Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primarily makes money by collecting fees from drivers who complete rides on the platform.

| Element | Description |

|---|---|

| Value Proposition | Lyft offers a range of value propositions for its customers: – Convenience: Lyft provides an accessible and convenient way to request rides on-demand through its mobile app. – Affordability: Lyft offers competitive pricing, making it an economical choice for transportation compared to traditional taxis. – Ride-Sharing Community: Lyft fosters a sense of community by connecting riders with drivers, creating a friendly and social experience. – Safety: Lyft prioritizes passenger safety with background checks for drivers and real-time tracking features during rides. – Accessibility: Lyft offers various ride options, including shared rides and accessible vehicles for individuals with mobility needs. – Environmentally Friendly: Lyft promotes eco-friendly transportation by offering electric and hybrid vehicle options. |

| Core Products/Services | Lyft’s core products and services include: – Ride-Hailing: Lyft operates a ride-hailing platform that allows users to request rides from nearby drivers using the Lyft mobile app. – Multiple Ride Options: Lyft offers various ride options, including Lyft Standard, Lyft XL (larger vehicles), Lyft Lux (luxury vehicles), and Lyft Shared (carpooling). – Lyft Rentals: Users can rent vehicles through the Lyft app for longer durations, catering to travelers and those in need of a temporary vehicle. – Lyft Business: Lyft provides business accounts for companies to manage employee transportation needs and expenses. – E-scooters and Bicycles: In some markets, Lyft offers electric scooters and bicycles for short-distance transportation. – Lyft Concierge: A service that allows businesses to schedule rides for their customers or patients. |

| Customer Segments | Lyft’s customer segments include: – Riders: Individuals seeking convenient transportation for daily commutes, errands, social outings, and travel. – Drivers: Independent contractors who provide rides through the Lyft platform, earning income and enjoying flexible work schedules. – Businesses: Companies and organizations that use Lyft Business to manage employee transportation needs. – Tourists and Travelers: Visitors and tourists looking for reliable transportation options while exploring new cities. – Healthcare Providers: Medical facilities and healthcare providers using Lyft Concierge to arrange rides for patients. – Eco-Conscious Consumers: Individuals who prefer eco-friendly transportation options, such as electric vehicles and shared rides. |

| Revenue Streams | Lyft generates revenue through several revenue streams: – Ride Commissions: Lyft takes a percentage of the fare charged to riders as a commission for each completed ride. – Booking Fees: The company charges riders a booking fee for each ride, which contributes to revenue. – Subscription Services: Lyft offers subscription plans, such as Lyft Pink, which provide members with discounts and benefits for a monthly fee. – Lyft Business: Revenue is generated from businesses using Lyft Business accounts to manage employee transportation. – Lyft Rentals: Income comes from vehicle rentals booked through the Lyft app. – Advertising and Partnerships: Lyft may partner with brands and advertisers for promotional campaigns and advertising placements within the app. |

| Distribution Strategy | Lyft’s distribution strategy focuses on accessibility and user experience: – Mobile App: Lyft primarily operates through its mobile app, allowing users to request rides, track their drivers, and make payments conveniently. – Driver Recruitment: The company actively recruits and onboards drivers to ensure sufficient availability for riders. – Market Expansion: Lyft expands its services to new cities and regions to reach a broader customer base. – Customer Support: Lyft provides customer support to address rider and driver inquiries, ensuring a positive experience. – Partnerships: Lyft partners with businesses, healthcare providers, and other organizations to offer specialized services like Lyft Business and Lyft Concierge. – Sustainability Initiatives: The company explores eco-friendly transportation options, including electric vehicles and bicycles, to align with environmental goals. |

Lyft business model in less than a hundred words

Lyft is a transportation-as-a-service on-demand marketplace that allows riders to quickly find a driver and get from one place to another. However, Lyft has also expanded with a multimodal platform that gives more options like bike sharing or electric scooters.

And it is also experimenting with autonomous driving. Lyft primary makes money by collecting fees from drivers that complete rides on the platform. It also makes money via subscription fees and single-use ride fees paid by riders to access the network of shared bikes and scooters.

Related: How Does Uber Make Money? Uber Business Model In A Nutshell

The birth of Lyft value proposition

A business model starts with a value proposition, and Lyft built it on the modern mass transportation system which turned out to be inefficient.

Indeed, while mass transportation allowed people to move freely, it also created massive inefficiencies, stress among car users and wide underutilized spaces. Therefore, Lyft value proposition started from three key drawbacks of mass transportation:

- Underutilization: vehicles are not used most of the time

- Inefficiency: the large ownership of vehicles also made cities build large parking spaces which occupy a good chunk of cities’ urban landscapes

- Inequality: car ownership while distributed is still a large issue for many people that can’t afford to buy a car

The Lyft value proposition also got fueled by five key trends, that Lyft highlighted in its financial prospectus:

- The growth of Sharing Versus Ownership: a growing number of people prefer to use as they go rather than own a vehicle, that is still most of the time.

- The rise of On-Demand Services: the rise of web portals allow people to use services on demand. Rather than owning upfront an expensive vehicle.

- Greater Affinity Towards Mission-Driven Brands: younger generations are more concerned with brands that try to do it differently and value those brands more.

- Increasing Demand for Flexible Work Opportunities: as the job market becomes more unstable, the opportunity to have a flexible way to make additional income is valued by a growing number of people.

- The emergence of New Modes of Transportation: transportation is becoming more and more a multi-mode where people don’t mind having several options for their daily trips.

Lyft mission

Lyft’s mission is to “improve people’s lives with the world’s best transportation.”

It all started in 2012 when Lyft launched a peer-to-peer marketplace for on-demand ridesharing. This mission is fueled by a willingness to get rid of mass car ownership.

Transportation-as-a-Service

The core of Lyft business model can be described as transportation-as-a-service or TaaS. Indeed, Lyft facilitated the on-demand request of riders and drivers.

This model is facilitated by a transition from car ownership to ride-sharing and on-demand marketplaces. It is also getting fueled by a multimodal transportation platform.

Lyft multimodal transportation platform

Source: Lyft Financial Prospectus

A multimodel platform expands on several sets of transportation modes, that beyond cars, also leverages on a network of shared bikes, and scooters for shorter rides. This multimodal platform enables TaaS, which gives more options to Lyft users to get by without owning a car. For that matter, the Lyft multimodal system leverages on four primary transportation modes and platforms:

- Ridesharing Marketplace.

- Bikes and Scooters.

- Public Transit.

- Autonomous Vehicles.

Lyft core values

From its financial prospectus Lyft stated core values are summarized below:

- Visionary, Founder-LedCompany.

- Culture and Values.

- Authentic Brand.

- Singular Focus on Transportation.

- Driver-Centric.

- Innovative Multimodal Platform.

- Personalized, Data-Driven Insights.

- Unique, Established Partner Relationships.

- Pioneering Autonomous Vehicle Strategy.

Two-sided marketplace powered by local communities

Lyft key partners are:

- Drivers.

- Riders.

- And local communities.

Drivers

The driver side of the platform is a key element to Lyft success, that is also why the company uses dynamic pricing strategies to keep drivers’ presence stable.

As specified in Lyft financial prospects the drivers on the platform are parents, students, business owners, retirees and everything in between and the majority drive in their free time to supplement their income.

Why do they drive? For four primary reasons:

- Flexibility

- Income

- Trust and Safety

- Extensive Support

Riders

Riders are the other side of the marketplace. And they use Lyft for four primary reasons:

- Selection and Convenience

- Availability

- Affordability

- Trust and Safety

Local communities

As pointed out by Lyft on its financial prospectus “building community and having a positive local impact is fundamental to who we are.”

That is also why Lyft spends most of its efforts in establishing relationships with the local community, and it seeks to impact them in three ways:

- Socially: Connect people with their communities

- Economically: Increase the quality of life and reduce transportation inequality

- Environmentally: Replace car infrastructure with green space and reduce emissions

How does Lyft make money?

It primarily generates revenue from drivers for service fees and commissions paid for the use of the ridesharing marketplace to connect with riders and successfully complete a ride.

In 2018, Lyft also started to generate revenue from subscription fees and single-use ride fees paid by riders to access the network of shared bikes and scooters.

There is also a third service, called Under our Express Drive program, that connects drivers who need access to a car with third-party rental car companies. Lyft facilitates car rental transactions between car rental companies and drivers.

How does Lyft spend money?

As pointed out on its financial prospectus Lyft spends its money in a few ways:

- Cost of revenue consisting of insurance costs generally required under TNC.

- Operations and support expenses consisting of personnel-related compensation costs of local operations teams and teams who provide phone, email and chat support to users.

- Research and development expenses primarily consisting of personnel-related compensation costs and facilities costs.

- Sales and marketing expenses primarily consisting of advertising expenses, rider incentives and refunds, personnel-related compensation costs and driver incentives for referring new drivers or riders.

Lyft dynamic pricing

Source: Lyft Financial Prospectus

Just like Uber uses a dynamic pricing strategy so Lyft does the same to keep the drivers’ presence on the platform strong.

Lyft branding strategy

Lyft core strategy is based on strengthening its brand. For that matter, Lyft uses six main strategies:

- Lyft-Produced Content: original content with a range of partners to help showcase its brand (things like Undercover Lyft, a viral marketing series where celebrities, such as Shaquille O’Neal, Danica Patrick, Chance the Rapper, Odell Beckham Jr., Demi Lovato and Jerry Rice)

- Popular Culture: with the aim of spreading its brand, like the placement in the HBO TV series Insecure, The Equalizer 2 and more

- Marketing Partnerships: marketing partnerships with leading brands, such as Delta Air Lines, SkyMiles and more

- Local Events: sponsoring local events to boost brand awareness like unique campaigns such as Pride On! campaign showing support for the LGBTQ+

- Outdoor Advertising

- Specialty Modes: specialty or promotional ride modes for local events and organizations. For instance, Strange Mode to celebrate Halloween and the premiere of Netflix’s Stranger Things and Star Mode in Nashville during the 2018 CMA Music Festival

Looking ahead: bikes, scooters and autonomous platform

Just like Uber is investing in alternative transportation modes, Lyft is also widely betting on them.

Beyond bikes and scooters, Lyft is also experimenting with Open Platform, which enables partners to connect with a network that offers their autonomous vehicles on the Lyft platform. For example, Open Platform partnership with Aptiv enabled the deployment of a fleet of autonomous vehicles in Las Vegas that facilitated over 35,000 rides!

Is Lyft business model sustainable?

This isn’t a simple question to answer, as in this case, the success of the Lyft business model highly depends upon its ability to pass through a change in the way people and local communities use local transportation.

As of 2018, Lyft has massively invested in growth, and for that matter is still recording an almost billion-dollar in net losses. Only time will tell whether or not this business model will prove sustainable.

Key Highlights

- Transportation-as-a-Service Marketplace:

- Operates as an on-demand transportation marketplace, connecting riders with drivers for rides.

- Multimodal Platform:

- Expanded its offerings to include a multimodal platform, incorporating options like bike-sharing and electric scooters.

- Revenue Generation:

- Primary revenue comes from fees collected from drivers who complete rides on the platform.

- Also generates revenue through subscription fees and single-use ride fees from shared bikes and scooters.

- Customer Value Proposition:

- Offers an efficient and convenient way for riders to find transportation quickly.

- Expands options through a multimodal platform for shorter rides using bikes and scooters.

- Mission:

- Aims to “improve people’s lives with the world’s best transportation.”

- Key Trends:

- Capitalizes on trends like sharing versus ownership, on-demand services, affinity towards mission-driven brands, flexible work opportunities, and emerging transportation modes.

- Multimodal Transportation Platform:

- Offers various transportation modes, including ridesharing, shared bikes, scooters, public transit, and autonomous vehicles.

- Core Values:

- Upholds visionary, founder-led principles, focuses on culture and values, maintains an authentic brand, and centers around transportation innovation.

- Two-Sided Marketplace:

- Key partners include drivers and riders, forming a dynamic ecosystem.

- Drivers:

- Drivers are a crucial aspect of the platform’s success, and Lyft ensures their presence through dynamic pricing strategies.

- Riders:

- Riders are attracted by the selection, convenience, availability, affordability, and safety Lyft offers.

- Local Communities:

- Focuses on positively impacting local communities through social, economic, and environmental initiatives.

- Revenue Generation:

- Revenue primarily comes from driver fees and commissions for ridesharing.

- Additional revenue from subscription fees, single-use ride fees, and facilitating car rental transactions.

- Expenditures:

- Allocates funds to cover insurance costs, operations, support, research and development, and sales and marketing expenses.

- Dynamic Pricing:

- Utilizes dynamic pricing to maintain a stable presence of drivers on the platform.

- Branding Strategy:

- Investment in Alternative Modes:

- Explores alternative transportation modes like bikes, scooters, and autonomous vehicles.

- Sustainability:

- Challenges the traditional car ownership model, striving to create a more efficient and sustainable transportation system.

- Financial Landscape:

Related Visual Stories

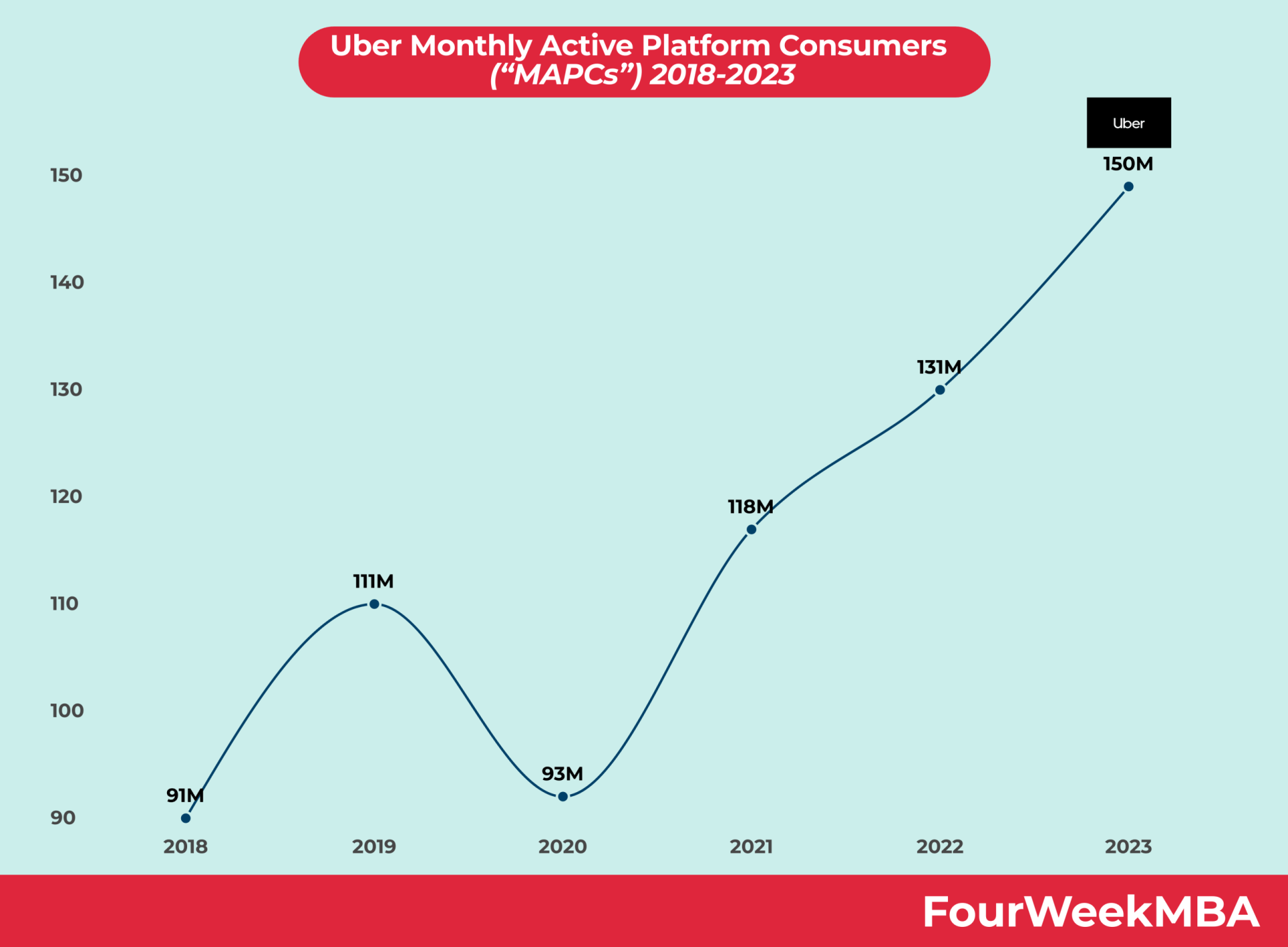

In 2022, Uber mobility took 27% of each booking on the platform. At the same time, Uber Eats took 20% of each booking on the delivery platform. The take rate varies according to demand and supply but also market dynamics. In short, in periods of increased competition, the service might charge lower take rates to keep up with it. In 2022, Uber pushed on efficiency, thus raising its take rates, to move toward profitability.

Uber Platform Users