It would be hard to argue the case for a more recognizable entertainment brand than Disney. Disney is of course synonymous with Walt Disney, but it was Walt and his brother Roy who started the company in 1923 in Burbank, California. Disney content is now broadcast on over 100 channels in 34 different languages across the globe.

Strengths

- Brand recognition – Disney has a prominent position in the entertainment market and indeed in society. Disney owns a large proportion of childhood characters of whom some become children’s role models. In this way, Disney is ever-present as children grow into adults with more purchasing power.

- Global reach – Disney reaches a truly global audience because of the universal themes in its entertainment shows that transcend language and culture. It has also established 11 theme parks worldwide to promote awareness of the brand and penetrate new markets.

- Diversification – many consumers will be surprised to learn that ESPN and Freeform are also Disney companies. The company has also acquired the rights for all Star Wars and Marvel franchises and their related products.

- Brand equity – in general, Disney is perceived as a respectable provider of high-quality goods and services. It does not need to defend or market product quality, and it would be difficult to see another company making a significant dent in Disney’s market share.

Weaknesses

- Omnipresence – some believe that Disney’s influence is so vast that the company’s presence has infiltrated almost every aspect of consumer life. This so-called “Disney-ization” is often pervasive and difficult to detect and has negative connotations for some customer relations.

- High-cost products and services – consumers are willing to pay for the privilege of owning Disney products because of the company’s brand equity – but only to an extent. Disney amusement parks are notoriously expensive, and its cable channels are often not included in standard cable packages.

- Seasonality – Disney’s media networks, amusement parks, and advertising revenue are all impacted by the changing seasons. As a result, Disney has to work harder to attract and retain customers during quiet periods, contributing to the pervasive presence in consumer lives mentioned above.

Opportunities

- Diversification through acquisition – in late 2019, Disney acquired 21st Century Fox and its streaming service Hulu. It also gained the rights to National Geographic and 21st Century Fox’s vast library of content. This will allow Disney to diversify its programming reach to children and adults alike.

- Movie rights – currently, Turner Broadcasting holds the rights to early Star Wars films. The benefits for Disney gaining the rights to these films would mean it has complete ownership of the franchise.

- Changes in media consumption in children – the children of today are more technologically savvy than ever. They are also more empowered about what they watch, with studies showing they spend almost 11 hours a day consuming media across various devices. This represents a huge opportunity for Disney market their content.

Threats

- Streaming competition – while Disney enjoys little competition elsewhere, it is very much a late adopter of streaming services. Netflix and Amazon are long-established players in this segment that Disney will find difficult to take market share from.

- Anti-technology sentiment – as children become more technologically savvy, their parents are taking an increasingly active role in preserving a child’s innocence by encouraging them to interact in the “real world”. This compromises Disney’s ability to reach children in what is undoubtedly one of their core strategies.

- Increased regulatory pressure – changes in consumer trends in media consumption have created many new laws and regulations regarding privacy, data protection, safety, licensing, and distribution. These have the potential to reduce company profits and restrict expansion into new markets.

Key Highlights

Strengths:

- Brand Recognition: Disney is an iconic and highly recognizable entertainment brand with a strong influence on childhood and consumer preferences.

- Global Reach: Disney’s universal themes and 11 theme parks worldwide contribute to its ability to reach a diverse global audience.

- Diversification: Disney’s ownership of ESPN, Freeform, Star Wars, and Marvel franchises expands its portfolio and market presence.

- Brand Equity: Disney is widely perceived as a provider of high-quality goods and services, allowing it to maintain a significant market share.

Weaknesses:

- Omnipresence: Some critics argue that Disney’s pervasive influence, known as “Disney-ization,” negatively impacts customer relations.

- High-Cost Products and Services: Disney’s amusement parks and cable channels can be expensive, potentially limiting consumer access.

- Seasonality: Disney’s revenue is affected by seasonal fluctuations, requiring efforts to attract and retain customers during quieter periods.

Opportunities:

- Diversification through Acquisition: Disney’s acquisition of 21st Century Fox and Hulu diversifies its programming reach, appealing to both children and adults.

- Movie Rights: Gaining the rights to early Star Wars films could enhance Disney’s control and ownership of the franchise.

- Changing Media Consumption in Children: Disney can capitalize on children’s increased media consumption and technological savvy to market its content effectively.

Threats:

- Streaming Competition: Established streaming giants like Netflix and Amazon pose significant competition to Disney in the streaming services segment.

- Anti-Technology Sentiment: As parents encourage children to engage more in the “real world,” Disney faces challenges in reaching its target audience through digital platforms.

- Increased Regulatory Pressure: Evolving laws and regulations related to privacy, data protection, safety, licensing, and distribution may impact Disney’s profits and market expansion efforts.

Related Visual Stories

SWOT Analysis Case Studies

Read Next: SWOT Analysis, Personal SWOT Analysis.

Other case studies:

- Amazon SWOT Analysis Example

- Apple SWOT Analysis Example

- Facebook SWOT Analysis Example

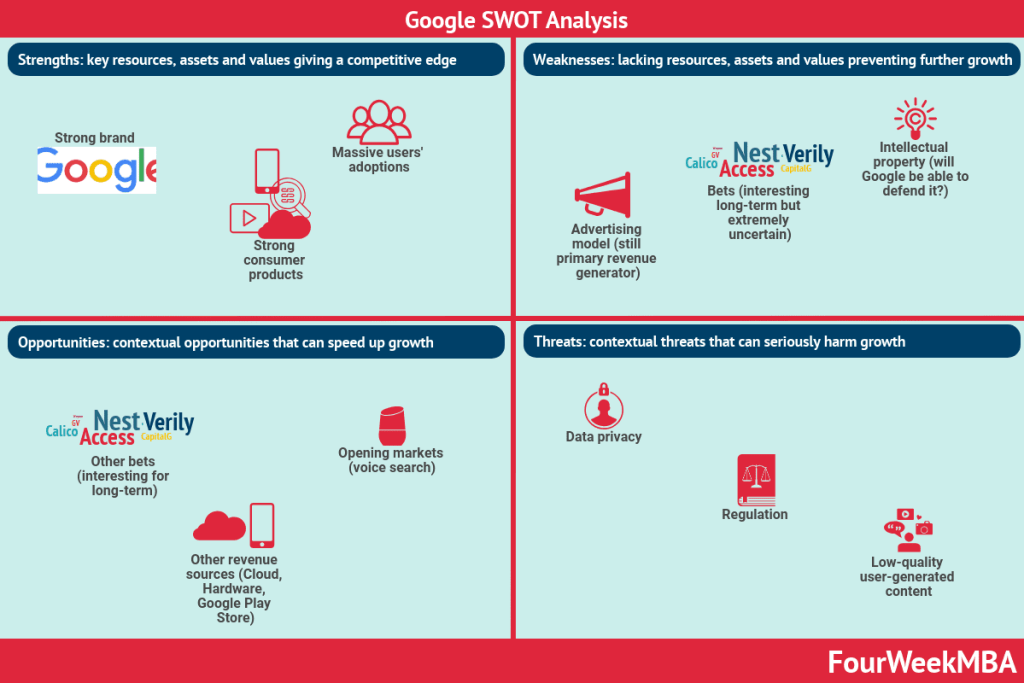

- Google SWOT Analysis Example

- Netflix SWOT Analysis Example

- Starbucks SWOT Analysis Example

- Tesla SWOT Analysis Example

Other resources: