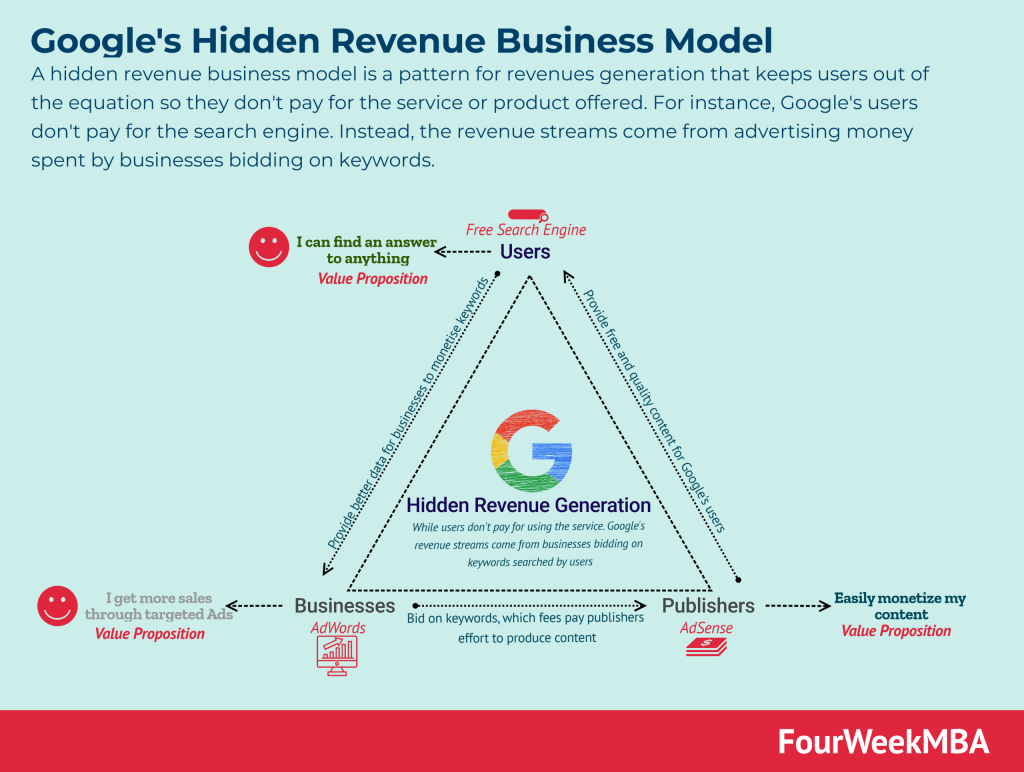

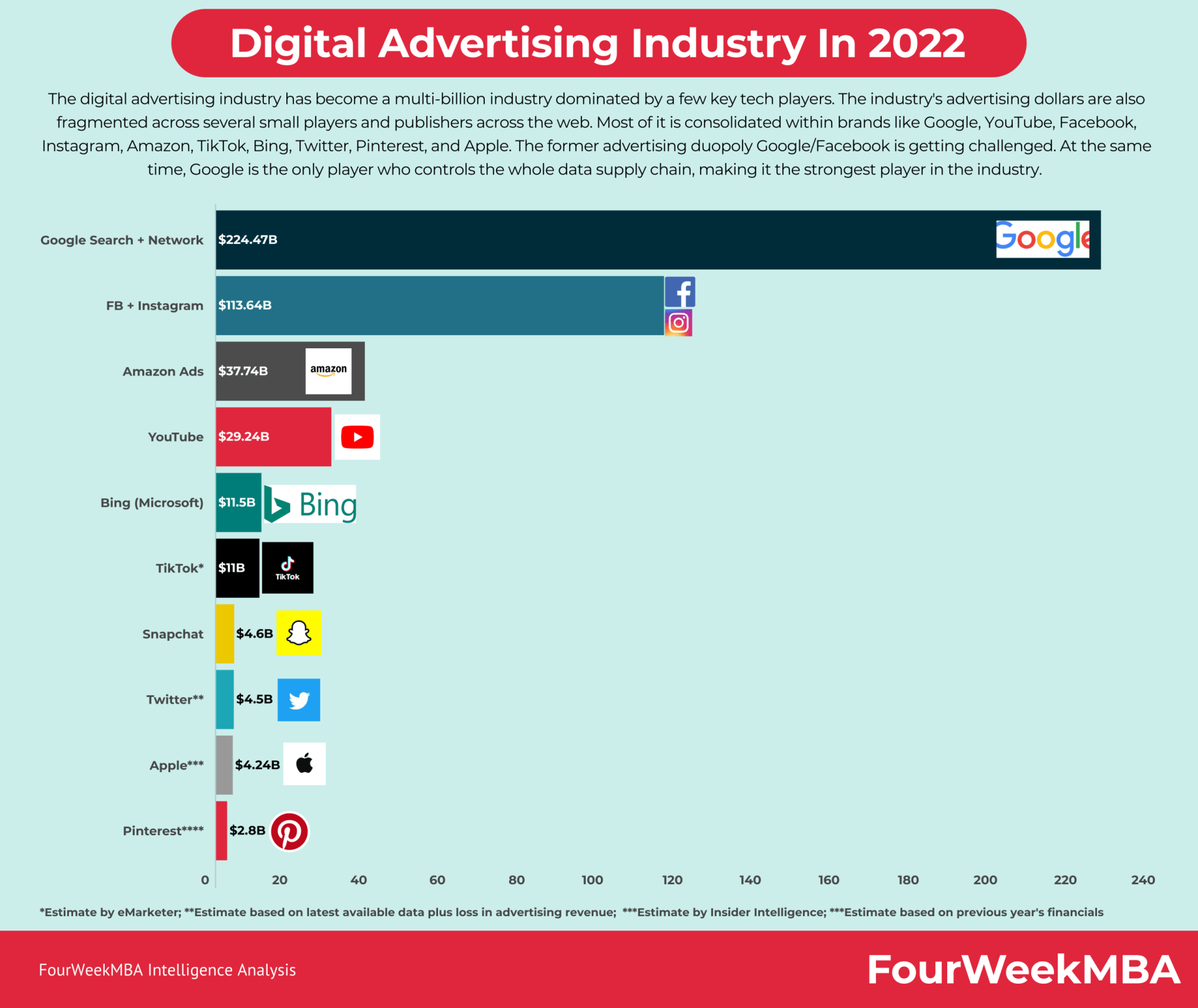

Facebook and Google are the two tech giants that in the space of a decade have disrupted the old media industry and created an empire. Google in the late nineties up to these days has built a business model based on advertising, which leverages two networks (AdSense and AdWords).

Both companies have a secret weapon. For Google that is the SERP, while for Facebook that is the News Feed. Both target one thing: users’ attention. The more attention they get, the more they monetize.

Yet, the whole digital advertising industry is getting now reshaped, with the expansion of digital ad networks by Apple and Amazon, and new entrants like TikTok.

| Elements | Similarities | Differences | Competitive Advantage | ||

|---|---|---|---|---|---|

| Customer Segments | Individuals (users) and businesses (advertisers) | Individuals (users) and businesses (advertisers) | Both target individual users and businesses as customers. | While both serve similar customer segments, Facebook primarily focuses on social interaction and content sharing, while Google primarily focuses on information access through search. | Extensive user data for highly targeted advertising. |

| Value Proposition | Social connection, content sharing, targeted advertising | Search engine, access to information, targeted advertising | Both offer targeted advertising as a core value proposition. | Facebook’s value is centered around social interaction, content sharing, and user-generated content. Google’s value is centered around providing easy access to information through its search engine and other services. | Deep user engagement and content sharing on the platform (Facebook). Search dominance and extensive data indexing (Google). |

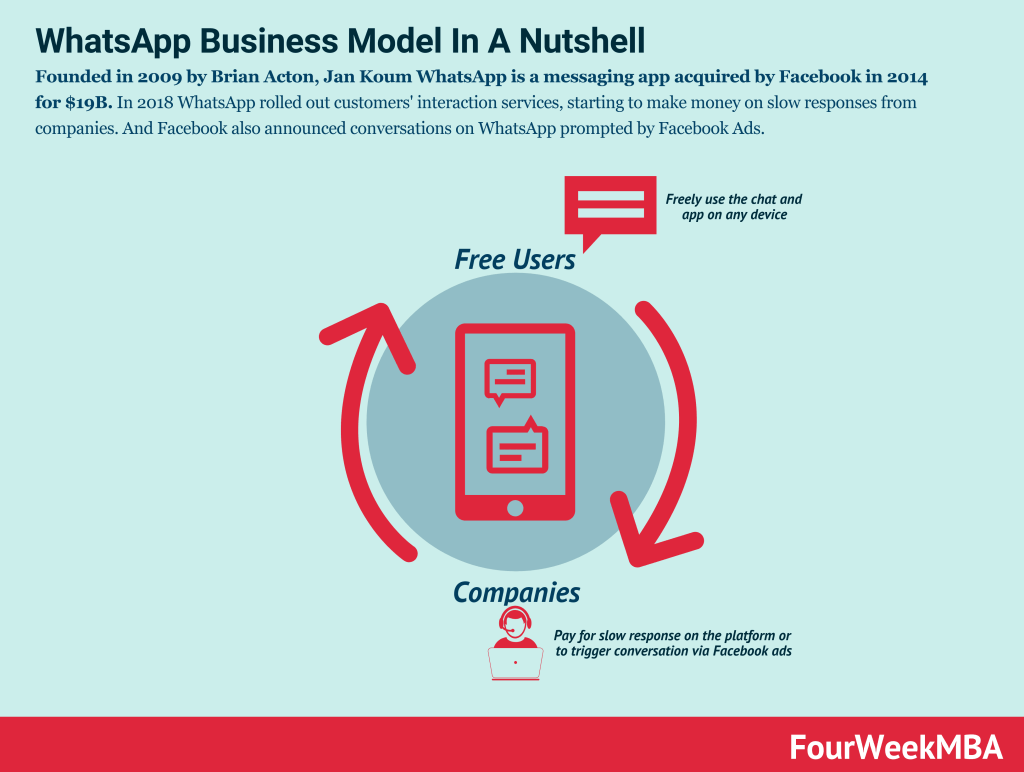

| Channels | Website, mobile apps, Messenger, WhatsApp, Instagram, Oculus VR | Google Search, YouTube, Android, Google Ads Network, Partners | Both utilize web and mobile channels, along with partnerships. | Facebook has a more diversified portfolio of products, including social media platforms and VR (Oculus). Google primarily relies on its search engine but has expanded into various sectors, including hardware (Android) and online video (YouTube). | Comprehensive ecosystem of products and services. |

| Customer Relationships | Social interaction, content sharing, advertising interaction | Search, content access, advertising interaction | Both focus on building relationships through user interaction and advertising. | Facebook emphasizes social interaction and user-generated content sharing. Google emphasizes efficient search and access to information. | Strong user engagement and retention (Facebook). Dominance in search and information retrieval (Google). |

| Key Activities | Content hosting, user data collection, ad targeting, acquisitions | Search engine algorithms, content indexing, ad platforms | Both collect user data for targeted advertising and engage in acquisitions. | Facebook’s activities center around content hosting, user data collection, and social engagement. Google’s core activities involve search engine algorithms, content indexing, and ad platforms. | Rich user data collection (both). Advanced search technology and AI (Google). |

| Key Resources | User base, data centers, AI algorithms, Oculus VR, acquisitions | Search technology, data centers, AI, acquisitions | Both rely on data centers, AI technologies, and acquisitions. | Facebook has a more diversified set of resources, including a vast user base, content, and VR technology. Google’s core resources are focused on search technology, data centers, and AI. | Large and engaged user base (both). Extensive AI capabilities (Google). |

| Key Partnerships | Advertisers, Oculus VR content developers, app developers | Advertisers, web publishers, Android phone manufacturers | Both partner with advertisers. | Facebook collaborates with Oculus VR content developers and app developers. Google partners with web publishers and Android phone manufacturers. | Ecosystem of third-party developers (both). Hardware partnerships (Google). |

| Revenue Streams | Advertising revenue (display, video, sponsored posts) | Advertising revenue (search ads, display ads, YouTube ads, etc.) | Both generate revenue primarily through advertising. | Facebook generates advertising revenue through sponsored content and video ads. Google’s revenue streams include search ads, display ads, YouTube ads, and more. | Diverse revenue streams within the advertising domain. |

| Cost Structure | Data centers, R&D, marketing, acquisitions, content moderation | Data centers, R&D, marketing, acquisitions, content licensing | Both incur costs related to data centers, R&D, marketing, and acquisitions. | Facebook invests in content moderation and user-generated content management. Google invests in content licensing agreements. | High adaptability to changing user behaviors and demands (both). |

Facebook’s secret weapon: The News Feed

Back in 2006 a significant transformation silently revolutionized Facebook: the news feed.

Before that, Facebook was primarily a directory of profiles. If you wanted to see what any other person in your network was doing, you had to look for that actively.

When Facebook introduced the news feed, a new homepage allowed any user to be continuously updated on what her/his network was up to.

The news feed is a critical part of Facebook‘s success.

In fact, without the news feed, there is no way Facebook could have managed to make its users stick.

Also, the news feed is where Facebook monetizes its user base.

Google’s most valuable asset: The Search Engine Results Page

Today we give for granted that Google is an advertising company.

However, in the 2000s that wasn’t a trivial choice.

One of the reasons why Google had been so successful was its ability to create a search engine that offered relevant results through a powerful algorithm called PageRank.

That is also why Page and Brin (Google’s co-founders) didn’t want their search to be associated with a company that mixed paid advertising with organic results. Google’s UX got simpler and simpler over the years:

Google UX in 1996. Source: uxpin.com

Google’s search page is the most important asset the company owns.

That is the place where billions of people each day ask anything from “how to tie a tie” to “why am I alone.”

It is so popular that back in 2006 the verb “to google” was added to the Oxford Dictionary.

Google in the Oxford Dictionary

The ability of the company to keep users going back to its results pages is also the secret to its past, present, and future success.

News Feed vs. SERP: The fight for attention

Before we get into financials, it is crucial to stress why the primary sources of business value for Google and Facebook are the SERP and news feed respectively.

When we think about traditional companies, it’s easy to understand what’s their most important asset.

Take a real estate company that owns a resort. You know that resort is a vital asset for the company. Instead, when it comes to tech companies, it gets a bit trickier.

For instance, if you think about Google or Facebook, what’s their most valued asset? In short, what’s the property that generates most of its long-term business value?

Probably the 2,000,000 square feet Googleplex in Mountain View or the 307,000 square feet Facebook data center in Prineville?

Undoublty they have enormous value.

However, I believe the two most important assets respectively for Google and Facebook are the search results page (SERP) and the news feed.

That is the place where each day the battle for the attention of billions of people is fought.

Those are also – I argue – the leading company’s assets. Google without its SERP and Facebook without its news feed would be worthless.

The engagement of users is crucial for both Google and Facebook.

It is true that the SERP‘s logic is slightly different from Facebook‘s news feed. Google needs to be able to provide relevant results quickly and allow its users to leave the results page.

Indeed, by clicking on a sponsored advertising – part of Google’s AdWords network – or by surfing a website – part of Google’s AdSense program – that is how the tech giant from Mountain View monetizes.

Instead, Facebook‘s news feed logic is to keep the users for as long as possible trapped in the feed. What a behavioral psychologist would call a “slot-machine mechanism.”

The news feed has an infinite scroll.

There’s no limit!

You could spend days scrolling that, and you’d be always finding content available for you to consume.

In a sense, I’m not surprised that Facebook wins against Google.

It is true though that Google in the last years has developed a set of features that also serve the purpose of keeping users for as long as possible on the SERP.

Think about the featured snippet (a little box that gives users answers to specific questions) or the more recent people’s also ask feature. Those allow you to find most of the content you need in the SERP.

Read Successful Types of Business Models You Need to Know

Comparing Google and Facebook business models

The foundation and cash cow of both Facebook and Google business models is the advertising business.

While Facebook, as of 2022, is primarily driven by advertising (more than 97% of its revenues).

Google, as of 2022, makes most of its revenues from advertising as well.

On the one hand, Google has been able to diversify its business model.

However, that model is still primarily driven by data gathering, curation, and re-packaging through its algorithms.

Google and Facebook both collect a massive amount of data about their users to monetize them via advertising.

While Google monetizes via its search pages or with in-app advertising via the Play Store. Facebook primarily monetizes via its newsfeed within its products (Facebook, Messenger, and Instagram).

Facebook has higher margins than Google, thanks to its cost structure, and the strong brands of its products.

Indeed, Facebook and Instagram are very sticky on people’s minds, which makes them connect to those apps without relying on Google. That might seem trivial, yet it is critical.

Many brands derive their visibility via Google search pages.

While also Facebook does, it is only for a small chunk of it. The remaining is direct traffic going through it, thanks to its stickiness (so far).

Even though the number of users in the US and Canada has stalled, other products like Instagram are still growing.

As for Google, the tech giant is also investing in other areas, hoping a small bet might become the next big hit!

Summary and Conclusion

Google and Facebook most important assets are the SERP and News Feed respectively.

While both companies are attention merchants. They are fundamentally different. Google is vertically integrated, owning most of the supply chain of data.

Facebook mostly relies on strong brands, which it had acquired over the years (Instagram, WhatsApp, Oculus, Messenger). Yet, those brands are distributed across other companies’ pipelines (App Store and Android Store).

This makes Facebook, now Meta, more susceptible to attacks from other tech giants like Apple and Googe.

That is why Facebook is investing billions into VR and the Metaverse.

Key Highlights

- Google and Facebook’s Impact: Google and Facebook have disrupted the media industry and built empires within a decade by leveraging attention-based business models and dominating their respective domains.

- Attention as Currency: Both Google and Facebook compete for users’ attention, realizing that the more they capture it, the more they can monetize it through advertising.

- Google’s Secret Weapon – SERP: Google’s most valuable asset is its Search Engine Results Page (SERP), which provides relevant search results to billions of users daily. The simplicity and effectiveness of its search engine contributed to Google’s success.

- Google’s Advertising Model: Google’s business model revolves around advertising, primarily through its AdWords and AdSense networks. Advertisers pay for visibility in search results and websites across the internet.

- Facebook’s Secret Weapon – News Feed: Facebook’s transformation in 2006 introduced the News Feed, revolutionizing the platform from a directory of profiles to a continuous stream of updates from users’ networks. The News Feed is central to Facebook’s success and monetization.

- Monetization Strategies: Google monetizes by quickly delivering relevant search results, leading users to sponsored ads and websites. Facebook’s News Feed aims to keep users engaged and scrolling, employing a “slot-machine mechanism” to maximize user retention.

- Assets and Business Value: For Google and Facebook, their most critical assets are the SERP and News Feed, respectively. These platforms are where the battle for users’ attention is fought and where long-term business value is generated.

- User Engagement: Both companies prioritize user engagement, with Google aiming for relevant results and quick interactions, while Facebook seeks to keep users immersed in its infinite-scrolling News Feed.

- Comparison of Business Models: Both Google and Facebook heavily rely on advertising as their main revenue source, but Google has diversified its model more with services like Google Play and Cloud. Facebook’s brands, such as Instagram and WhatsApp, contribute to its strong margins.

- Competition and Future Directions: Facebook, now Meta, faces challenges from tech giants like Apple and Google, especially due to its reliance on external pipelines like app stores. Meta is investing in VR and the Metaverse to strengthen its position.

- Ongoing Evolution: Both Google and Facebook continue to invest in innovation and new areas to maintain their dominance and expand their offerings.

Handpicked related articles:

- Successful Types of Business Models You Need to Know

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

Case studies:

- How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- The Trillion Dollar Company: Apple Business Model In A Nutshell

- How Does Netflix Make Money? Netflix Business Model Explained

- How Does Google Make Money? It’s Not Just Advertising!

Related Visual Stories

Facebook Organizational Structure