Uber’s principal individual shareholders are Yasir Al-Rumayyan (3.64%), the Governor of the Public Investment Fund, the sovereign wealth fund of the Kingdom of Saudi Arabia, and Dara Khosrowshahi, Uber’s CEO. Institutional investors are Morgan Stanley, with 7.32% ownership, Fidelity, with 6.34%, and The Vanguard Group, with 5.85% ownership.

| Detail | Description |

|---|---|

| Company | Uber Technologies, Inc. |

| Ownership Structure | Publicly traded company with major shareholders |

| Major Shareholders | Institutional investors such as Vanguard Group, BlackRock, FMR LLC, Morgan Stanley, individual shareholders, and company insiders |

| Founding Date | March 2009 |

| Founders | Travis Kalanick and Garrett Camp |

| Headquarters | San Francisco, California, USA |

| Primary Business | Providing ride-hailing services, food delivery, freight transportation, and autonomous vehicle research |

| Strategic Goals | Expanding mobility services, enhancing platform safety, integrating autonomous and electric vehicles, and growing international market presence |

Additional Ownership Details

- Corporate Structure and Ownership: Uber Technologies, Inc. is publicly traded on the New York Stock Exchange under the ticker symbol UBER. The company went public in May 2019, and its ownership is distributed among institutional investors, company insiders, and individual shareholders. Notable institutional shareholders include Vanguard Group, BlackRock, and FMR LLC. These investors provide strategic input and financial stability, influencing Uber’s long-term vision and operational strategies.

- Corporate Strategy and Business Model: Uber’s business model is based on a multi-sided platform that connects drivers and riders through a mobile app. This model extends to other verticals, such as Uber Eats for food delivery and Uber Freight for logistics. Uber takes a commission from each transaction, generating revenue while providing flexibility and earning opportunities for drivers. The company aims to diversify its offerings by expanding into autonomous driving and electric vehicles, enhancing its transportation ecosystem.

- Product Innovation and Technology: Uber invests heavily in technology to enhance its platform and service offerings. The company is at the forefront of developing autonomous vehicle technology through its Advanced Technologies Group, focusing on safety and efficiency. Uber also invests in AI and data analytics to optimize routing, improve user experiences, and enhance safety features for both drivers and passengers.

- Market Expansion and Growth: Uber operates in over 70 countries and continues to expand its market presence by entering new regions and cities. The company’s international growth strategy involves adapting to local regulations, forming strategic partnerships, and leveraging technology to meet diverse transportation needs. Uber’s focus on expanding Uber Eats and Uber Freight complements its core ride-hailing business, diversifying its revenue streams.

- Community and Safety Commitment: Uber emphasizes safety and community engagement, implementing features like driver background checks, real-time ride tracking, and in-app emergency support. The company is committed to creating a safer platform for users and drivers while actively participating in community programs and partnerships that promote social responsibility and environmental sustainability.

- Sustainability and Environmental Goals: Uber is dedicated to reducing its environmental impact by promoting electric vehicle adoption and setting a goal to become a zero-emission platform by 2040. The company encourages drivers to switch to electric vehicles through partnerships, incentives, and the development of charging infrastructure.

- Cultural and Economic Impact: Uber has significantly impacted the gig economy, providing flexible work opportunities for millions of drivers worldwide. The company’s influence extends beyond transportation, affecting how people view work, technology, and urban mobility. Uber’s role in transforming urban transportation makes it a key player in shaping the future of mobility and smart cities.

| Aspect | Description | Analysis | Examples |

|---|---|---|---|

| Products and Services | Uber offers several services, including ride-sharing (UberX, UberPool, UberXL), premium ride options (Uber Black, Uber Comfort), food delivery (Uber Eats), and freight and logistics services (Uber Freight). Users can request rides, order food, or arrange freight transportation through the Uber mobile application or website. | Uber’s product and service lineup caters to different transportation needs, from everyday rides to premium options and food delivery. The platform’s convenience and accessibility through the mobile app have contributed to its widespread adoption. Expanding into logistics with Uber Freight diversifies its offerings. | Ride-sharing, premium rides, food delivery, freight and logistics, mobile application, convenience, accessibility, diversified offerings. |

| Revenue Streams | Uber generates revenue primarily through service fees and commissions. For ride-sharing, the company charges passengers a fare, from which it deducts a commission. Drivers pay Uber a portion of their earnings as well. Uber also earns from delivery fees in the case of Uber Eats. Additionally, Uber Freight generates revenue by connecting shippers and carriers. | The core revenue stream for Uber comes from service fees and commissions for ride-sharing and food delivery. Uber Freight adds a new source of revenue through its brokerage service. The company’s platform connects service providers (drivers, restaurants, carriers) with consumers and businesses, earning a share of the transaction. | Revenue from service fees, commissions, ride-sharing fares, delivery fees, Uber Freight brokerage service, diversified revenue sources. |

| Customer Segments | Uber serves a diverse range of customer segments, including passengers seeking convenient transportation, drivers looking to earn income, restaurants and food delivery customers, and businesses in need of logistics solutions. The platform addresses the needs of individuals and organizations across various sectors. | Uber’s customer segments encompass passengers, drivers, restaurants, food delivery customers, and businesses requiring logistics services. The platform’s versatility and convenience cater to a broad range of transportation and delivery needs. | Passengers, drivers, restaurants, food delivery customers, businesses, diverse customer segments, transportation and delivery needs, versatility, convenience. |

| Distribution Channels | Uber primarily distributes its services through its mobile application, available on app stores (iOS, Android) and through its website. Users can download the app or access the platform via web browsers. The mobile app’s accessibility and user-friendly interface have been key to Uber’s success. | Distribution channels for Uber include mobile applications (iOS, Android) and web access. The mobile app’s accessibility, user-friendly design, and features like GPS-based location services make it a convenient and widely used platform for ride requests and food delivery. | Mobile applications (iOS, Android), website, accessibility, user-friendly design, GPS-based location services, convenience. |

| Key Partnerships | Uber forms partnerships to enhance its services and expand its reach. These partnerships may include collaborations with vehicle manufacturers to provide drivers with vehicle rental options, agreements with restaurants to offer food delivery, and partnerships with businesses for corporate travel solutions. Uber also partners with financial institutions for payment processing and offers various promotions and loyalty programs. | Partnerships with vehicle manufacturers provide drivers with rental options, expanding Uber’s driver base. Collaborations with restaurants enhance the food delivery service. Partnerships with businesses offer corporate travel solutions, and financial institution partnerships ensure smooth payment processing. Promotions and loyalty programs attract and retain customers. | Vehicle manufacturer partnerships, restaurant collaborations, corporate travel solutions, financial institution partnerships, promotions, loyalty programs, expanded driver base, enhanced food delivery, payment processing. |

| Key Resources | Key resources for Uber include its mobile application and website, user base, network of drivers, restaurant partnerships, logistical infrastructure for Uber Freight, and technical team for app development and maintenance. Uber’s vast user base and extensive driver network are critical resources. | Uber’s resources encompass its technology infrastructure, extensive user base, large network of drivers, partnerships with restaurants, logistical infrastructure for Uber Freight, and a dedicated technical team for app development and maintenance. These resources are essential for ensuring smooth operations and expansion. | Mobile application, website, user base, driver network, restaurant partnerships, logistical infrastructure, technical team, crucial resources for smooth operations and expansion. |

| Cost Structure | Uber incurs various costs related to its operations, including expenses for driver incentives and earnings, marketing and advertising to attract passengers and drivers, platform development and maintenance, employee salaries and benefits, insurance costs, legal and regulatory compliance, and administrative overhead. Driver incentives and earnings are typically the most significant expenses. | Costs associated with Uber’s operations include driver incentives, marketing and advertising expenses, platform development and maintenance, employee salaries and benefits, insurance costs, legal and regulatory compliance, and administrative overhead. Driver incentives and earnings constitute a substantial operational cost. | Driver incentives, marketing and advertising expenses, platform development and maintenance, employee salaries and benefits, insurance costs, legal and regulatory compliance, administrative overhead, substantial driver incentive and earnings expenses. |

| Competitive Advantage | Uber’s competitive advantage lies in its extensive user base, driver network, and a wide range of service offerings. The platform’s convenience and user-friendly app have contributed to its popularity. Uber’s ability to adapt to changing market dynamics and regulatory challenges has allowed it to maintain a leading position in the ride-sharing and food delivery sectors. | Uber’s strengths include its vast user base, extensive driver network, diverse service offerings, convenience, and a user-friendly app. The company’s adaptability to market changes and regulatory hurdles has enabled it to remain a dominant player in the ride-sharing and food delivery markets. | Extensive user base, driver network, diverse service offerings, convenience, user-friendly app, adaptability, leading position in ride-sharing and food delivery markets. |

How did Uber’s ownership change over the last years?

Shareholders’ ownership in Uber completely changed in 2022, when Softbank, the main shareholder, liquidated its stake to keep up with the mounting losses of its portfolio.

The history of Uber

As Dara Khosrowshahi, CEO of Uber, pointed out in its financial prospectus.

Uber started at a specific moment in the business world.

The “rise of smartphones, the advent of app stores, and the desire for on-demand work supercharged Uber’s growth and created an entirely new standard of consumer convenience.”

Some context below:

Uber is the very definition of a disruptor. The company, which at one point was the most valuable private startup in the world, has revolutionized the way consumers hail a ride, order takeout from their favorite restaurant, and even earn a living.

With its various transportation and delivery services now available in more than 10,500 cities across 72 countries, it is sometimes easy to forget that Uber started as a humble startup selling limousine rides.

One simple idea

It is December 2008, and friends Travis Kalanick and Garrett Camp are attending the LeWeb technology conference in Paris.

Both men were entrepreneurs cashed up after recently selling their respective startups.

One night during the conference, the two could not find a cab in the middle of a snowstorm.

Kalanick credits Camp with the idea for Uber, which at that time consisted of a rideshare limousine service that could be requested from a smartphone app.

UberCab

Kalanick and Camp went their separate ways after the conference, but the latter remained interested in the idea and started work on a prototype with friends Conrad Whelan and Oscar Salazar while he was still CEO of StumbleUpon.

Camp purchased the domain name UberCab.com and convinced Kalanick to come on board as a chief incubator.

In early 2010, the app was tested in New York City with three vehicles, and an official launch was held in San Francisco a few months later.

The service, which was initially more expensive than a traditional taxi, was nevertheless popular in the city among tech employees.

UberCab then became known as Uber after the founders realized that it was not a cab company in the traditional sense.

Around this time, Uber hired its first employee Ryan Graves with a now-infamous tweet from Kalanick explaining that he was looking for a product manager.

Expansion and funding

In May 2011, Uber expanded into New York City and was met with resistance and criticism from the city’s established taxi industry.

Uber then became available in Paris in December as an almost ceremonious nod to the place where it had all started three years earlier.

In the same month, at the 2011 LeWeb technology conference, Kalanick announced a Series B funding round worth $37 million with Jeff Bezos and Goldman Sachs among the backers.

The company launched UberX in July 2012 to open up the platform to non-limousine vehicles such as the Cadillac Escalade and Toyota Prius Hybrid.

This would mark the first time the company would seek out drivers using their own vehicles as transportation.

Perhaps more significantly, UberX would eventually expand into other vehicle models and other forms of transportation, such as scooters and bikes.

In August 2013, Uber expanded into Africa and India with a Series C funding round worth $258 million.

The following year, the first Uber ride was hailed in China – which may prove to be Uber’s largest market in the future.

Recapping the Uber history

- Uber was, at one point, the most valuable startup in the world and has now revolutionized how consumers hail a ride, order takeout, and even earn a living.

- The idea for the company came after co-founders Garrett Camp, and Travis Kalanick struggled to hail a cab in a snowstorm during a tech conference in Paris. Camp and two friends developed a prototype app for a service that would be known as UberCab.

- Uber gained early traction with tech employees after officially launching in San Francisco in 2010. Uber became available in New York City and Paris in 2011 and then in other countries in 2012 and 2013. The launch of UberX signaled a turning point for Uber as it allowed drivers to use their non-luxury vehicles.

Uber companies

Uber Freight

Uber Freight is a subsidiary that provides a digital freight brokerage platform. The platform connects shippers with carriers and helps them manage their transportation needs.

By digitizing the freight industry, Uber Freight aims to make it more efficient, reliable, and affordable.

The platform uses real-time data and machine learning algorithms to match shippers with carriers and optimize routes, resulting in faster and more cost-effective delivery of goods.

Uber Freight is also committed to sustainable transportation practices and has implemented initiatives to reduce carbon emissions.

At present, the company has around $17 billion in Freight Under Management (FUM) and more than 200,000 users.

Uber Health

Uber Health is a subsidiary that provides transportation for healthcare organizations and their patients.

Primarily, the platform aims to provide a reliable and efficient transportation solution for patients who face barriers to accessing healthcare.

Healthcare providers can schedule rides for their patients through the Uber Health dashboard, and patients receive trip information and reminders via text message.

Uber Health also provides a higher level of privacy and security for healthcare-related trips, ensuring that a patient’s personal information is protected.

Jump Bikes

Jump Bikes is a dockless electric bike-sharing system.

The bikes are equipped with electric motors and GPS trackers that enable customers to find and unlock them using the Uber app.

Jump Bikes provides a convenient and affordable transportation option for short trips, reducing congestion and emissions in urban areas.

The bikes are also designed with safety in mind and feature bright colors, front and rear lights, and a sturdy frame. Jump Bikes has expanded rapidly since its launch and is now available in over 30 cities worldwide.

Uber acquired the bike-share start-up JUMP for around $200 million in 2018.

The company later transferred the business to Lime in May 2020, but as part of the deal, Uber led a $170 million investment in Lime and Jump Bikes itself is still available in both the Uber and Lime apps.

Careem

Careem is a transportation network company based in Dubai, United Arab Emirates.

The company was founded in 2012 and has since expanded to over 100 cities in 14 countries in the Middle East, Africa, and South Asia.

Careem offers a variety of transportation services, including ride-hailing, bike-sharing, and food delivery.

The company also provides employment opportunities for thousands of drivers in the regions it serves.

What’s more, Careem has a strong commitment to social responsibility and has implemented various initiatives to support the communities in which it operates.

These include providing free rides for healthcare workers during the COVID-19 pandemic and partnering with local organizations to support refugees and vulnerable populations.

Uber acquired Careem for $3.1 billion in early 2020 and later launched the digital payment platform Careem Pay in April 2022.

Driazly

Drizly is an online alcohol delivery service that allows customers to order beer, wine, liquor, and mixers for delivery to their doorstep.

The company was founded in 2012 by Nick Rellas, Spencer Frazier, and Justin Robinson and is headquartered in Boston, Massachusetts.

Drizly partners with local liquor stores in over 1,400 cities across the United States and Canada to provide a wide selection of products to customers.

Customers can use the Drizly website or mobile app to browse products, place orders, and track delivery.

There are several delivery options such as same-day delivery and scheduled delivery for a future date.

Uber acquired Drizly for $1.1 billion in cash and stock in 2021

Uber Business Model Today

Nowadays, Uber is a platform business that spans through mobility, delivery, and freight.

During the pandemic, the delivery segment played a key role in Uber’s business growth, as the lockdown measures constrained the mobility platform.

Yet by 2022, the mobility platform was back on track.

Indeed, by 2022, gross bookings on the mobility platform passed the delivery platform again, and Uber’s core mobility platform generated $8.36 billion in revenue, compared to Uber Eats’s $6.95 billion in revenue.

The revenue growth of the mobility platform was driven by massive growth in gross bookings post-pandemic and an increased take rate of the core platform vs. the delivery platform.

The main focus of Uber is on the mobility and delivery platform.

Visual Stories Related To the Uber Business Model

In 2022, Uber mobility took 27% of each booking on the platform. At the same time, Uber Eats took 20% of each booking on the delivery platform. The take rate varies according to demand and supply but also market dynamics. In short, in periods of increased competition, the service might charge lower take rates to keep up with it. In 2022, Uber pushed on efficiency, thus raising its take rates, to move toward profitability.

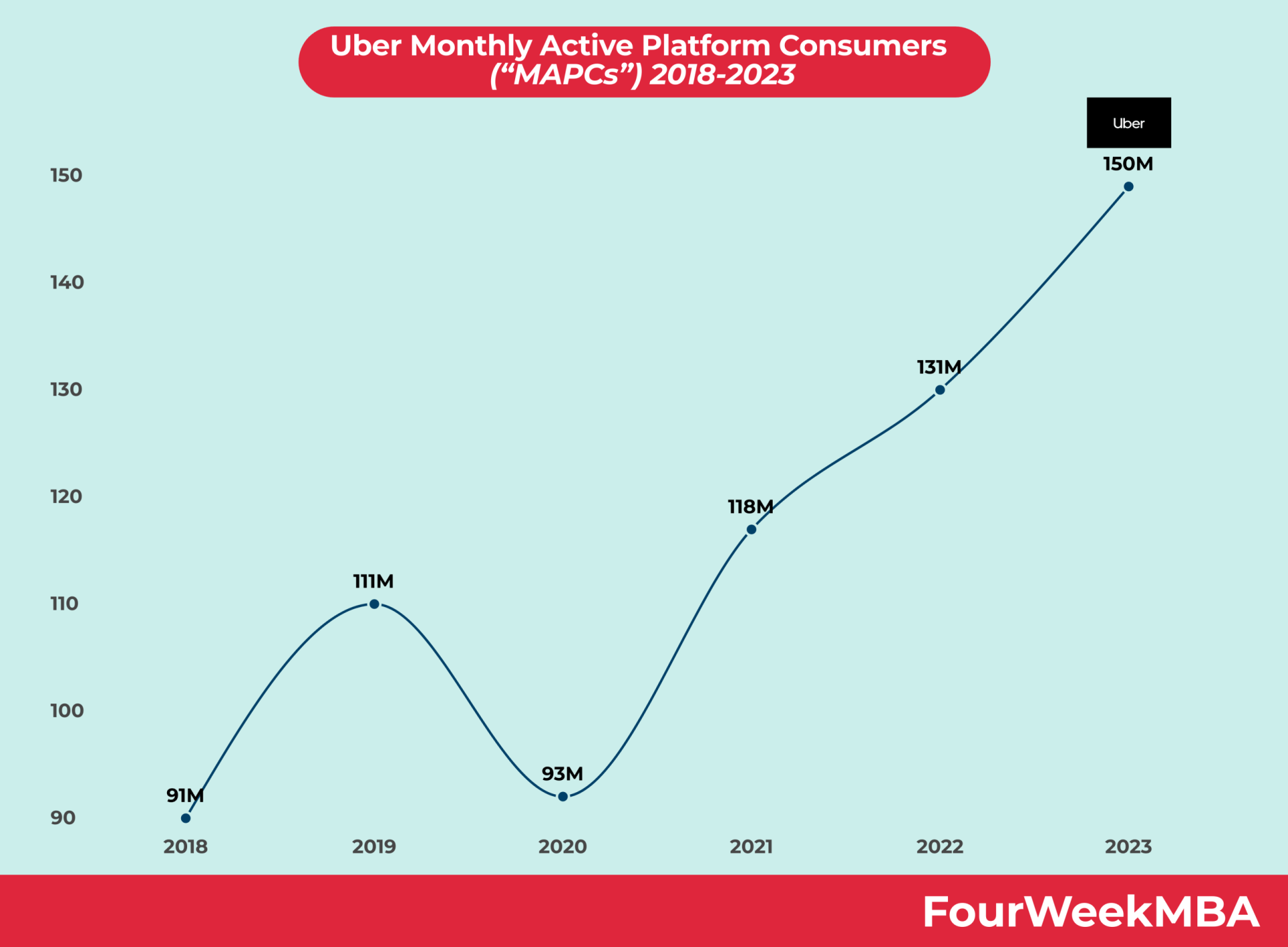

Uber Platform Users

Related Tech Ownership Case Studies

Read More: