Uber fees, or take rates, can vary between 20% and 30%. For instance, in 2023, Uber took from drivers around nearly 29%, while it took 28% in 2022, in fees through its ride-sharing platform. At the same time, it took around 20% of riders through its delivery platform (Uber Eats).

Visual Stories Related To the Uber Business Model

In 2022, Uber mobility took 27% of each booking on the platform. At the same time, Uber Eats took 20% of each booking on the delivery platform. The take rate varies according to demand and supply but also market dynamics. In short, in periods of increased competition, the service might charge lower take rates to keep up with it. In 2022, Uber pushed on efficiency, thus raising its take rates, to move toward profitability.

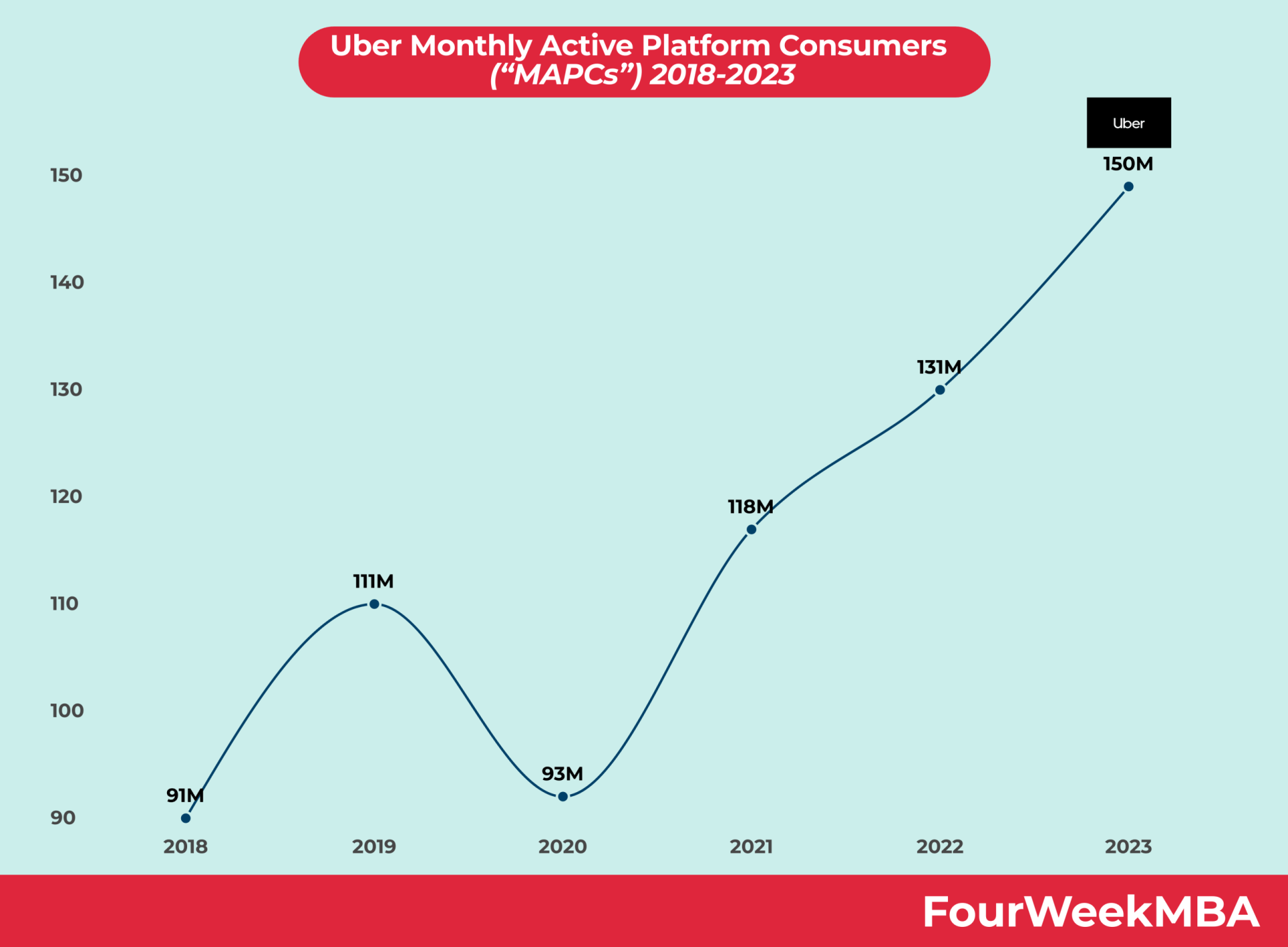

Uber Platform Users