Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forces:

- Competition in the industry

- Potential of new entrants into the industry

- Power of suppliers

- Power of customers

- The threat of substitute products

Porter’s five forces is a business framework that can provide a qualitative assessment and come up with a corporate strategy.

| Aspect | Explanation |

|---|---|

| Concept Overview | Porter’s Five Forces is a strategic framework developed by Harvard Business School professor Michael E. Porter. It is used for analyzing and assessing the competitive dynamics and attractiveness of an industry or market. The framework consists of five key forces that collectively determine the level of competition and profitability within an industry. These forces include the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of competitive rivalry. By analyzing these forces, businesses can make informed decisions about market entry, competitive strategy, and profitability. |

| Key Elements | Porter’s Five Forces framework comprises five critical elements: – Threat of New Entrants: This force assesses how easy or difficult it is for new competitors to enter the market. Barriers to entry, such as capital requirements, economies of scale, and government regulations, influence the threat level. – Bargaining Power of Buyers: This element examines the influence that buyers or customers have in determining prices and terms. Factors include the number of buyers, their information access, and switching costs. – Bargaining Power of Suppliers: It assesses the power suppliers have in influencing prices and supply conditions. Factors include supplier concentration, uniqueness of inputs, and the availability of substitutes. – Threat of Substitute Products or Services: This force considers the availability of alternative products or services that could replace those offered in the market. Substitutes’ quality, price, and ease of switching are factors to consider. – Intensity of Competitive Rivalry: This element evaluates the level of competition among existing firms in the industry. Factors include the number of competitors, industry growth rate, and differentiation strategies. |

| Applications | Porter’s Five Forces is applied in various strategic contexts, including: – Market Entry Analysis: It helps businesses assess the feasibility and risks associated with entering a new market or industry. – Competitive Strategy Formulation: Firms use the framework to devise strategies that capitalize on competitive advantages and mitigate threats. – Pricing Strategies: Understanding buyer power and competitive rivalry influences pricing decisions. – Supplier Negotiations: Assessing supplier power helps in negotiation and procurement strategies. – Mergers and Acquisitions: Companies evaluate the competitive landscape and industry attractiveness before engaging in M&A activities. – Investment Decisions: Investors use the framework to evaluate the potential risks and returns of investing in specific industries. |

| Benefits | Embracing Porter’s Five Forces offers several benefits: – Strategic Insight: The framework provides a structured approach to understanding market dynamics and formulating strategies. – Risk Mitigation: It helps identify and assess potential risks and threats to a business’s profitability. – Competitive Advantage: Understanding forces helps companies identify sources of competitive advantage and differentiate themselves. – Informed Decision-Making: It supports informed decision-making, such as market entry, pricing, and resource allocation. – Resource Allocation: Businesses can allocate resources effectively by focusing on areas of competitive advantage. – Long-Term Planning: Companies can develop long-term strategies based on industry attractiveness and competitive pressures. |

| Challenges | Challenges associated with Porter’s Five Forces analysis include: – Dynamic Markets: Industries are subject to rapid changes, making it challenging to assess and predict competitive forces accurately. – Data Availability: Gathering comprehensive data on all five forces may be difficult, especially in emerging markets or niche industries. – Interconnected Forces: The forces are interconnected, and changes in one force can affect others, making analysis complex. – Subjectivity: Assessment of forces may involve subjectivity and interpretation. – Assumption of Industry Homogeneity: The framework assumes industries have similar characteristics, but industries can vary widely. – Disruptive Innovation: The framework may not adequately address disruptive innovations that create entirely new markets. |

| Prevention and Mitigation | To address challenges, businesses can: – Frequent Monitoring: Continuously monitor industry conditions and competitive forces to adapt to changes promptly. – Data Analytics: Leverage data analytics and technology to collect and analyze relevant data for informed decision-making. – Scenario Analysis: Use scenario planning to account for uncertainty and dynamic market conditions. – Collaboration: Collaborate with industry partners to mitigate common challenges and share insights. – Customization: Tailor the framework to suit the unique characteristics of specific industries or markets. – Innovation Readiness: Be prepared to adapt strategies in response to disruptive innovations. |

Breaking down Porter’s five forces

Porter’s five forces help, according to the author, to identify the attractiveness of an industry and whether this might be retained in the long run.

According to Porter, the industry’s attractiveness and competitive positioning (either through cost leadership or differentiation) can help a firm build a competitive advantage.

Competitive rivalry

This force examines the intensity of the competition in the marketplace.

Several factors, such as barriers to entry, the bargaining power of buyers and suppliers, and the threat of substitute products or services, cause competition.

All those factors combined determine the competitive rivalry within an industry and how attractive that is.

Some of the critical elements that Porter takes into account in his book, “Competitive Strategy” are:

- Industry growth.

- Fixed (or storage} costs value-added.

- Intermittent overcapacity.

- Product differences.

- Brand identity.

- Switching costs.

- Concentration and balance.

- Informational complexity.

- Diversity of competitors.

- Corporate stakes.

- Exit barriers.

Barriers to entry

Imagine operating in a business where anyone can become your competitor.

This is a market with no high capital requirement to start a business, and there are no particular regulations to limit entrance from new competitors.

For example, in today’s world, where anyone with internet access can create a blog or website with very few overhead costs, barriers to entry are very low.

Therefore, the competition is fierce, and keeping the market share for too long is tough.

What does determine barriers to entry?

According to Porter, there are some key factors:

- Economics of Scale.

- Proprietary product differences.

- Brand identity.

- Switching costs.

- Capital requirements.

- Access to distribution.

- Absolute cost advantages (Proprietary learning curve, Access to necessary inputs).

- Proprietary low-cost.

- Government policy.

- Expected retaliation.

Bargaining power of suppliers

This force studies the number of suppliers in the marketplace.

Indeed, a smaller number indicates the power of those suppliers to dictate prices.

A more significant number shows no power of those suppliers over price control.

For example, Coca-Cola operates in a market where the suppliers are neither concentrated nor differentiated.

Indeed, Coke ingredients such as caffeine and sweetener can be easily found in the marketplace.

Therefore suppliers, in general, cannot control prices. Other factors that, according to Porter, determine the power of suppliers are:

- Differentiation of inputs.

- Switching costs of suppliers and firms in the industry.

- Presence of substitute inputs.

- Supplier concentration.

- Importance of volume to a supplier.

- Cost relative to total purchases in the industry.

- Impact of inputs on cost or differentiation.

- The threat of forward integration is relative to the threat of backward integration by firms in the industry.

Bargaining power of customers

This is the flip side of the power of the supplier. Imagine a business with very few customers, and switching between one supplier and the other is extremely easy.

Undeniably, this gives total control to customers to set the prices they want.

Returning to our previous example, Coke is mighty to its bottling suppliers.

According to Porter, there are two significant factors affecting the bargaining power of customers:

- Bargaining leverage: perhaps how many buyers (concentration vs firm concentration there is in that industry). The switching costs for the buyer compared to those for the firm and how much information buyers have.

- Price sensitivity: include price/total purchases, Product differences, Brand identity, Impact on quality performance, Buyer profits, and Decision-makers’ incentives.

Threats of substitute products or services

This force examines how easy it is for customers to switch from a product or service to the other.

For example, Coke is mighty in relation to its can manufacturer.

Indeed, competition among can suppliers is fierce. Also, the threat of substitution is very high. In effect, Coke can easily switch to plastic bottles.

That includes

- The relative price performance of substitutes.

- Switching costs.

- Buyer propensity to substitute.

Competitive advantage and competitive positioning, according to Porter

Are Porter’s five forces still relevant today?

Having analyzed the factors that influence an organization through Porter’s five forces, a company can draw conclusions on its corporate strategy and integrate it with its business strategy, to maintain a competitive advantage.

However, it’s important to highlight that the world has changed substantially since the 1980s.

And one force broke down the walls of Porter’s five forces: buyers’ information.

In the previous era, factors that spanned from economies of scale, integration, and distribution played a primary role.

In today’s business world, a core factor flipped it upside down: data and information.

The Internet enabled many innovations.

And yet, at the business level, it helped companies get to know customers in ways that were not possible before (or at least it was not possible to mass customize marketing activities).

And it gave much more information to customers. Indeed, today the matter isn’t much about how much information customers have.

But instead, what information to ignore?

In an era of information overload, easy access to the web and its applications has given customers many options.

With more information on the side of customers, lower switching costs (you can access offers from several competitors in a few clicks), and platform business models, competitive advantages have turned much more inward.

The customer-centered approach (what you see in design thinking, business model innovation, and lean methodologies) has taken over.

And those companies that obsessed over customers also managed to build valuable businesses:

Porter’s forces might still be helpful as an exercise to analyze industries.

Yet, the faster you gather customers’ feedback, the more you will know whether you’re moving in the right direction.

Shorter product cycles, customer-centered frameworks, and lean methodologies have become the rule in this era.

Beyond the five forces and into the Six Forces Model

Another important variation of Porter’s Five Forces Model is the Six Forces Model, where complementary products represent the sixth force.

This force was added throughout the 1990s, when different markets, especially in the tech industries, had been reshaped by innovations, which were seen by consumers as complementary products first, then replaced completely existing products.

Indeed, Andrew Grove, former Intel’s CEO and the father of the OKR Goal-Setting System, in his book “Only The Paranoid Survive,” highlighted how the sixth force – complementary products – was one of the critical forces that determined a complete reshaping of the way of doing business.

And therefore, one of the forces that most (especially in the tech industry traveling at a faster speed compared to other sectors) could change business models, leading to what Andrew Grove called a strategic inflection point.

A point from which the way of doing business would never be the same.

This could become both a significant threat for existing players and an opportunity for new entrants, but also a way for existing dominant players to redefine their business models completely.

That is why it makes sense, especially for companies operating in the tech business world, to map and analyze the context by adding this sixth force.

Case Studies

- Fast Food Industry:

- Competition: Major fast-food chains like McDonald’s, Burger King, and Wendy’s compete fiercely for market share.

- Threat of New Entrants: The fast-food industry has a low barrier to entry, leading to the constant emergence of new local and regional competitors.

- Bargaining Power of Suppliers: Fast-food chains often have significant bargaining power over suppliers, driving down ingredient costs.

- Bargaining Power of Buyers: Customers have a high degree of choice and can easily switch between fast-food options.

- Threat of Substitute Products: Substitutes include home-cooked meals, casual dining, and healthier alternatives.

- Airline Industry:

- Competition: Airlines compete intensely for passengers, often resulting in price wars and route expansion.

- Threat of New Entrants: High capital requirements, regulatory hurdles, and economies of scale create barriers to entry.

- Bargaining Power of Suppliers: Aircraft manufacturers hold significant power in negotiations with airlines.

- Bargaining Power of Buyers: Passengers have some bargaining power, particularly when choosing between airlines.

- Threat of Substitute Products: Substitute transportation options include trains, buses, and, to some extent, teleconferencing.

- Soft Drink Industry:

- Competition: Major players like Coca-Cola and PepsiCo compete globally for market share.

- Threat of New Entrants: Brand loyalty and distribution networks create barriers to entry.

- Bargaining Power of Suppliers: Suppliers of ingredients, like sugar and flavorings, have some power but are often diversified.

- Bargaining Power of Buyers: Retailers, such as supermarkets, can negotiate prices and shelf space.

- Threat of Substitute Products: Substitutes include water, juices, and healthier beverage alternatives.

- Retail Industry:

- Competition: Retailers face intense competition, both from brick-and-mortar stores and e-commerce platforms.

- Threat of New Entrants: E-commerce has lowered barriers to entry, but established retailers benefit from brand recognition and logistics.

- Bargaining Power of Suppliers: Suppliers may have some power, especially for unique or proprietary products.

- Bargaining Power of Buyers: Consumers have high bargaining power, particularly in a saturated retail market.

- Threat of Substitute Products: Online shopping and direct-to-consumer brands are substitutes for traditional retail.

- Pharmaceutical Industry:

- Competition: Pharmaceutical companies compete globally to develop and market drugs.

- Threat of New Entrants: High research and development costs and stringent regulations create entry barriers.

- Bargaining Power of Suppliers: Suppliers of raw materials have limited bargaining power.

- Bargaining Power of Buyers: Health insurers and government agencies exert pressure on drug prices.

- Threat of Substitute Products: Generic drugs often serve as substitutes for brand-name medications.

- Telecommunications Industry:

- Competition: Telecommunication providers compete for customers in areas like mobile services, internet, and cable television.

- Threat of New Entrants: High infrastructure costs and regulatory requirements deter new entrants.

- Bargaining Power of Suppliers: Suppliers of network equipment may have some power.

- Bargaining Power of Buyers: Customers often have limited choices for service providers in their geographic area.

- Threat of Substitute Products: Wireless communication apps and over-the-top (OTT) services like Skype serve as substitutes for traditional telecom services.

- Automotive Industry:

- Competition: Global automakers, such as Toyota, Ford, and Volkswagen, fiercely compete for market share and innovation.

- Threat of New Entrants: High capital requirements, brand loyalty, and economies of scale pose significant entry barriers.

- Bargaining Power of Suppliers: Suppliers of auto parts and components have some power but face competition from other suppliers.

- Bargaining Power of Buyers: Car buyers have varying degrees of bargaining power, influenced by factors like brand loyalty and market competition.

- Threat of Substitute Products: Public transportation, cycling, and ridesharing services are potential substitutes for car ownership.

- Hotel Industry:

- Competition: Hotel chains, independent hotels, and online travel agencies (OTAs) compete for guests and bookings.

- Threat of New Entrants: Entry barriers include capital requirements, location, and established brand presence.

- Bargaining Power of Suppliers: Suppliers of linens, food, and other hotel necessities may have limited bargaining power.

- Bargaining Power of Buyers: Guests have some bargaining power, particularly when comparing prices and amenities.

- Threat of Substitute Products: Alternatives to traditional hotels include vacation rentals, hostels, and Airbnb.

- Pharmaceutical Retail:

- Competition: Pharmacy chains and independent pharmacies compete for prescription and over-the-counter (OTC) drug sales.

- Threat of New Entrants: Regulatory requirements and the need for specialized licenses create entry barriers.

- Bargaining Power of Suppliers: Pharmaceutical wholesalers have some power in supplying drugs to pharmacies.

- Bargaining Power of Buyers: Patients may have limited bargaining power when seeking specific medications.

- Threat of Substitute Products: Online pharmacies and mail-order prescription services are potential substitutes for brick-and-mortar pharmacies.

- Airlines (Low-Cost Carriers):

- Competition: Low-cost carriers like Southwest and Ryanair compete aggressively on price and routes.

- Threat of New Entrants: While barriers to entry are lower for low-cost carriers, they still face challenges in establishing networks and brand recognition.

- Bargaining Power of Suppliers: Aircraft manufacturers have considerable influence over airline companies.

- Bargaining Power of Buyers: Passengers often prioritize price and flexibility when choosing low-cost carriers.

- Threat of Substitute Products: Traditional full-service airlines offer alternatives to low-cost carriers, especially on long-haul routes.

- Fast Fashion Retail:

- Competition: Fast fashion retailers like Zara, H&M, and Forever 21 compete based on rapid inventory turnover and low prices.

- Threat of New Entrants: Entry barriers are relatively low, as fast fashion relies on efficient supply chains and trend responsiveness.

- Bargaining Power of Suppliers: Suppliers of textiles and manufacturing services may have limited bargaining power due to the volume of orders.

- Bargaining Power of Buyers: Fashion-conscious consumers have choices among various fast fashion brands.

- Threat of Substitute Products: High-end fashion brands and second-hand clothing stores can serve as substitutes for fast fashion.

Key Highlights

- Porter’s Five Forces:

- Developed by Michael Porter to understand industries and competition.

- Analyzes industries through five forces: competition, potential new entrants, supplier power, buyer power, threat of substitutes.

- Helps identify industry attractiveness and competitive positioning for a company’s advantage.

- Competition in the Industry:

- Examines intensity of competition within the marketplace.

- Determined by factors like barriers to entry, buyer and supplier bargaining power, and threat of substitute products.

- Barriers to Entry:

- Factors that make it difficult for new competitors to enter the market.

- Includes economies of scale, proprietary product differences, brand identity, capital requirements, and more.

- Bargaining Power of Suppliers:

- Studies the influence of suppliers on prices.

- Factors affecting supplier power include differentiation of inputs, switching costs, supplier concentration, and more.

- Bargaining Power of Customers:

- Examines customers’ control over prices.

- Factors affecting customer power include bargaining leverage, price sensitivity, and switching costs.

- Threat of Substitute Products:

- Analyzes the ease of customers switching to alternative products.

- Determined by relative price performance of substitutes, switching costs, and buyer propensity to substitute.

- Competitive Advantage and Positioning:

- Competitive advantage can be achieved through low cost, differentiation, or focus.

- Companies must choose a clear strategic positioning to avoid being stuck in the middle.

- Relevance Today:

- The business landscape has changed since the 1980s.

- Information and data play a crucial role in shaping competitive advantage.

- Customer-centered approaches, shorter product cycles, and lean methodologies are vital.

- Six Forces Model:

- An extension of Porter’s Five Forces, adding complementary products as the sixth force.

- Especially relevant in tech industries where innovations reshape markets.

- Companion Frameworks:

- Ansoff Matrix, BCG Matrix, Balanced Scorecard, Blue Ocean Strategy, PEST Analysis, Scenario Planning, SWOT Analysis, Growth Matrix, Comparable Analysis Framework, Business Model Canvas, Business Experimentation, Speed-Reversibility Matrix, AIDA Model, Pirate Funnel.

| Comparison’s Table | Porter’s Five Forces | SWOT Analysis | PESTEL Analysis | Competitor Analysis |

|---|---|---|---|---|

| Purpose | Analyze industry attractiveness and competitive intensity. | Assess internal strengths, weaknesses, external opportunities, and threats. | Analyze external factors: Political, Economic, Social, Technological, Environmental, Legal. | Evaluate strengths, weaknesses, strategies, and capabilities of competitors. |

| Focus | External environment and industry structure. | Internal and external factors affecting business performance. | External macro-environmental factors influencing business operations. | Direct competitors and their strategies. |

| Key Features | Focuses on five forces: supplier power, buyer power, threat of new entrants, threat of substitutes, competitive rivalry. | Considers strengths, weaknesses, opportunities, and threats related to the business. | Examines political, economic, social, technological, environmental, and legal factors. | Analyzes competitor strengths, weaknesses, strategies, and market positioning. |

| Application | Strategic planning, industry analysis, market positioning. | Strategic planning, risk assessment, decision-making. | Environmental scanning, strategic planning, risk management. | Strategic planning, market analysis, competitive positioning. |

| Strengths | Provides a structured framework to assess industry attractiveness and competitive dynamics. | Holistic analysis of internal and external factors impacting the business. | Comprehensive analysis of external factors influencing business operations. | Helps understand competitive landscape and develop effective strategies. |

| Weaknesses | Focuses primarily on external factors and may overlook internal capabilities. | May oversimplify complex internal and external dynamics. | Lack of focus on internal factors and strategic capabilities. | Limited to direct competitors and may overlook indirect threats. |

| Scope | External industry environment and competitive forces. | Internal and external factors affecting the organization. | External macro-environmental factors influencing business operations. | Competitors and their strategies within the industry. |

| Emphasis | Industry analysis and competitive strategy formulation. | Internal and external assessment for strategic planning and decision-making. | External environmental analysis for strategic planning and risk management. | Understanding competitive dynamics and formulating competitive strategies. |

Case Study: Coca-Cola vs. PepsiCo

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | Coca-Cola vs. PepsiCo | Intense competition between two major beverage companies in the soft drink industry. |

| Bargaining Power of Suppliers | Key ingredient suppliers for both companies | Both Coca-Cola and PepsiCo rely on suppliers for essential ingredients like sugar, flavorings, and packaging materials. |

| Bargaining Power of Buyers | Retailers and consumers | Retailers have significant power in deciding which products to stock, while consumers can easily switch between brands. |

| Threat of New Entrants | Barriers to entry for new soft drink companies | High barriers, including distribution networks, brand recognition, and economies of scale, make it difficult for new entrants. |

| Threat of Substitutes | Other beverage options (juices, water, tea, etc.) | Consumers have various alternatives to carbonated soft drinks, including healthier options like juices and bottled water. |

Case Study: Apple Inc.

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | Apple vs. Samsung in the smartphone industry | Fierce competition between two major players in the smartphone market, vying for market share and innovation leadership. |

| Bargaining Power of Suppliers | Apple’s relationship with suppliers like Foxconn and TSMC | Suppliers hold significant power due to their importance in manufacturing Apple products and the limited number of alternative suppliers. |

| Bargaining Power of Buyers | Consumer demand for Apple products | High customer loyalty and demand for Apple products give the company leverage over pricing and features to meet consumer preferences. |

| Threat of New Entrants | High entry barriers in the tech industry | Apple benefits from substantial entry barriers, including brand loyalty, R&D investments, and access to distribution channels. |

| Threat of Substitutes | Android-based smartphones and other tech devices | Consumers have choices beyond Apple, such as Android devices, which serve as substitutes for iPhones and iPads. |

Case Study: Walmart

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | Walmart vs. Amazon in retail | Intense competition between Walmart and e-commerce giant Amazon in the retail industry, especially in the online space. |

| Bargaining Power of Suppliers | Walmart’s relationship with product suppliers | Walmart’s size gives it significant bargaining power over suppliers, allowing it to negotiate favorable terms. |

| Bargaining Power of Buyers | Consumer price sensitivity | Walmart’s customer base is highly price-sensitive, giving customers substantial influence over pricing and product offerings. |

| Threat of New Entrants | Barriers to entry in the retail sector | High barriers, including economies of scale and distribution networks, discourage new entrants from competing effectively. |

| Threat of Substitutes | Alternative retail options | Consumers have multiple retail options, both online and offline, providing substitutes for Walmart’s products and services. |

Case Study: Netflix

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | Netflix vs. Amazon Prime Video and Disney+ | Intense competition among streaming platforms, with Netflix, Amazon Prime Video, and Disney+ competing for subscribers. |

| Bargaining Power of Suppliers | Licensing content from media production studios | Netflix negotiates content licensing agreements with media studios, impacting its content library and competitive position. |

| Bargaining Power of Buyers | Subscribers’ ability to switch between platforms | Subscribers can easily switch between streaming services based on content libraries, pricing, and exclusive offerings. |

| Threat of New Entrants | Entry barriers in the streaming industry | High barriers, including content acquisition costs and subscriber acquisition, limit the entry of new streaming platforms. |

| Threat of Substitutes | Traditional cable TV and free content options | Viewers can opt for cable TV or free content platforms as substitutes for streaming services like Netflix. |

Case Study: Microsoft

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | Microsoft vs. Google in the cloud computing market | Intense competition between Microsoft’s Azure and Google Cloud Platform for dominance in the cloud computing industry. |

| Bargaining Power of Suppliers | Microsoft’s partnerships with hardware manufacturers | Microsoft collaborates with hardware manufacturers to supply Windows OS, giving it leverage and a presence in the PC market. |

| Bargaining Power of Buyers | Enterprise customers purchasing software licenses | Large enterprises can negotiate volume discounts with Microsoft for software licenses and services, influencing pricing. |

| Threat of New Entrants | High entry barriers in the software and cloud services industry | Microsoft’s established presence, patents, and proprietary technologies create significant barriers to new entrants. |

| Threat of Substitutes | Open-source software and alternative operating systems | Open-source software like Linux and alternative OS options provide substitutes for Microsoft’s software products. |

Case Study: Amazon Web Services (AWS)

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | AWS vs. Microsoft Azure and Google Cloud Platform | Intense competition among leading cloud service providers, including AWS, Microsoft Azure, and Google Cloud, for market share. |

| Bargaining Power of Suppliers | Relationships with data center equipment suppliers and network providers | AWS’s large-scale infrastructure relies on suppliers for data center equipment and network services, giving it bargaining power. |

| Bargaining Power of Buyers | Enterprise clients and startups procuring cloud services | Enterprises and startups have options to choose cloud providers, impacting pricing, service quality, and contract terms. |

| Threat of New Entrants | High entry barriers in the cloud computing industry | The capital-intensive nature of building data centers, security standards, and established brands deter new cloud entrants. |

| Threat of Substitutes | Private cloud solutions, on-premises data centers, and hybrid cloud configurations | Organizations have alternatives like private clouds, on-premises solutions, and hybrid clouds that serve as substitutes for AWS. |

Case Study: Starbucks

| Force | Example | Description |

|---|---|---|

| Competitive Rivalry | Starbucks vs. Dunkin’ in the coffee industry | Ongoing competition between Starbucks and Dunkin’ in the coffee and quick-service restaurant (QSR) market. |

| Bargaining Power of Suppliers | Coffee bean suppliers and dairy producers | Starbucks relies on suppliers for coffee beans and dairy products; supplier relationships can affect pricing and quality. |

| Bargaining Power of Buyers | Customer preferences and loyalty | Starbucks maintains customer loyalty through rewards programs, influencing buyers’ decisions and brand preferences. |

| Threat of New Entrants | Barriers to entry in the coffee shop industry | High startup costs, real estate requirements, and brand competition make it challenging for new entrants to compete. |

| Threat of Substitutes | Alternatives like home-brewed coffee and tea | Consumers have options to brew coffee or tea at home, or opt for other QSR brands, serving as substitutes for Starbucks. |

Other frameworks from Michael Porter

Porter’s Generic Strategies

Porter’s Value Chain Model

Porter’s Diamond Model

Porter’s Four Corners Analysis

Six Forces Models

Other companion frameworks to Porter’s five forces

Other frameworks that you can use in conjunction with Porter’s five forces are:

Ansoff Matrix

Read: Ansoff Matrix In A Nutshell

BCG Matrix

Read: BCG Matrix

Balanced Scorecard

Read: Balanced Scorecard

Blue Ocean Strategy

Read: Blue Ocean Strategy

PEST Analysis

Read: Pestel Analysis

Scenario Planning

Read: Scenario Planning

SWOT Analysis

Read: SWOT Analysis In A Nutshell

Growth Matrix

Read: Growth Matrix In A Nutshell

Comparable Analysis Framework

Read: Comparable Analysis Framework In A Nutshell

Business Model Canvas

Read: Business Model Canvas In A Nutshell

Business Experimentation

Read: Business Experimentation

Speed Reversibility

The speed-reversibility Matrix, by FourWeekMBA will help you understand how to allocate the resources based on the worst-case-scenario-test.

Read: Speed-Reversibility Matrix

Blue Ocean

Read: Blue Ocean Strategy

BCG Matrix

Read more: BCG Matrix

AIDA Model

Read more: AIDA Model

Pirate Funnel

Read more: Pirate Funnel

What are the 5 Forces of M. Porter's model?

Porter’s Five Forces comprise:

- Competitive rivalry

- Barriers to entry

- Bargaining power of suppliers

- Bargaining power of customers

- Threats of substitute products or services

Andrew Grove, former Intel’s CEO and the father of the OKR Goal-Setting System, in his book “Only The Paranoid Survive,” highlighted how the sixth force – complementary products – was one of the critical forces that determined a complete reshaping of the way of doing business.

What is Porter's 5 forces model how different is it from a SWOT analysis?

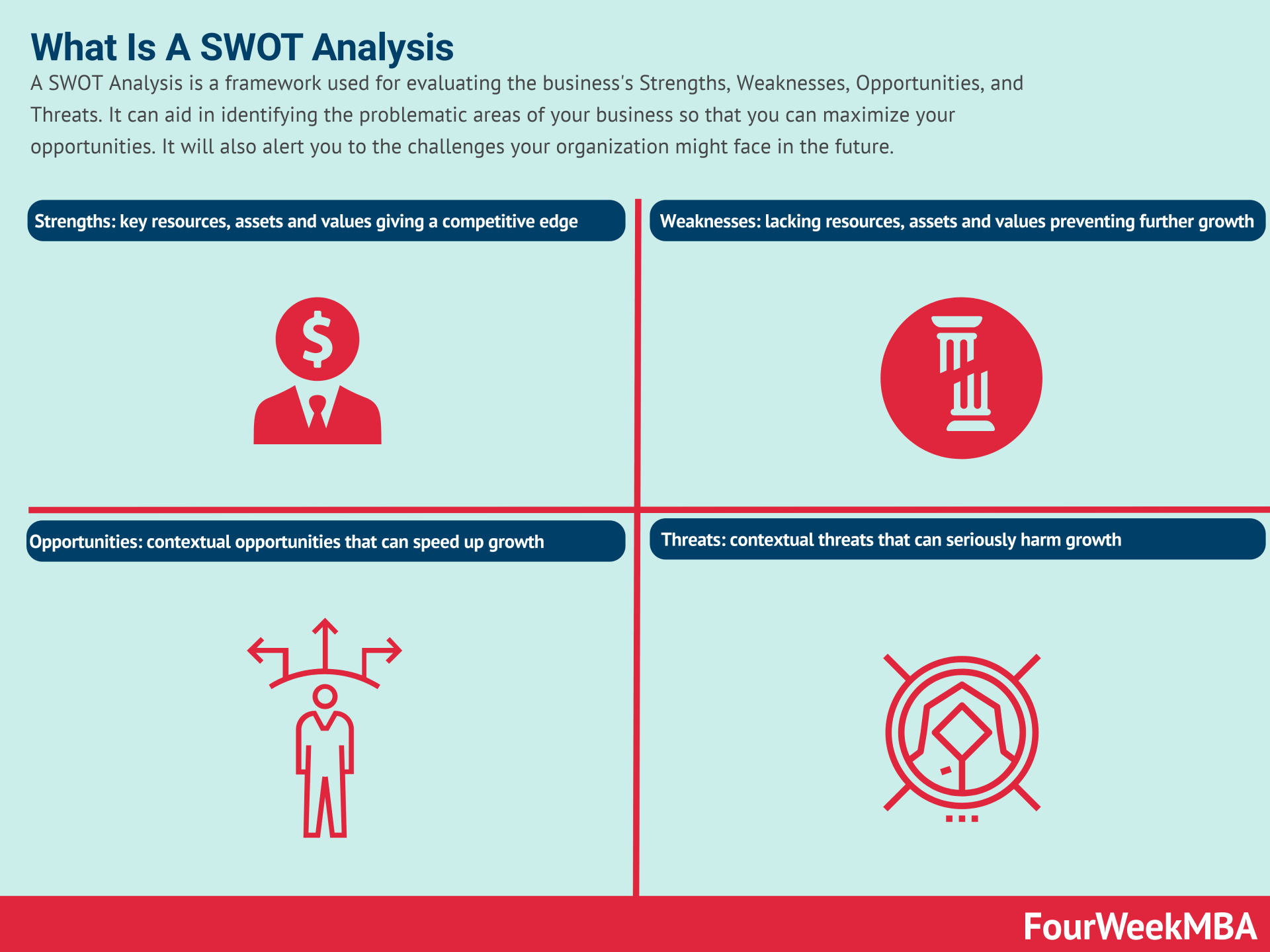

Both frameworks are to understand the competitive business landscape. In comparison, Porter tries to understand the business landscape through five forces. A SWOT Analysis is a framework for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. Porter’s five forces, comprised of the six forces model, is a great companion to the SWOT Analysis framework.

Why Porters five forces is outdated?

Porter’s Five Forces proved as a practical framework in the 1980-the 90s, when the business world looked quite different, and barriers to entry in many industries were much stronger. The current business landscape, made of Internet players, moves along more blurred boundaries. In that case, business modeling can address the current business landscape more effectively.

Read Next: Business Model Innovation, Business Models.

Related Innovation Frameworks

Other resources:

- Successful Types of Business Models You Need to Know

- The Complete Guide To Business Development

- Business Strategy Examples

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

agree Vinay, it’s not easy also to predict what threats usually turns out to be these that really impact your business, but it’s a great exercise.