In the realm of subscription-based businesses, understanding the Subscriber Acquisition Cost (SAC) is paramount. SAC represents the total expenses incurred by an organization to acquire a new subscriber or customer. Delving into the intricacies of SAC provides invaluable insights into the economics of subscription models, the effectiveness of marketing strategies, and the overall financial health of the business.

Significance of SAC:

The significance of SAC cannot be overstated. It serves as a fundamental metric for assessing the viability and sustainability of subscription-based business models.

By quantifying the cost per acquisition, organizations gain clarity on the financial implications of acquiring new subscribers and can make informed decisions regarding resource allocation, pricing strategies, and revenue forecasting.

SAC also enables organizations to evaluate the effectiveness of their marketing and sales initiatives, identifying areas for improvement and optimization to maximize return on investment (ROI) and drive business growth.

Calculation Methods for SAC:

Calculating SAC entails various methodologies, each tailored to suit the specific needs and nuances of the business. Some common calculation methods include:

- Simple Calculation: The simplest approach to calculating SAC involves dividing the total marketing and sales expenses incurred within a specific period by the number of new subscribers acquired during the same period. This straightforward method provides a basic understanding of the cost per acquisition but may overlook certain expenses and nuances.

- Fully Loaded Calculation: The fully loaded calculation method takes into account all costs associated with subscriber acquisition, including marketing expenses, sales commissions, overhead costs, and any discounts or promotions offered to attract new subscribers. This comprehensive approach provides a more accurate depiction of the true cost per acquisition and enables organizations to assess the overall financial impact of subscriber acquisition efforts.

- Cohort Analysis: Cohort analysis involves tracking the SAC for different groups or cohorts of subscribers over time. By analyzing SAC trends by cohort, organizations can gain deeper insights into how acquisition costs vary across different channels, campaigns, or demographic segments. This granular analysis facilitates targeted optimization efforts and helps organizations allocate resources more effectively.

Strategies for SAC Optimization:

Optimizing SAC is essential for improving the efficiency and effectiveness of subscriber acquisition efforts. Organizations can implement a variety of strategies to optimize SAC and enhance the overall performance of their subscription-based business, including:

- Targeted Marketing Campaigns: Leveraging data analytics and customer segmentation, organizations can identify high-value customer segments and tailor marketing campaigns to effectively reach and engage these target audiences. By focusing resources on the most promising prospects, organizations can optimize SAC and maximize ROI.

- Conversion Rate Optimization (CRO): Improving the conversion rate of marketing and sales funnels is a key strategy for reducing SAC. By optimizing website design, streamlining the checkout process, and implementing targeted messaging, organizations can enhance conversion rates and lower the cost per acquisition.

- Retention and Upselling Initiatives: Increasing customer retention and maximizing customer lifetime value (CLV) can help offset acquisition costs and improve overall profitability. Organizations can focus on delivering exceptional customer experiences, offering personalized recommendations, and implementing retention strategies to retain existing subscribers and encourage upselling or cross-selling.

Metrics to Consider Alongside SAC:

While SAC is a critical metric for assessing the cost of acquiring new subscribers, organizations should also consider other key metrics that provide a holistic view of subscriber acquisition efforts. Some metrics to consider alongside SAC include:

- Customer Acquisition Cost (CAC): CAC represents the total cost of acquiring a new customer, encompassing all expenses associated with marketing and sales efforts. Comparing SAC to CAC can provide insights into the efficiency of subscriber acquisition relative to other customer acquisition channels and strategies.

- Customer Lifetime Value (CLV): CLV measures the total revenue generated by a customer over their entire relationship with the organization. Comparing CLV to SAC enables organizations to assess the long-term profitability of subscriber acquisition efforts and determine the potential return on investment over time.

- Churn Rate: Churn rate measures the percentage of subscribers who cancel their subscriptions within a given period. Monitoring churn rate is essential for understanding subscriber retention and the overall health of the subscriber base. By reducing churn and improving subscriber retention, organizations can maximize the value of subscriber acquisition efforts and enhance long-term profitability.

Conclusion:

Subscriber Acquisition Cost (SAC) is a cornerstone metric in subscription-based businesses, providing valuable insights into the cost of acquiring new subscribers and the overall effectiveness of marketing and sales efforts. By understanding the significance of SAC, employing effective calculation methods, and implementing optimization strategies, organizations can enhance the efficiency and ROI of subscriber acquisition initiatives, driving sustainable growth and profitability in the dynamic landscape of subscription-based business models.

| Framework Name | Description | When to Apply |

|---|---|---|

| Churn Rate Analysis | – Measures the rate at which customers unsubscribe or cancel their subscriptions over a specific period, providing insights into customer retention and satisfaction levels. | – When assessing customer loyalty and the effectiveness of retention strategies, to identify areas for improvement and reduce churn. |

| Customer Lifetime Value (CLV) | – Predicts the total revenue a customer will generate over their entire relationship with a business, helping to prioritize customer acquisition and retention efforts. | – When evaluating the profitability of acquiring and retaining customers, to optimize marketing strategies and allocate resources effectively. |

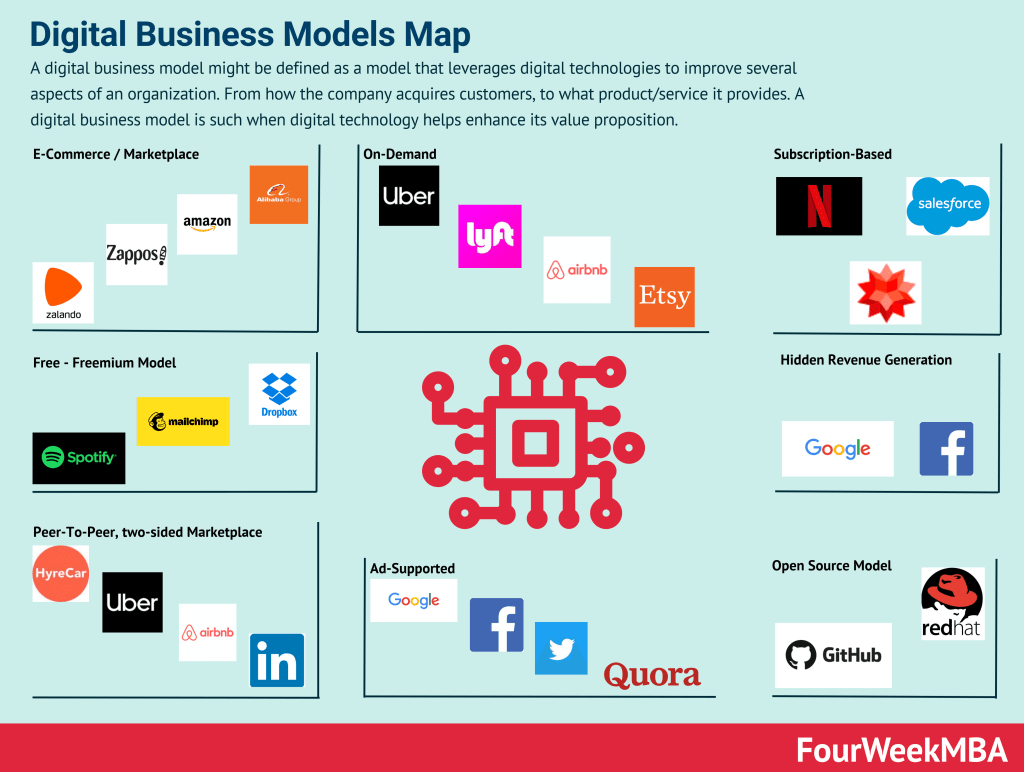

| Freemium Model | – Offers a basic version of a product or service for free, with the option to upgrade to a premium version with additional features or functionality for a subscription fee. | – When introducing new products or services, to attract users with a free offering and convert them into paying subscribers through value-added features. |

| Tiered Pricing Structure | – Offers different subscription tiers with varying levels of features or benefits at different price points, catering to the diverse needs and budgets of customers. | – When pricing subscription plans or packages, to provide options that appeal to different customer segments and maximize revenue potential. |

| Usage-based Billing | – Charges customers based on their actual usage of a product or service, providing flexibility and aligning costs with value received, particularly relevant for software-as-a-service (SaaS) businesses. | – When pricing subscription plans or services, to offer transparent pricing and incentivize usage without overcharging or undercharging customers. |

| Retention Strategies | – Focuses on engaging and retaining customers over the long term, employing tactics such as personalized communication, loyalty programs, and continuous value delivery. | – When reducing churn and improving customer lifetime value, to foster loyalty and strengthen the relationship between the business and its subscribers. |

| Subscriber Acquisition Cost (SAC) | – Measures the cost of acquiring a new subscriber, including marketing expenses and sales commissions, relative to the revenue generated from that subscriber. | – When evaluating marketing campaigns and customer acquisition channels, to optimize spending and maximize the return on investment in subscriber acquisition. |

| Content Personalization | – Tailors content, recommendations, and experiences to individual subscriber preferences and behaviors, enhancing engagement and satisfaction with the subscription service. | – When delivering content or services to subscribers, to increase relevance and value perception, driving retention and reducing churn. |

| Automatic Renewal | – Enables subscriptions to renew automatically at the end of each billing period unless canceled by the subscriber, streamlining the renewal process and ensuring continuity of service. | – When managing subscription billing and renewal processes, to minimize subscriber effort and maintain a predictable revenue stream for the business. |

| Feedback Loop Management | – Establishes a systematic process for collecting, analyzing, and acting on customer feedback to continuously improve the subscription offering and address customer needs and concerns. | – When refining subscription services or introducing new features, to iterate based on customer insights and enhance the value proposition, driving satisfaction and retention. |

Connected Business Model Types And Frameworks

Attention Merchant Business Model

Main Free Guides: