Less than four years after it was founded, Facebook surpassed Myspace in 2008 as the most visited social media site on the internet.

This is a position the platform still holds today with approximately 2.96 billion users – some 348 million more than second-placed YouTube.

Despite Facebook’s obvious popularity and influence, some believe the company’s rebranding to Meta is evidence of systemic problems within the company.

In this article, we’ll take a look at some recent history of the social media platform and where it may be headed in the future.

Declining popularity

Facebook’s declining popularity has been years in the making. This is particularly true of users from developed countries in the 18-24 age bracket whose numbers have been on a downtrend since around 2012.

Engagement, a key metric in predicting ad revenue, was down 16% for teenagers and 5% for adults in the United States in 2021.

Facebook’s decline in younger users is due to the emergence of competitors such as TikTok which has captured the short video market with ease.

But Mark Zuckerberg is more concerned with the amount of time users are spending on TikTok as opposed to the number of young users Facebook is losing to the Chinese-owned platform.

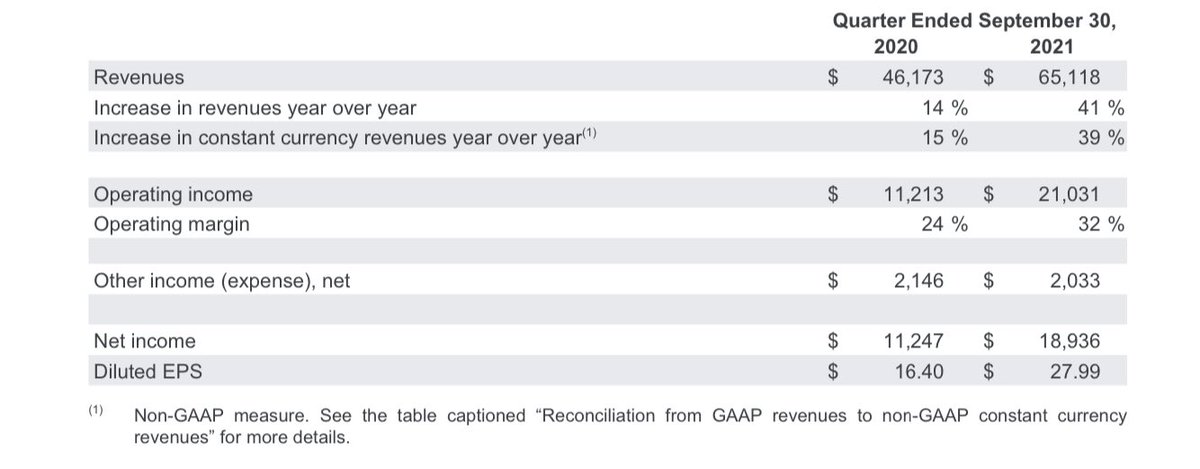

Engagement, as we noted above, reduces ad spend and subsequent ad revenue.

Many users also abandoned Facebook after Apple introduced a transparency feature requiring users to provide consent for ID-based app monitoring.

Many unsurprisingly declined to be monitored by apps, which no doubt contributed to the company reporting a $10 billion decline in ad revenue and an associated decrease of 500,000 daily active users.

The company has vast resources to draw on, but this was the first time it had reported an overall decline in user numbers.

It remains to be seen whether the drop in users and ad revenue will cause a downward spiral that impacts the platform’s future viability.

Rebranding

Nevertheless, in October 2021, Zuckerberg announced that Facebook would change the name of its holding company to Meta.

The move was based on the company’s belief that the metaverse is poised to be the true successor of the mobile internet.

The rebranding would also remove the “confusion and awkwardness” of the company sharing a name with its core product.

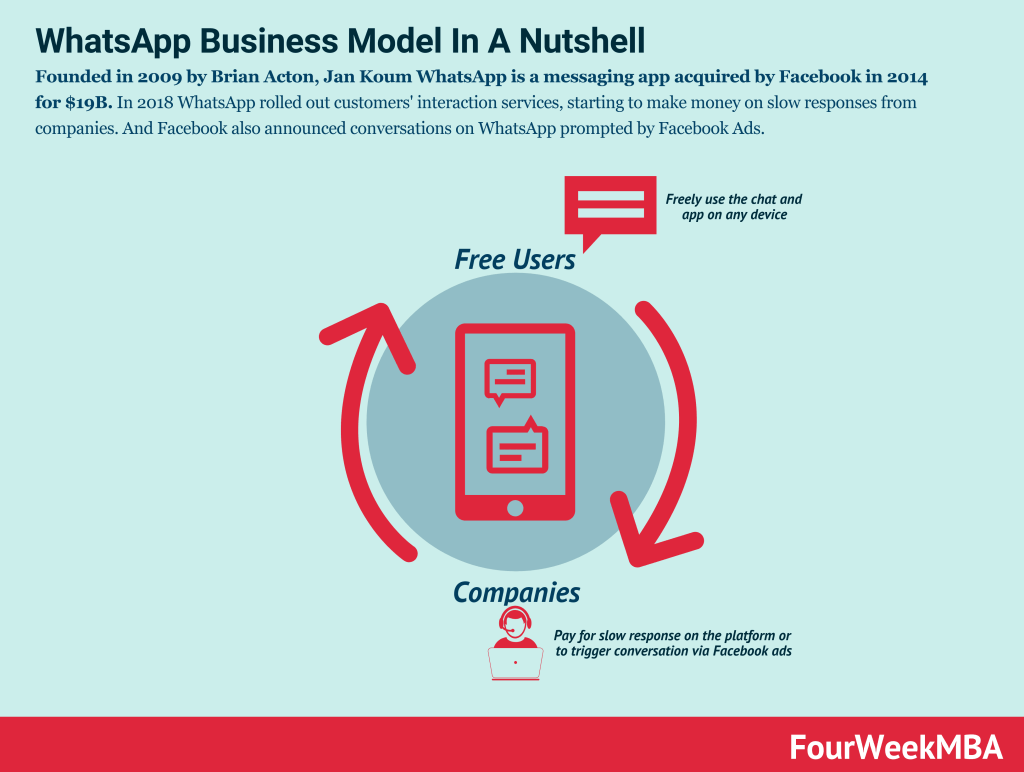

Meta now encompasses Facebook – its largest subsidiary – in addition to apps such as WhatsApp, Messenger, and Instagram.

Virtual reality-based brands such as Oculus now report their revenue separately thanks to substantial growth in the industry.

Public relations crises

While many believe in the long-term viability of the metaverse, others point toward Facebook’s history of public relations crises as a driver of the rebranding effort.

Tens of thousands of documents were leaked by a former employee in late 2021 which showed the company was well aware of the deleterious health effects of its products.

Cited examples included Instagram’s effect on teenage mental health and Facebook’s history of fanning ethnic violence in countries such as Ethiopia.

Facebook was also cited as a major source of misinformation concerning the 2020 US Presidential Election.

These crises have permeated Facebook’s corporate culture, with many employees frustrated at the company’s strict policy toward employee dissent and preference to prioritize profits over people.

The future of Meta

Irrespective of the reasons behind the rebranding, the future success of Meta is not guaranteed.

There is a risk that Zuckerberg’s vision of the future does not materialize, which would negatively impact the company’s bottom line.

Even if the metaverse does succeed, however, there is the risk it will be construed as just another social media network where the company can exert influence via its sometimes questionable practices.

Key takeaways:

- Despite Facebook’s influence and title as the world’s most popular social media platform, some believe the company’s rebranding to Meta is evidence of systemic problems within the company.

- Facebook has suffered a decline in users in recent times, especially among younger people whose numbers have been decreasing since 2012. As engagement levels have dropped, so too has ad revenue – a critical source of income.

- Some believe Facebook’s rebranding to Meta was an attempt to repair a tarnished brand, while others, including Zuckerberg himself, claim it was to position the company to profit from the future metaverse.

Read Also: Facebook Business Model

Related Visual Stories

Facebook Organizational Structure

![How Does Facebook [Meta] Make Money? Facebook Business Model Analysis 2024 facebook-business-model](https://i0.wp.com/fourweekmba.com/wp-content/uploads/2024/02/facebook-business-model.png?resize=150%2C113&ssl=1)