The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity).

Why the balance sheet is important

It has been my experience that competency in mathematics, both in numerical manipulations and in understanding its conceptual foundations (accounting), enhances a person’s ability to handle the more ambiguous and qualitative relationships that dominate our day-to-day financial decision- making by Alan Greenspan former FED Governor

Understanding the balance sheet is critical to be able to dissect any business.

By looking at it, you will be able to answer questions, such as: What is the leverage? Is the company liquid enough?

Remember, leverage is the proportion between equity and debt, while liquidity is the capacity of the business to repay for its short-term obligations, to run the operations.

We’ll start from the ten commandments of the GAAP accounting system.

A quick introduction to the main GAAP principles

Although the fundamental accounting system hasn’t changed, the principle and rules applying today have been updated in the last century.

The generally accepted accounting principles are the standards and procedures used by organizations to submit their financial statements.

Today we have two main accepted frameworks, globally: GAAP and IFRS.

Indeed, after the 1929 market crash, the American government felt the necessity to create a set of rules to discipline and to harmonize the accounting system, and avoid what had happened.

In the decade after the 1929 market crash institutions such as the Securities and Exchange Commission were created.

In 1934, the SEC, assisted by the American Institute of Accountants (AIA), started to work on the GAAP. The AIA subsequently instituted an organism to specifically create these principles, The Committee on Accounting Procedure (CAP).

Finally, the first set of GAAP was created, and in 1973 and the CAP board was substituted by the Financial Accounting Standards Board (FASB).

From this work came out ten basic principles, that are the foundation of the modern accounting system in the US:

- Economic entity assumption: If you have a business, even if you are a sole proprietor, the accountant will consider yourself separately from your business.

- Monetary Unit Assumption: The Business activity you undertake is considered in US Dollars.

- Time Period Assumption: a Business activity you undertake can be reported in separated time intervals, such as weeks, months, quarters or fiscal years.

- Cost Principle: If you buy an item in 1980 at $100, it will be reported on your balance sheet as worth $100 today, independently on inflation or appreciation of the asset.

- Full Disclosure Principle: You have to report all the relevant information of the business in the financial statements or the footnotes.

- Going Concern: The accountant assumes that your business will continue its operations in the foreseeable future.

- Matching Principle: If you incur an expense, it should be matched with the revenues, according to the accrual principle. If you decide to pay your employees a bonus related to 2015 but you pay it in 2016, you still will report it as 2015. You will report the expense when it was recognized and not when the actual cash disbursed (accrual principle).

- Revenue Recognition Principle: if you sold a product in January 2015, but you will receive the money from the customer in April 2015, you will report the sale in January since it was the period when the actual sale was realizable.

- Materiality Principle: when you report the financials, it will be allowed to round them, since if an amount is insignificant can be neglected by your accountant.

- Conservatism Principle: When in doubt between $80 or $100 loss, your accountant has to choose the most conservative alternative, report $100.

These principles are the “ten commandments” of the accountant. Keep them in mind. They will guide you throughout the book.

Also, the accrual principle in practical terms states: “Revenues and expenses are recognized when occurred, independently from cash disbursement.”

This principle is crucial to building our primary financial statements, in particular, the Income Statement and Balance Sheet.

A quick glance at the main accounts of a financial statement

An account is an item on the financial statements that has certain characteristics. Usually, the accountant groups them in five main types. Each of those types has subtypes.

For now, it is critical to understand each main type to have a better understanding of how financial statements work. The main accounts are:

Assets

Resources owned by an organization. They will produce future benefits for the company. For example, you own a bakery that has to produce biscuits. For you to produce them, you have to buy a machine. The machine will be an asset to your organization.

Liabilities

Obligations (Debt) contracted by an organization. Your bakery bought $100 of raw material from the supplier, and you will pay in 60 days. Until the payment will be made the $100 will show as a liability (future debt) on your balance sheet.

Owner’s Equity

Amount of money or resources you endowed to your organization. The accounting definition is Owner’s Equity = Assets – Liabilities.

Revenue or Income

The $ amount of sales occurred in a certain period. According to the accrual principle, income is recognized independently from cash receipt.

Expenses

The $ amount of costs occurred in a certain period. According to the accrual principle, expenses are recognized independently from cash disbursement.

While assets, liabilities, and equity will be shown on the balance sheet. Revenue and expenses will be shown on the income statement.

A snapshot of the primary financial statements

“Unless you are willing to put in the effort to learn accounting – how to read and interpret financial statements – you really shouldn’t select stocks yourself” Warren Buffet

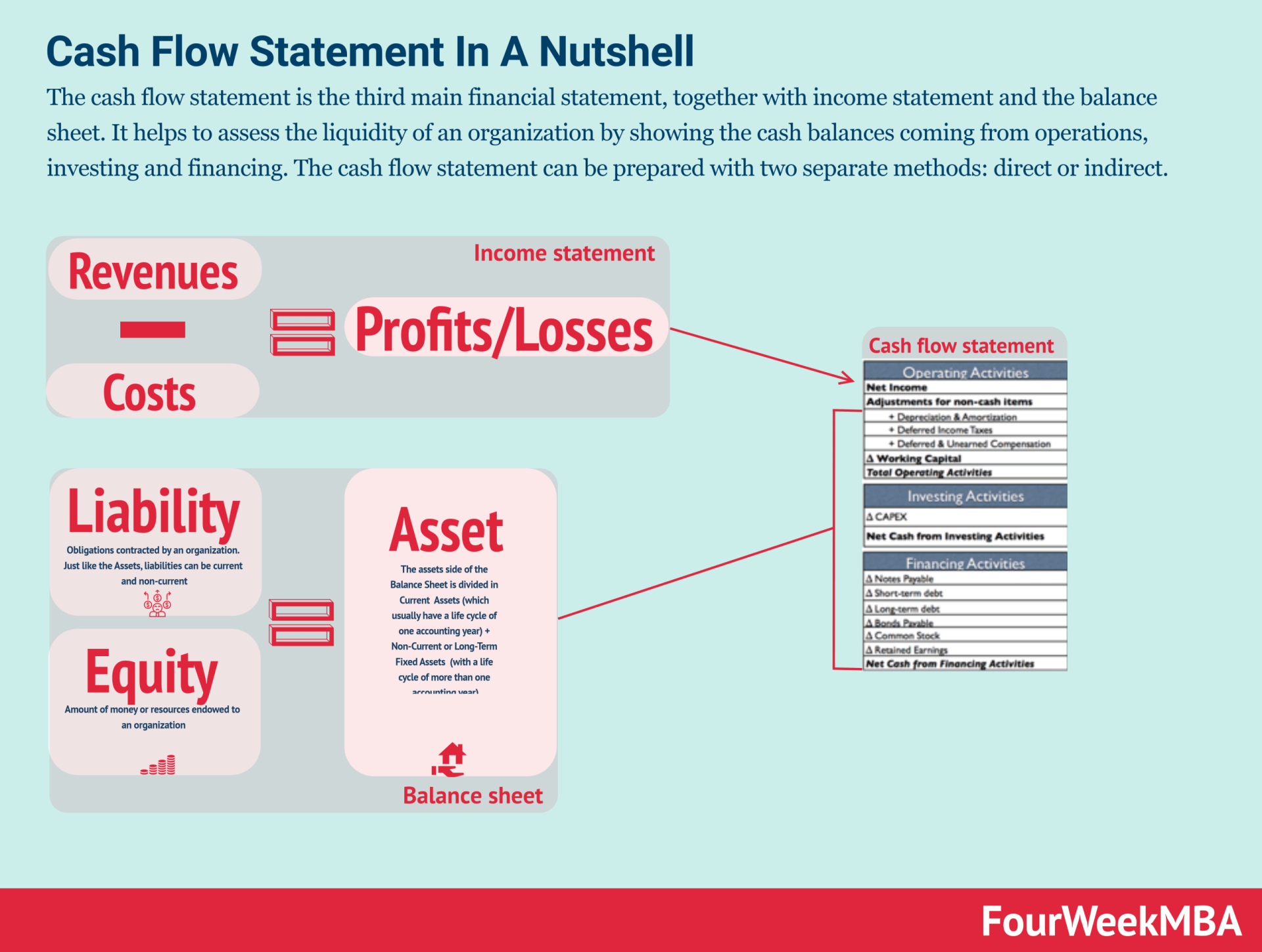

The primary financial statements are the Balance Sheet, Income Statement, and Cash Flow Statement. Each of these statements has a different purpose, and together they give us specific information in regard to: “Return, Risk, and Cash.”

First, if you look at the income statement, there is no way you would make any assessment about the risk of the organization at that particular point in time or the cash produced in a certain period.

Instead, the Income Statement (or Profit & Loss) will show you the return generated by the business.

Second, if you want to understand how an organization acquired the resources to operate the business, you have to look at the Balance Sheet.

How does the balance sheet assess the risk of an organization?

Simple: there are two ways a company can acquire resources, either through Equity or Debt.

As you can imagine, too much debt can be dangerous. What would occur if you run a business, and suddenly your creditors ask for the money you owe them?

You would go bankrupt. Instead, when debt in proportion to the equity is dismal, this makes your organization creditworthy and safer.

Third, it is highly probable to see an organization that makes profits but out of cash. The cash flow statement helps you to answer questions such as: How much cash did we make?

Where this cash came from? An organization can find cash through three main activities: Operating, Investing, and Financing.

What is the income statement?

The primary purpose of the income statement is to show the return of the business in a certain period: Quarterly, Biannually, or Yearly. The income statement is built around the bottom line, the “net profit.”

Do not be surprised to notice your eyes unexplainably falling on the net income. Accountants make it as visible as a fluorescent fish ready to mate.

This distracts you by other metrics on the Income Statement that are as important as the Net Income.

What is the balance sheet?

The primary purpose of the Balance Sheet is to show the risk of the business in the particular moment you are looking at it.

If you look at the balance sheet on January 1st, it won’t be the same on January 2nd.

Of course, this is true for the P&L and CFS (Cash Flow Statement) as well, but the balance sheet is an instant snapshot of the business more than a collage of pictures taken in different moments, like the Income Statement.

What is the cash flow statement?

The primary purpose of the CFS is to show the cash generated by an organization in a certain period: Quarterly, Biannually or Yearly.

It doesn’t matter how much profits a business is making, one way to know whether the business will survive in the next future is to look at the cash.

Generating cash is not an easy task, and the organizations that can keep their profits stable and make enough cash to sustain their operations and invest for future growth are the ones who thrive.

Sample of a balance sheet

The purpose of the balance sheet is to report the way the resources to run the operations of the business were acquired. The Balance Sheet helps us to assess the risk of the business.

By looking at it, you will be able to answer questions, such as: What is the leverage? Is the company liquid enough?

Remember, leverage means the proportion between equity and debt, while liquidity is the capacity of the business to repay for its short-term obligations, to run the operations.

Imagine you have to open a restaurant. The overhead costs, plus the costs of running the business are $200,000.

There are two ways for you to find the money needed to open the business, assuming you don’t have the resources to do it your own.

Either you find a partner that would put personal money, or you ask for a loan. Therefore, Equity and Debt are the two ways to finance your business. This is how a typical balance sheet looks like:

Let’s look now at some practical case studies.

Understanding the accounting equation

Alphabet (Google) Balance Sheet

Source: Google 10K, 2018

It is important to notice that while the balance sheet will keep its structure. It might vary based on the kind of business we’re analyzing.

In Google’s case, I’m focusing the analysis on a few key items:

- Cash and cash equivalents and Marketable securities

- Accounts receivable

- Inventory

- Non-marketable securities

- Property and equipment

Cash equivalents and marketable securities

For instance, for a company like Google, you’ll notice how the top sections with items like cash and cash equivalents and marketable securities are the ones that bring most resources to the company.

These comprise assets that can be easily turned into cash.

As the company explains in its 10K those are primarily composed of “time deposits, money market funds, highly liquid government bonds, corporate debt securities, mortgage-backed and asset-backed securities.”

In short, the company keeps part of its cash reserves as short and longer terms investments where it can earn interest income.

Some of those marketable securities are also represented by companies in which Googe might be investing from time to time.

These resources are extremely important as they are liquid. Thus, the company can turn to them as a buffer in case of emergencies. But also to keep them as a strategic asset when it is time to make strategic acquisitions.

For instance, the company invests in other bets, which while today don’t contribute much to the overall revenue of the business, they might become important sources of income in the coming decade.

Accounts receivables

In Google’s case, as the company specifies “accounts receivable are typically unsecured and are derived from revenues earned from customers located around the world.”

More precisely the company’s income recorded but not received yet, it will be reported as accounts receivable. In Google’s case, as it sells advertising to businesses, we can imagine those sums is money to get from some of those businesses.

Some of the money turned into the accounts receivable might become uncollectible over time, as the customer who owes them might become insolvent. That is why it is critical to check the age of those accounts.

Google, indeed, keeps together reserves in case those accounts won’t be collected anymore.

Inventory

If you’re wondering what kind of inventory a company like Google might hold.

A small chunk of Google’s revenues (as of 2019) comes from Hardware. In short, the company sells phones (the Pixel), and other voice devices (Google Home and Google Mini), and other devices.

Thus the inventory is primarily comprised of these devices. And as you’ll see this number is extremely low compared to companies like Amazon which instead focused more over the years in selling physical goods.

Non-marketable investments

While in the marketable securities we see lumped those investments that can be easily liquidated. In the non-marketable investments, we’ll find those investments which can be hardly sold for several reasons.

For instance, those might be long-term bonds or private companies which as they are not yet traded publicly can’t be considered as highly liquid.

And limited partnerships, which once again are not as easy to liquidate (at least from the accounting standpoint) as those that we find under the marketable securities.

That is why we find the non-marketable securities under the long-term assets of the organization.

Property and equipment

One thing you might be surprised about businesses which seem to be primarily digital like Google is the fact that they have billions and billions of dollars in physical assets.

In Google’s case, you don’t see them under inventories, or other intangible assets. But you do see them under property and equipment. As specified by Google those include:

- Land and buildings

- Information technology assets

- Construction in progress

- Leasehold improvements

- Furniture and fixtures

Things like land and building and IT assets are critical resources that make the Google business model sustainable over time. The former to host the human resources that keep the company going.

The latter, to enable the company to have enough data centers to host billions of sites of Google’s index and the billions of queries that each day goes through the search engine.

So if you’re surprised to see almost sixty billion dollars under this item, you might ignore the fact that also digital businesses that scaled up require massive resources.

While it is possible to be extremely lean when growing. It becomes hard to keep that kind of organizational structure.

Thus culture becomes a key element that holds the company together. As of December 31, 2018, Google reported over 98 thousand full-time employees.

Which seems a huge number. But if compared to Microsoft’s reported 144 thousand employees, considering the Microsoft made about $110 billion in revenues in 2018 (Google reported over $130 billion in revenues in 2018), you can appreciate how so far the company is leaner.

The interesting part is as the company transition more to its mission to be AI-first it also consumes more computer power, which requires more data centers.

Let’s look now how Amazon balance sheet looks.

Amazon Balance Sheet

I’ve covered the Amazon business model at great length. For the sake of this article, we’ll look through its balance sheet to make also some comparison with Google’s balance sheet.

Source: Amazon 10K, 2018

In Amazon’s balance sheet you might notice right away a few differences with Google’s balance sheet. For instance, Amazon carries less marketable securities, more inventories, and more accounts payable.

This can be explained by the fact that Google and Amazon are fundamentally different businesses. I want to highlight that while Amazon and Google have wholly different business models.

If we look at the competitive landscape, we can use several lenses. But if we use a simple heuristic and look at the overlapping of users that use both platforms.

While those two companies have wholly different business models they still might be considered as competitors.

For instance, in the race to dominate voice search Amazon and Google are (fierce) competitors. And while this is not yet showing on the bottom line it might in the coming years.

Thus, it’s hard sometimes to assess the nature of strategy and when doing a financial assessment starting from hard numbers is good.

But you need to make sure to look also at things that don’t have yet a tangible return today but they might in five, ten years.

For the sake of understanding Amazon balance sheet and compare it to Google, we’ll focus on:

- Cash and cash equivalents and Marketable securities

- Inventories

- Accounts receivable

- Accounts payable

- Property and equipment

I want to show you how the Amazon cash machine works.

Cash equivalents and marketable securities

When it comes to cash and cash equivalents Amazon specifies those are “highly liquid instruments with an original maturity of three months or less as cash equivalents.”

The company also explains to “hold cash equivalents and/or marketable securities in foreign currencies including British Pounds, Euros, and Japanese Yen.”

That might be used as a hedging strategy designed to offset potential loss due to currency fluctuations. But also simply as revenues which are not necessarily turned into US dollars.

Inventories

When we look at platform business models one key element is that they don’t necessarily own assets but control the so-called network effects.

However, when a platform identifies a key strategic asset, owning and controlling it is crucial for its business model.

In Amazon’s case, when the company transitioned more and more to become a platform (that happened when Amazon third-party sellers made up for more than 50% of Amazon e-commerce revenue).

The company had to make sure its fulfillment centers would be as efficient as possible, thus becoming one of the most important strategic assets for the company.

Indeed, while third-party sellers might stock their inventories or part of it with Amazon. Amazon can still guarantee a fast delivery experience (a key element of Amazon’s customer obsession).

And the key to maintaining control over the overall customer experience!

That is why among its business risks Amazon mentions “If We Do Not Successfully Optimize and Operate Our Fulfillment Network and Data Centers, Our Business Could Be Harmed.”

In addition, Amazon highlights how “because of our model we are able to turn our inventory quickly and have a cash-generating operating cycle.”

In short, the company is able to quickly sell its inventory, thus making short term cash which is and has been a bonanza for the company in the past decades.

The inventory management strategy that Amazon uses also enables us to understand how the company generates a lot of cash from its operations.

As Amazon explains “on average, our high inventory velocity means we generally collect from consumers before our payments to suppliers come due.”

In other words, Amazon is able to collect money right away from customers, which thanks to Amazon’s fast delivery, pay right away.

In meanwhile, Amazon collects the cash but (as we’ll see in the accounts payable) the company doesn’t have to pay its suppliers right away.

Thus, generating extra short-term cash which can be easily invested in the operations of the business and fuel growth.

Accounts receivable

Another element of Amazon cash machine is the ability to keep its accounts receivable under control while turning inventory quickly, and having advantageous payout agreements with suppliers and third-party sellers.

Indeed, even though Amazon is a company that sells hundreds of billions of goods and services on its platform. Yet its accounts receivable are lower than Google.

That might also be due to how the company reports them. But as Amazon clarifies in its financial statements, “because consumers primarily use credit cards to buy from us, our receivables from consumers settle quickly.”

Accounts payables

Just to close the puzzle of Amazon cash machine, its accounts payable are kept relatively higher than its inventories and receivables as they enable the company to stretch short-term cash resources for the liquidity of the business.

The difference between Accounts receivable, inventories, and accounts payable makes up the so-called working capital, which again is the set of short-term liquidity of the organization.

Indeed, paradoxically when a company lacks short term liquidity (not enough cash or assets easily convertible in cash) it might go bankrupt nonetheless the business might be solid in the long-run (long-term assets are higher than long-term liabilities).

Case study: Imagine the case of a company which owns a beautiful building which is worth millions. But it can’t sell right away. And creditors call up the company to return a couple of hundred thousand dollars in a month. While the company seems viable in the long-run. The complete lack of short-term available resources might jeopardize the overall organization!

Property and equipment

As the company highlights “property includes buildings and land that we own, along with property we have acquired under build-to-suit, finance, and capital lease arrangements.

Equipment includes assets such as servers and networking equipment, heavy equipment, and other fulfillment equipment.”

Balance sheet infographic

Key takeaways

The balance sheet is a very important financial statement as it enables us to understand the assets that the company built over time.

It also enables us to see the short and long-term liabilities the company owes.

At the same time from a balance sheet, we can appreciate the differences among several businesses and also understand some of the key elements of their business models.

That is why looking at the balance sheet should be an exercise to practice dissecting and understanding any business.

What’s Next?

By looking at the balance sheet, we can compute important metrics that help us assess the profitability, liquidity, efficiency, and return of a business.

This is at the core of financial ratio analysis. In short, by crossing some of the numbers from the balance sheet, together with what we have in the income statements, we can get, with a very simple set-up the state of health of a business, for the past and current moment.

Beware of the lagging effect

While balance sheets can be useful to understand the current and past picture of a business and to have an overview of how the business operates, from a financial and operating standpoint. This is just the tip of the iceberg.

In some cases, balance sheets can uncover important signals (for instance a company might lack the liquidity to sustain the business in the short-term, the balance sheet can help break that down).

However, going forward it’s important to also have an open-minded approach that goes beyond the current numbers on the balance sheets, and looks at the strategic side, of how the business landscape might change going forward.

Case Studies

- Working Capital Analysis: A manufacturing company reviews its balance sheet to ensure it has enough current assets (like cash and accounts receivable) to cover its current liabilities (like accounts payable and short-term debt). This helps in managing day-to-day operations effectively.

- Investor Decision-Making: An investor assesses the balance sheet of two competing tech startups. By comparing their equity levels, the investor can determine which one is better capitalized for future growth.

- Credit Risk Assessment: A bank evaluates the balance sheet of a potential borrower to determine their creditworthiness. They focus on the debt levels, collateral, and liquidity to decide whether to extend a loan.

- Mergers and Acquisitions: During an acquisition, the acquiring company closely examines the target company’s balance sheet. It helps them assess the fair value of assets, identify any hidden liabilities, and make informed decisions about the purchase price.

- Real Estate Investment: A real estate investor reviews the balance sheet of a property management company. By analyzing the property assets and debts, they can gauge the potential return on investment and the risk associated with the property portfolio.

- Debt Management: A small business owner uses the balance sheet to track and manage their outstanding loans. They ensure that the interest payments and principal repayments are within their financial capabilities.

- Startup Valuation: Venture capitalists assess a startup’s balance sheet to determine its pre-money valuation. They consider the assets, liabilities, and equity to negotiate terms for an investment.

- Liquidity Planning: A retail company uses the balance sheet to plan for seasonal fluctuations in demand. By monitoring cash reserves and credit lines, they ensure they have enough liquidity to meet increased inventory needs during peak seasons.

- Financial Modeling: Financial analysts build complex financial models using balance sheet data to forecast a company’s future financial performance. This includes predicting future assets, liabilities, and equity based on historical trends.

- Bankruptcy Prediction: Credit rating agencies and financial analysts use balance sheet ratios to assess the risk of bankruptcy for publicly traded companies. They look at metrics like the debt-to-equity ratio and the current ratio to make predictions.

- Dividend Decisions: A company’s management examines its balance sheet to determine whether it can afford to pay dividends to shareholders. They consider retained earnings and the overall financial position.

- Government Regulation Compliance: Publicly traded companies must comply with regulatory requirements regarding financial reporting. The balance sheet ensures transparency and compliance with accounting standards like GAAP or IFRS.

- Tax Planning: Businesses review their balance sheets to assess the tax implications of asset sales or acquisitions. This helps in making tax-efficient decisions.

- Nonprofit Organizations: Nonprofits use balance sheets to show their financial health to donors and stakeholders. It helps build trust and secure funding for their missions.

- Capital Budgeting: Companies use balance sheet data to make decisions about capital investments. They analyze the impact of purchasing assets on the balance sheet and assess the return on investment.

Key Highlights

- Balance Sheet Purpose:

- Provides a snapshot of how a company’s resources are acquired and funded.

- Demonstrates the financial position at a specific point in time.

- Follows the accounting equation: Assets = Liabilities + Equity.

- Importance of Understanding Balance Sheet:

- Essential for assessing a company’s financial health.

- Reveals financial risk, leverage, and liquidity.

- Leverage: Proportion of debt to equity; high leverage indicates higher risk.

- Liquidity: Company’s ability to meet short-term obligations.

- Ten Commandments of GAAP Accounting:

- Economic entity, monetary unit, time period assumptions.

- Cost principle, full disclosure, going concern principles.

- Matching, revenue recognition, materiality, conservatism principles.

- Primary Financial Statements:

- Income Statement: Reveals profitability through revenues, expenses, net income.

- Balance Sheet: Assesses financial risk and resources financing.

- Cash Flow Statement: Details cash inflows and outflows from operations, investing, financing.

- Account Types:

- Assets: Owned resources (cash, equipment, property).

- Liabilities: Obligations (debts to creditors, suppliers).

- Equity: Residual interest after deducting liabilities from assets.

- Revenue: Income from sales.

- Expenses: Costs of running the business.

- Interpreting Balance Sheet:

- Analyzing financial position and making informed decisions.

- Assessing leverage (equity vs. debt) and liquidity (current assets vs. liabilities).

- High leverage indicates risk; healthy liquidity indicates short-term stability.

- Comparing Case Studies:

- Comparing balance sheets reveals unique business models.

- Allocation of resources varies based on industry and strategy.

- Companies prioritize liquid assets or strategic investments differently.

- Generating Cash from Operations:

- Consider Future Changes:

- Balance sheets offer historical view; anticipate future changes.

- External factors impact financial health (competition, technology).

- Analyzing past data and predicting future dynamics for comprehensive analysis.

Financial Ratios Table

| Ratio | Type | Description | When to Use | Example | Formula |

|---|---|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | Valuation | Measures a company’s current share price relative to its earnings per share (EPS). | Assess valuation and growth prospects. | A P/E ratio of 15 means investors pay $15 for every $1 of earnings. | P/E = Price per Share / Earnings per Share |

| Price-to-Sales (P/S) Ratio | Valuation | Compares a company’s market capitalization to its total sales revenue. | Evaluate valuation when earnings are not meaningful. | A P/S ratio of 1 indicates the company’s market cap is equal to its annual revenue. | P/S = Market Cap / Total Revenue |

| Price-to-Book (P/B) Ratio | Valuation | Compares a company’s market price per share to its book value per share. | Assess valuation relative to tangible assets. | A P/B ratio of 2 suggests the stock is trading at twice its book value. | P/B = Price per Share / Book Value per Share |

| Price/Earnings to Growth (PEG) Ratio | Valuation/Growth | Combines the P/E ratio with the expected earnings growth rate to assess valuation with growth prospects. | Evaluate valuation relative to expected growth. | A PEG ratio of 0.75 indicates potential undervaluation considering growth. | PEG = P/E Ratio / Earnings Growth Rate |

| Dividend Yield | Dividend | Measures the annual dividend income relative to the stock’s price. | Evaluate income potential from dividend stocks. | A 3% dividend yield means $3 in annual dividends for every $100 invested. | Dividend Yield = Annual Dividend per Share / Price per Share |

| Dividend Payout Ratio | Dividend | Shows the proportion of earnings paid out as dividends. | Assess sustainability of dividend payments. | A 50% payout ratio means half of earnings are distributed as dividends. | Payout Ratio = Dividends / Earnings |

| Debt-to-Equity Ratio | Solvency | Measures the proportion of a company’s debt to its equity. | Evaluate the financial risk and leverage. | A debt-to-equity ratio of 0.5 suggests moderate leverage. | Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity |

| Current Ratio | Liquidity | Compares a company’s current assets to its current liabilities. | Assess short-term liquidity and solvency. | A current ratio of 2 indicates good liquidity with twice as many assets as liabilities. | Current Ratio = Current Assets / Current Liabilities |

| Quick Ratio (Acid-Test Ratio) | Liquidity | Similar to the current ratio but excludes inventory from current assets. | Assess immediate liquidity without relying on inventory. | A quick ratio of 1 means current liabilities can be fully covered by liquid assets. | Quick Ratio = (Current Assets – Inventory) / Current Liabilities |

| Return on Equity (ROE) | Profitability | Measures a company’s profitability relative to shareholders’ equity. | Assess how efficiently equity is used to generate profits. | An ROE of 15% indicates a company generated a 15% return on shareholders’ equity. | ROE = Net Income / Shareholders’ Equity |

| Return on Assets (ROA) | Profitability | Measures a company’s profitability relative to its total assets. | Assess how efficiently assets are used to generate profits. | An ROA of 10% means a company earned a 10% return on total assets. | ROA = Net Income / Total Assets |

| Gross Margin | Profitability | Measures the percentage of revenue that remains after subtracting the cost of goods sold (COGS). | Assess a company’s ability to control production costs. | A gross margin of 30% indicates a 70% profit on COGS. | Gross Margin = (Revenue – COGS) / Revenue |

| Operating Margin | Profitability | Measures the percentage of revenue that remains after operating expenses are deducted. | Assess a company’s operational efficiency. | An operating margin of 15% means 15% of revenue remains as profit after operating expenses. | Operating Margin = Operating Income / Revenue |

| Net Profit Margin | Profitability | Measures the percentage of revenue that remains as profit after all expenses, including taxes and interest. | Assess overall profitability. | A net profit margin of 8% means 8% of revenue is profit after all expenses. | Net Profit Margin = Net Income / Revenue |

| Earnings Before Interest and Taxes (EBIT) Margin | Profitability | Measures the percentage of revenue that remains before interest and taxes are deducted. | Assess operating performance without considering financing decisions. | An EBIT margin of 20% indicates strong operational performance. | EBIT Margin = EBIT / Revenue |

| Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Margin | Profitability | Measures the percentage of revenue that remains before interest, taxes, depreciation, and amortization are deducted. | Assess operating performance with a focus on cash flow. | An EBITDA margin of 25% indicates efficient operation. | EBITDA Margin = EBITDA / Revenue |

| Free Cash Flow (FCF) Margin | Cash Flow | Measures the percentage of revenue that remains as free cash flow after all operating and capital expenses. | Evaluate a company’s ability to generate cash. | An FCF margin of 10% means 10% of revenue is available as free cash flow. | FCF Margin = FCF / Revenue |

| Price-to-Cash Flow (P/CF) Ratio | Valuation | Compares a company’s market price per share to its cash flow per share. | Assess valuation based on cash flow. | A P/CF ratio of 8 suggests investors pay $8 for every $1 of cash flow. | P/CF = Price per Share / Cash Flow per Share |

| Inventory Turnover Ratio | Efficiency | Measures how quickly a company sells and replaces its inventory. | Assess inventory management efficiency. | An inventory turnover ratio of 5 suggests inventory is sold and replaced 5 times a year. | Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory |

| Accounts Receivable Turnover Ratio | Efficiency | Measures how quickly a company collects payments from its customers. | Assess accounts receivable collection efficiency. | An AR turnover ratio of 6 suggests accounts receivable turn over 6 times a year. | Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable |

| Total Asset Turnover Ratio | Efficiency | Measures how efficiently a company uses its assets to generate revenue. | Evaluate asset utilization and efficiency. | A total asset turnover ratio of 0.8 suggests assets generate 80% of revenue annually. | Total Asset Turnover Ratio = Revenue / Total Assets |

| Operating Cash Flow to Sales Ratio | Cash Flow | Measures the percentage of sales revenue that is converted into operating cash flow. | Assess the conversion of sales into cash. | An operating cash flow to sales ratio of 15% means 15% of sales become cash flow. | Operating Cash Flow to Sales Ratio = Operating Cash Flow / Revenue |

| Operating Income Margin | Profitability | Measures the percentage of revenue that remains as operating income before interest and taxes. | Assess profitability from core operations. | An operating income margin of 12% suggests strong operational profitability. | Operating Income Margin = Operating Income / Revenue |

| Debt Ratio | Solvency | Compares a company’s total debt to its total assets. | Assess the proportion of assets financed by debt. | A debt ratio of 0.4 indicates 40% of assets are financed by debt. | Debt Ratio = Total Debt / Total Assets |

| Quick Assets Ratio | Liquidity | Compares a company’s quick assets (cash, marketable securities, and receivables) to its current liabilities. | Assess immediate liquidity without relying on inventory. | A quick assets ratio of 1.2 indicates strong liquidity. | Quick Assets Ratio = (Cash + Marketable Securities + Receivables) / Current Liabilities |

| Earnings Per Share (EPS) | Profitability | Represents the portion of a company’s profit allocated to each outstanding share of common stock. | Assess profitability on a per-share basis. | EPS of $2 means $2 of profit for each outstanding share. | EPS = Net Income / Number of Shares Outstanding |

| Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) | Profitability | Measures a company’s operating earnings before non-operating expenses. | Assess operating profitability. | EBITDA of $500,000 indicates strong operating earnings. | EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization |

| Earnings Before Interest and Taxes (EBIT) | Profitability | Represents a company’s operating profit before interest and taxes. | Assess core operational profitability. | EBIT of $1 million indicates strong operating profit. | EBIT = Earnings Before Interest and Taxes |

| Operating Cash Flow (OCF) | Cash Flow | Measures the cash generated or used by a company’s core operating activities. | Evaluate cash flow from operations. | OCF of $800,000 indicates positive cash flow from operations. | OCF = Operating Cash Flow |

| Free Cash Flow (FCF) | Cash Flow | Represents the cash generated or used by a company after capital expenditures. | Assess cash available for investors or debt reduction. | FCF of $400,000 indicates cash available for dividends or debt reduction. | FCF = Free Cash Flow |

| Return on Investment (ROI) | Profitability | Measures the return on an investment relative to its cost. | Evaluate the efficiency of an investment. | An ROI of 20% indicates a 20% return on an investment. | ROI = (Gain from Investment – Cost of Investment) / Cost of Investment |

| Return on Capital Employed (ROCE) | Profitability | Measures the return generated from the capital employed in a business. | Assess the efficiency of capital utilization. | ROCE of 15% indicates a 15% return on capital employed. | ROCE = Earnings Before Interest and Taxes (EBIT) / Capital Employed |

| Operating Cycle | Efficiency | Measures the time it takes for a company to convert inventory to cash. | Assess the efficiency of inventory and receivables management. | An operating cycle of 45 days suggests efficient working capital management. | Operating Cycle = Average Days of Inventory + Average Days of Receivables |

| Cash Conversion Cycle (CCC) | Efficiency | Measures the time it takes for a company to convert inventory and receivables into cash, considering payables. | Assess cash flow efficiency and liquidity management. | A CCC of 30 days indicates quick conversion of assets into cash. | CCC = Operating Cycle – Average Days of Payables |

| Net Working Capital | Liquidity | Represents the difference between a company’s current assets and current liabilities. | Assess liquidity and short-term solvency. | Net working capital of $500,000 indicates good short-term liquidity. | Net Working Capital = Current Assets – Current Liabilities |

| Quick Liquidity Ratio | Liquidity | Compares a company’s quick assets (cash, marketable securities, and receivables) to its current liabilities. | Assess immediate liquidity without relying on inventory. | A quick liquidity ratio of 1.5 indicates strong immediate liquidity. | Quick Liquidity Ratio = (Cash + Marketable Securities + Receivables) / Current Liabilities |

| Times Interest Earned (TIE) | Solvency | Measures a company’s ability to cover interest payments with its earnings before interest and taxes. | Assess solvency and ability to meet interest obligations. | A TIE ratio of 4 indicates earnings are four times the interest expenses. | TIE = Earnings Before Interest and Taxes (EBIT) / Interest Expense |

| Price-to-Operating Cash Flow (P/OCF) Ratio | Valuation | Compares a company’s market price per share to its operating cash flow per share. | Assess valuation based on operating cash flow. | A P/OCF ratio of 10 suggests investors pay $10 for every $1 of operating cash flow. | P/OCF = Price per Share / Operating Cash Flow per Share |

| Price-to-Free Cash Flow (P/FCF) Ratio | Valuation | Compares a company’s market price per share to its free cash flow per share. | Assess valuation based on free cash flow. | A P/FCF ratio of 12 suggests investors pay $12 for every $1 of free cash flow. | P/FCF = Price per Share / Free Cash Flow per Share |

| Return on Sales (ROS) | Profitability | Measures the percentage of revenue that remains as profit after all expenses. | Assess overall profitability. | An ROS of 12% means 12% of revenue is profit after all expenses. | ROS = Net Income / Total Revenue |

Case studies:

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- How Does Google Make Money? It’s Not Just Advertising!

Other business resources:

- Types of Business Models You Need to Know

- The Complete Guide To Business Development

- Business Strategy Examples

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

- What is Growth Hacking?

- Growth Hacking Canvas: A Glance At The Tools To Generate Growth Ideas

Connected Financial Concepts

Read next:

- Accounting Equation

- Financial Statements In A Nutshell

- Cash Flow Statement In A Nutshell

- How To Read A Balance Sheet Like An Expert

- Income Statement In A Nutshell

- What is a Moat?

- Gross Margin In A Nutshell

- Profit Margin In A Nutshell

Main Free Guides:

- Business Models

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

What is included in the balance sheet?

The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity). That means that in order to acquire an asset a company will use either liability (short or long term debt) or equity (capital endowments),

What is a balance sheet example?

What are the 5 basic accounting principles?

– Economic entity assumption: If you have a business, even if you are a sole proprietor, the accountant will consider yourself separately from your business.

– Monetary Unit Assumption: The Business activity you undertake is considered in US Dollars.

– Time Period Assumption: a Business activity you undertake can be reported in separated time intervals, such as weeks, months, quarters or fiscal years.

– Cost Principle: If you buy an item in 1980 at $100, it will be reported on your balance sheet as worth $100 today, independently on inflation or appreciation of the asset.

– Full Disclosure Principle: You have to report all the relevant information of the business in the financial statements or the footnotes.

What is the balance sheet used for?

The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired and it helps us assess the financial risk of an organization.

What is the accounting equation?

The accounting equation (assets = liability + equity) describes how a balance sheet works. That means that in order to acquire an asset a company will use either liability (short or long term debt) or equity (capital endowments),