Airbnb is a peer-to-peer platform collecting a “platform tax” by charging guests a service fee between 5%-15% of the booking and hosts 3%. In 2022, Airbnb generated $8.4 billion in service fees by charging an average of 13.3% on an average booking value of $161.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Airbnb’s value proposition is built on several key elements: – Unique Accommodations: Offers a wide range of unique and personalized lodging options. – Local Experience: Connects travelers with local hosts for a more authentic experience. – Affordability: Provides a cost-effective alternative to traditional hotels. – User Reviews: Builds trust through user-generated reviews and ratings. Airbnb empowers travelers to explore and stay in distinctive places while fostering connections with locals. | Offers travelers unique and personalized accommodation choices. Enhances travel experiences by connecting guests with local hosts. Attracts budget-conscious travelers with affordable options. Builds trust through user reviews, ensuring quality and safety. Appeals to travelers seeking authentic and memorable stays. | – Offering unique and personalized accommodations. – Enhancing travel experiences through local connections. – Providing affordable alternatives to hotels. – Building trust through user-generated reviews. – Attracting travelers seeking authentic and memorable stays. |

| Customer Segments | Airbnb serves diverse customer segments, including: 1. Travelers: Individuals and families looking for accommodations. 2. Hosts: Property owners who list their spaces for rent. 3. Business Travelers: Professionals seeking lodging options. 4. Experience Seekers: Travelers interested in unique experiences. Airbnb caters to various traveler types and property owners, promoting diverse offerings. | Addresses the accommodation needs of different traveler types. Provides a platform for property owners to monetize their spaces. Attracts business travelers and experience seekers seeking unique stays. Offers customization for various customer segments. | – Meeting the accommodation needs of travelers. – Enabling property owners to monetize their spaces. – Attracting business travelers and experience seekers. – Customizing offerings for diverse customer preferences. |

| Distribution Strategy | Airbnb’s distribution strategy includes several key elements: – Online Platform: Provides a user-friendly website and mobile app for booking. – Host Recruitment: Encourages property owners to list their spaces on the platform. – Global Reach: Offers lodging options in numerous countries and cities. – Booking Process: Simplifies the booking and payment process for users. Airbnb ensures accessible booking, extensive property listings, global coverage, and a streamlined user experience. | Provides accessible web and mobile platforms for booking convenience. Encourages property owners to join the platform, expanding listings. Offers lodging options worldwide, catering to diverse traveler needs. Simplifies the booking and payment process for user convenience. Prioritizes accessibility and a seamless booking experience. | – Offering web and mobile apps for booking. – Encouraging property owners to list their spaces. – Providing lodging options worldwide. – Simplifying the booking and payment process. – Prioritizing accessibility and a seamless user experience. |

| Revenue Streams | Airbnb generates revenue through various sources: 1. Host Fees: Charges hosts a percentage of each booking. 2. Guest Fees: Charges guests a service fee for each reservation. 3. Experience Hosts: Takes a commission from experiences hosted on the platform. 4. Airbnb Plus: Offers premium property listings for a fee. 5. Business Travel: Offers corporate travel solutions and charges fees. Airbnb diversifies income through host and guest fees, experience commissions, premium listings, and corporate travel services. | Relies on revenue from host and guest fees as the primary income source. Earns commissions from experiences and premium property listings. Expands revenue potential through corporate travel solutions. Diversifies income sources for financial stability. | – Earnings from host and guest fees for each booking. – Generating commission income from hosted experiences. – Offering premium property listings for a fee. – Expanding revenue potential through corporate travel solutions. – Diversifying income sources for financial stability. |

| Marketing Strategy | Airbnb’s marketing strategy focuses on the following elements: – User Reviews: Showcases user-generated reviews to build trust and credibility. – Host Promotion: Encourages hosts to create appealing listings with quality photos. – Local Experiences: Promotes unique experiences hosted by locals. – Content Marketing: Utilizes blog articles and travel guides to inspire travelers. Airbnb prioritizes trust-building, appealing listings, local experiences, and travel inspiration in its marketing efforts. | Builds trust and credibility through positive user reviews. Encourages hosts to create attractive listings for guests. Promotes unique local experiences to attract travelers. Inspires travelers through content marketing with travel guides and articles. Prioritizes elements that enhance user experience and engagement. | – Showcasing user-generated reviews for trust. – Encouraging hosts to create appealing listings. – Promoting unique local experiences for travelers. – Utilizing content marketing for travel inspiration. – Prioritizing elements that enhance user experience and engagement. |

| Organization Structure | Airbnb’s organizational structure includes: – Leadership Team: Led by a CEO responsible for strategic direction. – Host Community: Supports hosts in listing and managing their spaces. – Guest Experience: Ensures a positive experience for travelers. – Legal and Compliance: Addresses regulatory and legal matters. – Marketing and Branding: Manages marketing initiatives and brand development. Airbnb emphasizes host and guest support, legal compliance, and marketing to deliver quality service and growth. | Led by a CEO, responsible for strategic direction and decision-making. Supports hosts in listing and managing their spaces effectively. Ensures a positive and seamless experience for travelers. Addresses regulatory and legal matters for compliance. Manages marketing initiatives and brand development to attract users. Prioritizes various functions for operational efficiency and growth. | – Led by a CEO for strategic direction. – Supporting hosts in listing and management. – Ensuring a positive traveler experience. – Addressing regulatory and legal matters. – Managing marketing and branding for user attraction. – Prioritizing functions for operational efficiency and growth. |

| Competitive Advantage | Airbnb’s competitive advantage is derived from: – Diverse Listings: Offers a wide range of unique accommodations. – Trust-Building: Prioritizes user reviews for trust and credibility. – Global Reach: Provides lodging options in numerous countries and cities. – Host Community: Fosters strong host support and engagement. – Experience Offerings: Offers unique experiences hosted by locals. Airbnb stands out with diverse listings, trust-building, global reach, host support, and unique experiences, positioning itself as a leading platform in the online accommodation industry. | Derives a competitive advantage from offering diverse and unique accommodations. Builds trust and credibility through user-generated reviews. Extends global reach with lodging options worldwide. Fosters a strong and engaged host community for quality service. Offers unique local experiences to attract travelers. Maintains a strong position in the online accommodation industry. | – Offering diverse and unique accommodations worldwide. – Prioritizing trust-building through user reviews. – Extending global reach with lodging options. – Fostering a strong and engaged host community. – Attracting travelers with unique local experiences. – Maintaining a leading position in the accommodation industry. |

| Key Financial Facts (Analysis by FourWeekMBA) | 2022 |

| Gross Booking Value | $63.2 Billion |

| Revenue | $8.4 Billion |

| Nights and Experiences Booked | $393.7 Million |

| Average Service Fee | 13.3% |

| Average Value per Booking | $161 |

According to the FourWeekMBA Analysis, in 2022, Airbnb charged an average 13.3% service fee at an average value per booking of $1161.

| Key Facts | |

| Total Revenues in 2022 | $8.4 Billion |

| Net Profits in 2022 | $1.9 Billion |

| Founders |

Brian Chesky, Nathan Blecharczyk, Joe Gebbia

|

| Year & Place Founded |

August 2008, San Francisco, CA

|

| Airbnb’s first investor |

Y Combinator, on January 2009

|

| Year of IPO | December 10, 2020 |

| IPO Price | $146.00 |

| Total Revenues at IPO |

$2.5 billion as of Nine Months Ended on September 30, prior to the IPO

|

| Airbnb Employees |

6,811 employees in 27 cities around the world

|

| Revenues per Employee | $977,129.81 |

Airbnb business model short breakdown

Airbnb is a peer-to-peer platform business model, leveraging two-sided network effects and making money by charging guests a service fee between 5% and 15% of the reservation. In comparison, the commission from hosts is generally 3%.

For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.

In 2023, Airbnb generated nearly $10 billion in service fees on over $73 billion Gross Booking Value through the platform.

With a 13.5% take rate.

We describe the Airbnb business model via the VTDF framework developed by FourWeekMBA.

| Airbnb Business Model | Description |

| Value Model: Expanding the hospitality industry, at scale. |

Airbnb’s mission is to “create a world where people can belong through healthy travel that is local, authentic, diverse, inclusive and sustainable.” A peer-to-peer platform enables hosts to easily list and monetize their real estate and guests to find alternative locations across the world. Airbnb created a whole new category for travel, expanding the industry and making it viable at scale.

|

| Technological Model: Peer-to-peer platform. Two-sided network effects. |

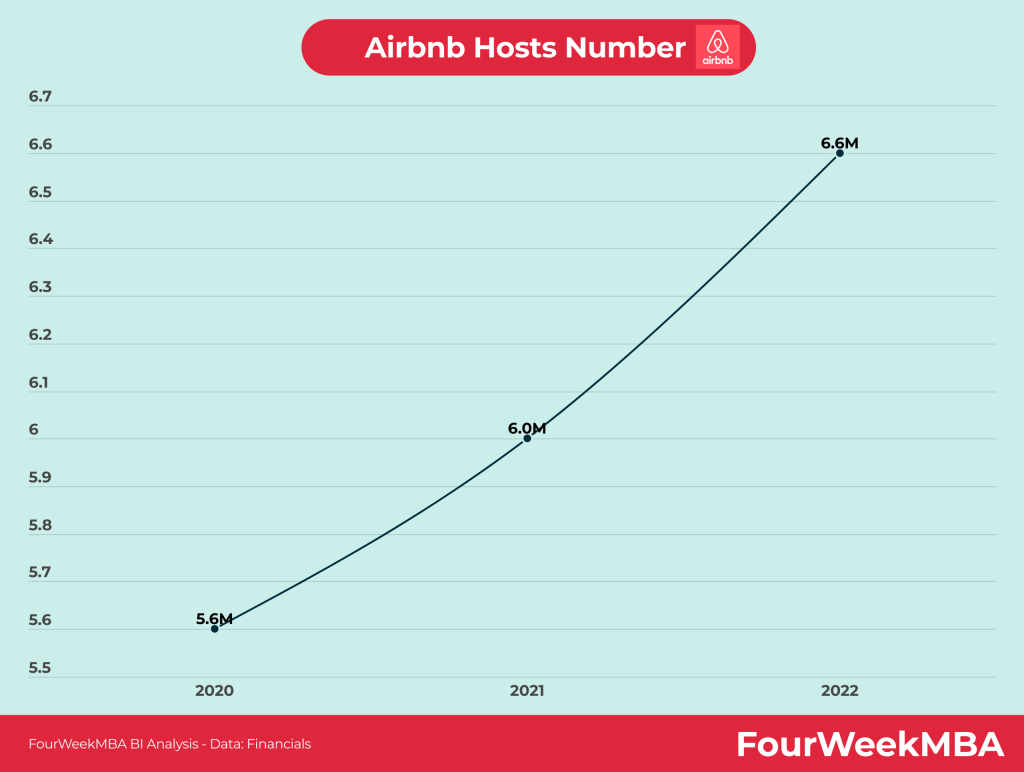

As a peer-to-peer platform, Airbnb enjoys two-sided network effects. The more hosts join the platform, the more it becomes valuable to guests, who can find alternative locations at various price points, depending on their experience. On the other hand, the more the community of guests is thriving, the more hosts are incentivized to invest back in their locations, making Airbnb the go-to location for travel worldwide.

|

| Distribution Model: Brand, Growth Engine, Continous Improvement, Community Building. |

Airbnb has built a strong brand over the years, thanks to its seamless platform and support to hosts. The company’s main growth asset is the community of guests and hosts that interact, making the whole platform thrive long-term. In addition, the platform is fast in releasing new features, testing them out, and trying to figure out new ways for hosts and guests to connect (as Airbnb shows throughout the pandemic).

|

| Financial Model: Platform Tax. |

Airbnb makes money by charging a service fee on top of each booking. Thus making money as more bookings go through it repeatedly. In 2021, Airbnb generated $5.99 billion in service fees.

|

Airbnb business model evolution

In 2007, Brian Chesky and Joe Gebbia tried to make extra income to pay their rent.

Chesky and Gebbia, friends from design school, saw a big opportunity when back in 2007, a large international design conference was about to be hosted in San Francisco.

It wasn’t unusual to have all hotels sold out during these large conferences.

However, at that time, Chesky and Gebbia swiftly built a website called AirBedandBreakfast.com (their guests would sleep on air beds), and surprisingly rented it to three designers attending the conference.

As Chesky and Gebbia recalled, at the time, most people thought the idea was crazy as strangers would have never accepted to “stay in each other’s homes.”

And yet, that first weekend, something interesting happened.

As the three designers had rented the air beds at Chesky and Gebbia’s apartment, they realized the potential of offering an experience as a local to someone coming from out of town.

Indeed, that was one of the key elements that would make Airbnb different from traditional Hotels.

It wasn’t just a room but potentially a whole end-to-end experience that made guests feel like locals and hosts become the ambassadors of their own local community while building their own entrepreneurial journey.

That event made Chesky and Gebbia continue with this experiment, and by 2008, software engineer Nathan Blecharczyk joined the two co-founders to focus on the UX of the platform, to solve what would become the central problem for Airbnb, that of “making strangers comfortable enough to stay in each other’s homes.”

Some of the elements that would make this possible, combined a platform with:

- Host and guest profiles.

- Integrated messaging.

- Two-way reviews.

- And secure payments.

Over the years, other key elements were added to the platform that helped gain further traction (like hiring professional freelance photographers to enrich the visual experience on the platform or adding experiences on top of the stay).

Each of those elements would help Airbnb achieve a larger and larger scale until the pandemic hit, and Airbnb had to figure out how to make its business model even more sustainable to survive.

Image Source: Airbnb Financial Prospectus

As Airbnb went through the pandemic, it had to shift its business model.

Brian Chesky highlighted the “pivot” (in startup lingo, the change of direction) Airbnb went through:

Yet as Airbnb managed to go through the pandemic.

It is also managing to thrive, as the short-term travel industry is bouncing back many times over:

How Airbnb turned things around

From being almost bankrupt, Airbnb became one of the most interesting tech companies in about two years.

In 2023, on $73.25 billion in gross bookings, the company reported revenues of $9.92 billion, a record of $4.79 billion in net income, and 13.5%, in take rates.

As Brian Chesky has highlighted on Twitter:

2 years ago, our business dropped 80%, our IPO was put on hold, and some didn’t think we’d make it at all.

Here’s how Airbnb turned things around, according to Brian Chesky:

1. First, we simplified our business. We got back to our roots, prioritizing the everyday people who host their homes and offer experiences

2. We cut the vast majority of our projects, shuttered our business units, and made the painful decision to do a layoff

3. We significantly improved our cost structure, decreasing our cost of revenue (merchant fees and servers), and tightly managed our fixed costs

4. Next, we changed our approach to marketing. When travel stopped, we paused all performance marketing and shifted our focus to PR (there have been 1M+ stories written about Airbnb since then)

5. By 2021, we started investing in brand marketing again, but reduced our overall marketing spend from 34% of our revenue in 2019 to 20% in 2021

6. Soon, people weren’t just traveling on Airbnb, they were living on Airbnb.

What has changed after the pandemic? Brian Chesky highlighted:

In 2021, around 20% of our nights booked were for stays of a month or longer, and nearly 50% for a week or longer.

These trends continue to this day. And now, urban and cross-border travel, which were the majority of our business before the pandemic, are back to 2019 levels

In 2021, we completely overhauled our product as the world became more flexible.

He closed with:

We made 150+ upgrades and improvements, including launching the “I’m Flexible” feature, which has been used more than 2 billion times.

The history of Airbnb

While the concept of short-term vacation rentals is certainly nothing new, Airbnb was the first company to see the potential of home sharing in the accommodation industry.

To profit from this potential, however, the company had to face and overcome various obstacles with determination, ingenuity, hard work, and a bit of luck.

The early history of Airbnb is a borderline rags-to-riches story with the ability to inspire millions of people from all walks of life.

Airbedandbreakfast.com

In essence, the idea for Airbnb was born from a need to simply pay the rent. When San Francisco-based designers Joe Gebbia and Brian Chesky were struggling to make ends meet, they were forced to come up with a novel way to support themselves.

After noticing that a design conference caused many of the city’s hotels to become booked out, the pair offered three air mattresses to any attendee who needed a place to sleep.

Gebbia and Chesky launched the site airbedandbreakfast.com in August 2008 with the belief that Craigslist was a little too impersonal.

For their efforts, the pair received $80 for hosting three designers over the duration of the conference.

Fundraising

Sensing they were onto something, the pair enlisted the help of computer science graduate Nathan Blecharczyk to build a more functional website that allowed other users to share their homes online.

To validate their idea, the company targeted users in the Denver area with the Democratic National Convention, causing a similar shortage of hotel rooms.

While the campaign was successful, the co-founders still lost money and could not secure investment funding after meeting with 15 different angel investors.

Gebbia and Chesky decided to take advantage of the imminent 2008 US election to raise cash and keep the fledgling company afloat.

Using their design skills, they created custom-made cereal boxes based on the two presidential candidates, Barack Obama and John McCain. The pair sold 750 boxes at $40 each, netting them a total of $30,000.

Y Combinator

In January 2009, computer programmer Paul Graham invited the pair to a winter session of the renowned Y Combinator startup accelerator, where they received training and $20,000 in cash in exchange for a small slice of the company.

The first few months of 2009 were spent perfecting the product, with the co-founders using some of the cash to travel to New York, where most Airbnb users lived.

In the city, they spent time building deep relationships with hosts by staying with every single one of them on the platform, leaving a review, and taking professional photographs of their accommodation.

In March, the company officially became known as Airbnb and secured a $600,000 seed investment from Sequoia Capital in April.

Growth and further funding

Over the next couple of years, Airbnb secured further rounds of funding to be a profitable company with a global reach. By 2011, over 1 million nights had been booked on the platform in 89 countries.

After a Series B funding round led by Andreessen Horowitz in mid-2011, Airbnb then became a unicorn with a valuation of $1.3 billion.

The rest, as they say, is history.

Key takeaways from Airbnb’s story:

- The idea for Airbnb was born from a need to pay the rent simply. When designers Joe Gebbia and Brian Chesky noticed that a design conference booked out many of the hotels in San Francisco, they decided to host attendees with air mattresses on the floor of their apartments.

- To raise cash and keep the company afloat long enough to receive sufficient interest, the co-founders sold custom cereal boxes based on the presidential candidates of the 2008 U.S. election. Eventually, Y Combinator co-founder Paul Graham took notice and provided training and $20,000 in funding.

- Gebbia and Chesky traveled to Airbnb hotspot New York City in 2011 to stay with each Airbnb host, leave a review, and take professional photographs of their listing. The platform’s popularity grew quickly that year and boasted over 1 million nights booked across 89 countries. After a Series B funding round, the company also became a unicorn in 2011.

Airbnb’s early success? Make it into a storyboard

- Uncover customer experience.

- Align on a longer-term vision.

- Pitch a broader project idea.

- And more.

It’s no secret that Brian Chesky is a huge fan of Walt Disney. And as the story goes, he was on a short vacation from Airbnb, as he dived into Disney’s biography. There he figured out about storyboarding and how to leverage this process for Airbnb’s growth:

How much money does Airbnb make?

The digitalization that happened in the last two decades has facilitated the creation of peer-to-peer platforms in which business models disrupted the hospitality model that was created in the previous century by hotel chains like Marriott, Holiday Inn, and Hilton.

As a platform, Airbnb makes money by enabling transactions on the peer-to-peer network of hosts and guests. And it charges both for the successful transactions that happened through the platform.

In 2023, Airbnb reached its best year ever.

And for the first time in years, the company generated a net profit of $1.9 billion in 2022.

Breaking down the economics of an Airbnb booking

As a peer-to-peer platform, once the transaction between host and guest goes through, Airbnb will collect a fee from both key players.

As an example, from a $100 booking per night set by the host, Airbnb might collect $3 as a hosting fee.

While it might increase the price for the guest to $116 ($16 above the price set by the host) to collect its guest fees of $12 and taxes for the remaining amount.

Therefore, for a similar transaction, Airbnb will collect $15, the host will make $97 from an initial set price of $100, and the guest will pay $116 (tax comprised).

How much is Airbnb worth?

In March 2017, the company was valued at $31 billion.

As of that date, the company had $5 billion at the bank and rejected an investment offer by SoftBank. Airbnb was among the largest potential tech unicorns.

Then, in 2020 the COVID pandemic hit particularly the travel industry, which had to adapt. And at the time of the Airbnb IPO, the company might have been valued around $20 billion.

By February 2022, Airbnb got valued at more than $70 billion in market cap.

Airbnb’s mission and vision

Airbnb’s mission is to create a world where people can belong through healthy travel that is local, authentic, diverse, inclusive and sustainable.

This is how Airbnb describes its mission. And it continues:

Airbnb uniquely leverages technology to economically empower millions of people around the world to unlock and monetize their spaces, passions and talents and become hospitality entrepreneurs.

The key element of a platform and peer-to-peer business model like Airbnb is the creation of a viable ecosystem. In this case, Airbnb becomes a platform for other entrepreneurs or aspiring hospitality entrepreneurs:

Airbnb’s people-to-people platform benefits all our stakeholders, including hosts, guests, employees and the communities in which we operate.

What are the key partners for Airbnb?

There are three key strategic partners:

- Hosts.

- Guests.

- Local communities.

In the initial traction stage, freelance photographers also played a key role in the growth of the platform.

Guests (travelers) can easily find hosts (pretty much anyone with a private home for rent) through the Airbnb marketplace.

Also, Real estate agencies that have vacant units can use Airbnb as a way to rent the excess properties they were not able to rent on the market. Instead, freelance photographers can earn a living by joining Airbnb as independent contractors.

But let’s look at what makes Airbnb platform compelling for each of those key partners.

Airbnb value proposition to its key partners

There are several value propositions for both hosts and guests. And for freelance photographers.

Hosts

The Airbnb hosts’ platform, as shown in its prospectus.

- Hosts can earn an extra income stream by renting additional space they have at home.

- Hosts can also turn into entrepreneurs by renting multiple locations with longer-term leases and making money with short-term rentals or by buying properties and generating a higher income with short-term rents.

- Hosts also have a set of tools for pricing, scheduling, payments, and more, which makes it easier for them to handle their customers without having to invest in proprietary technology.

- Hosts are also provided with insurance and liability coverage, the “Host Protection Coverage.”

Trust, indeed, is a key element of the platform. In part, Airbnb’s success is given by its effort to make transactions as smooth as possible on its peer-to-peer marketplace.

Guests

The Airbnb guests’ platform, as shown in its prospectus.

- The booking process is straightforward and the digital platform very effective.

- Travelers find affordable prices.

- Guests can also benefit from different experiences compared to the traditional hotel. Indeed, the host can act as a local touchpoint for the guest in the new community.

For both hosts and guests

- The review system for both hosts and guests guarantee standards of quality.

- A secure payment system.

- A set of tools for them to connect, and to design experiences beyond the traditional stay.

What is the revenue generation model?

Airbnb makes money in two ways:

1. It collects a commission from property owners, which is generally 3%. While it collects a commission fee from the same owners offering experiences, which is generally 20%.

2. It collects a transaction fee from guests of between 5% and 15% of the reservation subtotal

What are two key challenges to Airbnb’s success and further scale?

There are two main issues Airbnb has to face:

Trust

When hosts are listing their rooms and homes, they’re trusting the platform to put them in touch with good people. The same applies to guests. Would this trust be eroded over time so will be the value of the marketplace.

How does Airbnb tackles that? There are several buit-in features, developed over the years within Airbnb’s marketplace to enable trust at scale. As explained it its prospectus some of them are:

- Reviews: user-generated reviews both for hosts and guests are the underlying factor enabling both parties to deal with each other.

- Secure messaging and account protection.

- Risk scoring through predictive analytics and machine learning to evaluate hundreds of signals to flag and investigate fraudulent accounts.

- Secure payments.

- Watchlist and background checks (for hosts and guests based in the United States).

- Cleanliness (become extremely important during the pandemic to make environment COVID-free).

- Fraud and scam prevention.

- Insurance and protections.

- Booking restrictions.

- Urgent Safety Line.

- 24/7 Neighborhood Support Line.

- Guest refund policy.

Customer retention

Travelers nowadays have plenty of options. If they revert back to hotels or other solutions, Airbnb loses momentum. Also, another risk might be that of losing guests that make friends with hosts. In fact, they might choose to organize their next transaction privately.

The paradox then is that Airbnb rather than strong incentive tie between hosts and guests. It has to create an experience so that both parties can trust each other enough to make the transaction but not so much to get out of the Airbnb marketplace.

Airbnb through the pandemic

Airbnb has been among the most hit companies though the pandemic, as its business model was fine-tuned around global travel, and short-term stays and experiences.

In May 2020, this is how Brian Chesky, CEO, and co-founder of Airbnb explained the current scenario:

Let me start with how we arrived at this decision. We are collectively living through the most harrowing crisis of our lifetime, and as it began to unfold, global travel came to a standstill. Airbnb’s business has been hit hard, with revenue this year forecasted to be less than half of what we earned in 2019. In response, we raised $2 billion in capital and dramatically cut costs that touched nearly every corner of Airbnb.

He also explained how uncertain the situation is at a global level:

- We don’t know exactly when travel will return.

- When travel does return, it will look different.

Airbnb which was among the companies that most surfed the change in the travel and real estate industry, of the last decade, can also give us a better perspective of what might happen in the coming years for this industry.

Airbnb new business strategy based on a sustainable cost model

Travel in this new world will look different, and we need to evolve Airbnb accordingly. People will want options that are closer to home, safer, and more affordable. But people will also yearn for something that feels like it’s been taken away from them — human connection. When we started Airbnb, it was about belonging and connection. This crisis has sharpened our focus to get back to our roots, back to the basics, back to what is truly special about Airbnb — everyday people who host their homes and offer experiences.

As Airbnb moves forward in this new normal, it looks at a few core elements:

- Local travel

- Safety

- Affordability

At the same time, the company is focusing back on its core, and yet converting from physical experiences to online experiences.

Airbnb stretching its business model

As Airbnb knows the travel industry might not look as it used to, it’s now trying to redefine the boundaries of its business model, by leveraging on its tech platforms, an existent global audience, that used to be interested in physical experiences.

By stretching and extending its business model, Airbnb is trying to diversify it while the global pandemic will be over:

Example of the new section available on the Airbnb platform: Online Experiences

By leveraging on its audience Airbnb can test quickly a new product:

Example of an online experience where the “digital hosts” provide the format of the experience and the “digital guests” take part to it.

The online experience can take also the form of a private group where a limited number of “digital guests” can join by paying a premium price.

Will this platform be able to supplant, and integrate part of Airbnb’s revenues while the pandemic is over and the company can redesign also physical travel experiences?

Key lessons in redefining travel experiences and changing a whole business strategy, fast!

- Back in March 2017, Airbnb was valued at $31 billion. Then by May 2020, due to the pandemic, the company valuation fell to $18 billion.

- While its core business model is still sustained by two key strategic partners: hosts, guests. Airbnb has been also testing the expansion of its business model toward online experiences.

In an interview in late June 2020, Airbnb’s CEO remarked a few key findings for the future of the company and of the overall travel industry.

He explained how he learned “not to try to get in the business of predicting the future.” And the only way to do that is to run a super lean organization (Airbnb cut over a billion in marketing expenses throughout the pandemic).

This key lesson came as Airbnb risked to lose it all in the space of a few weeks. While Airbnb’s CEO remarked the trend in travel was still very strong. He also explained how things had changed for Airbnb.

Safety comes first, this makes still people concerned about getting on planes or traveling to crowded cities. Instead, as he explained, “they are willing to do is to get in a car and drive a couple hundred miles to a small community where they are willing to stay in a house.”

Airbnb’s CEO explained how “one trend that is going to happen is that travel as we knew it is over. It doesn’t mean travel is over, just the travel we knew is over… and it’s never coming back. It’s just not.”

And he continued, “Instead of the world’s population traveling to only a few cities and staying in big tourist districts we are going to see a redistribution of where people travel. They’re going to start traveling because they are going nearby to thousands of local communities.”

That changes the whole Airbnb strategy. Skewed more toward digital experiences and local expansion, rather than just growing quickly in large crowded cities.

How the Airbnb product changed throughout the pandemic

As the company highlighted in its financial prospectus, it had to adjust its whole platform servicing to fit what its users needed at that moment, and how the global economy had been temporary shifted.

So the product and platform focused on:

Local travel

Above the example of the Airbnb platform changes to fit the local experiences.

Support for hosts and guests

Airbnb kicked off an hosts fund to support them through the pandemic. While the fund itself ($250 million + $17 million for Superhosts) was a small contribution in comparison to the loss many hosts experienced. It was at least a minimum release for some hosts.

Enhanced cleaning services

To enable more people to keep traveling, at least locally, during the pandemic, cleaning services to make environments COVID-free became a built-in features of the platform.

Online experiences

Airbnb also launched the online experiences platform, to help hosts to keep offering part of their services online.

Airbnb and how the future of travel is changing

By 2021, as Arbnb finally managed to go back to its pre-pandemic levels, it also found out how the world of travel is changing.

In fact, Airbnb had the most profitable quarter ever. Even better than 2019 Q3 revenue of $2.2 billion was its highest ever—36% higher than Q3 2019. Some realizations from Airbnb were:

- People can travel anytime.

- People are traveling everywhere: Travel isn’t anymore toward cities but rather to rural destinations. Over 40% of gross nights booked in Q3 2021 were within 300 miles of home, up from 32% in Q3 2019, while gross nights booked to rural destinations increased more than 40% in Q3 2021 from Q3 2019.

- People are living on Airbnb: Long-term stays of 28 days or more remained Airbnb fastest-growing category by trip length and accounted for 20% of gross nights booked in Q3 2021, up from 14% in Q3 2019.

- More people are interested in hosting.

In a tweet on November 9, Brian Chesky further explained:

1. I think we’re on the verge of a revolution in travel

2. Before the pandemic, most people were tethered to the place they worked because they had to go into an office

3. The pandemic accelerated the mass adoption of technologies (like Zoom) that allowed millions of people (not everyone, but a large chunk) to work from home

4. Suddenly, they were untethered from the need to work in specific places at specific times

5. Millions of people can now travel anytime, anywhere, for any length — and even live anywhere

6. All you have to believe is that Zoom is here to stay to believe this trend is here to stay

7. This newfound flexibility is bringing about a revolution in how we travel

8. In recent months, some of the largest companies in the world, like Amazon, P&G, Ford, and PwC, have announced increased flexibility for employees to work remotely, and I expect more companies to follow

9. We’re seeing this in our own data

10. Travel anytime: Monday’s and Tuesday’s are our fastest growing days of the week for families to travel

11. Travel anywhere: over 100,000 towns & cities had a booking on Airbnb during the pandemic (6,000 places had their 1st booking)

12. Live anywhere: between July and September, 1 in 5 nights booked were for a month or longer. This is our fastest growing category by trip length

13. So basically, people aren’t just traveling on Airbnb, they’re now living on Airbnb

14. Okay, last tweet… to respond to this moment, I’ll share some updates to the Airbnb service at 8am pst tomorrow on our homepage (I have a short demo that I’ll share)

Airbnb’s new organizational design

In April 2022, Brian Chesky, CEO of Airbnb just announced the new organizational design for Airbnb, as he pointed out the five key features:

-

1. You can work from home or the office—whatever works best for you.

-

2. You can move anywhere in the country, like from San Francisco to Nashville, and your compensation won’t change.

-

3. You have the flexibility to live and work in 170 countries for up to 90 days a year in each location..

-

4. We’ll meet up regularly for team gatherings. Most employees will connect in person every quarter for about a week at a time (some more frequently).

-

5. To pull this off, we’ll operate off of a multi-year roadmap with two major product releases a year, which will keep us working in a highly coordinated way.

Brian Chesky highlighted:

Why did we come up with this design?

The world has become more flexible. Our business wouldn’t have recovered as quickly from the pandemic if it hadn’t been for millions of people working from Airbnbs.”

And he further highlighted:

We also had the most productive two-year period in our company’s history—all while working remotely.

But he also emphasized:

But there’s a tension.

The most meaningful connections happen in person. Zoom is great for maintaining relationships, but it’s not the best way to deepen them. And some creative work is best done in the same room.

And concluded:

The right solution should combine the efficiency of Zoom with the meaningful human connection that happens when people come together.

Our design attempts to combine the best of both worlds.

As Brian Chesky highlighted:

Two decades ago, Silicon Valley startups popularized open floor plans and on-site perks. Today’s startups have embraced flexibility and remote work. I think this will become the predominant way companies work 10 years from now.

These are the founding principles of Airbnb’s organizational structure.

Airbnb’s complete redesign of the customer experience

In May 2022, as a result of the rehauled Airbnb’s business model and organizational design, the company also announced a complete change in the way customers experience the platform.

This is what Brian Chesky, CEO and co-founder of Airbnb, defined as “the biggest change to Airbnb in a decade.”

Why does it matter?

As Airbnb had to redefine its business model to survive during the pandemic, and eventually thrive, it had to redefine three key aspects of the organization:

- Its business model.

- The organizational design of the company.

- And the customer journey.

These three things combined, created an organization able to thrive in this post-pandemic business context.

In fact, as Airbnb highlighted:

People are more flexible than ever about where and when they travel. To help them take advantage of these new possibilities, we’re introducing our biggest change in a decade—including a completely new way to search, a better way to stay longer, and an unmatched level of protection.

The whole search experience has been redesigned around categories:

Source: Airbnb

Why does it matter?

Organizing the whole user journey around categories, help guests find locations, in places, that they would have never thought of.

In short, the company’s goal here is to enable guests to find “hidden gems” by creating a curated selection of places organized according to three main criteria:

- Style.

- Location.

- And nearby activities

- Booking Protection Guarantee: in case a host cancels the booking, within 30 days from the trip Airbnb will help the guest find alternatives in the same category and location.

-

Check-In Guarantee: in case the guest has issues in checking into the home, Airbnb will provide assistance in finding an alternative home based on category and location.

-

Get-What-You-Booked Guarantee: if also here guests don’t find the apartment booked fits the way it was advertised, Airbnb will help them find a different place.

-

24-hour Safety Line: as the company highlights “If a guest ever feels unsafe, they’ll get priority access to specially-trained safety agents, day or night.”

Airbnb’s first-ever pitch deck

Related Visual Stories To Airbnb

Airbnb Business Model Economics

OTAs Connected Business Models

Booking

Expedia

Google (Google Travel)

Kayak

OpenTable

Oyo

Tripadvisor

Trivago

![How Does Facebook [Meta] Make Money? Facebook Business Model Analysis 2024 facebook-business-model](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2024/02/facebook-business-model.png?resize=150%2C113&ssl=1)