In the first quarter of 2024, Pinterest Inc. witnessed a remarkable surge in revenue, reporting a substantial 23% increase amounting to $740 million. This surge can be attributed to various strategic initiatives undertaken by the company, including a renewed focus on shopping and enhanced user engagement strategies. Additionally, Pinterest experienced robust user growth, particularly among Gen-Z users, who now constitute over 40% of its total user base. The platform’s global monthly active users (MAUs) reached 518 million as of March 31, marking a noteworthy 12% year-over-year increase.

Driving Factors

- Shopping Focus: Pinterest’s strategic emphasis on shopping played a pivotal role in driving revenue growth during the first quarter. The platform introduced user-friendly features that facilitate direct purchases, thereby enhancing user experience and monetization opportunities.

- Gen-Z Targeting: Targeting Gen-Z users has been a key focus area for Pinterest. The company tailored its offerings to cater to the preferences and behaviors of this demographic, resulting in increased user engagement and platform adoption.

- AI Integration: Investments in AI-driven tools and ad formats have significantly improved the relevancy of content and advertisements on the platform. Pinterest’s AI algorithms analyze user behavior and preferences to deliver personalized recommendations, driving higher user interaction and advertiser ROI.

Financial Performance and Market Response

Pinterest’s financial performance in Q1 2024 surpassed analysts’ expectations, with adjusted earnings per share (EPS) standing at 20 cents on sales of $740 million. The company’s shares surged by nearly 20% in after-hours trading following the announcement of its financial results, indicating strong investor confidence in its performance and growth prospects.

Strategic Initiatives

- AI Integration: Pinterest’s continued investment in AI-integrated tools has been instrumental in enhancing user experience and advertising effectiveness. The platform’s AI algorithms analyze user behavior to deliver personalized content recommendations and targeted advertisements, driving higher user engagement and revenue.

- Shopping Focus: The platform’s strategic push into shopping has expanded monetization opportunities and strengthened its position as a destination for product discovery and inspiration. Pinterest’s user-friendly features, such as shoppable pins and curated shopping boards, have facilitated direct purchases, driving revenue growth.

- Gen-Z Engagement: Targeting and engaging Gen-Z users strategically has enabled Pinterest to capture a growing segment of the digital audience. The company’s efforts to understand and cater to the preferences of this demographic have resulted in increased user adoption and platform engagement.

Future Outlook

Looking ahead, Pinterest anticipates second-quarter revenue in the range of $835 million to $850 million, indicating sustained growth momentum and confidence in its strategic direction. Continued investments in AI-driven technologies are expected to further enhance user engagement, content relevancy, and advertising effectiveness, driving long-term revenue growth. Furthermore, Pinterest’s focus on shopping and Gen-Z engagement positions it competitively in the digital advertising landscape, with opportunities to capture market share and expand its user base.

Implications and Strategic Analysis

- Monetization Opportunities: Pinterest’s emphasis on shopping and AI integration presents significant monetization opportunities through targeted advertising, sponsored content, and e-commerce partnerships. By leveraging user data and AI algorithms, the company can deliver personalized shopping experiences and drive higher conversion rates for advertisers.

- User Engagement: The success of Pinterest in attracting and engaging Gen-Z users underscores the importance of audience targeting and tailored content strategies in driving user growth and revenue. By continuously refining its algorithms and content recommendations, Pinterest can enhance user engagement and retention, thereby increasing its competitive advantage in the digital advertising space.

- Brand Positioning: Pinterest’s strong brand positioning as a destination for inspiration and product discovery enhances its appeal to advertisers and users alike. The platform’s curated content and visually-driven interface differentiate it from other social media platforms, making it an attractive platform for brands looking to connect with consumers in a meaningful way.

Conclusion

Pinterest Inc.’s impressive performance in Q1 2024 reflects its strategic focus on shopping, Gen-Z engagement, and AI integration. With sustained revenue growth, expanding user base, and promising future outlook, Pinterest remains well-positioned to capitalize on emerging opportunities in the digital advertising landscape. By leveraging its AI-driven technologies and user-friendly features, Pinterest can continue to drive user engagement, attract advertisers, and maintain its competitive edge in the market.

Sources:

[1] https://www.bloomberg.com/news/articles/2024-04-30/pinterest-revenue-surges-on-popularity-of-shopping-push

[2] https://www.theinformation.com/briefings/pinterest-shares-surge-as-revenue-growth-rebounds

[3] https://www.reuters.com/technology/pinterest-forecasts-quarterly-revenue-above-estimates-robust-ad-spend-2024-04-30/

[4] https://www.investors.com/news/technology/pinterest-stock-surges-on-earnings-beat-big-revenue-acceleration/

[5] https://finance.yahoo.com/news/pinterest-pins-q1-earnings-beat-141500713.html

[6] https://www.thestar.com.my/business/business-news/2024/05/02/pinterest-revenue-surges-on-popularity-of-shopping

[7] https://www.businesstimes.com.sg/companies-markets/pinterest-revenue-surges-popularity-shopping-push

[8] https://www.channelnewsasia.com/business/pinterest-forecasts-quarterly-revenue-above-estimates-shares-surge-4304571

Connected Business Models

Handpicked related business models:

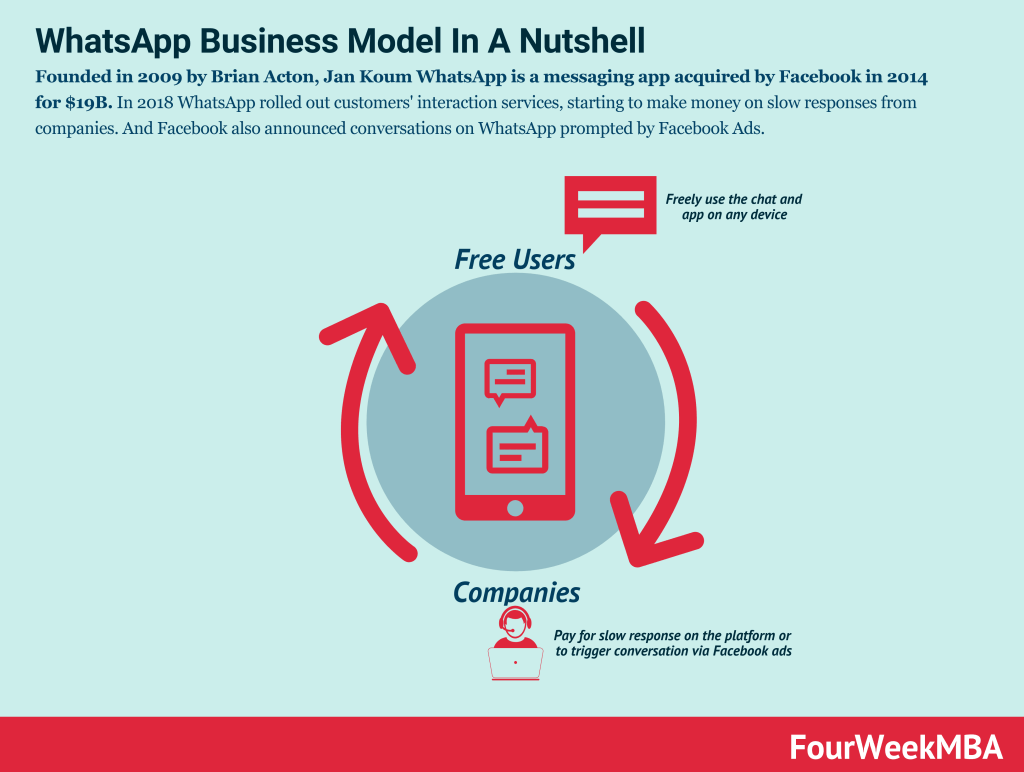

- How Does WhatsApp Make Money? WhatsApp Business Model Explained

- How Does Google Make Money? It’s Not Just Advertising!

- The Google of China: Baidu Business Model In A Nutshell

- How Does Twitter Make Money? Twitter Business Model In A Nutshell

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

Other resources:

- Successful Types of Business Models You Need to Know

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

Main Free Guides: