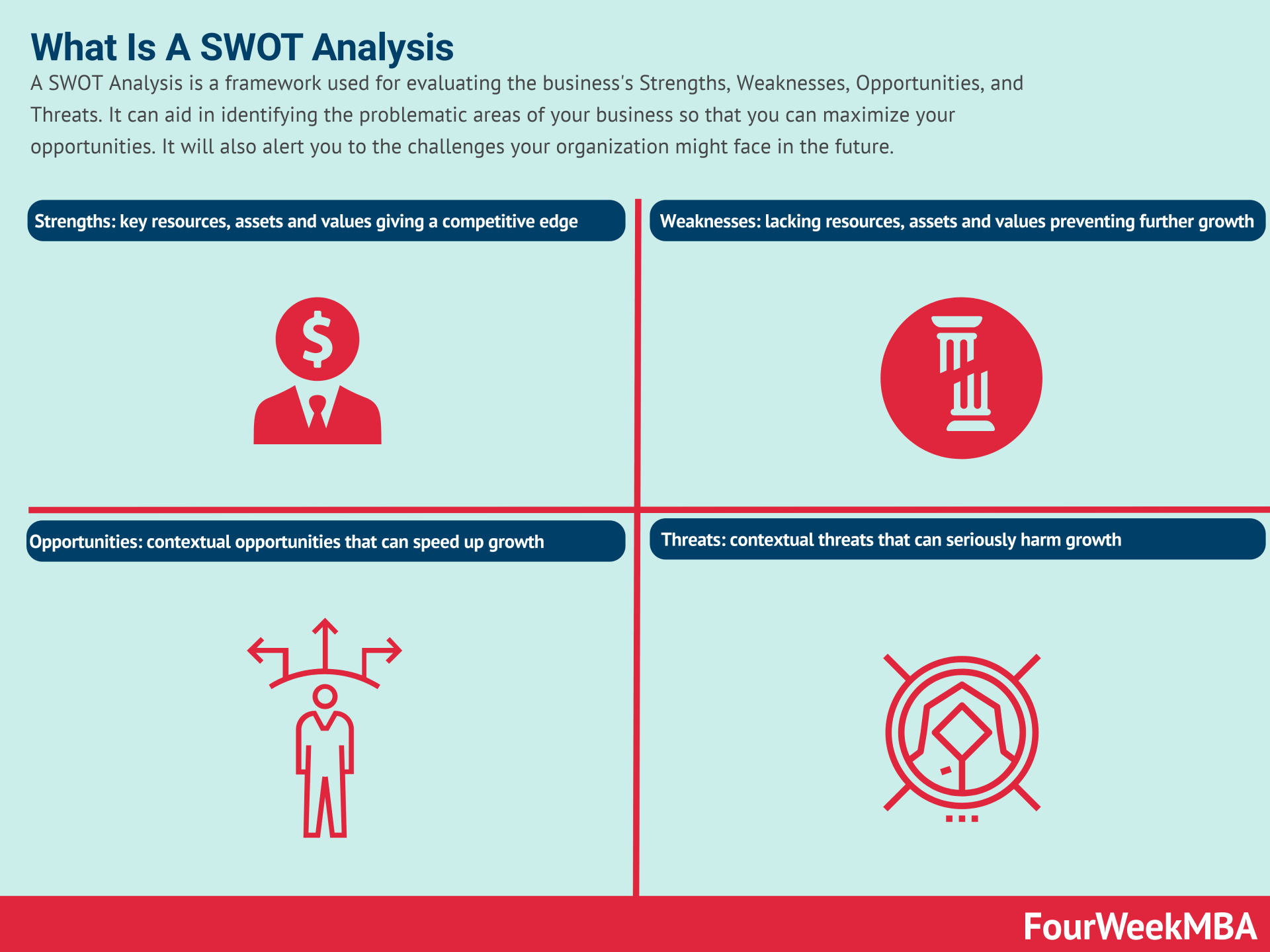

The PESTEL analysis is a framework that can help marketers assess whether macroeconomic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks, such as SWOT, or to gain a broader and better understanding of the overall marketing environment.

| PESTEL Analysis | Description | Analysis | Implications | Applications | Examples |

|---|---|---|---|---|---|

| 1. Overview | PESTEL Analysis is a strategic framework for examining the macro-environmental factors that impact an organization, project, or industry. | – Evaluate the key factors within the categories of Political, Economic, Sociocultural, Technological, Environmental, and Legal. – Analyze how each factor may affect the entity. | – Provides a comprehensive understanding of external influences on strategies. – Guides strategic planning and risk assessment. | – Assessing market conditions before entering a new market. – Evaluating potential risks and opportunities in a specific industry. – Scanning the external environment for strategic planning. | Analyzing the impact of new environmental regulations (Environmental) on a manufacturing company’s operations. Assessing the influence of trade policies (Political) on international trade. |

| 2. Political Factors (P) | Political factors encompass government policies, regulations, and political stability that can influence business operations, trade, and market access. | – Identify and analyze political factors such as government policies, regulations, trade agreements, and political stability that affect the entity. – Consider potential political risks. | – Guides compliance with government regulations and trade policies. – Assesses political risks and their impact on market access and stability. | – Assessing the impact of government regulations (P) on healthcare providers. – Evaluating political stability (P) for investment decisions in foreign markets. – Analyzing the influence of trade agreements (P) on global supply chains. | Recognizing changes in taxation policies (P) and their impact on corporate finances. Assessing the influence of political instability (P) on investment risk in a specific region. |

| 3. Economic Factors (E) | Economic factors encompass economic conditions, trends, and indicators that can impact an organization’s financial performance, consumer behavior, and market dynamics. | – Evaluate economic indicators, inflation rates, interest rates, currency exchange rates, and market conditions affecting the entity. – Assess economic trends. | – Drives financial planning and budgeting based on economic forecasts. – Helps in risk assessment related to economic fluctuations. | – Analyzing consumer spending patterns based on economic conditions (E). – Assessing the impact of inflation rates (E) on pricing strategies. – Evaluating currency exchange rate fluctuations (E) for international business. | Recognizing the potential impact of a recession (E) on consumer spending habits and adjusting pricing strategies accordingly. Assessing the implications of currency devaluation (E) for global market expansion. |

| 4. Sociocultural Factors (S) | Sociocultural factors involve societal and demographic influences on consumer behavior, cultural trends, social attitudes, and lifestyle changes. | – Identify and analyze sociocultural trends, consumer preferences, demographics, cultural shifts, and social attitudes that affect the entity. – Consider potential societal changes. | – Guides marketing strategies and product development based on changing consumer behaviors. – Helps adapt products and services to meet cultural and social preferences. | – Assessing consumer preferences (S) for product launches and marketing campaigns. – Understanding demographics (S) to target specific market segments. – Evaluating cultural shifts (S) that may impact advertising strategies. | Recognizing changing consumer preferences (S) toward healthier food options and adjusting product offerings. Assessing the influence of cultural shifts (S) on fashion industry trends. |

| 5. Technological Factors (T) | Technological factors involve advancements, innovations, and technological trends that can influence an organization’s operations, products, and services. | – Identify and analyze technological innovations, trends, and disruptions that may impact the entity. – Consider the rate of technological change. | – Drives innovation and competitiveness by adopting emerging technologies. – Helps in technology planning and adaptation to industry changes. | – Evaluating the potential of artificial intelligence (T) in streamlining operations. – Assessing cybersecurity threats and measures (T) in technology projects. – Identifying opportunities in the Internet of Things (IoT) (T) for a smart city project. | Recognizing the potential of 5G technology (T) for faster data transmission and its impact on mobile services. Assessing the implications of blockchain technology (T) for secure data management. |

| 6. Environmental Factors (E) | Environmental factors pertain to ecological and sustainability considerations, including climate change, environmental regulations, and ecological trends. | – Identify and analyze environmental regulations, climate change impacts, sustainability trends, and ecological factors relevant to the entity. – Assess environmental compliance. | – Encourages sustainability initiatives and compliance with environmental regulations. – Prepares for the potential effects of climate change on operations. | – Assessing the environmental impact of a manufacturing process (E) and compliance with regulations. – Identifying opportunities for sustainability initiatives (E) in product development. – Evaluating the risk of natural disasters (E) on a project’s location. | Recognizing stricter environmental regulations (E) and the need for sustainable practices in manufacturing. Assessing the impact of climate change (E) on supply chain disruptions. |

| 7. Legal Factors (L) | Legal factors encompass laws, regulations, and legal issues that can affect business operations, contractual agreements, intellectual property rights, and compliance. | – Identify and analyze legal factors, including laws, regulations, industry standards, contractual obligations, and potential legal risks affecting the entity. – Consider legal compliance. | – Ensures compliance with laws and regulations governing the industry. – Helps in managing legal risks, contractual obligations, and intellectual property protection. | – Assessing data protection laws (L) for compliance in a tech startup. – Identifying intellectual property rights (L) for product development and protection. – Evaluating labor laws (L) for HR policies and practices. | Recognizing new data privacy regulations (L) and their impact on data handling practices. Assessing potential patent infringement risks (L) in a new product launch. |

Why does a PESTEL analysis matter?

A PESTEL analysis is one of the tools and frameworks that marketers can use to assess the impact of external market forces on the organization’s growth and profitability over time.

Indeed, the PESTEL analysis becomes a companion to other tools and frameworks, like the SWOT analysis, as it allows one to gain a broader perspective on the overall market and industry where the organization operates.

Too often, marketers fall into the trap of analyzing an organization as it operates in a vacuum.

Understanding macro trends and how those are and will affect the organization is a crucial skill for marketers to gain perspective on the company’s overall marketing strategy.

And to perform a better analysis of the current and future scenario.

This also allows an organization to formulate a better business strategy.

This also helps organizations adapt their business models based on the changing macroeconomic landscape.

Related: Business Strategy: Definition, Examples, And Case Studies

What are the critical components of a PESTEL analysis?

The PESTEL analysis comprises six macro-environmental factors that span from political to legal:

Political

How much is the government involved in the economy or in that particular market? And how much a government policy can influence that?

Economic

How many economic factors, such as interest rates, employment, foreign exchange, unemployment, and other factors, will affect the company’s profitability?

Social

How much do emerging trends or demographics, such as population growth, age distribution, and so on, affect the organization?

Technological

How much technological innovation, development, and disruption might affect a market or the industry in which the organization operates?

Environmental

How much the surrounding environment and the impact of a business on ecological aspects are influencing the organization’s policies as well?

Legal

How will change in legislation affect the organization’s profitability, sustainability, and growth?

Read next: SWOT Analysis

SWOT analysis vs. PEST analysis

The PEST analysis is another tool that businesses can use to evaluate their external environment. It differs from the SWOT analysis in that it evaluates market trends and fluctuations as opposed to a company’s business units.

These trends are arranged into four categories:

- Political – such as future, domestic, and international legislation, government policies, elections, lobbying, pressure groups, wars, and conflicts.

- Economic – such as economic trends, taxation issues, natural disasters, market and commodity price cycles, and exchange rates.

- Social – this includes consumer attitudes, opinions, lifestyles, and the role of the media. Social factors also encompass brand image, fashion and role models, advertising, publicity, and ethical issues.

- Technological – and increasingly important category that includes competing innovations, research funding, patents, licensing, and intellectual property issues.

The PEST analysis is commonly used to evaluate a market and its players from a business or particular proposition standpoint.

Conversely, decision-makers use the SWOT analysis to assess their own business or, in some cases, one or more competitors.

While strategic planning is far from an exact science, many organizations undertake a PEST analysis to identify factors that can be analyzed in a SWOT analysis.

The PEST analysis is also arguably more versatile.

It is most valuable for large corporations with complex market environments but is still useful for smaller businesses as a means of identifying potentially significant issues.

Summarizing the key differences between PEST analysis and SWOT analysis

- The PEST analysis is another tool that businesses can use to evaluate their external environment. It differs from the SWOT analysis in that it evaluates market trends and fluctuations as opposed to a company’s business units.

- PEST analyses are used by businesses to evaluate a market and the players within that market. The SWOT analysis is more of an introspective tool that is used to evaluate the business itself or, in some cases, its competitors.

PESTEL analysis examples

The PESTEL analysis is a tool used by marketers to evaluate the macro-environmental factors that impact the business or its particular industry.

PESTEL is an acronym for six such factors: political, economic, social, technological, environmental, and legal.

The PESTEL analysis is one of the most popular situational analysis methods and is best suited to extremely dynamic markets and business environments.

With that said, let us take a look at some PESTEL analysis examples of two well-known companies.

Tesla PESTLE analysis

Political

As a manufacturer of electric vehicles, Tesla must source battery minerals from countries where there are political risks.

One example is the Democratic Republic of Congo (DRC), where more than 70% of the world’s cobalt is sourced.

The country is characterized by political instability, child labor, conflict, and corruption.

More beneficial political factors unique to Tesla’s business include a government focus on clean energy.

Economic

Tesla has benefitted from the decreasing costs of battery technology thanks in no small part to its own culture of innovation and forward-thinking.

However, the cost of some raw materials remains a concern, as does rising inflation.

States such as California and Nevada have also provided substantial tax subsidies to the company.

Social

Most citizens now appreciate or accept that electric vehicles are an important part of a sustainable future.

This is particularly true of the next generation of young professionals who not only possess environmental values but can also afford a Tesla vehicle in the first instance.

Technological

As hinted at earlier, Tesla is a constant innovator on a never-ending quest to optimize and refine its batteries.

The company has also endeavored to address the number one criticism of electric vehicles: range.

It has removed many of the luxurious features consumers expect in a normal car in favor of better aerodynamics.

The Tesla Model S Long Range Plus, for example, has a range of 402 miles which is industry-leading.

Environmental

Tesla is well-positioned to profit from climate change initiatives and rising standards of battery waste disposal and raw material recycling.

However, the sourcing of these raw materials does not come without an environmental cost.

Tesla is also creating battery packs that can be charged with solar panels instead of coal power plants, with the latter situation contradicting the green credentials of electric vehicles.

Legal

Tesla is not immune from the various legal factors that are inherent to global expansion, such as labor laws, environmental laws, and patents and copyrights.

In the United States, there are also laws against direct selling that force car manufacturers to sell to the consumer via third-party dealerships.

Nike Pestel Analysis Example

Political

Nike, like many global companies, is no stranger to political factors with 533 factories across 41 countries.

Nike has to account for import duties and various other costs that can be destabilized by world events.

Tensions between the United States and China in 2019 saw President Trump threaten to increase tariffs on all footwear by 10%.

Economic

Nike was able to survive the 2008 GFC because of a massive restructure and widespread terminations.

The company also suffered a 38% loss in sales because of COVID-19 closing retail stores.

In response, it redirected its efforts to grow its online presence.

Social

Nike was one of the pioneers of sneaker culture in America.

Thanks to visionary CEO Phil Knight, the company sold running shoes before running as a sport was socially acceptable.

It then partnered with sports stars like Michael Jordan which created a resale market worth billions and keeps the Nike brand top-of-mind for fanatics.

Technological

The mission of the Nike brand is to expand human potential with innovation.

The company runs the Nike Sport Research Lab in Beaverton, Oregon, where advanced research and development occurs in biomechanics, engineering, industrial design, and exercise physiology.

One recent innovation is foot-scanning technology Nike Fit which helps consumers find shoes that fit the unique shape of their feet.

Environmental

Nike is also committed to sustainable innovations that reduce environmental impact.

For one, 75% of all shoes contain recycled material. The company has also pledged to use less freshwater to dye and finish textiles, with 99% of all dye water recycled and not released into water catchments.

Most impressively, 99.9% of all the waste left over from the footwear manufacturing process is diverted away from landfills or incineration.

Legal

In the 1980s, Nike was sued for failing to disclose poor working conditions in “sweatshop” factories in Asia.

The company has also been involved in lawsuits with Adidas and Skechers over various copyright infringements.

Uber Pestel Analysis Example

Political

Uber seems to attract political discourse as soon as it enters a new market. Discussion tends to be centered around culpability in the event of an accident and whether or not Uber drivers need to obtain taxi licenses or comply with minimum wage standards.

The company spent around $2.63 million in 2020 lobbying governments around the world for favorable outcomes in the aforementioned areas.

Economic

As transportation starts to return to normal levels in 2022, the price of fuel has risen accordingly.

This may force Uber to raise its fares and cause consumers to look elsewhere for a ride.

Nevertheless, Uber’s place in the sharing economy – which many believe it pioneered – has the company well placed to grow over the long term.

Social

Uber is active on social media and has broad appeal to consumers across various demographics.

With 20% of Americans expected to be 65 years or older by 2030, the company also has the potential to take advantage of less tech-savvy generations that are perhaps not in its target audience.

In the short term, the shift toward remote work may impact Uber’s bottom line to some extent.

Technological

The introduction of alternative forms of transport such as bikes and scooters has allowed Uber to capitalize on shorter-distance trips.

The features of the Uber app itself are also well documented, allowing consumers to estimate ride costs and track their drivers in real-time.

Technology and high-speed cell networks are vital to the efficient functioning of the company, which makes Uber vulnerable to app issues and network outages.

Environmental

The most obvious environmental factor for Uber is the air pollution vehicles emit and consumer preferences toward greener energy sources.

As part of its Green Future program, the company will help hundreds of thousands of drivers transition to electric vehicles by 2025.

Uber has also made a bold commitment to offering 100% zero-emission rides by 2040 – whether that be traditional rides, micro-mobility, or public transport.

Legal

Uber must work within the bounds of various state and federal laws which has been made more difficult by confusion over the company’s core business model.

It has been subject to minimum wage lawsuits and fines resulting from privacy breaches.

In countries such as France, Uber was fined heavily for operating without the required permits. It was also banned from Germany in 2019 for a similar reason.

Airbus Pestel Analysis Example

- Political – as the primary airline manufacturer in Europe, Airbus will need to navigate Brexit and its associated impact on import duties, export duties, and customs laws. Political instability in Europe and other parts of the world will increase demand for the company’s land, air, sea, space, and cyber combat systems.

- Economic – Airbus has experienced a decline in revenue for the past two years with international travel severely restricted because of COVID-19. Travel is now starting to return to pre-pandemic levels, but rising fuel costs are another economic factor that has the potential to reduce airline patronage.

- Social – while Airbus was forced to reduce its workforce by 15,000 during the pandemic, it is now looking to recruit 6,000 new employees around the world. It remains to be seen whether chronic skilled and unskilled labor shortages will hamper this effort.

- Technological – the company is always looking toward innovation to reduce operating costs and increase engine efficiency. Airbus also believes that artificial intelligence is a key competitive advantage, with core focuses including computer vision, anomaly detection, natural language systems, autonomous flight, and knowledge extraction.

- Environmental – air travel is responsible for around 2.1% of all CO2 emissions and 12% of the total emissions from transport. To counter this, Airbus has the bold ambition to develop the world’s first zero-emission commercial aircraft by 2035. The aircraft is part of an initiative called ZEROe and will be powered by hydrogen.

- Legal – in 2020, Airbus was fined $3.9 billion for using third-party business partners to bribe government officials on its behalf. Among other objectives, the bribes were paid in the United States so that the company could obtain a valuable license to export American military technology. Airbus was also sued by Qatar Airways in a separate incident over a dispute about the surface and paint quality of the A350 aircraft.

Airbnb Pestel Analysis Example

- Political – Airbnb’s political factors are well-publicized, with the company attracting the ire of local governments in many cities. Disputes typically revolve around the company not paying the correct occupancy taxes or failing to abide by safety and zoning laws.

- Economic – like many other companies with a similar reach, Airbnb is affected by currency conversion rates in the countries in which it operates. To a lesser extent, the company has been affected by several major banks in the United Kingdom refusing to finance lenders who plan to turn their properties into accommodation.

- Social – Airbnb’s idea of a shared economy where users can rent out some or all of their homes has been lauded by some and derided by others. While the notion of resource sharing has many benefits, the company’s business model has made the rental housing market more expensive and reduced the number of homes available for rent. Some Airbnb properties also harm the amenity of the local neighborhood with excessive noise a common complaint.

- Technological – each reservation made with Airbnb interacts with the platform’s proprietary machine learning and artificial intelligence technology. This enables smoother search functionality, prevents instances of fraud, and helps hosts optimize their pricing.

- Environmental – in 2018, Airbnb launched the Office of Healthy Tourism initiative to foster authentic, local, and sustainable tourism around the world. The company also notes that 88% of its hosts incorporate green practices such as providing solar energy, eco-friendly transportation such as bicycles, and recycling or composting facilities.

- Legal – as noted earlier, Airbnb is no stranger to political issues in various cities and countries. Officials in Berlin, for example, have created new laws to ban periodic short-term rental accommodation, while existing laws banning stays under 30 days already exist in New York City. However, some cities such as Amsterdam have introduced “Airbnb-friendly” laws to cater to the sharing economy.

PESTEL Analysis vs. STEEPLE Analysis

The STEEPLE analysis is one of several iterations of Aguilar’s original model, which only varies by the order in which factors are analyzed.

These variations include the SLEPT, PESTEL, and PESTLED analyses.

In the STEEPLE analysis, however, there is also a seventh factor that needs to be considered.

The seventh factor deals with common business ethics that can influence both internal employee behavior and external customer, partner, or competitor behavior.

While business ethics is a multifaceted term that is context-dependent, it is based on a general belief that economics should serve man and not the opposite.

Put differently, the actions of companies should not be solely determined by their profit potential.

Ethics also concerns the areas of:

Communication

Companies should tell the truth about their products and services. Greenwashing is an example of poor communication ethics.

Behavior

Ethics also encompasses diverse recruitment practices and the prevention of verbal or physical abuse in the workplace.

Production

Which includes the removal of unsafe working environments, adequate waste recycling, and not profiting from products deleterious to human health (drugs, alcohol, cigarettes, and the like).

This is the key difference between Pestel analysis and STEEPLE analysis.

Amazon PESTEL Analysis Example

Let’s now evaluate the global retail giant Amazon in the context of a PESTEL Analysis by looking at the following external factors:

- P – Political.

- E – Economic.

- S – Social.

- T – Technological.

- E – Environmental.

- L – Legal.

Let’s now perform a PESTEL Analysis on Amazon, addressing each factor in more detail.

Political

Political factors encompass the level of governmental intervention in an economy. This may include policy decisions relating to foreign trade and tax or laws relating to labor or the environment.

As a global retailer, Amazon is not immune to political factors. Politically stable western countries with similar laws to the USA offer Amazon expansion opportunities. However, the company has faced stiff competition in China where the government tends to back Chinese e-commerce companies.

Economic

Economic factors are those that directly impact the performance of the economy.

In turn, these factors influence the profitability of an organization.

Economic factors may include unemployment rates, raw material costs, and foreign exchange rates.

In the wake of the coronavirus pandemic, Amazon has benefitted tremendously from economic stimulus measures that have increased consumer discretionary income. However, this income has also allowed competitors to enter the market.

Social

Social factors describe the general beliefs and attitudes of a population, most often related to cultural and demographical trends. These factors ultimately determine and then drive consumer behavior.

With the shift toward convenient, fast, and contactless delivery, Amazon has again taken advantage. Savvy and computer literate millennial consumers are also driving huge growth in mobile shopping as the availability of 5G networks increases.

Technological

This describes the rate of technological innovation and development and how it might influence a given market.

Digital technology is often the focus, but non-tech companies also look for advances in distribution, manufacturing, and logistics.

Amazon is highly innovative within the retail sector. The company has invested heavily in drones to deliver parcels. It has also created an unattended locker system called Amazon Hub so that consumers can receive parcels when it is convenient for them to do so.

Environmental

In the 21st century, environmental factors are becoming increasingly prevalent. They encompass such things as carbon footprint, waste disposal, and sustainable access to raw materials. Climate change has also meant that businesses must be more adaptable to frequent natural disasters.

As Amazon’s distribution network grows, the company must sustainably address its greenhouse gas emissions. In the United States, Amazon Prime is particularly polluting because of the promise of 1 or 2-day delivery.

Legal

Large organizations that operate in many countries must have a detailed understanding of the laws applicable to each. This is especially true in countries where employment, consumer, tax, and trade law directly impacts on business operations.

Airbus Pestel Analysis Example

- Political – as the primary airline manufacturer in Europe, Airbus will need to navigate Brexit and its associated impact on import duties, export duties, and customs laws. Political instability in Europe and other parts of the world will increase demand for the company’s land, air, sea, space, and cyber combat systems.

- Economic – Airbus has experienced a decline in revenue for the past two years with international travel severely restricted because of COVID-19. Travel is now starting to return to pre-pandemic levels, but rising fuel costs are another economic factor that has the potential to reduce airline patronage.

- Social – while Airbus was forced to reduce its workforce by 15,000 during the pandemic, it is now looking to recruit 6,000 new employees around the world. It remains to be seen whether chronic skilled and unskilled labor shortages will hamper this effort.

- Technological – the company is always looking toward innovation to reduce operating costs and increase engine efficiency. Airbus also believes that artificial intelligence is a key competitive advantage, with core focuses including computer vision, anomaly detection, natural language systems, autonomous flight, and knowledge extraction.

- Environmental – air travel is responsible for around 2.1% of all CO2 emissions and 12% of the total emissions from transport. To counter this, Airbus has the bold ambition to develop the world’s first zero-emission commercial aircraft by 2035. The aircraft is part of an initiative called ZEROe and will be powered by hydrogen.

- Legal – in 2020, Airbus was fined $3.9 billion for using third-party business partners to bribe government officials on its behalf. Among other objectives, the bribes were paid in the United States so that the company could obtain a valuable license to export American military technology. Airbus was also sued by Qatar Airways in a separate incident over a dispute about the surface and paint quality of the A350 aircraft.

Airbnb Pestel Analysis Example

- Political – Airbnb’s political factors are well-publicized, with the company attracting the ire of local governments in many cities. Disputes typically revolve around the company not paying the correct occupancy taxes or failing to abide by safety and zoning laws.

- Economic – like many other companies with a similar reach, Airbnb is affected by currency conversion rates in the countries in which it operates. To a lesser extent, the company has been affected by several major banks in the United Kingdom refusing to finance lenders who plan to turn their properties into accommodation.

- Social – Airbnb’s idea of a shared economy where users can rent out some or all of their homes has been lauded by some and derided by others. While the notion of resource sharing has many benefits, the company’s business model has made the rental housing market more expensive and reduced the number of homes available for rent. Some Airbnb properties also harm the amenity of the local neighborhood with excessive noise a common complaint.

- Technological – each reservation made with Airbnb interacts with the platform’s proprietary machine learning and artificial intelligence technology. This enables smoother search functionality, prevents instances of fraud, and helps hosts optimize their pricing.

- Environmental – in 2018, Airbnb launched the Office of Healthy Tourism initiative to foster authentic, local, and sustainable tourism around the world. The company also notes that 88% of its hosts incorporate green practices such as providing solar energy, ecofriendly transportation such as bicycles, and recycling or composting facilities.

- Legal – as noted earlier, Airbnb is no stranger to political issues in various cities and countries. Officials in Berlin, for example, have created new laws to ban periodic short-term rental accommodation, while existing laws banning stays under 30 days already exist in New York City. However, some cities such as Amsterdam have introduced “Airbnb-friendly” laws to cater to the sharing economy.

Key Highlights

- PESTEL Analysis Overview:

- PESTEL analysis is a framework used by marketers to evaluate macroeconomic factors affecting organizations.

- It assists in identifying threats and weaknesses, informing strategies, and understanding the marketing environment.

- Components of PESTEL Analysis:

- Political: Government involvement and policies’ influence.

- Economic: Factors like interest rates, employment, and exchange rates.

- Social: Demographics, trends, and cultural factors.

- Technological: Innovation and disruption in the industry.

- Environmental: Ecological impact and sustainability.

- Legal: Legislation and its effects on the organization.

- Importance of PESTEL Analysis:

- PESTEL complements tools like SWOT analysis, offering a broader view.

- Helps in adapting business strategies based on changing macroeconomic trends.

- Comparison with SWOT Analysis:

- PEST analysis evaluates market trends, while SWOT focuses on internal factors.

- PEST analysis is used to analyze markets and players, while SWOT assesses a business or its competitors.

- Examples of PESTEL Analysis for Companies:

- Tesla: Examined political, economic, social, technological, environmental, and legal factors affecting the company.

- Nike: Analyzed political, economic, social, technological, environmental, and legal factors influencing the company.

- Uber: Explored political, economic, social, technological, environmental, and legal aspects affecting the ride-sharing platform.

- Airbus: Evaluated political, economic, social, technological, environmental, and legal factors impacting the aircraft manufacturer.

- Airbnb: Investigated political, economic, social, technological, environmental, and legal factors relevant to the lodging platform.

- PESTEL Analysis vs. STEEPLE Analysis:

- STEEPLE analysis adds ethical as an additional factor to PESTEL.

