The razor and blade business model is a strategy that relies on selling what is supposed to be the primary product at a low price or given away for free; while complementary goods get sold at high margins. For instance, Gillette’s razor would cost a few bucks. Instead, a set of blades will be 3-4 times more expensive.

| Aspect | Explanation |

|---|---|

| Razor and Blade Model | The Razor and Blade Model, also known as the Razor and Razorblade Model, is a business strategy where a company sells a complementary product (the “blade”) at a low cost or even gives it away for free to stimulate demand for a related product (the “razor”). |

| Metaphor | The model is named after the practice of selling razors cheaply to promote the sale of replacement blades. The initial product (razor) is often sold at a low margin or even a loss, while the recurring purchase (blade) yields profit over time. |

| Core Principle | The core principle is to attract customers with an affordable or free base product and then generate ongoing revenue from sales of the complementary or consumable product or service. |

| Examples | Examples of this model include printer manufacturers offering inexpensive printers (razor) and profiting from the sale of ink cartridges (blade), and video game consoles (razor) with revenue from game sales (blade). |

| Lock-In Effect | The Razor and Blade Model often creates a lock-in effect, as customers who have invested in the initial product (razor) are more likely to continue purchasing the related products (blades) due to compatibility and convenience. |

| Long-Term Revenue | The model is particularly effective for building long-term revenue streams as customers continue to buy the complementary product or services over time. It can result in recurring and predictable income. |

| Customer Acquisition | -It serves as a customer acquisition strategy, as the low-cost or free initial product can attract a large user base quickly, creating a market for the higher-margin complementary product. |

| Profit Margin | Companies using this model may initially sacrifice profit margin on the razor but can enjoy higher margins on the blades or related products, often making up for the initial loss. |

| Sustainability | The sustainability of the Razor and Blade Model relies on the ongoing need or desire for the complementary product. If customers have a continuous need for the blades, the model can be highly profitable. |

| Challenges | Challenges include the need to continuously innovate the complementary product to maintain customer interest and the potential for customer backlash if prices of blades rise substantially over time. |

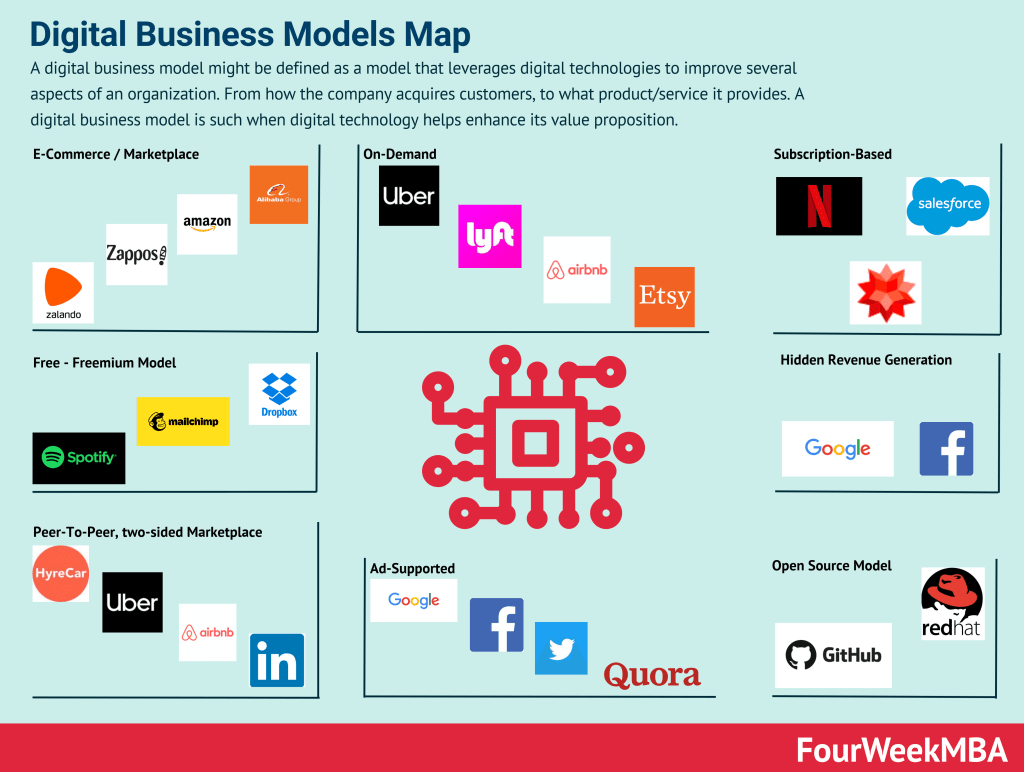

| Applicability | This model is applicable to various industries, including consumer electronics, software, printer ink, gaming consoles, and even some online services that offer a free basic version with paid premium features (freemium model). |

Razor and reverse razor and blade business model

The razor & blade business model implies that a company doesn’t make money on the primary products.

Instead, it makes money, at high margins, on the complementary, ancillary products and services, which are usually perishable or have a high turnover, therefore, generating a continuous income stream for the razor and blade business model player.

There is a reverse strategy, called reversed razor and blade business model. Where instead, the company uses ancillary products/services, mostly sold for free, or at a very low cost for the customers.

These ancillary products and services make the main product way more attractive, thus, enabling the company to raise the price of the main product, and stay competitive.

Companies like Apple, follow this variation of the razor and blade business model, called reverse razor and blade where the core product (the iPhone) is sold at a wide premium, and the ancillary products/services (apps) are mostly free, or inexpensive.

Apple and the reversed razor and blade business model

If you ever bought an iPhone, you’re aware of the fact that it can cost as much as a computer.

In fact, Apple rather than decrease its prices over time actually uses the opposite strategy. In fact, the latest confirmation of this strategy comes from the iPhone X, which has an even higher margin compared to the iPhone 8.

As reported by reuters.com:

The iPhone X smartphone costs $357.50 to make and sells for $999, giving it a gross margin of 64 percent, according to TechInsights, a firm that tears down technology devices and analyzes the parts inside. The iPhone 8 sells for $699 and has a gross margin of 59 percent.

In short, In this case, the iPhone is the blade. What is the razor then? That is the iTunes or the set of digital products Apple made available through its store.

In fact, when Apple launched iTunes, a CD would cost anywhere between $16 and $18. Today you can get an album for $9.99 or 99 cents per song.

In fact, as reported by billboard.com:

Steve Jobs “said to us, ‘There’re two things you have to accept: 99 cents for every single song, and every song has to be sold as a single.’ And we went home and swallowed hard because that was tough for us to accept for us as a music industry…. If certain songs were really popular we should be able to set the price at whatever we thought was the right price as opposed to the $1 price. Steve said, ‘You know, you’ve got to keep it simple, you’ve got to keep it clean.’”

By Thomas Hesse: President, Corporate Development and New Businesses, Chief Digital Officer at Bertelsmann. He was Chief Strategy Officer for BMG Music Entertainment when the iTunes Music Store launched.

As you can see above, Apple’s iPhone is still the most important revenue generator for the company, making up over 52% of the company’s sales in 2021.

And it has also substantially contributed to Apple’s growth in the last couple of years.

Thanks to the fact that the functionalities and wealth of apps, available on the App Store, mostly for free, make the hardware, the iPhone way more interesting to consumers.

Thus, enabling the company to sell it at a wide premium.

Apple has also been leveraging indirect distribution channels to amplify the sales of iPhones further.

Understanding the razor-blade business model

The razor blade business model, also known as the razor-razorblade model, involves selling a product at a lower price to then selling a related product later for a profit. The razor and blade business model has been popularized by King C. Gillette, founder of the safety razor company Gillette, which sold a durable razor at cost while selling disposable blades at a premium.

The razor blade business model describes the strategic positioning of one product as free or complimentary to boost sales of a dependent product that generates revenue.

The model is often attributed to King C. Gillette, founder of the safety razor company Gillette. The entrepreneur reasoned that if he could sell consumers a durable razor handle for very little, he could sell the disposable replacement blades at a premium price.

The company reaped the rewards of Gillette’s strategy since the expensive blades needed to be replaced constantly. What’s more, the consumer had no choice but to purchase them as they were the only blades that were compatible with the razor handle. The strategy was such a success that current owner Proctor & Gamble continues to use it today.

The razor-blade business model intends to avoid competition by offering a free or low-cost product in the first instance – even if the business must incur a loss. Once customer loyalty has been attained, the company has an easier time selling them more profitable products.

Note that the razor-blade model is similar to the freemium model, where digital products and services are offered for free under the expectation that a consumer will pay for features at some future point.

Companies utilizing the razor-blade business model

Aside from razor blades themselves, there are many other brands in different industries utilizing this business model.

Let’s take a look at a few of these below:

- Keurig – the company sells a range of single-serve coffee makers, with some available for less than $100. Where Keurig makes money is in the sale of coffee pods, with a 6-pack alone retailing for around $20.

- Microsoft, Nintendo, and Sony – these companies have almost always sold their video game consoles at close to cost price or less. The razor-blade model is prevalent in the industry because consoles require hardware updates and price cuts to ensure they remain relevant over long periods. The “blade” in this case is the video game itself.

- Hewlett Packard – HP has a wide range of printers, with some of the cheapest retailing for around the same cost as an ink refill. The company is counting on its customers having to constantly replace the toner cartridges to make money

Potential limitations of the razor-blade business model

The benefits of the razor-blade business model for businesses are well stated. But there do also exist some limitations:

- Environmental costs – some companies using the model have been criticized for the amount of waste they generate. In today’s world, businesses are expected to be environmental stewards and those that are seen to be destructive will lose customers to their competitors. Coffee pod brands were banned in some workplaces because their compositional mix of plastic, metal and coffee grounds made them impossible to recycle.

- Brand resentment – some consumers also become resentful of the company for effectively forcing them to use a certain product. This feeling may be exacerbated by prices the consumer considers too expensive. For example, many consumers are bemused by the fact that the price of ink is comparable to the price of a printer.

- Outlay risk – brands who implement the razor-blade model always run the risk that they will not recoup their initial costs. If the business is heavily subsidizing the initial product, poor sales in the premium product may result in an overall loss.

- Competition – when a company sells its premium product with a higher margin, a competitor can offer the same product for less without incurring the expenses associated with developing the free or low-cost product.

What is the reverse razor blade model?

The reverse razor blade model involves a business attracting consumers with a premium product and then selling them less expensive products over time.

Understanding the reverse razor blade model

As the name may suggest, the reverse razor blade model is an inversion of the razor and blade business model made popular by The Gillette Company.

Like its namesake, the reverse razor blade model has a consumable and dependent product. However, unlike its namesake, the business offers the dependent product at a premium price and the consumable product at a price that is lower or more convenient. In most cases, the dependent product is durable which allows the consumer to utilize the consumable product(s) over a longer period.

Apple was an early proponent of the reverse razor blade model, selling its iPod as the dependent product and songs from the iTunes store as the consumable product. Similarly, consumers who purchase an Apple Mac receive access to the Mac operating system and office software free of charge. To some extent, the reverse approach helps Apple offset its expensive products and the fact that the company rarely offers discounts.

Amazon is another company that utilizes the reverse razor blade model, selling its Kindle e-readers to give consumers access to a vast library of book titles.

Advantages and disadvantages of the reverse razor blade model

Let’s now take a look at some of the pros and cons of this business model.

Advantages

- Customer retention – the reverse razor blade model tends to increase customer retention because a user willing to invest a large amount of money upfront is more likely to stay with the company for longer. This phenomenon, where a person is reluctant to abandon a course of action if a large investment has been made, is known as the sunk-cost fallacy. Furthermore, consumers who purchase expensive products may also be brand advocates that will stick with the company regardless of price.

- Minimal risk – in the standard razor and blade model, the company often makes a loss on the dependent product and relies on the more expensive consumable to boost revenue. In the reverse model, the company makes an initial profit on the dependent product and is less reliant on sales of the consumable.

Disadvantages

- Prohibitive cost – the cost of purchasing a premium product upfront may be prohibitive for consumers. Some may not be able to afford the product, while others may be reluctant to purchase the product before they have full access to its features.

- Brand exposure – a consequence of prohibitive cost is reduced brand exposure. When consumers are effectively priced out of the market, there is no scope for the business to build relationships with them.

Case Studies

Traditional Razor and Blade Business Model:

- Gillette (Procter & Gamble):

- Primary Product (Razor): Gillette sells razors at a relatively low cost.

- Complementary Product (Blade): The company makes profits by selling replacement blades at higher margins, making them the core revenue driver.

- Keurig (Keurig Dr Pepper):

- Primary Product (Coffee Maker): Keurig offers coffee makers at affordable prices.

- Complementary Product (Coffee Pods): Keurig generates revenue through the sale of coffee pods, which are priced at a premium compared to traditional ground coffee.

- HP (Hewlett-Packard):

- Primary Product (Printers): HP sells printers at competitive prices.

- Complementary Product (Ink Cartridges): The company profits from ink cartridge sales, which are often more expensive than the printers themselves.

- Microsoft, Nintendo, and Sony (Gaming Consoles):

- Primary Product (Gaming Consoles): These companies often sell gaming consoles at or near cost.

- Complementary Product (Video Games): Profits come from selling video games, which have higher margins.

- Nespresso (Nestlé):

- Primary Product (Coffee Machines): Nespresso offers coffee machines at competitive prices or even below cost.

- Complementary Product (Coffee Capsules): Nespresso generates substantial profits from selling coffee capsules, which are specifically designed for their machines and are sold at premium prices.

- Printer Manufacturers (Epson, Canon, Brother):

- Primary Product (Printers): Printer manufacturers often sell printers at relatively low prices.

- Complementary Product (Ink/Toner Cartridges): These companies rely on the sale of ink or toner cartridges, which can be quite expensive, to sustain profitability.

- Video Game Consoles (Microsoft Xbox, Sony PlayStation):

- Primary Product (Gaming Consoles): Companies like Microsoft and Sony sell gaming consoles at cost or slightly above.

- Complementary Product (Video Games): They profit from the sale of video games and subscriptions, often priced higher than the consoles themselves.

- Razer Inc. (Gaming Peripherals):

- Primary Product (Gaming Hardware): Razer manufactures gaming peripherals like mice, keyboards, and headsets.

- Complementary Product (Customizable Accessories): The company sells complementary accessories and customization options for their gaming products, increasing their revenue.

Reverse Razor and Blade Business Model:

- Apple:

- Primary Product (iPhone): Apple sells iPhones at premium prices.

- Ancillary Products/Services (Apps, iTunes): Ancillary products like apps are often free or inexpensive, making the iPhone more attractive. Apple generates significant revenue through the App Store and iTunes.

- Amazon (Kindle):

- Primary Product (Kindle e-Reader): Amazon offers Kindle e-readers as premium products.

- Ancillary Products/Services (E-books): Amazon sells e-books at lower prices, encouraging Kindle users to purchase and read more books.

- Tesla:

- Primary Product (Electric Vehicles): Tesla’s electric cars are premium products with higher price tags.

- Ancillary Products/Services (Autopilot, Full Self-Driving): Tesla offers additional services like Autopilot and Full Self-Driving, enhancing the value of their vehicles for customers.

- Dyson (Vacuum Cleaners and Fans):

- Primary Product (Vacuum Cleaners and Fans): Dyson’s vacuum cleaners and fans are known for their premium quality and pricing.

- Ancillary Products/Services (Accessories and Filters): Dyson sells replacement accessories and filters, ensuring customer satisfaction and additional revenue.

- Bang & Olufsen (Audio Equipment):

- Primary Product (Audio Equipment): Bang & Olufsen offers high-end audio equipment.

- Ancillary Products/Services (Speaker Accessories, Apps): The company sells speaker accessories and apps, enriching the customer experience.

- Peloton (Fitness Equipment):

- Primary Product (Exercise Bikes, Treadmills): Peloton’s fitness equipment is a premium offering.

- Ancillary Products/Services (Subscription Services): Peloton generates revenue through subscription services that provide access to live and on-demand fitness classes.

Key takeaways:

- The razor blade business model also known as the razor-razorblade model, involves selling a product at a lower price to then sell a related product later for a profit.

- The razor blade business model has been used by brands such as Keurig, Microsoft, Nintendo, Sony, and Hewlett Packard.

- The razor blade business model endeavors to reduce competition and enable consumers to try a product at a low cost before turning them into repeat buyers. However, the model has been associated with environmental concerns and brand resentment. There is also the risk that the premium product becomes unprofitable or a new competitor emerges.

- The reverse razor blade model involves a business attracting consumers with a premium product and then selling them less expensive products over time.

- Apple was an early proponent of the reverse razor blade model, selling the iPod as the dependent product and songs from the iTunes store as the consumable product. Amazon does the same with the Kindle e-reader, which affords consumers access to a vast library of inexpensive e-books.

- The reverse razor blade model improves customer retention and is a less risky approach than the standard razor and blade strategy. However, the cost may be prohibitive for some consumers and as a result, brand exposure may also be reduced.

Key Highlights

- Reverse Razor Blade Model: This is a business strategy that aims to enhance customer retention by flipping the traditional “razor and blade” model. In the standard model, a company sells a base product (razor) at a low cost or even a loss, and then makes profits from selling complementary products (blades) over time. In the reverse razor blade model, the initial product is of high quality and carries a higher price tag, but subsequent purchases of complementary items are more affordable.

- Customer Retention Improvement: The reverse razor blade model is designed to improve customer retention by providing a high-quality initial product that offers value to the customer. This approach focuses on building loyalty by offering a positive and lasting experience with the initial purchase.

- Lower Risk: Compared to the traditional razor and blade strategy, the reverse model is considered to be less risky. In the standard model, the company relies on continuous sales of complementary products to generate revenue. If these sales decline, it can lead to financial instability. The reverse model, on the other hand, relies on the higher-margin initial product, which reduces the dependency on ongoing complementary product sales.

- Cost Considerations: While the reverse razor blade model may enhance customer retention, the initial higher cost of the product can be a deterrent for some consumers. This might limit its appeal, especially to price-sensitive customers or those who are not willing to make a significant upfront investment.

- Reduced Brand Exposure: The higher initial price of the reverse razor blade model might lead to reduced brand exposure. Lower-priced products in the traditional model can attract a larger number of customers, providing more opportunities for brand recognition and visibility.

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: