Alternative communication platforms and CPaaS providers to Twilio for building and managing messaging and voice applications comprise options like Nexmo, Plivo, Sinch, MessageBird, and Twilio Flex for communication platforms. Or Vonage, Infobip, Bandwidth, Telnyx, and OpenMarket for CPaaS solutions, offering various communication APIs and services.

| Alternative | Key Features | Core Strengths | Weaknesses |

|---|---|---|---|

| Nexmo (Vonage) | 1. Global Reach: Extensive global network for SMS and voice. 2. Video APIs: Offers video calling and conferencing APIs. 3. CPaaS: Provides comprehensive communication platform-as-a-service. | – Extensive global network ensures reliable SMS and voice services worldwide. – Video APIs enable video calling and conferencing capabilities. – Comprehensive CPaaS solution for various communication needs. | – Pricing may vary based on usage, with some features requiring additional fees. – Documentation and support resources may not be as extensive as Twilio’s. – Integration with certain platforms may require additional development effort. |

| Plivo | 1. Voice and SMS: Offers voice and SMS APIs. 2. Global Coverage: Extensive global network for communication services. 3. Scalability: Scales to support high volumes of communication. | – Voice and SMS APIs for building communication features into applications. – Reliable global coverage ensures message and call delivery worldwide. – Scalable platform suitable for businesses with high communication volumes. | – Pricing may vary based on usage, with additional fees for premium features. – May not have as extensive third-party integrations as Twilio. – User interface and dashboard may not be as user-friendly for beginners. |

| Tropo (Cisco) | 1. Voice and Messaging: Provides voice and messaging APIs. 2. Scalability: Scales to handle large volumes of communication. 3. Cisco Integration: Integrates with Cisco’s collaboration tools. | – Offers voice and messaging APIs for building communication features. – Scalable platform capable of handling high communication volumes. – Integration with Cisco’s collaboration tools enhances business communication. | – Documentation and support resources may be limited compared to Twilio. – Pricing may not be as transparent, with potential fees based on usage. – Integration with non-Cisco tools and platforms may require additional development effort. |

| MessageBird | 1. Omnichannel Communication: Supports multiple communication channels, including SMS, voice, email, and chat. 2. Global Coverage: Provides global reach for messaging services. 3. Rich Communication: Supports rich messaging features. | – Offers a wide range of communication channels, making it suitable for omnichannel strategies. – Global coverage ensures message delivery worldwide. – Supports rich messaging features for interactive and engaging communication. | – Pricing may vary based on usage, with some features incurring additional costs. – Complex pricing structure may require careful evaluation. – Advanced features may not be as developer-friendly compared to Twilio. |

| Agora | 1. Real-Time Video and Voice: Specializes in real-time video and voice communication APIs. 2. Interactive Broadcasting: Supports interactive broadcasting and live streaming. 3. Scalability: Scales for high concurrency. | – Specialized in real-time video and voice communication, ideal for applications requiring live interactions. – Interactive broadcasting features for live streaming and audience engagement. – Scalable platform capable of handling high concurrency. | – Focused primarily on real-time video and voice, may not cover a wide range of communication needs. – Pricing may vary based on usage and features. – Integration with certain platforms may require additional development effort. |

Communication Platforms:

- Nexmo: A cloud communication platform with messaging, voice, and authentication capabilities.

- Plivo: A scalable API platform for voice and messaging applications with global reach.

- Sinch: A communication platform offering messaging, voice, and video capabilities for applications.

- MessageBird: A cloud communications platform providing SMS, voice, and chat functionalities.

- Twilio Flex: An omnichannel contact center platform for customer support and engagement.

CPaaS (Communication Platform as a Service):

- Vonage: A CPaaS provider offering APIs for messaging, voice, video, and authentication.

- Infobip: A global CPaaS provider offering messaging, voice, and omnichannel communication services.

- Bandwidth: A CPaaS provider with APIs for messaging, voice, and emergency services.

- Telnyx: A global CPaaS provider offering programmable messaging, voice, and SIP trunking.

- OpenMarket: A CPaaS provider specializing in global messaging solutions for enterprises.

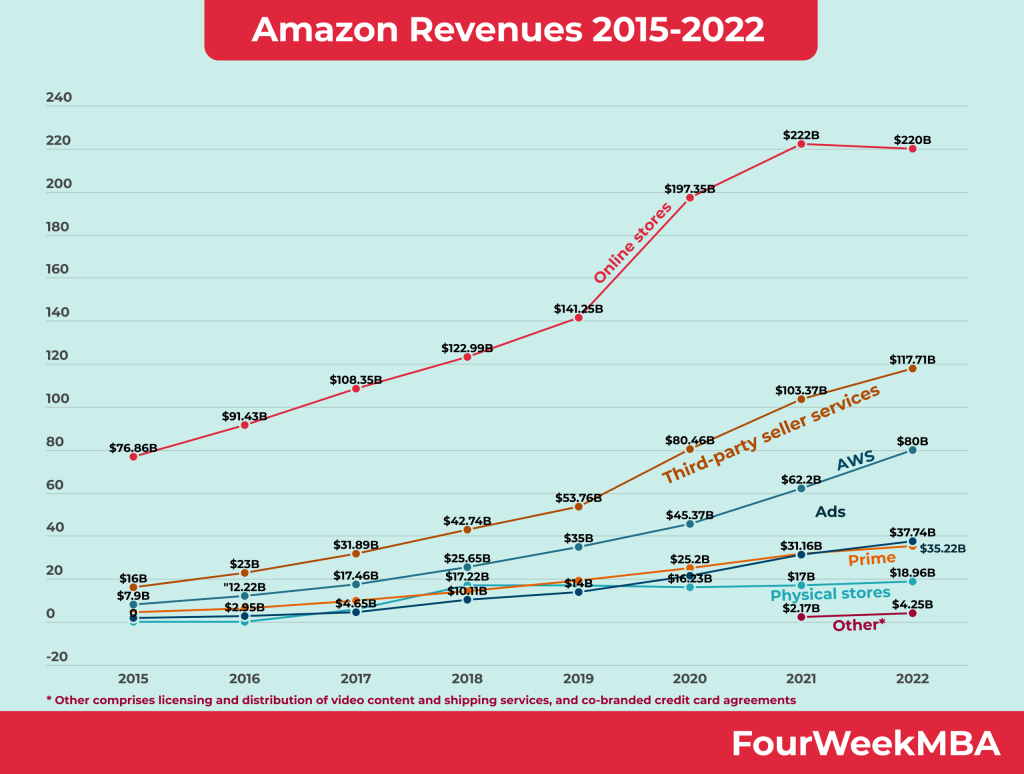

Connected to Amazon Business Model

Is Amazon Profitable Without AWS?