The Coca-Cola pricing strategy involves considering factors like demand, competition, and brand value. Pricing strategies include premium pricing and penetration pricing. Benefits include brand loyalty and market share, while challenges include price sensitivity and regulatory compliance for optimized pricing decisions.

| Pricing Strategy | Description | Example | Implications | Integration |

|---|---|---|---|---|

| Value-Based Pricing | Coca-Cola employs value-based pricing by setting prices based on the perceived value and preferences of its customers, as well as the cost of production. | Pricing Coca-Cola Classic higher than store-brand sodas due to its strong brand reputation and unique taste. | – Reflects the premium image of Coca-Cola products. – Capitalizes on brand loyalty and perceived quality. – Allows for higher profit margins. | Value-based pricing aligns with Coca-Cola’s brand positioning strategy, integrating with psychological pricing to enhance customer perception. It complements tiered pricing for a range of options. |

| Tiered Pricing | Coca-Cola offers a range of product sizes and packaging options, allowing customers to choose based on their budget and needs. | Offering Coca-Cola products in various sizes, including 12 oz cans, 2-liter bottles, and 20 oz PET bottles. | – Accommodates different customer budgets and preferences. – Provides flexibility for customers to choose the right product size. – Enhances market coverage and accessibility. | Tiered pricing is fundamental to Coca-Cola’s product strategy, integrating with dynamic pricing for vending machines and promotional pricing for bundled deals. It complements trade discounts for large-volume orders. |

| Regional and Market-Specific Pricing | Coca-Cola adjusts prices to account for regional variations in production costs, local competition, and consumer preferences. | Offering promotional pricing or discounts in specific markets or during seasonal events. | – Addresses local market conditions and consumer behavior. – Supports competitiveness in diverse regions. – Encourages local market penetration. | Regional pricing aligns with Coca-Cola’s market-specific strategies, integrating with promotional pricing for localized campaigns and trade discounts for retailers in specific regions. It complements dynamic pricing for real-time adjustments. |

| Brand Loyalty and Premium Pricing | Coca-Cola leverages its strong brand loyalty to command premium prices for its products compared to generic or store-brand alternatives. | Pricing Coca-Cola’s specialty or limited-edition beverages, such as Coca-Cola Zero Sugar with unique flavors, at higher price points. | – Capitalizes on brand loyalty and trust. – Supports premium positioning in the market. – Encourages customers to choose Coca-Cola over competitors. | Premium pricing is at the core of Coca-Cola’s brand strategy, integrating with tiered pricing for various product ranges and psychological pricing for perception management. It complements promotional pricing for limited-edition offerings. |

| Psychological Pricing | Coca-Cola uses psychological pricing strategies, such as setting prices just below round numbers, to make products appear more affordable or appealing. | Pricing products at $1.99 instead of $2.00 to make them seem less expensive to consumers. | – Influences consumer perceptions of affordability. – Encourages more purchases due to perceived lower prices. – Enhances the attractiveness of Coca-Cola products. | Psychological pricing is integrated into Coca-Cola’s pricing tactics across product lines, complementing value-based pricing and dynamic pricing in vending machines. It aligns with promotional pricing for limited-time offers. |

| Bundling and Combo Pricing | Coca-Cola often promotes bundled deals or combo pricing, encouraging customers to buy multiple products together at a discounted rate. | Offering a combo meal at fast-food restaurants that includes a Coca-Cola beverage along with a burger and fries. | – Increases sales of multiple products in one transaction. – Provides added value to customers through discounts. – Encourages customers to choose Coca-Cola as part of bundled deals. | Bundling and combo pricing are an integral part of Coca-Cola’s promotional strategy, integrating with value-based pricing for bundled product offerings. They align with subscription services for convenience offerings. |

| Dynamic Pricing | Coca-Cola may adjust prices in real-time based on factors like demand, location, and time of day, particularly in vending machines and at events. | Adjusting vending machine prices for Coca-Cola products during hot summer months or at amusement parks. | – Optimizes pricing for specific circumstances and demand fluctuations. – Maximizes revenue during peak times and events. – Offers flexibility in pricing adjustments. | Dynamic pricing is a crucial component of Coca-Cola’s vending machine strategy, integrating with value-based pricing for different products and psychological pricing for perception management. It aligns with tiered pricing for various vending options. |

| Promotional Pricing | Coca-Cola frequently runs promotional pricing campaigns, such as discounts, buy-one-get-one-free (BOGO) offers, and sweepstakes, to stimulate sales and engage consumers. | Running limited-time promotions like “Share a Coke” with personalized labels or seasonal discounts during the holidays. | – Boosts short-term sales and consumer engagement. – Creates excitement and urgency among consumers. – Increases brand visibility and consumer participation. | Promotional pricing is an essential element of Coca-Cola’s marketing strategy, integrating with regional pricing for localized campaigns and bundle pricing for combo promotions. It aligns with psychological pricing for perception enhancement. |

| Trade Discounts | Coca-Cola offers trade discounts to retailers and distributors based on the quantity and volume of products purchased, encouraging bulk orders. | Providing discounts to large supermarket chains for carrying a wide range of Coca-Cola products. | – Incentivizes bulk purchases from retailers and distributors. – Supports strong distribution networks. – Enhances relationships with trade partners. | Trade discounts are a key component of Coca-Cola’s distribution strategy, integrating with tiered pricing for various product sizes and regional pricing for localized promotions. They align with subscription services for regular deliveries. |

| Subscription Services | Coca-Cola introduces subscription services like beverage delivery or subscription boxes, offering convenience and cost savings to regular customers. | Launching subscription-based services that deliver Coca-Cola products to consumers’ homes on a regular schedule. | – Encourages repeat purchases and customer loyalty. – Provides convenience and cost savings to subscribers. – Increases customer lifetime value. | Subscription services are a newer addition to Coca-Cola’s strategy, complementing dynamic pricing for convenience offerings and trade discounts for bulk orders. They integrate with promotional pricing for subscription discounts. |

| Price Matching | Coca-Cola may match or beat competitors’ prices for specific products to remain competitive and retain market share. | Offering price matching guarantees for certain Coca-Cola products if customers find lower prices from competitors. | – Retains market share and competitiveness. – Assures customers of competitive pricing. – Mitigates the risk of losing customers to competitors. | Price matching is part of Coca-Cola’s competitive strategy, integrating with value-based pricing for premium products and regional pricing for market-specific adjustments. It aligns with psychological pricing for perception management. |

Definition and Overview

- Coca-Cola Pricing Strategy: Coca-Cola, one of the world’s leading beverage companies, employs a value-based pricing strategy, focusing on delivering value to consumers while maintaining premium pricing for its products.

Key Concepts and Components

- Value-Based Pricing: Coca-Cola’s pricing strategy is centered on delivering value to consumers by offering quality products, strong branding, and enjoyable experiences associated with its beverages.

- Premium Brand Positioning: Coca-Cola positions itself as a premium brand in the beverage industry, allowing it to charge higher prices for its products compared to many competitors.

- Product Differentiation: Coca-Cola differentiates its products by offering a wide range of beverages, each with its unique flavor profile and packaging. This variety allows the company to cater to diverse consumer preferences and price points.

- Psychological Pricing: Coca-Cola often uses psychological pricing techniques, such as setting prices just below round numbers (e.g., $1.99 instead of $2.00), to create the perception of lower prices while maintaining profitability.

The Coca-Cola Pricing Process

- Market Research: Coca-Cola conducts extensive market research to understand consumer preferences, trends, and competitive landscapes. This research informs pricing decisions.

- Competitor Analysis: The company monitors the pricing strategies of its competitors to ensure that its pricing remains competitive and aligned with market dynamics.

- Consumer Insights: Coca-Cola values consumer feedback and adjusts its pricing strategies based on consumer insights, ensuring that its products continue to meet customer expectations.

- Price Optimization: Coca-Cola employs price optimization models that consider factors like demand elasticity, production costs, and market conditions to determine the optimal pricing for each product.

Benefits and Applications

- Brand Loyalty: Coca-Cola’s premium pricing strategy has contributed to strong brand loyalty. Consumers are willing to pay more for Coca-Cola products because of their perceived quality and brand reputation.

- Revenue Maximization: By maintaining premium pricing, Coca-Cola maximizes its revenue and profit margins, allowing for continued investments in marketing, innovation, and sustainability efforts.

- Global Presence: Coca-Cola’s pricing strategy is adaptable to various global markets, allowing the company to operate successfully in diverse regions with different consumer preferences and economic conditions.

Challenges and Considerations

- Price Sensitivity: While Coca-Cola’s premium pricing has been effective, the company must monitor price sensitivity, especially during economic downturns when consumers may seek more affordable alternatives.

- Competition: Intense competition in the beverage industry requires Coca-Cola to continuously innovate and differentiate its products to justify premium pricing.

- Health and Wellness Trends: Growing consumer awareness of health and wellness may lead to increased demand for healthier beverage options. Coca-Cola must balance its product portfolio and pricing accordingly.

Key Highlights

- Coca-Cola Pricing Strategy: Coca-Cola’s pricing strategy is influenced by factors such as demand, competition, and brand value.

- Demand & Supply: Striking a balance between the demand and supply of Coca-Cola products in the market.

- Competition: Analyzing and responding to pricing strategies employed by competitors in the beverage market.

- Brand Value: Leveraging the strong brand value of Coca-Cola to inform pricing decisions.

- Cost Structure: Understanding the various cost components to determine profitable pricing levels.

- Market Segmentation: Dividing customers into segments based on their preferences and willingness to pay.

- Pricing Strategies:

- Premium Pricing: Setting higher prices based on the premium brand image and perceived quality of Coca-Cola products.

- Penetration Pricing: Entering new markets with lower prices to capture market share quickly.

- Promotional Pricing: Employing temporary discounts and promotions to stimulate sales during specific periods.

- Benefits:

- Brand Loyalty: Cultivating customer loyalty and encouraging repeat purchases through strategic pricing.

- Market Share: Establishing and retaining a significant share in the competitive beverage market.

- Profitability: Achieving sustained profitability through well-calibrated pricing decisions.

- Challenges:

- Price Sensitivity: Evaluating how sensitive customers are to changes in pricing and adjusting strategies accordingly.

- Global Market Variation: Adapting pricing strategies to accommodate variations in regional and country-specific market dynamics.

- Regulatory Compliance: Ensuring adherence to pricing-related laws and regulations in various markets.

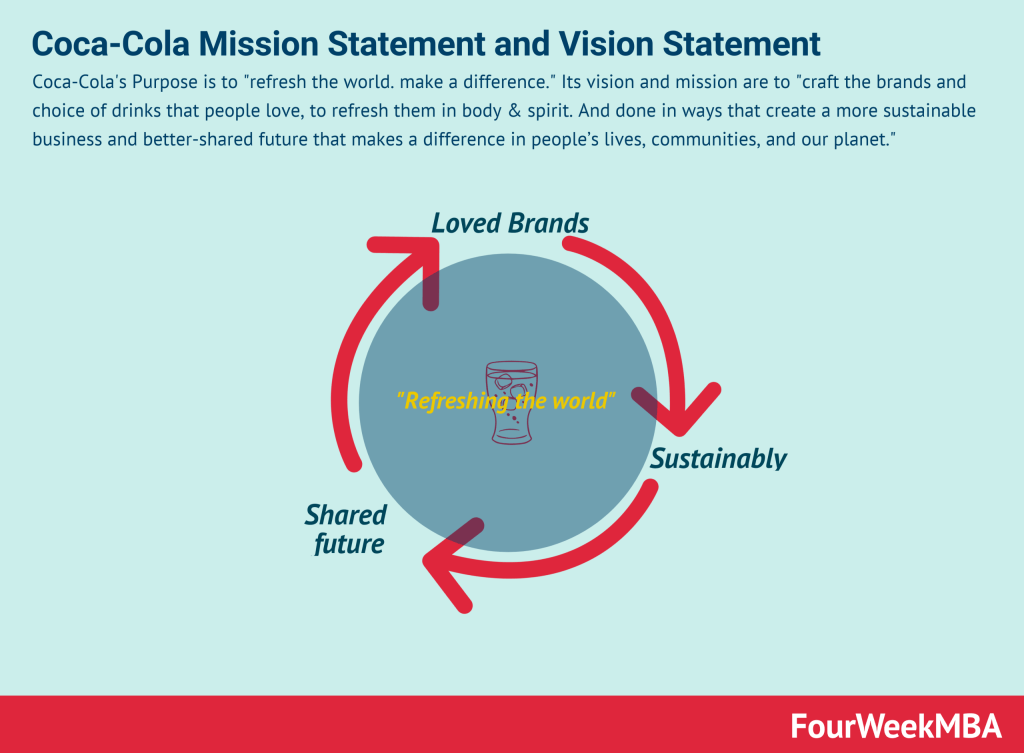

Read Next: Coca-Cola’s Business And Distribution, Coca-Cola Mission Statement and Vision, Coca-Cola Competitors, What Does Coca-Cola Own?, Coca-Cola PESTEL Analysis, Coca-Cola SWOT Analysis, Coca-Cola Vs. Pepsi.

Related Visual Stories

Coca-Cola Revenue Per Employee

Pricing Related Visual Resources

Read Next: Pricing Strategy.

Connected Business Concepts

Business resources:

- Successful Types of Business Models You Need to Know

- The Complete Guide To Business Development

- Business Strategy: Definition, Examples, And Case Studies

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales:

- How To Write A Mission Statement

- What is Growth Hacking?

- Growth Hacking Canvas

Handpicked popular case studies from the site: