The general concept of Bootstrapping connects to “a self-starting process that is supposed to proceed without external input.” In business, Bootstrapping means financing the growth of the company from the available cash flows produced by a viable business model. Bootstrapping requires the mastery of the key customers driving growth.

| Component | Description |

|---|---|

| Definition | Bootstrapping, in the context of startups and entrepreneurship, refers to the practice of building and growing a business using internal resources, personal savings, and revenue generated by the business itself, without relying heavily on external investors or loans. It emphasizes self-sufficiency and sustainable growth. |

| Origin | The term “bootstrapping” originates from the phrase “pulling oneself up by one’s bootstraps,” which signifies self-reliance and resourcefulness. In the business context, it has been used for decades, with entrepreneurs finding creative ways to fund and develop their ventures independently. |

| Principles | – Frugality: Bootstrapping encourages a culture of thriftiness and careful financial management. Entrepreneurs focus on minimizing expenses and making efficient use of available resources. – Revenue Generation: Generating revenue is a priority from the outset. Startups often create products or services that can generate income quickly. – Control: Bootstrapping allows founders to retain full control and ownership of the business, avoiding dilution from external investors. – Sustainability: The goal is to achieve self-sustainability and positive cash flow, ensuring the business can support its own growth. |

| Importance | Bootstrapping is important for startups and entrepreneurs who want to maintain independence and control over their ventures. It offers several advantages, including preserving equity, reducing debt, and fostering financial discipline. It can also be a viable option when external funding is limited or unavailable. |

| Benefits | – Independence: Founders retain full control of their business and decision-making. – Ownership: There is no dilution of ownership or equity distribution to external investors. – Financial Discipline: Bootstrapping promotes financial discipline and resource efficiency. – Sustainable Growth: The focus on revenue generation supports sustainable growth. – Risk Mitigation: Reduces reliance on external funding, minimizing financial risk. |

| Drawbacks | – Limited Resources: Bootstrapping may limit the resources available for rapid expansion. – Slower Growth: Growth may be slower compared to ventures with substantial external funding. – Risk: Entrepreneurs bear the full financial risk, and failure can result in personal financial loss. – Resource Constraints: Limited resources may restrict marketing, hiring, and development efforts. |

| Contemporary Relevance | Bootstrapping remains relevant in the contemporary startup ecosystem, particularly for software startups, small businesses, and service-oriented ventures. It aligns with the “lean startup” philosophy, emphasizing efficient resource allocation and rapid iteration. |

| Applications | Bootstrapping is applied by startups and entrepreneurs across various industries, including technology, e-commerce, consulting, and creative services. It is suitable for businesses with lower initial capital requirements or those that can generate revenue quickly. |

| Examples | – Basecamp: The software company Basecamp (formerly 37signals) bootstrapped its way to success, creating project management and collaboration tools. – MailChimp: Email marketing platform MailChimp initially relied on bootstrapping before accepting external funding. – Atlassian: The software company Atlassian started with minimal external investment and grew into a multi-billion-dollar enterprise. |

Inside the Bootstrapper Bible

A bootstrapper isnʼt a particular demographic or even a certain financial situation. Instead, itʼs a state of mind.

That is how Seth Godin described bootstrapping in his “The Bootstrapper Bible.”

As firms that are venture capital-backed get so much media attention, it’s easy to miss the other 99% of businesses out there that made it and that built a sustainable business model by bootstrapping.

That’s because, by definition, firms that are looking for venture capital need continuous PR coverage to play the “look cool game” to ease the hand in the pocket of the venture capitalist next door.

Thus, it’s easy to forget the army of entrepreneurs that from day one decide to go the other route and first build a viable business model, then and when they feel the time is right (if it ever is) take outside money to scale the business.

Let’s start with a simple definition of bootstrapping.

What is bootstrapping?

The general concept of Bootstrapping connects to “a self-starting process that is supposed to proceed without external input.”

In business, Bootstrapping means financing the company’s growth from the available cash flows produced by a viable business model.

This means using customers as the primary source of cash to grow the business.

The bootstrapping process is critical when building up a new company.

It enables us to reach product/market fit without relying on external money, which might distract the founders from the customer development journey.

But are all businesses made to be bootstrapped?

Not all businesses can bootstrap

It is essential to distinguish between companies with very high entry barriers and those without.

Indeed, due to regulations, technological development, or capital requirements, in general, bootstrapping might hardly become feasible.

If you’re building up a new technology in a whole new market, no matter how good you are, there will be no customers for years to come.

That is because the development of that market requires that technology be mature.

It also requires an ecosystem to develop.

Therefore, in these cases, bootstrapping is not only not a good idea, but it’s not viable.

In that scenario, you’ll need outside capital and substantial resources to keep going for years before seeing the first customer.

Instead, if you’re launching a business in an existing market where other business models proved viable, bootstrapping is the way to go.

Thus, you want first to understand the playground you’re in to identify the best way to go. Steve Blank identifies four main types of markets:

Existing markets

Usually well-defined with existing customers and well-known competitors.

This is straightforward, and there isn’t necessarily a dominant player or monopoly in this kind of market.

Re-segmented markets

When a market, for instance, is taken over by one or a few companies (monopoly or duopoly), re-segmentation is the way to go.

Thus you enter by addressing a need that other dominating businesses can’t tackle.

This way, you can distinguish your brand (think of the case in which you target a specific niche of that existing market).

We discussed several times how DuckDuckGo entered the search engine market relatively late, and when Google was already a monopoly by targeting a specific niche, users’ who cared about privacy.

Clone markets

This is about copying existing business models to transpose them either in other markets (think of how Baidu built its fortune in China due to the impossibility of Google taking off).

Or taking a successful business model in a market and transposing it into an adjacent one.

Think of the “uberization” of several industries.

New markets

In this scenario, your solution is such a novelty that it is tough to identify a potential customer or competitor.

Now, if you find yourself in a new market or trying to clone an existing business model in a clone market, where regulations might make it capital-intensive to enter, bootstrapping is not the way to go.

That’s because the market type and, therefore, the territory will determine the kind of company you can build, at least in short term.

However, assuming you are in an existing market or a re-segmented market, that is where the opportunity lies for bootstrapping your company.

Let’s now dive into what bootstrapping means, what its commandments are, and why it makes sense.

The Bootstrapper’s commandments

In thebootstrappersworkshop.com Seth Godin sets the commandments for the bootstrapper.

He highlights the posture of a bootstrapper:

- Ship real work.

- Do it now. Not later.

- Serve clients that are eager to pay for what you do.

- Resist the urge to do average stuff for average people.

- Build and own an asset that’s difficult to reproduce.

- Scale is not its own reward.

- Charge a lot and be worth more than you charge.

- Create boundaries for yourself about what you do (and don’t do).

- Become ever more professional.

Those principles are fundamental to internalize.

Bootstrapping is difficult, as you’re developing the business without outside resources.

Thus, you need to be very good at understanding what’s your market, who your niche is, and what the customers in that niche want.

That’s because customers are your investors.

Customers are your investors

In bootstrapping mode, you don’t have venture capitalists giving you a free ride to get clear about your business.

Therefore, customers purchasing what you make will be your investors.

It is essential to highlight that.

Also, other key partners will act as investors.

Your suppliers also invest in the business if they extend the credit terms.

Your employees are your investors if they work extra hours to get the business off the ground.

Those are all key players that will make your business model viable.

The company’s vision is in your hands

Another thing to understand about bootstrapping is you won’t rely on someone giving you the vision for your business.

You’ll need to have a clear vision and mission for where you want to go.

As you’re not taking outside money, you will be in control and in charge of your business, which requires a lot of focus.

Focus as the North Star

I am a bootstrapper. I have initiative and insight and guts, but not much money. I will succeed because my efforts and my focus will defeat bigger and better-funded competitors. I am fearless. I keep my focus on growing the business—not on politics, career advancement, or other wasteful distractions.

This is what Seth Godin says in his “The Bootstrapper Bible.”

A bootstrapper can’t lose focus. Money is scarce at the beginning, and either she manages to build a profitable business early on, she risks failing.

Speed of execution

My secret weapon is knowing how to cut through bureaucracy. My size makes me faster and more nimble than any company could ever be.

Once again, Seth Godin makes a good point when he mentions that a bootstrapper needs to focus on being faster and more agile and avoid bureaucracy or politics.

Where the founder who took a substantial investment from venture capital might be in the position of having to show how she is putting that money in motion.

The bootstrapper has nothing to prove except that building a viable business model for the employees and the customers.

Mastery and Passion

When you build a company, especially in a re-segmented market, you better be passionate and be willing to master that niche.

Otherwise, it will be hard to gain a strong position where incumbents already have an established brand.

In short, you want to look at being the best in the world for that vertical, which requires a lot of mastery.

A little to lose but a lot to gain

As you bootstrap your way up. You’ll initially have very little to lose.

That’s because you don’t have an established business model.

And where incumbents can’t tweak their business model, as they would risk killing their cash cow – think of the case of Google (now Alphabet).

If it were to stop tracking users, it would lose its advertising business which makes up most of its revenues.

You can go all the way in. You can experiment with your business model and make money in unconventional ways.

I like to call these asymmetric bets, as you have a significant potential upside and a limited downside.

Salesmanship

If you’re bootstrapping your way up, you need to understand you are the most critical salesman of the company.

Thus, you need to understand your market, your customers, and why your solution makes sense to them.

You need to be able to communicate it.

It would be best if you talked to your community regularly, and that is how you enable bootstrap.

In it for the long-term

A bootstrapper is in it for the long term.

As we’ve seen, bootstrapping requires mastering and passion.

And those don’t go along with short-term thinking.

Bootstrapping is about survival

A lot of this manifesto is about survival. A true bootstrapper worries about survival all the time. Why? Because if you fail, itʼs back to company cubicles, to work you do for someone else until you can get enough scratched together to try again.

Once again, Seth Godin highlights a critical point in “The Bootstrapper Bible,” there is no alternative to the failure of your business.

That is why you need to be paranoid about survival.

Start from a proven business model

You don’t have to reinvent the wheel to be a successful bootstrapper.

You can start from a proven business model and copy it.

Copying a business model won’t get you far, so you’ll need to add your twist or improve X times on that existing business model.

You can start by looking at how existing companies organized their distribution, sales, and marketing and how they positioned themselves to bootstrap your way up.

Differentiate from the incumbent

The fact that a company controls a market limits competition.

However, usually, that same company won’t be able to satisfy the whole market.

If you’re good at listening to those people who are not satisfied with the incumbent, you can build a business on top of that.

Thus, be careful about what opportunities an existing market hides.

You might think that as a market is dominated by a prominent player, a monopolist, you have fewer chances.

However, you’ll find out this is far from reality.

The longer a company has been monopolized, the more it might have imposed unfavorable conditions on its end customers, which might grow unsatisfied over time.

What the bootstrapper has that the big corporations don’t?

As we have seen so far, the bootstrapper starts from an unfavorable position regarding money and human capital.

However, the bootstrapper also has a few unfair advantages.

It is focused, is fast in executing, has nothing to lose, and can grow its brand equity quickly due to an intimate relationship with its customers and the ability to charge higher prices if going for a niche.

Coupled with the inability of the large corporation to cover that niche.

Beware, a bootstrapper is not a freelancer, but an entrepreneur

A freelancer sells her talents. While she may have a few employees, basically sheʼs doing a job without a boss, not running a business.

In “The Bootstrapper Bible,” Seth Godin highlights the critical difference between the bootstrapper, which is by nature an entrepreneur, and a freelancer.

In today’s world, that might be easily confused. But Seth Godin helps us understand the difference:

An entrepreneur is trying to build something bigger than herself. She takes calculated risks and focuses on growth. An entrepreneur is willing to receive little pay, work long hours, and take on great risk in exchange for the freedom to make something big, something that has real market value.

When to play the venture capital game?

Source: blog.leanstack.com

In my interview with Ash Maurya, we looked at when it made more to look for money from venture capitalists.

And it was clear that the best time for that is scale.

As we’ve seen, scale is not a prerogative of the bootstrapper, which is, in the first place, building a business for the long haul.

However, if the bootstrapper decides that it makes sense to scale the business further, at that point, when product/market fit has been achieved, money and the competence of a venture capitalist might help.

It is worth mentioning that if you get to that stage, you’re in a desirable place.

That’s because you managed to pass the most challenging obstacle of an entrepreneur’s path (the product/market fit), and now you have the option to keep growing organically or scale.

In that circumstance, you’ll be able to negotiate the best deal to secure capital and keep control of your company.

In a few cases, even when product/market fit is achieved, the business might still be in jeopardy if the competition has picked up quickly, as scale might become a necessary condition to survive.

In that scenario, you either plan for an exit or get ready to blitzscale!

Scale requires money, and network effects

After product/market fit, you proved your business model at the point where money, which before was secondary, becomes critical.

That’s because scaling becomes a game of dominating a larger and larger share of a market.

Let’s be clear, scaling up is often a matter of choice. And as you scale, you might lose or change your initial vision.

Also, scale requires (especially in industries dominated by regulations) a strong network of people that can help pass and involve prominent stakeholders.

Thus, it makes sense to reanalyze the market and see how it has changed in that scenario.

If competition still enables you to keep growing organically, you can keep bootstrapping your way up.

If market conditions have changed, that is where you want to look at money as a way to defend your position by scaling or niching down again!

How MailChimp bootstrapped to over $700 million in revenues

How did MailChimp grow from scratch to $700 million in revenues (as of 2019)?

That would require a whole book. Yet, as a quick intro, MailChimp’s founders had a web design agency focusing on enterprise clients. And by the early 2000s, they had designed an email marketing service for small businesses.

Therefore, initially, they used the money from the web design agency to fund MailChimp.

And only in 2007 would they shut down the web design agency to focus a hundred percent of their time on MailChimp.

It took them another couple of years to transition MailChimp from an email marketing tool to become what they call an all-in-one Marketing Platform with a set of other functionalities.

In September 2009, MailChimp went freemium. Its user base went to in one year to 450,000 users.

Ever since, MailChimp has grown into a successful company.

Later on, MailChimp would use freemium as a growth strategy. However, MailChimp didn’t start as a freemium.

When they launched the company in 2001, they didn’t even have a free trial.

They didn’t have a clue what freemium was.

They only started to consider the freemium when they realized that each paying customer could sustain at least nine unpaying customers.

As remarked by MailChimp:

We’d never consider freemium until our “1” was big enough. Enough to pay for 70+ employees, their health benefits, stash some cash for the future, etc.

They leveraged their data to decide what pricing made more sense to them.

As highlighted on drift.com by co-founder and CEO of MailChimp, Ben Chestnut:

Ever since inception, I’ve been fascinated with the art and science of pricing. I’ve tinkered with pay-as-you-go and monthly plans for $9, $9.99, $25, $49, $99.99 and so on. We’ve changed our pricing models at least a half-dozen times throughout the years, and along the way we tracked profitability, changes in order volume, how many people downgraded when we reduced prices, how many refunds were given, etc. We’re sitting on tons of pricing data. When we launched our freemium plan in 2009, you betcha we used that data to see what would happen if we cannibalized our $15 plan. If we had started with freemium at ground zero, the story would’ve been different.

From there, the company kept building a loyal user base with its free plans, and by already having a solid paying customer base, it could also afford to add features to its marketing platform and make its SaaS product sticky.

In the meantime, the freemium offering enabled MailChimp to grow its user base quickly (the year after the launch, MailChimp’s user base grew by 5x, its paying customers by 150%, and its profits by 650%).

Over the years, MailChimp focused on expanding its capabilities of MailChimp to have it become more and more of a marketing platform.

As a quick recap:

- MailChimp founders used the resources from their web design agency to develop a scalable product. Email software for small businesses.

- It took them a few years before the founders could shut down the web design agency and focus a hundred percent on MailChimp.

- The company focused for almost a decade on building a sustainable customer base, able to potentially cover the cost of a forever-free plan.

- By 2009, MailChimp launched its forever-free plan, quickly expanding its user base, paying customers, and profits.

- The next decade would be spent developing more and more features to make MailChimp more of an all-in-one marketing platform rather than just an email software company.

Over time MailChimp became so valuable that Intuit bought it for $12 billion in 2021!

Airbnb: the most exemplary bootstrapping case study

Back in 2008, venture capitalist Paul Graham wrote a piece entitled “Why To Start A Startup In A Bad Economy“

He remarked on a few key points on why resourceful people should start a company during a recession or a bad economy.

About a month after I wrote that essay, we funded a company called Airbed and Breakfast.

And one of the reasons they started to grow during the winter was that, during the recession, hosts needed the money to pay their rent.

Airbnb, at the time, was tapping into the existing travel market.

However, it was proposing a whole new way of doing it.

That didn’t stop them from starting the business.

And together with Paul Graham, they figured out a simple objective, ramen profitability.