- Ethical factors encompass areas like communication, behavior, and production in business operations.

- Conclusion:

- PESTEL analysis is a vital tool for understanding the external market forces influencing an organization’s growth and profitability.

- It aids in formulating strategies, adapting to changes, and making informed business decisions.

| Comparison’s Table | PESTEL Analysis | SWOT Analysis | STEEP Analysis |

|---|---|---|---|

| Type | Strategic analysis tool used to assess the external environment’s impact on a business or organization. | Strategic planning tool for evaluating an organization’s internal strengths and weaknesses, as well as external opportunities and threats. | Strategic tool for evaluating the external environment by examining social, technological, economic, environmental, and political factors. |

| Components | – Political factors – Economic factors – Socio-cultural factors – Technological factors – Environmental factors – Legal factors | – Strengths – Weaknesses – Opportunities – Threats | – Social factors – Technological factors – Economic factors – Environmental factors – Political factors |

| Purpose | To identify and analyze key external factors that could influence or impact a business or organization’s operations, strategies, or decisions. | To assess an organization’s internal capabilities and vulnerabilities, as well as external opportunities and threats, to inform strategic planning and decision-making. | To assess the broader external context and identify potential risks, opportunities, and trends that could affect the organization’s future success or performance. |

| Focus | Focuses on political, economic, socio-cultural, technological, environmental, and legal factors that may affect the organization. | Focuses on internal strengths and weaknesses, as well as external opportunities and threats, that impact the organization’s performance and competitiveness. | Focuses on social, technological, economic, environmental, and political factors to understand the external environment’s complexities and dynamics. |

| Application | Used to inform strategic decision-making, market analysis, business planning, and risk management processes. | Utilized in strategic planning, business development, market analysis, and competitive positioning activities. | Applied in strategic planning, risk assessment, policy analysis, and market intelligence initiatives. |

| Benefits | – Provides insights into external factors influencing the organization. – Helps anticipate changes in the business environment. – Facilitates strategic planning and decision-making. | – Identifies internal strengths to leverage and weaknesses to address. – Identifies external opportunities for growth and threats to mitigate. – Supports strategic alignment and competitive positioning. | – Offers a comprehensive view of external factors affecting the organization. – Enhances understanding of market trends and dynamics. – Guides strategic adaptation and innovation. |

| Examples | – Analyzing political stability and government policies’ impact on business operations. – Assessing economic indicators such as GDP growth and inflation rates. – Examining socio-cultural trends to understand consumer behavior. – Evaluating technological advancements to identify opportunities for innovation. – Considering environmental regulations and sustainability initiatives. – Analyzing legal factors such as industry regulations and compliance requirements. | – Identifying internal strengths such as strong brand reputation and skilled workforce. – Assessing weaknesses such as limited financial resources and outdated technology. – Identifying opportunities such as market expansion and new product launches. – Analyzing threats such as intense competition and economic downturns. | – Examining social trends like demographics and lifestyle preferences. – Assessing technological developments and their implications for industry transformation. – Analyzing economic factors such as market growth and inflation rates. – Considering environmental concerns and sustainability initiatives. – Monitoring political developments and regulatory changes affecting the business environment. |

What are the key elements of a PESTEL Analysis?

The critical elements of a PESTEL Analysis are:

What's the difference between PESTEL and SWOT Analysis?

The PESTEL analysis differs from the SWOT analysis as it evaluates market trends and fluctuations as opposed to a company’s business units. PEST analyses are used by businesses to evaluate a market and the players within that market. The SWOT analysis is more of an introspective tool used to evaluate the business itself or, in some cases, its competitors.

What's the difference between PESTEL Analysis and STEEPLE Analysis?

The STEEPLE analysis is a similar framework to the PESTEL analysis, with a core difference; the STEEPLE analysis adds a set of factors related to ethical and environmental concerns, thus making it skewed toward a more holistic understanding of the context.

Other case studies

Other connected frameworks

Porter’s Five Forces

SWOT Analysis

BCG Matrix

Balanced Scorecard

Blue Ocean Strategy

Scenario Planning

References:

- Porter’s Five Forces

- SWOT Analysis

- BCG Matrix

- Balanced Scorecard

- Blue Ocean Strategy

- Scenario Planning

Other resources:

- Successful Types of Business Models You Need to Know

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples