Back in the year 2000, Amazon’s business model was facing scalability issues, primarily due to its massive infrastructure growth.

More precisely, Amazon was looking for a way to allow merchants to build their own e-commerce on top of Amazon.

This would later become a critical strength and competitive advantage for Amazon.

That is also why, with “really no fanfare,” Amazon started to put together the infrastructure that would later become Amazon AWS.

Today Amazon AWS is a company’s separate segment, and it made over seventeen billion dollars in revenues!

Related: Amazon Business Model Analysis

Amazon AWS’s expenses are primarily comprised of its technology and content costs. Throughout the years, Amazon has doubled down on that.

Amazon AWS changed the whole profitability of the company. From a company running at tight margins, AWS became a segment with a huge impact on growth and profits.

For the first time since 2014, Amazon generated a net loss of $2.7 billion in 2022, nonetheless Amazon’s AWS incredible profitability.

Amazon, over the years, has been using an aggressive expansion strategy, what I like to call continuous blitzscaling.

In fact, in a blitzscaling scenario, a company defends its market position by attacking competitors. It’s an effective strategy, especially if a company is threatened.

Yet, Amazon has been using blitzscaling as a default mode. By aggressively expanding from books to adjacent niches with incredible speed.

Amazon’s business model, indeed, is skewed toward customer obsession. This leads to lower prices, wider selection, and extremely fast delivery for customers.

Yet, this might go at the expense of suppliers, third-party stores on Amazon, and delivery partners.

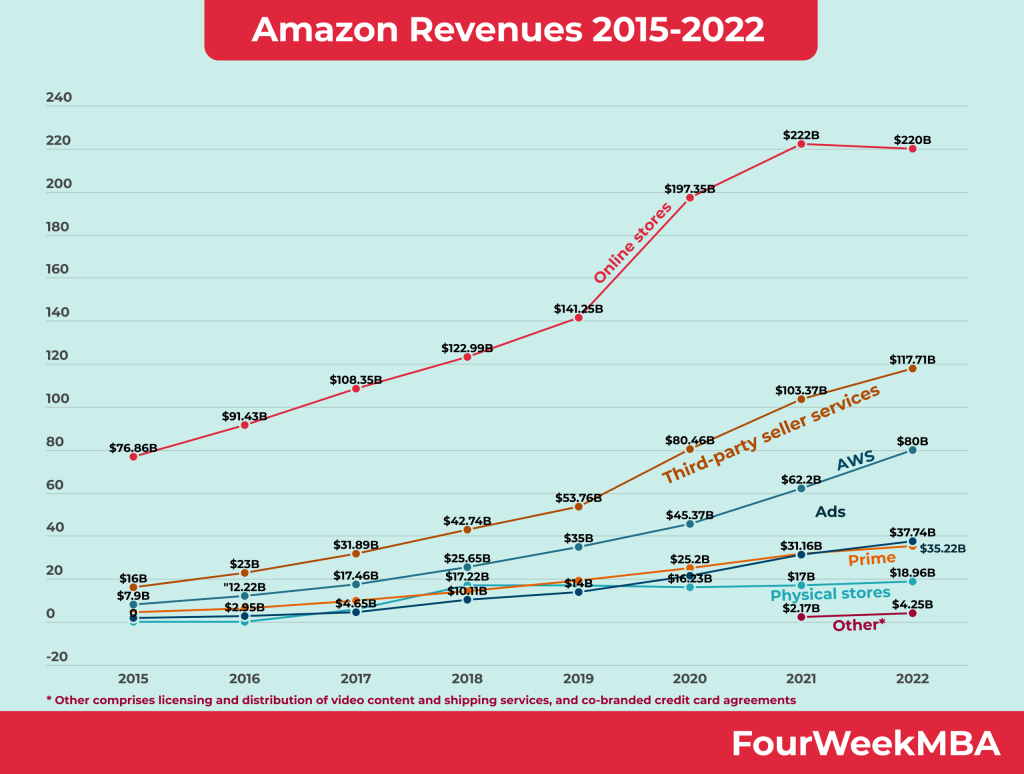

By looking at Amazon’s revenue model over the years, it is easy to appreciate how Amazon AWS has grown in importance for the overall Amazon business model:

As the successor of Jeff Bezos, Andy Jassy, CEO of Amazon (which had been in charge of AWS since the onset) explained, in the 2021 shareholders letter:

When the pandemic started in early 2020, few people thought it would be as expansive or long-running as it’s been. Whatever role Amazon played in the world up to that point became further magnified as most physical venues shut down for long periods of time and people spent their days at home. This meant that hundreds of millions of people relied on Amazon for PPE, food, clothing, and various other items that helped them navigate this unprecedented time. Businesses and governments also had to shift, practically overnight, from working with colleagues and technology on-premises to working remotely. AWS played a major role in enabling this business continuity. Whether companies saw extraordinary demand spikes, or demand diminish quickly with reduced external consumption, the cloud’s elasticity to scale capacity up and down quickly, as well as AWS’s unusually broad functionality helped millions of companies adjust to these difficult circumstances.

With the AWS segment, Amazon serves “developers and enterprises of all sizes, including start-ups, government agencies, and academic institutions, through its AWS segment, which offers a broad set of global compute, storage, database, and other service offerings.”

The interesting part of Amazon AWS is that unlike its core business model (online store), this segment runs at high-profit margins.

For instance, by comparing the revenues and operating income growth over the years, you can appreciate how the cost structure for Amazon AWS gets better over time:

That makes it easy to understand why Amazon is doubling down on its AWS business segment!

As explained by Andy Jassy, when he was still Amazon AWS CEO, in a 2017 interview on Forbes:

If you look at what’s happening in the enterprise and the public sector over the last two to three years, it’s exponential and dramatic for AWS,” he says. “You can see it in really every imaginable vertical business segment. So it’s not like these enterprises are running just a couple applications. We have an $18 billion revenue run rate. You don’t have a business that big just on startups. We’re just at the beginning of mainstream enterprise mass migration to the cloud.

Connected to Amazon Business Model

Read Next: Amazon Business Model