A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company.

In short, we want to select companies, which present the same features as our target firm.

The objective, then, is to understand the competitive context of the organization we’re analyzing.

Joshua Rosenbaum and Joshua Pearl, authors of “Investment Banking,” offer us two main criteria to select our comparable companies:

- The business profile

- And the financial profile

These two profiles will help us find those companies that can be used as comparables for our financial analysis.

| Comparable Company Analysis (CCA) | Description | Analysis | Implications | Applications | Examples |

|---|---|---|---|---|---|

| 1. Comparable Company Selection (CCS) | Identify a set of comparable companies in the same industry or sector to serve as benchmarks for analysis. | – Define criteria for selecting comparable companies, such as industry, size, business model, and geography. – Compile a list of potential comparable companies based on the criteria. – Apply screening and filtering to narrow down the list to a final set of peers. – Ensure that the selected peers closely resemble the target company in terms of business and financial characteristics. | – Establishes a peer group that accurately reflects the market and industry dynamics. – Ensures comparability in terms of business operations, industry exposure, and financial performance. | – Valuation of a publicly traded company using market multiples. – Benchmarking a private company’s financial performance against industry peers. | Comparable Company Selection Example: Choosing a group of technology companies with similar revenue size and growth rates as the target tech firm. |

| 2. Business Description and Industry Analysis (BDIA) | Provide an overview of the target company’s business operations, industry position, and competitive landscape. | – Describe the target company’s core products or services, customer segments, and geographical reach. – Conduct an industry analysis, including market trends, growth prospects, and competitive forces. – Identify key competitors and their market shares. – Highlight the target company’s unique value proposition and competitive advantages. | – Offers a comprehensive understanding of the target company’s industry context and competitive position. – Facilitates the assessment of how the company fits within the broader market landscape. | – Evaluating a startup’s market potential and competitive position in a pitch presentation. – Assessing a mature company’s industry positioning for strategic planning. | Business Description and Industry Analysis Example: Providing an overview of a fintech company’s business model and its competitive position in the evolving financial technology sector. |

| 3. Financial Statement Analysis (FSA) | Analyze the historical financial performance and position of both the target company and comparable peers. | – Review financial statements (income statement, balance sheet, cash flow statement) for the target company and comparable peers. – Calculate and compare key financial metrics and ratios, such as revenue, EBITDA, net income, debt levels, and profit margins. – Identify trends and patterns in financial performance over multiple years. – Assess the financial stability and creditworthiness of the target and peers. | – Evaluates the financial health, profitability, and operational efficiency of the target company and peers. – Identifies areas of strength or weakness compared to industry norms and peers. | – Determining a fair market value for an acquisition target using financial statement analysis. – Assessing the creditworthiness of potential lending clients in the banking industry. | Financial Statement Analysis Example: Comparing the revenue growth rates and debt-to-equity ratios of a pharmaceutical company with those of its industry peers. |

| 4. Valuation Multiples Calculation (VMC) | Calculate relevant valuation multiples for both the target company and comparable peers to assess relative value. | – Select appropriate valuation multiples, such as Price-to-Earnings (P/E), Price-to-Sales (P/S), or Enterprise Value-to-EBITDA (EV/EBITDA). – Calculate these multiples for the target company and each comparable peer using historical financial data. – Determine the median or average multiples for the peer group. – Compare the target company’s multiples to those of the peers. – Assess any disparities or deviations in multiples. | – Provides a basis for estimating the target company’s fair market value relative to its peers. – Highlights valuation trends and discrepancies within the industry. | – Determining the fair market value of a startup for investment purposes. – Assessing the relative attractiveness of publicly traded stocks for investment decisions. | Valuation Multiples Calculation Example: Calculating the P/E ratio for a retail company and comparing it to the P/E ratios of other retail peers in the industry. |

| 5. Implications and Decision (ID) | Interpret the results of the CCA and make informed decisions regarding the target company’s valuation and strategic direction. | – Interpret the valuation multiples, financial metrics, and industry positioning derived from the analysis. – Consider the implications of the findings on the target company’s market positioning, competitive strategy, and potential areas for improvement. – Make decisions based on the relative valuation and competitive standing of the target company within the industry. | – Informs stakeholders about the target company’s relative valuation and competitive position. – Guides decisions on pricing, mergers and acquisitions, investment, or strategic planning. | – Making investment decisions by comparing the valuations of multiple potential acquisition targets. – Advising a company on its market positioning strategy based on industry analysis. | Implications and Decision Example: Recommending a higher valuation for a technology startup based on favorable comparisons with industry peers and growth prospects. |

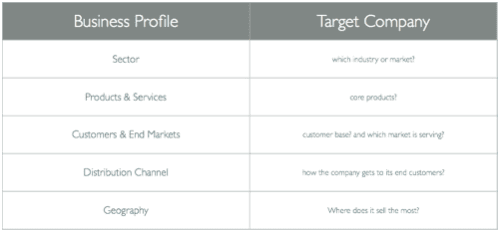

Business Profile

The business profile attains to qualitative aspects of the business, which we can synthesize in five properties:

Sector

In what sector does the target company operate?

Product and services

What are the core products and services the target company offers?

Customers and end markets

What’s the customer base? And which market is the company serving?

Distribution channel

How does the target company get to its end customers?

Geography

What is the main market where our target company operates?

For instance, Apple Inc. operates in the consumer goods category and electronic equipment category. Its main products are iPhone, iPod, MAC (which make up most of its revenues).

Apple Inc. distributes its products mainly through its own retails stores and the main market is the U.S. (although the company operates worldwide and currently Greater China also makes up for a good chunk of the company’s sales).

Financial Profile

The financial profile attains to quantitative aspects of the business. We are going to consider five main elements:

Size

Market cap, revenues, net income

Profitability

Average net margin, or gross margin last three or five years

Growth profile

Where does the revenue growth come from? Geography and product analysis

Return on investment

Net Income/Total Assets

Credit profile

What rating was the company assigned lately? Or what level of liquidity the company has?

For instance, Apple Inc. 2015 market cap surpassed $500 billion, with over $230 billion in revenues and over $50 billion in net profit.

As for the profitability, the company showed an average net margin (net income/sales) of 23% in the last five years. Its revenue growth came mainly from one product, the iPhone and one market, Greater China.

Select Comparable: Apple’s case study

It is time to select Apple’s main comparable.

For simplicity’s sake, here I want to highlight the fact that when selected Apple comparable I gave more importance to criteria such as geography, products and services, size, and profitability.

Apple has been able to achieve a dominant position in so many different industries in the tech world, and therefore it has also several direct competitors. For instance, in the smartphone industry, Apple’s direct competitors are Samsung, Sony, Lenovo and so on.

In the personal computer industry, Apple’s main competitors are Microsoft, Dell, HP, and Lenovo. We could go on forever. Although, my assumption here is that de facto Apple’s success was mainly due to its ability to integrate several products through a very intuitive interface that differentiated it from its competitors.

In short, I am assuming that the future battle in the tech industry will be played on the software side, rather than the hardware. Therefore, the two most prominent players, which are competing against Apple in this respect, are Microsoft and Google.

Understand that although the business and financial profiles criteria help use a lot in discerning the competitors of our target company personal judgment is a determinant factor.

For instance, if you believe that the future battle will be played on a different ground you may be tempted to select other comparable for Apple and that is fine. Or you could pick a larger group of comparable than I did. In short, you can personalize the analysis as much as you want if it gives a better picture of Apple’s overall competitive landscape.

CCA Examples In Various Business Verticals

Retail Industry:

- A multinational fashion retailer is conducting a CCA to assess its financial performance.

- The company selects comparable retailers with similar business profiles (e.g., fashion apparel, multi-brand stores) and financial profiles (e.g., annual revenue, gross margin).

- The analysis helps the retailer benchmark its same-store sales growth, inventory turnover, and e-commerce penetration against industry peers.

- Key financial metrics include operating margin, inventory turnover, and revenue per square foot.

- Business profile aspects include product categories, target demographics, geographic reach, and online vs. brick-and-mortar presence.

Tech Startups:

- A tech startup specializing in AI-driven chatbots is seeking venture capital funding.

- To justify its valuation, the startup conducts a CCA and identifies similar startups in terms of industry focus (e.g., AI, chatbots), customer base (e.g., B2B, e-commerce), and funding stage.

- The analysis showcases the startup’s competitive edge by comparing factors like customer acquisition cost (CAC), monthly recurring revenue (MRR), and churn rate.

- Business profile aspects encompass product offerings, target industries, customer segments, and scalability potential.

- Financial profile elements include funding rounds, revenue growth, and burn rate.

Banking Sector:

- A regional bank is considering merging with a neighboring financial institution.

- As part of due diligence, the bank conducts a CCA to assess compatibility.

- Comparable companies are selected based on business profiles (e.g., retail banking, asset management) and financial profiles (e.g., total assets, return on equity).

- The analysis identifies potential synergies in branch networks, customer base, and operational efficiencies.

- Financial metrics of interest include net interest margin (NIM), non-performing loan (NPL) ratios, and Tier 1 capital adequacy.

- Business profile aspects include service offerings, geographic footprint, customer demographics, and digital banking capabilities.

Pharmaceutical Companies:

- A pharmaceutical company seeks to evaluate its market position in the oncology therapeutic area.

- It performs a CCA by identifying comparable companies with a focus on oncology drugs and similar financial characteristics.

- The analysis compares research pipelines, drug development timelines, and market share.

- Key financial metrics assessed include R&D expenditure as a percentage of revenue, revenue from flagship drugs, and EBITDA margins.

- Business profile aspects encompass drug portfolios, clinical trial phases, target patient populations, and global presence.

- The analysis helps the company strategize for portfolio expansion and competitive positioning.

Automotive Industry:

- An automotive manufacturer is expanding its electric vehicle (EV) offerings.

- It conducts a CCA by comparing its EV lineup to established EV manufacturers like Tesla.

- Comparable companies are selected based on product range, production capacity, and revenue from EV sales.

- The analysis assesses factors such as battery technology, charging infrastructure, and global EV market share.

- Financial metrics of interest include revenue from EVs, research and development investments in EV technology, and vehicle delivery volumes.

- Business profile aspects include EV models, target customer segments, charging networks, and sustainability initiatives.

Fast Food Chains:

- A fast-food chain aims to evaluate its performance relative to peers.

- A CCA is conducted by selecting comparable chains in the quick-service restaurant (QSR) segment.

- Criteria include product offerings (e.g., burgers, fries), international presence, and revenue per store.

- The analysis benchmarks same-store sales growth, franchise expansion strategies, and menu innovation.

- Key financial metrics assessed include average transaction value, operating margin, and franchise fee revenue.

- Business profile aspects encompass menu diversity, marketing strategies, store formats, and sustainability initiatives.

Energy Sector:

- An energy company plans to optimize its renewable energy project investments.

- It performs a CCA by comparing itself to renewable energy peers with similar business focuses (e.g., solar, wind).

- Financial metrics such as project revenue, EBITDA margins, and project pipeline size are evaluated.

- The analysis assesses renewable energy project types, geographic presence, and regulatory environments.

- Business profile aspects encompass project development capabilities, renewable energy portfolio diversity, and environmental commitments.

SaaS Companies:

- A SaaS company aims to attract investors by justifying its valuation.

- It conducts a CCA by selecting peers in the SaaS industry with similar subscription models, customer segments, and recurring revenue growth.

- The analysis showcases the company’s scalability, customer acquisition efficiency, and product innovation.

- Key financial metrics assessed include annual recurring revenue (ARR), customer churn rate, and customer lifetime value (CLTV).

- Business profile aspects encompass software applications, target industries, integration capabilities, and global reach.

Telecommunications:

- A telecom operator is evaluating its network infrastructure investments.

- A CCA is conducted by comparing the operator to peers with a focus on 5G technology deployment, subscriber growth rates, and capital expenditure efficiency.

- The analysis identifies best practices in network rollout and cost optimization.

- Financial metrics of interest include capital intensity (capex/revenue), average revenue per user (ARPU), and spectrum holdings.

- Business profile aspects encompass network technologies, coverage areas, 5G roadmap, and strategic partnerships.

Hospitality Industry:

- A hotel chain assesses its performance in the luxury hospitality segment.

- A CCA is performed by selecting comparable luxury hotel brands.

- Criteria include average daily rates (ADR), occupancy rates, and guest satisfaction scores.

- The analysis benchmarks room revenue, guest loyalty programs, and service offerings.

- Key financial metrics assessed include RevPAR (revenue per available room), GOPPAR (gross operating profit per available room), and average length of stay.

- Business profile aspects encompass hotel amenities, target clientele, marketing strategies, and sustainability practices.

Agricultural Equipment Manufacturing:

- An agricultural equipment manufacturer plans global expansion.

- A CCA is conducted by comparing the manufacturer to peers with a similar product portfolio (e.g., tractors, combines).

- Financial metrics such as market share, revenue growth, and profitability are assessed.

- The analysis identifies market-specific opportunities and competitive advantages.

- Business profile aspects encompass product range, distribution channels, customer support, and aftermarket services.

Airlines:

- An airline company assesses its competitiveness in the low-cost carrier (LCC) segment.

- A CCA is conducted by comparing the airline’s routes, fleet size, load factors, and operating costs to other LCCs.

- The analysis identifies potential route expansion opportunities and cost optimization strategies.

- Key financial metrics assessed include cost per available seat mile (CASM), revenue per available seat mile (RASM), and load factor.

- Business profile aspects encompass route networks, fleet composition, passenger experience, and ancillary revenue sources.

Financial Services Sector:

A fintech startup aims to assess its competitive standing in the digital payments space.

- The startup conducts a CCA by selecting peers in the fintech industry with similar payment processing solutions and market positioning.

- Criteria include transaction volume, merchant partnerships, and customer acquisition channels.

- The analysis benchmarks transaction fees, payment processing speeds, and fraud prevention measures.

- Key financial metrics assessed include revenue per transaction, customer retention rates, and regulatory compliance costs.

- Business profile aspects encompass payment platforms, integration capabilities, target industries, and geographic expansion plans.

Real Estate Market:

A real estate investment trust (REIT) evaluates its performance in the commercial office space segment.

- The REIT conducts a CCA by identifying comparable REITs with a focus on commercial office properties and similar financial structures.

- Criteria include property portfolio composition, occupancy rates, and lease renewal trends.

- The analysis benchmarks rental income, property maintenance costs, and tenant satisfaction levels.

- Key financial metrics assessed include funds from operations (FFO) per share, net operating income (NOI) growth, and capitalization rates.

- Business profile aspects encompass property locations, tenant industries, lease terms, and asset management strategies.

E-commerce Industry:

An online marketplace seeks to evaluate its competitive position in the global e-commerce market.

- The company performs a CCA by selecting peers with a similar business model (e.g., online retail, third-party sellers) and geographic reach.

- Criteria include product categories, customer demographics, and fulfillment capabilities.

- The analysis benchmarks gross merchandise volume (GMV), customer acquisition costs, and seller commission rates.

- Key financial metrics assessed include revenue growth by region, average order value (AOV), and customer lifetime value (CLTV).

- Business profile aspects encompass platform features, seller support services, international expansion strategies, and brand partnerships.

Automotive Manufacturing:

An electric vehicle (EV) startup evaluates its competitive landscape in the electric sedan market.

- The startup conducts a CCA by identifying EV manufacturers with similar vehicle offerings and technological capabilities.

- Criteria include battery range, charging infrastructure, and autonomous driving features.

- The analysis benchmarks vehicle performance metrics, production scalability, and brand reputation.

- Key financial metrics assessed include EV sales growth, manufacturing costs per unit, and research investment in battery technology.

- Business profile aspects encompass vehicle models, target customer segments, dealership networks, and brand positioning strategies.

Hospitality Sector:

A boutique hotel chain assesses its market positioning in the luxury hospitality segment.

- The hotel chain conducts a CCA by selecting comparable luxury hotel brands with a focus on boutique accommodations and personalized service.

- Criteria include room rates, occupancy levels, and guest satisfaction ratings.

- The analysis benchmarks average daily rates (ADR), revenue per available room (RevPAR), and guest loyalty program benefits.

- Key financial metrics assessed include profitability per guest segment, marketing spend effectiveness, and room revenue contribution by season.

- Business profile aspects encompass hotel amenities, culinary offerings, concierge services, and experiential packages.

Key Highlights

- Purpose and Process: Comparable Company Analysis (CCA) is a method used to understand a target company’s business and financial performance by comparing it to similar companies in the industry. The goal is to identify comparable companies that share similar characteristics for analysis.

- Selection Criteria: The selection of comparable companies is based on two main profiles: the business profile and the financial profile. These profiles help ensure a meaningful comparison between companies.

- Business Profile: Qualitative aspects of the business are considered, including the sector, core products and services, customer base, distribution channels, and geographical presence.

- Financial Profile: Quantitative aspects are analyzed, including size (market cap, revenues, net income), profitability (net margin or gross margin), growth sources (geography, products), return on investment (net income/total assets), and credit profile (rating or liquidity).

- Apple Case Study: The example of Apple is used to illustrate the process of selecting comparable companies. When choosing comparable companies for Apple, criteria such as geography, products and services, size, and profitability are given more importance. Apple’s success is attributed to its integration of products through an intuitive interface, differentiating it from competitors.

- Comparable Selection Process: The selection of comparables involves personal judgment and considerations about the future competitive landscape. The author suggests that personalization of the analysis is possible to provide a more accurate representation of a target company’s competitive landscape.

- Importance of Personal Judgment: While the business and financial profile criteria provide a structured approach, personal judgment plays a significant role in refining the selection of comparable companies. Factors like the future battleground of competition can influence the choice of comparables.

- Customization and Analysis: Comparable Company Analysis can be tailored to suit the specific context of the industry, company, and analyst’s insights. This customization allows for a more comprehensive understanding of a target company’s competitive environment.

| Related Framework | Description | When to Apply |

|---|---|---|

| Industry Classification | – Industry Classification categorizes companies into industry groups based on similarities in products, services, and business models. – Standard industry classification systems such as GICS (Global Industry Classification Standard) or NAICS (North American Industry Classification System) provide a standardized framework for grouping comparable companies. | – Conducting initial screening and selection of comparable companies based on industry peers. – Identifying benchmarking groups or industry cohorts for financial analysis and valuation comparisons. |

| Financial Ratios Analysis | – Financial Ratios Analysis examines key financial ratios and metrics to assess a company’s financial health, performance, and risk profile. – Common financial ratios include profitability ratios, liquidity ratios, leverage ratios, and efficiency ratios, providing insights into various aspects of a company’s business and financial operations. | – Evaluating and comparing the financial performance and position of comparable companies across different dimensions. – Identifying trends, strengths, weaknesses, and areas for improvement relative to industry peers. |

| Revenue and Revenue Mix | – Analyzing Revenue and Revenue Mix involves examining a company’s sources of revenue and the composition of its revenue streams across products, services, geographic regions, customer segments, or distribution channels. – Understanding revenue diversification and concentration helps assess a company’s growth prospects, market exposure, and business model resilience. | – Assessing revenue drivers, growth opportunities, and market penetration strategies of comparable companies. – Identifying revenue sources contributing to overall business performance and evaluating revenue sustainability and predictability. |

| Market Share Analysis | – Market Share Analysis evaluates a company’s market position and competitive standing relative to its peers within the industry. – Market share metrics, such as revenue market share, unit market share, or customer market share, indicate the company’s relative strength or weakness compared to competitors. | – Assessing competitive dynamics and market positioning of comparable companies within the industry landscape. – Understanding market concentration, competitive advantages, and barriers to entry affecting market share dynamics. |

| Operating Margin and Efficiency | – Analyzing Operating Margin and Efficiency focuses on a company’s profitability and operational efficiency metrics, such as operating margin, gross margin, EBITDA margin, and return on assets (ROA) or return on equity (ROE). – These metrics reflect the company’s ability to generate profits from its core operations and utilize its resources effectively. | – Comparing the operational performance, efficiency, and profitability of comparable companies to assess cost management and operational effectiveness. – Identifying opportunities for margin improvement, cost optimization, or operational streamlining relative to industry peers. |

| Capital Structure and Debt Levels | – Examining Capital Structure and Debt Levels involves analyzing a company’s capitalization, debt-to-equity ratio, leverage ratios, and debt maturity profile. – Understanding the company’s capital structure and debt levels helps assess its financial risk, solvency, and ability to meet its debt obligations over the long term. | – Evaluating the financial risk, stability, and leverage position of comparable companies within the industry. – Assessing the impact of debt financing on a company’s cost of capital, financial flexibility, and investment opportunities relative to peers. |

| Cash Flow Generation and Liquidity | – Cash Flow Generation and Liquidity analysis focuses on a company’s ability to generate cash from its operating activities and maintain adequate liquidity to meet short-term obligations. – Key metrics include operating cash flow, free cash flow, cash conversion cycle, and current ratio or quick ratio. | – Assessing the cash flow generation capabilities, liquidity position, and working capital management efficiency of comparable companies. – Identifying liquidity risks, cash flow volatility, or liquidity buffers affecting financial resilience and operational stability. |

| Growth Prospects and Market Outlook | – Evaluating Growth Prospects and Market Outlook involves assessing a company’s growth trajectory, market opportunities, and industry dynamics. – Factors such as market growth rates, industry trends, competitive positioning, and innovation potential impact a company’s future growth prospects and valuation multiples. | – Analyzing growth drivers, market dynamics, and competitive advantages influencing the growth potential of comparable companies. – Understanding industry disruptions, technological advancements, and regulatory changes shaping market outlook and future growth opportunities. |

| Valuation Multiples Comparison | – Valuation Multiples Comparison compares a company’s valuation multiples, such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, or enterprise value-to-EBITDA (EV/EBITDA) ratio, to those of its industry peers. – This analysis helps determine whether a company is undervalued, overvalued, or fairly valued relative to its comparable companies. | – Conducting relative valuation analysis to determine a company’s fair value or assess its valuation attractiveness compared to industry peers. – Identifying valuation gaps, mispricings, or market anomalies for potential investment or divestment decisions. |

| Risk Factors and Contingencies | – Identifying Risk Factors and Contingencies involves assessing a company’s exposure to various internal and external risks that may impact its business operations, financial performance, and valuation. – Common risk factors include market risk, regulatory risk, operational risk, competitive risk, and macroeconomic risk. | – Analyzing risk profiles, risk management strategies, and risk mitigation measures of comparable companies within the industry. – Assessing the impact of risk factors on financial projections, valuation models, and investment decision-making processes. |

Read: Business Analysis: How To Analyze Any Business

Other resources:

- Successful Types of Business Models You Need to Know

- Business Analysis: How To Analyze Any Business

- The Complete Guide To Business Development

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

- What Is Porter’s Five Forces And Why It Matters

- What Is A SWOT Analysis And Why It Is Important

- Always Be Closing: Five Effective Strategies For Closing A Sale

Connected Analysis Frameworks

Failure Mode And Effects Analysis

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework, BCG Matrix, GE McKinsey Matrix, Kotter’s 8-Step Change Model.