As Paul Graham pointed out in a piece “The Airbnbs:”

Ramen profitability is not, obviously, the end goal of any startup, but it’s the most important threshold on the way, because this is the point where you’re airborne. This is the point where you no longer need investors’ permission to continue existing. For the Airbnbs, ramen profitability was $4000 a month: $3500 for rent, and $500 for food. They taped this goal to the mirror in the bathroom of their apartment.

As Airbnb was trying to open a new market within the existing travel industry, they started from a subset of that market.

From the search volume, they knew that New York City was the hottest place for enabling the initial traction of Airbnb, and that is where they focused.

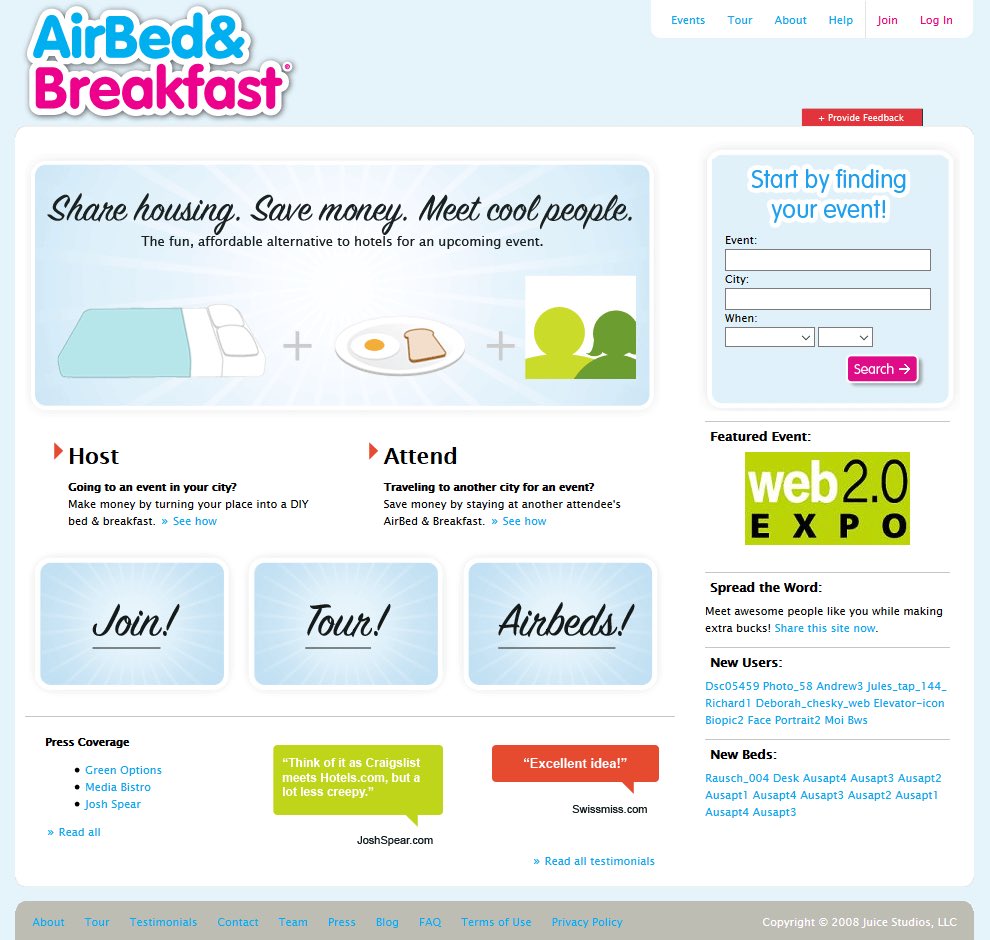

Initially, Airbnb was quite far from the company we know today.

This is how Airbnb looked like in 2008.

Source: Brian Chesky, Twitter

Airbnb’s co-founders went to New York with professional cameras and started meeting hosts and taking pictures of the places, which helped them make the platform more appealing to future guests.

This gave them a perspective into their initial niche, and three weeks since the start of the Y Combinator acceleration program, they managed to become ramen profitable.

Below is the email from Brian Chesky to Paul Graham regarding the rate of bootstrapped growth of Airbnb:

Source: Paul Graham Twitter

This phase of initial traction through bootstrapping to reach ramen profitability was also critical to proving the business’s viability to investors to access further capital for growth.

Key takeaways

- Bootstrapping is about building and growing a business by having customers as critical investors. In short, your business is so fine-tuned around customers that it can grow organically and with high margins, thus financed by them.

- The bootstrapper is an entrepreneur at all effects. She/he doesn’t think of a freelancer but ad an entrepreneur able to build a scalable business. A bootstrapper starts as a solopreneur, but if the business becomes scalable, the bootstrapper will evolve the business model.

- Bootstrapping often starts by identifying profitable niches, or microniches and adding value from there.

Suggested resource

Key Highlights

- Bootstrapping Definition and Mindset:

- Bootstrapping refers to building and growing a business using available cash flows from a viable business model, without relying on external investments.

- Bootstrapping is a mindset and approach that involves self-starting and self-sufficiency.

- Not All Businesses Can Bootstrap:

- Bootstrapping might not be suitable for businesses with high entry barriers, regulatory constraints, or where technology and ecosystem maturity are lacking.

- Businesses in existing markets or re-segmented markets are better suited for bootstrapping.

- Market Types:

- Markets can be categorized into existing markets, re-segmented markets, clone markets, and new markets.

- The type of market influences whether bootstrapping is a viable strategy.

- Bootstrapper’s Commandments:

- Seth Godin outlines principles for bootstrappers:

- Focus on shipping real work promptly.

- Serve eager paying clients.

- Avoid average work for average customers.

- Build unique and difficult-to-replicate assets.

- Scale should not be the sole objective.

- Charge appropriately and deliver value.

- Set boundaries and be professional.

- Continuously improve and be passionate.

- Seth Godin outlines principles for bootstrappers:

- Customers as Investors:

- In bootstrapping, customers are your primary investors.

- Suppliers, employees, and partners also play a crucial role in investment.

- Founder’s Vision:

- Bootstrappers need a clear and focused vision for their business.

- They are in control of their company’s direction and growth.

- Speed of Execution:

- Bootstrappers are agile and prioritize speed in execution, avoiding bureaucracy.

- Mastery and Passion:

- Bootstrappers need to master their niche and demonstrate passion to differentiate from competitors.

- Long-Term Perspective:

- Bootstrappers are in it for the long haul, focused on building sustainable businesses.

- Survival and Paranoia:

- Bootstrappers are constantly concerned about survival, which drives their decisions.

- Starting from Proven Models:

- Bootstrappers can start with existing business models and add their twist or improvements.

- Venture Capital Timing:

- Bootstrappers might consider venture capital funding for scaling after achieving product/market fit.

- Scaling and Network Effects:

- Scaling requires capital and a strong network, especially in regulated industries.

- Venture capital might become necessary for rapid scaling.

- Case Studies:

- MailChimp’s journey from web design to email marketing and freemium model.

- Airbnb’s resourceful start during a recession, focusing on a niche, and achieving ramen profitability.

Business resources:

- Successful Types of Business Models You Need to Know

- The Complete Guide To Business Development

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

- What is Growth Hacking?

- Growth Hacking Canvas: A Glance At The Tools To Generate Growth Ideas

FourWeekMBA Business Toolbox To Bootstrap Your Business

Asymmetric Betting

- What Is Business Model Innovation And Why It Matters

- Types of Business Models You Need to Know

- Business Strategy: Definition, Examples, And Case Studies

- Marketing Strategy: Definition, Types, And Examples

- Platform Business Models

What does bootstrapping mean in business?

The general concept of Bootstrapping connects to “a self-starting process that is supposed to proceed without external input.” In business, Bootstrapping means financing the growth of the company from the available cash flows produced by a viable business model. Bootstrapping requires the mastery of the key customers driving growth.

Why do some entrepreneurs use bootstrapping?

Bootstrapping is a great way to grow a business organically as it gets financed by the customers. Indeed, bootstrapping is about fine-tuning a business based on its key customers. And as a business grows without outside funding and investments, founders can keep control over the equity, strategy, and vision of the organization.

What is the difference between debt and equity financing?

In debt financing, the company contracts a loan that needs to be repaid with interests. Creditors have the right to claim their credits. With equity financing, investors endow a company with capital. The company doesn’t have to repay the money received. However, equity holders own a piece of the company and earn when dividends are issued, or the equity gains value.