Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another.

| Aspect | Explanation |

|---|---|

| Concept Overview | Switching Costs refer to the expenses, effort, or inconveniences that customers or businesses may incur when they decide to change from one product, service, or supplier to another within a particular market or industry. These costs can be financial, such as cancellation fees, or non-financial, such as the time and effort required to adapt to a new solution. Switching costs are a significant factor in customer retention and loyalty, as they can act as a barrier that prevents customers from easily switching to competitors. |

| Types of Switching Costs | Switching costs can be categorized into various types: – Financial Costs: These include fees for canceling a subscription or contract, the cost of purchasing new equipment, or the expense of transitioning to a different vendor. – Procedural Costs: The effort and time needed to learn how to use a new product or service can be considered procedural costs. – Relational Costs: Relationships with existing suppliers or service providers can create switching costs due to the trust and familiarity developed over time. – Psychological Costs: The emotional discomfort or uncertainty associated with making a change can act as psychological switching costs. – Search Costs: The time and effort required to research and identify alternative options can also be considered switching costs. |

| Factors Influencing Switching Costs | Several factors can influence the level of switching costs in a market: – Product Differentiation: Unique features, proprietary technologies, or customization options can increase switching costs as customers may not find comparable alternatives. – Contracts and Agreements: Long-term contracts, early termination fees, and exclusive agreements can lock customers into a specific provider. – Integration: High integration of a product or service into a customer’s existing processes or systems can raise switching costs. – Brand Loyalty: Strong brand loyalty can create emotional and psychological switching costs. – Network Effects: Services with network effects become more valuable as more users join, making it challenging for customers to switch. – Cost of Learning: Products or services that require substantial learning or training may have higher procedural switching costs. |

| Applications | Understanding switching costs is crucial in various business contexts: – Marketing and Customer Retention: Businesses use knowledge of switching costs to design loyalty programs, incentives, and customer retention strategies. – Pricing Strategies: Pricing decisions often consider the level of switching costs in the market, as customers may tolerate price increases if switching is costly. – Competitive Strategy: Companies may focus on reducing their customers’ switching costs while simultaneously increasing the switching costs for their competitors. – Market Entry: Assessing switching costs is essential for new entrants to understand market dynamics and challenges. – Mergers and Acquisitions: Assessing switching costs helps companies evaluate the potential benefits of merging with or acquiring another business. |

| Benefits | Recognizing and managing switching costs offer several benefits: – Customer Retention: Businesses can use switching costs to retain existing customers and reduce churn rates. – Competitive Advantage: High switching costs can create a competitive advantage and act as a barrier to entry for competitors. – Revenue Stability: Reducing customer turnover can lead to more stable and predictable revenue streams. – Enhanced Customer Loyalty: Successful management of switching costs can foster stronger customer loyalty and long-term relationships. – Market Positioning: Businesses can strategically position themselves in the market by either offering lower switching costs than competitors or by creating products or services with such high value that switching is not desirable. |

| Challenges | Challenges in addressing switching costs include the need for a deep understanding of customer behavior, the risk of customer dissatisfaction when costs are artificially inflated, and the potential for antitrust scrutiny in cases where high switching costs hinder competition. |

Why switching costs matter

When launching a new product on the market, it’s critical to look at existing alternatives, as your solution might work, only if it is convenient (either in times of money, effort, or else) for existing customers.

Indeed, for customers to change brand, and use your product there will be an element of friction, defined as switching cost.

Switching costs go beyond price and money

Let’s imagine a simple example.

You use Google as a primary search engine, and Google Chrome as a browser. With Google and Chrome, you get a set of advantages and products (for instance, the Chrome extensions marketplace enables you to download any app to do anything within your browser).

Even if those serivces are free it’s still very hard to switch to any other search engien or browser, as the effort it takes to get used to a new combination of search engien, browser, extensions and so forth is too “expensive” psychologically to take the leap.

Building up moats

Companies that are able to create high switching costs (either through cost leadership, differentiation, or else) will also be able to create a competitive advantage.

A higher friction fro customers to change toward a new product or service might help the company to “lock them in.” Yet, this strategy to be successful it also needs to offer a great customer experience across the several products.

Thnk for instance the case of Microsoft Office that bundles up its products to create a lock-in experience for users to prevent them to switch (together with Office, customers also get other services that go from email to company’s chat like Microsoft Teams).

This closed environment might make it harder for users to switch to a new brand. Yet, the experience can be also frustrating and limiting if those products don’t work extremely well.

Monetary switching costs

A lower price can help as switching costs in those categories where products and services are more commoditized, therefore, the price will have a higher impact and importance on customers’ behaviors.

A lower price will also be more attractive. In those cases, building up switching costs become harder as the

Imagine the case of the gas station selling gasoline. If it is able to offer a lower price compared to the gas station half a mile away, consumers will prefer it, as it might not make much of a difference were to fuel the vehicle, if not the price.

Non-monetary switching costs

Other non-monetary switching costs can be classified in several ways. Some key switching costs require:

- Effort: it might take the time or mental energy to move from a product to another. Think of the case to change the software that costs less, and yet it’s more complicated to use, therefore requiring more time and effort to learn. The user might still stick with the other more expensive software if that perceived as more comfortable to use.

- Perception: other switching costs are more related to perception. Let’s take two cases:

- Branding and status quo: imagine you can buy a pair of shoes from a less known brand, which costs less. Who is passionate about shoes knows that those are fashion statements, not just things to cover your feet. Therefore, the more recognized brand or the brand that is more in line with the perception of the individual will be the preferred one, independently from price (or at least price is less critical).

- Branding and reliability: imagine the case of a person buying a laptop from a known brand vs. an unknown brand. At the same time, the unknown brand’s laptop might be cheaper, more performant, and overall better. The customer might not switch to it as she/he fears it won’t be reliable.

- Offering an alternative: think of the case of DuckDuckGo, a search engine prioritizing on privacy. Even if that might not be as good as Google, it will still be the preferred choice for those switching to it due to privacy. And those people will stick around.

Low vs. high switching costs

The inability to create high switching costs (either through pricing, better and simpler product, brand, or all these) might prevent the company to create a long-term competitive advantage.

Key Highlights

- Understanding Switching Costs:

- Switching costs refer to the barriers that customers face when they consider changing from one brand or product to another.

- These costs can be monetary or non-monetary and involve factors beyond just the price.

- Importance of Switching Costs:

- When introducing a new product, it’s crucial to consider existing alternatives and how convenient it is for customers to switch.

- Switching costs create friction and make it less likely for customers to switch to a new brand.

- Non-Monetary Switching Costs:

- Non-monetary switching costs include effort and perception-based factors.

- Effort: Customers might hesitate to switch to a product that requires more time and energy to learn and adapt to.

- Perception: Branding, status quo, and reliability influence customers’ decisions.

- Branding and Status Quo: Recognizable and well-regarded brands can have an advantage even if their products cost more.

- Branding and Reliability: Customers might stick to a known brand due to concerns about the reliability of alternatives.

- Creating High Switching Costs:

- Companies that successfully create high switching costs can build competitive advantages.

- High switching costs can be achieved through cost leadership, differentiation, or other means.

- An example is Microsoft Office, which offers a suite of interconnected products, creating a lock-in experience for users.

- Low vs. High Switching Costs:

- The inability to establish high switching costs might hinder a company’s ability to maintain a long-term competitive advantage.

- In certain cases where products are commoditized, a lower price can influence customer behavior.

- Examples of Switching Costs:

- Example of Effort: Changing to software that is cheaper but more complex to use might deter customers from switching.

- Example of Perception: Customers might choose a more recognized brand or a brand that aligns with their perception, regardless of price.

- Example of Reliability: Even if a lesser-known brand offers better features, customers might stick to a familiar brand due to reliability concerns.

- Example of Offering an Alternative: DuckDuckGo, a search engine prioritizing privacy, can attract users who value privacy even if it’s not as feature-rich as competitors.

- Creating Competitive Advantage:

- Building high switching costs is a way to create a competitive advantage.

- However, the experience across products must be excellent for this strategy to be successful.

Case Studies

| Case Study | Description | Switching Costs Impact |

|---|---|---|

| Apple’s Ecosystem Lock-In | Apple has created a robust ecosystem of products and services, including the iPhone, Mac, and iCloud. Customers who invest in Apple products often face high switching costs due to the integration and compatibility of Apple devices and services. | Apple’s ecosystem lock-in encourages customer loyalty and reduces the likelihood of users switching to non-Apple products and services. |

| Microsoft’s Enterprise Software | Microsoft’s Office suite and Windows operating system are widely used in businesses and organizations. The compatibility, familiarity, and reliance on Microsoft software create substantial switching costs for companies considering alternative solutions. | Microsoft’s dominance in enterprise software results in significant switching costs for organizations that have standardized on Microsoft products. |

| Adobe Creative Cloud Subscription | Adobe’s Creative Cloud, including software like Photoshop and Illustrator, operates on a subscription model. Users who rely on Adobe’s tools for professional work often find it challenging to switch to alternative software due to the familiarity and compatibility of Adobe products. | Adobe’s subscription model creates switching costs by locking users into ongoing subscriptions and making it difficult to transition to different tools. |

| Amazon Web Services (AWS) | Amazon’s AWS provides cloud computing and infrastructure services. Companies that host their applications and data on AWS face switching costs related to data migration, reconfiguration, and potential disruptions to their operations if they consider migrating to another cloud provider. | AWS’s market dominance and specialized services contribute to substantial switching costs for organizations using its cloud infrastructure. |

| LinkedIn’s Professional Network | LinkedIn has established itself as a leading professional networking platform. Users and organizations invest time in building connections, profiles, and content on the platform. Switching to an alternative professional network would entail recreating networks and content. | LinkedIn’s strong user base and network effect result in switching costs, as users and businesses are reluctant to abandon their established profiles and connections. |

| Oracle’s Enterprise Database Solutions | Oracle provides enterprise-grade database solutions. Organizations that rely on Oracle databases face significant switching costs, including data migration, reprogramming of applications, and potential compatibility issues if they consider switching to alternative databases. | Oracle’s stronghold in the enterprise database market leads to substantial switching costs for businesses entrenched in its ecosystem. |

| Salesforce Customer Relationship Management (CRM) | Salesforce offers a widely used CRM platform. Companies that implement Salesforce CRM invest in customization, data integration, and employee training. Switching to a different CRM solution would involve transferring data, retraining staff, and potentially disrupting sales and marketing processes. | Salesforce’s CRM dominance creates switching costs as businesses are reluctant to overhaul their customer management systems and retrain employees. |

| IBM Mainframe Computing | IBM’s mainframe computers have long been essential for large-scale data processing and mission-critical applications. Organizations that rely on IBM mainframes face substantial switching costs, including software reconfiguration and data migration, if they consider transitioning to alternative platforms. | IBM’s continued dominance in mainframe computing results in switching costs for enterprises deeply integrated with IBM mainframe technology. |

| Loyalty Programs and Airline Miles | Airlines and retail companies often offer loyalty programs with rewards, such as airline miles or points. Customers who accumulate rewards and loyalty points may hesitate to switch to competitors because they would lose the benefits and rewards they have earned over time. | Loyalty programs create switching costs by incentivizing customers to stay loyal to a particular brand or service provider to retain accumulated benefits. |

| Proprietary File Formats in Software | Some software applications use proprietary file formats, making it difficult to switch to alternative software without data conversion or compatibility issues. For example, design software often uses unique file formats that require specific software for editing and viewing. | Proprietary file formats in software create switching costs, as users must invest time and effort in converting or recreating files when transitioning to different software. |

| Related Concepts | Description | When to Apply |

|---|---|---|

| Switching Costs | Switching Costs refer to the expenses, effort, or inconvenience associated with changing from one product, service, or supplier to another. These costs can be tangible, such as termination fees or retraining expenses, or intangible, like the time and effort required to learn a new system or adapt to a different workflow. Understanding switching costs is crucial for businesses as they impact customer retention, loyalty, and the competitive landscape. Higher switching costs can deter customers from switching to competitors, providing a competitive advantage to businesses. | – When analyzing customer behavior, retention strategies, or competitive positioning in a market where switching costs play a significant role in customer decision-making. |

| Lock-in Effect | The Lock-in Effect is a consequence of high switching costs, where customers become “locked-in” to a product, service, or platform due to the barriers preventing them from switching to alternatives. This effect can lead to customer loyalty and reduced churn rates for businesses. Understanding the lock-in effect is essential for businesses looking to build sustainable customer relationships and mitigate the risk of losing customers to competitors. | – When designing products, services, or platforms with features or incentives that increase switching costs and promote customer loyalty and retention. |

| Vendor Lock-in | Vendor Lock-in occurs when customers become dependent on a specific vendor’s products, services, or technologies, making it difficult or costly to switch to alternative providers. Vendor lock-in can result from proprietary formats, integration dependencies, or contractual obligations, tying customers to a particular vendor’s ecosystem. Businesses can leverage vendor lock-in to build long-term relationships with customers and secure recurring revenue streams. | – When formulating business strategies or partnerships that aim to establish strong customer relationships and reduce the likelihood of customers switching to competitors. |

| Customer Churn | Customer Churn refers to the rate at which customers discontinue using a company’s products or services over a given period. High switching costs can reduce customer churn by making it more difficult or expensive for customers to switch to alternative solutions. Understanding customer churn and its drivers is critical for businesses seeking to improve customer retention and maximize customer lifetime value. | – When assessing customer satisfaction, loyalty programs, or retention strategies to reduce customer churn and increase customer lifetime value. |

| Lock-in Strategies | Lock-in Strategies are tactics employed by businesses to increase switching costs and retain customers within their ecosystem. These strategies may include offering proprietary formats, creating network effects, providing loyalty rewards, or integrating products and services to create dependencies. Lock-in strategies aim to enhance customer retention, drive recurring revenue, and strengthen competitive advantages in the market. | – When developing marketing, sales, or product strategies aimed at building customer loyalty and reducing churn through tactics that increase switching costs and lock customers into the business ecosystem. |

| Contractual Obligations | Contractual Obligations are legal agreements or commitments that bind customers to a specific product, service, or vendor for a defined period. These obligations can include service contracts, subscription agreements, or licensing arrangements that impose penalties or termination fees for early cancellation or switching. Businesses can leverage contractual obligations to secure recurring revenue and minimize customer churn by incentivizing long-term commitments. | – When structuring pricing plans, subscription models, or contractual terms to encourage long-term commitments from customers and reduce the likelihood of churn or early termination. |

| Cost-Benefit Analysis | Cost-Benefit Analysis is a decision-making tool used to evaluate the potential benefits and costs associated with a particular course of action or investment. When assessing switching costs, businesses conduct cost-benefit analyses to weigh the advantages of switching to alternative solutions against the costs and challenges involved. This analysis helps businesses make informed decisions regarding customer retention strategies, vendor relationships, and competitive positioning. | – When evaluating the impact of switching costs on customer behavior, competitive dynamics, or investment decisions to inform strategic planning and decision-making. |

| Product Differentiation | Product Differentiation is the process of distinguishing a product or service from competitors’ offerings through unique features, attributes, or value propositions. By differentiating their products or services, businesses can reduce the substitutability of their offerings and increase switching costs for customers. Product differentiation strategies aim to create perceived value and loyalty among customers, making them less likely to switch to alternative solutions. | – When developing products or services that incorporate unique features, functionalities, or value propositions to differentiate offerings and increase switching costs for customers. |

| Customer Onboarding | Customer Onboarding refers to the process of integrating new customers into a product or service and helping them achieve success and satisfaction with their purchase. Effective onboarding experiences can reduce perceived switching costs for customers by minimizing friction, providing guidance, and demonstrating value early in the customer journey. Businesses invest in customer onboarding to increase adoption, retention, and overall customer satisfaction. | – When designing customer onboarding processes or experiences that aim to reduce switching costs, accelerate time-to-value, and improve customer retention and satisfaction. |

| Data Portability | Data Portability is the ability for customers to transfer their data and information between different products, services, or platforms. Providing data portability options can lower switching costs for customers by enabling them to migrate their data seamlessly to alternative solutions. Businesses may offer data portability features as a competitive advantage to attract customers concerned about vendor lock-in or data ownership. | – When developing products, services, or platforms that prioritize data portability as a means to reduce customer switching costs and enhance user flexibility and control. |

| Competitive Advantage | Competitive Advantage refers to the unique strengths or capabilities that enable a business to outperform competitors in the market. High switching costs can contribute to a sustainable competitive advantage by creating barriers to entry, reducing customer churn, and increasing customer lifetime value. Businesses leverage competitive advantages to differentiate themselves, capture market share, and drive long-term success and profitability. | – When identifying and leveraging sources of competitive advantage, such as high switching costs, to strengthen market position, drive growth, and achieve sustainable business success. |

FourWeekMBA Toolbox

FourWeekMBA Squared Triangle Business Model

This framework has been thought for any type of business model, be it digital or not. It’s a framework to start mind mapping the key components of your business or how it might look as it grows. Here, as usual, what matters is not the framework itself (let’s prevent to fall trap of the Maslow’s Hammer), what matters is to have a framework that enables you to hold the key components of your business in your mind, and execute fast to prevent running the business on too many untested assumptions, especially about what customers really want. Any framework that helps us test fast, it’s welcomed in our business strategy.

FourWeekMBA VTDF Framework For Tech Business Models

This framework is well suited for all these cases where technology plays a key role in enhancing the value proposition for the users and customers. In short, when the company you’re building, analyzing, or looking at is a tech or platform business model, the template below is perfect for the job.

Download The VTDF Framework Template Here

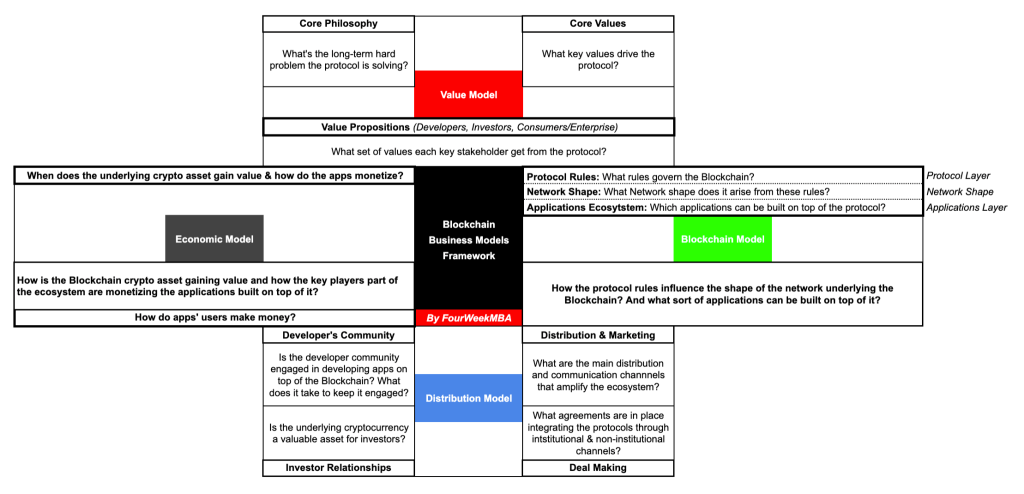

FourWeekMBA VBDE Framework For Blockchain Business Models

This framework is well suited to analyze and understand blockchain-based business models. Here, the underlying blockchain protocol, and the token economics behind it play a key role in aligning incentives and also in creating disincentives for the community of developers, individual contributors, entrepreneurs, and investors that enable the whole business model. The blockchain-based model is similar to a platform-based business model, but with an important twist, decentralization should be the key element enabling both decision-making and how incentives are distributed across the network.

Download The VBDE Framework Template Here

Connected Business Concepts

Main Free Guides:

- Business Models

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

Read next:

- Diseconomies Of Scale

- Network Effects

- Negative Network Effects

- Platform Business Model

- Amazon Business Model

- What Is A Moat

- Competitive Advantage

Read also: