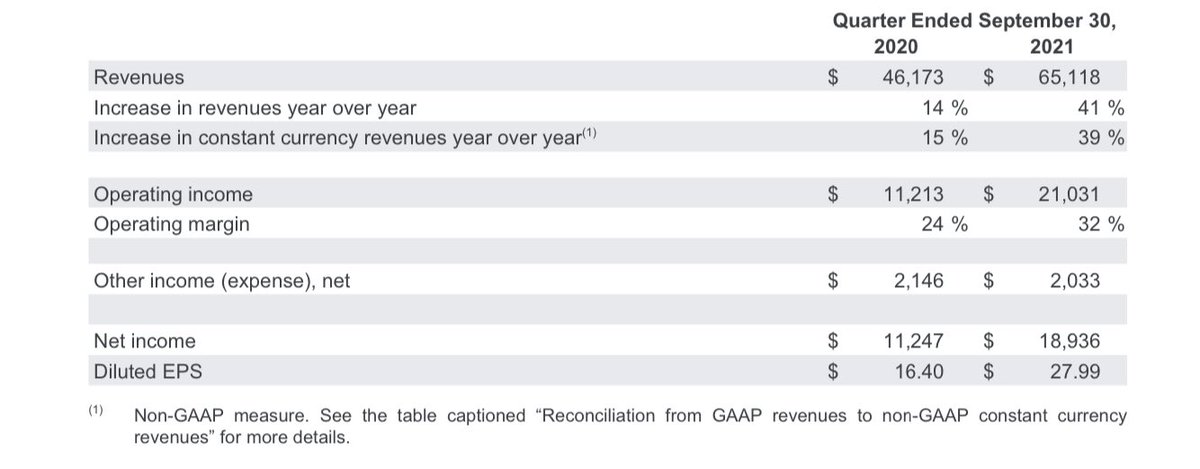

Facebook generated $131.95 billion in revenue in 2023, compared to $113,64 billion in 2022, $115.6 billion in 2021, and nearly $85 billion in 2020.

| Meta Revenue Breakdown | 2022 | % |

| Advertising | $113.64B | 97.5% |

| Other revenue (payments and fees) | $809MM | 0.7% |

| Reality Labs (primarily sales of Oculus, now called Meta Quest) | $2.16B | 1.9% |

| Total | $116.6B |

In 2022, advertising revenues represented 97.5% of the total revenues for Facebook (now Meta), with $113.64 billion in revenues, representing a slowdown compared to $115.65 in revenues for 2021.

Other revenues, comparing payments and fees, were $808 million in 2022, or 0.7% of the total revenues.

While Reality Labs (primarily sales of Oculus, rebranded as Meta Quest) amounted to $2.16 billion, or 1.9% of the total revenues, in 2022.

Three core changes are impacting and reshaping the whole digital advertising industry:

Cookieless web

The cookie has represented the enabler of the digital advertising industry, enabling tech companies to track the user journey across several platforms, thus making it possible to build the whole attribution machine.

Indeed, without attribution (the ability to say how a lead was generated), there would not be a digital advertising industry in the first place.

Yet, the cookie is getting retired. Google has planned the retirement of the cookie to its Chrome browser, thus determining the end of an era.

iOS privacy changes

Apple forced, in 2021, a privacy change policy, which makes the opt-in to advertising from third-party apps, like Facebook, explicit.

This means Apple will ask users whether they want to be tracked.

As you can imagine, this is already having a massive impact on Facebook’s business model, which had to rebrand as Meta and invest billions into VR.

Privacy from regulation

Regulators are also pushing for more and more privacy within various platforms.

This makes it much harder to track users and thus makes the whole digital advertising machine lose efficacy.

While in 2021, Google and Facebook still peaked in terms of revenues.

By 2022, with a changed market context, Facebook’s revenues would be slashed for the first time, forcing the company into mass layoffs!

The year of efficiency

As the company was affected by a massive slowdown for the first time in its history, it started to rethink its efforts in the future.

First, by refocusing its efforts from the Metaverse to Generative AI.

Indeed, in the last couple of years, the Metevarse has cost Facebook a massive amount of money, which was not justified as a return.

Indeed, in 2022, for some context, Reality Labs (the segment related to the Metaverse) generated $1.43 billion in revenue while posting an almost ten billion dollars loss!

As announced by Meta, the year of efficiency moves along a few key pillars:

- Flatter is better

- Leaner is better

- Keep technology the main thing

- Invest in tools to get more efficient

- In-person time to build relationships and get more done

Read Also: Facebook Business Model

Facebook Key Facts

| Key Facts | |

| Founders | Mark Zuckerberg, Andrew McCollum, Dustin Moskovitz, Eduardo Saverin, Chris Hughes |

| Year Founded | February 2004, Cambridge, MA |

| Year of IPO | May 18, 2012 |

| IPO Price | $38.00 |

| Market Cap at IPO | $104 Billion |

| Total Revenues at IPO | $3.7 Billion by 2011, prior to the IPO |

| Total Revenues in 2022 | $116.6B |

| Changed name | Meta, in October 2021 |

| Employees | 71,970 employees globally, as of December 31, 2021 |

| Revenues per Employee | $1,642,693.97 |

| Who owns Meta? | Mark Zuckerberg is the primary individual shareholder, with 81.7% of Class B shares, and 52.9% of the total voting power |

Related Visual Stories

Facebook Organizational Structure

![How Does Facebook [Meta] Make Money? Facebook Business Model Analysis 2024 facebook-business-model](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2024/02/facebook-business-model.png?resize=150%2C113&ssl=1)