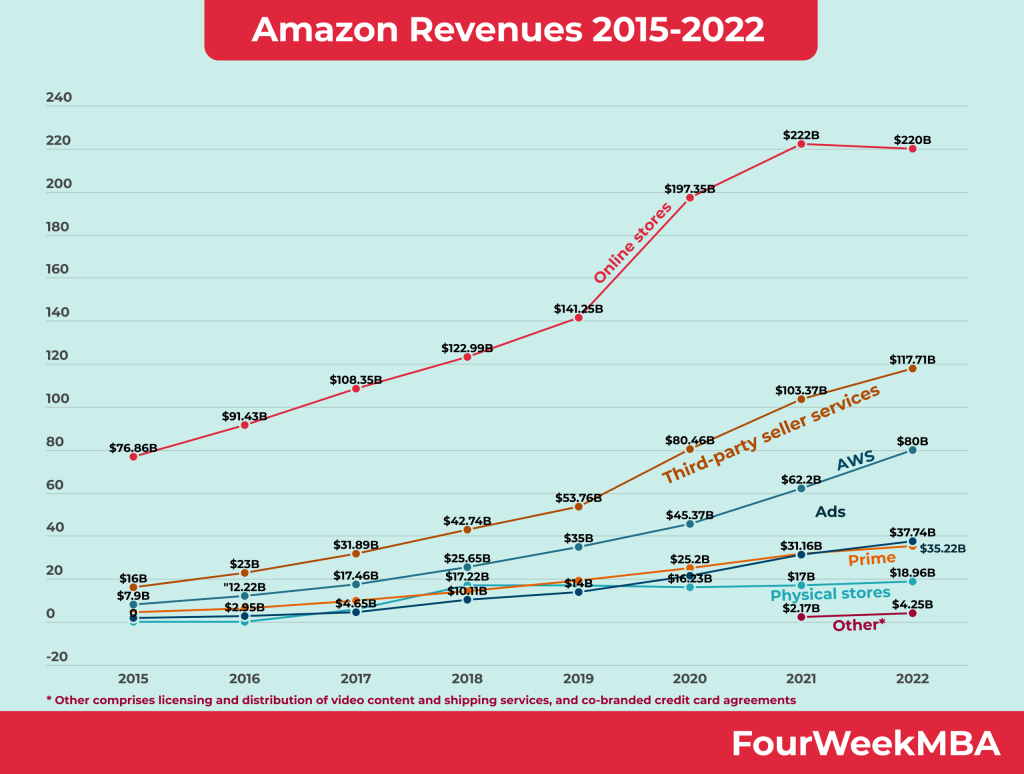

Amazon acquired audiobook seller Audible in 2008 for $300 million. Founded in 1997, Audible had already sold more than 80,000 audio versions of books, newspapers, magazines, and television and radio content by the time of the acquisition in 2008. Today, Audible is part of Amazon’s empire, which generated over half a trillion dollars in revenue in 2023.

| Detail | Description |

|---|---|

| Company | Audible, Inc. |

| Ownership Structure | Wholly owned subsidiary |

| Parent Company | Amazon.com, Inc. |

| Acquisition Date | March 19, 2008 |

| Founding Date | 1995 |

| Founder | Donald Katz |

| Headquarters | Newark, New Jersey, USA |

| Primary Business | Producing and selling audiobooks, audio content, podcasts, and spoken-word entertainment |

| Strategic Goals | Expanding audiobook and podcast offerings, enhancing user experience, leveraging Amazon’s ecosystem, and promoting content diversity and accessibility |

Additional Ownership Details

- Corporate Structure and Ownership: Audible, Inc. is a wholly owned subsidiary of Amazon.com, Inc. Audible was acquired by Amazon in March 2008 for approximately $300 million. This acquisition allowed Amazon to integrate Audible’s extensive library of audiobooks and audio content into its own ecosystem, offering a comprehensive digital media experience to its customers. As part of Amazon, Audible benefits from the parent company’s vast resources, technological infrastructure, and global reach, enhancing its ability to deliver high-quality audio content to a broad audience.

- History and Brand Development: Audible was founded in 1995 by Donald Katz, a journalist and author who recognized the potential of digital audio for storytelling and information delivery. The company pioneered the digital audiobook market, launching the Audible Player, the first portable digital audio player, in 1997. Audible quickly gained popularity as a platform for audiobooks, podcasts, and other spoken-word content, partnering with major publishers and authors to expand its catalog. The acquisition by Amazon accelerated Audible’s growth, allowing it to become a leading provider of digital audio content worldwide.

- Business Model and Revenue Streams: Audible operates a subscription-based business model, offering users access to a vast library of audiobooks, podcasts, and original audio content. Customers can choose from various subscription plans, including Audible Plus and Audible Premium Plus, which offer different levels of access and benefits. Audible also generates revenue through the sale of individual audiobooks and content, both on its platform and through partnerships with other digital retailers. The company’s business model emphasizes convenience, flexibility, and personalized recommendations to enhance the user experience and drive customer loyalty.

- Product Offerings and Content Library: Audible’s product offerings include a wide range of audiobooks, podcasts, and original audio content across various genres and categories. The platform boasts an extensive library of titles, featuring bestsellers, classics, self-help, non-fiction, and exclusive Audible Originals. Audible has invested in producing high-quality original content, collaborating with renowned authors, celebrities, and creators to deliver unique audio experiences. The company’s focus on content diversity and accessibility ensures that it caters to a broad audience with varied interests and preferences.

- Integration with Amazon Ecosystem: As part of Amazon, Audible is integrated into the broader Amazon ecosystem, benefiting from seamless connectivity with devices like Amazon Echo and Kindle. Audible’s integration with Amazon’s voice assistant, Alexa, allows users to listen to audiobooks and manage their Audible library through voice commands. This integration enhances the convenience and accessibility of Audible’s services, providing users with a cohesive digital media experience. Amazon’s vast distribution network and marketing capabilities also support Audible’s efforts to reach new audiences and expand its market presence.

- Global Market Expansion: Audible has a significant global presence, offering its services in multiple countries and languages. The company continues to expand its reach by entering new markets and localizing its content offerings to suit regional preferences. Audible’s international strategy involves building partnerships with local publishers and content creators to develop region-specific content, enhancing its appeal to diverse audiences. The company’s focus on global expansion supports its mission to make audio content accessible and enjoyable for people around the world.

- Technology and User Experience: Audible invests heavily in technology to enhance its platform’s functionality and user experience. The company offers a user-friendly app and website that provide seamless access to its content library, personalized recommendations, and features like offline listening and speed adjustments. Audible’s technology initiatives also include AI-driven content curation and discovery, ensuring that users receive relevant and engaging content based on their preferences and listening history. The company’s commitment to innovation and user satisfaction is central to its strategy for retaining and growing its customer base.

- Brand Positioning and Marketing: Audible positions itself as a leader in the digital audio content market, emphasizing quality, diversity, and innovation. The company’s marketing strategy highlights the benefits of audiobooks and spoken-word content, such as convenience, accessibility, and the ability to multitask while consuming content. Audible’s campaigns often feature endorsements from authors, celebrities, and influencers, reinforcing its reputation as a premium audio platform. The brand’s messaging focuses on inspiring and educating listeners, promoting audio content as a valuable complement to traditional reading.

- Leadership and Governance: Audible is led by a team of experienced executives and a board of directors responsible for guiding its strategic direction and operations. Bob Carrigan serves as the CEO, overseeing the company’s growth and innovation initiatives. Under his leadership, Audible focuses on expanding its content offerings, enhancing user experience, and driving international growth. The company’s governance structure ensures alignment with Amazon’s broader goals while maintaining Audible’s distinct brand identity and mission.

| Aspect | Description | Analysis | Examples |

|---|---|---|---|

| Products and Services | Audible offers a subscription-based platform for accessing and listening to audiobooks, spoken-word content, podcasts, and original audio shows. Subscribers can choose from a vast library of audiobooks across various genres, making it convenient to enjoy literature and content on the go. Audible also provides an audiobook production and publishing platform for authors and narrators. | Audible’s primary revenue source is subscription fees from its audiobook and spoken-word content platform. The extensive library caters to a wide range of interests and preferences, attracting a diverse subscriber base. Additionally, Audible offers audiobook production and publishing services, expanding its reach to content creators and authors. | Audiobooks, spoken-word content, podcasts, original audio shows, subscription-based platform, diverse content library, convenience, audiobook production, publishing services, content creators, authors. |

| Revenue Streams | Audible generates revenue primarily through subscription fees paid by its members. Subscribers pay a monthly fee in exchange for access to audiobooks and other content in Audible’s library. Revenue also comes from the sale of individual audiobooks to non-subscribers and partnerships with content creators, authors, and publishers. | Subscription fees constitute Audible’s primary revenue stream, with subscribers paying for access to its vast library. The sale of individual audiobooks to non-subscribers and partnerships with content creators, authors, and publishers further contribute to the company’s income. These revenue streams ensure a diversified income base. | Subscription fees, monthly membership fees, individual audiobook sales, content creator partnerships, author collaborations, publisher agreements, diversified revenue sources. |

| Customer Segments | Audible serves a diverse customer base, including book enthusiasts, commuters, individuals with busy lifestyles, and those who prefer listening to content rather than reading. It attracts customers who value the convenience of audiobooks for entertainment and learning while multitasking. Additionally, content creators and authors looking to publish audiobooks or spoken-word content are part of Audible’s customer ecosystem. | Audible primarily caters to individuals who enjoy books and spoken-word content but have limited time for traditional reading due to busy schedules or while commuting. Its convenience-oriented approach appeals to customers who can listen to content while engaged in other activities. Content creators, authors, and narrators seeking to publish audiobooks or spoken-word content also form a significant customer segment. | Book enthusiasts, commuters, busy individuals, multitaskers, convenience seekers, content creators, authors, narrators, audiobook publishers, spoken-word content creators. |

| Distribution Channels | Audible distributes its audiobook and spoken-word content through its online platform and mobile app. Subscribers can access and listen to content on various devices, including smartphones, tablets, and smart speakers. The platform offers recommendations, personalized playlists, and a seamless listening experience. | Audible’s primary distribution channels include its online platform and mobile app, ensuring accessibility across a wide range of devices. The user-friendly platform provides features like personalized recommendations and playlists, enhancing the listening experience and encouraging customer engagement. | Online platform, mobile app, multi-device accessibility, personalized recommendations, playlists, user-friendly interface, enhanced listening experience, customer engagement. |

| Key Partnerships | Audible collaborates with publishers, authors, and content creators to acquire and feature audiobooks and spoken-word content on its platform. These partnerships help expand the content library and cater to diverse audience interests. Additionally, Audible may enter into exclusive partnerships with authors or celebrities to produce original audiobooks and content. | Collaborations with publishers, authors, and content creators are essential for acquiring a diverse range of audiobooks and spoken-word content for Audible’s platform. Exclusive partnerships with well-known authors or celebrities can create buzz and attract subscribers. Building a robust network of partnerships strengthens Audible’s content offerings. | Publisher collaborations, author partnerships, content creator relationships, exclusive content agreements, diverse content acquisition, original content production, buzzworthy partnerships. |

| Key Resources | Key resources for Audible include its extensive library of audiobooks and spoken-word content, its online platform and mobile app, a subscription-based business model, partnerships with publishers and authors, a global user base, and a team of narrators and audiobook producers. Investment in technology and content acquisition is vital for maintaining a competitive edge. | Audible’s resources consist of a vast library of audiobooks and spoken-word content, an intuitive online platform and mobile app, a subscription-based business model, valuable partnerships with publishers and authors, a global user base of subscribers, and a team of skilled narrators and audiobook producers. Continuous investment in technology infrastructure and content acquisition is essential to remain competitive and satisfy subscriber demands. | Extensive content library, online platform, mobile app, subscription model, publisher and author partnerships, global user base, narrator and producer team, technology investments, content acquisition efforts, competitive edge. |

| Cost Structure | Audible incurs various costs, including expenses related to content acquisition and licensing agreements with publishers and authors, technology infrastructure maintenance, employee salaries and benefits, marketing and advertising campaigns, distribution and hosting, and administrative overhead. Investment in exclusive content production can be substantial. | Costs associated with Audible’s operations encompass content acquisition and licensing expenses, technology infrastructure maintenance, salaries and benefits for employees, marketing and promotional campaigns, distribution and hosting costs, and administrative overhead. The production of exclusive content may involve significant investments in talent and production facilities. | Content acquisition costs, licensing agreements, technology infrastructure expenses, employee salaries and benefits, marketing costs, distribution expenses, administrative overhead, exclusive content production investments, production facility costs. |

| Competitive Advantage | Audible’s competitive advantage lies in its extensive library of audiobooks and spoken-word content, offering a vast selection for subscribers. The convenience of its platform, accessible across multiple devices, appeals to busy individuals and multitaskers. Collaborations with publishers, authors, and content creators ensure a constant flow of fresh and diverse content. Exclusive partnerships and original content production contribute to brand exclusivity and subscriber retention. | Audible’s strengths include its extensive and diverse content library, catering to various interests and preferences. The convenience and accessibility of its platform on multiple devices resonate with customers who prioritize multitasking and on-the-go learning and entertainment. Collaborations and partnerships with content creators ensure a constant stream of new content. Exclusive partnerships and original content production enhance brand exclusivity and subscriber loyalty. | Vast content selection, convenience, multi-device accessibility, diverse content acquisition, collaborations with content creators, exclusive partnerships, original content production, brand exclusivity, subscriber retention. |

The Acquisition of Audible by Amazon Explained

- Acquisition by Amazon: Audible, a prominent audiobook seller, was acquired by Amazon in 2008 for $300 million.

- Established Company: Founded in 1997, Audible had already established itself as a leading provider of audiobooks, offering a diverse collection of audio versions of books, newspapers, magazines, and television and radio content.

- Expanding Amazon’s Portfolio: The acquisition of Audible was part of Amazon’s strategy to diversify its offerings and expand into the audiobook market.

- Recognized Audiobook Provider: Audible’s reputation as a recognized audiobook provider added value to Amazon’s existing services and enhanced its entertainment offerings.

- Bolstering Amazon’s Media Platform: With the acquisition of Audible, Amazon strengthened its media platform, providing customers with a wide range of entertainment options beyond traditional books and e-books.

- Integration with Amazon Ecosystem: Audible became an integral part of Amazon’s ecosystem, providing a seamless experience for Amazon customers interested in audiobooks and other audio content.

- Leveraging Audible’s Expertise: Amazon leveraged Audible’s expertise in the audiobook industry to enhance its audio content library and improve customer experiences.

- Contributing to Amazon’s Revenue: Audible’s inclusion in Amazon’s portfolio contributed to the company’s overall revenue growth and diversification of income streams.

- Growing Audiobook Market: The acquisition of Audible allowed Amazon to tap into the growing audiobook market, catering to the preferences of consumers seeking audio-based content.

- Long-Term Success: Over the years, Audible has continued to thrive under Amazon’s ownership, contributing to Amazon’s overall success as a global e-commerce and technology giant.

- Key Component of Amazon’s Empire: Audible, as part of Amazon’s empire, complements the company’s diverse range of offerings, contributing to Amazon’s impressive revenue of over half a trillion dollars in 2022.

- Customer-Focused Experience: The combination of Amazon’s customer-centric philosophy and Audible’s commitment to providing high-quality audiobooks has resulted in a positive and satisfying experience for customers.

- Continued Growth: As part of Amazon, Audible has continued to grow, attracting more customers and expanding its audiobook catalog, cementing its position as a leading player in the audiobook industry.

Connected to Amazon

Is Amazon Profitable Without AWS?