devices in stores and online. Apple Pay competes with PayPal in the mobile payment and digital wallet market. | Apple Pay enables users to make payments at brick-and-mortar stores, in-app, and online using their Apple devices, such as iPhones and Apple Watches. | Both offer mobile payment and digital wallet solutions, but Apple Pay is integrated into Apple’s ecosystem and focuses on in-store payments with mobile devices. | Apple Pay’s integration with Apple devices and security features. |

| Shopify Payments | A payment processing solution offered by Shopify, designed for e-commerce businesses to accept online payments seamlessly on their Shopify stores. Shopify Payments competes with PayPal in the e-commerce payment processing market. | Shopify Payments provides an integrated payment solution for online stores built on the Shopify platform, simplifying the payment process for merchants. | Both offer e-commerce payment processing, but Shopify Payments is tailored for Shopify’s e-commerce ecosystem and emphasizes seamless integration. | Shopify Payments’ integration with Shopify’s e-commerce platform and simplified setup. |

| Braintree | A full-stack payment platform owned by PayPal, offering payment processing solutions, including online and mobile payments. Braintree competes with PayPal in the online payment processing market. | Braintree provides payment processing services for online and mobile businesses, focusing on developer-friendly APIs and customizable payment solutions. | Both are owned by PayPal and offer online payment processing, but Braintree is known for its developer-centric features and customization options. | Braintree’s developer-friendly APIs and customization capabilities. |

Google Pay

Google Pay is not that different from Amazon Pay, Samsung Pay, or even Apple Pay. However, it does come the closest to matching PayPal for functionality and, using the influence of parent company Google, has the ability to pose a serious threat.

Like PayPal, Google Pay users can send and receive money wherever and whenever they want for almost any purpose. Payments can also be attached to Gmail messages and merchants can also use it to manage their businesses and customer loyalty programs.

What’s more, Google does not charge merchants transaction fees for accepting Google Pay in their stores. This makes it a more attractive option than PayPal, with fees as high as 3.49% for sellers in the United States.

Payoneer

Payoneer is another American fintech company founded in 2005 that offers online money transfers, digital payment services, and also provides small and medium-sized businesses with working capital. The latter feature makes it popular among eCommerce businesses, online advertisers, freelancers, and even vacation rental owners.

Sending and receiving money between Payoneer is free up to a specified amount. Like services such as TransferWise, the platform also provides a branded debit card so that funds can be withdrawn from ATMs. The same card can also be used as a hybrid credit card, but fees tend to be higher when compared to bank credit cards.

Skrill

Skrill was founded as Moneybookers in 2001 by Daniel Klein and Benjamin Kullmann and, just six years later, was one of the top three online payment solution providers in Europe.

Skrill’s merchant fees tend to be lower than those of PayPal, and while the platform has millions of global users, it is not as recognized or widespread as its larger competitor.

Nevertheless, Skrill has an attractive product suite that incorporates forex, cryptocurrency, online games, sports, and betting. However, most enjoy the platform for its digital wallet that has zero withdrawal and deposit fees and the ability to send and receive money for free.

Stripe

Stripe bills itself as “the new standard in online payments” and has millions of businesses on its platform from the smallest startups to the largest corporations. Stripe offers a fully integrated suite of payments products that is more diverse and functional than what PayPal offers.

Stripe fees are also competitive at 2.9% + 30 cents on every transaction in the United States. It may also be more convenient for business owners and consumers since the checkout process is self-hosted. In other words, there is no need to leave a merchant’s site to complete the transaction using an intermediary like PayPal.

Stripe’s API, dubbed Stripe Connect, is also more flexible in terms of payment processing. Transfers between businesses, customers, and recipients are handled with fewer manually initiated transfers, which makes the API ideal for marketplace and software platform business models. This also reduces the likelihood of fraud or delays that result from account holds.

Key takeaways:

- PayPal is an American multinational fintech company that offers a multitude of money transfer and associated services around the world. The PayPal platform is multi-dimensional and enjoyed a first-mover advantage in P2P transactions, but competitors have emerged to exploit various segments of the consumer and business finance market.

- Google Pay is not much different from several other payment platforms from other tech companies. However, it does come the closest to matching PayPal for functionality and can leverage the influence of parent company Google to become a serious threat.

- Other PayPal competitors include business-centric payment platform Payoneer, English digital wallet provider Skrill, and financial services and software company Stripe.

Key Competitors of PayPal:

- Google Pay:

- Payoneer:

- Offers online money transfers and digital payment services.

- Provides working capital for SMBs, popular among freelancers.

- Offers a branded debit card for withdrawals and payments.

- Used by eCommerce businesses, online advertisers, and more.

- Skrill:

- Founded as Moneybookers in 2001, popular in Europe.

- Offers lower merchant fees compared to PayPal.

- Features a digital wallet with zero withdrawal and deposit fees.

- Includes forex, cryptocurrency, online games, and more.

- Stripe:

- Offers a suite of diverse online payments products.

- Used by startups to large corporations.

- Competitive fees, self-hosted checkout process.

- Flexible API (Stripe Connect) for various business models.

See Also: History of PayPal

Related to PayPal

PayPal Transactions Per Active Users

Read More: How Does TD Ameritrade Make Money, How Does Dave Make Money, How Does Webull Make Money, How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

List of FinTech Business Models

Braintree

Read Next: Fintech Business Models, IaaS, PaaS, SaaS, Enterprise AI Business Model, Cloud Business Models.

Read Next: Affirm Business Model, Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Main Free Guides:

![The History of PayPal with Jimmy Soni [FourWeekMBA Podcast] history-of-paypal](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2022/02/history-of-paypal-150x150.png?resize=150%2C150&ssl=1)