The pay-as-you-go business model enables consumers to make a one-time purchase of a product or service without having to subscribe to a regular payment. The pay-as-you-go business model has become an important companion and alternative, to subscription-based business models. Where users that don’t want to pay regularly for a service, can opt into a pay-as-you-go-plan. For cloud business models, an hybrid (subscription and pay-as-you-go) is often the standard.

| Aspect | Explanation |

|---|---|

| Definition of Pay-As-You-Go Business Model | The Pay-As-You-Go Business Model is a pricing and payment strategy in which customers are charged for products or services based on their actual usage or consumption. Instead of traditional upfront fees or fixed contracts, customers pay only for what they use, typically on a per-unit basis or through incremental payments. This model is often associated with subscription services, cloud computing, utilities, and various on-demand services. It offers flexibility, cost control, and scalability to customers, aligning costs with actual usage. The pay-as-you-go model can benefit both businesses and consumers by minimizing waste and optimizing resource allocation. |

| Key Concepts | Several key concepts define the Pay-As-You-Go Business Model: |

| – Usage-Based Billing | Usage-based billing is at the core of the pay-as-you-go model. Customers are charged based on their consumption or usage of a product or service. This can include metered usage, time-based usage, or other relevant units of measurement. Usage-based billing ensures that customers pay proportionally to the value they receive. |

| – Flexibility | The pay-as-you-go model provides customers with flexibility and control over their expenses. They can increase or decrease their usage and corresponding costs as needed, making it adaptable to changing circumstances or business requirements. Flexibility is a key selling point of this model. |

| – Scalability | Scalability is inherent to the pay-as-you-go model. Customers can scale their usage up or down without being tied to fixed contracts or commitments. This is particularly valuable for businesses experiencing growth or fluctuating demand. Scalability supports cost-efficiency. |

| – Resource Optimization | Pay-as-you-go encourages resource optimization by aligning costs with actual usage. It reduces overprovisioning and wastage, making it an environmentally sustainable and cost-effective approach. Resource optimization promotes efficiency. |

| Characteristics | The Pay-As-You-Go Business Model is characterized by the following attributes: |

| – No Upfront Costs | In this model, customers typically do not incur significant upfront costs or long-term commitments. This reduces the financial barriers to entry and allows for easy adoption of products or services. |

| – Variable Pricing | Pricing in the pay-as-you-go model is variable and directly tied to usage. Customers pay different amounts based on how much they use, making it a fair and transparent pricing structure. |

| – Subscription Options | Pay-as-you-go offerings often include subscription options. Customers can subscribe to a service while still benefiting from the flexibility of variable pricing. This combination caters to a wider range of customer preferences. Subscription options enhance customer choice. |

| – Real-time Monitoring | The model frequently incorporates real-time monitoring and reporting of usage. Customers can track their consumption and expenses, helping them make informed decisions and avoid unexpected costs. Real-time monitoring enhances transparency and control. |

| Examples of Pay-As-You-Go Business Model | The Pay-As-You-Go Business Model is prevalent in various industries and services: |

| – Cloud Computing | Cloud service providers offer pay-as-you-go pricing, where customers pay for computing resources, storage, and data transfer based on actual usage. This allows businesses to scale their IT infrastructure without large upfront investments. |

| – Utilities | Utilities such as electricity, water, and gas often use a pay-as-you-go model. Customers are billed based on their consumption, encouraging efficient resource usage. |

| – Software as a Service (SaaS) | Many SaaS companies offer subscription-based services with pay-as-you-go elements. Customers can subscribe to software applications and pay based on the number of users, features, or usage levels. |

| – Mobile Plans | Mobile phone plans frequently incorporate pay-as-you-go options. Customers can choose plans with a predetermined number of minutes, texts, or data, or opt for pay-as-you-go options where they pay per call, text, or megabyte of data used. |

| Benefits and Considerations | The Pay-As-You-Go Business Model offers several benefits and considerations: |

| – Cost Control | Customers have better control over costs in the pay-as-you-go model, as they only pay for what they use. This can lead to cost savings and efficient resource allocation. |

| – Scalability | Businesses can scale their operations without worrying about fixed costs or contractual obligations. The pay-as-you-go model supports growth and flexibility. |

| – Transparency | Pricing transparency is a key advantage. Customers can monitor their usage and expenses in real-time, reducing surprises and budget uncertainties. |

| – Environmental Impact | The model encourages resource optimization and can lead to reduced waste and environmental impact. |

Understanding the pay-as-you-go business model

For whatever reason, many consumers are reluctant to migrate to a subscription plan from a free product. Unless the product is supported by a revenue stream such as advertising, there can be little scope for the business to make money.

One alternative is the pay-as-you-go (PAYG) business model, which minimizes costs for the consumer since they only need to pay when they require access and can afford to do so. As a result, this model may appeal to budget-conscious consumers who are infrequent or temporary users of a product or service.

There are two ways this model can be implemented:

- The customer purchases a certain amount of credits for a fee, with the credit balance decreasing as they use the product or service. Once the credit balance reduces to zero, the customer no longer has access and must purchase more credit.

- The customer is billed for the number of resources they use over a predetermined period. Resources may be data, user, feature, storage, or time-based.

Note that some companies will utilize a mixture of both approaches.

Examples of the pay-as-you-go business model

Consumption-based pricing models can be found in many industries, including:

Telecommunications

Most smartphone and internet providers offer prepaid data to consumers for a fee. Once the data has been used, some providers revert to dial-up speeds or require the consumer to purchase more.

Internet advertising

Google and Facebook make money by selling prepaid advertising credits for their respective pay-per-click (PPC) platforms.

Software-as-a-service (SaaS)

These platforms tend to charge clients based on the resources they consume, including the number of messages sent or the amount of storage used in gigabytes.

Cloud infrastructure

Similarly, companies selling access to cloud infrastructure may charge based on storage costs, API calls, or bandwidth, among other things.

Utilities

Power and water companies bill customers according to how much power and water they use. Some may also offer consumers credit to put toward future bills if they pay the current bill before the due date.

Strengths and weaknesses of the pay-as-you-go business model

There are several clear and important strengths of the pay-as-you-go business model for consumers and businesses. These include:

- A smaller barrier to entry – for the low-income consumer, the model makes products and services once out of their reach more accessible. Accessibility is also increased for the consumer who prefers not to commit to a subscription. For the business, this increases the size of the total addressable market.

- Better tracking – since the consumer is only paying when they use the product, the business can better manage its cost-per-use. Products and product features that deliver the best returns will become evident over time and the business can gain a deeper understanding of consumer buying and usage patterns.

Let’s now take a look at some of the weaknesses:

- Lack of customer retention – by its very nature, the pay-as-you-go business model does not favor customer retention. Without an established and consistent opportunity to build a relationship, the business may find it difficult to keep consumers engaged.

- Unpredictable revenue – it can also be problematic to predict revenue because consumers are purchasing the product or service on their schedule. Revenue may fluctuate to such an extent that cash flow may be impacted.

Case Studies

- Zipcar

- Background: Zipcar is a car-sharing company that operates in urban areas and on college campuses across the United States, Canada, and Europe. Founded in 2000, Zipcar revolutionized urban transportation by offering on-demand access to vehicles without the hassles of ownership.Implementation:

- Zipcar operates on a pay-as-you-go model where customers pay hourly or daily rates to rent vehicles.Customers sign up for a membership and can reserve cars online or through the mobile app.Usage fees are based on the duration of the rental and include fuel and insurance costs.Members have access to a fleet of vehicles parked in designated locations, and they can pick up and return cars at their convenience.

- Background: Zipcar is a car-sharing company that operates in urban areas and on college campuses across the United States, Canada, and Europe. Founded in 2000, Zipcar revolutionized urban transportation by offering on-demand access to vehicles without the hassles of ownership.Implementation:

- Airbnb

- Background: Airbnb is an online marketplace that connects travelers with hosts who rent out their properties for short-term stays. Founded in 2008, Airbnb disrupted the hospitality industry by offering alternative accommodations that cater to diverse traveler preferences and budgets.Implementation:

- Airbnb operates on a pay-as-you-go model where guests pay for accommodations on a per-night basis.Hosts list their properties on the Airbnb platform and set their own nightly rates, cleaning fees, and house rules.Guests browse listings, read reviews, and book accommodations directly through the Airbnb website or app.Airbnb charges hosts a service fee for each booking, while guests pay a separate booking fee.

- Airbnb’s pay-as-you-go model provides travelers with affordable and flexible lodging options, ranging from private rooms to entire homes.

- The platform has democratized travel by empowering hosts to monetize their spare space and offering guests authentic and unique experiences.

- Airbnb has become a global leader in the sharing economy, with millions of listings in over 220 countries and regions.

- Despite facing challenges related to regulatory scrutiny and the COVID-19 pandemic, Airbnb continues to innovate and adapt to changing consumer preferences.

- Background: Airbnb is an online marketplace that connects travelers with hosts who rent out their properties for short-term stays. Founded in 2008, Airbnb disrupted the hospitality industry by offering alternative accommodations that cater to diverse traveler preferences and budgets.Implementation:

- Spotify

- Background: Spotify is a digital music streaming service that offers users access to millions of songs, podcasts, and videos. Founded in 2006, Spotify transformed the music industry by providing on-demand access to a vast catalog of content without the need to purchase individual tracks or albums.Implementation:

- Spotify operates on a pay-as-you-go model where users pay a monthly subscription fee for access to ad-free music streaming.Subscribers can listen to unlimited music on-demand, create playlists, and download content for offline listening.Spotify offers a free tier supported by advertisements, allowing users to access limited features with occasional interruptions.The platform also offers premium subscription plans with additional features such as offline playback, higher audio quality, and unlimited skips.

- Spotify’s pay-as-you-go model has attracted millions of subscribers worldwide, including music enthusiasts, casual listeners, and audiophiles.

- The platform’s personalized recommendations, curated playlists, and algorithmic discovery features enhance the user experience and drive engagement.

- Spotify has disrupted traditional music distribution channels and monetization models, generating revenue through subscription fees, advertising, and partnerships with artists and record labels.

- Despite facing competition from other streaming services, Spotify remains a dominant player in the digital music ecosystem and continues to innovate with new features and content offerings.

- Background: Spotify is a digital music streaming service that offers users access to millions of songs, podcasts, and videos. Founded in 2006, Spotify transformed the music industry by providing on-demand access to a vast catalog of content without the need to purchase individual tracks or albums.Implementation:

- Zipcar’s pay-as-you-go model appeals to urban dwellers who need occasional access to a car for errands, appointments, or leisure activities.

- The convenience and flexibility of Zipcar’s service have attracted a loyal customer base, including individuals who prefer not to own a car or cannot afford the expenses associated with car ownership.

- Zipcar has expanded its footprint to over 500 cities worldwide and continues to grow its membership base by offering innovative mobility solutions.

Key takeaways:

- The pay-as-you-go business model enables consumers to make a one-time purchase of a product or service without having to subscribe to a regular payment.

- The pay-as-you-go business model is found in many industries, including telecommunications, advertising, software-as-a-service, cloud infrastructure, and utilities.

- The pay-as-you-go business model lowers entry barriers for consumers and enables the business to determine the products delivering superior ROI. However, the model does not favor customer retention and revenue is difficult to predict.

Key Highlights

- Definition of PAYG Model: The pay-as-you-go business model allows consumers to purchase a product or service with a one-time payment, without committing to a regular subscription fee. It’s an alternative to subscription-based models and is particularly appealing to users who want flexibility in payment.

- Hybrid Model: In many cases, businesses adopt a hybrid approach, combining subscription and pay-as-you-go elements. This is common in cloud-based services.

- Consumer Perspective: PAYG caters to budget-conscious consumers who use a product or service infrequently and prefer paying only when they need access.

- Implementation Methods:

- Credit-Based Model: Consumers purchase credits and use them as they access the product or service. When the credit balance reaches zero, they need to purchase more to continue using.

- Resource-Based Model: Consumers are billed based on the resources they consume over a specific period. Resources could include data, features, storage, or time.

- Industries Using PAYG Model:

- Telecommunications: Prepaid mobile and internet plans where users pay for a set amount of data.

- Internet Advertising: Platforms like Google and Facebook sell prepaid advertising credits for their pay-per-click (PPC) services.

- Software-as-a-Service (SaaS): Charging clients based on the resources they use, like the number of messages sent or storage consumed.

- Cloud Infrastructure: Charges based on factors like storage, API calls, and bandwidth in cloud services.

- Utilities: Billing customers based on their consumption of power and water.

- Strengths:

- Accessibility: Lowers the barrier to entry, making products/services accessible to low-income consumers and those who prefer non-committal options.

- Better Tracking: Businesses can analyze cost-per-use and gain insights into consumer behavior and preferences.

- Total Addressable Market: Expands the potential customer base by catering to a wider range of users.

- Weaknesses:

- Customer Retention: Lacks inherent mechanisms for customer retention as there’s no ongoing commitment. Building relationships can be challenging.

- Unpredictable Revenue: Revenue fluctuates based on when consumers choose to make purchases, impacting cash flow predictability.

Read More: Cloud Business Models, IaaS vs PaaS vs SaaS, AIaaS Business Model.

Main Free Guides:

- Business Models

- Business Strategy

- Business Development

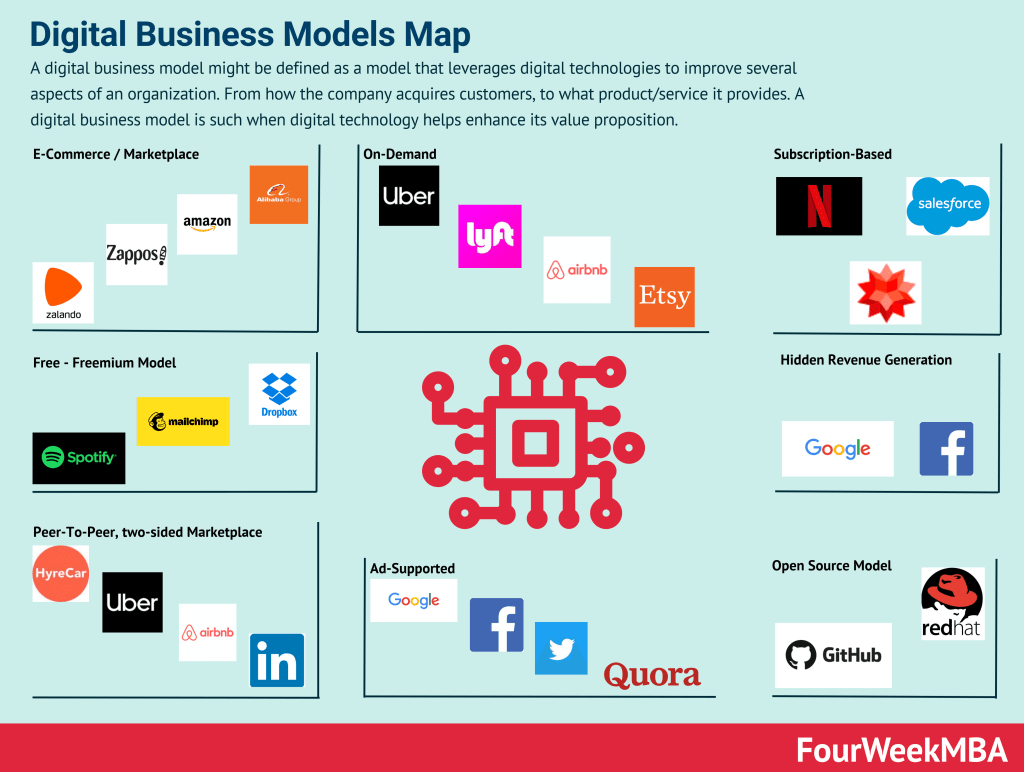

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

Connected Business Models

C3.ai

Microsoft Azure

As you can see from the visualizations above, cloud players are manufacturing models and algorithms, that becomes an integrated part of their cloud-based offering and platform. This is what attracts more AI developers and companies to become part of the ecosystem, thus, in turn, consuming more cloud infrastructure.

Google Cloud

Amazon AWS

IBM Cloud

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: