Wealthfront and Betterment are major players in the Robo-advising space. Both companies make money via advisory fees. And Betterment has additional revenue streams like the service for advisors, the cash reserves, and the checking accounts.

| Business Model Element | Wealthfront | Betterment | Similarities | Differences | Competitive Advantage |

|---|---|---|---|---|---|

| Customer Segments | Individual investors, high-net-worth individuals, trusts | Individual investors, families, retirement accounts | Both target individual investors and families seeking automated investment solutions. | Wealthfront’s focus on high-net-worth individuals and trusts. Betterment’s broader reach across individual investors, including retirement accounts. | Broad Customer Reach (Betterment), Focus on High-Net-Worth (Wealthfront). |

| Value Proposition | Automated investing, robo-advisory, tax-efficient strategies | Robo-advisory, goal-based investing, tax-loss harvesting | Both offer automated investing and robo-advisory services. Wealthfront emphasizes tax-efficient strategies. Betterment provides goal-based investing and tax-loss harvesting features. | Wealthfront’s specialization in tax-efficient investing strategies. Betterment’s focus on goal-based investing and tax-loss harvesting. | Tax-Efficient Strategies (Wealthfront), Goal-Based Investing (Betterment). |

| Channels | Website, mobile app, financial advisors | Website, mobile app, financial advisors | Both operate through websites, mobile apps, and offer access to financial advisors. | Wealthfront’s availability to high-net-worth clients through financial advisors. Betterment’s accessibility to a wider range of individual investors through websites and mobile apps. | High-Net-Worth Access (Wealthfront), Broad Accessibility (Betterment). |

| Customer Relationships | Automated investment management, access to financial advisors | Automated investment management, access to financial advisors | Both platforms offer automated investment management with optional access to human financial advisors. | Wealthfront’s engagement with high-net-worth clients through financial advisors. Betterment’s reach to a broader audience with automated investment management and optional advisory services. | Human Advisory Options (Both), High-Net-Worth Focus (Wealthfront). |

| Key Activities | Portfolio management, tax optimization, rebalancing | Portfolio management, goal tracking, tax-efficient investing | Both engage in portfolio management and tax optimization. Wealthfront focuses on rebalancing portfolios, while Betterment offers goal tracking and tax-efficient investing. | Wealthfront’s emphasis on portfolio rebalancing. Betterment’s focus on goal tracking and goal-based investing. | Portfolio Rebalancing (Wealthfront), Goal-Based Investing (Betterment). |

| Key Resources | Investment algorithms, financial advisors, data analytics | Investment algorithms, financial advisors, data analytics | Both rely on investment algorithms, data analytics, and provide access to human financial advisors. | Wealthfront’s utilization of investment algorithms and data analytics. Betterment’s focus on goal tracking and algorithmic investing. | Investment Algorithms and Data Analytics (Both), Goal Tracking (Betterment). |

| Key Partnerships | Financial institutions, regulatory bodies, financial advisors | Financial institutions, regulatory bodies, financial advisors | Both collaborate with financial institutions, regulatory bodies, and financial advisors to provide their services. | Wealthfront’s emphasis on high-net-worth clients and partnerships with financial advisors. Betterment’s wider range of individual investors and partnerships with various financial institutions. | High-Net-Worth Partnerships (Wealthfront), Broad Financial Institution Collaborations (Betterment). |

| Revenue Streams | Management fees, account fees, additional services | Management fees, account fees, additional services | Both generate revenue through management fees and account fees. They also offer additional paid services. | Wealthfront’s specialized additional services for high-net-worth clients. Betterment’s broader range of individual investors and additional service offerings. | Specialized Additional Services (Wealthfront), Broader Audience (Betterment). |

| Cost Structure | Technology development, advisory fees, marketing | Technology development, advisory fees, marketing | Both platforms have costs related to technology development, advisory services, and marketing. | Wealthfront’s focus on high-net-worth advisory services. Betterment’s emphasis on a wider range of individual investors and marketing. | High-Net-Worth Advisory Costs (Wealthfront), Broader Marketing Focus (Betterment). |

Similarities between Wealthfront and Betterment:

- Robo-Advising: Both Wealthfront and Betterment are major players in the Robo-advising space, offering automated investment and financial advisory services.

- Advisory Fees: They make money primarily through advisory fees charged to their clients based on the assets under management.

- Cash Management: Both platforms offer cash management solutions, with Wealthfront providing cash accounts and Betterment offering cash reserves and checking accounts.

Differences between Wealthfront and Betterment:

- Additional Revenue Streams:

- Wealthfront generates revenue through a line of credits and earns interest on cash accounts in addition to advisory fees.

- Betterment has a more diverse range of revenue streams, including investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts.

- Product Offering:

- Wealthfront provides investment, retirement, and cash management products to retail investors.

- Betterment offers investment plans, financial advice packages, and specialized services for advisors and businesses, along with cash management solutions.

Read Next: Affirm Business Model , Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Connected Business Models

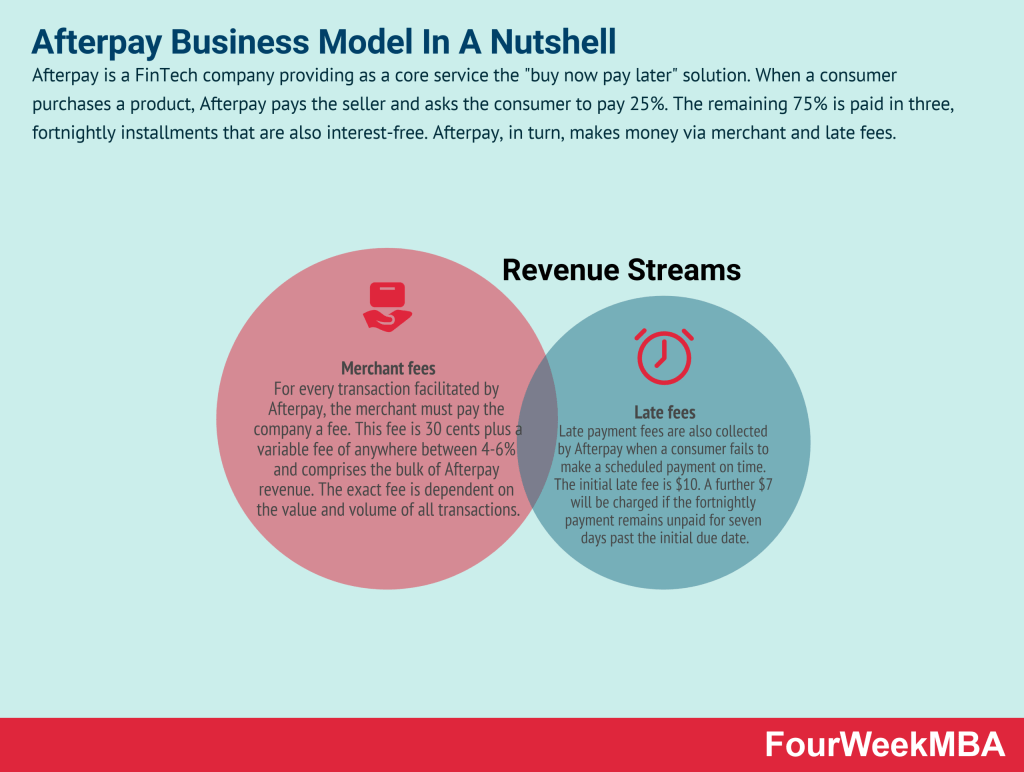

Afterpay Business Model

Quadpay Business Model

Klarna Business Model

SoFi Business Model

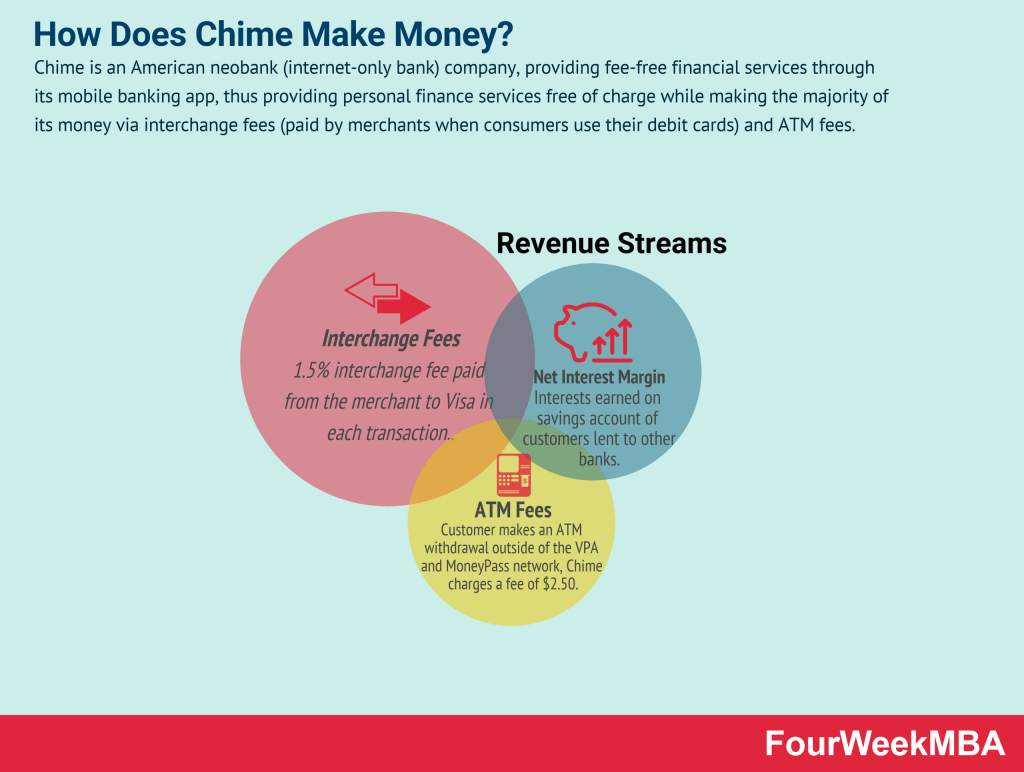

Chime Business Model

How Does Venmo Make Money

FinTech Business Models

List of FinTech Business Models

Braintree

Read Next: Fintech Business Models, IaaS, PaaS, SaaS, Enterprise AI Business Model, Cloud Business Models.

Read Next: Affirm Business Model, Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Main Free Guides: